MEMBERS ONLY

DP Trading Room: Spotlight on Mega-Cap Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

This week we have four Magnificent Seven stocks reporting earnings. We also take a look at McDonalds (MCD) and Ford (F) going into earnings. How are the chart technicals setup on the precipice of earnings? Carl and Erin give you there thoughts.

Carl reviews the DP Signal Tables to see...

READ MORE

MEMBERS ONLY

Will the S&P 500 Break 5000 by September?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week saw the major equity averages continue a confirmed pullback phase, with some of the biggest gainers in the first half of 2024 logging some major losses. Is this one of the most buyable dips of the year? Or is this just the beginning of a protracted decline with...

READ MORE

MEMBERS ONLY

Recovery Rally In Stock Market Offers Hope: What You Need To Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* After two days of massive selloffs, Friday's recovery offers some hope.

* Investors await earnings from mega-cap tech companies, economic data, and Fed meeting.

* Small caps continue to trend higher.

Major equity indexes rose on Friday after a selloff that hit the Technology sector especially hard. But...

READ MORE

MEMBERS ONLY

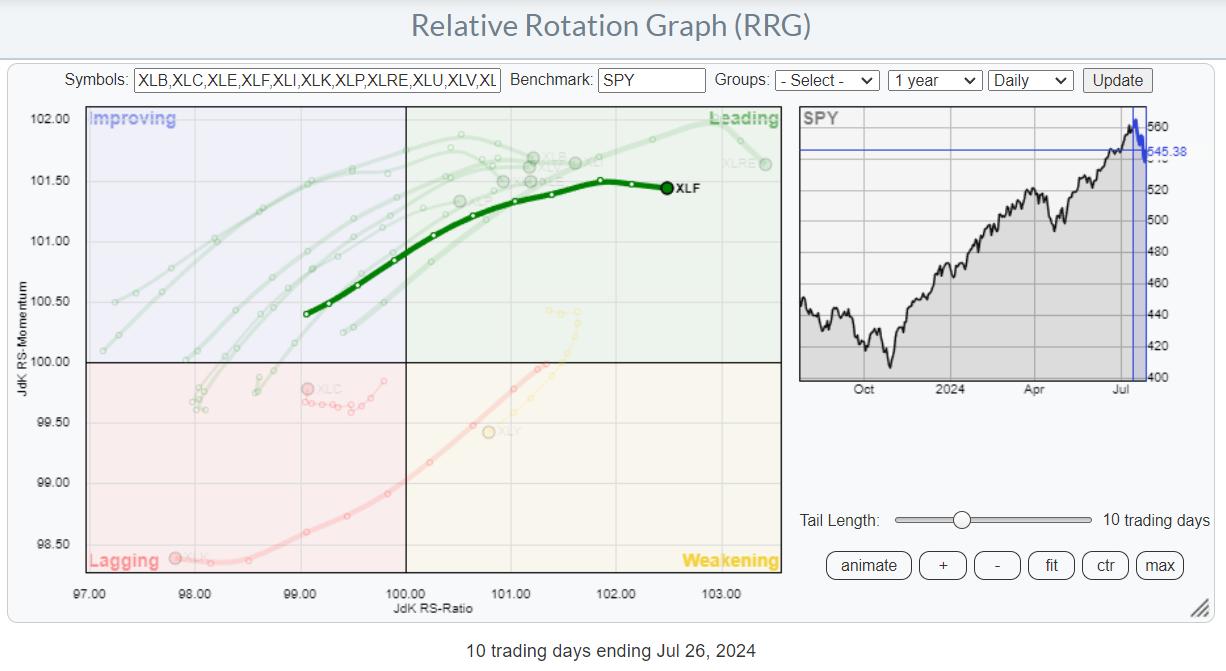

Flying Financials. Will It Be Enough?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Strong Sector Rotation Out Of Technology

* Financials and Real Estate Lead

* Stock/Bond Ratio Triggers Sell Signal

Flying Financials

In the recent sector rotation, basically OUT of technology and INTO anything else, Financials and Real-Estate led the relative move.

On the RRG above, I have highlighted the (daily)...

READ MORE

MEMBERS ONLY

After the Tech Bloodbath: Ways to Strategize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks took a dive on Wednesday but look like they are making up some of those losses prior to hitting the next support level.

* Expect volatility in the stock market in the coming weeks since it's earnings season and there's a Fed meeting...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Key Trendline as Growth Stocks Plunge

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators.

See Dave's MarketCarpet featuring the Vanilla...

READ MORE

MEMBERS ONLY

1-2-3 Reversal Pattern: What It Is and How to Use It

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains the 1-2-3 reversal pattern, its criteria, and what it will take for QQQ to complete the pattern. He also discusses how the pattern is not always as clean as we would like. Joe then shares a few Crypto markets which are starting...

READ MORE

MEMBERS ONLY

Small Caps Surge, Markets React to TSLA & GOOGL Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave previews earnings releases from TSLA and GOOGL, breaks down key levels to watch for SPOT, GE, and more, and analyzes the discrepancy between S&P 500 and Nasdaq breadth indicators.

This video originally premiered on July 23, 2024....

READ MORE

MEMBERS ONLY

The Stock Market is Bracing for Earnings IMPACT!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down today's upside recovery day for stocks, then shares the charts of TSLA, NVDA, and more. He also illustrates the conflicting messages from AAII and NAAIM sentiment surveys, and also highlights the VIX testing the key...

READ MORE

MEMBERS ONLY

DP Trading Room: Behind the Scenes: CrowdStrike (CRWD)

by Erin Swenlin,

Vice President, DecisionPoint.com

Friday was a bad day for CrowdStrike Holdings (CRWD) as a bug was pushed out that disrupted Windows machines worldwide. The trouble for CRWD is the follow-up lawsuits etc that will likely plague the stock for some time to come. You'll be shocked to see the warning signs...

READ MORE

MEMBERS ONLY

Time for a Pause That Refreshes Stocks and Gold?

by Martin Pring,

President, Pring Research

Most weekends, I run through a chart list featuring weekly bars and candlesticks of bonds, stocks and commodities to see if any one or two bar patterns or candlestick formations have developed. Last week produced a crop of bearish messages from the major averages and some sectors. Before you rush...

READ MORE

MEMBERS ONLY

CrowdStrike: Did On-Balance Volume See the "Largest IT Outage In History" Coming?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Friday's CrowdStrike software disaster has been described as "the largest IT outage in history," and it brought home just how vulnerable the planet is to itty-bitty coding errors. We were busy publishing the DecisionPoint ALERT Weekly Wrap, so I didn't have a chance to...

READ MORE

MEMBERS ONLY

Is It Game Over for Growth Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen examines which areas of the market have moved into favor amid the S&P 500 pullback. She compares value vs. growth stocks and the merits of both, and highlights the move away from technology stocks. Which areas are poised for more downside?...

READ MORE

MEMBERS ONLY

Important Market Breadth Indicators to Watch: Making Sense of Three Consecutive Down Days

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Three consecutive declining days in the stock market increases risk appetite

* Semiconductors were the catalyst for the selloff and trading below two support levels

* Keep an eye on market breadth indicators to get indications of whether the stock market is correcting or if the selloff will be longer-term...

READ MORE

MEMBERS ONLY

What Does a Market Top Look Like?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 remains in a primary uptrend, as confirmed by a fairly consistent pattern of higher highs and higher lows. But what would confirm that a top is in place for our major equity benchmarks? To answer that, it may be helpful to review other charts that...

READ MORE

MEMBERS ONLY

VIX SPIKES! Is a Market Correction Coming?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares a market update including key levels to watch for the S&P 500 index, what a VIX above 15 means for a possible market correction, the improvement in value-oriented sectors, and why DPZ may be the world&...

READ MORE

MEMBERS ONLY

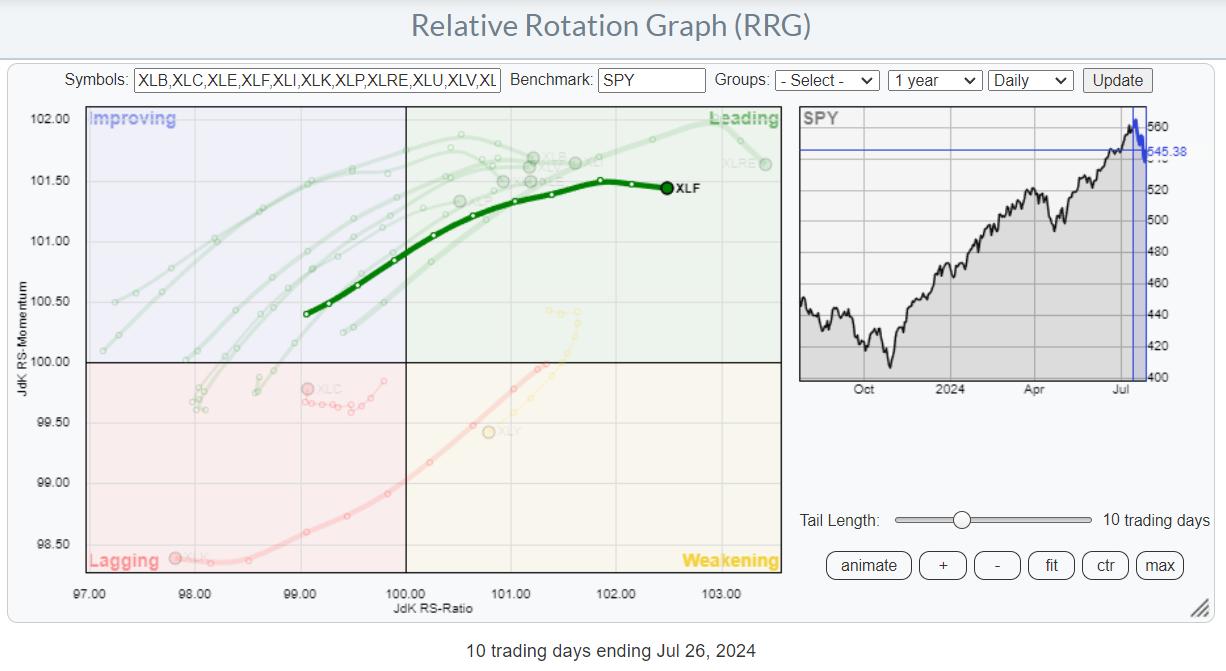

Will This Sector Rotation Be the Start of Something Bigger?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Technology is rotating out of favor

* Market Capitalization is a two-edged sword

* Negative divergences on Technology and S&P 500 charts are executing

Strong Rotations on Daily RRG

This daily RRG shows the sector rotation over the last five days. With only one more trading day to...

READ MORE

MEMBERS ONLY

Election Year Patterns | Larry's "Family Gathering" July 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

What stocks right now does Larry have his eye on? Which ones is he saying "see you later... for now"? And which ones does he not like very much at all?

In this month's Family Gathering video, Larry presents an in-depth discussion on the patterns we...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

Find Trades Using These POWERFUL MACD Combinations

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows how to use 2-3 specific MACD patterns on the monthly and weekly charts to set the stage for potential trading ideas. Joe then goes through the shifts in the Sector action and shows where the money is flowing. He covers the stock...

READ MORE

MEMBERS ONLY

Dow Theory Bull Confirmed! What Happens Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave comments on the Newer Dow Theory signal, improving market breadth conditions, impact of lower interest rates, and key levels to watch for GLD, UNH, CAT, and BAC. He also breaks down today's rally driven by small caps...

READ MORE

MEMBERS ONLY

Why Stocks are STILL the BEST Investment

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius looks at the markets from an asset allocation perspective using various RRGs. Stocks are (still) beating bonds, while commodities are rotating out of favor and the USD is losing steam. BTC is jumping higher off support, and the Yield Curve is steepening against...

READ MORE

MEMBERS ONLY

Small Caps & Value Sectors are Booming (For Now)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a strong Monday for value stocks, with the Financial and Energy sectors leading the S&P 500 and Nasdaq to new highs. He shares an update on the Hindenburg Omen, how Bitcoin has regained its 200-day moving...

READ MORE

MEMBERS ONLY

These Two Sectors are Showing Promising Silver Cross Setups

by Martin Pring,

President, Pring Research

A silver cross occurs when a 20-day MA crosses above its 50-day counterpart. While far from perfect, such signals enable you to ride a persistent trend. However, like all trend following techniques, problems can occur in a trading range environment.

Chart 1 features two recent buy signals for the S&...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, July 18 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, July 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

DP Trading Room: PMO Sort on Earnings Darlings

by Erin Swenlin,

Vice President, DecisionPoint.com

Earnings are coming into focus and today Erin looks at the big earnings stocks to find out which look the best going into earnings. She took the list of stocks and sorted them by the Price Momentum Oscillator (PMO) which put the strongest stocks at the top of the list....

READ MORE

MEMBERS ONLY

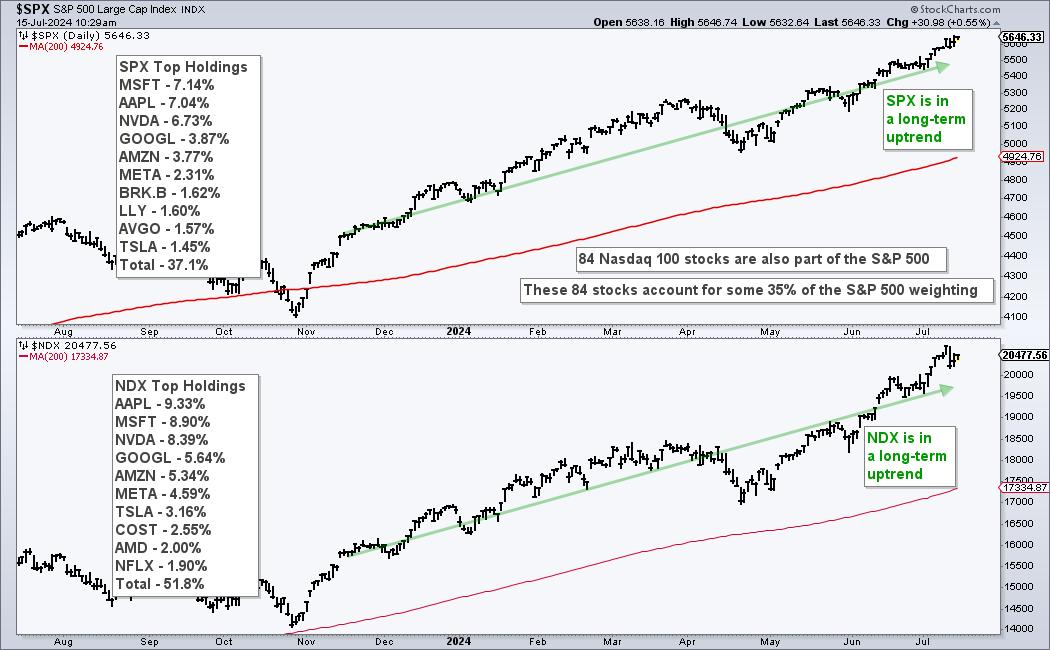

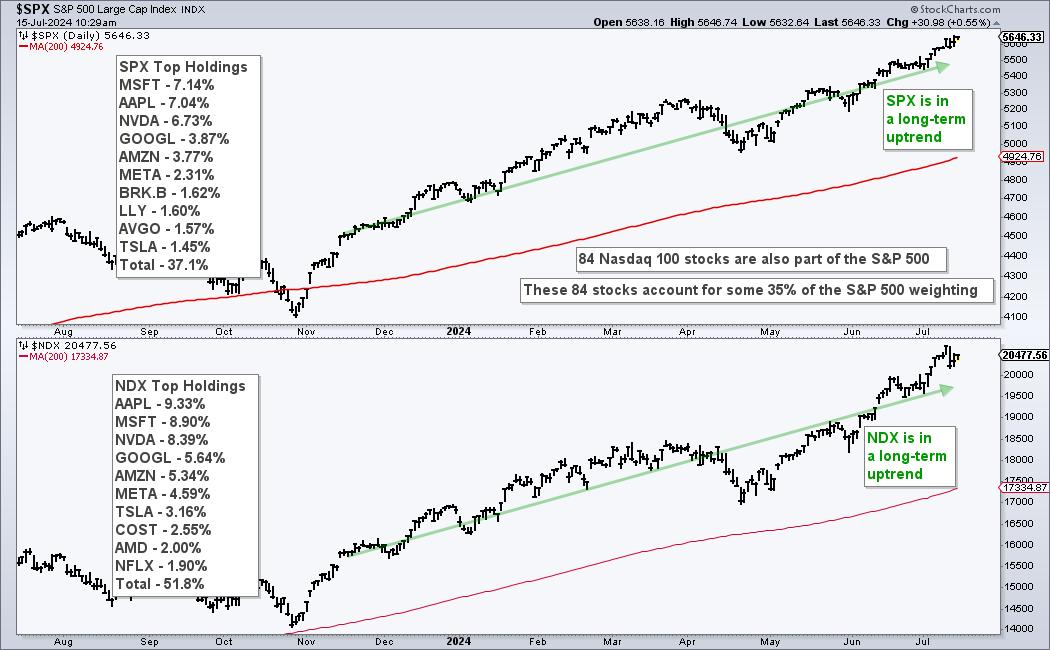

Using Nasdaq 100 Specific Breadth to Measure Risk Appetite

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Nasdaq 100 stocks account for over 30% of the S&P 500.

* Nasdaq 100 stocks represent the risk appetite in the stock market.

* Chartists can quantify the risk appetite using Nasdaq 100 specific breadth indicators.

The Nasdaq 100 is a major driver in the stock market and...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Remains Significantly Deviated From Mean; Stay Vigilant at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was the sixth week in a row that saw the Nifty 50 index ending with gains. Over the past few days, the markets largely experienced trending days as they continued inching higher despite the intraday moves staying ranged. The Nifty also continued forming its new lifetime highs; the current...

READ MORE

MEMBERS ONLY

Is It Time To SELL Your Magnificent 7 Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the sharp rotation that took place in the markets after inflation data came in below estimates. She also highlights new areas of possible leadership as interest rates decline. Most importantly, she shares the best way to uncover leadership names that are in...

READ MORE

MEMBERS ONLY

Stock Market Makes Spectacular Run, and It's Not From the Popular Magnificent Seven

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market sees rally in areas aside from the Magnificent Seven stocks

* Small-cap stocks had an impressive performance in the last two trading days of the week

* The stock market continues to show its bullish strength as we enter earnings season

What a strange trip it's...

READ MORE

MEMBERS ONLY

NVDA & Mag 7 Breaking Down; Russell 2000 (IWM) and Retail (XRT) Get "Silver Cross" BUY Signals

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

KEY TAKEAWAYS

* NVIDIA (NVDA) breaks down with Magnificent Seven

* Russell 2000 (IWM) gets IT Trend Model "Silver Cross" BUY Signal

This is a complimentary excerpt from the subscriber-only DecisionPoint Alert.

NVIDIA (NVDA) broke down today in what looks like an echo of last month's pullback. There...

READ MORE

MEMBERS ONLY

How To Manage Risk Using Technical Analysis!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave completes a three-part series based on the successful "Top Ten Charts" episodes ofThe Final Bar. Today, he wraps the series with talks about risk management and how to use technical analysis tools to better manage risk vs....

READ MORE

MEMBERS ONLY

Simple RSI Trend Strategy: Entry BEFORE a Breakout!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows an RSI strategy that offered a few opportunities to get into AAPL before the big breakout. He then highlights what to watch for in TSLA, which may provide the same type of RSI setup sometime over the next week or so; this...

READ MORE

MEMBERS ONLY

When Will the Stock Market's Bullish Momentum Snap? Charts You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market could continue its bullish run on interest rate cut speculation

* The S&P 500 Equal-Weighted Index is a good indication of the health of the overall stock market

* Bond market action is often a leading indicator of stock market action

With the S&...

READ MORE

MEMBERS ONLY

They Say Three Steps and Stumble; This Market is Taking a Fourth

by Martin Pring,

President, Pring Research

The legendary technician Edson Gould had a rule that, after three discount rate hikes, the stock market would be likely to stumble. That doesn't apply to emerging markets, but it did make a catchy headline. What is relevant to the iShares MSCI Emerging Market ETF (EEM) is that,...

READ MORE

MEMBERS ONLY

The BEST Way to Track Stock and ETF Performance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave continues a three-part series on selecting top charts to follow every month. In this second episode, Dave reviews charts he and Grayson Roze selected in May and June, reflecting on what has happened, what has...

READ MORE

MEMBERS ONLY

Identifying Top Charts with Upside Potential in 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave begins a three-part series on selecting top charts to follow every month. In this first episode, he shares how he and Grayson Roze select the charts to include in the Top 10 lists using the...

READ MORE

MEMBERS ONLY

Market Foundation Showing CRACKS!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius continues to look at the narrowing market breadth and puts things into (another) perspective. The conclusion remains the same: it's a Risk-ON market, but the Risk is BIG.

This video was originally broadcast on July 9, 2024. Click anywhere on the...

READ MORE

MEMBERS ONLY

DP Trading Room: These Banks are Bullish Going Into Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

Earnings season is kicking off and Carl and Erin spotlight the banks that will be reporting on Friday. The setups aren't good for all of these banks, but some are set up nicely going into their earnings calls. Earnings are always tricky as good earnings can still result...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Hovers Around Crucial Points; Keep Guarding Profits at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets continued with their unabated up move in the week that went by and ended once again with net gains. While continuing with the advance, the Nifty 50 Index extended its move higher. However, as compared to the previous week, this time, the trading range got narrower as the...

READ MORE