MEMBERS ONLY

Master Multi-Timeframe Analysis to Find Winning Trades!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shares how to use multi-timeframe analysis — Monthly, Weekly, and Daily charts — to find the best stock market opportunities. See how Joe uses StockCharts tools to create confluence across timeframes and spot key levels. Joe then identifies strength in commodities, QQQ, and finishes up by...

READ MORE

MEMBERS ONLY

Stock Market Momentum Slows Down: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tuesday's stock market action was lackluster with not much movement in either direction.

* Lack of followthrough from the previous trading day's upside action shows uncertainty is still in the air.

* Keep an eye on the health of the overall U.S. economy by monitoring...

READ MORE

MEMBERS ONLY

DP Trading Room: Tariffs Narrowing, Sparks Market Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

Over the weekend it was announced that tariffs will be narrowing and possibly not as widespread as initially thought. Negotiations are continuing in the background and this seems to be allaying market participants' fears. The market rallied strongly on the news.

Carl and Erin gave you their opinions of...

READ MORE

MEMBERS ONLY

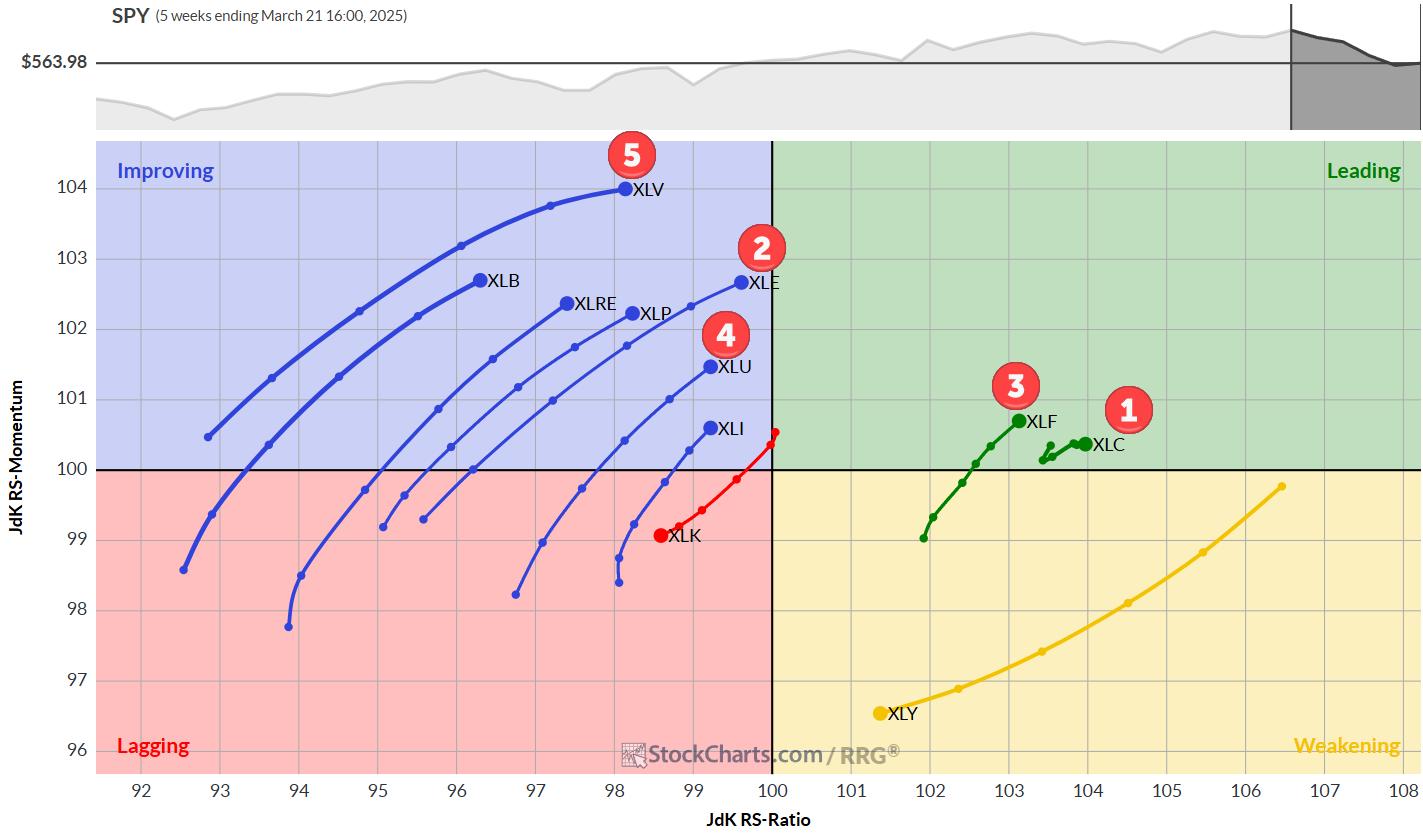

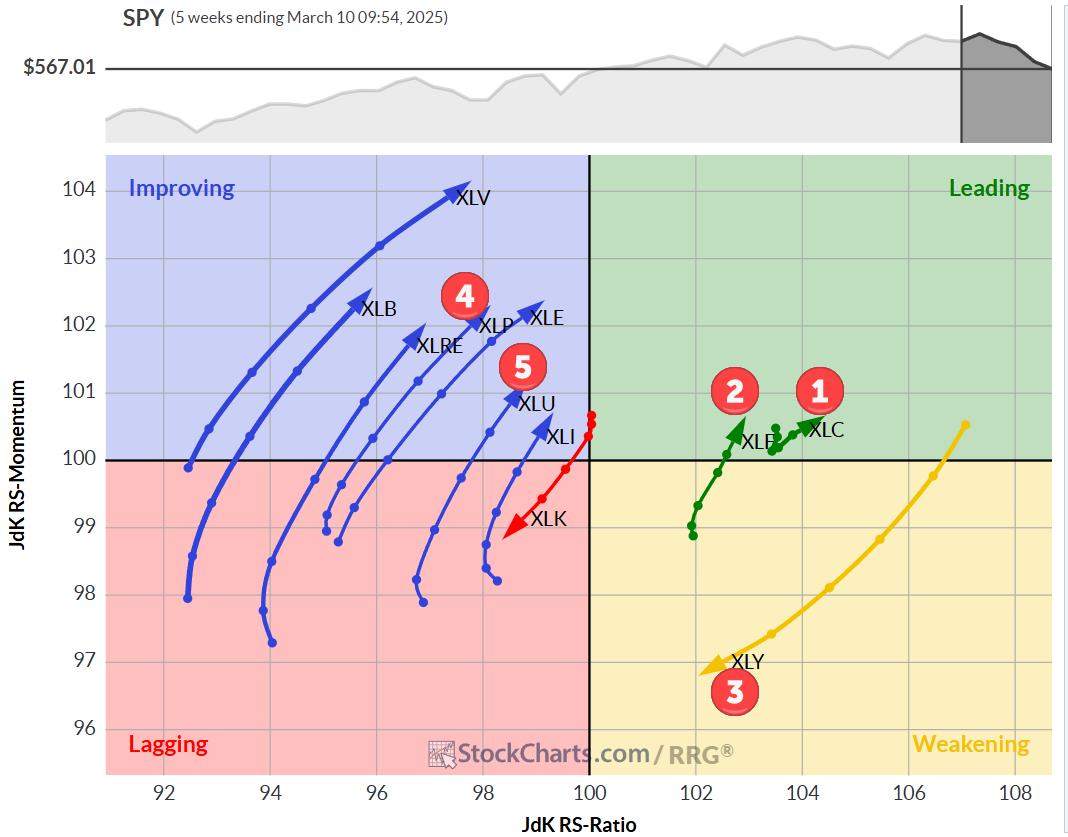

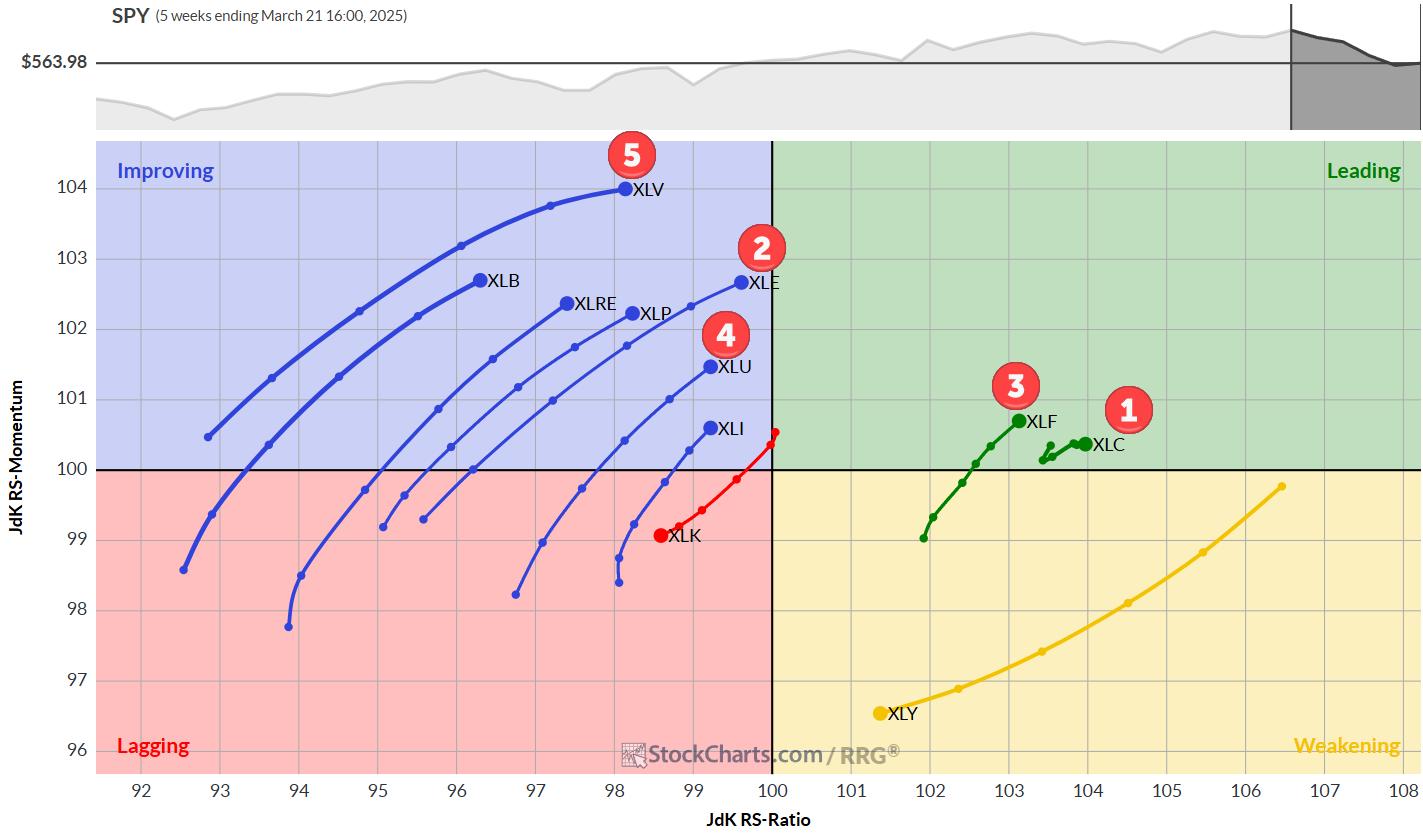

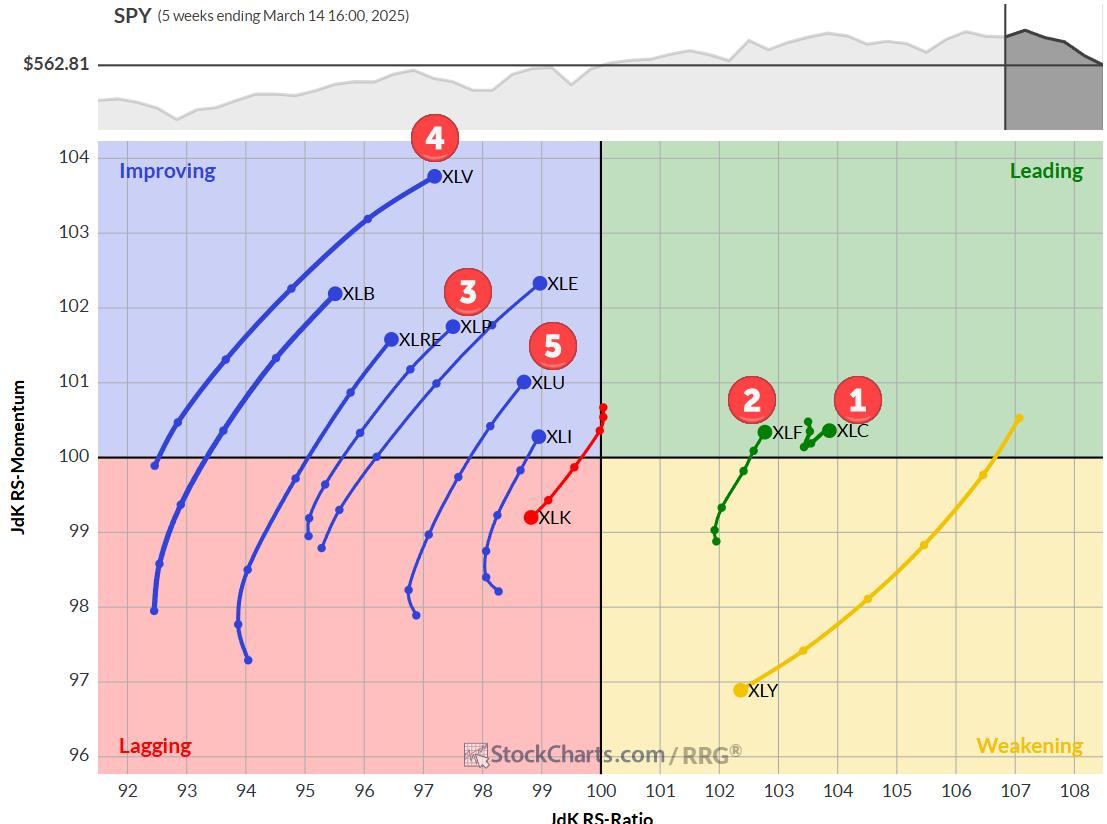

The Best Five Sectors, #12

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector jumps to position #2 in top 5

* Consumer Staples drops out of portfolio

* Communication Services remains at #1 spot

* Modest pick up of relative momentum for XLK and XLY not enough yet

Energy Jumps to #2

A big move for the energy sector last week as...

READ MORE

MEMBERS ONLY

Uncover the Week's Key Stock Market Movements

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Price action was sideways this week, with a lot of up and down movement.

* FedEx's weak guidance sent the stock price sliding 6.45%.

* Precious metals rally with gold prices hitting an all time high this week.

If one word could characterize this week's...

READ MORE

MEMBERS ONLY

American Association of Individual Investors (AAII) Breaks Record

by Erin Swenlin,

Vice President, DecisionPoint.com

We wrote about the American Association of Individual Investors (AAII) poll results a few weeks ago. Since then, the bearish activity on the chart has broken a record for the poll. Going back to the poll's inception in 1987, we have never seen four weeks in a row...

READ MORE

MEMBERS ONLY

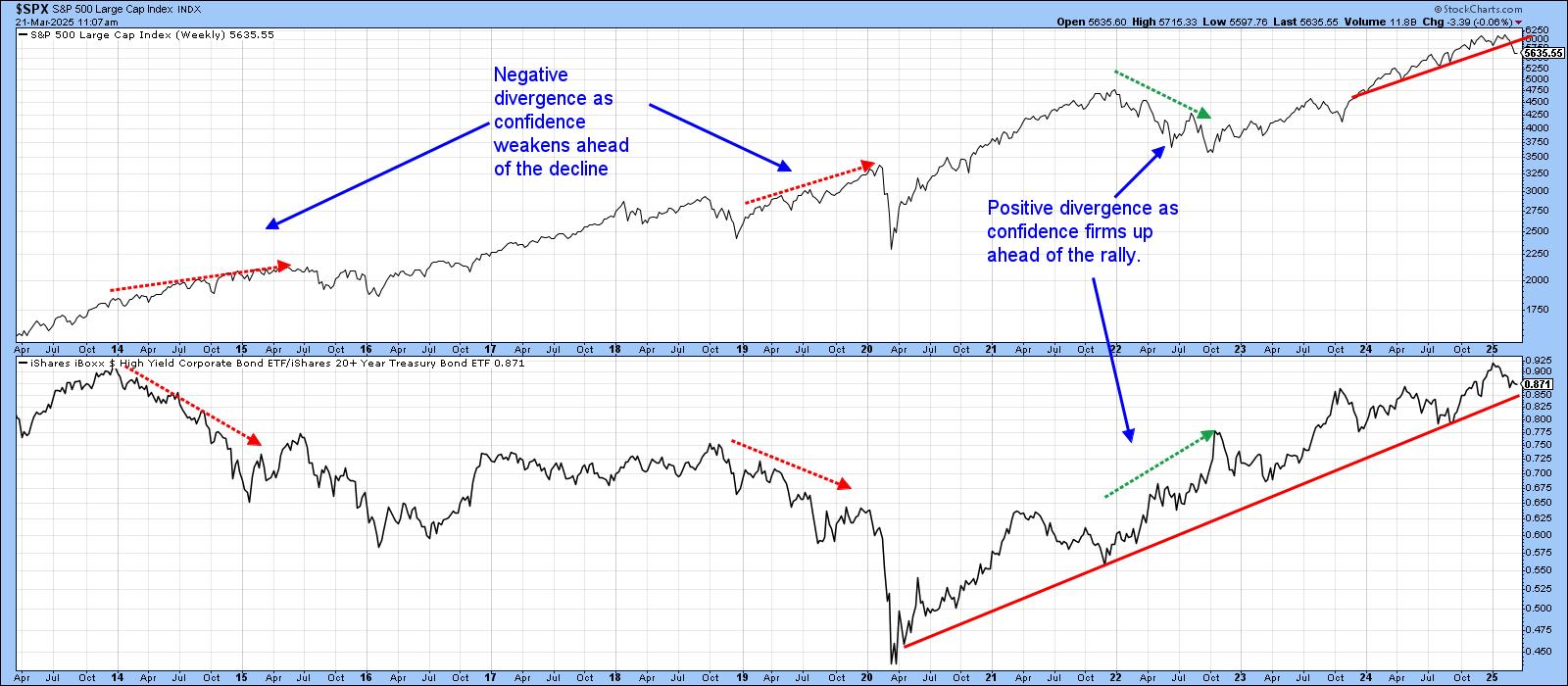

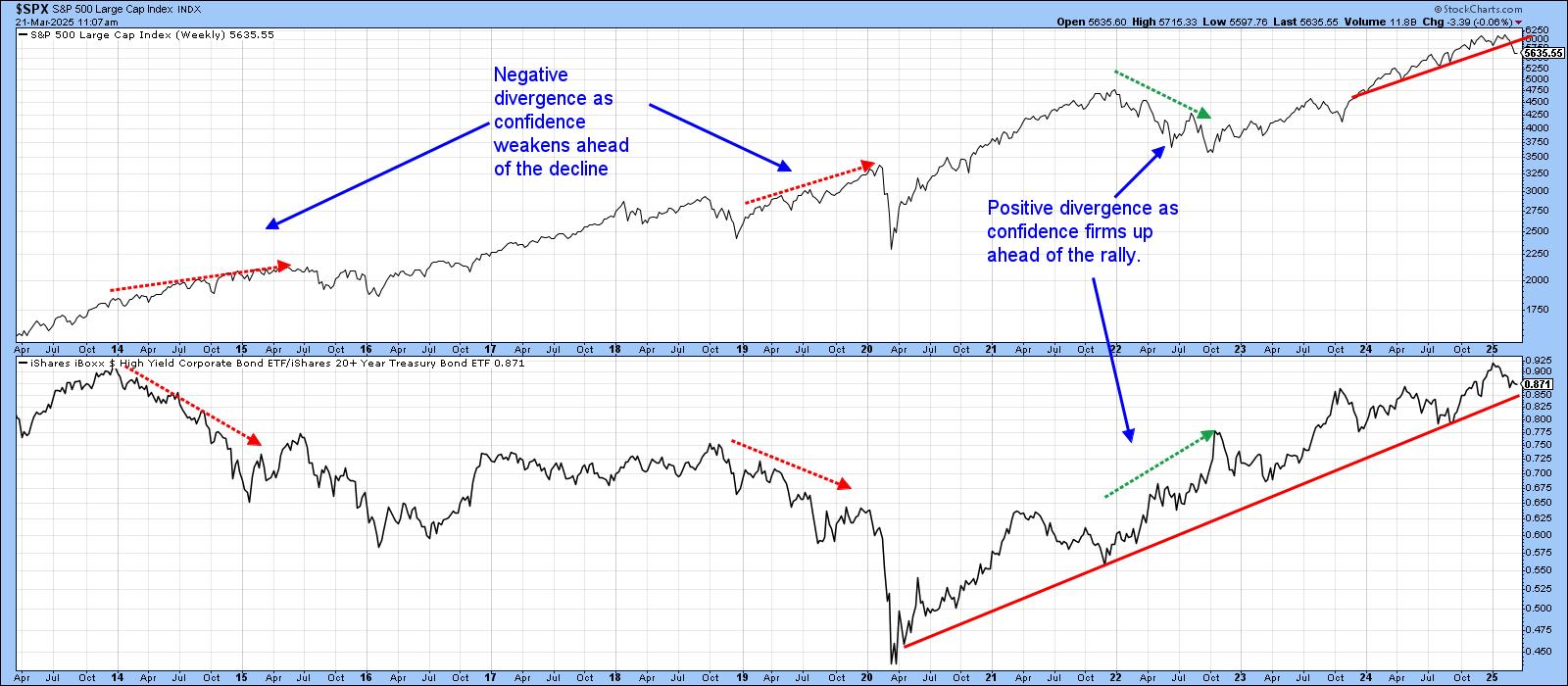

Confidence Ratios are in an Uptrend, But Looking Vulnerable

by Martin Pring,

President, Pring Research

At this week's news conference, Jerome Powell mentioned that the Fed is cautious about making significant changes to interest rates due to unclear economic conditions, citing factors like trade policies and inflation, which have contributed to this uncertainty. If the "experts" don't know, it&...

READ MORE

MEMBERS ONLY

Two Ways to Use the Zweig Breadth Thrust - Plus an Added Twist

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The Zweig Breadth Thrust is best known for its bullish reversal signals.

* Traders can also use the "setup" period to identify oversold conditions.

* Nasdaq stocks were left out of the original, but there is solution.

The Zweig Breadth Thrust is best known for its bullish reversal...

READ MORE

MEMBERS ONLY

Will QQQ Retest All-Time Highs By End of April?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

After reaching an all-time around $540 in mid-February, the Nasdaq 100 ETF (QQQ) dropped almost 14% to make a new swing low around $467. With the S&P 500 and Nasdaq bouncing nicely this week, investors are struggling to differentiate between a bearish dead-cat bounce and a bullish full...

READ MORE

MEMBERS ONLY

New SPX Correction Signal! How Long Will It Last?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe breaks down a new SPX correction signal using the monthly Directional Lines (DI), showing why this pullback could take time to play out. He explains how DI lines influence the ADX slope and how this impacts shorter-term patterns. Joe also reveals a strong area...

READ MORE

MEMBERS ONLY

Stock Market Shifts Gears: Indexes Plunge After Climb

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes break their two day winning streak.

* Gold prices hit a new all-time high.

* European stocks are in a solid uptrend.

Tuesday's stock market action marked a reversal in investor sentiment, with the broader indexes closing lower. The S&P 500...

READ MORE

MEMBERS ONLY

Riding the Wave: What the Stock Market Rebound Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes rebounded with Real Estate, Energy, and Consumer Staples leading.

* Retail sales data for February were slightly below expectations but better than January's data.

* Investors are looking forward to Wednesday's FOMC meeting to hear what the committees thoughts are on economic...

READ MORE

MEMBERS ONLY

4 Scenarios for Nasdaq 100: Bullish Surge or Bearish Collapse?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Can the Nasdaq 100 rally to all-time highs or break down below key support? In this video, Dave uses probabilistic analysis to explore 4 possible scenarios for the QQQ over the next 6 weeks — from a super bullish surge to a bearish breakdown below the August 2024 low. Discover the...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax?

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday DP indicators logged an Upside Initiation Climax. This exhaustion events often mark the beginning of new rallies and could indicate that the market is indeed ready to rebound. However, we do question its veracity given lukewarm trading to begin Monday's trading.

Carl started us off by...

READ MORE

MEMBERS ONLY

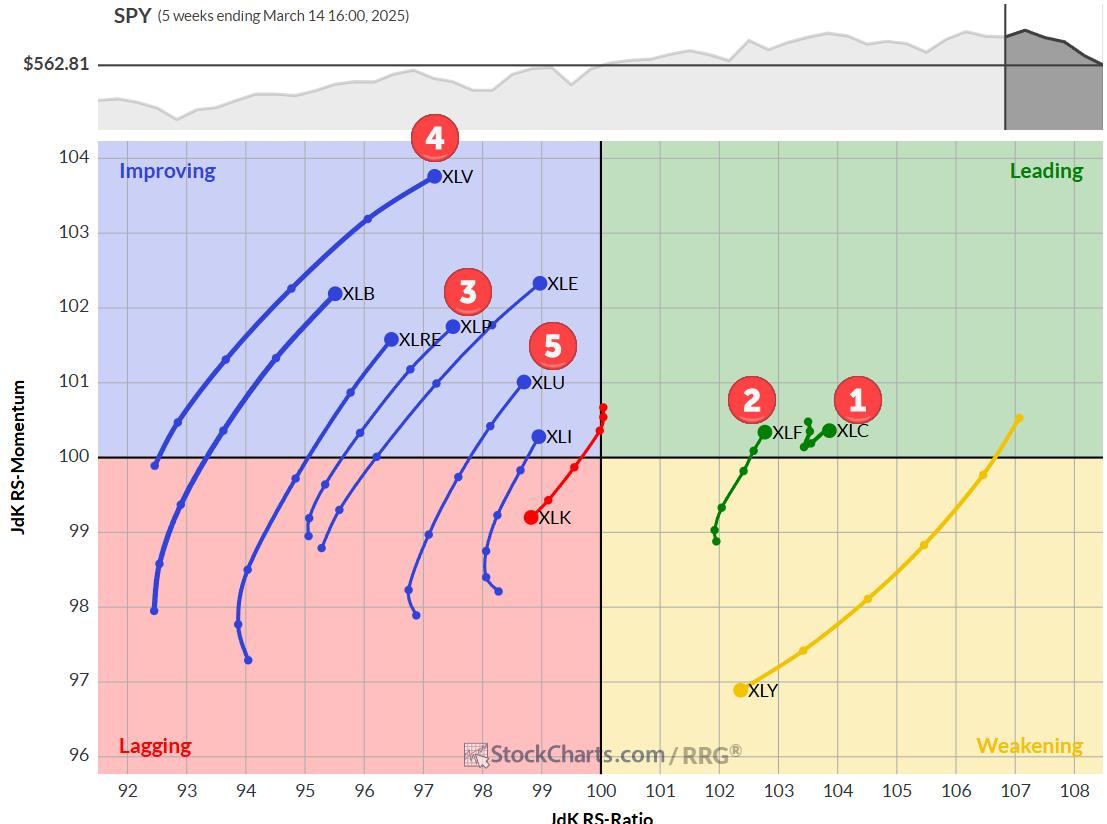

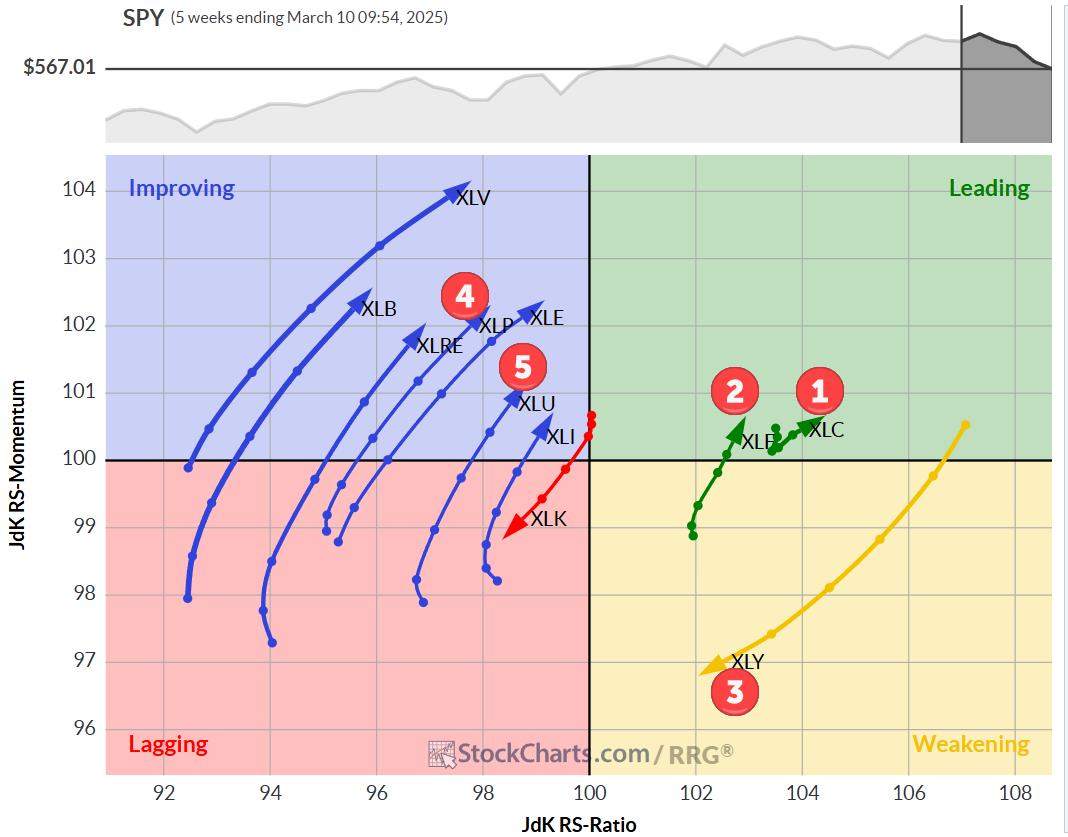

The Best Five Sectors, #11

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* At the moment, we're seeing a big shakeup in sector rankings.

* Healthcare has entered the top five.

* Technology is dropping to last position.

* All defensive sectors are now in the top five.

Big Moves in Sector Ranking

The ranking of US sectors continues to shift. At...

READ MORE

MEMBERS ONLY

Why the Market is Ready to Rally!

by Larry Williams,

Veteran Investor and Author

In this exclusive video, legendary trader Larry Williams breaks down why the stock market is primed for a rally, using technical analysis, fundamental signals, and seasonal trends. He explains how tariffs, crude oil, and cyclical patterns could fuel the next big market surge, plus stocks to watch during this potential...

READ MORE

MEMBERS ONLY

Three Reasons to Consider Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Gold has dramatically outperformed the S&P 500 and Nasdaq in 2025.

* Gold prices remain in a primary uptrend, with our Market Trend Model reading bullish on all time frames.

* Gold stocks are outperforming physical gold, and could represent a "catch up" trade going into...

READ MORE

MEMBERS ONLY

Is a New Market Uptrend Starting? Key Signals & Trading Strategies

by Mary Ellen McGonagle,

President, MEM Investment Research

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal. She dives into sector rotation, explains why defensive stocks are losing ground, and shares actionable short-term trading strategies for oversold stocks....

READ MORE

MEMBERS ONLY

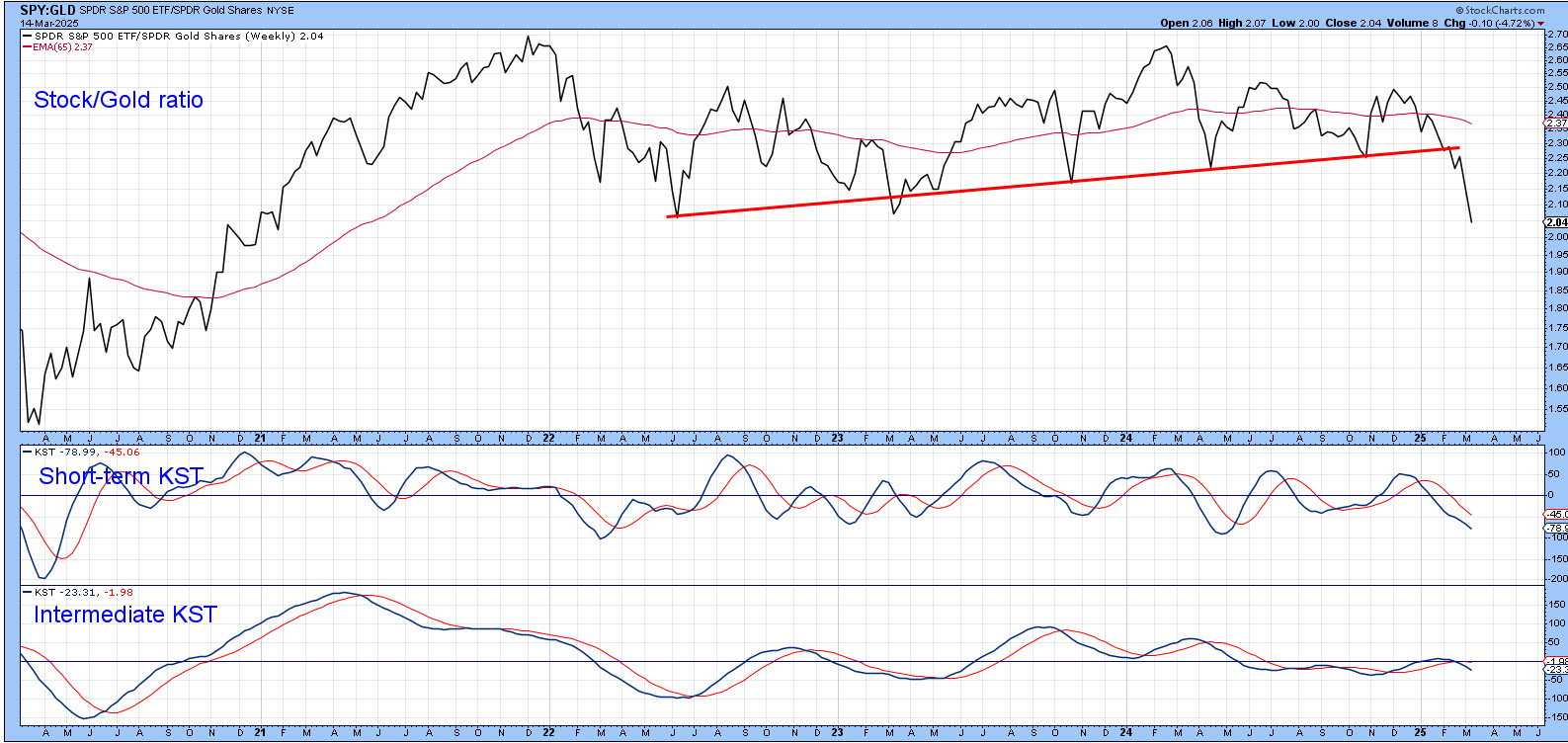

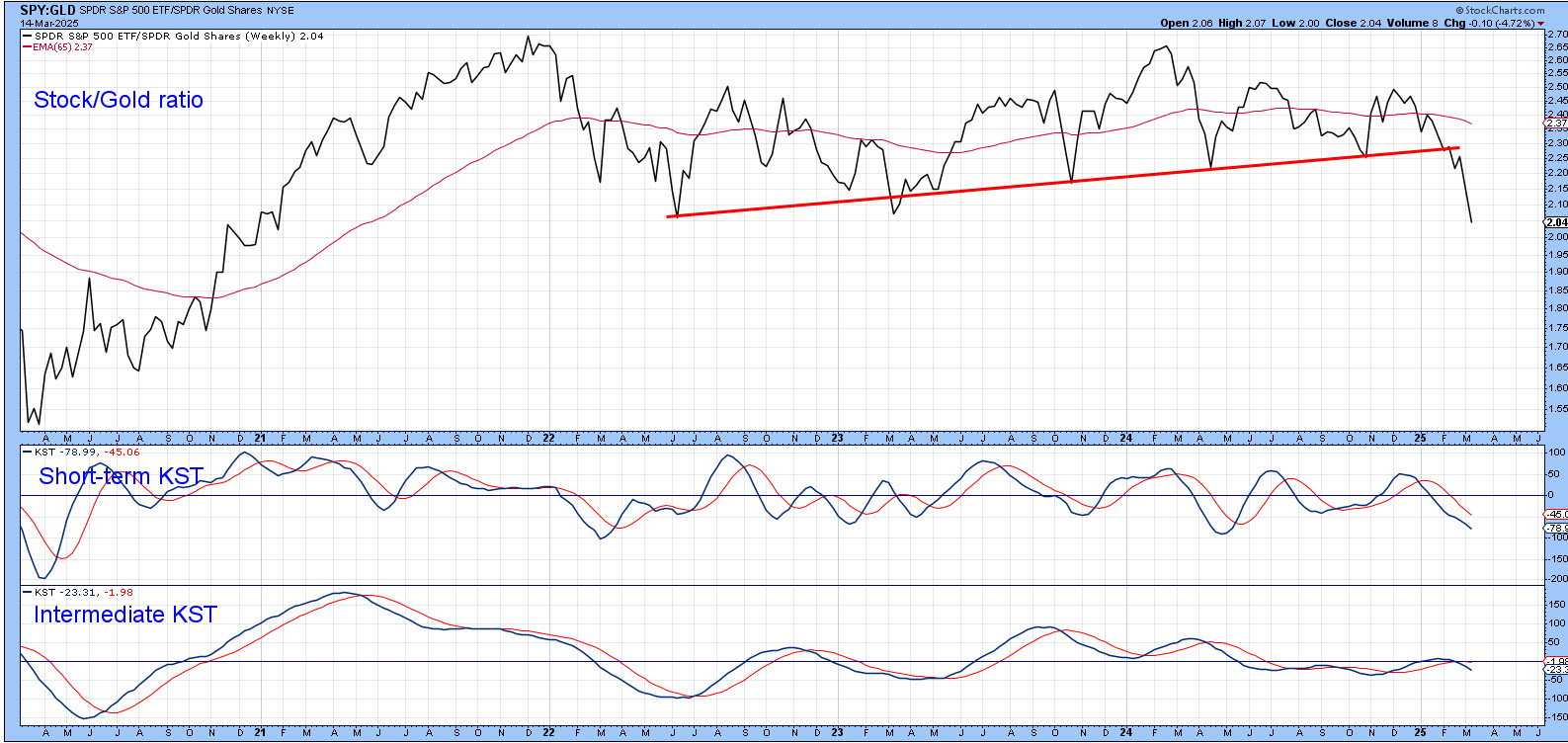

Stocks May No Longer Be the Preferred Asset Class

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote that stocks were beginning to slip against the gold price. Chart 1 shows that the ratio has now decisively broken below an important uptrend line, marking the lower region of a three-year top. The short-term KST is currently oversold, so some kind of...

READ MORE

MEMBERS ONLY

SPY Reverses Long-term Uptrend with Outsized Move - Now What?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SPY reverses uptrend with sharpest decline in over two years.

* Large-caps underperform the average S&P 500 stock.

* Broken support and 40-week SMA turn resistance.

The weight of the evidence shifted to the bears over the last few weeks. First, the major index ETFs reversed their long-term...

READ MORE

MEMBERS ONLY

Sector Rotation Breakdown: Spotting Market Leaders Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes US sector rotation using Relative Rotation Graphs (RRG), starting with the 11 S&P sectors and breaking them into Offensive, Defensive, and Sensitive sectors to uncover unusual market rotations. He then dives into the Financials sector, identifying top stocks with potential for...

READ MORE

MEMBERS ONLY

Bearish ADX Signal on S&P Plays Out - Now What?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe revisits a critical ADX signal that gave a major market warning, explaining the pattern and a new low ADX setup to watch. He breaks down SPY and QQQ support zones, sector rotation, and reviews viewer symbol requests including T, WBD, and more. Don'...

READ MORE

MEMBERS ONLY

How to Spot a Market Rebound Before Everyone Else Does

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* While the major indices represent the market's state, their market cap weighting can sometimes distort what's happening internally.

* Breadth indicators like the McClellan Oscillator provide insight into the internal dynamics of the market.

* Understanding how market participation happens within an index can help you...

READ MORE

MEMBERS ONLY

Stock Market Dips Below 200-Day Moving Average: Are Your Investments Ready for a Shift?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader indexes are breaking down technically, but their one-year performance is in positive territory,

* Percentage performance charts give a different perspective on the stock market's performance.

* Monitor percentage performance and market breadth to look for any signs of reversal.

The S&P 500 ($SPX)...

READ MORE

MEMBERS ONLY

5 Strong Stocks Defying the Bearish Market!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes the bearish rotation in his Market Trend Model, highlighting the S&P 500 breakdown below the 200-day moving average and its downside potential. He also identifies five strong stocks with bullish technical setups despite market weakness. Watch now for key technical analysis insights to...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Sell-Off

by Erin Swenlin,

Vice President, DecisionPoint.com

The market sell-off continued in earnest after a brief respite on Friday. Uncertainty of geopolitical tensions and tariff talk has spooked the market and given the weakness of mega-cap stocks, we are likely to see more downside before a snapback rally.

Carl was off today so Erin had the controls!...

READ MORE

MEMBERS ONLY

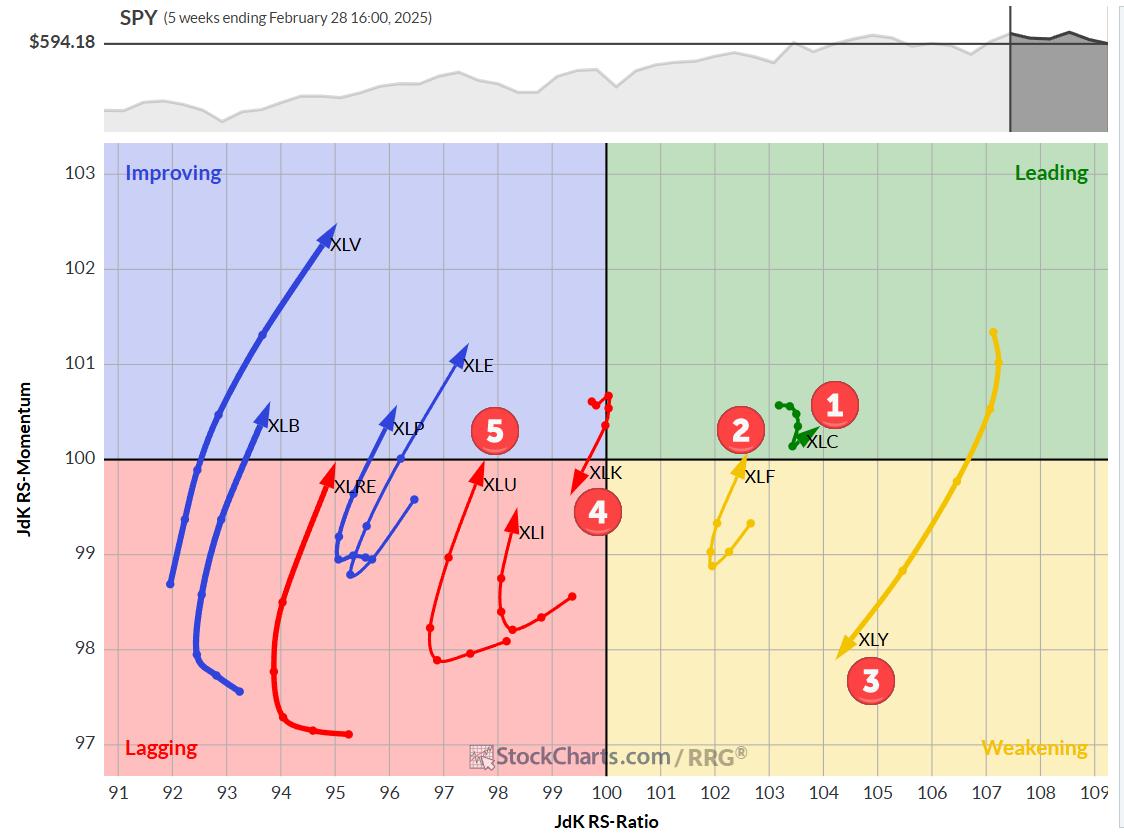

The Best Five Sectors, #10

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

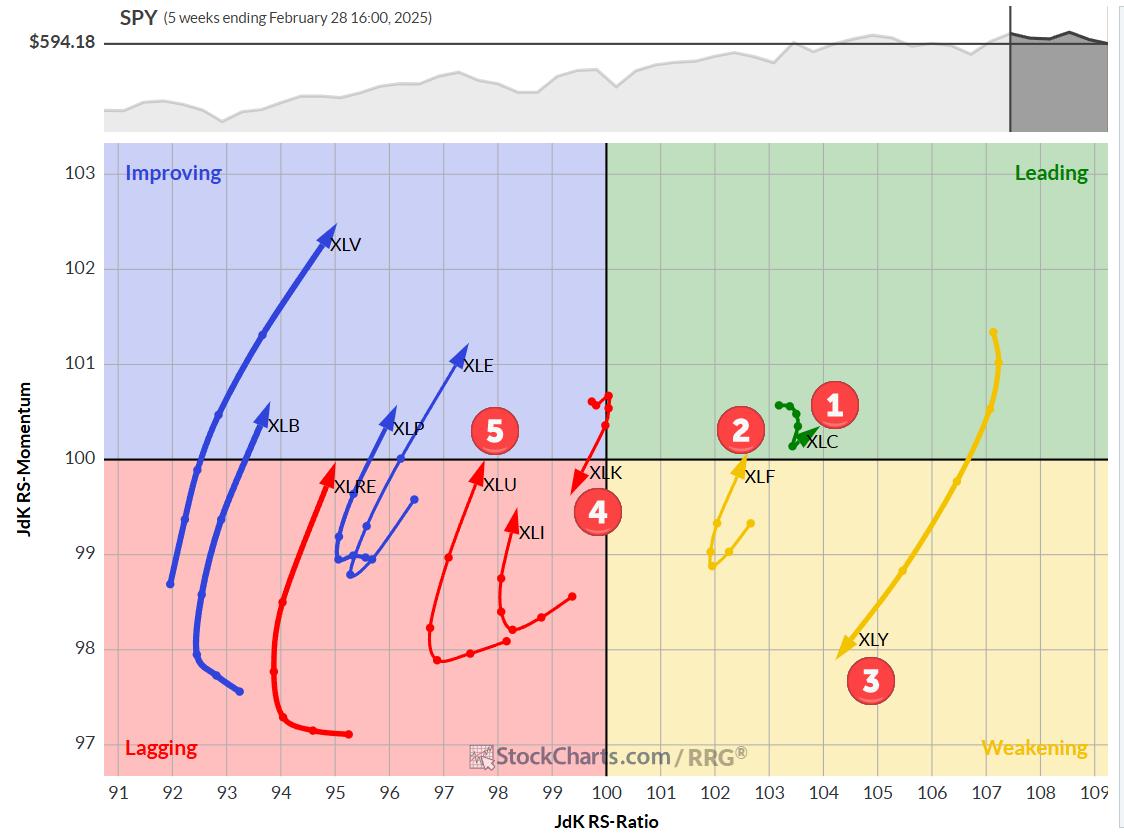

KEY TAKEAWAYS

* Communication Services (XLC) maintains top spot, Tech (XLK) plummets

* Shift towards defensive sectors evident in rankings

* Consumer Discretionary (XLY) showing signs of weakness

* Portfolio slightly outperforming SPY benchmark

Sector Shake-Up: Defensive Moves and Tech's Tumble

Last week's market volatility stirred up the sector rankings,...

READ MORE

MEMBERS ONLY

Up Now, Down Later?

by Martin Pring,

President, Pring Research

The Hysteria

Last week I saw more references to the stock market and its sharp drop on cable TV than I can ever recall.

Normally, as Humphrey Neil, the father of contrarian thinking put it, "When everyone thinks the same, everyone is usually wrong." That's because...

READ MORE

MEMBERS ONLY

Sector Rotation Warning: More Downside Ahead for US Markets?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes sector rotation in US markets, assessing recent damage and potential downside risks. He examines the Equal Weight RSP vs. Cap-Weighted SPX ratio and the stocks vs. bonds relationship to identify key market trends. Don't miss this deep dive into market rotation...

READ MORE

MEMBERS ONLY

My Downside Target for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Once our "line in the sand" of SPX 5850 was broken, that confirmed a likely bear phase for stocks.

* We can use Fibonacci Retracements to identify a potential downside objective based on the strength of the previous bull trend.

* A confirmed sell signal from the Newer...

READ MORE

MEMBERS ONLY

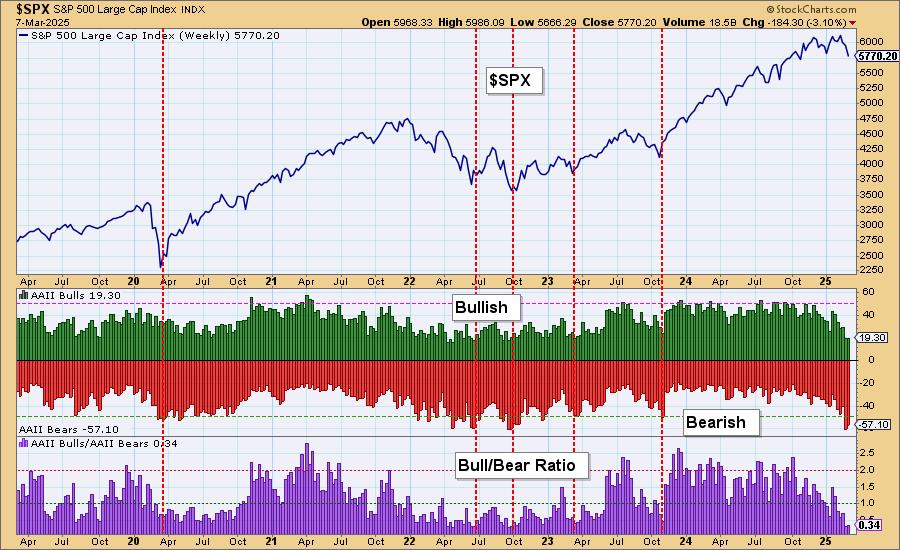

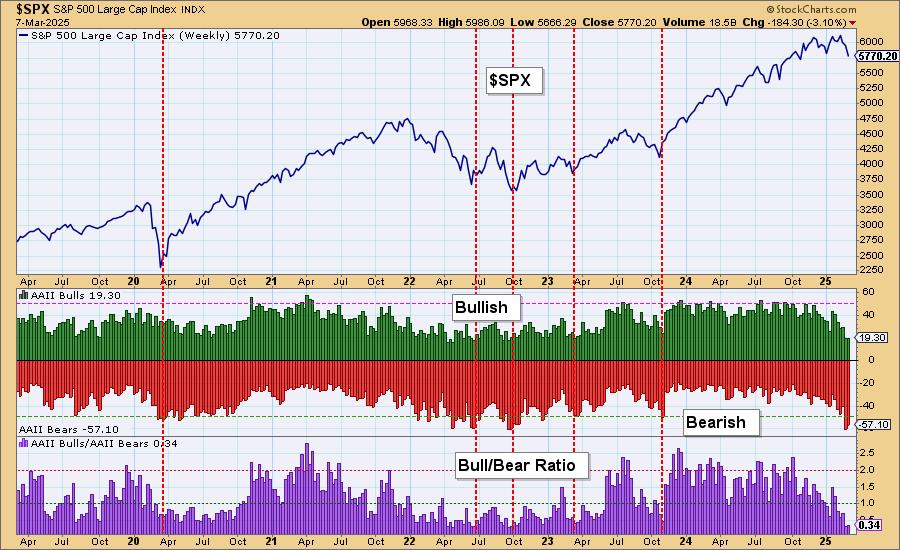

American Association of Individual Investors (AAII) Hitting Bearish Extremes

by Erin Swenlin,

Vice President, DecisionPoint.com

One thing to understand about sentiment measures is that they are contrarian. If investors are too bullish or too bearish, everyone has jumped on the bandwagon, and now it is time for the wheels to fall off.

Right now, we are seeing extraordinarily bearish sentiment coming out of the American...

READ MORE

MEMBERS ONLY

Navigating Tariffs: Master the Charts to Outsmart Market Volatility

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tariffs have caused shifts in investor sentiment.

* Investors are rotating out of offensive sectors and into defensive sectors.

* The US dollar has weakened relative to the Canadian dollar and Mexican peso.

Tariffs have thrown the stock market into dizzying moves, moving up and/or down based on whatever...

READ MORE

MEMBERS ONLY

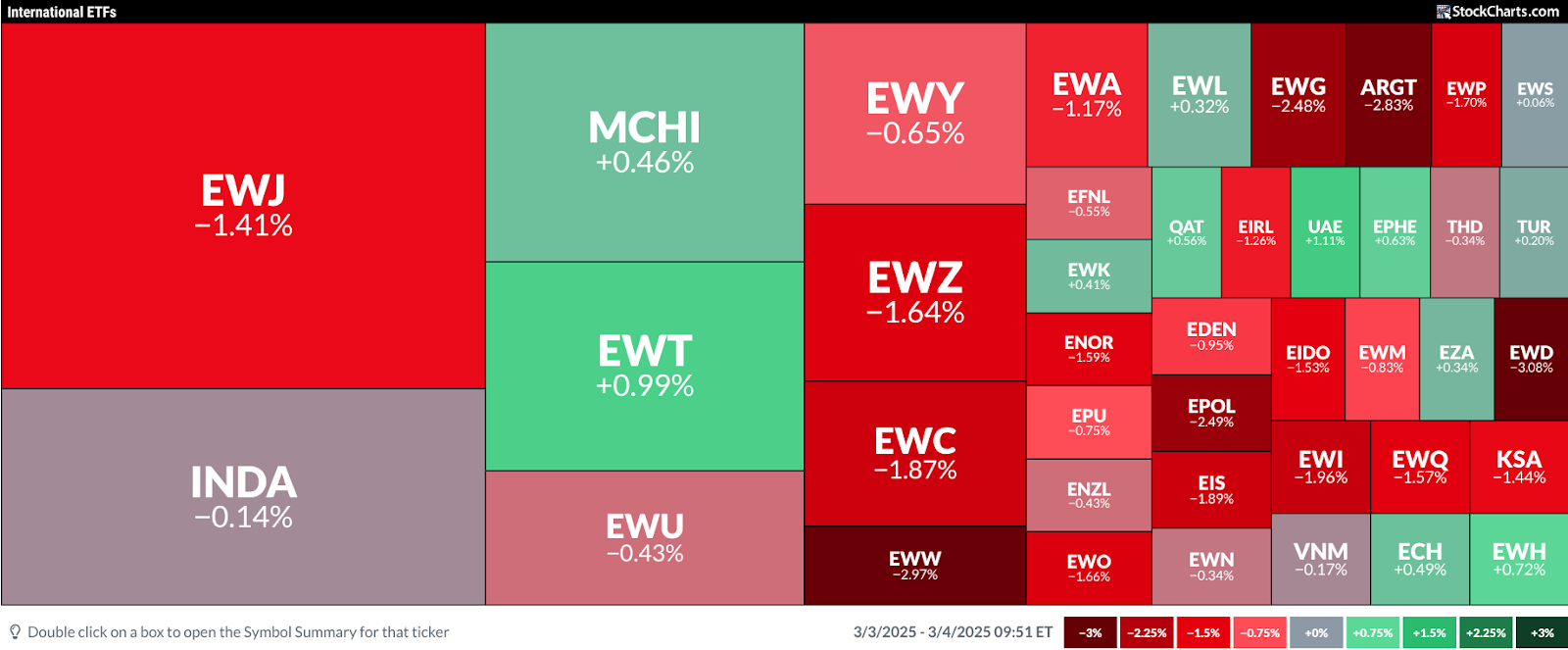

Trade War Panic: Are International Stocks the Safer Bet Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Tariffs on China, Canada, and Mexico are officially in effect.

* While US stocks have declined in response, might there be investing opportunities in international markets?

With US tariffs on Canada, Mexico, and China having taken effect at midnight on Tuesday, US indexes extended their Monday losses, deepening concerns...

READ MORE

MEMBERS ONLY

S&P 500 Selloff: Bearish Rotation & Key Downside Targets!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes market conditions, bearish divergences, and leadership rotation in recent weeks. He examines the S&P 500 daily chart, highlighting how this week's selloff may confirm a bearish rotation and set downside price targets using moving averages and Fibonacci retracements. To validate a...

READ MORE

MEMBERS ONLY

Bitcoin Faces Important Technical Test

by Martin Pring,

President, Pring Research

Over the weekend, Donald Trump declared the creation of a U.S. strategic crypto reserve, which will include Bitcoin and four other cryptocurrencies. The price immediately responded with a substantial rally over the weekend, but, by the close of business on Monday, had given up all of those gains. That...

READ MORE

MEMBERS ONLY

DP Trading Room: Bitcoin Surges!

by Erin Swenlin,

Vice President, DecisionPoint.com

The news is that the United States will have a Cryptocurrency reserve. How this will occur is still murky, but Bitcoin surged on the news. Carl and Erin give you their opinion on Bitcoin's chart setup and possible future movement.

Carl opens the trading room with a review...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #9

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication services maintains top spot in sector ranking.

* Financials moves up to #2, pushing consumer discretionary down to #3.

* Technology and utilities hold steady at #4 and #5 respectively.

* Portfolio performance now on par with benchmark after recent outperformance.

Sector Rotation: Financials Climb as Consumer Discretionary Slips

While...

READ MORE

MEMBERS ONLY

New Indicator for Your Toolbox

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of our regular market review in the DP Alert, we have begun to notice a very good indicator to determine market weakness and strength. It may not be new to all of you, but we've found as of late that this indicator tells a story.

We...

READ MORE

MEMBERS ONLY

Sector Rotation & Seasonality: What's Driving the Market Now?"

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes seasonality for U.S. sectors and aligns it with current sector rotation. He explores how these trends impact the market (SPY) and shares insights on potential movements using RRG analysis. By combining seasonality with sector rotation, he provides a deeper look at market...

READ MORE

MEMBERS ONLY

Hidden MACD SIGNAL? Key Trade Signals Explained!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe breaks down reverse divergences (hidden divergence), key upside & downside signals, and how to use ADX and Moving Averages for better trades! Plus, he examines market trends and viewer symbol requests!

This video was originally published on February 26, 2025. Click this link to...

READ MORE