MEMBERS ONLY

Sector Spotlight: US Stocks Once Again Lead the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I highlight the short-term weakness in BTC, the price strength in USD, and the clear strength of stocks over all other asset classes. In sectors, I analyze the continuing rotation out of defensive sectors, which is another positive for stocks...

READ MORE

MEMBERS ONLY

Economic Modern Family Has Divisive Weekly Charts

Over the weekend, I covered the daily charts on the Economic Modern Family, featuring the Russell 2000 (IWM) and Retail (XRT). Both are lagging the benchmark and in the middle of their January trend calendar ranges.

As Semiconductors, NASDAQ, the Dow, and S&P 500 continue to post new...

READ MORE

MEMBERS ONLY

Small Caps Surge Higher As S&P 500 Stalls

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave observes the S&P 500 index pressing higher after achieving new all-time highs on Friday. While large caps have dominated small caps so far in January, days like today suggest small-cap strength as a potential emerging trend. He...

READ MORE

MEMBERS ONLY

MEM TV: Tech Stocks Blast Higher! S&P 500 Bull Market Confirmed!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish price action in the markets and shares her longer-term outlook. She also highlights the primary driver of last week's rally and which areas and stocks pushed the S&P 500 higher. In...

READ MORE

MEMBERS ONLY

Three Behavioral Biases You're Probably Struggling With Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've spent much of my career helping investors become more like pilots. Why is this such an important mindset to adopt? Well, pilots have to maintain good situational awareness, understanding what is happening around them. They need to make difficult decisions and recognize when conditions are changing. And,...

READ MORE

MEMBERS ONLY

Don't Ignore This Unusual Event on the Market's March to New Highs

by Mary Ellen McGonagle,

President, MEM Investment Research

The S&P 500 gained 1.1% last week in a move that puts this Index at a record high. While this is exciting news for investors, those that owned some of last week's top performers are in even better spirits, as the average gain for the...

READ MORE

MEMBERS ONLY

Dow Jones and S&P 500 Close At Record High -- Time to Add Tech Stocks To Your Portfolio?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Dow Jones Industrial Average and S&P 500 close at record highs

* Technology stocks are back in the spotlight, with the Nasdaq 100 closing up 1.95%

* Keep an eye on momentum and volatility as earnings reports continue to pour in

Tech stocks are striking back after...

READ MORE

MEMBERS ONLY

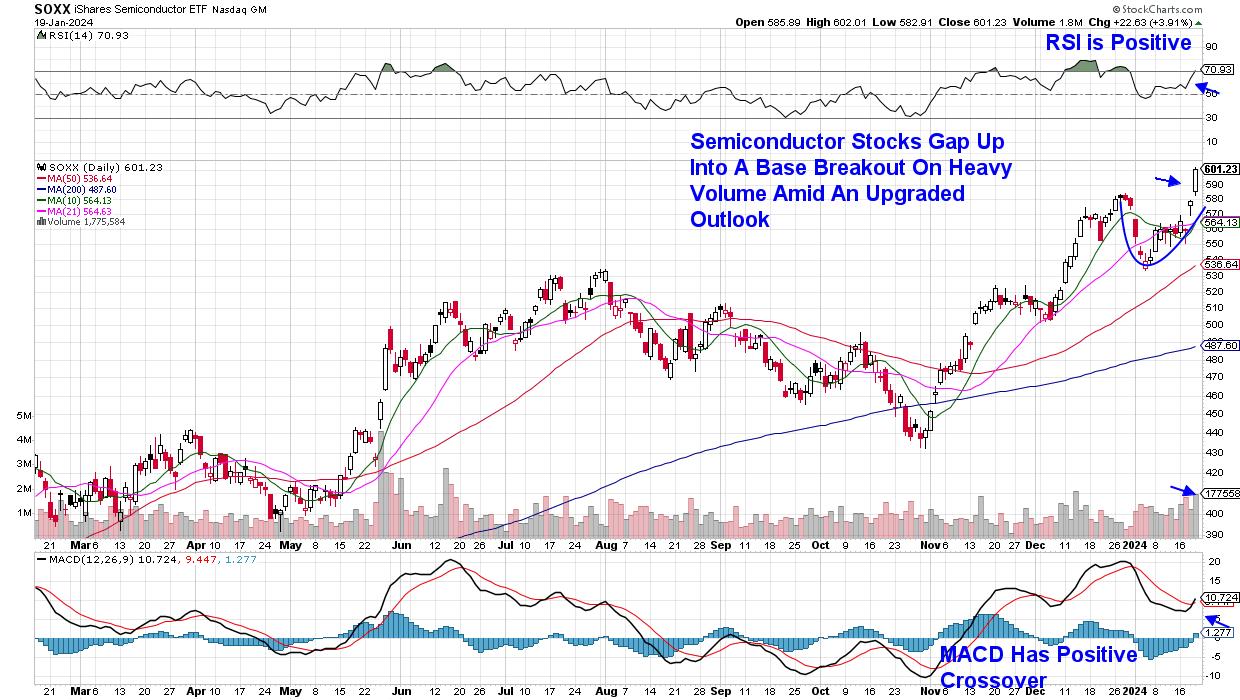

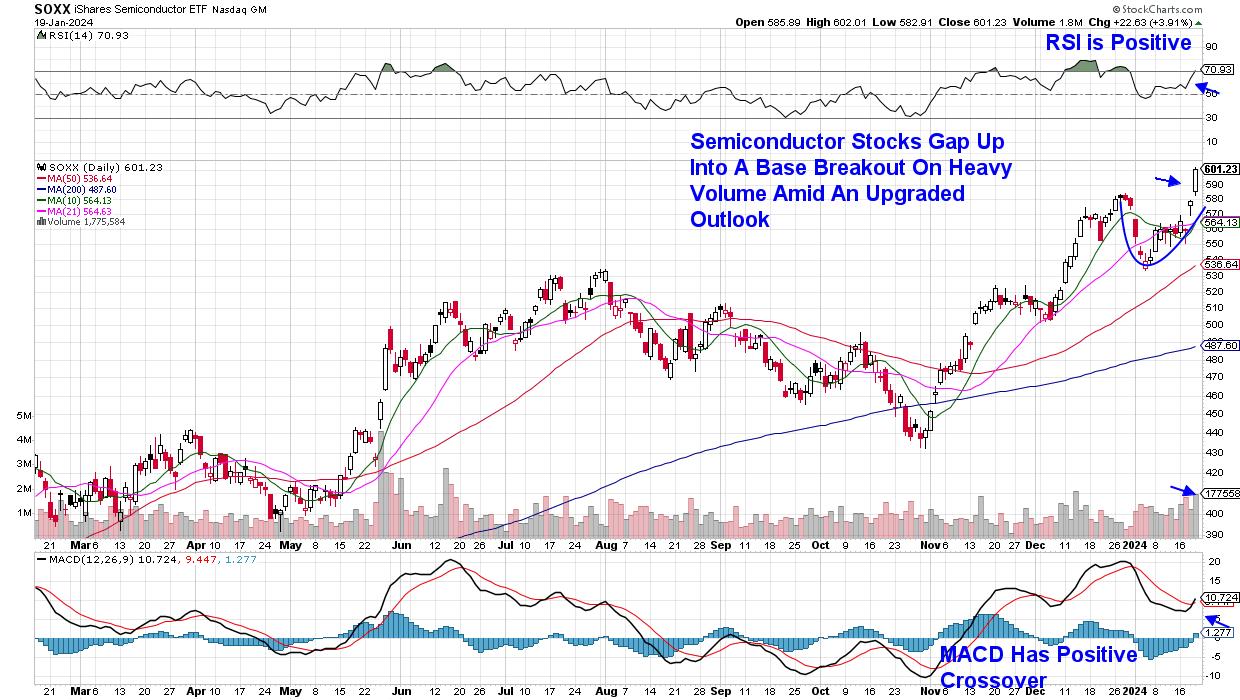

Tech and Semis Leading from the Dip

by TG Watkins,

Director of Stocks, Simpler Trading

The market was severely overbought going into the new year, so some steam was left off, which, as TG Watkins notes, we can see in the breadth readings. Now with notable names in the tech space leading and taking off, its time to get back in and see if the...

READ MORE

MEMBERS ONLY

These Stocks Have the HIGHEST PROBABILITY of Being Big Winning Trades -- and You Can Find 'Em in One Click

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you the simplest way to find the market's strongest stocks with the highest probability of becoming big winners -- the Sample Scan Library. With this tool, you can scan for stocks making new...

READ MORE

MEMBERS ONLY

Economic Modern Family's Engine Idles While Growth Goes Fast and Furious

Let's get right to it. The charts and our tools are telling.

To start, I always look at moving averages and phases. Then I look at Real Motion and momentum to see if there is a divergence to price. After that, I check out our Leadership indicator which...

READ MORE

MEMBERS ONLY

Viewer Questions: How Does the Fed Manipulate the Yield Curve?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave hosts a special all-mailbag edition, answering viewer questions on leading vs. lagging indicators, arithmetic vs. log scale charts, and how the Fed manipulates the yield curve. He digs into specific trading strategies using RSI, MACD, On Balance Volume, and...

READ MORE

MEMBERS ONLY

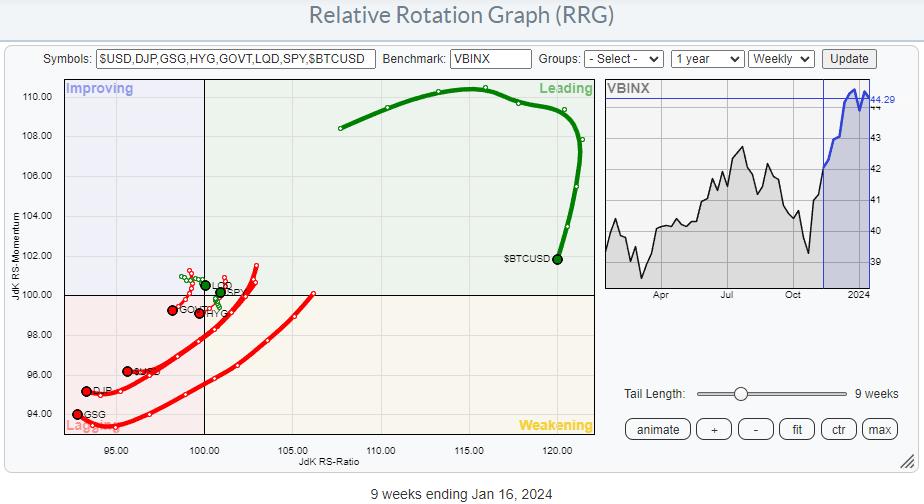

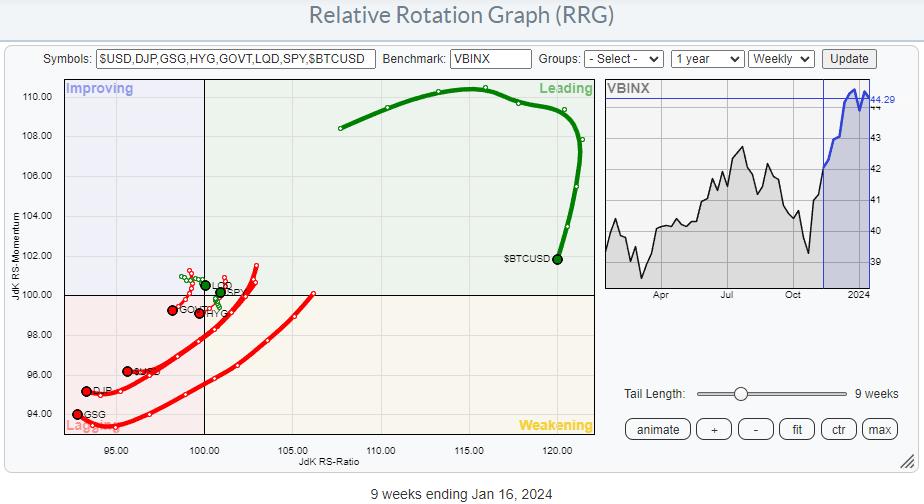

Watch Stocks Triumph in Latest Asset Allocation Battle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Commodities and USD rotating deep inside the lagging quadrant, indicating weak relative strength

* Bitcoin is in a strong relative uptrend vs all other asset classes, but going through a corrective phase

* Stocks are the clear winner in this asset allocation battle

The RRG above shows the rotation of...

READ MORE

MEMBERS ONLY

Technology Stocks Rise, but Market Internals Look Vulnerable

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Nasdaq Composite index rises 1.35% thanks to semiconductor stocks and an upgrade for Apple

* The Nasdaq Composite is trading close to its 52-week high, but market breadth isn't sharing the bullish sentiment

* Market breadth indicators, such as the advance-decline issues and percent above moving average,...

READ MORE

MEMBERS ONLY

GNG TV: Active vs. Passive Investing

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the S&P 500 digests the rally to all time highs, Alex and Tyler take a look at GoNoGo Trend® conditions of several areas of the market on this edition of the GoNoGo Charts show. Amongst US equity indices, the Nasdaq and S&P offer more constructive...

READ MORE

MEMBERS ONLY

Why SMALL CAPS MATTER in January 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kolovos, CFA CMT of Macro Risk Advisors describes how the market is reacting to "good overbought" conditions in late 2023, and why the Russell 2000 small cap ETF may be the chart to watch in Q1...

READ MORE

MEMBERS ONLY

Has Rate Cut Anticipation Run Its Course?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Fed stopped raising rates in July, and, by mid-October, yields had peaked. Since then, yields have begun to decline in anticipation of the Fed beginning rate cuts this year. At this point, it appears that yields have found support and may possibly bounce, or begin moving sideways. This chart...

READ MORE

MEMBERS ONLY

Trend Trade: January 6-Month Calendar Range Reset!

We are super excited to announce that today starts the official January 6-month calendar range!

As you can see in the chart for Apple, the small red and green horizontal lines have appeared on one of our favorite platforms at StockCharts.com. In fact, Geoff Bysshe and I recently did...

READ MORE

MEMBERS ONLY

USD Strength Accelerates After Completing Bearish Flag in EUR/USD

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* EUR/USD executes bearish flag formation

* Leaves rising trend channel by breaking rising support line as a result

After a rally from $1.045 to a high of $1.1140 from October to December 2023, the EUR/USD exchange rate has now executed a bearish flag formation, which...

READ MORE

MEMBERS ONLY

Sector Spotlight: Is the S&P 500 Facing a Double Top?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I look at asset class rotation and examine the continued preference for stocks over bonds. After that, I move on to sector rotation and the Technology sector, breaking it down into industry groups and plotting them on a Relative Rotation...

READ MORE

MEMBERS ONLY

The Case for a Tactical Stock Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Adam Turnquist of LPL Financial lays out the case for a tactical selloff for stocks, as well as why long-term indicators remain constructive in early 2024. Dave breaks down the bearish momentum divergence prevalent in the technology sector, and...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" January 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry digs into rate cuts and how they affect the markets. When interest rates are high, money is in circulation. He's been watching the rate of inflation; as he notes, an object in motion tends to stay on the same path. He also warns against...

READ MORE

MEMBERS ONLY

Are Key Commodities Decoupling from Equities?

After a long weekend, the market action on January 16th held some surprises.

The Bullish Trends, or gainers, were the dollar and -- here is the surprise for some -- many different commodities. The Bearish Trends, or losers, were foreign currencies, long bonds, and (not shown on the chart) US...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Buying Bitcoin ETFs is the Easy Part, But What Comes Next?

by Martin Pring,

President, Pring Research

Last week, eight new Bitcoin-based ETFs began trading courtesy of recent SEC approval. This launch was well anticipated, as the price had already run up in the hope that these new buyers would push it to an even higher level. The thought occurred to me that the situation is not...

READ MORE

MEMBERS ONLY

View The Large Cap - Small Cap Debate in a Direct Comparison on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Using RRG to see Large-Cap vs Small-Cap sector rotation

* The current strength for Small-Cap stocks vs Large-Caps is evident

At the end of last year, I wrote a blog article about the relationship between Large-Cap and Equal-Weight sectors. It involved plotting the ratios of the large-cap sector ETFs...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Showing Strong Rotation For Stocks in All Time Frames

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Stocks Showing Relative Strength in All Time Frames on RRG

On this episode of StockCharts TV's Sector Spotlight, 2024's first episode, I dive into both Asset Class and Sector Rotation to set the stage for 2024. Today, I focus on a synchronized rotation of...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY In Uncharted Territory; Adopt This Simple Approach Towards Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating for most of the week, the markets extended their upmove and ended at yet another record lifetime high. In the past four out of five sessions, the markets were seen consolidating and staying under limited corrective retracement. However, they did find themselves taking support at the short-term 20-Day...

READ MORE

MEMBERS ONLY

MEM TV: The Easy Way to Uncover Stocks Poised to Outperform

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at some of the items that drove price action last week. Growth stocks came roaring back for week two of 2024, which is great news for those that were believers last year. They can renew...

READ MORE

MEMBERS ONLY

S&P 4300 by End of February?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We kicked off the new year of 2024 with an overheated stock market, excessively bullish breadth indicators, and euphoric sentiment levels. While the first week in January felt like a "wake-up call" pullback for awestruck bulls, this last week saw the S&P 500 push right back...

READ MORE

MEMBERS ONLY

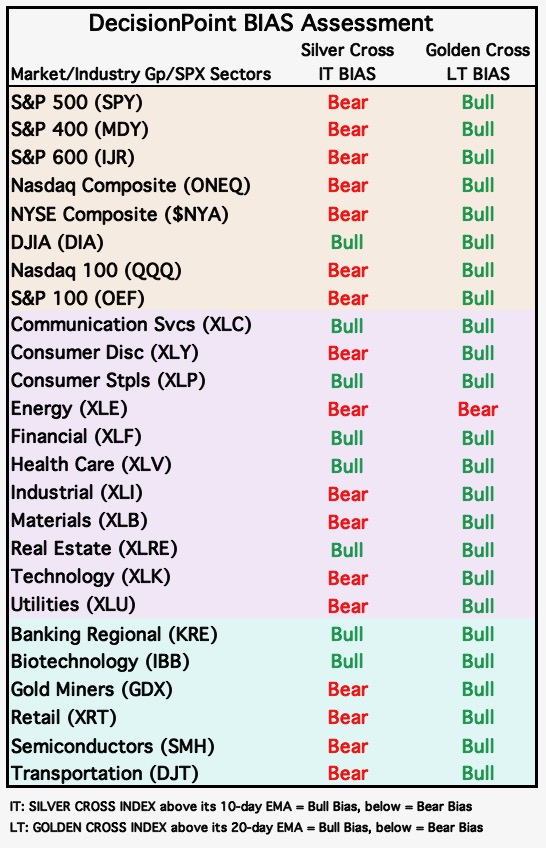

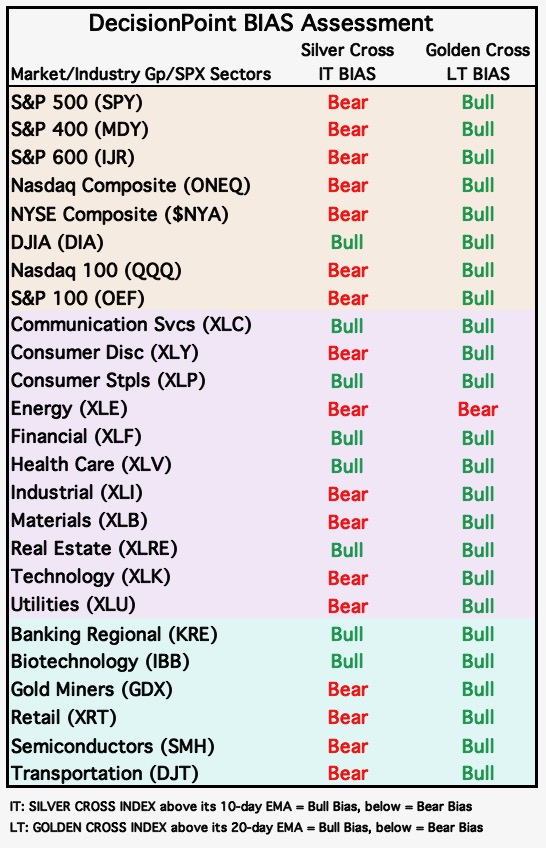

Dramatic Bearish Bias Shift on Major Market Indexes This Week

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DecisionPoint Alert on DecisionPoint.com)

This week, the markets experienced a dramatic bias shift. We measure the Intermediate-Term Bias using our Silver Cross Index (SCI). The SCI measures how many stocks within an index, sector, or industry group hold "silver crosses"...

READ MORE

MEMBERS ONLY

Stock Market Was Tentative This Week: S&P 500 Tested New High But Pulled Back

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market exhibited tentative behavior this week probably due to uncertainty about inflation and geopolitical developments

* S&P 500 index touched a high but pulled back to close slightly higher

* Crude oil prices broke above $75 but pulled back and is holding support at its 200-week...

READ MORE

MEMBERS ONLY

Larry's First LIVE "Family Gathering" Webinar of 2024 Airs NEXT WEEK - Tuesday, January 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Tuesday, January 16 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

Is the Market Ready for Another Dip?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out how the market is still digesting the big move from the November/December run. It ran a huge sprint, and now needs to cycle down in order to create room for the next leg up. The internals...

READ MORE

MEMBERS ONLY

Drilling Down Into Gold and Silver

With the news on geopolitical escalation, soft versus hard landing, disinflation versus reinflation, growth versus value, and credit default versus available disposable income, gold and silver are even more interesting now.

Gold's behavior has been more of sell strength and buy weakness for some time. What has changed...

READ MORE

MEMBERS ONLY

GNG TV: Nothing "CRYPTIC" About These Go Trends!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the SEC approved spot Bitcoin ETFs Wednesday, investors in a broad basket of cryptocurrencies witnessed strengthening Go trends and substantial advances in trends which took hold in October 2023. In this edition of the GoNoGo Charts show, Alex and Tyler review current trends across asset classes and sector groups....

READ MORE

MEMBERS ONLY

Your Questions Answered! Moving Averages, Chart Patterns, Inflation & More

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on simple vs. exponential moving averages, the benefits of analyzing sector rotation, and a good first chart for beginners learning technical analysis.

This video originally premiered on January 12, 2024. Watch...

READ MORE

MEMBERS ONLY

Common Lessons Amongst Corporate, Sports & Investment Portfolio Turnarounds!

by Gatis Roze,

Author, "Tensile Trading"

My many decades of business, investing, and sports experience has shown me time and time again that parallel lessons in all three arenas are remarkably worthy teachers. One essential lesson today (January 2024) is to not allow yourself to become a "legend in your own mind." Yes, you...

READ MORE

MEMBERS ONLY

From Selloff to Surge: Growth Stocks Rebound After CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights three leading growth stocks continuing to push to new swing highs. He also breaks down key market sentiment indicators, including the VIX, AAII survey, NAAIM Exposure Index, Rydex fund flows, and put/call ratios.

This video originally premiered...

READ MORE

MEMBERS ONLY

Markets: Recap of This Week's Market Dailies

I began the week focused on bank earnings, which we will wake up to tomorrow. In that Daily, I wrote, "one can assume that bank stocks, which already started off the year extremely well, have potential to shine.

"However, we know that assumptions can be tricky. There are...

READ MORE

MEMBERS ONLY

The Secret Behind My Moving Average "Buddy" System

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how the 18MA can be a powerful tool when used in conjunction with the 40MA line. First, Joe explains why he uses a 18MA instead of a 20MA, demonstrating how this MA line can act as...

READ MORE