MEMBERS ONLY

The Most Successful Base Pattern is Seeing a Pickup in Breakouts; Here Are Two Examples

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, the S&P 500 posted a modest 0.2% gain, which puts it within points of a 4-month base breakout at 4607. In addition to a breakout, a move above this level would put this Index above its July high, which is a key area of possible...

READ MORE

MEMBERS ONLY

Will the S&P 500 Push Above 4600 Before Year-End?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 index has stalled out at its July high around 4600, and overbought readings from RSI indicate a likely pullback.

* Breadth indicators have reached bullish extreme readings, confirming the long-term bullish, short-term bearish thesis.

* Individual stocks from both growth and value sectors are overbought...

READ MORE

MEMBERS ONLY

This Li'l Checkbox is KEY When Comparing Stocks & Charting Multiple Timeframes

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares the secret to comparing symbols and making multi-timeframe analysis a breeze! Using the "Load Symbol Only" checkbox, he demonstrates how to review a list of symbols with different chart templates, all without having...

READ MORE

MEMBERS ONLY

MEM TV: Here's Why Growth Stocks Outperformed Last Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's muted price action in the markets, which occurred despite impactful economic data. She also highlights where the broader markets are headed and best ways to participate in the select areas that are outperforming...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch in December 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave is joined by StockCharts' own Grayson Roze as they break down the trends for the top ten stocks and ETF charts for December 2023. Together, they identify key levels and signals to watch for using technical analysis tools...

READ MORE

MEMBERS ONLY

Small-Caps Take Pole Position In Overbought Market

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG notes that the market is finally letting some steam out which is what we want since we need this to present fresher opportunities for us to buy. TG presents some great examples of how to use and read the...

READ MORE

MEMBERS ONLY

Lift Off! Aerospace and Defense Stocks Showing Multi-Year Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners highlights one industry within the Industrial sector showing a multi-year breakout, and lays out the bull case for gold in 2024. Dave reviews travel and tourism charts, speaks to the strength in...

READ MORE

MEMBERS ONLY

GNG TV: What Lies Ahead For End-of-the-Year Equities?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a top-down approach to the markets as they apply the GoNoGo suite of tools to all the major asset classes. Starting with a look at macro factors effecting equity investors, they discuss the technical analysis from trend, momentum,...

READ MORE

MEMBERS ONLY

Useful Directional Indicator Criteria for Your Success as a Trader!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the 2 criteria he is looking for in directional indicators to determine when the buyers or sellers are taking command. He explains how this signal can be used to your advantage in both analysis and trading....

READ MORE

MEMBERS ONLY

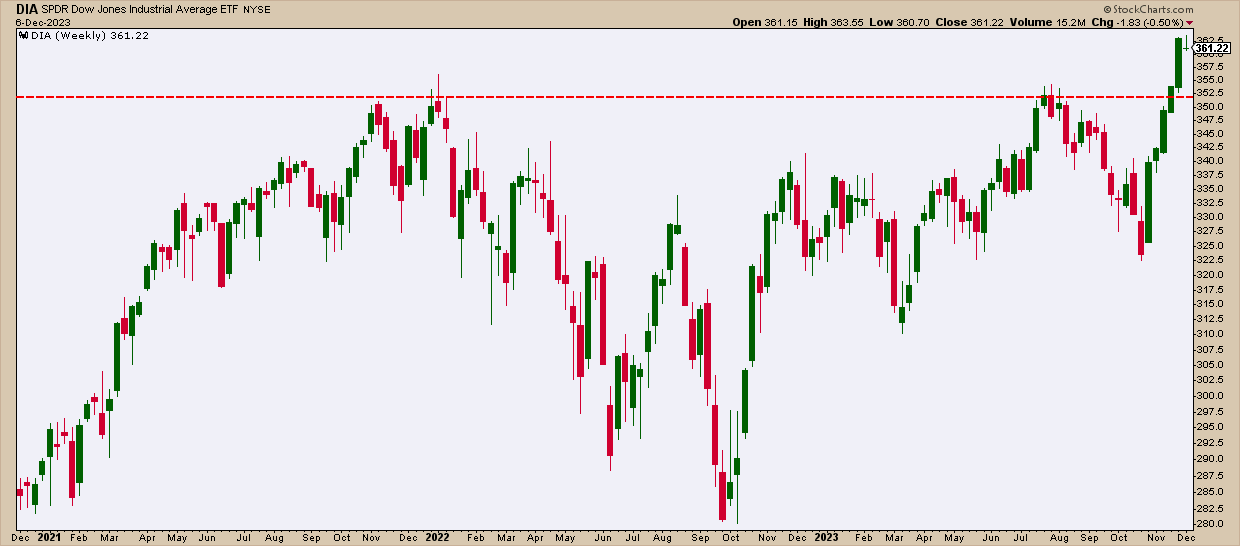

Santa Claus Rally Alert: Predicting a 70% Chance of Surge in the Dow Jones This December!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* December has seen the Dow Jones Industrial Average rally 7 out of 10 times in December since 1896.

* DIA is seeing support at its former resistance level of $352.

* DIA has pulled back from "overbought" highs, which looks favorable for market engagement.

It's that...

READ MORE

MEMBERS ONLY

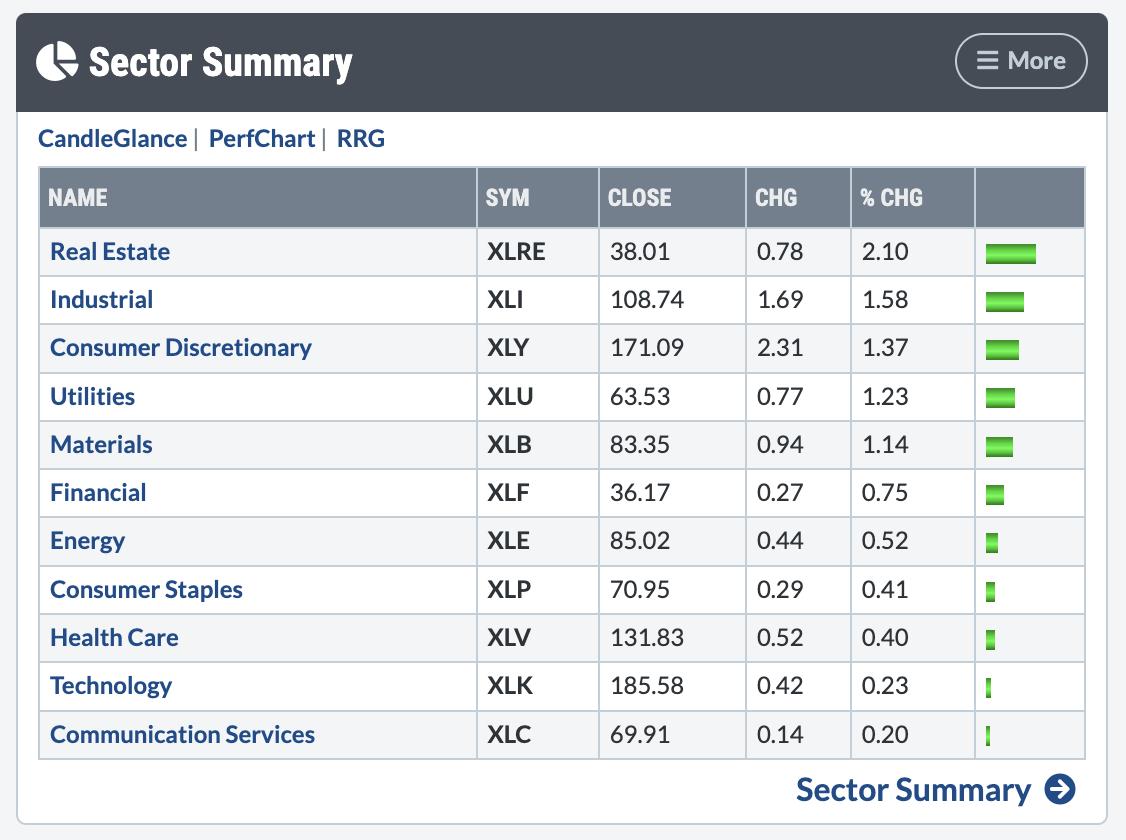

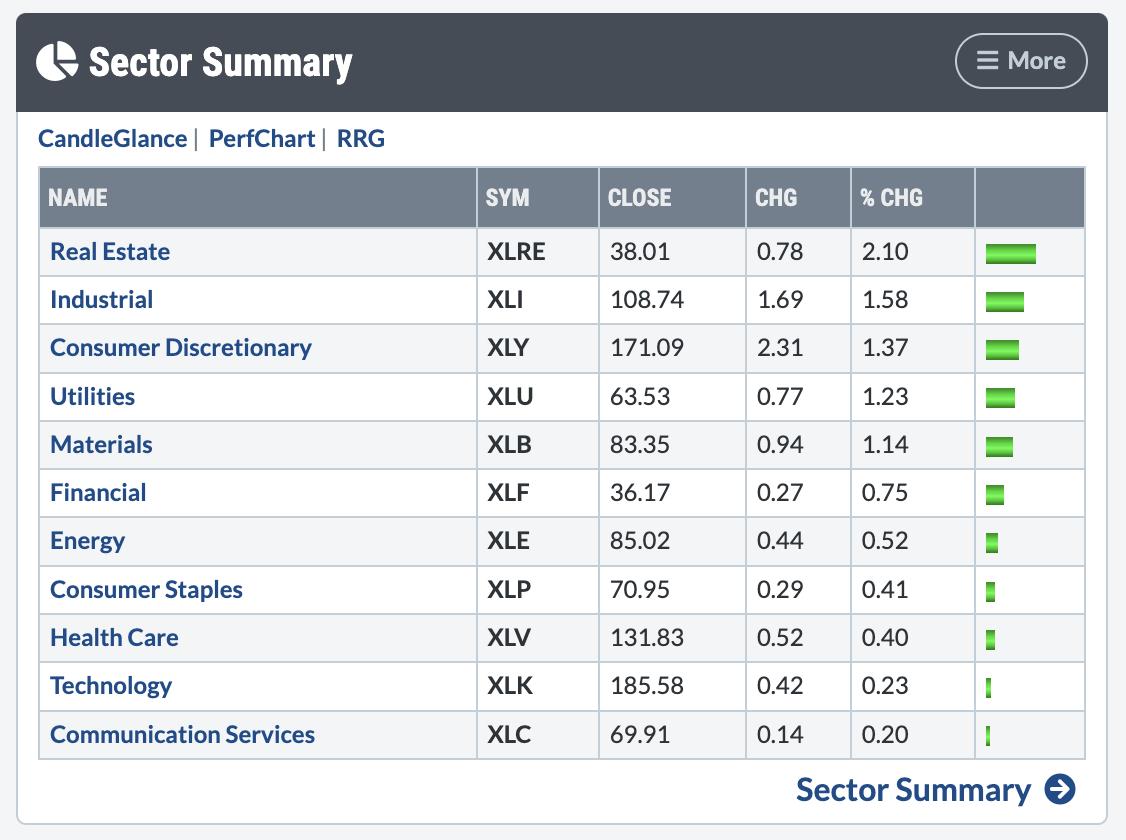

45% of Market Capitalization In S&P 500 Showing Strong Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG showing very distinct opposite rotations

* Once Sector Inside Leading and Two Sectors Inside Improving and Pushing toward Leading

* Energy Sector At Risk of Completing a Massive Double Top Formation

Usually, I would do this week's Sector Spotlight on the completed monthly charts for November. But...

READ MORE

MEMBERS ONLY

High Risk of Market Downside in December?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research updates his Asbury Six tactical market model and shares how investors can be better positioned for market uncertainty into 2024. Host Dave highlights the strong rally in financials and airlines, and reveals one...

READ MORE

MEMBERS ONLY

Trend Channels Help Define Stock Pullback Scenarios

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Sam Burns, CFA of Mill Street Research focuses on strength in financials, weakness in crude oil, and key macro themes he'll be tracking into 2024. Meanwhile, Dave tracks the relentless upswing for Bitcoin, the pullback in gold...

READ MORE

MEMBERS ONLY

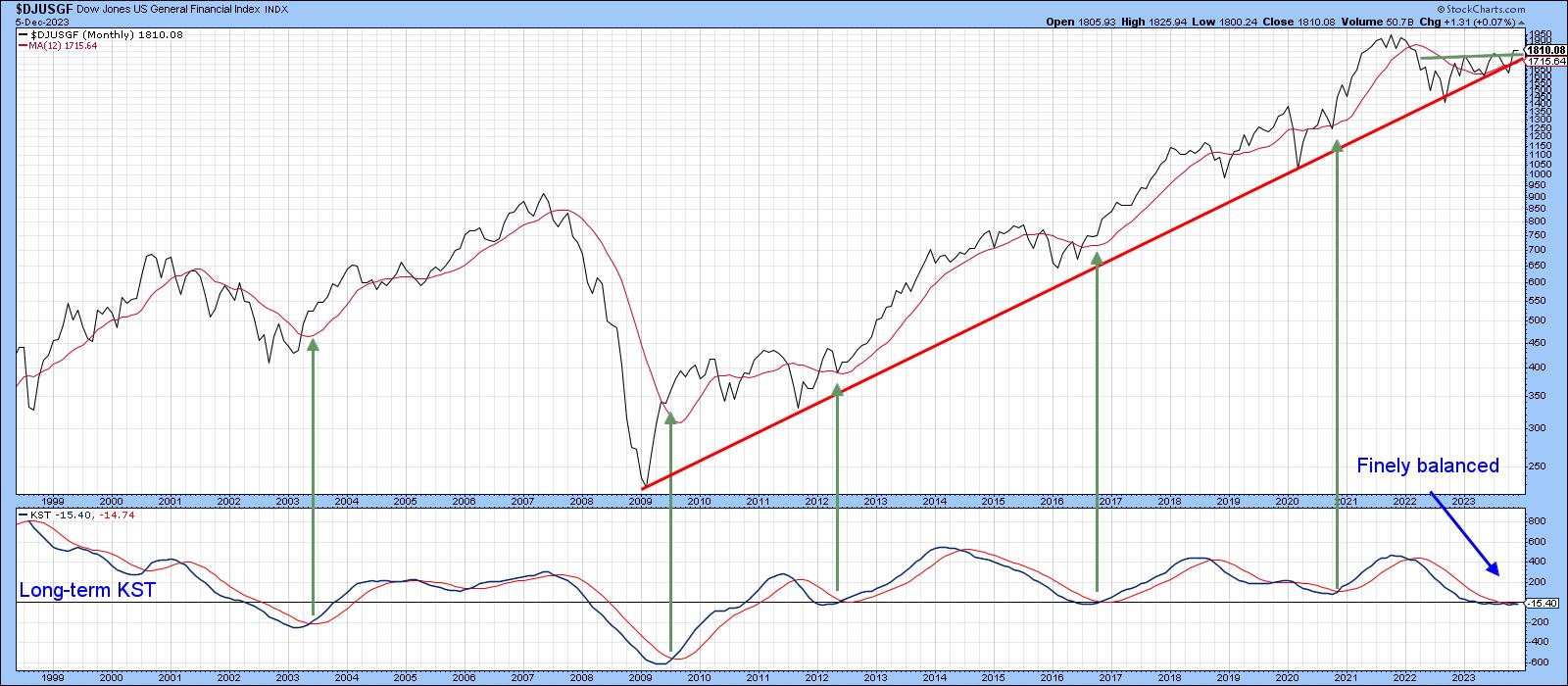

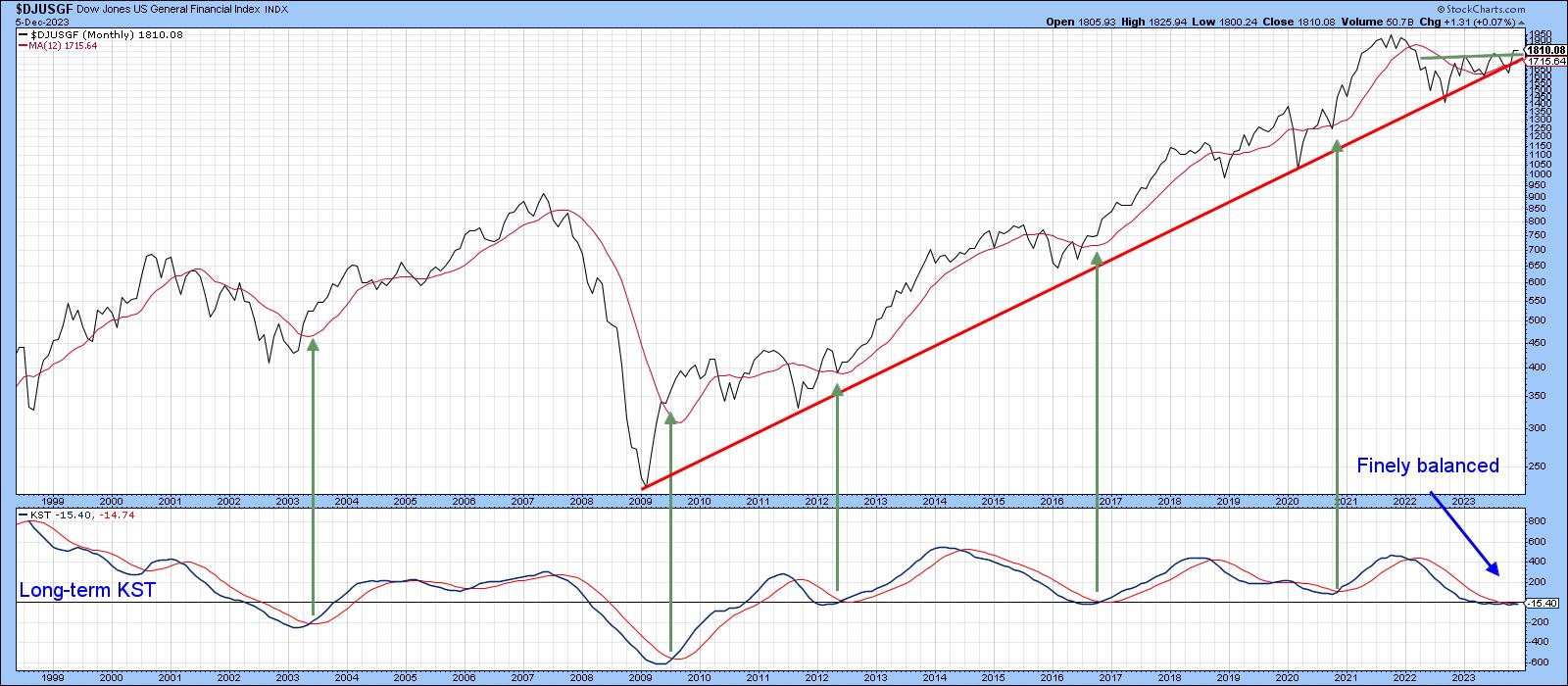

Are Financials Ready to Extend their Leadership?

by Martin Pring,

President, Pring Research

Technology (XLK) and Communications Services (XLC) have been the leaders since the bull market began in October of last year. However, they may need to look over their shoulders, as financials have been creeping up since the October 27 intermediate low. The short answer to the question posed by the...

READ MORE

MEMBERS ONLY

Is Every Stock on the Planet Overbought?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host David Keller, CMT shows how mega-cap growth stocks like NFLX and GOOGL have pulled back from overbought conditions, and reviews how other market segments like gold and small caps are experiencing a similar pattern of upside exhaustion. He takes...

READ MORE

MEMBERS ONLY

Cryptocurrency Prices in the Spotlight, Small Caps Now in an Uptrend

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Bitcoin closes above 42,000, a 20-month high

* Small caps also closed higher and are now in an uptrend

* Watch how seasonal patterns play out in December as it can be an indication of what to expect in 2024

The stock market seems to be pulling back after...

READ MORE

MEMBERS ONLY

DP Trading Room: How Bad Data From Major Indexes Leads to Bad Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses his recent epiphany regarding data derived from major indexes. Bad data will lead to bad analysis, so it's important to understand this concept for analyzing major indexes. He and Erin discuss the implications of Magnificent...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares At Scaling New Highs; These Sectors May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Following a strong consolidation in the week before this one, the markets finally staged a decisive rally over the past four sessions of the truncated week. The benchmark index NIFTY50 surged in all four sessions; it went on to move past the previous lifetime high of 20222.45 and managed...

READ MORE

MEMBERS ONLY

Stock Market Starts December On A Strong Note: What This Means For the Rest of the Year

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 index closed at its 2023 high

* The Dow Jones Industrial Average hits a new 52-week high

* The S&P 600 Small Cap Index led the rally with a 2.89% gain

The stock market is off to a great start on the...

READ MORE

MEMBERS ONLY

Pullback Imminent for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The recent upside gap around $380 was a key moment for the QQQ, but if leading growth stocks continue to drop, this level may come into question.

* While a new all-time high for the Nasdaq 100 is a possibility over the next six to eight weeks, the overbought...

READ MORE

MEMBERS ONLY

MEM TV: Nasdaq Flat But These Top Areas Outperform!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the outperformance that took place amid a declining rate environment, while also highlighting price action in Tech, which trended sideways last week. She also reviews Dow stocks that just entered a new uptrend as the Index hits...

READ MORE

MEMBERS ONLY

Fresh Trade Opportunities as Market Eases Up on the Reins!

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG notes that the market is finally letting some steam out which is what we want since we need this to present fresher opportunities for us to buy. TG presents some great examples of how to use and read the...

READ MORE

MEMBERS ONLY

Emerging Markets vs. U.S. Markets

While December 1st brought out the bulls in nearly EVERYTHING, one area caught our attention.

In December 2019, I saw a similar chart showing an unsustainable ratio between equities and commodities, which started me on the notion that something had to give. Now that I see this chart, with emerging...

READ MORE

MEMBERS ONLY

Skepticism Over the OPEC + Oil Cuts

Despite the total cuts by all countries added at the November 30th OPEC+ meeting, oil sold off, testing key support. Countries like Angola have threatened not to stick to the new quota, promising to produce above target. Meanwhile, Brazil confirmed it will join OPEC+. That means that some of the...

READ MORE

MEMBERS ONLY

Unlock the Secrets of Five Candlestick Patterns

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe presents 5 specific candlestick patterns and how to use them. He explains how the location of these candles have an impact on their importance, and also discusses how a higher timeframe candle can help with trades on...

READ MORE

MEMBERS ONLY

Santa Comes to Wall Street | Focus on Stocks: December 2023

by Larry Williams,

Veteran Investor and Author

Santa Comes to Wall Street

Maybe St. Nick gets into the eggnog before he visits Wall Street each year, because the trading pattern has been a step up, then a stumble down before recovering at the end of the year. I first noticed this Up-Down-Up pattern back in the early...

READ MORE

MEMBERS ONLY

Follow This Powerful Seasonal Playbook in Election Years

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Hirsch of theStock Trader's Almanacshares the suggested seasonal pattern for 2024 and breaks down how previous election years have played out. Host David Keller, CMT highlights a breakout in gold miners, regional banks breaking above their...

READ MORE

MEMBERS ONLY

The Final Episode: Jesse Livermore Insights and Holding 'Dead Money' Positions

by Dave Landry,

Founder, Sentive Trading, LLC

In the final edition of Trading Simplified, Dave shows his methodology in action by sharing two positions that he continues to hold, even though they were "dead money" most of the time, and why he applied discretion to stick with a losing position to possibly avoid a loss....

READ MORE

MEMBERS ONLY

The Halftime Show: Are Rate Cuts on the Horizon? Watch the Jobless Claims

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

As Pete has said several times on theHalftimeshow before, the Fed will likely cut rates when the unemployment rate ticks higher. Year-to-date the unemployment rate is up 14% from its lows in January and even Christopher Waller, an economist and member of the Fed Board of Governors, mentioned the possibility...

READ MORE

MEMBERS ONLY

Three Markets That are Right At Significant Breakout Points

by Martin Pring,

President, Pring Research

A lot of the time, I write articles that focus on markets or technical situations that should be monitored for a potential turn. This one is no different, except to say that these markets are not close to breakout points, but right at them. In short, it's fish-or-cut-bait...

READ MORE

MEMBERS ONLY

Big View Slaps Bulls with Warnings

On Monday, after the close, some warning signs from our risk gauges popped up. These are especially interesting given the number of bulls and the amount of money coming into the market.

Technically, we still have the resistance that has not cleared in small caps, retail, or transportation. And this...

READ MORE

MEMBERS ONLY

Sector Spotlight: Decoding The S&P's Monthly Behavior With Sector Rotation and Insights!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's the end of the month, which means it's time for me to take a look at the seasonal behavior for the S&P 500 and its sectors on this episode of StockCharts TV's Sector Spotlight. Is there is any alignment between historical...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Home for the Holidays, Part 2

Over the weekend, I covered small caps, retail, semiconductors and transportation. The conclusion was that "If you put these four charts all together, we get a reunion that is filled with the makings of a family breakdown. While Granny XRT and Sister Semiconductors SMH give us investors reasons to...

READ MORE

MEMBERS ONLY

DP Trading Room: How To Time Your Trade Entries & Exits Like a Pro

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Erin flies solo today and gives everyone a refresher course on how to expertly time your entries and exits for trades, using the 5-minute candlestick chart. She covers the market in general, followed by analysis of sectors of interest...

READ MORE

MEMBERS ONLY

Market Secrets Revealed! Final Bar Mailbag -- US Dollar, S&P 500 ETF, Fibonacci Pivots

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave devotes the show to the Mailbag. He answers viewer questions about the impact of the US Dollar on the stock market, why he uses the S&P 500 ETF rather than the S&P Index for relative...

READ MORE

MEMBERS ONLY

Wrong Data Gets Wrong Answers

by Carl Swenlin,

President and Founder, DecisionPoint.com

A recent article on the Business Insider site reported a set of Death Cross/Golden Cross signals on the Dow Jones Industrial Average ($INDU). Specifically, on November 13, the 50-day moving average crossed down through the 200-day moving average, commonly called a Death Cross. Two days later, the 50-day moving...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Consolidating; May Stay Within Broad Trading Range

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets consolidated throughout the week. Although they stayed within a narrow range and traded sideways for almost all days of the week, the Indices were devoid of any directional trend. Following strong weekly gains of over 1.58% in the week before, the NIFTY chose to remain in...

READ MORE

MEMBERS ONLY

Long-term Breadth Indicators Hit Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The percentage of stocks in long-term uptrends rebounded sharply in November and returned to the highs from late August and early September. This rebound is impressive, but the absolute levels are still not that inspiring. We need to see participation breakouts and higher participation levels to get the broad bull...

READ MORE

MEMBERS ONLY

Now is NOT the Time to Start a Long Trade - Be Patient!

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG notes that the markets are deciding to hang on tight to their upper levels over the holiday week. He thinks we still need a pullback, but perhaps it will be more of a flag. Either way, initiating long trades...

READ MORE

MEMBERS ONLY

How RRG Helps Us Find Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* DJ Industrials closing in on overhead resistance

* Weekly RRG showing some strong opposite rotations

* Identifying two potential pair trading setups (MSFT-MRK & NKE-CAT)

The Dow Jones Industrial Index ($INDU) is reaching overhead resistance between 35.5k and 35.7k, which means that upside potential is now limited. Even...

READ MORE