MEMBERS ONLY

Will Breadth Divergences Signal the End of the Bull?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A negative McClellan Oscillator suggests short-term weakness in breadth conditions.

* About 30% of the S&P 500 members have already broken down below their 50-day moving average.

* The Bullish Percent Index has broken a key bearish threshold, indicating that many stocks have already begun bearish trends.

As...

READ MORE

MEMBERS ONLY

A Simple Candle With BIG Meaning

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shows a specific candlestick pattern that, when it develops at the right time, can signal the start of a new upleg. He uses NVDA, MSFT and GLD to explain how this can setup at different times and can give a timely signal to look...

READ MORE

MEMBERS ONLY

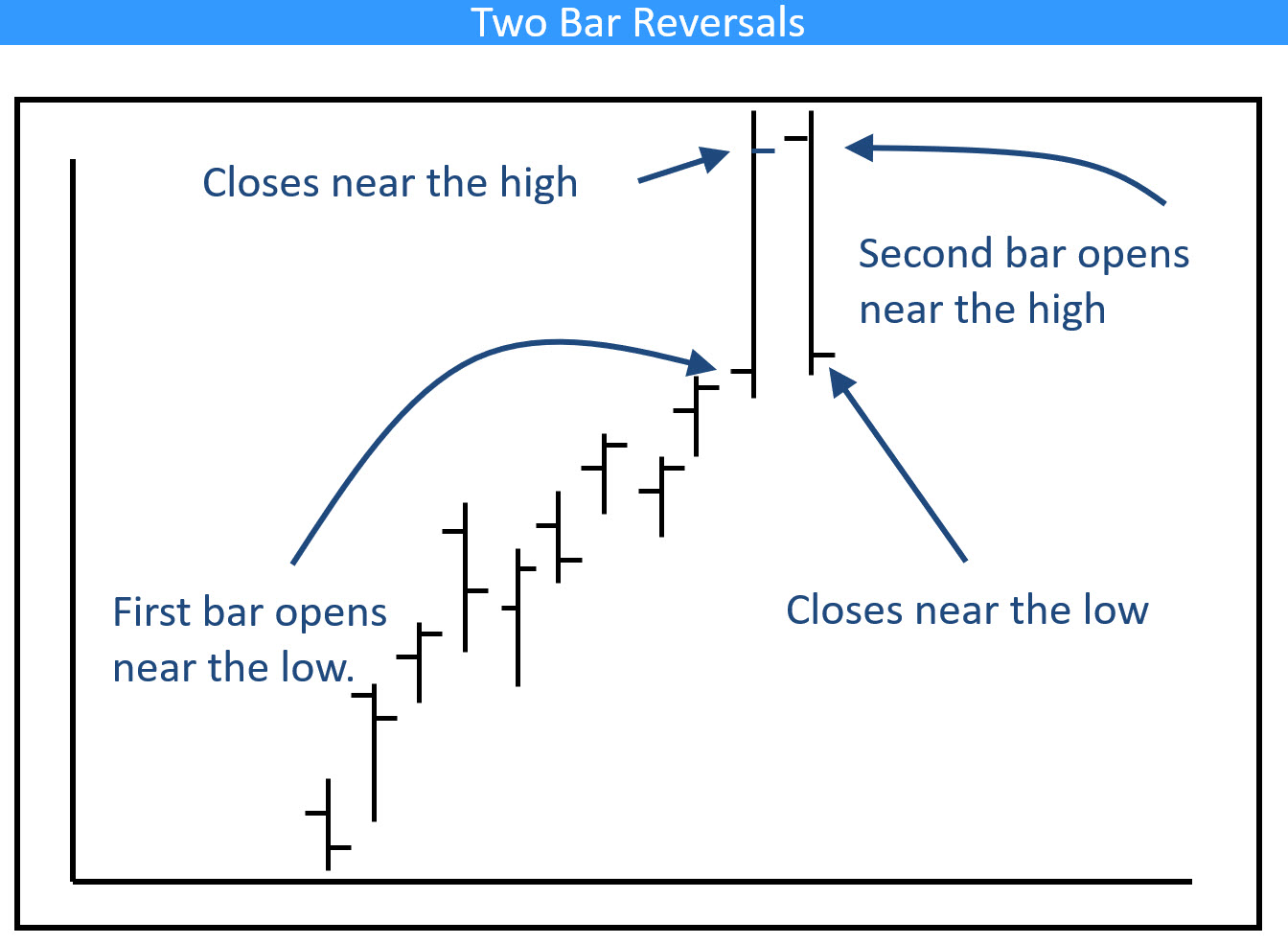

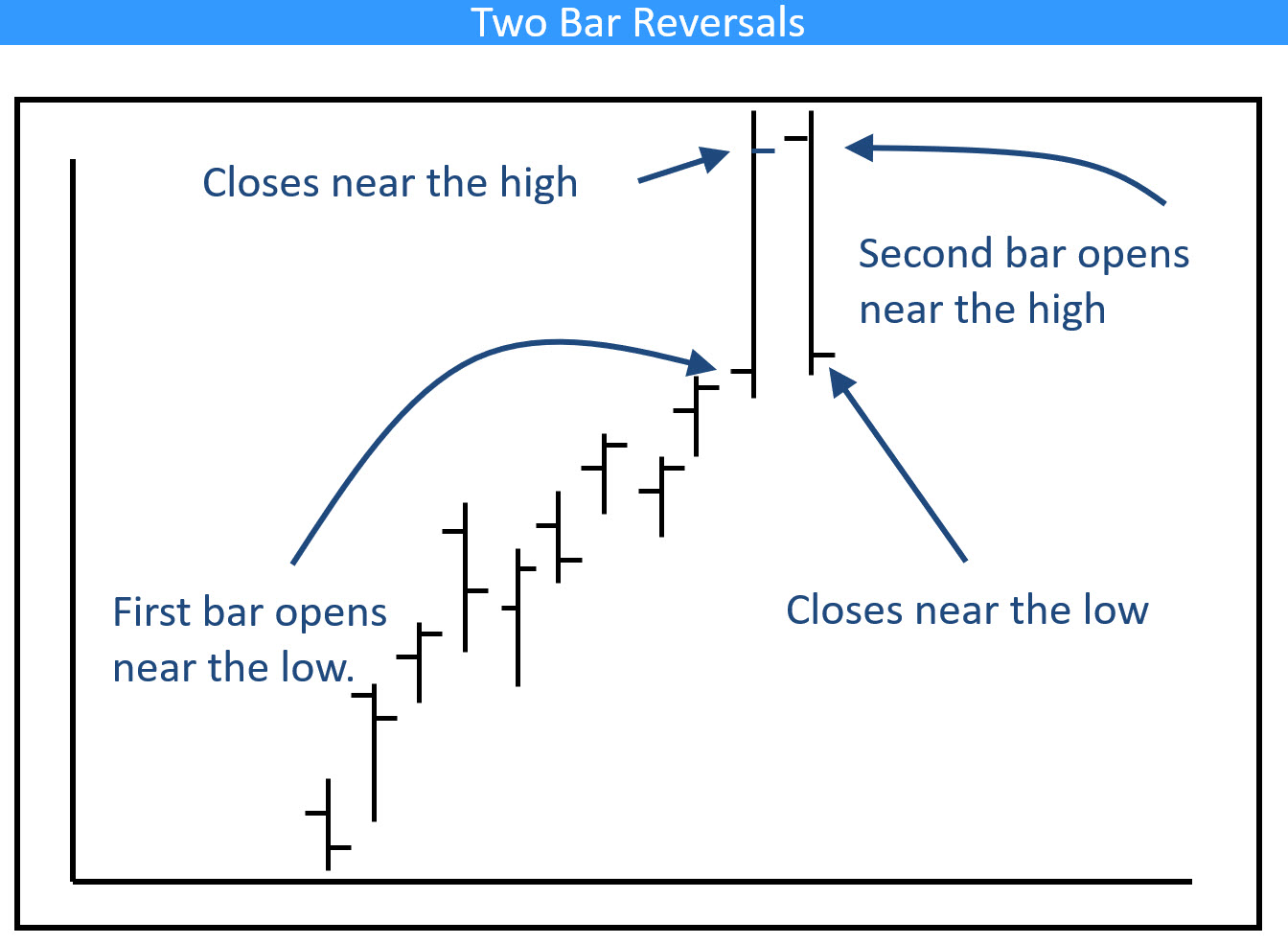

Four Sectors That Have Just Experienced Bearish Weekly Action

by Martin Pring,

President, Pring Research

Most weekends, I flip through a chartlist featuring weekly bars and candles for sectors, country ETFs, currencies, bonds and some commodities. The idea is to see whether any of these entities are showing signs of bullish or bearish reversals. Most of the time, this fishing exercise does not uncover a...

READ MORE

MEMBERS ONLY

Top 5 Breadth Indicators You Can't Afford to Ignore!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave digs into five market breadth indicators every investor should track as we navigate a volatile period including Q3 earnings, the US elections, and the November Fed meeting. He breaks down key insights on each of the five charts, talks about why breadth indicators are equal-weighted, and...

READ MORE

MEMBERS ONLY

DP Trading Room: Magnificent Seven Earnings Preview

by Erin Swenlin,

Vice President, DecisionPoint.com

As part of today's coverage of the Magnificent Seven we remind you when the big mega-caps are reporting and give you are current perspective of each. We also cover all of the Magnificent Seven in the short and intermediate terms with daily and weekly charts.

Carl gives us...

READ MORE

MEMBERS ONLY

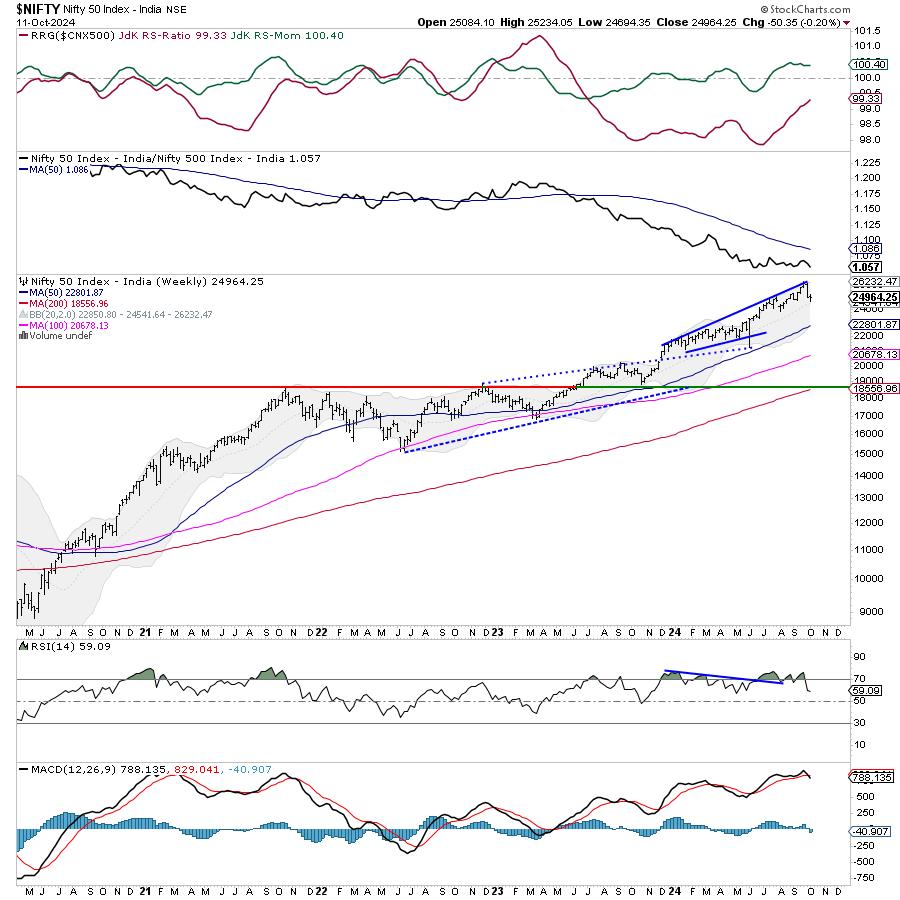

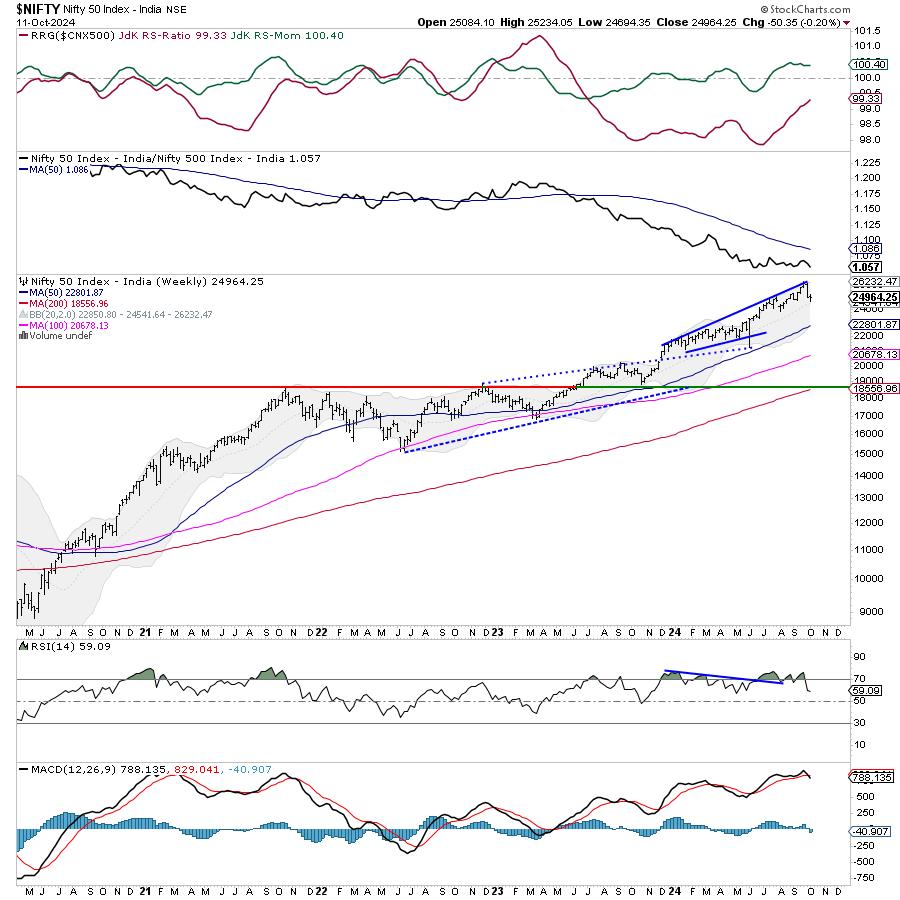

Week Ahead: NIFTY Violates Key Support Levels; Drags Resistance Lower

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The over-deviated markets continued to extend their losses for the fourth week in a row. The Nifty remained largely under sustained selling pressure over the past five days, barring a few feeble attempts to stage a technical rebound. The markets extended their downsides while giving up key supports on the...

READ MORE

MEMBERS ONLY

How to Trade Gaps Up (and Down) After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen shares how the markets trade right before the elections, and also reviews the move in Tesla (TSLA) after reporting earnings. She shares examples of what to watch for if your stock is due to report earnings - and what to do if it...

READ MORE

MEMBERS ONLY

Election Season: Keep Calm and Optimize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks gained some ground this week after better-than-expected earnings from Tesla.

* US Treasury yields continue to rise.

* Bullish momentum keeps gold prices rising higher.

Although earnings season is in full swing, trading volume has been relatively light this week. Perhaps investors are waiting for the stock market...

READ MORE

MEMBERS ONLY

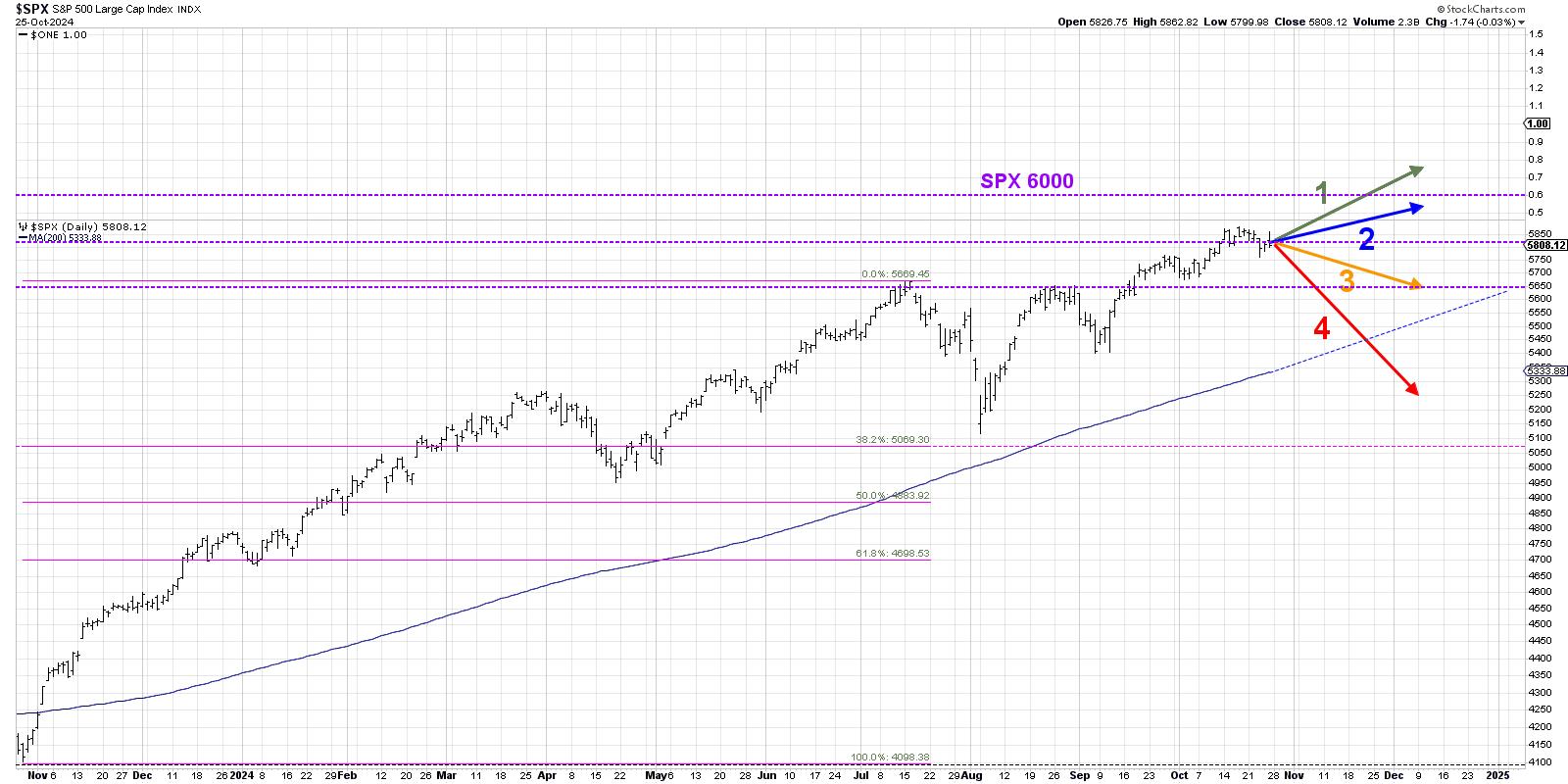

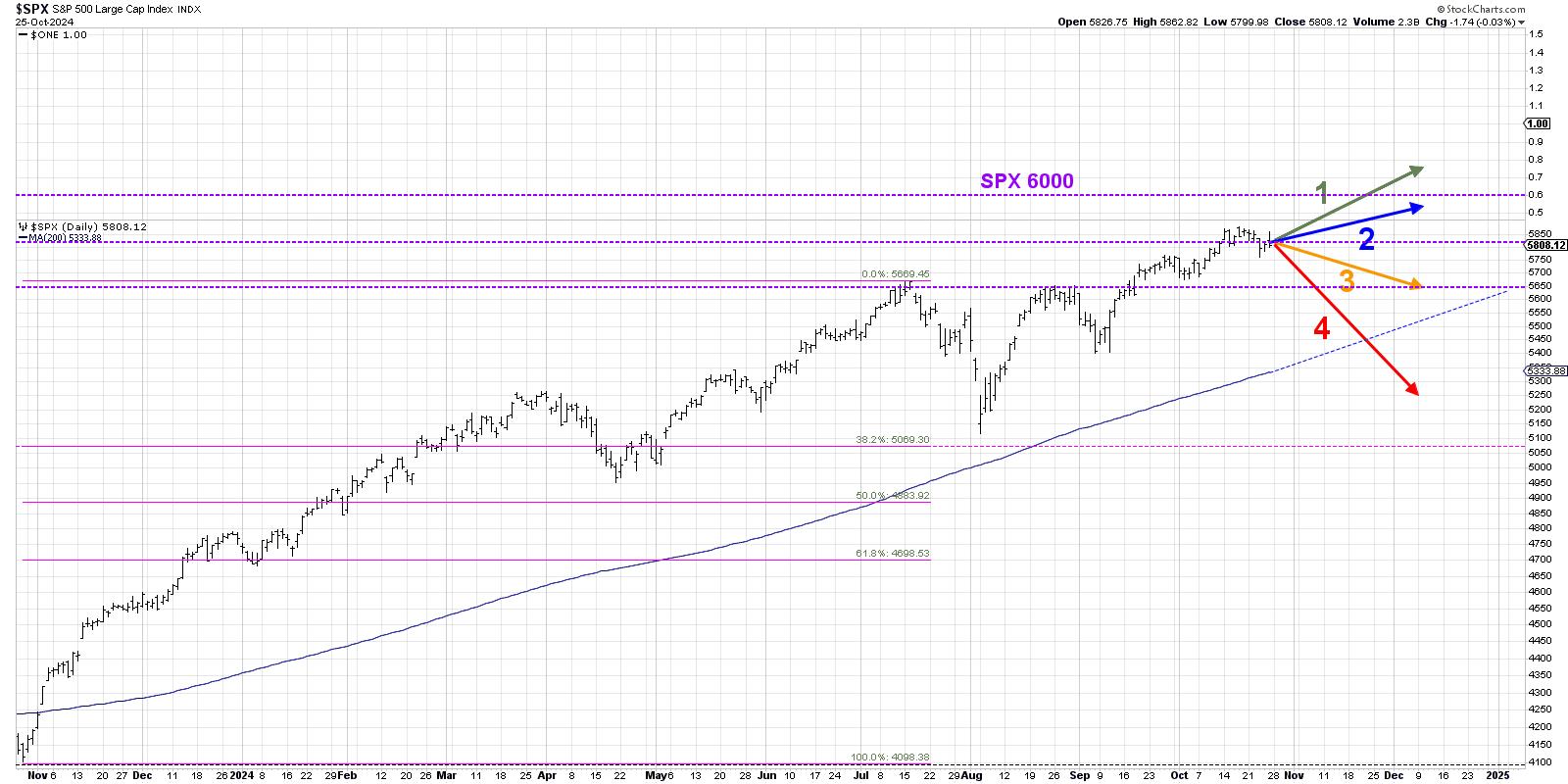

Why the S&P 500 Won't Break 6000 (Yet)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I was growing up, I loved Choose Your Own Adventure books. I see the world in shades of gray instead of black-and-white, so I was immediately drawn to the seemingly endless scenarios that the main characters could experience as I made different choices for them.

As investors, we often...

READ MORE

MEMBERS ONLY

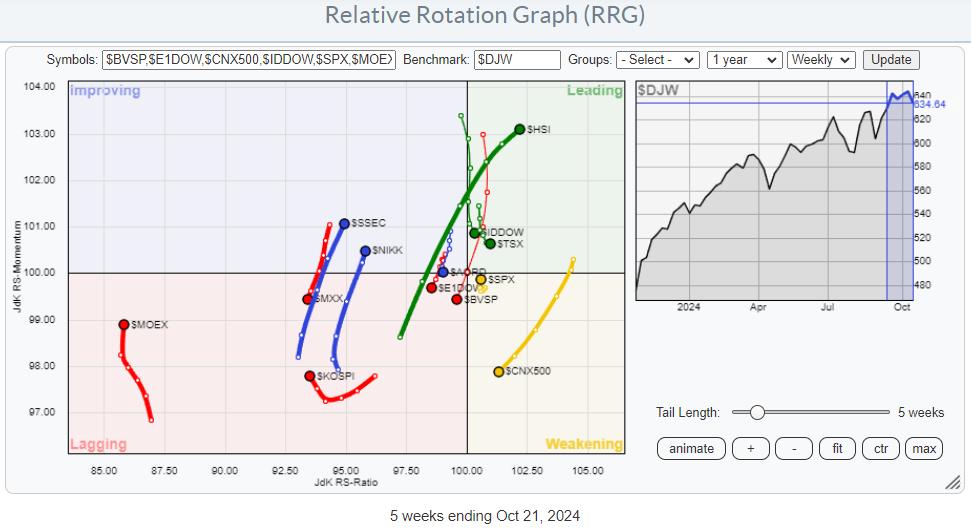

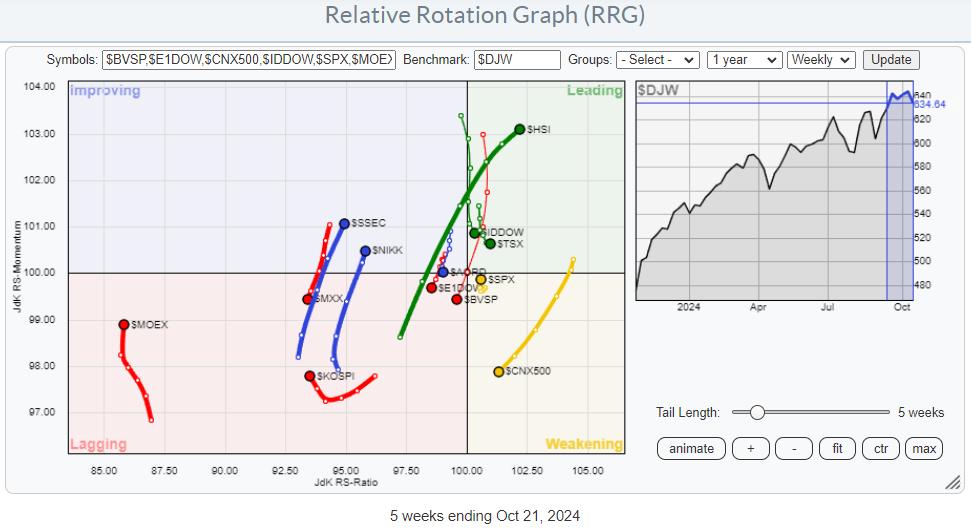

The US is Not the Only Stock Market in the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Asian stock markets showing strong relative trends.

* Meanwhile, India, Mexico, and Brazil are nosediving.

* Overall, the US is stull beating Europe.

The global stock market is a big place, and it extends far beyond the borders of the United States. While the US market is undeniably the largest...

READ MORE

MEMBERS ONLY

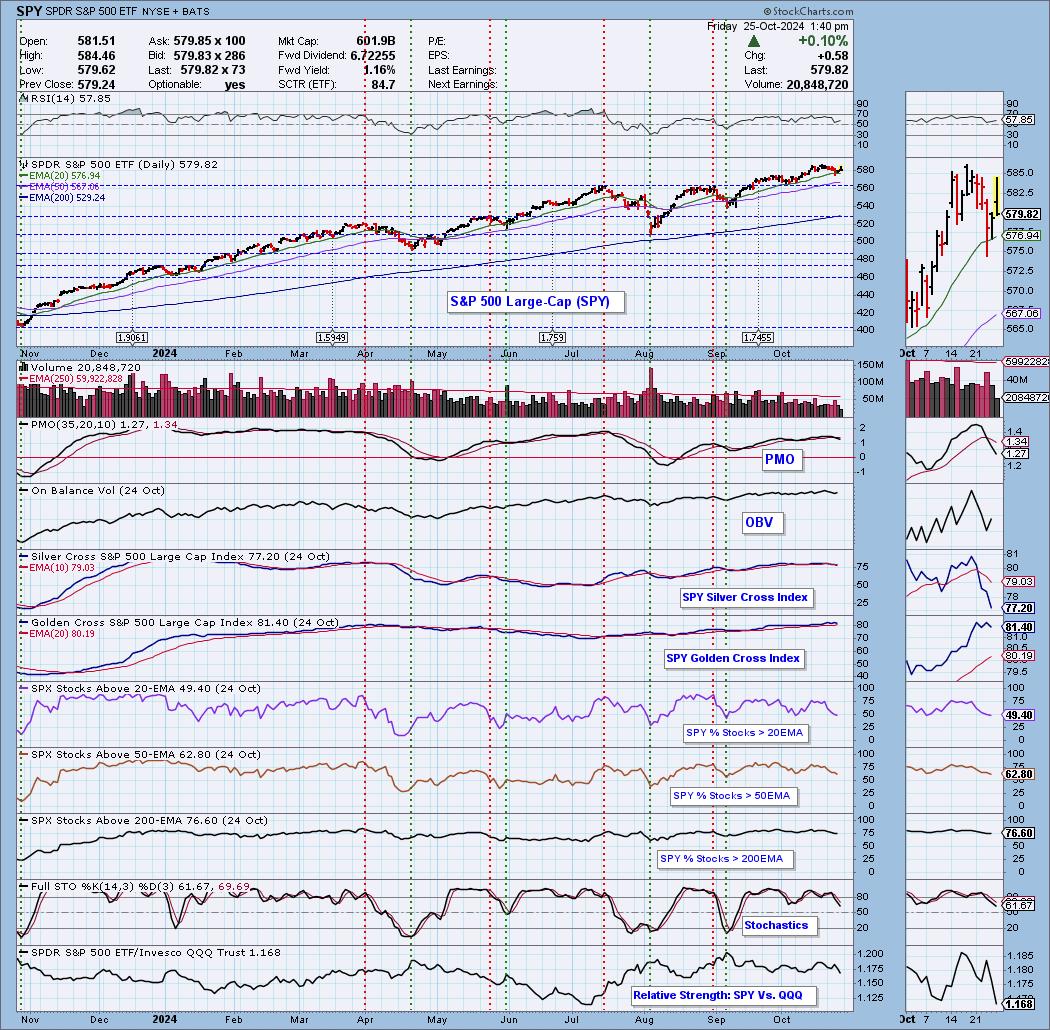

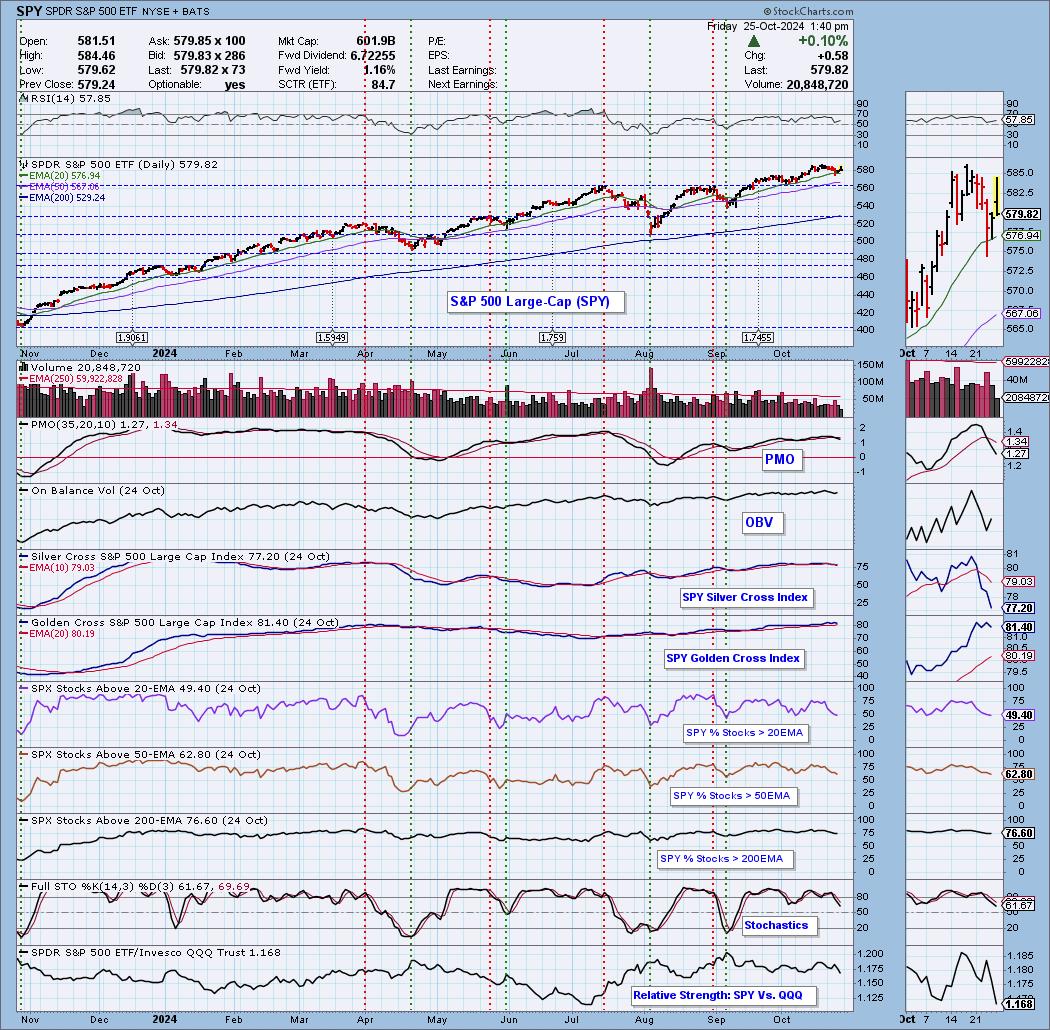

PMO SELL Signals on All Indexes But One

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's article and video, we'll discuss the weakness that pervades nearly all index charts.

Over the past few days, many of the indexes have lost their PMO BUY Signals. Nearly all have crossed beneath their signal lines, with the exception of the Nasdaq which is...

READ MORE

MEMBERS ONLY

This Stock Market Will Likely Outperform the World Index, But Could Be Outshone by Something Completely Different

by Martin Pring,

President, Pring Research

Since 2011, the US stock market, represented by the S&P Composite, has outperformed the world. In the last couple of weeks or so, it has managed to break out from a trading range in its relationship with the rest of the world and looks headed even higher on...

READ MORE

MEMBERS ONLY

Three Ways to Visualize the Start of a Potential Distribution Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 is nearing trendline support, which could provide a crucial signal of downside rotation.

* Market breadth indicators are beginning to diverge from the index, trending lower in the month of October.

* The MarketCarpet visualization shows a concerning drop in the mega-cap growth names which...

READ MORE

MEMBERS ONLY

Stocks Regain Some Ground Amid Rising Yields, Gold Prices, US Dollar

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market is treading softly as uncertainties loom on the horizon.

* Consumer Staples is the best-performing sector.

* Nasdaq breaks out above a consolidation pattern ahead of Tech earnings.

The overall trend in the stock market's broader indexes remains bullish. While the indexes were trading lower on...

READ MORE

MEMBERS ONLY

DISCOVER the Top Consumer Discretionary Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius begins by looking back at the completed monthly bars for October to assess the long term trends in the 11 S&P sectors. He follows that up with an updated view for SPY in coming weeks. After that, Julius looks forward using...

READ MORE

MEMBERS ONLY

What's the BEST Market Visualization Tool?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

How do you track movements of all the S&P 500 stocks on any given trading day? In this video, Dave will show you how he uses the StockCharts MarketCarpet to evaluate broad equity market conditions, assess the changes in the mega-cap stocks which dominate the benchmarks, and identify...

READ MORE

MEMBERS ONLY

DP Trading Room: Which is Better? SP600 (IJR) or Russell 2000 (IWM)

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl explores which index is best...the SP600 (IJR) or Russell 2000 (IWM). He makes a comparison over time and reveals which tends to be the better performer. Which one should you use to analyze what is happening in small-caps?

Carl gives us his market outlook as prices pullback today....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Ranged; Trending Moves to Occur Only If These Edges are Breached

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets closed on a negative note for the third week in a row; over the past five sessions, the Nifty remained largely on a declining trajectory, except for the last trading day where it saw some relief rally from the lower levels. Following a strong weekly decline of 1167...

READ MORE

MEMBERS ONLY

Be On the Lookout for THIS During Earnings Season!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what's driving the markets higher and how you can capitalize. Moves in TSLA, NVDA, and NFLX are highlighted. She also reviews price action greatly impacted by earnings, many driven by analyst upgrades and downgrades.

This video originally premiered October 18,...

READ MORE

MEMBERS ONLY

A Strong Week: Stocks, Gold, and Crypto's Robust Performance

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Dow Jones Industrial Average closed at record highs.

* Gold prices are on fire, closing at a record high.

* Bitcoin breaks out of a consolidation pattern.

Despite a light economic data week, the stock market continued its rally, with the S&P...

READ MORE

MEMBERS ONLY

Is This Still a Bull Market? | Larry's "Family Gathering" October 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Are we still in a bull market? That's a key question Larry considers in his final "Family Gathering" video, examining all the information available and what kind of conclusions about the state of the market we can draw from it.

Larry begins with a careful market...

READ MORE

MEMBERS ONLY

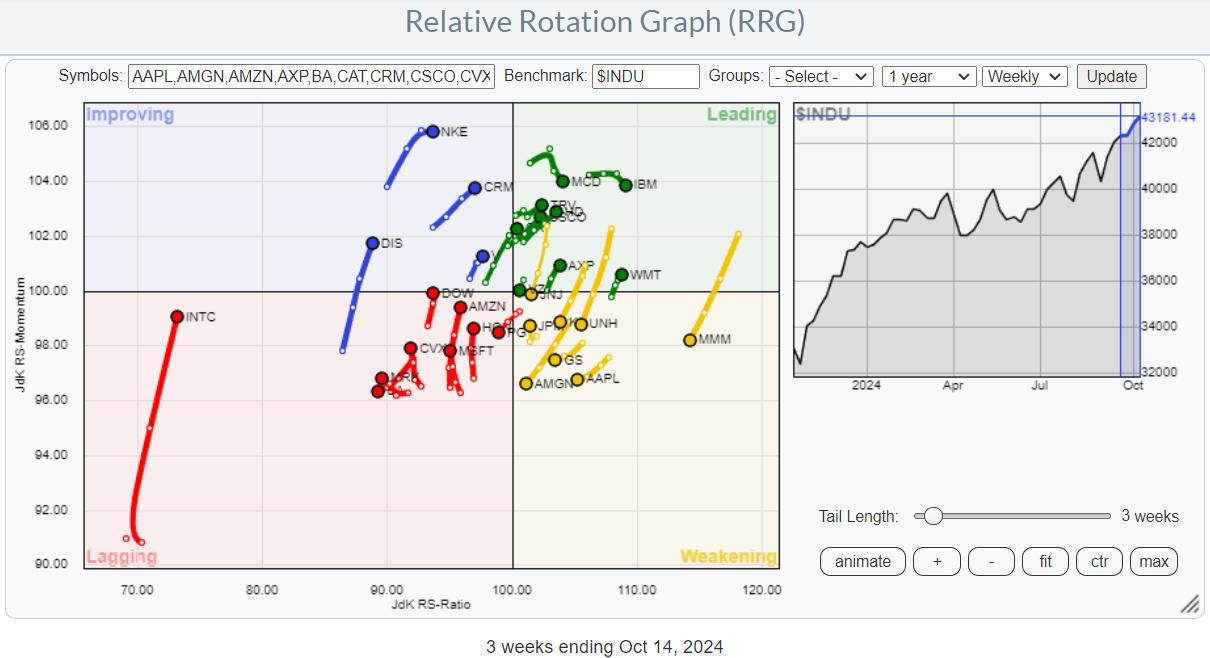

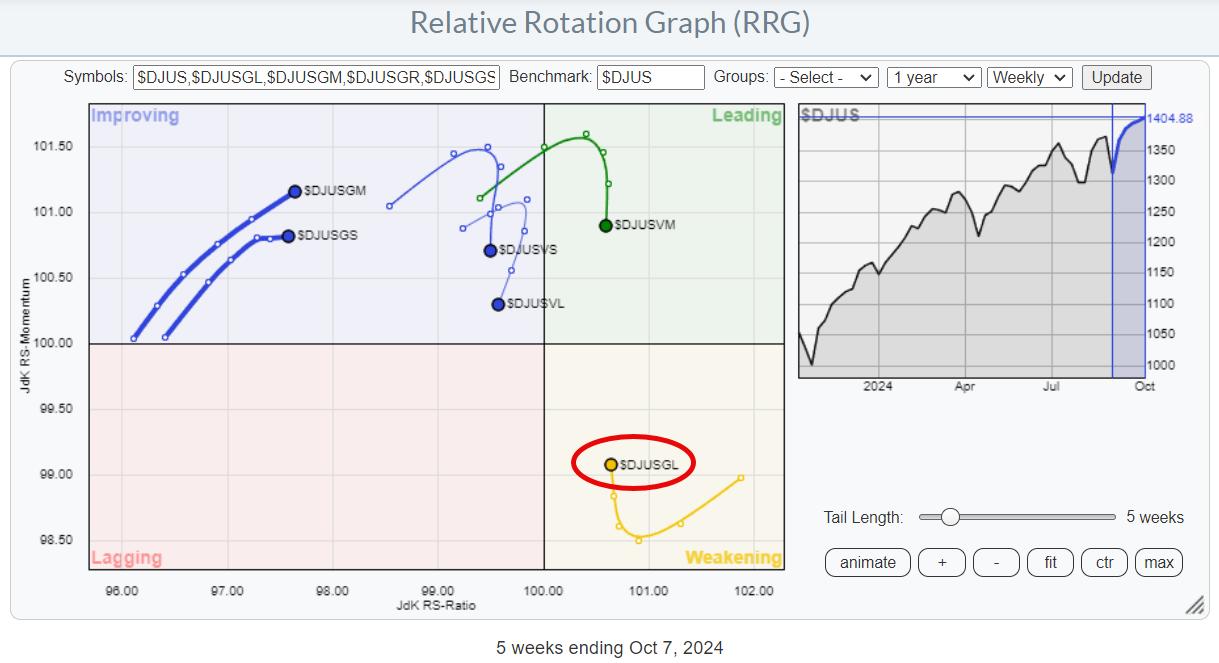

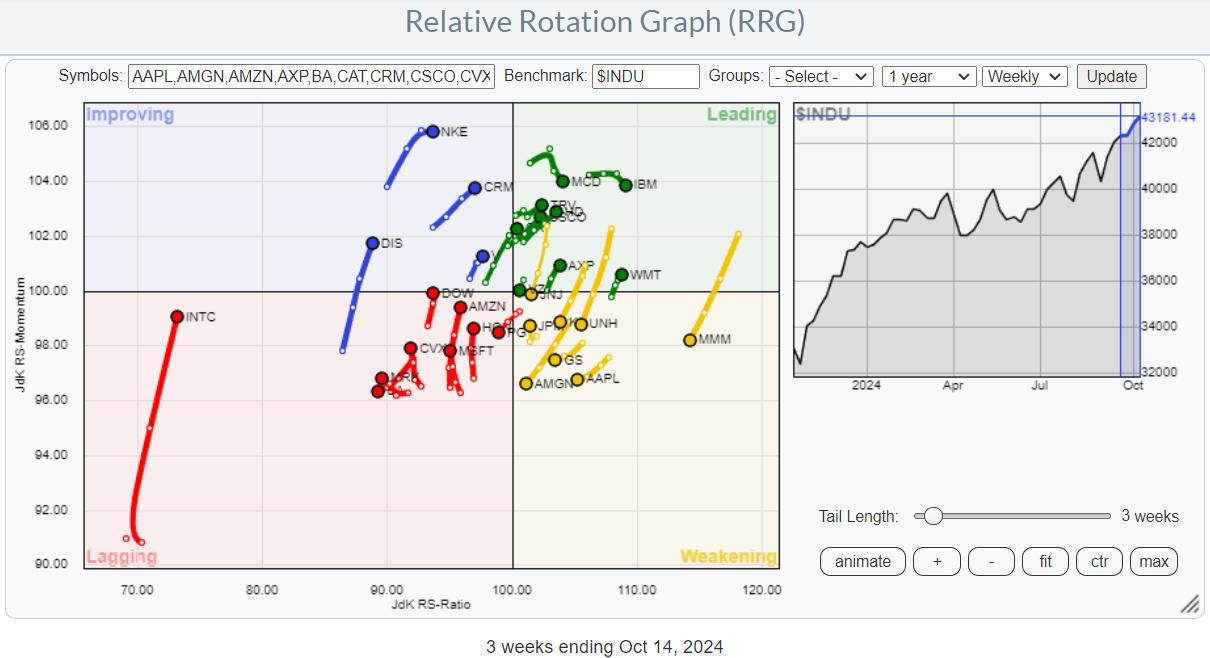

Using RRG To Find Best Three Stocks inside the DJ Industrials Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector Rotation Model and current sector rotation are not supporting broad market strength.

* Plotting the members of $INDU on a Relative Rotation Graph helps find the best names in that universe.

* TRV, WMT, and AXP are still strong, but now have too much risk for new positions.

* CAT,...

READ MORE

MEMBERS ONLY

Final "Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting his final "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for...

READ MORE

MEMBERS ONLY

Why the MACD Crossover Signal is SO Important

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shares the MACD downside crossover signal and explains the different ways it can play out when it takes place above the MACD zero line. These downside crossovers can lead to opportunities depending on other criteria, including the ADX action. He then shows how...

READ MORE

MEMBERS ONLY

Sector Rotation is Giving Conflicting Stories!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius dives in to the sector rotation model, trying to find any alignment between theoretical and real-life rotations of sectors in combination with the economic cycle. The positions of the various sectors and the economic indicators that are part of this model are not...

READ MORE

MEMBERS ONLY

The Master Sentiment Chart You Need to Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The put/call ratio measures volumes in the options market to compare bullish vs. bearish positioning.

* The AAII Survey is close to the 50% bullish level, which often coincides with major market tops.

* The NAAIM Exposure Index, currently just above 90%, tells us that money managers are not...

READ MORE

MEMBERS ONLY

Larry's Final LIVE "Family Gathering" Webinar Airs THIS WEEK - Friday, October 18 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming final "Family Gathering" webinar with Larry Williams, airing live through Zoom on Friday, October 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

The Next Big Move in Yields May Be Different Than You Think

by Martin Pring,

President, Pring Research

Below, Chart 1 shows a weekly plot for the 30-year yield, where we can see a perfectly formed top whose completion was followed by a negative 65-week EMA crossover. At the time of the breakdown, there were few grounds for suspecting a false break. However, in the last couple of...

READ MORE

MEMBERS ONLY

Stay Ahead: Key Sentiment Indicators to Track in October 2024!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Which market sentiment indicators should we follow to validate the current bull market phase and anticipate a potential market top? David Keller, CMT breaks down three sentiment indicators he's watching in October 2024, explains their calculations and methodology, reviews their signals during previous bull market cycles, and describes...

READ MORE

MEMBERS ONLY

MarketCarpets: The Fastest Way to Scan for Hidden Market Opportunities

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Use the StockCharts MarketCarpets to get a fast snapshot of market trends without sifting through endless news.

* Toggle between performance and technical rankings like SCTR to find hidden opportunities.

* Make MarketCarpets part of your daily routine to catch opportunities faster than traditional methods.

When Wall Street rings its...

READ MORE

MEMBERS ONLY

DP Trading Room: NVDA Lifts Semiconductors Higher

by Erin Swenlin,

Vice President, DecisionPoint.com

It's time to put Semiconductors in the spotlight. NVDA is starting to trade at all-time highs again and that is likely to bring the Semiconductor industry group up to its own all-time highs. Erin discusses Semiconductors "under the hood" and highlights the NVDA chart.

Carl brings...

READ MORE

MEMBERS ONLY

Week Ahead: While Nifty Consolidates, Keeping Above These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was in complete contrast to the week before, as the markets heavily consolidated in a tight range. In the previous week, the Nifty had seen a significant retracement of over 1167 points; however, over the past five trading days, the index stayed totally devoid of...

READ MORE

MEMBERS ONLY

The One Volume Indicator You Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the daily volume reading can give us limited insight on the balance of buyers and sellers, Chaikin Money Flow gives a much clearer picture of trends in volume.

* Major tops in the last 12-18 months have been marked with a particular pattern in the S&P...

READ MORE

MEMBERS ONLY

Last Week's Pullback is a Buying Opportunity!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights what's driving these markets higher despite a rise in interest rates. She also focuses on the leadership area in Technology and shares several stocks from this group. Last up, she reviews how to quickly uncover top stock candidates when a...

READ MORE

MEMBERS ONLY

Small-Caps Get on Board!

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, we posted a short video about the lack of participation within the mid-and small-cap universes. Here, we had a rally to new all-time highs, yet we weren't seeing much of anything out of the broad market. Today was a reversal of fortune for these indexes, which rallied...

READ MORE

MEMBERS ONLY

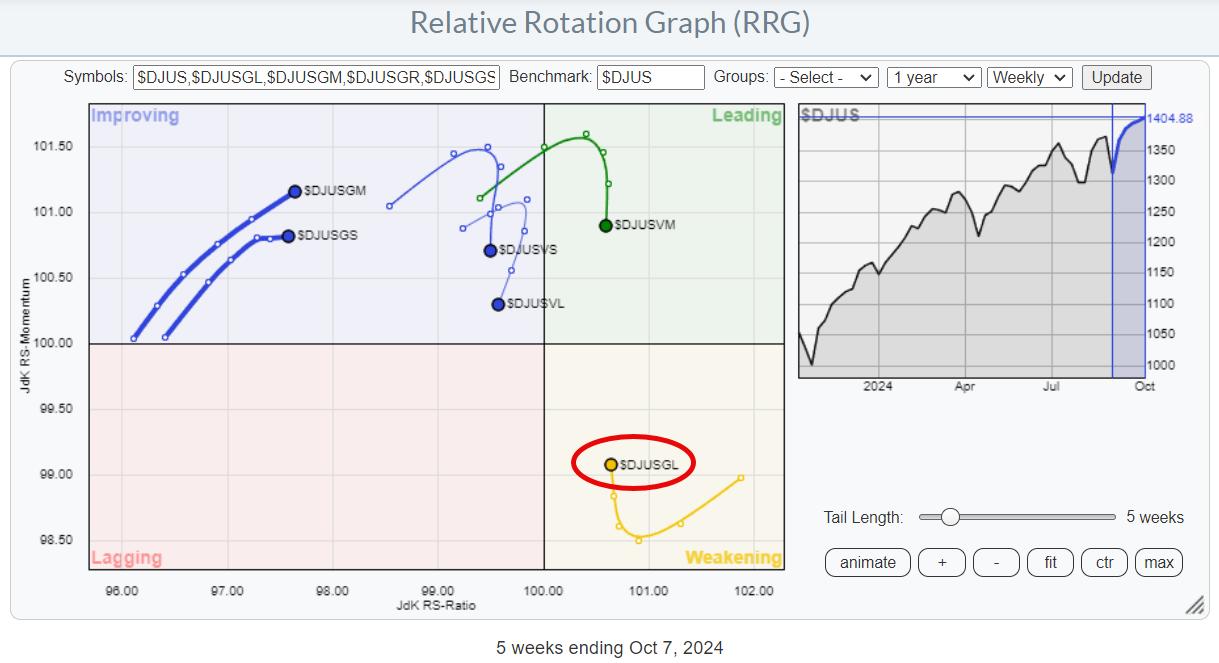

It's Large-Cap Growth Stocks (Mag 7) Once Again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is starting to resolve its negative divergence with RSI.

* Large-cap growth is coming back into favor.

* Magnificent 7 stocks provided 2.9% of the S&P 50's 6.8% performance over the past five weeks.

Where is the Recent Performance in the S&...

READ MORE

MEMBERS ONLY

Alert: Small-Caps Not Participating in New All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

DecisionPoint has started posting short video alerts on our YouTube Channel. These videos are less than four minutes and give you the scoop on news you need to know about the market right now. Subscribe to the DecisionPoint.com YouTube Channel HERE so you'll be notified when these...

READ MORE

MEMBERS ONLY

Tech vs Semiconductors: Which One Should You Be Trading?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Doing a top-down sector-to-industry analysis can be an effective way to find tradable opportunities.

* It makes sense to compare charts to see which ones are outperforming and which are underperforming.

* Get a bigger picture, drill down using relative performance indicators, and then examine specific key levels of each...

READ MORE

MEMBERS ONLY

What's Wrong With This SPX Breakout?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe presents the price pattern to follow the recent breakout in the S&P 500. He discusses narrow range bars, wide range bars and when they are important. Joe then explains what needs to take place now to either confirm a breakout or...

READ MORE

MEMBERS ONLY

Three Thoughts on Risk Management for October 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Watch the S&P 500's "line in the sand" for a signs of a breakdown in the major averages.

* Market breadth indicators could provide an early warning of a potential breakdown for the benchmarks.

* By being thoughtful about your position sizing for each...

READ MORE