MEMBERS ONLY

Markets Look Past DC Drama as Bank Earnings and Charts Take Center Stage

Earnings season kicks off this week with big banks reporting. Follow the price action and market-based indicators in these charts to get clear clues rather than media headlines....

READ MORE

MEMBERS ONLY

Nifty at a Crossroads; Awaits Clarity from Global Triggers

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Nifty was the only major global equity index to end the week in the red amid US tariff uncertainty. Is it vulnerable to further pressure?...

READ MORE

MEMBERS ONLY

How Government Policy Is Driving the Stock Market in 2026

by Mary Ellen McGonagle,

President, MEM Investment Research

Government policy decisions are moving industry groups as the focus shifts to energy security, housing affordability, and manufacturing. Find out which stocks are showing breakout potential....

READ MORE

MEMBERS ONLY

The Market Is Shifting — What You Should Be Watching Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle breaks down how market participation and sector movement are shifting early in the year, highlighting key signals investors should be watching as leadership rotates beneath the surface....

READ MORE

MEMBERS ONLY

The State of the Market: Trend, Breadth & Leadership, Plus a Trend-Momentum Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is in a clear uptrend with strong breadth, and three sectors leading the trend are Finance, Health Care, and Industrials. Arthur Hills shows you how to use a top-down approach to identify oversold stocks within uptrends....

READ MORE

MEMBERS ONLY

The Stock Market’s Moving, But It’s Tapping the Brakes

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The S&P 500 is edging higher but lacks conviction. Here are the key support levels, catalysts, and leadership shifts to watch as 2026 begins....

READ MORE

MEMBERS ONLY

The Market is Up, But the Warning Signs Are Adding Up!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Markets opened 2026 with solid gains, but Tom Bowley explains why several warning signs beneath the surface deserve attention. He breaks down leadership trends and intermarket relationships that are failing to confirm the rally, highlighting what traders should keep their eyes on....

READ MORE

MEMBERS ONLY

Momentum Is Building — These Stocks Stand Out!

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research breaks down a momentum shift, highlighting stocks beginning to stand out based on trend, momentum, and relative strength. He also reviews SPY market conditions, including volatility, sentiment, and multi-timeframe trend analysis....

READ MORE

MEMBERS ONLY

Financials, Semiconductors, and Bitcoin Are Moving: Here’s Why

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Frank Cappelleri breaks down why financials and semiconductors are showing strength and how Bitcoin is attempting to regain momentum early in 2026. Failed breakdowns, bullish patterns, and key levels are shaping what happens next in the market....

READ MORE

MEMBERS ONLY

Broadening, Broadening Everywhere in Early 2026: Record-High Mid-Caps

A shift is taking place in the stock market that investors shouldn't ignore. As leadership rotates beyond mega-cap stocks, mid-caps are breaking to record highs. What does this early-year price action indicate? Find out here....

READ MORE

MEMBERS ONLY

S&P 500 Earnings In for 2025 Q3; Overvaluation Persists

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 P/E in Q3 2025 is above normal and projected to rise in 2026. These charts will help you keep track of quarterly earnings....

READ MORE

MEMBERS ONLY

Strong Start to 2026, But Will Nifty Hold the Momentum?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Nifty's technical setup remains in a strong uptrend, trading above key moving averages. However, momentum seems to have moderated, suggesting possible fatigue. Here's a technical deep dive to prepare you for the coming week....

READ MORE

MEMBERS ONLY

What's Behind This Market Bounce? The Signals That Matter

by Mary Ellen McGonagle,

President, MEM Investment Research

The stock market kicked off the new year with a bounce, but is the strength as solid as it looks on the surface?

In this video, Mary Ellen McGonagle digs into the January rebound and takes a closer look at what's fueling the move. She breaks down recent...

READ MORE

MEMBERS ONLY

The Stock Market May Be Waking Up: It’s Not Just Tech Anymore

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Friday's market bounce brought a surprise: strength beyond Big Tech. See which sectors and ETFs are leading, and what it could mean for 2026....

READ MORE

MEMBERS ONLY

Warning Signs Are Growing, Be Prepared!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

What should investors look forward to in 2026? Here's Tom Bowley's outlook. ...

READ MORE

MEMBERS ONLY

Everyone’s Bullish on 2026 - That’s the Problem!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The market ended 2025 on shaky footing despite a strong overall year, raising questions about what lies ahead. Tom Bowley explains why rising complacency, fading leadership, and a weak year-end pattern may matter more in 2026 than most investors realize....

READ MORE

MEMBERS ONLY

5 Charts That Will Define Markets in 2026

What's on tap for 2026? Here's a deep dive into the five charts that matter most as this bull market matures....

READ MORE

MEMBERS ONLY

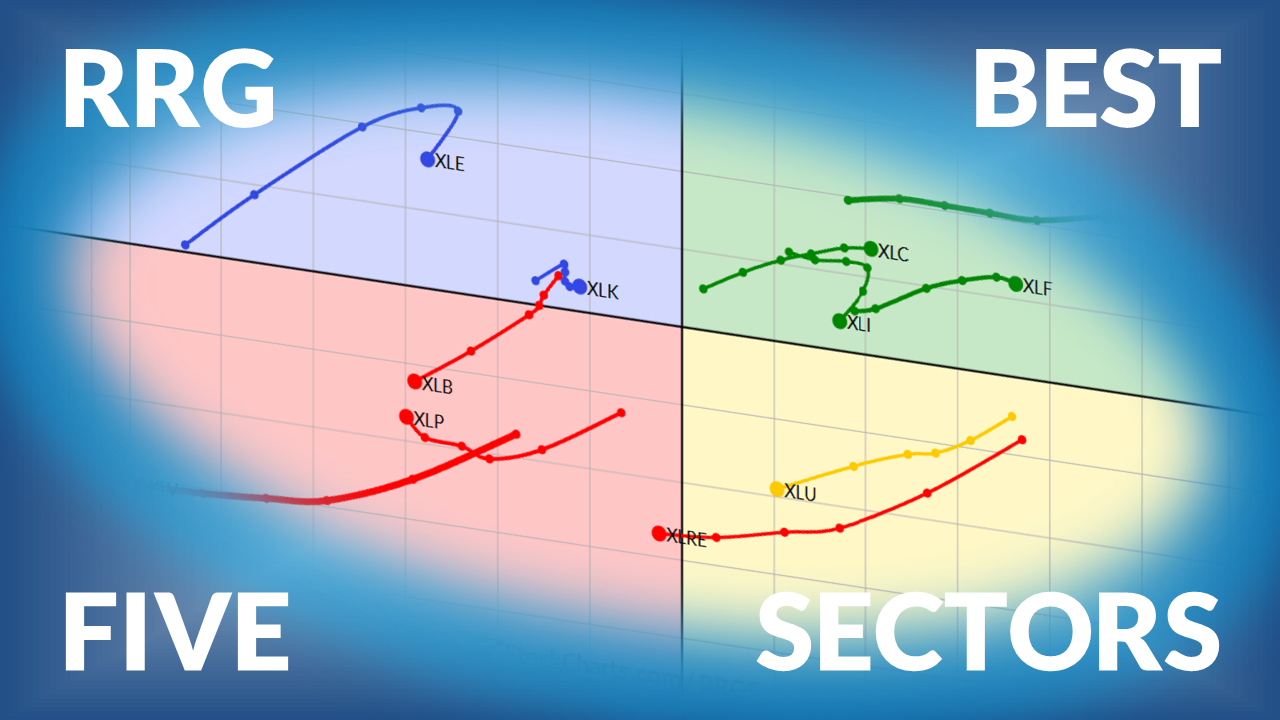

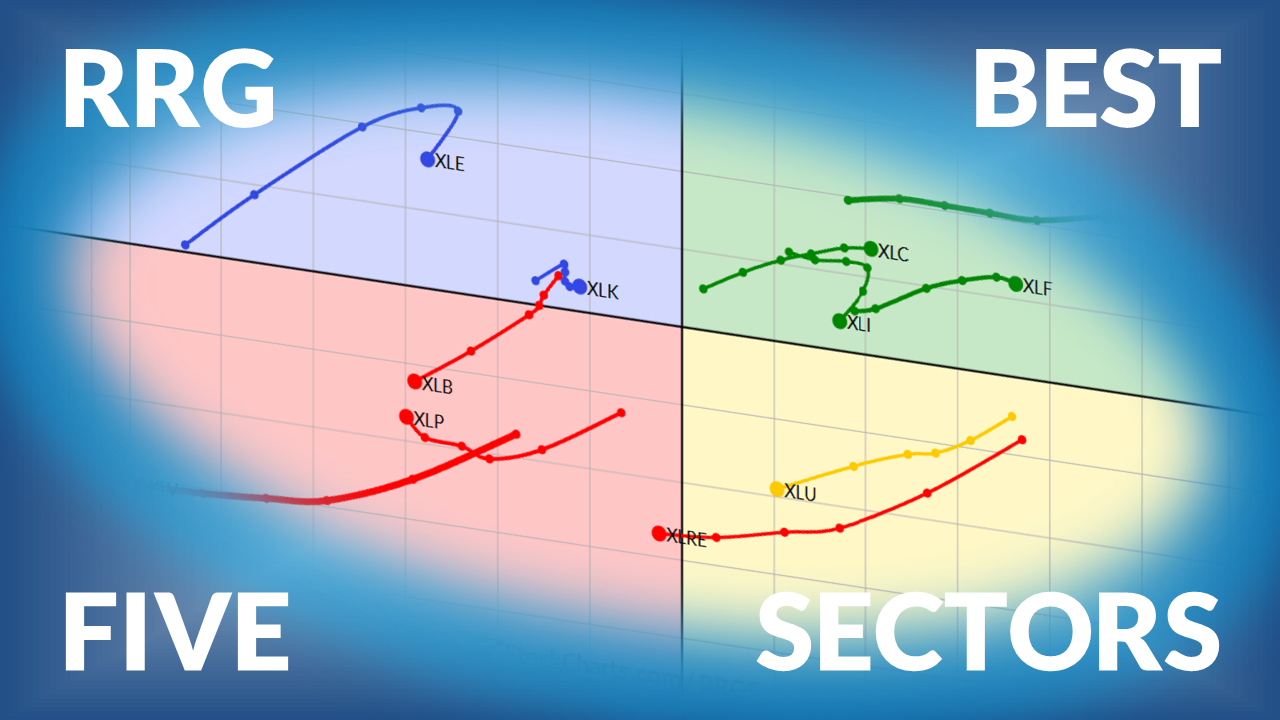

The Best Five Sectors This Week, #51

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Volatility Hits Rock Bottom, What It Means for the Week Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Though the NIFTY is trading just below lifetime highs, it appears to be in a zone of indecision. What's the best strategy in a setting where any adverse trigger could make the market vulnerable?...

READ MORE

MEMBERS ONLY

StockCharts Insider: How to Spot Style Rotation Before the Crowd

by Karl Montevirgen,

The StockCharts Insider

Before We Dive In…

The market isn’t one story. It’s a dozen stories fighting for the spotlight. And depending on the day, a different one steals the show. One of the cleanest ways to read those stories is through Market Factors—Value, Growth, Momentum, Quality, and more. Spot...

READ MORE

MEMBERS ONLY

Larry Williams’ 2026 Market Forecast: Cycles, Risks, and Opportunities

by Larry Williams,

Veteran Investor and Author

Larry Williams presents his full-year 2026 market outlook, explaining why many popular bearish forecasts don’t align with history or market data. With the help of cycles, valuations, and employment trends, Larry outlines what investors can realistically expect in the year ahead....

READ MORE

MEMBERS ONLY

Stocks are Improving - So Why Am I Still Cautious?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks may be improving again, but the signals aren’t lining up cleanly just yet. Julius de Kempenaer explains what’s getting better, what’s still holding the market back, and why caution might be warranted here....

READ MORE

MEMBERS ONLY

Watch This Chart — “Affordability” May Be About to Get Less Affordable

by Martin Pring,

President, Pring Research

Gold's historic leadership may be shifting. A critical Gold/CRB signal suggests a potential commodity bull market and rising affordability risks ahead. ...

READ MORE

MEMBERS ONLY

A Year of Market Fear — and Resilience: Breaking Down the VIX in 2025

Revisit the major volatility catalysts of 2025 to gain insight into what new ones could be in store next year....

READ MORE

MEMBERS ONLY

Consolidation Continues: Nifty Awaits Trigger for Directional Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the Nifty now in a sideways consolidation, what will it take to reignite upward momentum? And what does the truncated week ahead look like for the Indian market?...

READ MORE

MEMBERS ONLY

J.P. Morgan's Top Picks for 2026: A Closer Look at the Charts

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen McGonagle takes a close look at some seminconductor and networking names that J.P. Morgan has ranked as top picks for the new year. What are her thoughts?...

READ MORE

MEMBERS ONLY

Three Investing Lessons from a Challenging 2025 Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

After a challenging and highly rotational 2025, Dave Keller, CMT, shares three key investing lessons, from focusing on process over prediction to recognizing leadership shifts beneath the surface. Learn how investors can better prepare for market opportunities in 2026....

READ MORE

MEMBERS ONLY

Is a Santa Claus Rally Starting to Take Shape?

by Mary Ellen McGonagle,

President, MEM Investment Research

Mary Ellen analyzes a notable shift in the markets, how to capitalize, and what it might mean for the fabled Santa Claus Rally....

READ MORE

MEMBERS ONLY

2025 Market Recap & 2026 Outlook: Trends, Psychology, and What Comes Next

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Grayson and Dave give their year-end thoughts about the wild market action of 2025, what worked (or not) for traders over the course of the year, and what lessons to take for 2026. ...

READ MORE

MEMBERS ONLY

Semiconductors Crumble; Big Warning Signs Flashing!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tom looks at the last week's market action and what it means for bulls....

READ MORE

MEMBERS ONLY

What Is The Crypto Selloff Telling Us About Stocks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bitcoin and the S&P 500 often move in tandem, but when they move in opposite directions, it's time to pay attention. Find out what Tom Bowley's analysis reveals about Bitcoin signaling an early warning....

READ MORE

MEMBERS ONLY

To Be Invested or Not to be Invested? That is the Question

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

These three indicators will filter out the noise and identify whether the stock market is bullish or bearish. This, in turn, will help you determine whether you should remain invested or not. Explore these indicators and find out which key levels to watch....

READ MORE

MEMBERS ONLY

Stocks Showing Early Market Rotation Using Relative Strength

by Joe Rabil,

President, Rabil Stock Research

Joe Rabil of Rabil Stock Research looks at stocks rotating after a long bearish, discusses the prospects of a Santa Claus rally, and breaks down viewer-requested stocks....

READ MORE

MEMBERS ONLY

Calm Markets, Crude Chaos: Why Oil Is the Odd One Out This Holiday Season

While equities have remained relatively calm during this holiday season, oil prices have been under pressure. Even as energy stocks are performing better than crude, the overall trend remains bearish....

READ MORE

MEMBERS ONLY

Two Markets That Could Be Influenced by a Peace Settlement in Ukraine

by Martin Pring,

President, Pring Research

Martin Pring analyzes the two areas that could see a significant upside move if a peace settlement in the conflict in Ukraine is reached....

READ MORE

MEMBERS ONLY

Change of Character: Spotting the Shift From Downtrend to Uptrend

by David Keller,

President and Chief Strategist, Sierra Alpha Research

David Keller explains how to spot when a stock transitions from distribution to accumulation, and how you can use scanning, alerts, and scheduled scans to find the next breakout....

READ MORE

MEMBERS ONLY

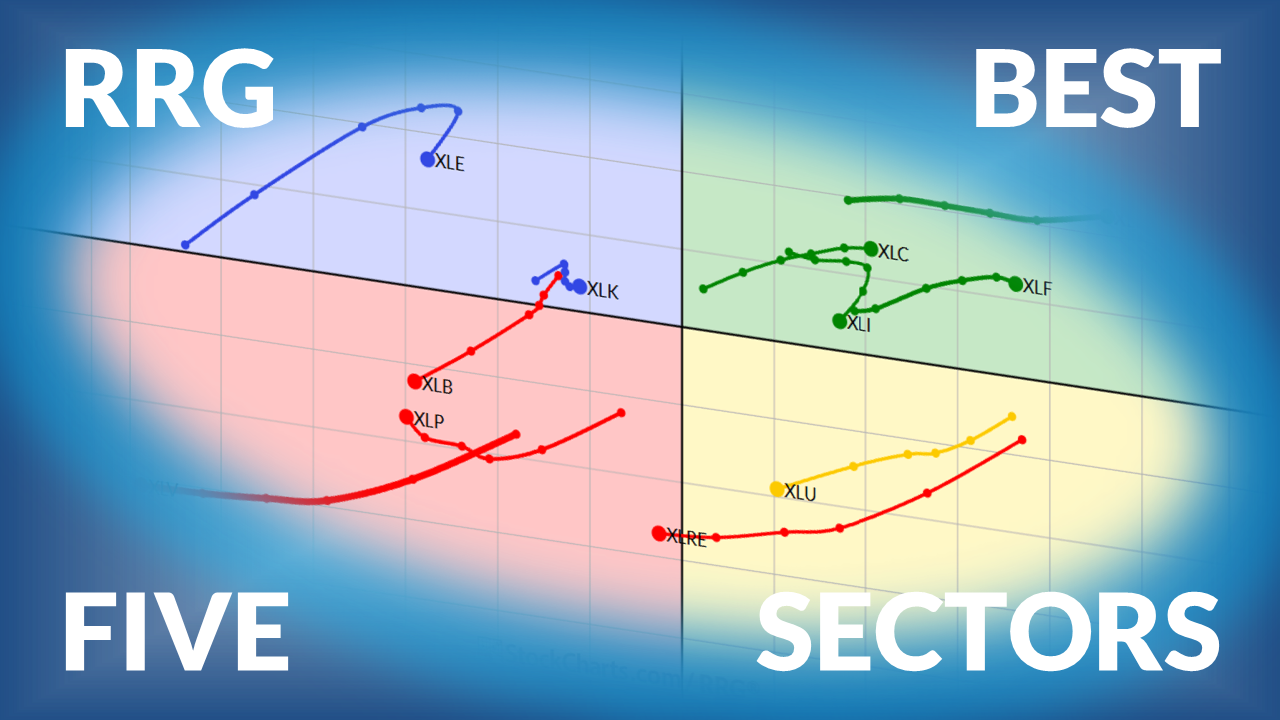

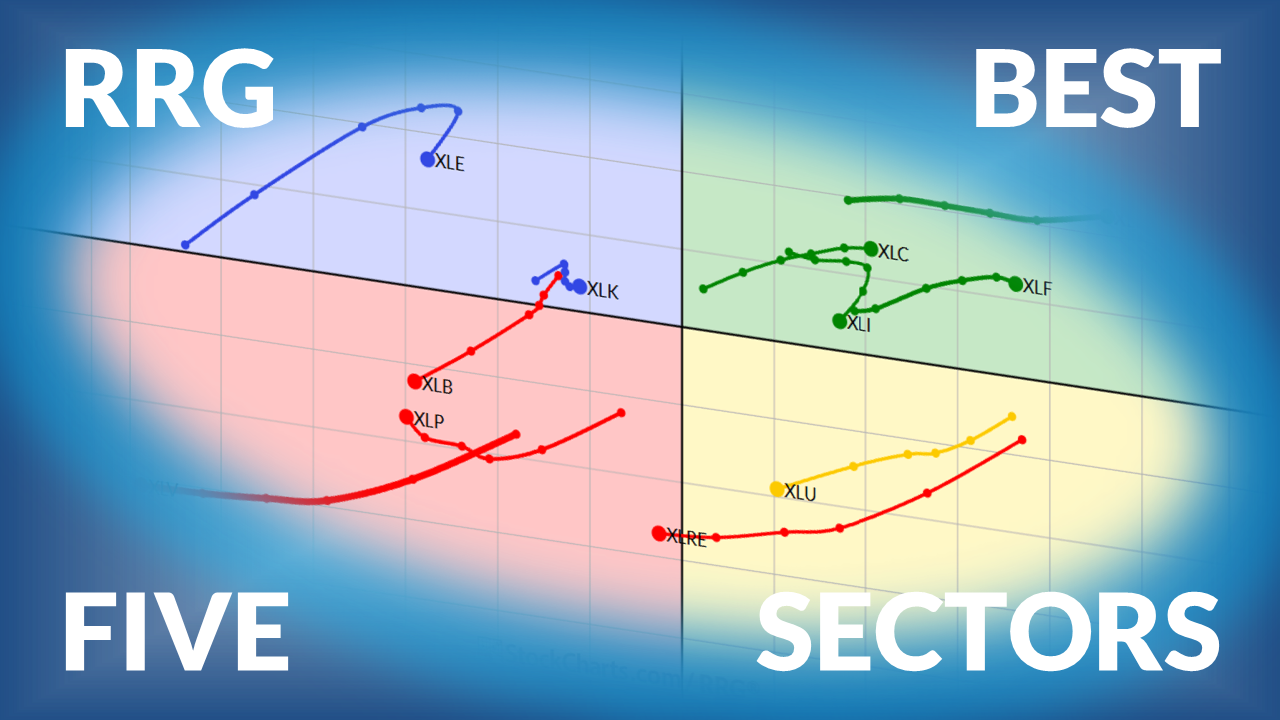

The Best Five Sectors This Week, #49

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on U.S. sector rotation using Relative Rotation Graphs....

READ MORE