MEMBERS ONLY

This Important Metal Could Be on the Verge of a Mega-Breakout

by Martin Pring,

President, Pring Research

Gold has been on a tear since 2022, leaving other metals in the dust. Nevertheless, it's important to remember that the yellow metal has a strong tendency to lead commodities in general, which implies the likelihood of inflationary pressures in the commodity pits going forward. The leads and...

READ MORE

MEMBERS ONLY

How I Find Up-trending Stocks Every Week (Step-by-Step Scan Tutorial)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares his weekly stock scan strategy used to identify bullish stock trends. He illustrates how to set up this powerful scan, reveals the tips and tricks he uses to identify the most constructive patterns, and explains the four winning chart setups that tend to come up...

READ MORE

MEMBERS ONLY

Hedge Market Volatility with These Dividend Aristocrats & Sector Leaders

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights key areas of the stock market that gained strength last week, including Staples and Aerospace stocks. She also shares several Dividend Aristocrat stocks that can help stabilize your portfolio in times of market volatility.Whether you're seeking defensive plays or looking to...

READ MORE

MEMBERS ONLY

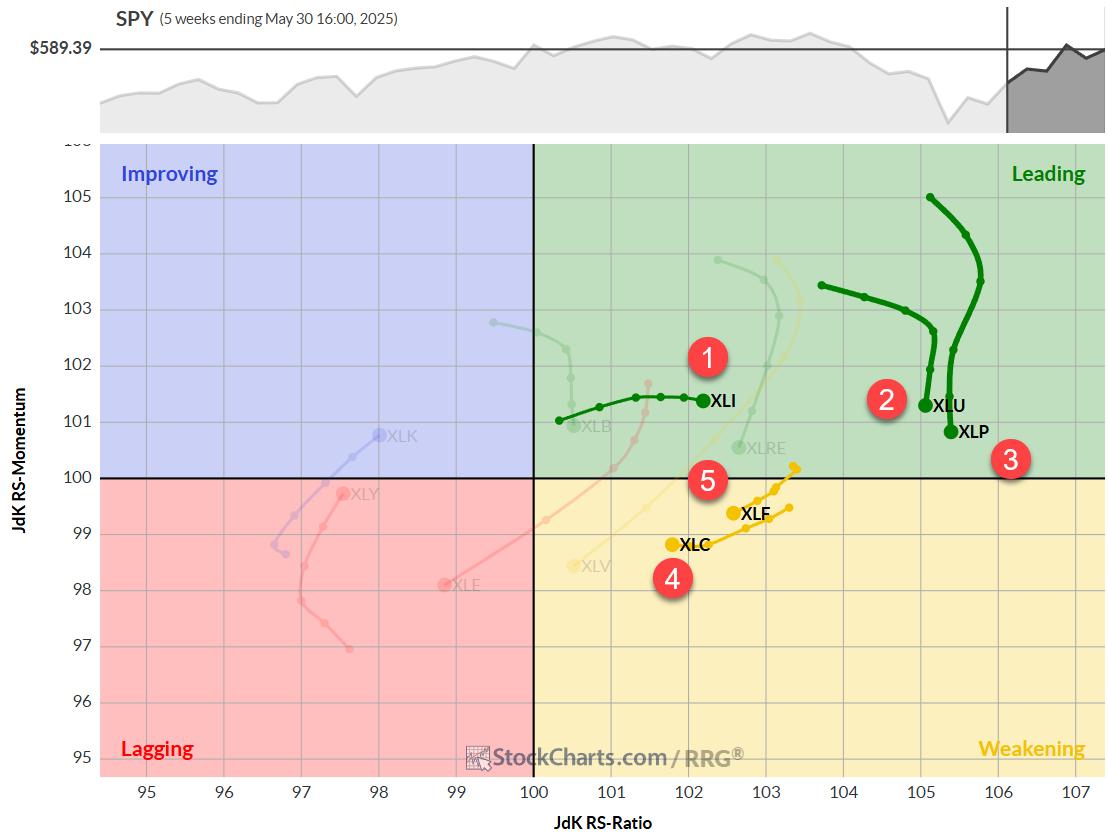

The Best Five Sectors, #21

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

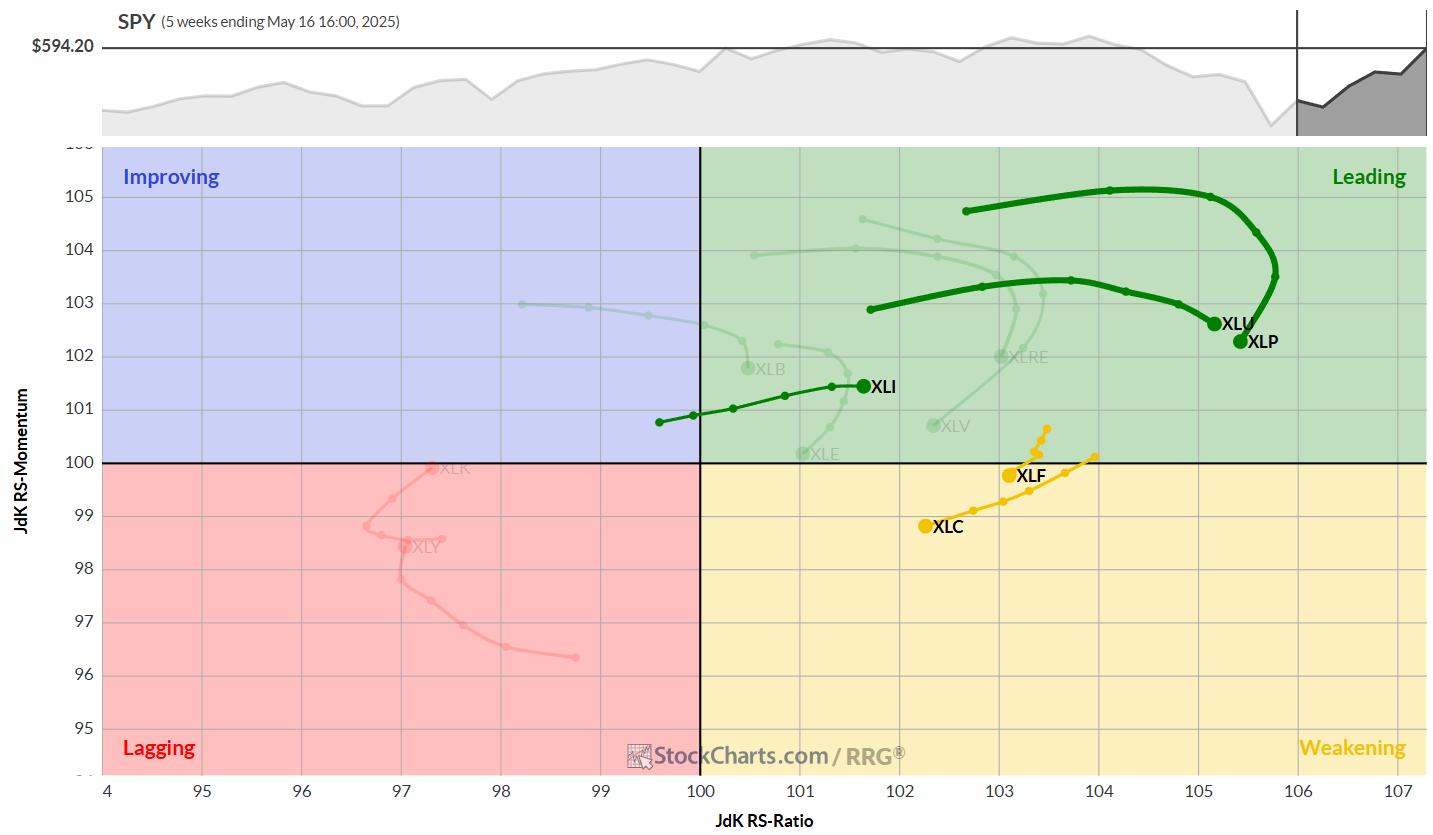

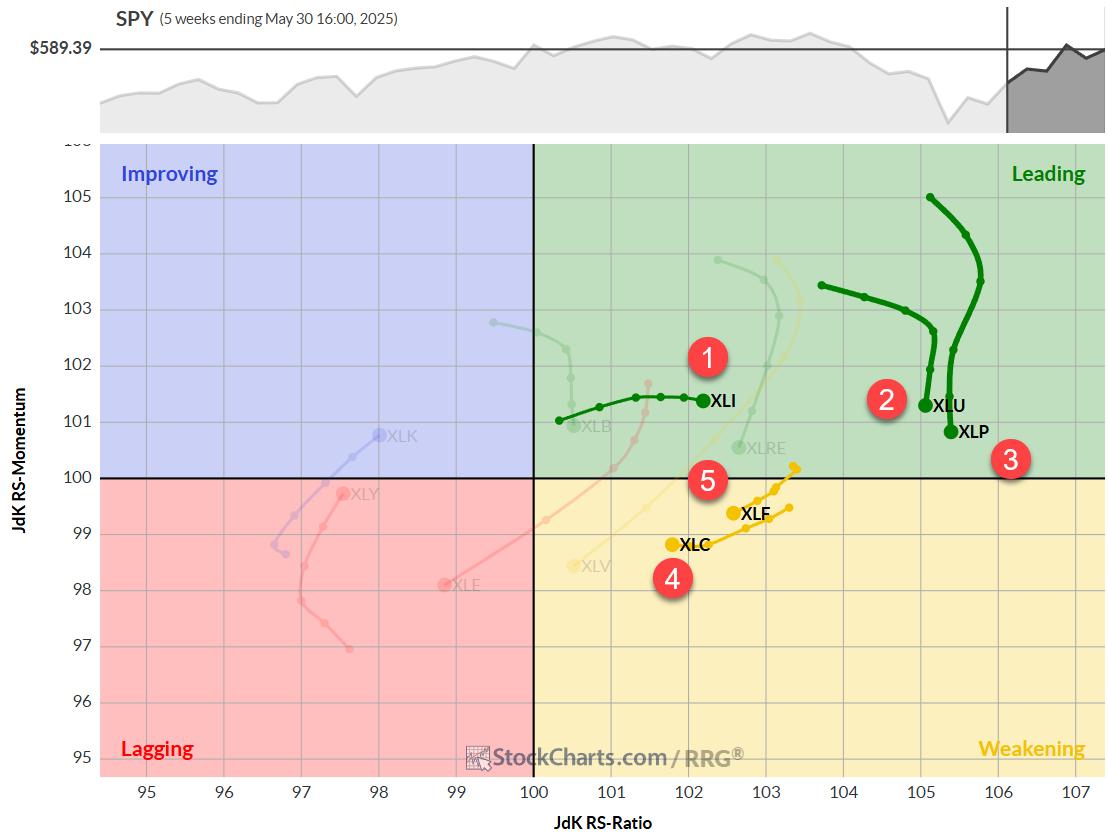

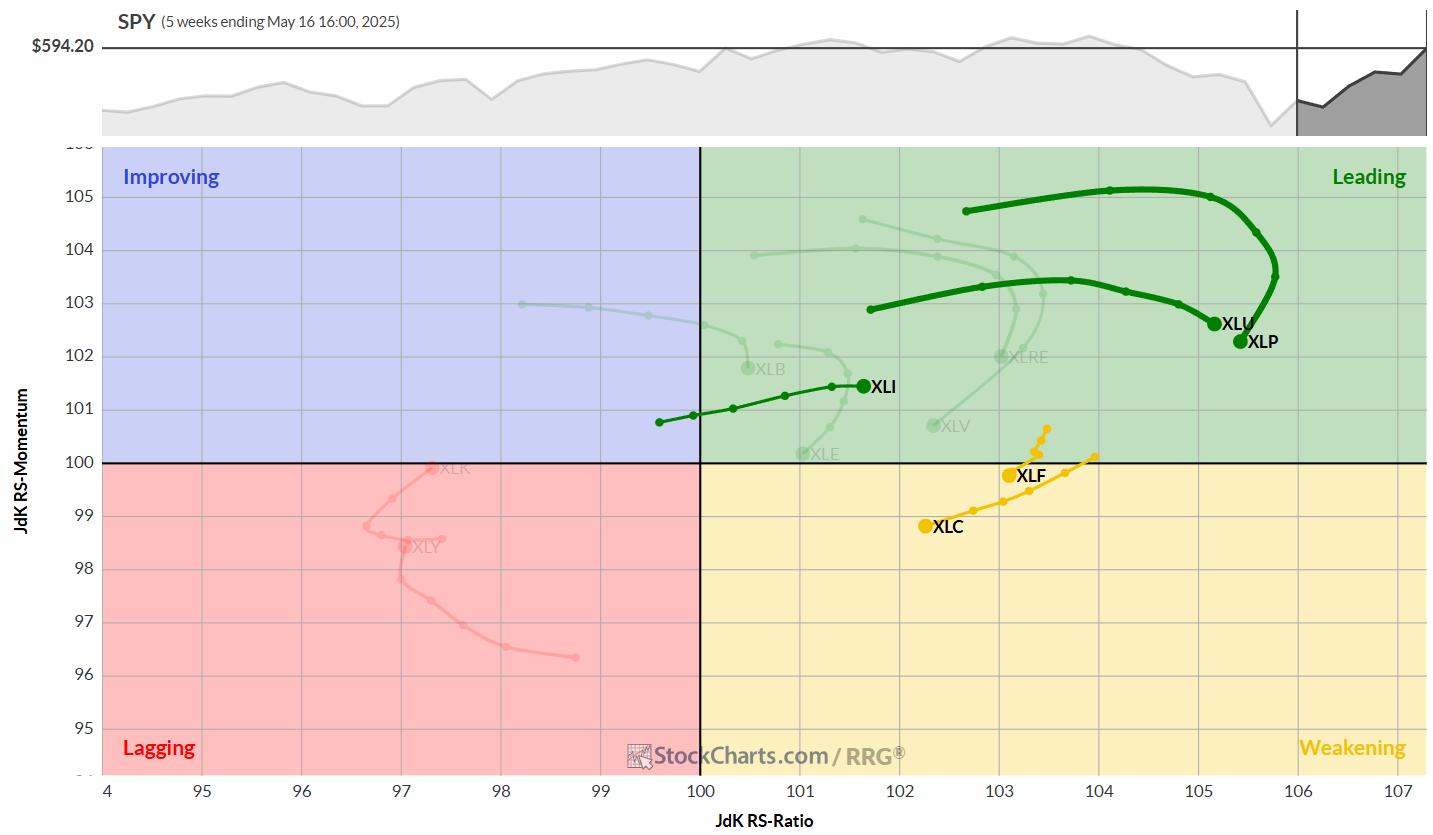

Staples and Tech Swap Positions Again

The weekly sector rotation continues to paint a picture of a market in flux, with defensive sectors gaining ground while cyclicals take a step back. This week's shifts underscore the ongoing volatility and lack of clear directional trade that's been...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays in Defined Range; Moving Past This Level Crucial for Resumption of Upmove

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five sessions, the Indian equity markets headed nowhere and continued consolidating in a defined range.

In the previous weekly note, it was categorically expected that the markets might stay devoid of any directional bias unless they either took out the upper edge or violated the lower edge...

READ MORE

MEMBERS ONLY

Breakouts, Momentum & Moving Averages: 10 Must-See Stock Charts Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Discover the top 10 stock charts to watch this month with Grayson Roze and David Keller, CMT. From breakout strategies to moving average setups, the duo walk through technical analysis techniques using relative strength, momentum, and trend-following indicators.

In this video, viewers will also gain insight into key market trends...

READ MORE

MEMBERS ONLY

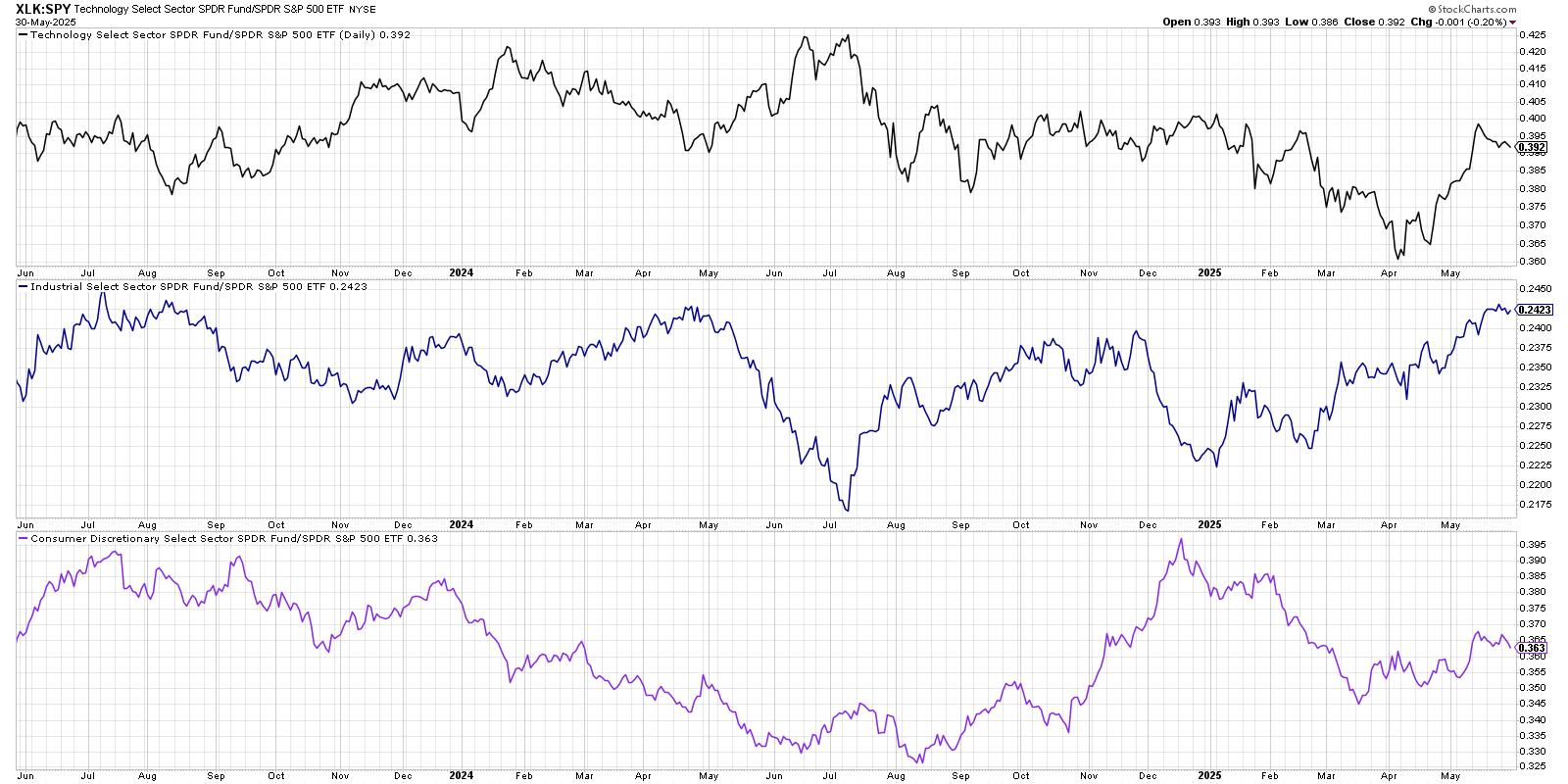

Leadership Rotation Could Confirm Corrective Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There's no denying that the equity markets have taken on a decisively different look and feel in recent weeks.

We've compared the charts of the S&P 500 and Nasdaq 100, as well as leading growth stocks like Nvidia, to an airplane experiencing a "...

READ MORE

MEMBERS ONLY

Run Your Stock Portfolio Like a Pro Sports Team

by Grayson Roze,

Chief Strategist, StockCharts.com

Manage your stock portfolio like a pro! Learn stock portfolio management, trading strategy, and how to build stock watchlists like a professional investor with this insightful video from Grayson. He shares how to run your portfolio like a championship sports team—organizing stocks like players, keeping top performers in play,...

READ MORE

MEMBERS ONLY

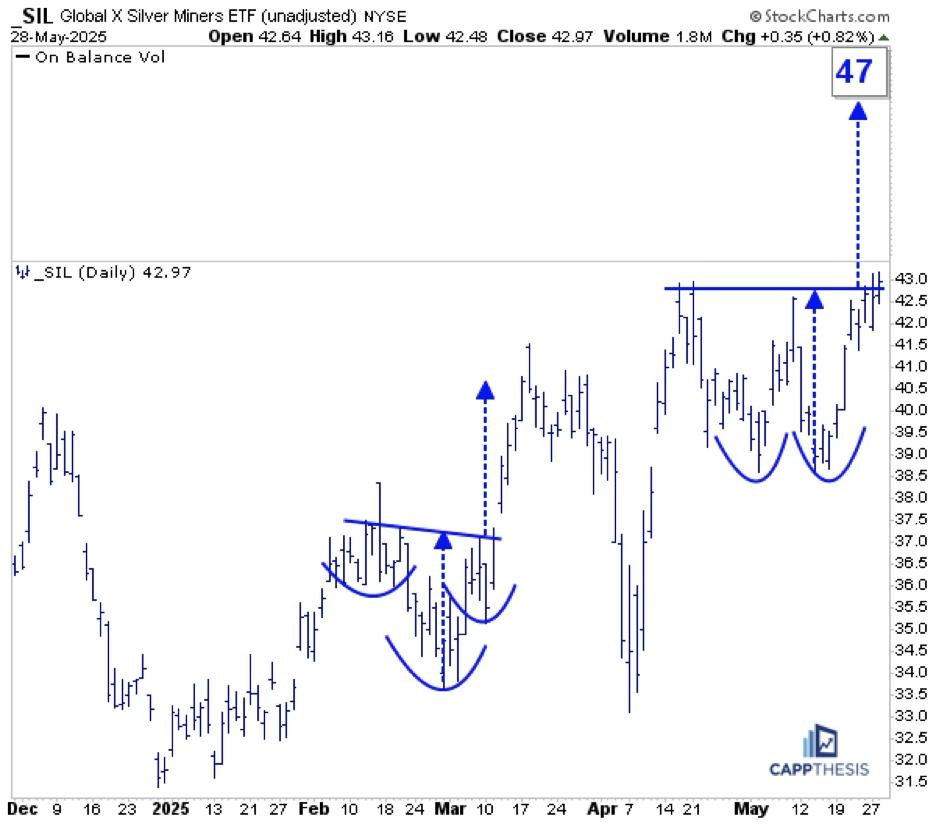

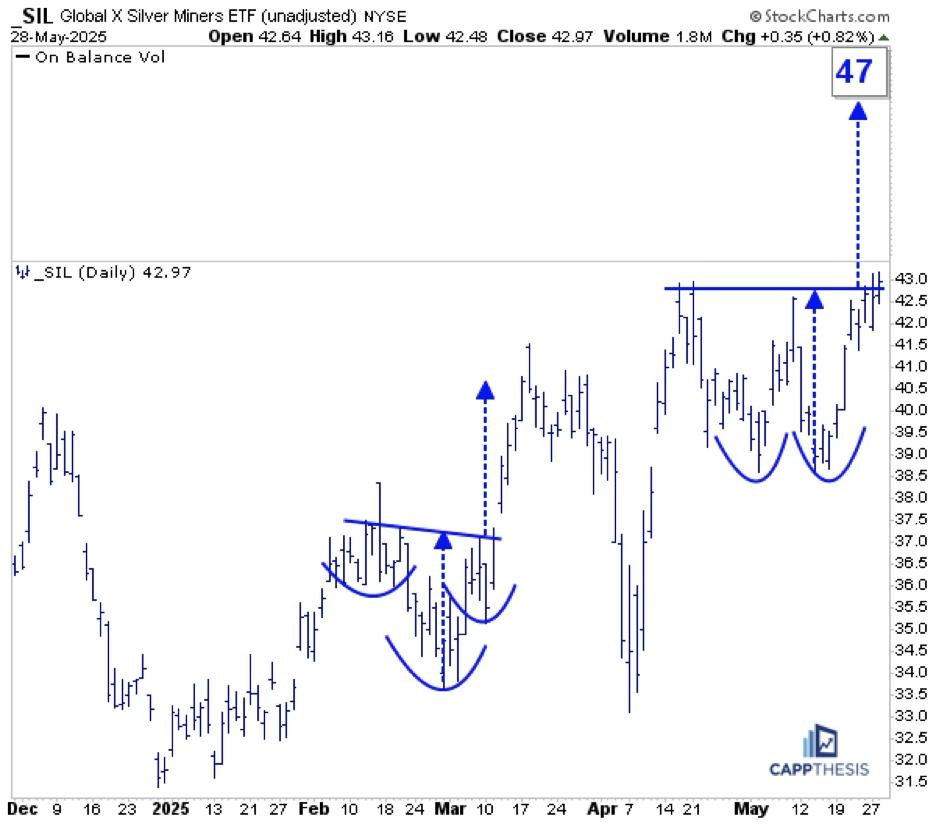

Analyzing SIL, USO, and NVDA: Could These Bullish Patterns Trigger?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

SIL Silver Miners

SIL was among the leaders yesterday and now is close to triggering this double-bottom bullish pattern. Staying above the 43-mark would target 47. That's not a big move, but let's remember that SIL is sporting bullish formations on its longer-term charts, too.

SIL...

READ MORE

MEMBERS ONLY

Nuclear Power Trio: OKLO, SMR, and CCJ in Focus

by Karl Montevirgen,

The StockCharts Insider

Nuclear energy stocks are on a tear, and Oklo Inc. (OKLO), Cameco Corp. (CCJ), and NuScale Power Corporation (SMR) are leading the charge, fueled by presidential executive orders, investor hype, and hopes for a nuclear-powered future.

Is It Time to Go Nuclear?

These names bucked the trend on Wednesday, rising...

READ MORE

MEMBERS ONLY

Top Sectors to Watch + The 18 SMA Setup Every Trader Should Know

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe analyzes which sectors to focus on when selecting new stocks. He demonstrates how to use the 18-period simple moving average (SMA) on monthly, weekly, and daily charts to identify the strongest stock patterns and the best timeframes to trade. He then provides chart analysis on the...

READ MORE

MEMBERS ONLY

Larry Williams on the Fed, Interest Rates & Markets! What's Next?

by Larry Williams,

Veteran Investor and Author

In this must-see market update, Larry Williams returns with timely stock market analysis, trading insights, and macroeconomic forecasts. Discover what's next for the Federal Reserve, interest rates, and inflation — and how it could impact top stocks like Tesla (TSLA), Nvidia (NVDA), Apple (AAPL), and consumer staples (XLP).

This...

READ MORE

MEMBERS ONLY

Mixed Signals on the Charts? RRG Reveals Market Rotation Tension

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Confused by mixed market signals? Follow along as Julius analyzes sector rotation, asset rotation, and global market trends using daily and weekly Relative Rotation Graphs (RRGs).

In this video, Julius puts the current sector rotation in perspective on both weekly and daily Relative Rotation Graphs (RRGs). He also examines asset...

READ MORE

MEMBERS ONLY

Is It A Pullback? Or is More Downside Ahead?

by Mary Ellen McGonagle,

President, MEM Investment Research

Get the latest stock market update with Mary Ellen McGonagle. Learn key downside signals, how to manage pullbacks, and which earnings reports could impact the market next week.

In this week's episode, Mary Ellen reviews where the markets currently stand and what to watch for to signal further...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #20

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technology Back in Top-5

Last week's market decline of 2-2.5% (depending on the index) has led to some notable shifts in sector performance and rankings.

This pullback, coming after a strong rally, is changing the order of highs and lows on the weekly chart -- a particularly...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays in Technically Challanging Situation; Sector Rotation Shows Likely Change In Leadership

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a very strong move in the week before this one, the markets chose to take a breather. Although they moved in a wide range, they ended the week on a mildly negative note after rebounding from their low point of the week. While defending the key levels, the markets...

READ MORE

MEMBERS ONLY

My Durable Advantage as an Investor is My Experience: Here are Seven Examples

by Gatis Roze,

Author, "Tensile Trading"

It scares me to admit I've been investing for over 50 years. It's been a great ride, and fortunately I'm still going strong. One of my investment mantras thru all these years has been Charlie Munger's quintessential advice: "try to be...

READ MORE

MEMBERS ONLY

What Happens When the S&P 500 Breaks Below Gap Support?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My main question going into this weekend was, "Will the S&P 500 finish the week above its 200-day moving average?" And while the S&P 500 did indeed finish the week above this long-term trend barometer, our main equity benchmark is now within the gap...

READ MORE

MEMBERS ONLY

Moving from Thrust Signals to a Bull Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bullish signals stacked up in April and May, but most long-term breadth indicators are still bearish. SPY and QQQ showed signs of capitulation in early April and rebounded into mid April. A Zweig Breadth Thrust triggered on April 24th and several other thrust indicators turned bullish in May. We...

READ MORE

MEMBERS ONLY

Applying Key Ratios to the Broader Market Surge: Are We at the Threshold of a New Trend?

by Karl Montevirgen,

The StockCharts Insider

The financial media is flooded with commentary questioning whether the current rise in stock indexes is sustainable enough to mark the beginning of a new bull market. In short, have we gotten out of the woods, or are we in a clearing with more uncertainty to come?

There are many...

READ MORE

MEMBERS ONLY

S&P 500 Slide Explained: What Past Price Action Reveals About Market Dips

by Frank Cappelleri,

Founder & President, CappThesis, LLC

On Wednesday, only 4% of the S&P 500's holdings logged gains — a pretty rare occurrence. Since the start of 2024, this has only happened three other times:

* August 5, 2024: The last day of the summer correction

* December 18, 2024: The Fed's hawkish cut...

READ MORE

MEMBERS ONLY

MACD + ADX: Spot the Pullbacks Worth Trading

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe shares how to use MACD and ADX indicators to analyze stock pullbacks, focusing on the good while avoiding the weak setups. He explains how these indicators can complement one another. Joe then shows the Summary Page in ACP and how he uses it on a regular...

READ MORE

MEMBERS ONLY

Become the Investor You Aspire to Be: Essential Insights for Success

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Retail traders and investors often don't get the credit they deserve. But in April, they showed they've got serious market smarts.

While headlines screamed about a tanking stock market — remember, post-Liberation Day— retail investors waited patiently. And when the time felt right, they jumped in, adding...

READ MORE

MEMBERS ONLY

Why the May 31 Close is Pivotal To Determine Primary Trend's Direction

by Martin Pring,

President, Pring Research

Way back in 1988, Robert W. Colby and Thomas A. Meyers authored a classic technical analysis book entitled Encyclopedia of Technical Market Indicators, in which they back-tested the performance of hundreds of market indicators. What caught my eye was their work on 12-month moving average (MA) crossovers, which offered the...

READ MORE

MEMBERS ONLY

S&P 500, Bitcoin & XLK: What the Charts Are Saying Now

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this video, Frank dives into some of his favorite features on StockCharts.com. He then dissects the S&P 500 and Bitcoin price action, before exploring the the XLK Technology ETF's explosive move off the lows. He also highlights a few recent trade ideas and setups...

READ MORE

MEMBERS ONLY

Not All Price Gaps Are the Same! Here's How to Trade Them

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Learn how to analyze stock price gaps with Dave! In this video, Dave discusses the different types of price gaps, why all price gaps are not the same, and how you can use the StockCharts platform to identify key levels and signals to follow on charts where price gaps occur....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #19

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Industrials surge to #1 in sector ranking, replacing Real Estate in top 5

* Communication Services showing vulnerability, moving into weakening quadrant

* Utilities and Consumer Staples losing momentum but maintaining leading positions

* Portfolio maintains defensive positioning despite underperformance vs SPY

Sector Rotation Shakeup: Industrials Take the Lead

Another week...

READ MORE

MEMBERS ONLY

Emerging Stocks to Watch – Breakouts, Momentum & Upgrades!

by Mary Ellen McGonagle,

President, MEM Investment Research

Looking for breakout stocks and top market leaders? Follow along as Mary Ellen shares stock breakouts, analyst upgrades, and sector leadership trends to help you trade strong stocks in today's market.

In this week's episode, Mary Ellen reveals the stocks leading the market higher and explains...

READ MORE

MEMBERS ONLY

S&P 500 Now in Weakest Seasonal Period... Or Is It?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* "Sell in May" is less about weakness in the spring and more about weakness in the autumn months.

* Since the COVID low, the S&P 500 has usually been quite strong in May-June-July.

* We're watching the SPX 5750 level along with other indicators...

READ MORE

MEMBERS ONLY

The Stock Market's Comeback: Key Takeaways for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500, Nasdaq, and Dow Jones all broke above their 200-day moving averages and signaled renewed strength.

* AI stocks like NVDA and PLTR posted double-digit gains, highlighting continued momentum in AI-driven investing opportunities.

* Investors are rotating into offensive sectors like Technology and Consumer Discretionary.

If...

READ MORE

MEMBERS ONLY

Applying Dow Theory to Today's Market: Are We in a Reversal or a New Trend?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Despite being over 100 years old, Dow Theory can still help you identify major turning points in the market.

* Like market breadth and sentiment indicators, many tools might enhance Dow's basic tenets.

* Secondary trends are vulnerable to geopolitical risk, so continue monitoring what's happening...

READ MORE

MEMBERS ONLY

What Sector Rotation Says About the Market Cycle Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Where are we in the market cycle? In this video, Julius reviews the sector rotation and asset class performance from the past 2-3 weeks to provide an objective take on where we stand in the current market cycle. Using his signature Relative Rotation Graphs (RRG), he uncovers shifts in momentum...

READ MORE

MEMBERS ONLY

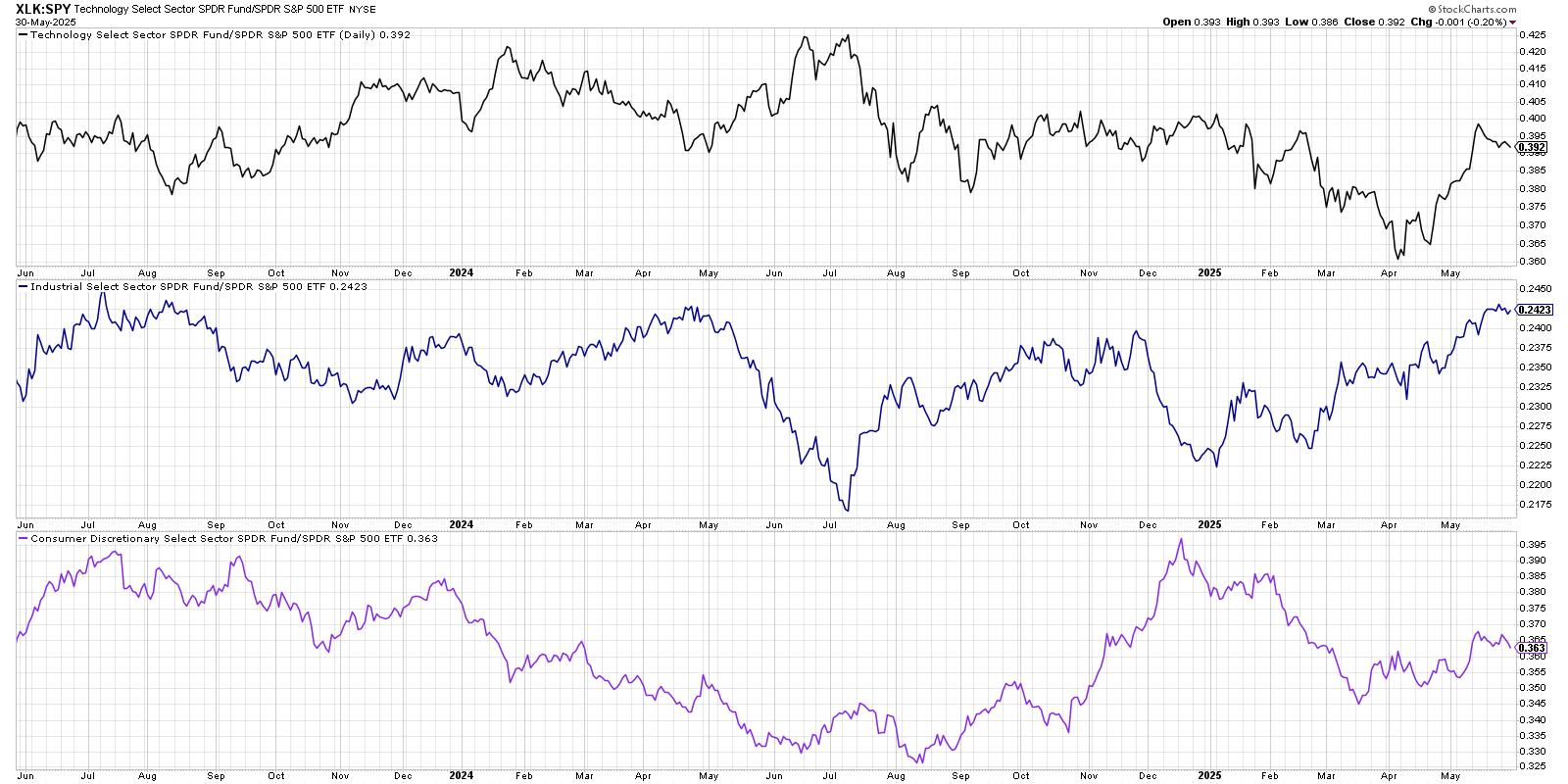

The S&P 500 Snapped Back Hard: Now What?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

KEY TAKEAWAYS

* The S&P 500's 14-week RSI hit its lowest point since the 2008 financial crisis.

* Sector ETFs like XLK (Technology) and XLI (Industrials) are showing bullish patterns.

* While the stock market's rapid reversal is encouraging, historical trends show that pullbacks often follow oversold...

READ MORE

MEMBERS ONLY

Is It Time for Emerging Markets to Emerge?

by Martin Pring,

President, Pring Research

The US market has been recovering nicely since the April low, but it has actually been outperformed by the rest of the world this year so far. In that respect, Chart 1 shows that a major shift away from the US could well be in the cards.

It is evident...

READ MORE

MEMBERS ONLY

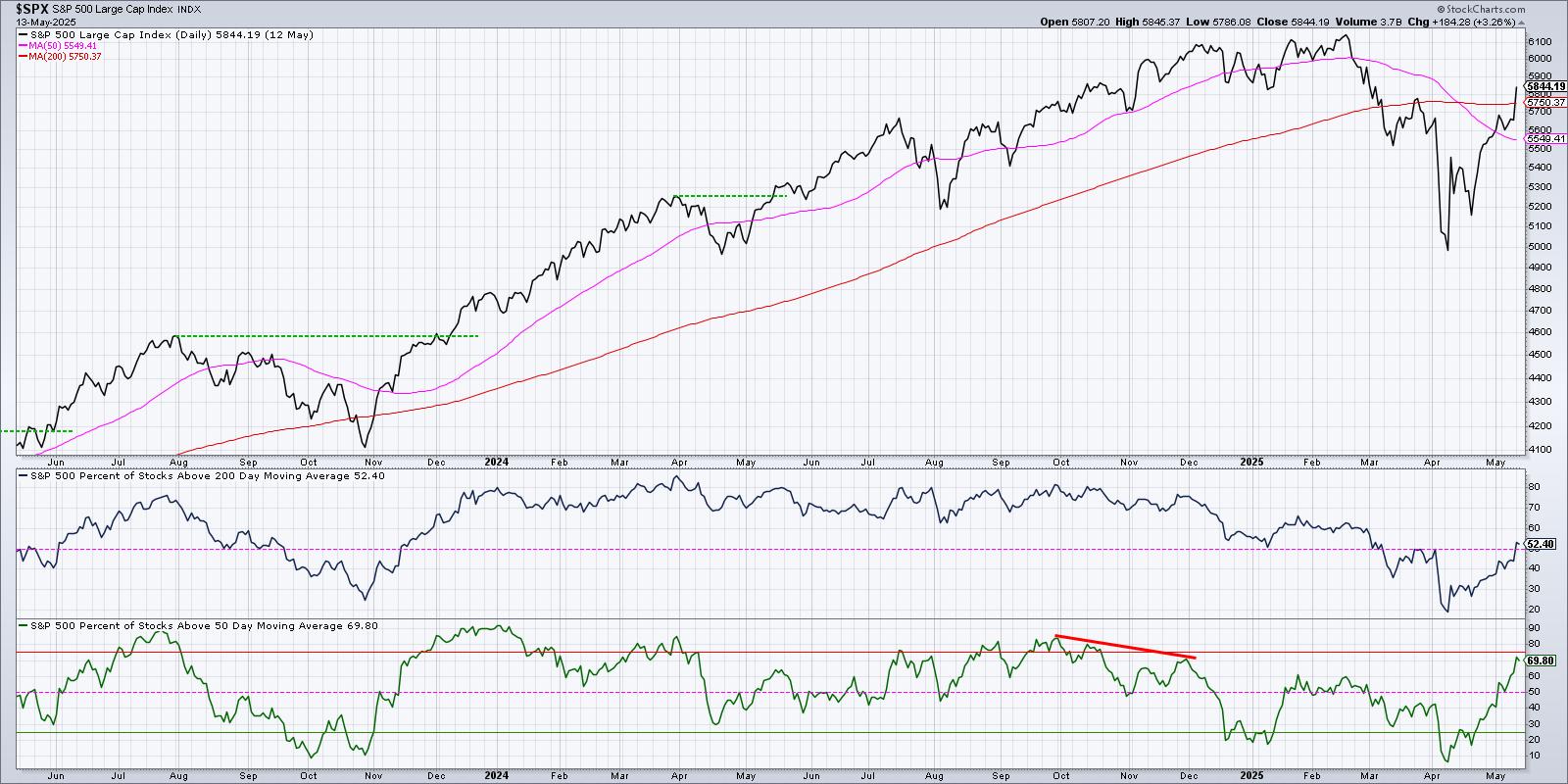

Bullish Breadth Improvement Suggests Further Upside for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

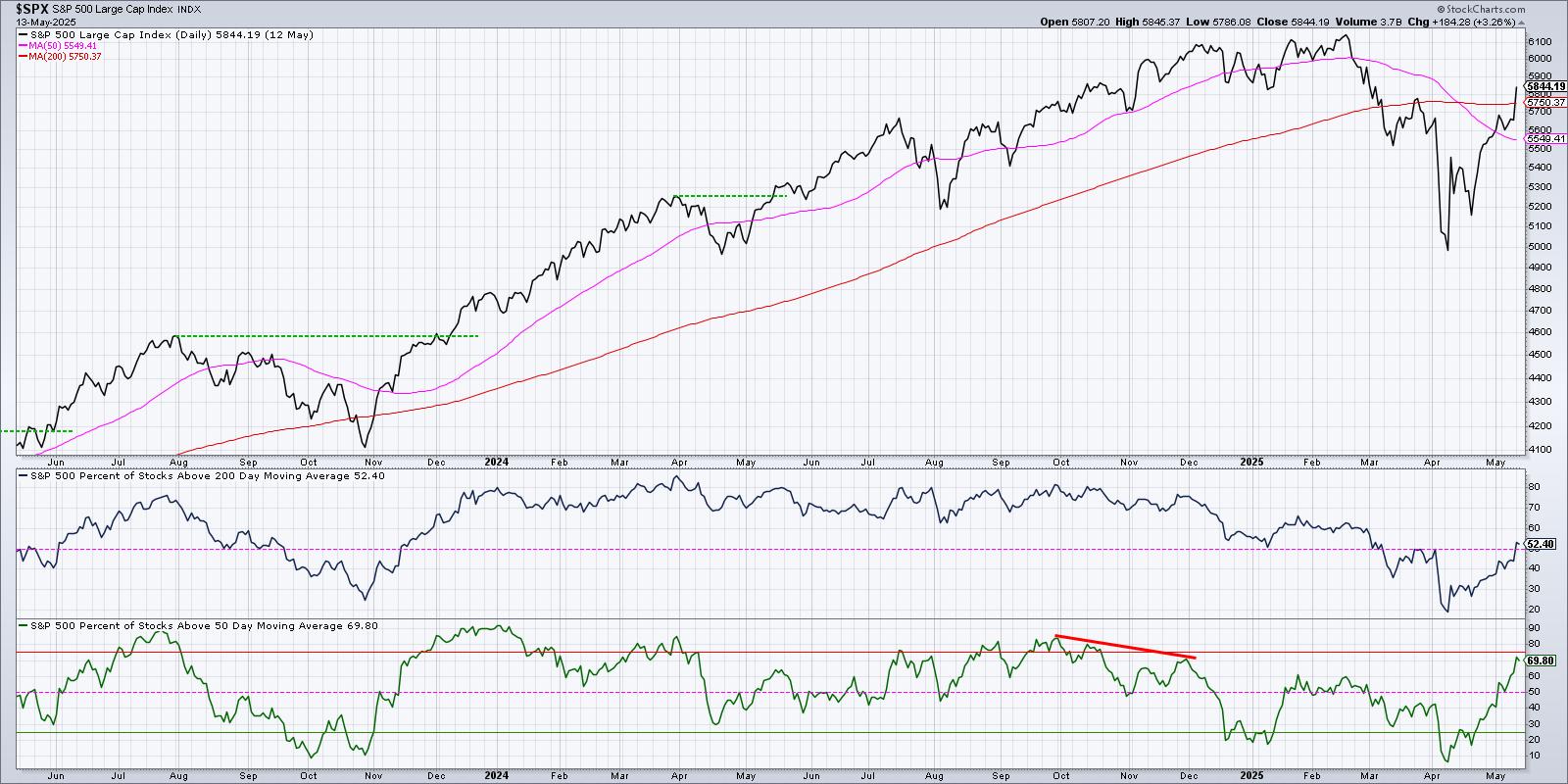

KEY TAKEAWAYS

* For the first time since early March, over 50% of S&P 500 members are above their 200-day moving average.

* When this long-term breadth indicator has gone from below 25% to above 50%, forward 12-month returns have been positive.

* Investors should keep a watchful eye on the...

READ MORE

MEMBERS ONLY

50% of S&P 500 Stocks Just Turned Bullish – What Happens Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Bullish signal alert! Over 50% of S&P 500 stocks are now above their 200-day moving average.

In this video, Dave explains this key market breadth indicator and what it means for stock market trends. He shows how moving average breadth has reached a bullish milestone, what this means...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* All 11 sectors changed positions, but the top-5 / bottom-6 composition remained the same.

* Utilities now strongest sector, despite overall market strength.

* Communication Services jumped from 5th to 2nd place.

* Portfolio still 3% behind the S&P 500 YTD, unchanged from last week.

Sector Shuffle: Same Players, New...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays in Technically Challanging Environment; Price Action Against These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Amid ever-increasing uncertainties on the global front and similarly rising geopolitical tensions between India and Pakistan, the Indian equity markets demonstrated strong resilience, consolidating before ending the week on just a modestly negative note. The trading range remained modest; the Nifty oscillated in a 590-point range. While the markets defended...

READ MORE

MEMBERS ONLY

Recession Ahead? Sector Rotation Model Warns of Rising Risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Is a recession coming? In this video, Julius breaks down the latest updates to his powerful Sector Rotation Model, analyzing four key macroeconomic indicators and their impact on sector performance.

This video was originally published on May 9, 2025. Click on the icon above to view on our dedicated page...

READ MORE

MEMBERS ONLY

Where the Market Goes Next: Key Resistance Levels + Top Bullish Stocks to Watch Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Want to know where the stock market is headed next? In this week's market update, Mary Ellen McGonagle analyzes key resistance levels and reveals what's fueling the current uptrend. She highlights top bullish setups among U.S. leadership stocks, plus global names showing strength.

This video...

READ MORE