MEMBERS ONLY

Top Ten Charts for August: Best Healthcare Stocks for August 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, honing in on two Health Care stocks showing renewed signs of strength. He also breaks down how earnings releases relate to price trends, and how investors should...

READ MORE

MEMBERS ONLY

Gold Miners' Performance vs. Gold -- Does It Say Sell Gold?

by Carl Swenlin,

President and Founder, DecisionPoint.com

In Monday's DecisionPoint Trading Room video, we were asked why we cover Gold Miners (GDX) as well as Gold (GLD). There are two reasons:

1. Some people prefer to own the commodity, Gold, and others prefer to own an operating company that benefits from the price of Gold,...

READ MORE

MEMBERS ONLY

Looking for the Next Entry Point in SPY? USE RSI!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use RSI in multiple timeframes to identify the next buying opportunity in the SPY. He explains why he thinks this rally is important and uses the ADX on the daily to distinguish between the strength in different indices. Joe also...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Key Defensive Plays

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, with a focus today on Utilities and Real Estate. Why do low-beta, high-income stocks do so well in bearish market phases, and do we still see signs...

READ MORE

MEMBERS ONLY

Disney Bust or Bargain? Here are the Levels to Watch!

by Karl Montevirgen,

The StockCharts Insider

The House of Mouse has taken a serious nosedive over the last three years, having gone from a high of about $201 down to $89 and change—a 55% drop that feels like one of its roller coaster rides. Not exactly the thrill Disney shareholders were hoping for.

But Disney...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Tempting Consumer Staples Names

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues a five-part series covering ten charts to watch in August 2024, focusing on potential ideas in the Consumer Staples sector. Are dividend-paying defensive names the way to ride out a period of market uncertainty?

This video originally premiered...

READ MORE

MEMBERS ONLY

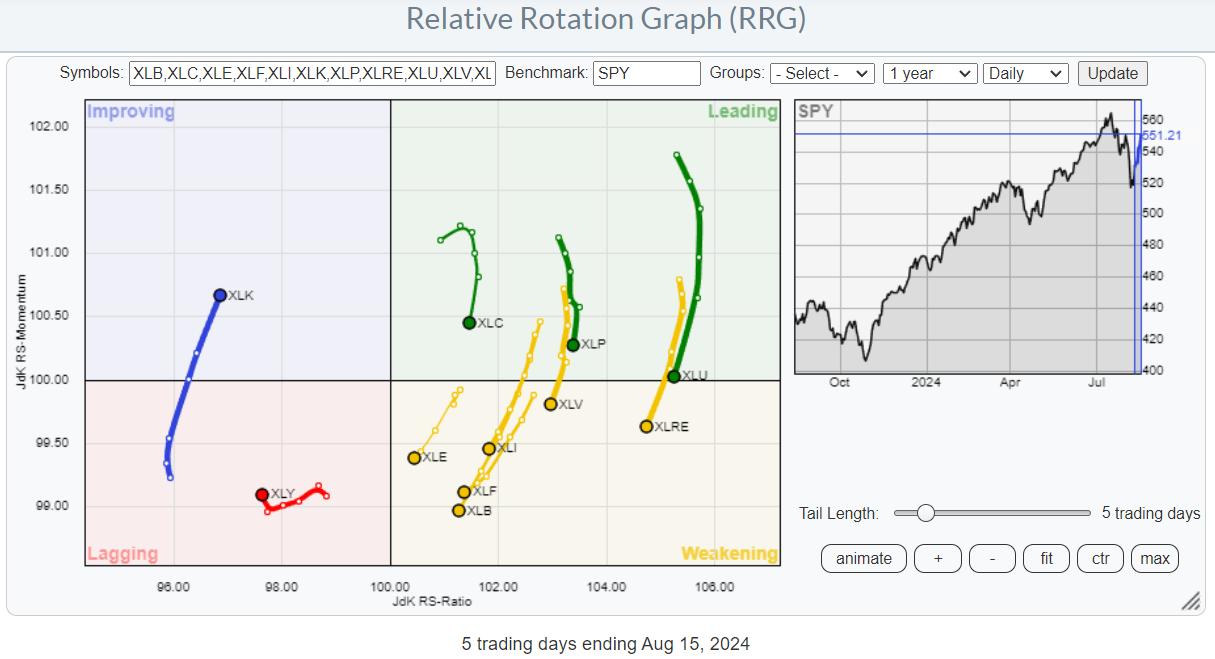

What Does This Mean for the S&P 500 Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the conflicting rotations in both asset classes and equity sectors. The weekly rotations differ significantly from their daily counterparts. What does it mean for the current rally in the S&P 500, and what does it mean for the relationship...

READ MORE

MEMBERS ONLY

Top Ten Charts for August: Two Magnificent 7 Stocks Worth Watching

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave kicks off a five-part series covering ten charts to watch in August 2024, starting with two mega-cap growth stocks testing key resistance levels. Will they power up to new all-time highs into September?

This video originally premiered on August...

READ MORE

MEMBERS ONLY

This Market is On Track for a 45-Year Breakout

by Martin Pring,

President, Pring Research

It's not very often that any market experiences a 10-year breakout, let alone a 45-year one. That, however, is what Chart 1 says is about to materialize for the inflation-adjusted gold price.

Since the chart is based on monthly data, we will not know for sure until the...

READ MORE

MEMBERS ONLY

DP Trading Room: Potential Housing Crash?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin discuss the potential of a housing crash as more evidence is coming in that many haven't thought of. Private Equity firms have become very involved in the housing market, buying up properties on high amounts of leverage. What happens when it's time...

READ MORE

MEMBERS ONLY

These Groups Just Turned BULLISH!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights what drove last week's sharp rally in the markets - posting their largest weekly gains for the year! She takes a close look at retail and cybersecurity stocks setting up for gains, and shares some of the best ways to...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs NEXT WEEK - Thursday, August 22 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, August 22 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

What Inflation Fear? Strong Retail Sales Fuel Growth

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong up day for growth leadership names, with ULTA and NVDA powering higher after retail sales numbers pushed aside inflation fears. He notes the cautious positioning in the NAAIM Exposure Index, Bitcoin's failed attempt to...

READ MORE

MEMBERS ONLY

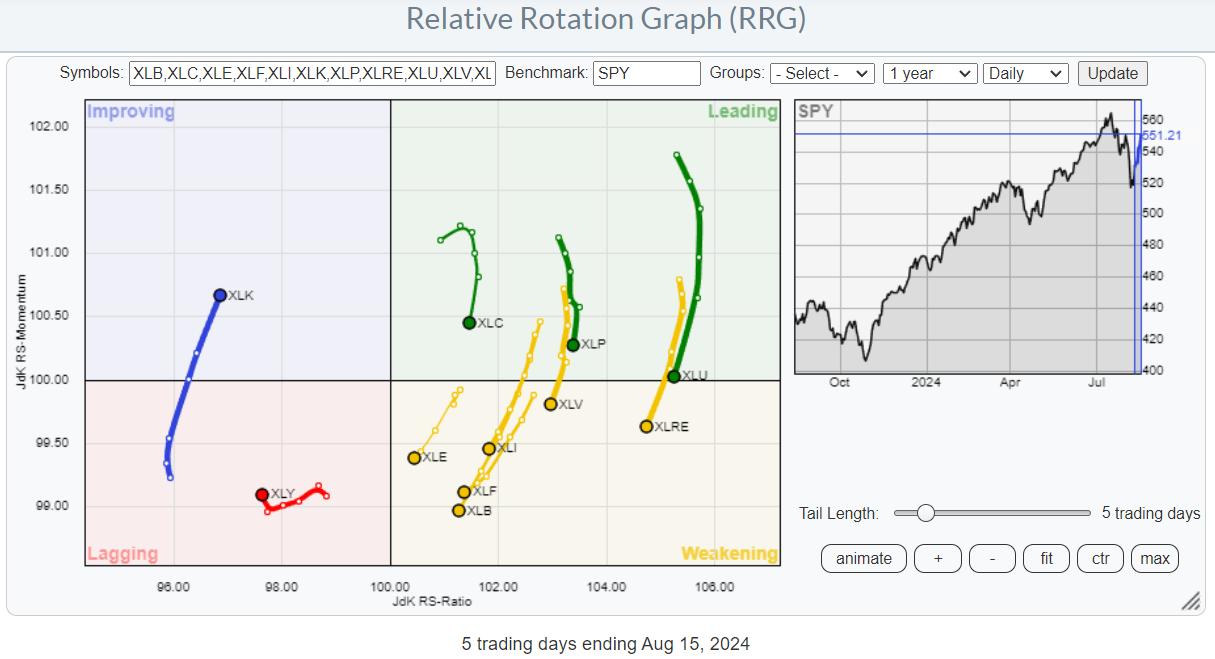

Strength Off the Lows, But Concerns Remain

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Rotation to large-cap growth is back

* And so is the narrow foundation/breadth supporting this rally

* Weekly and daily $SPX charts need to get in line

Stronger than Expected

The recent rally out of the August 5th low is definitely stronger than I had anticipated. I was watching...

READ MORE

MEMBERS ONLY

Mag 7 Stocks in the Spotlight as Stock Market Recovers

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling inflation data added some optimism in the market although trading volume was low

* The broader stock market indexes are seeing some daylight as they pop their heads out after being underwater

* The Mag 7 stocks are showing strength, which means there could be some buying opportunities soon...

READ MORE

MEMBERS ONLY

Head and Shoulders Top for Semiconductors?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how breadth conditions have evolved so far in August, highlights the renewed strength in the financial sector with a focus on insurance stocks, and describes how the action so far in Q3 could be forming a potential head-and-shoulders...

READ MORE

MEMBERS ONLY

How ADX Stage Analysis Can Make You a BETTER Trader!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows the four stages a stock or market can be in at any time. He explains each stage and how ADX & Volatility can help define each stage. He then shows what stage the SPY is right and why the bias is still...

READ MORE

MEMBERS ONLY

The Growth Trade is Back!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps an epic rally in mega cap growth stocks, with NVDA up over 6% and META threatening a new 52-week high. Dave highlights how gold and bond prices continue to rise in the face of stronger stocks, and breaks...

READ MORE

MEMBERS ONLY

CRITICAL Week Ahead for S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses various rotations using Relative Rotation Graphs, starting at asset class level and then moving to sectors. Julius zooms in on the industries of two sectors to get an idea of where pockets of out-performance may exist in the current market. He then...

READ MORE

MEMBERS ONLY

VIX Indicates Fear, But Is It Enough?

by Martin Pring,

President, Pring Research

Last Monday, markets around the world experienced a sharp drop as the unwinding of yen carry trades followed the previous Friday's response to a weak employment report. The speed and sharpness of the equity sell-off got the attention of the general-purpose media and just about everyone else.

From...

READ MORE

MEMBERS ONLY

Why Bonds and Gold Are Outperforming Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a choppy Monday for the equity markets, as gold tests new all-time highs and interest rates continue to plummet. He highlights the stock to bond ratio, revisits the classic 60:40 ratio favored by investors, and breaks down...

READ MORE

MEMBERS ONLY

DP Trading Room: Mortgage Rates are Falling - Watch Real Estate

by Erin Swenlin,

Vice President, DecisionPoint.com

Mortgage Rates fell quite a bit this past week and no one is really talking about it. One area that we will want to watch closely as rates fall is Real Estate (XLRE). This sector has already been moving in the right direction. It now has an opportunity to rally...

READ MORE

MEMBERS ONLY

CAUTION ADVISED Ahead of This Week's Inflation Data!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen dives into her broad market analysis, sharing what she needs to see before it's safe to get back in. She also shares her top candidates for once the markets turn positive, including META, LLY and NFLX. She finishes up by sharing...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Tentative As Defensive Setup Develops; Know These Levels Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The market extended its corrective move in the previous week; over the past five sessions, it has remained quite choppy and totally devoid of any definite directional bias. It absorbed a few global jerks and saw gaps on either side of its previous close on different occasions. While the level...

READ MORE

MEMBERS ONLY

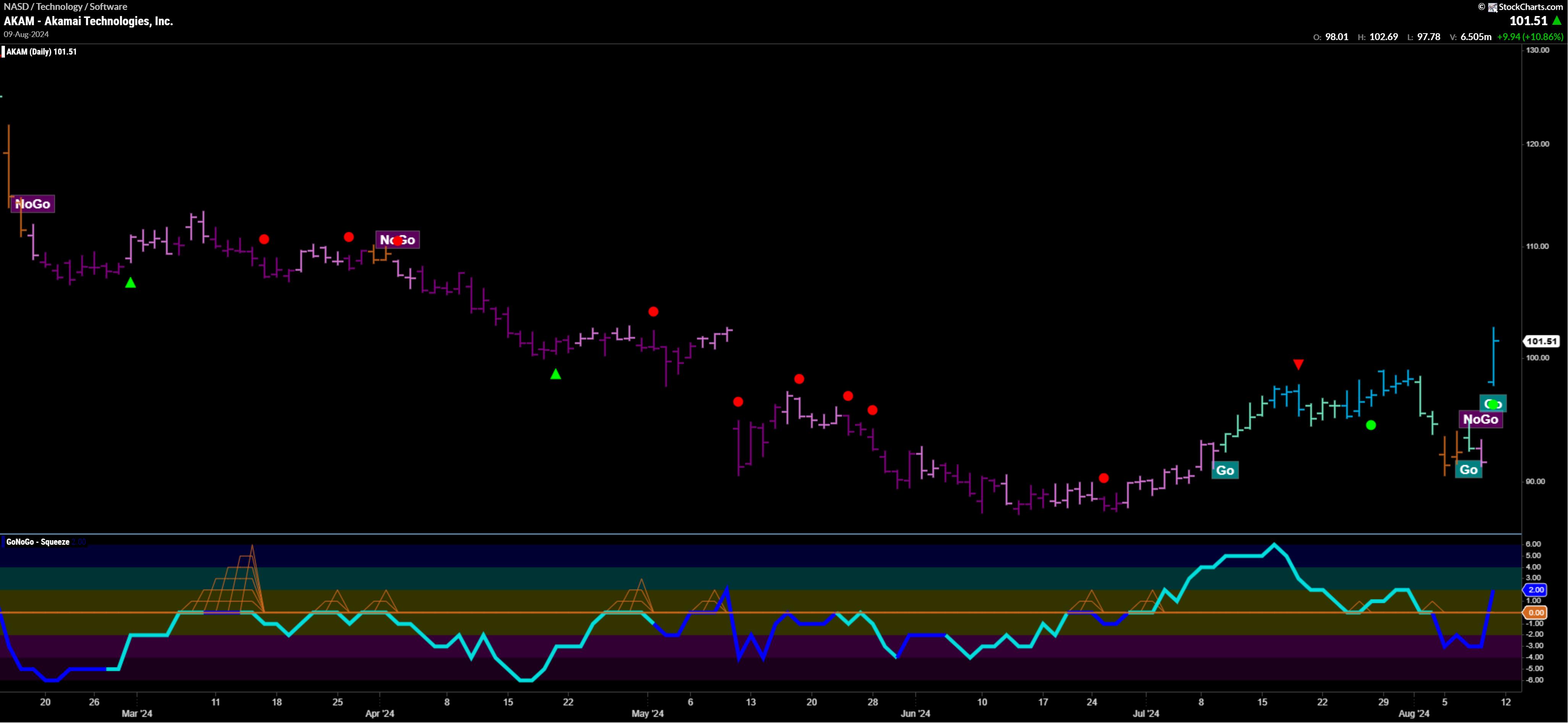

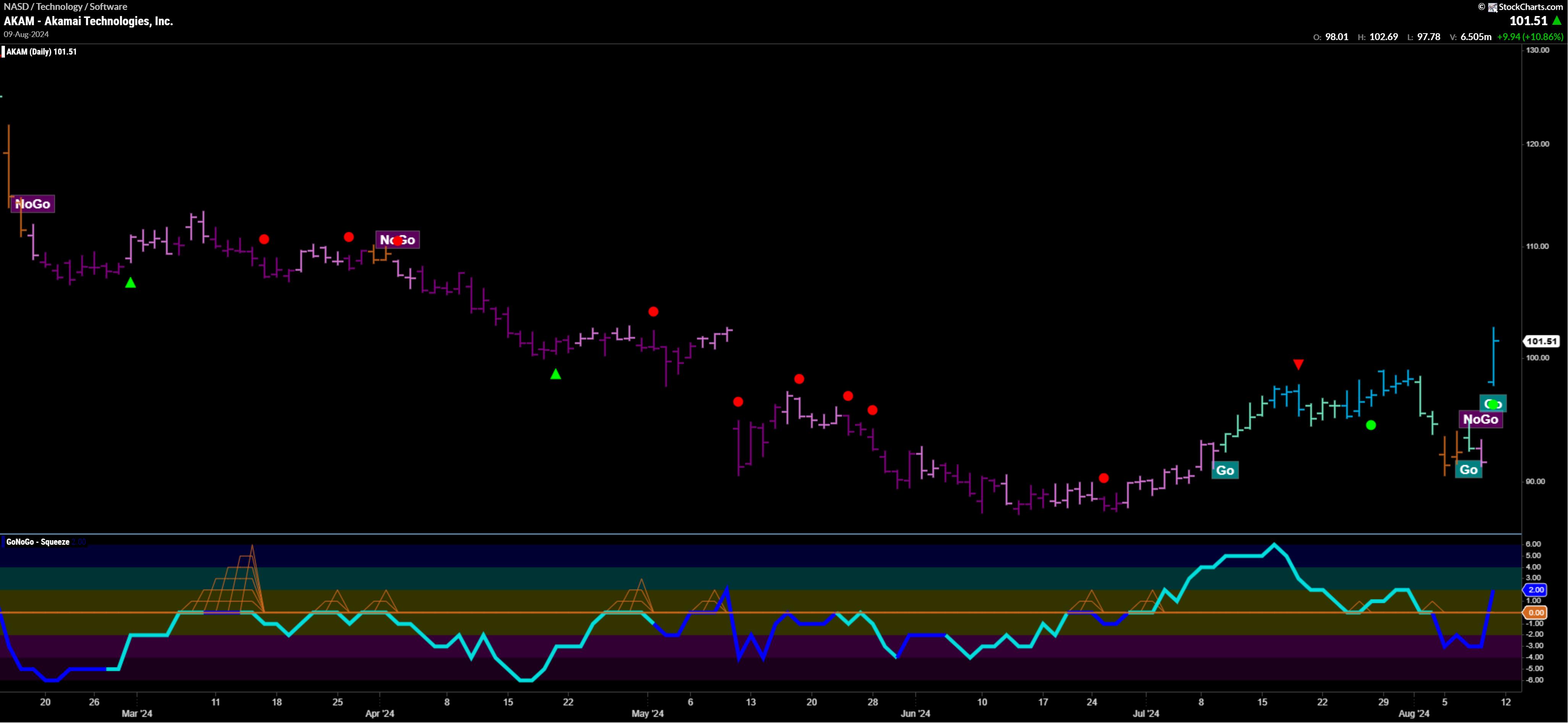

Top 5 Stocks in "Go" Trends | Fri Aug 9, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning for breakouts on heavy volume

* Momentum confirmations of underlying trends

* Leading Equities in trend continuation

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of...

READ MORE

MEMBERS ONLY

Three Market Sentiment Indicators Confirm Bearish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The VIX reaching 65 signals extreme volatility and elevated risk of market downside

* The AAII Survey is close to showing more bears than bulls, which would line up with previous corrections

* The NAAIM Exposure Index indicates that money managers were rotating to defensive positioning in early July

While...

READ MORE

MEMBERS ONLY

S&P 500 Teetering On 100-Day Moving Average Support

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indexes end the week on a positive note after a scary Monday

* Volatility steps back slightly after a brief spike over 65

* Next week's consumer and producer inflation data could help set direction

A sigh of relief? The US stock market started the...

READ MORE

MEMBERS ONLY

How the PROS Time Entry Points

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on optimizing entry points for long ideas, best practices for point & figure charts, and the relationship between gold and interest rates.

See Dave's chart showing Zweig Breadth Thrust...

READ MORE

MEMBERS ONLY

When Does This Selloff End?

by Larry Williams,

Veteran Investor and Author

In my last newsletter,I discussed cycle projections for the S&P 500, i.e., a rally and then down into a mid-September low. The recent price action in the stock market may have many of you wondering when to open long equity positions.

My cycle work suggests we...

READ MORE

MEMBERS ONLY

The Great Rotation: Not What You Think

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Small-cap stocks look like they have lost momentum.

* Market breadth in small-cap stocks appears to be weakening.

* The Utilities sector seems to be gaining momentum.

Just so we are on the same page, I looked up "Great Rotation" on Microsoft's Copilot and came away...

READ MORE

MEMBERS ONLY

DP Trading Room: Bear Market Rules Apply

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is dropping perilously right now and so it is time to review Bear Market Rules. Today Erin and Carl share their rules for trading during a bear market move. We aren't officially in a bear market and we may not get there, but there is likely...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Prone To Profit-Taking Bouts; Guard Profits and Stay Stock-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week turned out quite volatile for the markets as they not only marked a fresh lifetime high but also faced corrective pressure as well towards the end of the week. The markets maintained an upward momentum all through the week. It scaled the psychologically important 25000 level as...

READ MORE

MEMBERS ONLY

Recession Fears Top of Mind As Tech Stocks Selloff

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Weak manufacturing and jobs data sends investors into panic mode

* All broader stock market indexes fall over 2%

* Bond prices rise

The dog days of summer are here. And the stock market gives us a brutal reminder of this.

The first trading day of August began on a...

READ MORE

MEMBERS ONLY

It's Been a Long Time Mr Bear, Where Have You Been?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Some real damage for the markets

* Equal weight sector rotation paints a more realistic picture

* The BIG ROTATION into small caps has come to a halt

And then ..... all of a sudden..... things are heating up. Lots of (downside) market action in the past week.

Let's...

READ MORE

MEMBERS ONLY

This Breadth Indicator Points to More Downside and a Potential Opportunity

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Most stocks follow their underlying index or group.

* Oversold conditions in long-term uptrends are opportunities.

* Stocks can remain oversold so wait for an upward catalyst.

The broad market and the group are big drivers for stock performance. Recently, the Nasdaq 100 ETF (QQQ) led the market lower with...

READ MORE

MEMBERS ONLY

Bonds To Get Beat Up? | Focus on Stocks: August 2024

by Larry Williams,

Veteran Investor and Author

It looks to me like it's time for the bond market to take a breather, if not have a pullback from now into late October.

We can sum it up with the cycle projections from Chart 1. I have highlighted, in red, the down leg of the 450-day...

READ MORE

MEMBERS ONLY

Big Tech Earnings, Fed Meeting, Jobs Report: Will They Add More Pressure to the Stock Market?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investor sentiment has turned more bearish with a continuation of a selloff in big tech stocks.

* More earnings, an FOMC meeting, and jobs report are adding to investor uncertainty.

* Keep an eye on bond prices as the data starts to unravel.

Last week, there was a noticeable change...

READ MORE

MEMBERS ONLY

S&P 500 Equal Weight ETF Gains Strength

by Bruce Fraser,

Industry-leading "Wyckoffian"

The S&P 500 index ($SPX) is a capitalization-weighted stock index. Many lesser capitalization blue-chip stocks that compose these 500 companies have been performance laggards. Though smaller companies in the index, these corporations are among the bluest of the blue-chip stocks. These prestigious corporations have been overshadowed by the...

READ MORE

MEMBERS ONLY

Is the Bond Market About To Make a Big Move?

by Martin Pring,

President, Pring Research

The bond market experienced a secular bear between 1981 and the spring of 2020. Chart 1 offers three reasons why it has since reversed and given way to a secular uptrend or possibly multi-year trading range.

The first piece of evidence comes from violating the multi-decade trendline. Second, the price...

READ MORE