MEMBERS ONLY

Week Ahead: Upsides For NIFTY May Stay Capped; Sectoral Landscape Show These Changes

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past trading week, it was expected that, while technical pullbacks in the markets could get extended, NIFTY would likely remain under corrective pressure at higher levels. The past trading days witnessed this precise scenario. The markets initially extended their technical pullback and extended their upmove; however, at the...

READ MORE

MEMBERS ONLY

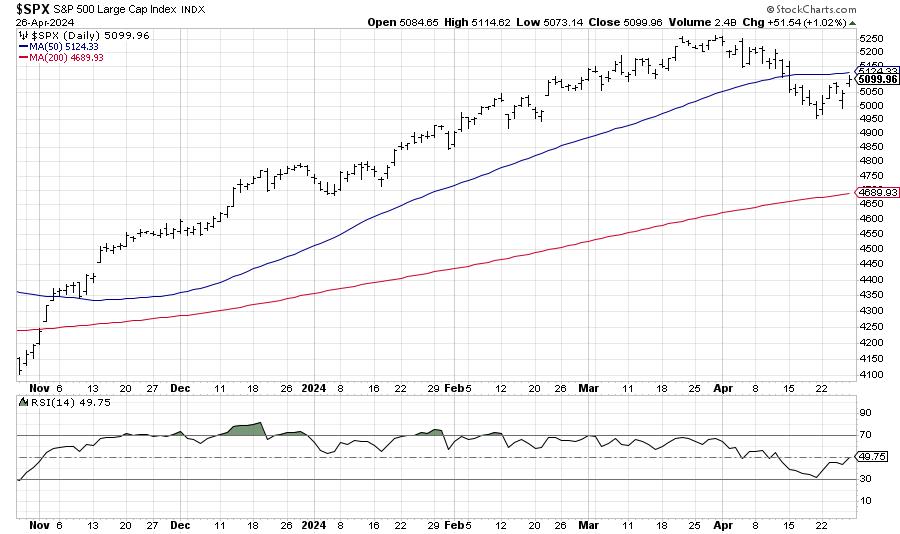

S&P 500 Makes a New All-Time High By End of June?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocksbreaking through their 50-day moving averages, to even thedramatic increase in volatilityoften associated with major market tops. While Q1 was marked by broad market strength and plenty of new...

READ MORE

MEMBERS ONLY

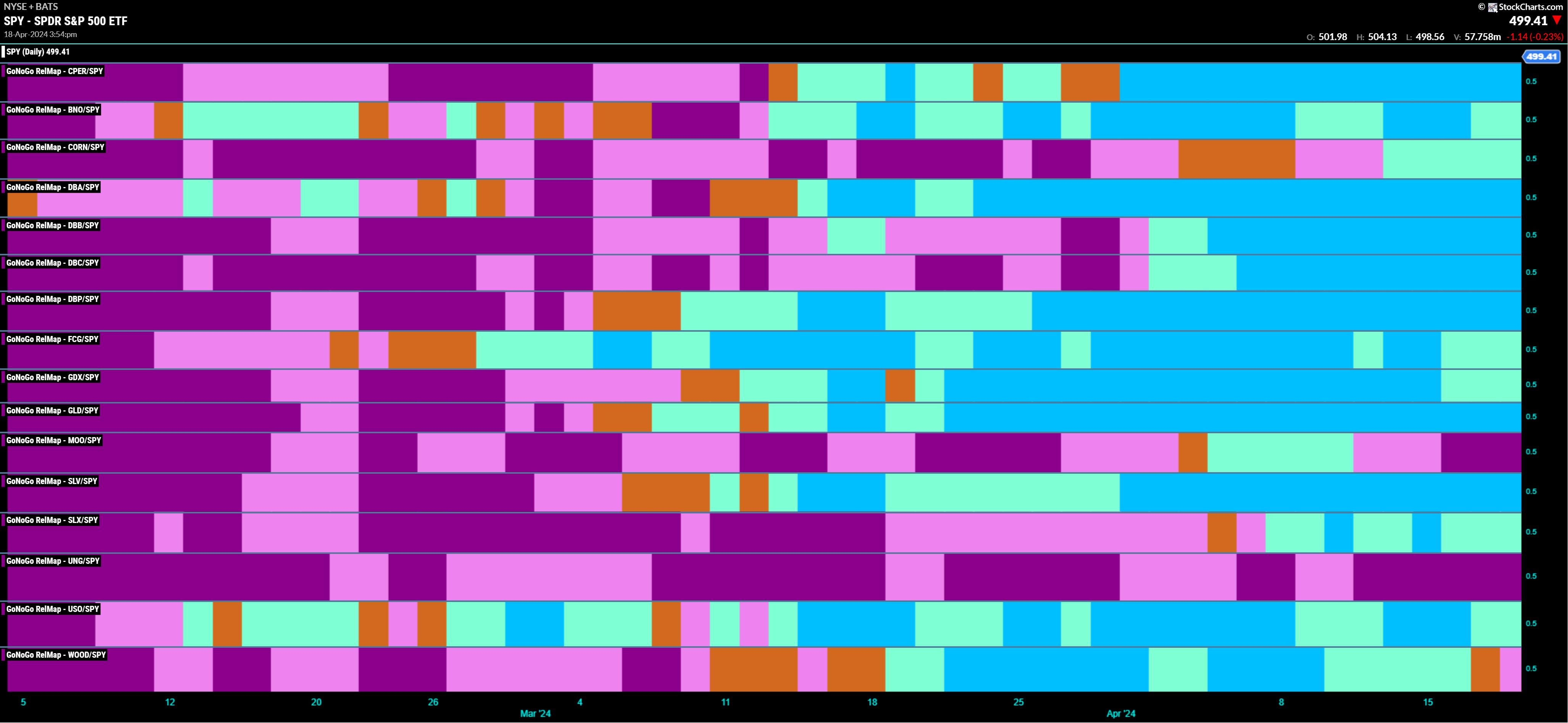

DEFENSE IS ON THE FIELD | GoNoGo Show APRIL 26, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Defensive Sector Leadership

* Risk Off Macro Environment

* Opportunities in Electricity Utilities Companies

Chart Above (XLU:SPY) highlights trending relative strength of Utilities Sector. Watch Video below for details:

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole...

READ MORE

MEMBERS ONLY

MEM TV: Wait For This Before Getting Back In

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

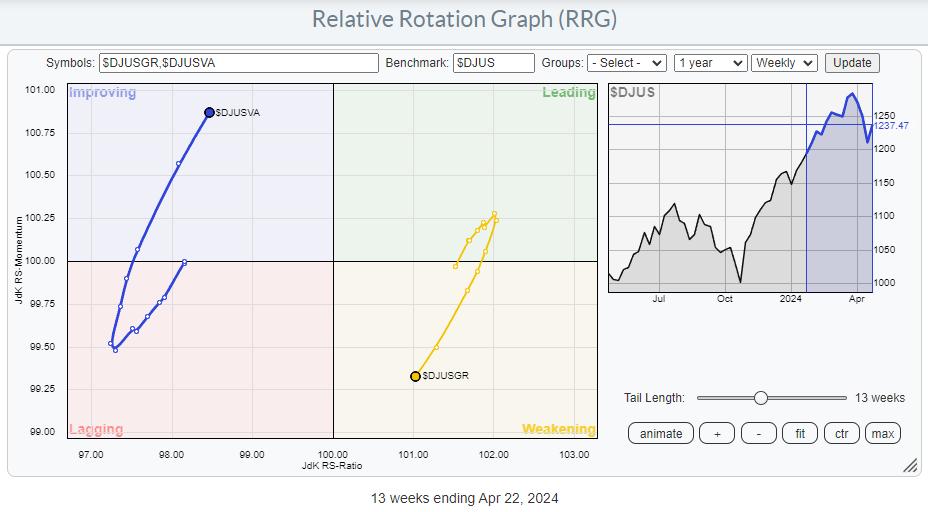

Spotting Downturns Early: Daily or Weekly Charts?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on spotting downturns in daily vs. weekly charts, using the Relative Rotation Graphs (RRG) to identify actionable ideas, and comparing the NYSE Composite Index ($NYA) to the S&P 500 Index ($SPX). He also shares...

READ MORE

MEMBERS ONLY

S&P 500 & Nasdaq Composite Approach Critical Resistance; Watch for These Important Levels!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Nasdaq Composite is trading above its last swing high, which could a the first sign of a reversal to the upside

* The S&P 500 is up against resistance from its 50-day moving average and a downward sloping trendline

* The Dow Jones Industrial Average has reversed...

READ MORE

MEMBERS ONLY

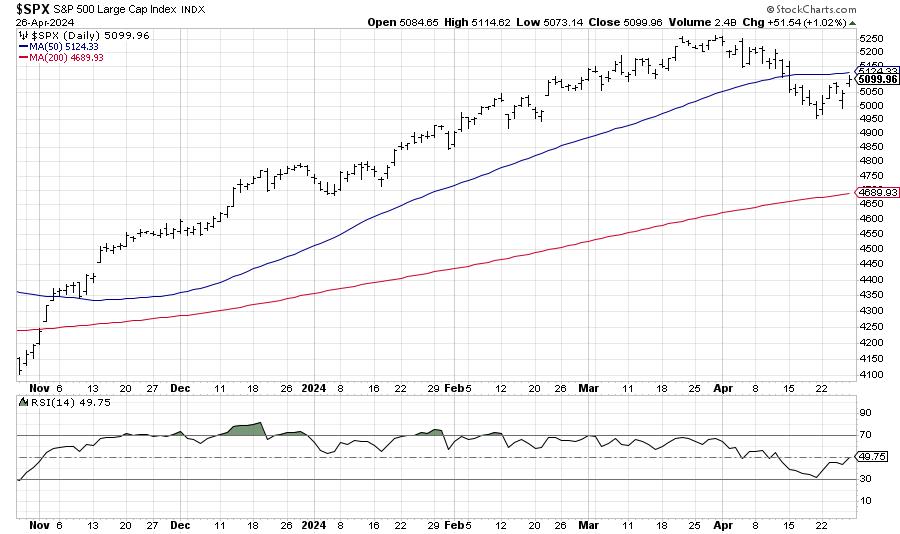

Analyzing the SPY: How to Know When the Pullback is Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* SPY is trading within a downward channel in the daily chart and has equal odds of breaking out in either direction

* The weekly chart shows the uptrend is still in play and SPY is going through a healthy correction

* Analyze different index and sector exchange-traded funds to identify...

READ MORE

MEMBERS ONLY

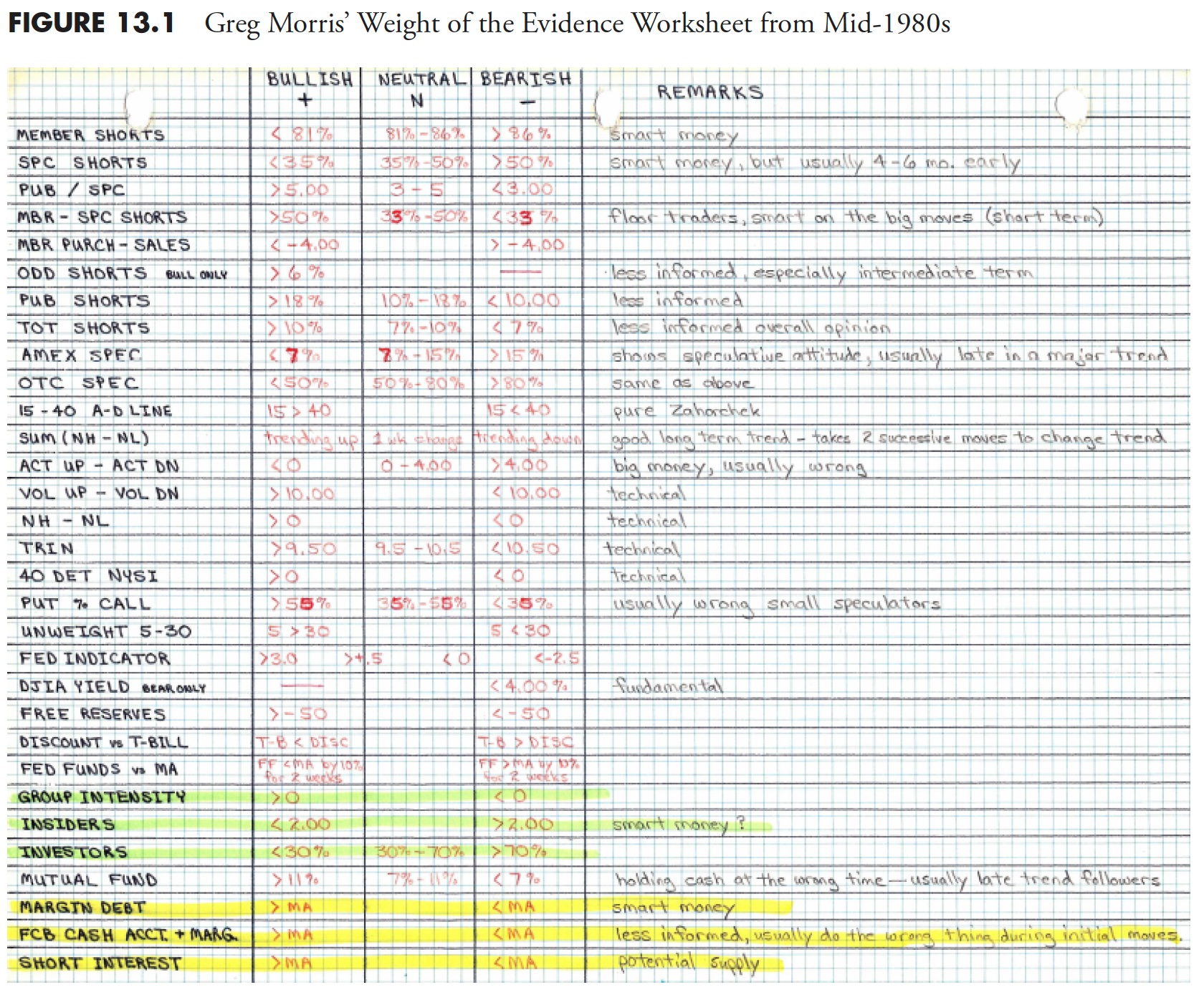

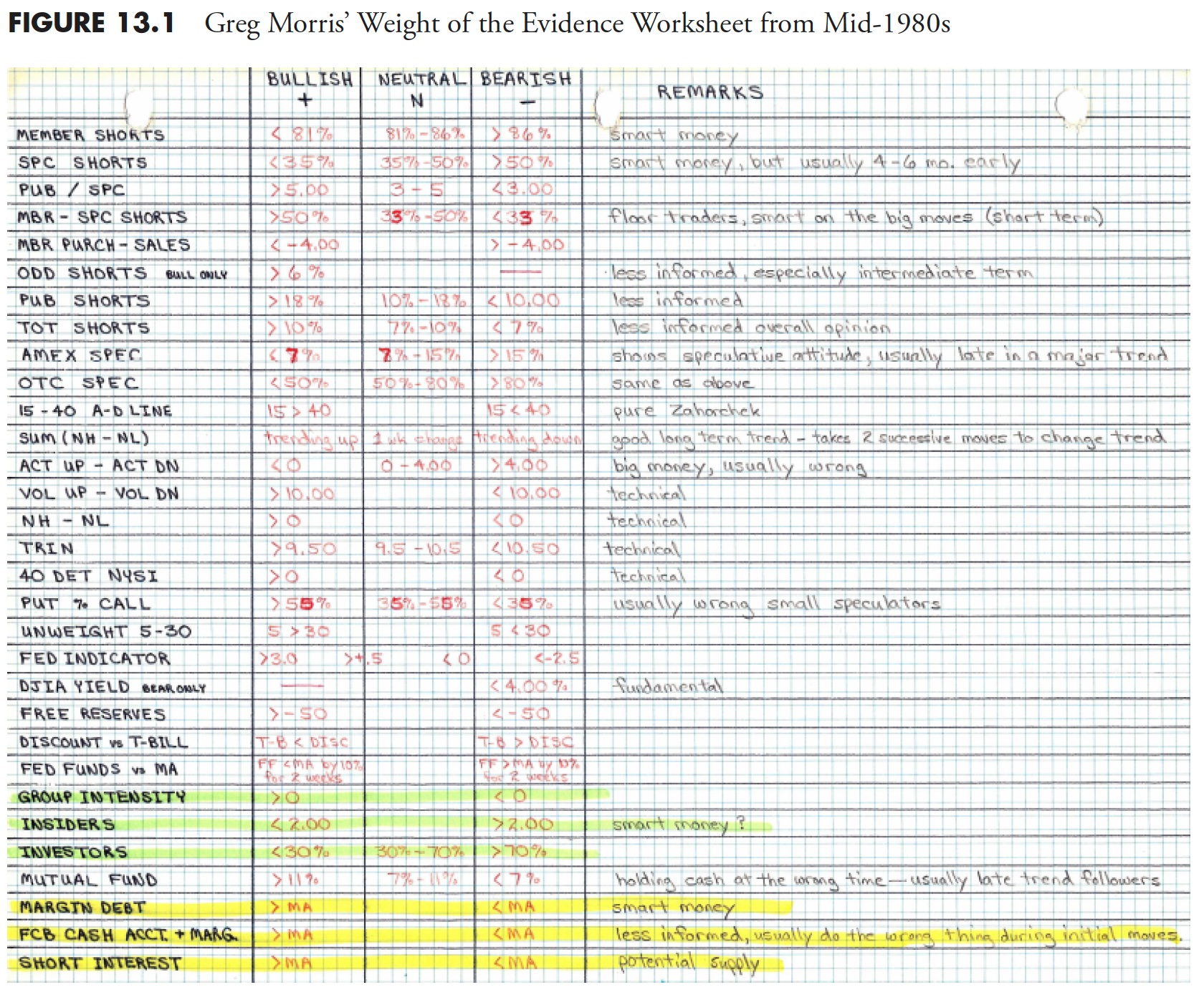

Rules-Based Money Management - Part 2: Measuring the Market

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eighteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

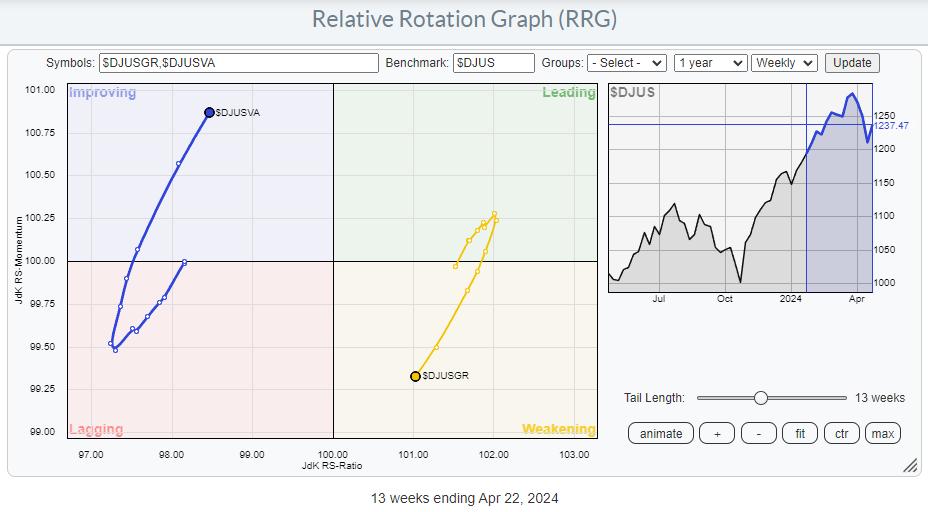

10% Downside Risk For Stocks as Value Takes The Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Value stocks are taking over the lead from Growth

* When Value beats Growth, the S&P 500 usually does not do too well

* The strength of Value is surfacing across all size segments of the market

* Important support areas for SPY at 480 and 460

Value Taking...

READ MORE

MEMBERS ONLY

Three Sectors are Showing Strength, Three are Not

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD. Ryan shares key levels to watch on the S&P 500, along with...

READ MORE

MEMBERS ONLY

Pinpoint the Next Buying Opportunity in SPY

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe uses the MACD to analyze SPY and shares what to look for to find the next buy point. Joe then analyzes stocks including ADBE, XOM, and CRM.

This video was originally published on April 24, 2024. Click...

READ MORE

MEMBERS ONLY

Buy the Dip or Sell the Rip?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Bret Kenwell of eToro. Bret shares the levels he's watching for AAPL and AMD, speaks to this week's bounce higher, and points out why Energy still shows long-term strength. David breaks down earnings names...

READ MORE

MEMBERS ONLY

Are We There Yet?

by Martin Pring,

President, Pring Research

Back in early February, I wrote an article entitled "Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes". In it, I was trying to point out that counter-cyclical corrections are notably difficult to identify, as they often terminate just at the...

READ MORE

MEMBERS ONLY

Weak Charts Keep Getting Weaker

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave examines names making moves in the market like Tesla (TSLA), Verizon (VZ), and Nucor (NUE). Explore the world of equity benchmarks and learn how large caps, mid caps, and small caps can offer unique opportunities based on sector rotation...

READ MORE

MEMBERS ONLY

DP TRADING ROOM: Find Shorts Using the Diamond Dog Scan

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin shared her Diamond Dog Scan that she uses to find shorting opportunities. She was able to uncover five possible shorts. She discusses each chart and let's you know what she looks for in a good short.

Carl did the market overview with special attention paid to...

READ MORE

MEMBERS ONLY

Week Ahead: Mild Technical Pullbacks Likely; NIFTY Remains Prone to Selling Pressure at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the truncated week, the markets looked largely corrective, as the key indices lost ground during the week. In the previous technical note, it was mentioned that, on the one hand, no runaway moves should be expected, and on the other hand, the support for Nifty exists much below at...

READ MORE

MEMBERS ONLY

Getting Perspective and Dealing with Volatility

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Primary moves define the long-term trend

* Secondary moves are corrections within bigger uptrends

* Corrections provide opportunities to partake in the bigger uptrend

The S&P 500 is down 5.5% this month and volatility is rearing its ugly head. This is a good time to get some...

READ MORE

MEMBERS ONLY

Breakdown in Mega-Cap Growth Confirms Bear Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Early breakdowns from AAPL and TSLA provided initial warnings of a late stage bull market.

* Exponential gains in stocks like SMCI and MSTR have now turned into steep pullbacks with both stocks breaking below moving average support.

* With AMZN and NFLX finishing the week below their 50-day moving...

READ MORE

MEMBERS ONLY

MEM TV: Capitulation Signals for a Market BOTTOM

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the negative shift that's evolved over the past week in the market and highlights key signals of capitulation you should be watching for. She then shares the move into Value stocks she's seeing...

READ MORE

MEMBERS ONLY

How to Chart In Multiple Timeframes Like A PRO

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to chart the same symbol in multiple timeframes with ease using ChartStyles and StyleButtons. Learn how to customize multiple charts with the periods and ranges that fit with your system and then set...

READ MORE

MEMBERS ONLY

S&P 500 Approaches 100-Day Moving Average: Is Now an Attractive Time to Buy Stocks?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The possibility of only one interest rate cut and escalation of geopolitical tensions increases uncertainty levels for investors

* The 100-day simple moving average could be the S&P 500's next support level

* Massive selloff in Tech stocks sends the Nasdaq Composite below its 100-day moving...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson run through top 10 charts to watch in April 2024! Together they cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into market dynamics and chart...

READ MORE

MEMBERS ONLY

Netflix Gets Island Reversal On Earnings

by Carl Swenlin,

President and Founder, DecisionPoint.com

Netflix (NFLX) earnings were released today, and the news was good. . . except for one little thing. They also suspiciously announced that, starting next year, they would no longer be reporting subscriber metrics. That's like General Motors saying that they will no longer report how many cars and trucks...

READ MORE

MEMBERS ONLY

Charts Flashing "No Go" for S&P 500!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Tyler Wood, CMT of GoNoGo Charts. Tyler walks through their proprietary momentum model which confirms a bearish rotation for the major equity benchmarks yet a bullish rotation for the commodity space. David walks through key earnings names...

READ MORE

MEMBERS ONLY

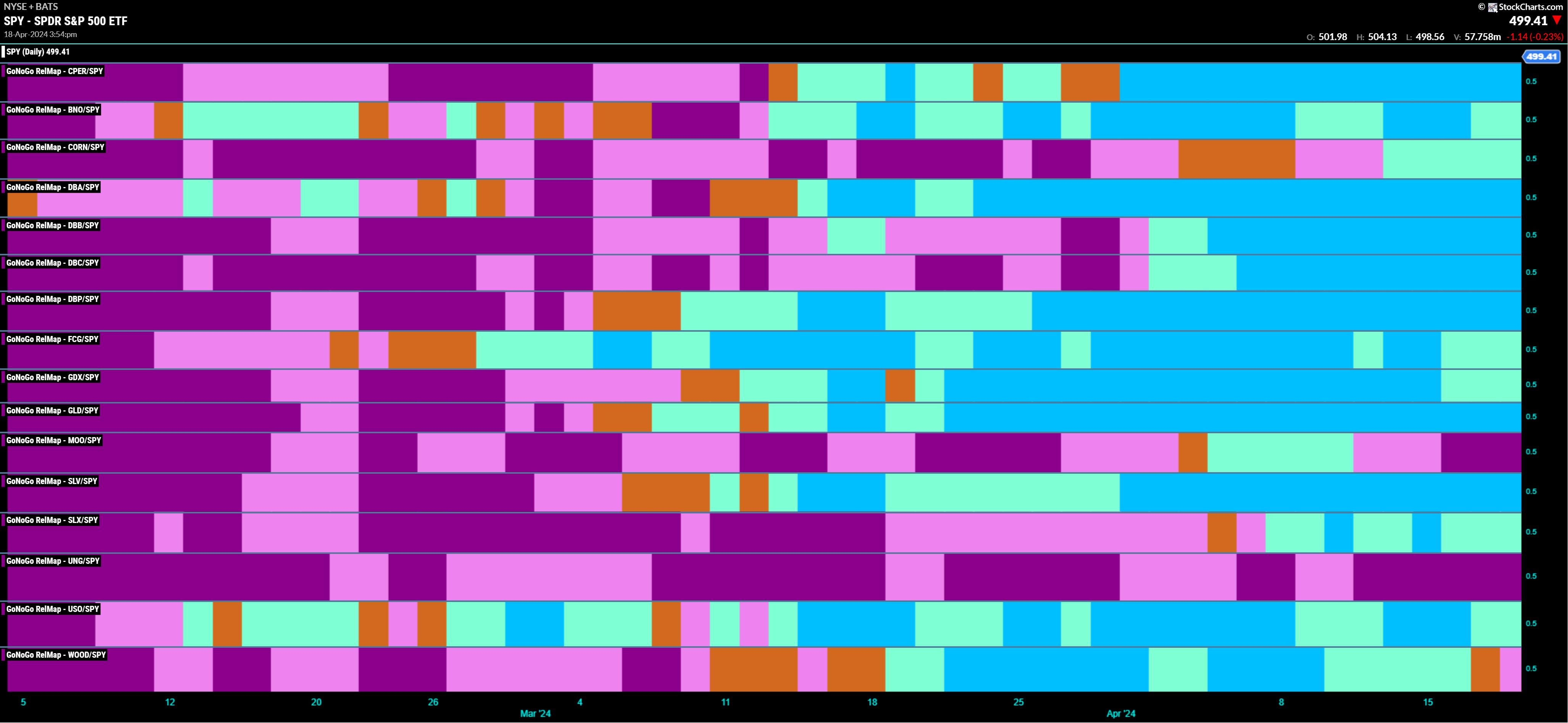

Rocks over Stocks | GoNoGo Show 041824

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* New Risk Off Environment for Equities

* Commodities Leading

The S&P500 trend conditions have reversed into "NoGo" and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" April 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Right now, there's lots of room for a downside in the market. Do we really want a rate cut?

In this video, Larry talks about past interest rate cuts from the Fed, and what happens to stock prices as a result. Historically, we've seen these cuts...

READ MORE

MEMBERS ONLY

Intraday Trading Entry and Exit Strategies

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe details a trade setup in the QQQ that demonstrates how he uses MACD and ADX in multiple timeframes for his trading. He gives detail on the entry and exit for this trade. Joe then covers the stock...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 1: Popular Indicators and Their Uses

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the seventeenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Semiconductors are at CRITICAL Level!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Danielle Shay of Simpler Trading. Danielle speaks to the downside rotation for the QQQ, SMH, and leading growth stocks, including why the $210 level is so crucial for the SMH. Dave highlights the recent downswing for Bitcoin,...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs TOMORROW - Thursday, April 18 at 2:00pm EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, April 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Bitcoin Halving Could Bring Massive Upside!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares a brief history of Bitcoin halving and relates it to the short-term and long-term technical outlook on this significant development for cryptocurrencies. He also focuses on stocks testing their 50-day moving averages, including NFLX, SMCI, and MSTR.

This...

READ MORE

MEMBERS ONLY

Is Market Breadth Signaling THE TOP?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how bearish short-term breadth combined with the deterioration in long-term breadth lines up well with previous market tops. He then breaks down key levels for the S&P 500 index as well as MSFT, TSLA, and more....

READ MORE

MEMBERS ONLY

DP Trading Room: Final Earnings are In for 2023 Q4!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl opens the show with a view of the final earnings results for 2023 Q4! His chart reveals whether stocks are fair valued, overvalued or undervalued. Get his take on the current readings.

Carl gave us his market overview including Bitcoin, Gold Miners, Gold and Crude Oil and many more....

READ MORE

MEMBERS ONLY

Precious Metals Reach Exhaustion

by Martin Pring,

President, Pring Research

In the last couple of weeks, I have been reading stories about shoppers picking up gold bars in, of all places, Costco. According to Gemini, the AI branch of Google, "Reports indicate they may be selling up to $200 million worth of gold bars every month."

Normally, thin...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Subdued Over the Truncated Week; Defensive Play May Seem Evident

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Going into the previous week, the markets had been expected to inch higher; however, at the same time, while it was believed that incremental highs may be formed, it was also expected that a runaway move would not happen. Over the past four trading sessions, the markets traded precisely on...

READ MORE

MEMBERS ONLY

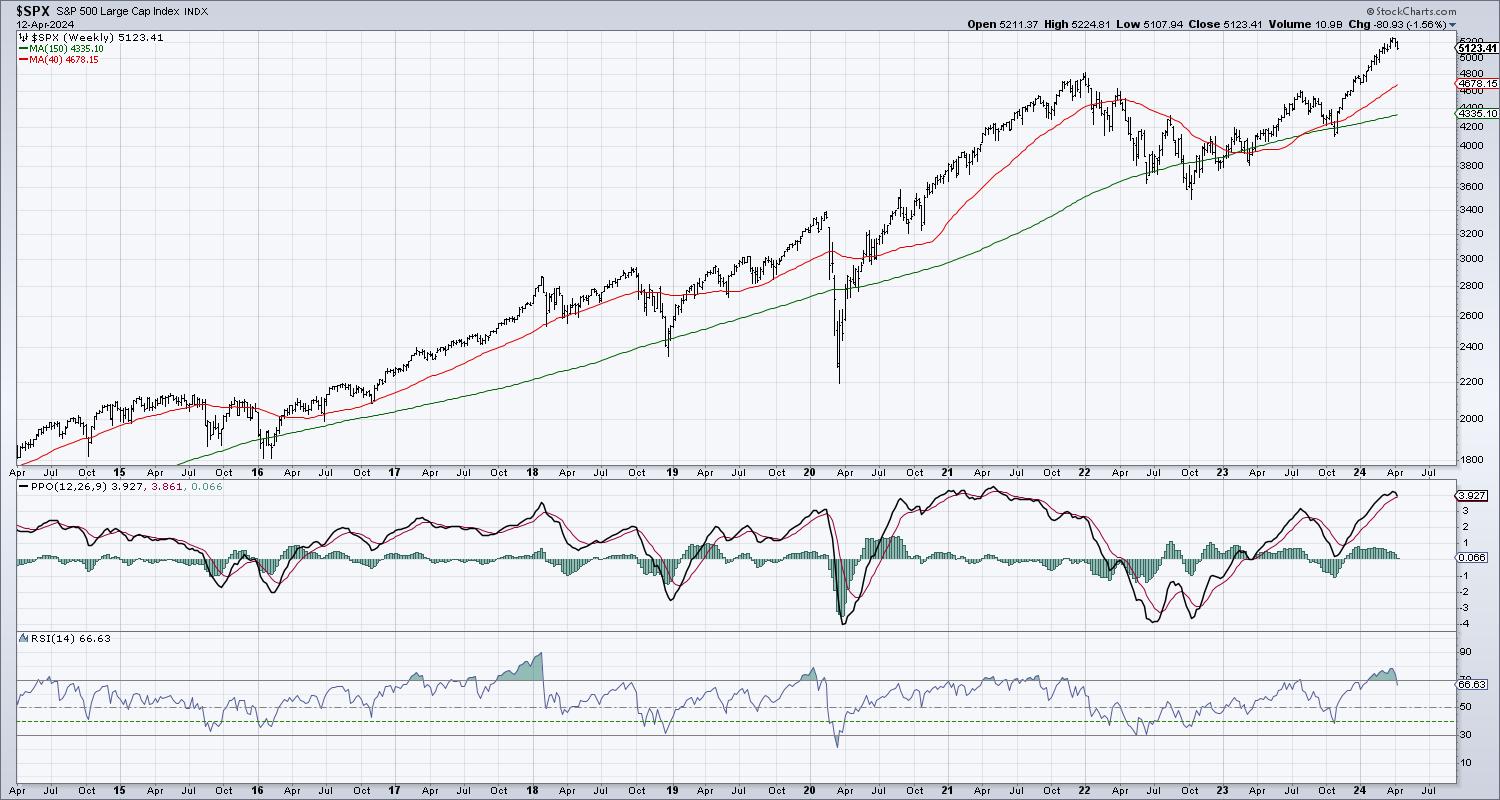

S&P 500 Flashes Major Topping Signals

by David Keller,

President and Chief Strategist, Sierra Alpha Research

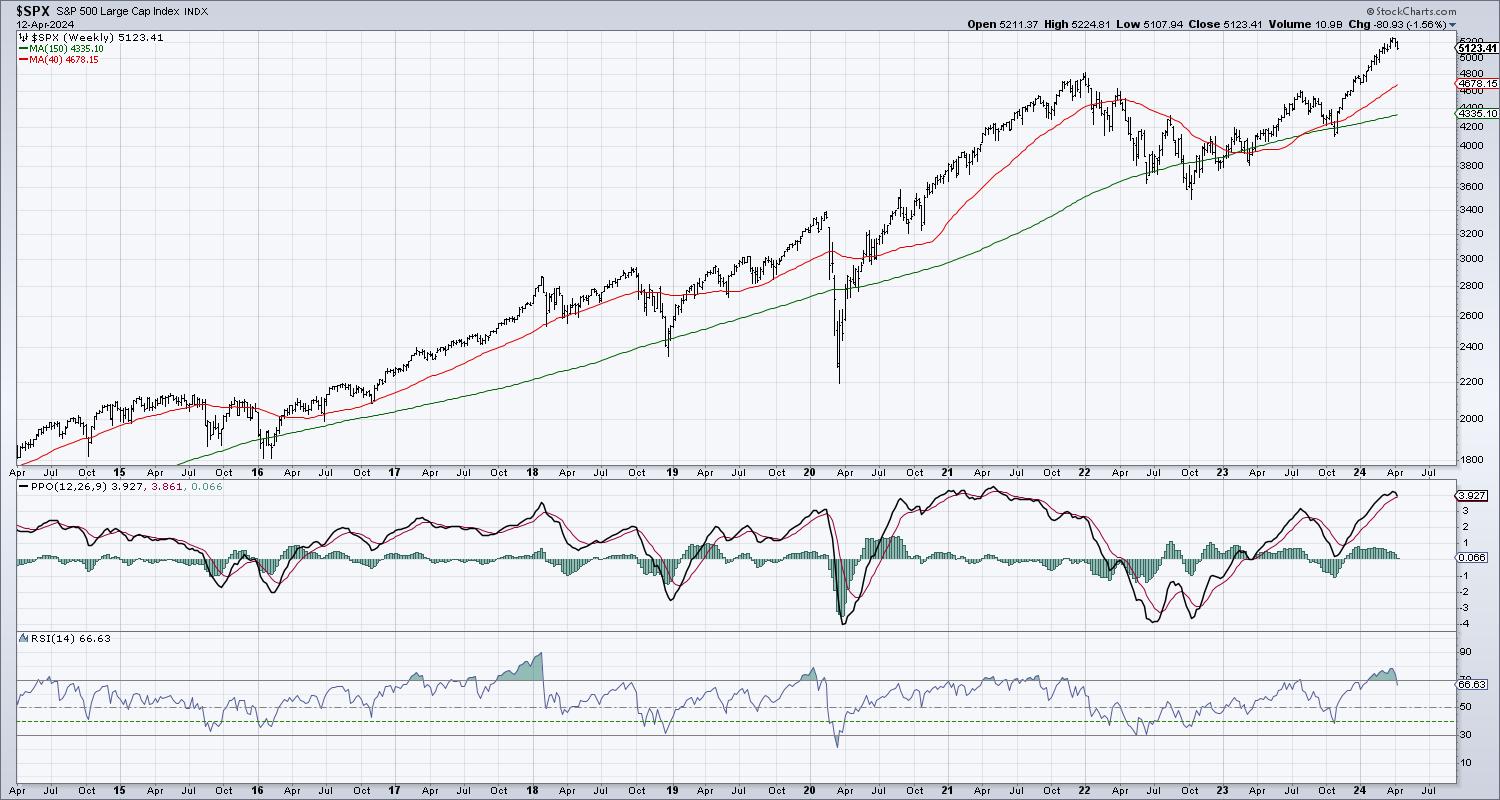

KEY TAKEAWAYS

* The weekly RSI has signaled an exit from overbought conditions, but the weekly PPO has not yet indicated a bearish reversal.

* A break below the 200-day moving average would validate the weekly sell signals, and align with previous market tops since the 2009 market bottom.

Toward the bottom...

READ MORE

MEMBERS ONLY

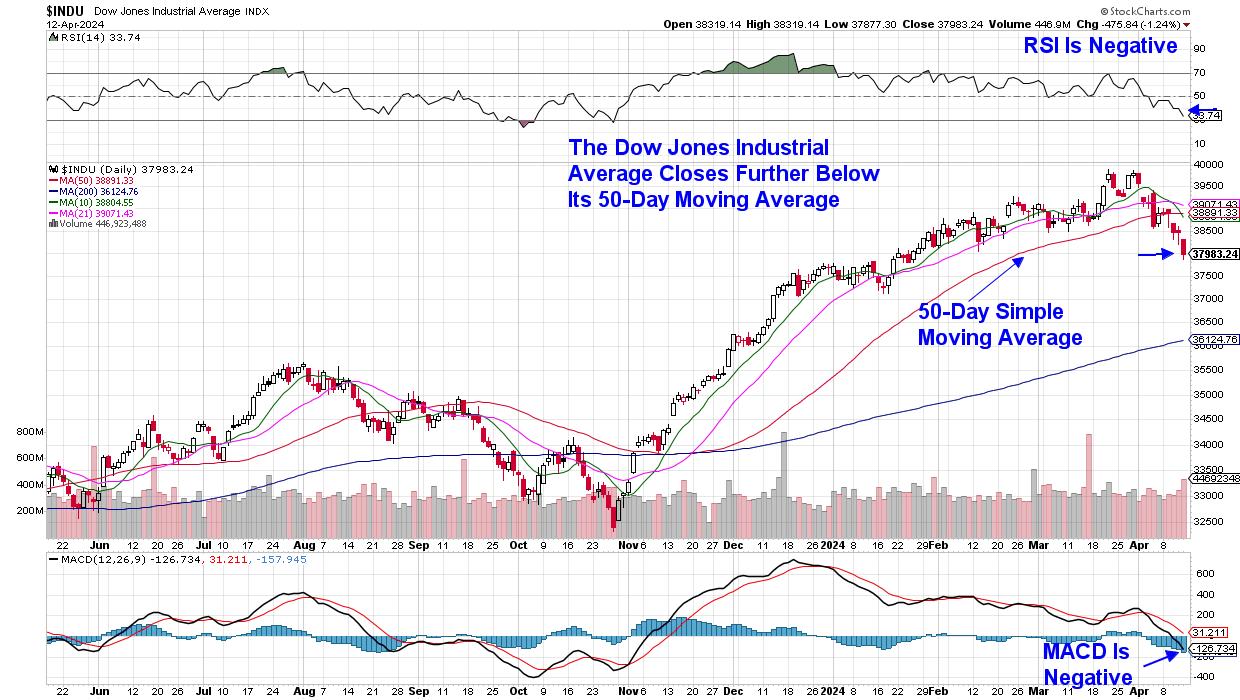

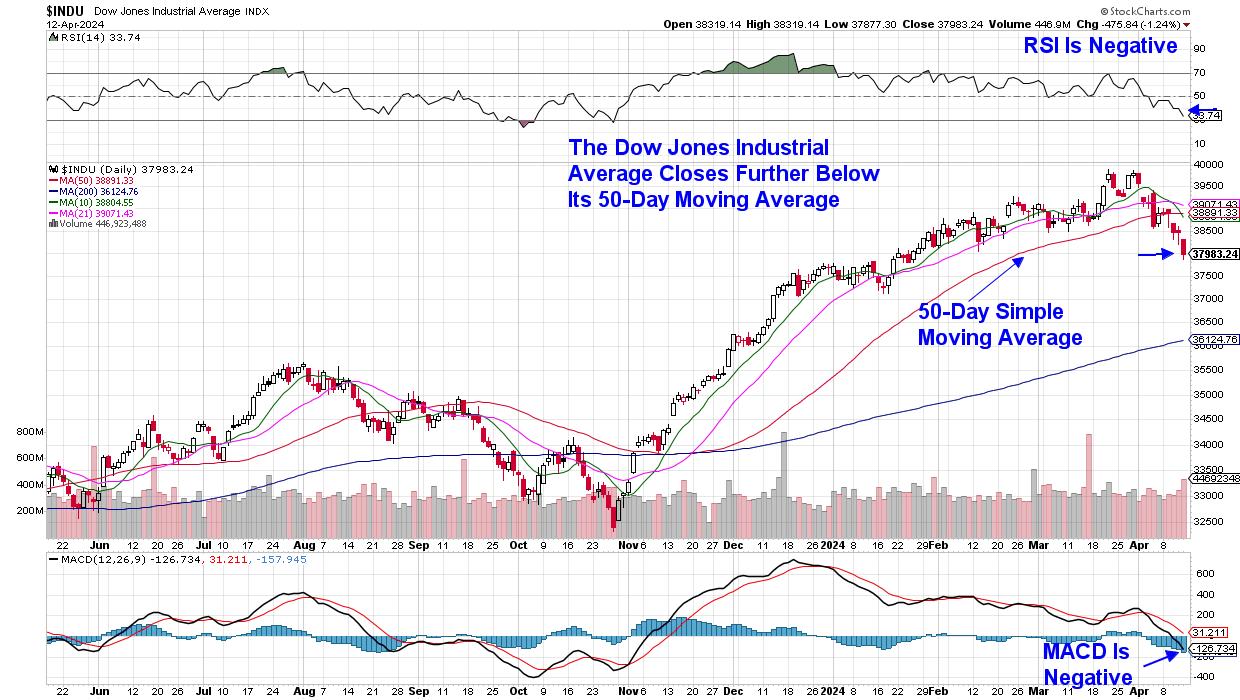

Keeping Up With The Jones - How Weakness in This Index May Foretell a Broader Market Correction

by Mary Ellen McGonagle,

President, MEM Investment Research

The Dow Jones Industrial Average fell 2.4% last week in a move that pushes this index further below its key 50-day simple moving average. While not the most widely followed index, the Dow has continued to evolve so that its 30 components more closely represent the current economy. Amazon&...

READ MORE

MEMBERS ONLY

MEM TV: Time To SELL EVERYTHING?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares key signals that it's time to sell a stock, using INTC as an example. She also reviews a key area of support for the markets, and new sectors that have entered a downtrend. She finishes...

READ MORE

MEMBERS ONLY

Stock Market Indexes Plunge After Hitting Resistance -- Support Levels You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average, S&P 500, and Nasdaq Composite dropped

* Gold keeps hitting new highs

* The VIX spiked above 18 but closed at 17.31

Now that earnings season has begun, what can you expect the stock market to do, especially after its stellar Q1 run?...

READ MORE