MEMBERS ONLY

Be ALERT for Warning Signs - S&P 500 Downturn

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe goes into detail on the S&P 500 ETF (SPY), sharing why using MACD and ADX together can be beneficial -- especially in the current environment. He touches on Sentiment, Volatility and Momentum, pointing to reasons why we need to be on alert...

READ MORE

MEMBERS ONLY

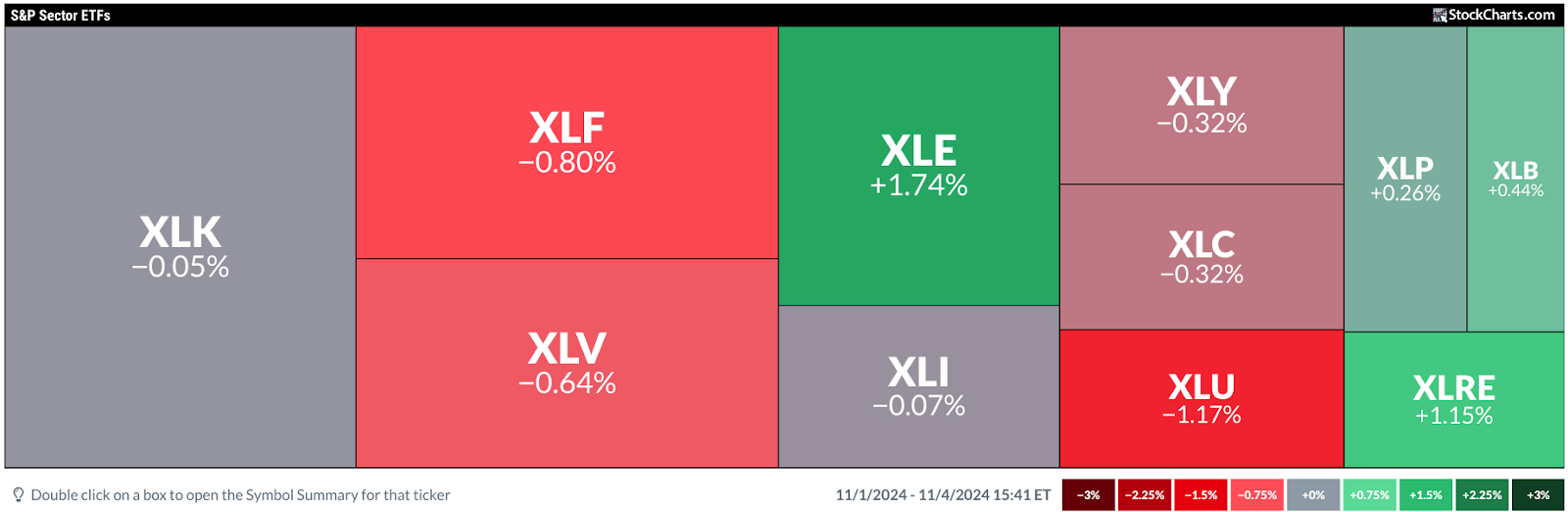

Sector Rotation Suggests Offense Over Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Relative strength trends show a recent rotation into Consumer Discretionary, Communication Services, Financials, and Energy.

* The offense to defense ratio still favors "things you want" over "things you need."

* RRG charts give a fairly clear roadmap of what to look for rotation-wise into early...

READ MORE

MEMBERS ONLY

Three Ways Top Investors Track Sector Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave outlines three tools he uses on the StockCharts platform to analyze sector rotation, from sector relative strength ratios to the powerful Relative Rotation Graphs (RRG). Dave shares how institutional investors think about sector rotation strategies, evaluating the current evidence to determine how money managers are allocating...

READ MORE

MEMBERS ONLY

Macro Market Outlook and Best Options Trade Ideas!

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs. value, current sector rotation, key earnings, and more.

This video premiered...

READ MORE

MEMBERS ONLY

Stocks: "...a PERMANENTLY high plateau"?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently. We talk about the quote: "Stock prices have reached 'what looks like a permanently high plateau,...

READ MORE

MEMBERS ONLY

Don't Miss These Breakouts Poised to Trade Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reveals what took place last week and how the markets closed. She also revealed what drove price action, and what to be on the lookout for next week. In addition, she shares several stocks that broke out of powerful bases on bullish news....

READ MORE

MEMBERS ONLY

Tech Stocks Plunge: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks, especially semiconductors, get hammered.

* Treasury yields continue to rally higher in response to Fed comments and strong economy.

* The US dollar rally confirms the strength of the US economy.

"The economy is not sending any signals that we need to be in a hurry to...

READ MORE

MEMBERS ONLY

Are the Magnificent 7 Still the Kings of Wall Street?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Breakout Names have already broken to new all-time highs in Q4, but will they be able to hold those gains?

* The Consolidating Charts have failed to break to new highs, so it's all about watching key price support levels.

* The Wild Cards may be the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Mild Rebounds; Painful Mean Reversion May Continue

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian benchmark Nifty 50 extended its corrective decline. Over the past four sessions of a truncated week, the Nifty 50 index remained largely under selling pressure, and the markets continued with their process of mean-reversion. The volatility, though, did not show any major surge. The volatility gauge, IndiaVIX rose...

READ MORE

MEMBERS ONLY

Riding the Cryptocurrency Wave: How to Maximize Your Gains

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* With a new administration set to take office in January, it may be time to seriously reconsider cryptocurrencies.

* Three cryptocurrencies to keep an eye on are Bitcoin, Ethereum, and (strangely) Dogecoin.

* Despite cryptocurrencies being a noisy market, the right tools can help guide you toward smarter decisions.

With...

READ MORE

MEMBERS ONLY

Upgrade Your Options Trading with OptionsPlay on StockCharts

by Tony Zhang,

Chief Strategist, OptionsPlay

by Grayson Roze,

Chief Strategist, StockCharts.com

Should you buy calls/puts? Should you write covered calls? Or should you trade bull/bear vertical spreads?

That's a lot to chew on -- and it's just the beginning. Once you decide on a strategy, you'll have to decide on which strikes and...

READ MORE

MEMBERS ONLY

The Sign of Strong Charts Getting Stronger

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I was originally taught to use RSI as a swing trading tool, helping me to identify when the price of a particular asset was overextended to the upside and downside. And, on the swing trading time frame, that approach very much works, especially if you employ a shorter time period...

READ MORE

MEMBERS ONLY

Key Support Levels for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's DP Alert short video we discuss the key support levels for Gold as it has likely begun a longer-term correction. We also take a look at Gold Miners under the hood! Charts and commentary are taken from our subscriber-only DP Alert publication. Subscribe now and try...

READ MORE

MEMBERS ONLY

Simple Way to Find Confluence FAST Using Moving Averages

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe explains how to use an 18 simple moving average in multiple timeframes to identify when a stock has confluence amongst 2-3 timeframes. He shows how to start with the higher timeframes first, before working down to the lower ones. Joe then covers the shifts...

READ MORE

MEMBERS ONLY

The Dollar's Technical Position is Crucial from a Short, Intermediate, Primary, and Secular Standpoint

by Martin Pring,

President, Pring Research

Chart 1 shows the Dollar Index has been in a trading range for the last couple of years and is now at resistance in the form of its upper part. The big question relates as to whether it can break to the upside, or if the resistance will once again...

READ MORE

MEMBERS ONLY

Are Extremely Overbought Conditions Good or Bad for Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When a stock shows an RSI value above 80, is that a good thing or a bad thing? In this video, Dave reviews a series of examples showing this "extreme overbought" condition, highlights how these signals usually occur not at the end of, but often earlier in an...

READ MORE

MEMBERS ONLY

Riding the Stock Market's Wave: How to Maximize Your Gains

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader US stock market indexes took a breather on Tuesday.

* Mega-cap Mag 7 stocks are back in the limelight.

* Investors are rotating into Technology and Communication Services sectors.

The post-election euphoria may have taken a breather on Tuesday, as the US stock market indexes closed lower. The...

READ MORE

MEMBERS ONLY

MUST SEE Updates to RRG Charts on StockCharts!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius pulls the curtain back on the updated Relative Rotation Graphs that are now available on the StockCharts website. He demonstrates a myriad of new features, including alignment of the intraday time frames with SharpCharts/ACP, zoom and position control with your mouse, and...

READ MORE

MEMBERS ONLY

Is the Trump Rally Like the Reagan Rally?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl compares this week's Trump Rally with the rally we saw after Reagan was elected in 1980. There are similarities and differences. The Trump rally has lifted certain sectors of the market as well as Cryptocurrencies. While the Reagan rally had different catalysts.

The market continues to...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Stay Sluggish; Multiple Resistances Nestled in This Zone

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets remained tentative over the past five days while continuing to trade with a weak undertone, while the Nifty digested the reaction to the US election outcome. There were two days of a strong technical rebound; this was subsequently sold into, which kept Nifty in a broadly-defined range. The...

READ MORE

MEMBERS ONLY

Best Way to Capitalize on Election Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen presents a deep dive into last week's sharp rally in the markets. She highlights what areas could perform best under a Trump administration and how to spot a pullback. She takes a close look at the "New Economy" and...

READ MORE

MEMBERS ONLY

Stock Market Hits Record Levels: Prepare for What Inflation Can Bring Next

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes hit milestone levels this week.

* Monitoring volatility in bonds could be a leading indicator in market action shifts.

* The US dollar can provide clues about future stock market action.

Another packed week for the stock market has come to a close. The broader...

READ MORE

MEMBERS ONLY

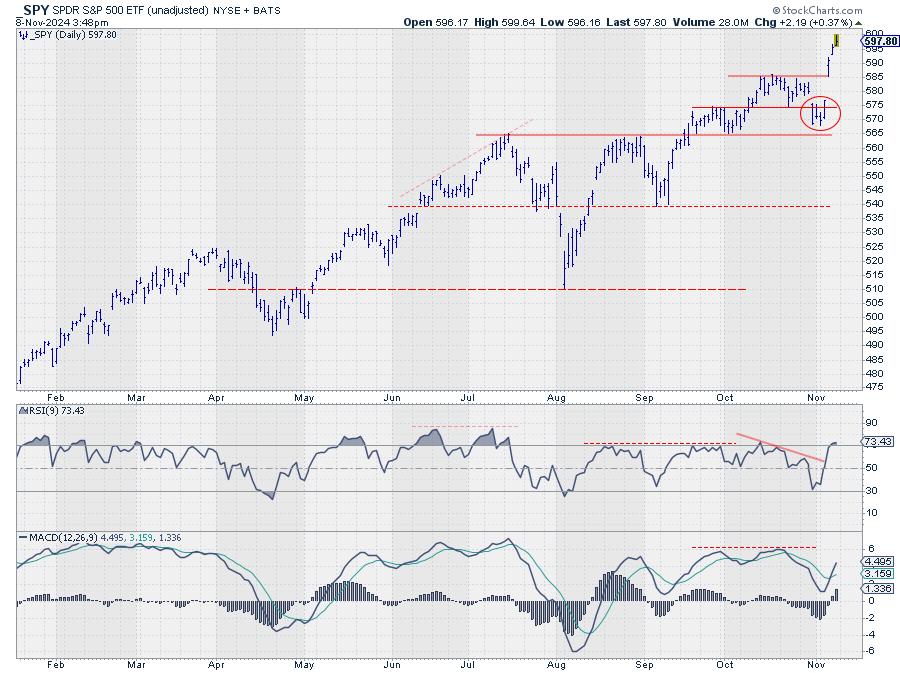

Three Sectors Leading SPY Back to Offense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The market came out of defensive mode after the election.

* Old resistance at 585 is now support for SPY.

* XLC, XLY, and XLF are all showing strength.

First of all, for those of you looking for a new video this week, I have intentionally skipped it because I...

READ MORE

MEMBERS ONLY

This Sector is Worth Watching, Not Just For Itself But as a Market Bellwether

by Martin Pring,

President, Pring Research

Last week, I drew your attention to the fact that out that three US market sectors had experienced bearish two-bar reversals on the weekly charts and were likely to retrace some of their previous advances. I also pointed out that this was only one piece of negative evidence and that...

READ MORE

MEMBERS ONLY

Election Aftermath: Unleashing Profitable Small Cap Stocks

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Small cap stocks were the biggest gainers in post-election Wednesday.

* Financials was the top-performing sector in Wednesday's trading.

* Cryptocurrencies, US dollar, and Treasury yields rose in anticipation of an inflationary environment.

The risk-on sentiment has returned to the stock market. Stocks traded significantly higher ahead of...

READ MORE

MEMBERS ONLY

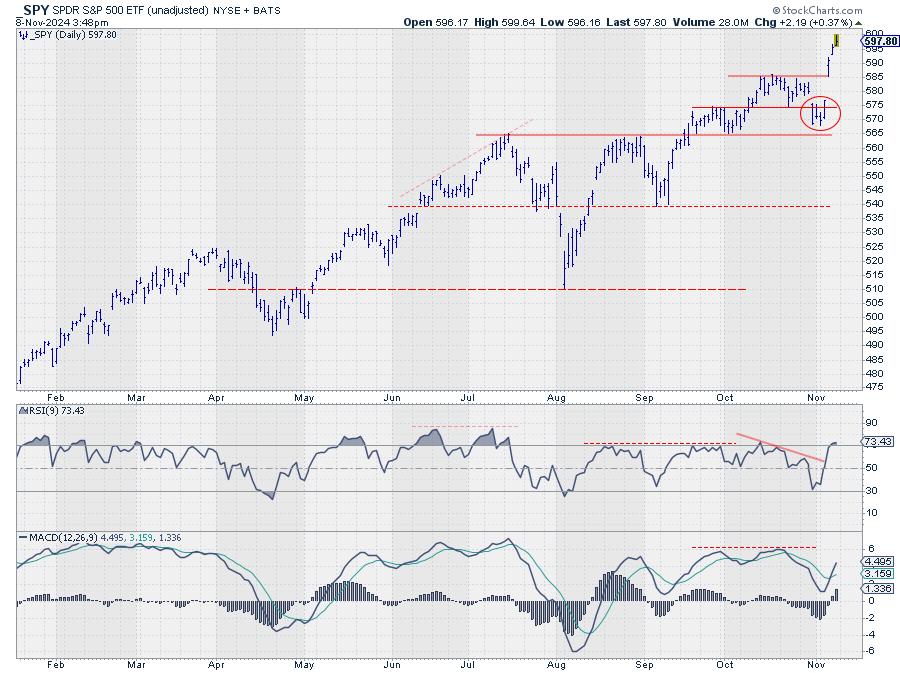

Markets Surge Post-Election: Is It Time to Go All-In?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The S&P 500 jumped post-election, exhibiting a strong gap.

* Sentiment indicators remain bullish, though not quite euphoric.

* Momentum indicators, however, signal a slowdown ahead for stocks.

When major shifts happen in the market, such as the one we're seeing the morning after the election,...

READ MORE

MEMBERS ONLY

It's GAME ON for These Stocks

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows a specific trade setup in multiple timeframes that identifies the start of an important trend. He explains the 4 keys to this setup and shows 5 examples of stocks meeting the criteria right now. Joe then covers numerous indices, commodities, 10-year Rates, and...

READ MORE

MEMBERS ONLY

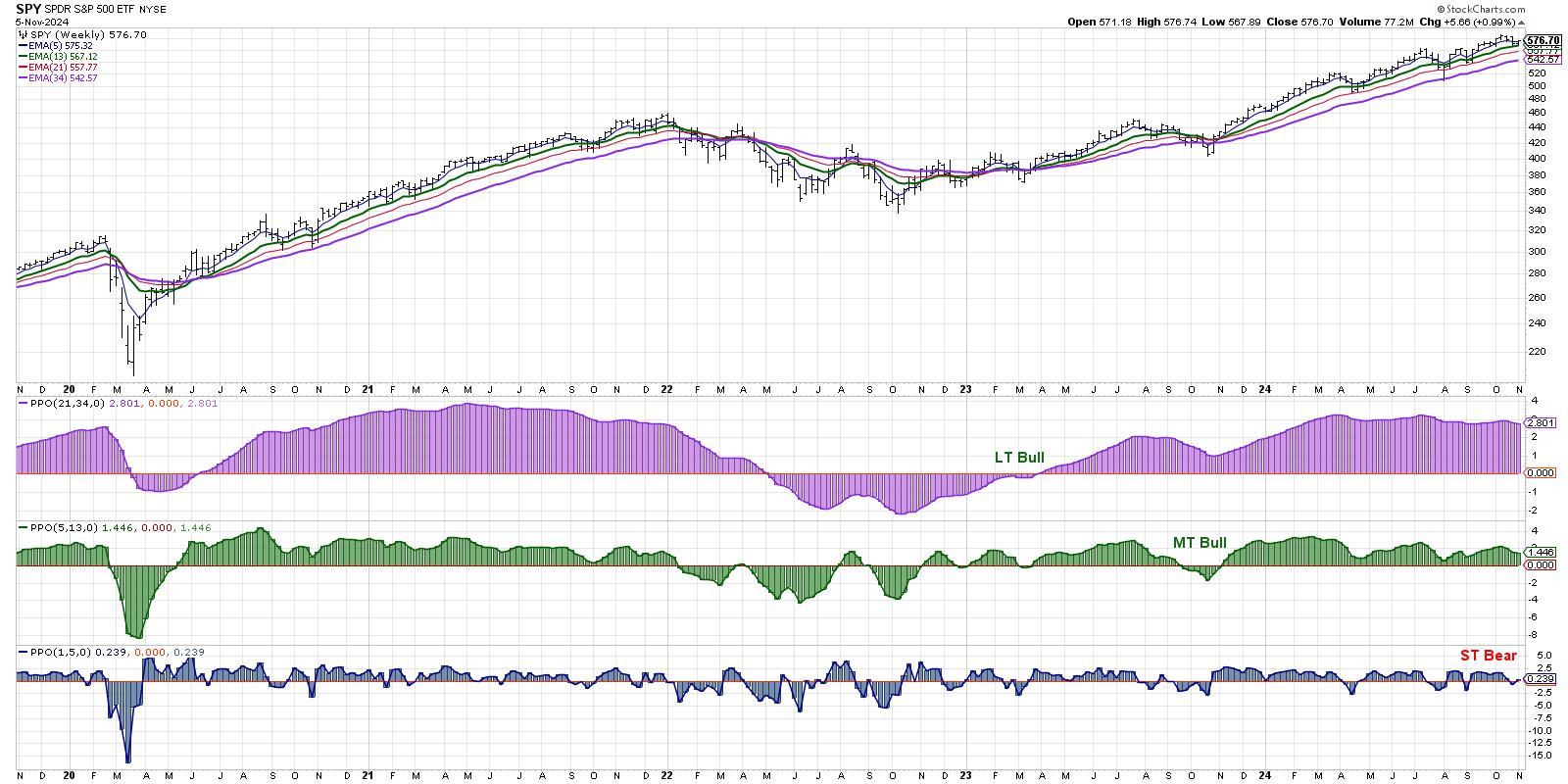

Short-Term Bearish Signal as Markets Brace for News-Heavy Week

by David Keller,

President and Chief Strategist, Sierra Alpha Research

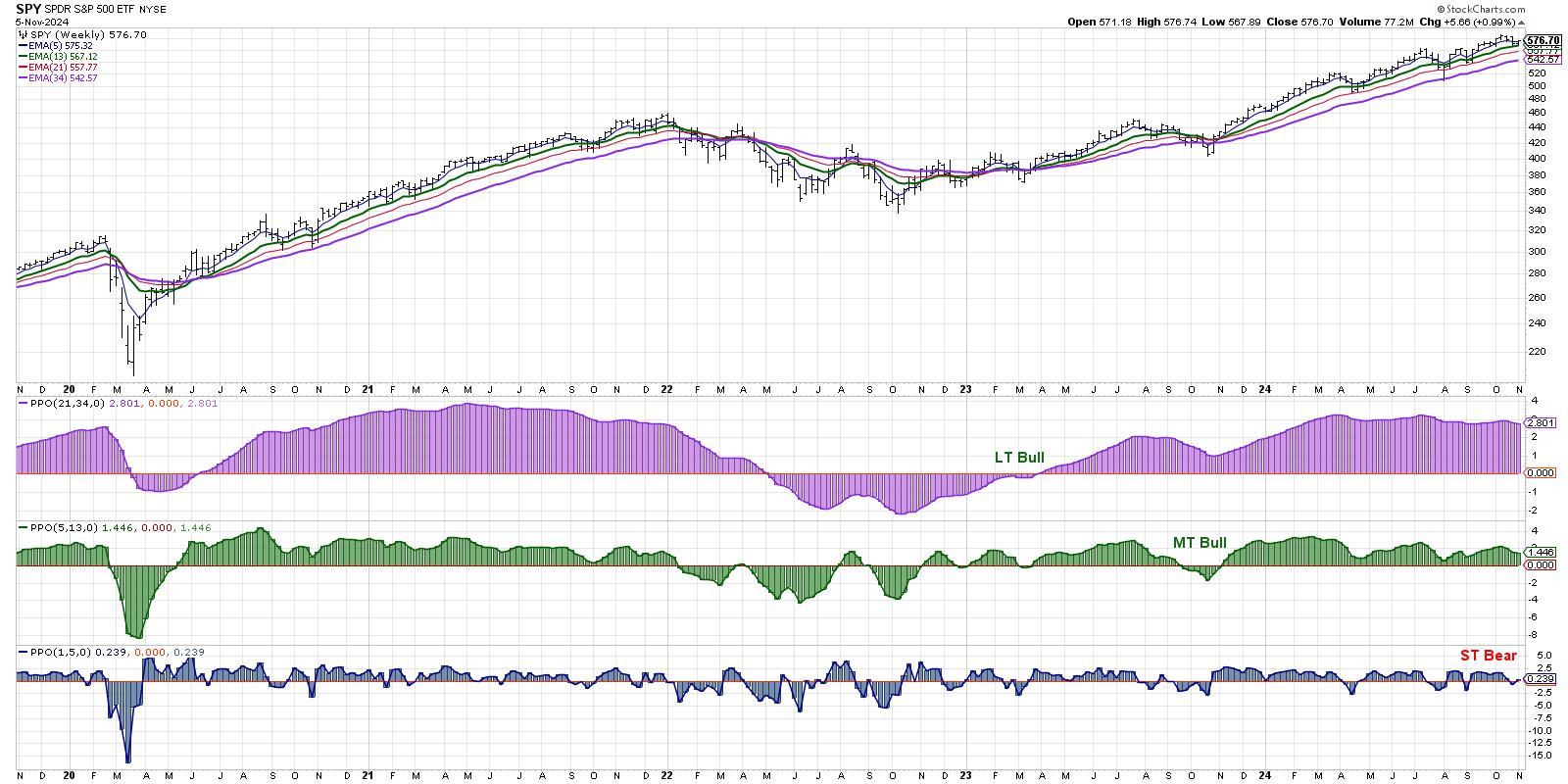

KEY TAKEAWAYS

* We can define the market trend on multiple time frames using a series of exponential moving averages.

* While our short-term Market Trend Model turned bearish last week, the medium-term and long-term models remain bullish.

* 2021 could provide a compelling analogue to what we're experiencing so far...

READ MORE

MEMBERS ONLY

Stock Market Today: How to Scan for Post-Election Profit Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Pre- and post-election jitters can cause market reactions and overreactions.

* The best thing you can do is get a bird's-eye view of opportunities that may unfold as the political fog clears.

* MarketCarpets is an effective tool to help you gauge market activity and spot high-probability trades....

READ MORE

MEMBERS ONLY

Market Trend Model Flashes Short-Term Bearish, What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down the three time frames in his Market Trend Model, reveals the short-term bearish signal that flashed on Friday's close, relates the current configuration to previous bull and bear market cycles, and shares how investors can best track this model to ensure they&...

READ MORE

MEMBERS ONLY

DP Trading Room: Six-Month Period of Favorable Seasonality Begins Now!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's here! The SPY starts a period of favorable seasonality for the next six months. Carl takes us through his charts and explains favorable versus unfavorable periods of seasonality.

Carl covers our signal tables showing new weakness seeping in despite this period of favorable seasonality. The market looks...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Stable Start; Likely to Remain Under Selling Pressure at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty largely consolidated over the past five sessions, but did so with a bearish undertone. The Nifty traded in a defined range and closed the week with a modest gain. Importantly, the index also stayed below its crucial resistance points. The volatility also expanded; the IndiaVIX surged higher by...

READ MORE

MEMBERS ONLY

S&P 500 Under Pressure, Can Strong Seasonality Save It?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks. After that, Julius looks forward using...

READ MORE

MEMBERS ONLY

These S&P 500 Stocks Are Poised To Outperform!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the negative price action in the broader markets while highlighting pockets of strength. She shares how the rise in interest rates is impacting the markets ahead of next week's FOMC meeting. Last up is a segment on how to use...

READ MORE

MEMBERS ONLY

Election-Related Market Swings: How to Stay Ahead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Markets bounced back after Thursday's selloff.

* Small-cap stocks are struggling to gain steam even though interest rates are likely to decline.

* Treasury yields continue to rise.

After yesterday's "trick," investors received a "treat" at the end of the trading week,...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch for November 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the Magnificent 7 stocks struggling to hold up through a tumultuous earnings season, what sort of opportunities are emerging on the charts going into November? Today, we'll break down some of the names we've included in our Top Ten Charts to Watch for November 2024....

READ MORE

MEMBERS ONLY

Price Momentum Oscillator (PMO) Internals Still a Problem

by Erin Swenlin,

Vice President, DecisionPoint.com

We noticed on Thursday evening how poor the internals were for the SPY, based on Price Momentum Oscillator (PMO) internals. These internals are the percent of stocks with rising PMOs and the percent of stocks with PMO Crossover BUY Signals. The accompanying short-term Swenlin Trading Oscillators (STOs), along with IT...

READ MORE

MEMBERS ONLY

Market Rotation Fueled by Large-Cap Growth (Again)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large-cap stocks are pushing the market higher.

* Large-cap growth is the only segment driving the market.

* AAPL, TSLA, NVDA, and AMD are having trouble pushing higher.

Following the recent market fluctuations, with a sharp decline and a subsequent rally, it's crucial to examine these movements'...

READ MORE

MEMBERS ONLY

Halloween Scare: The Stock Market Ends October on a Wicked Tone

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tepid earnings and negative news sends Tech stocks plunging.

* Economic data supports the narrative that the Fed will cut interest rates by 25 basis points in November.

* The long-term trend of the broader indexes are still bullish.

The Halloween effect caught up with the stock market! October 31...

READ MORE

MEMBERS ONLY

Will Breadth Divergences Signal the End of the Bull?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A negative McClellan Oscillator suggests short-term weakness in breadth conditions.

* About 30% of the S&P 500 members have already broken down below their 50-day moving average.

* The Bullish Percent Index has broken a key bearish threshold, indicating that many stocks have already begun bearish trends.

As...

READ MORE