MEMBERS ONLY

Economic Modern Family -- Home for the Holidays

In the 1995 film, Home for the Holidays, family reunions are explored using both drama and comedy. The film illustrates how we outsiders looking in never really know the love and the madness that goes on inside any one family's home during Thanksgiving.

Happily, our Economic Modern Family...

READ MORE

MEMBERS ONLY

These Three Intermarket Relationships are at Key Juncture Points

by Martin Pring,

President, Pring Research

We spend a lot of time analyzing sector rotation, but there are also other relationships that can offer useful insights to internal market dynamics. One aspect of this is the relationship between market averages.

NASDAQ vs. the DJIA

As an example, Chart 1 plots the relationship between the NASDAQ Composite...

READ MORE

MEMBERS ONLY

Breadth Analysis Suggests Pullback From S&P 4600

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave reviews the latest market breadth indicators, some of which are indicating a likely pullback from resistance around the 4600 level for the S&P 500. He also focuses on stocks with actionable patterns including GOOGL, NFLX, SPOT, NVDA,...

READ MORE

MEMBERS ONLY

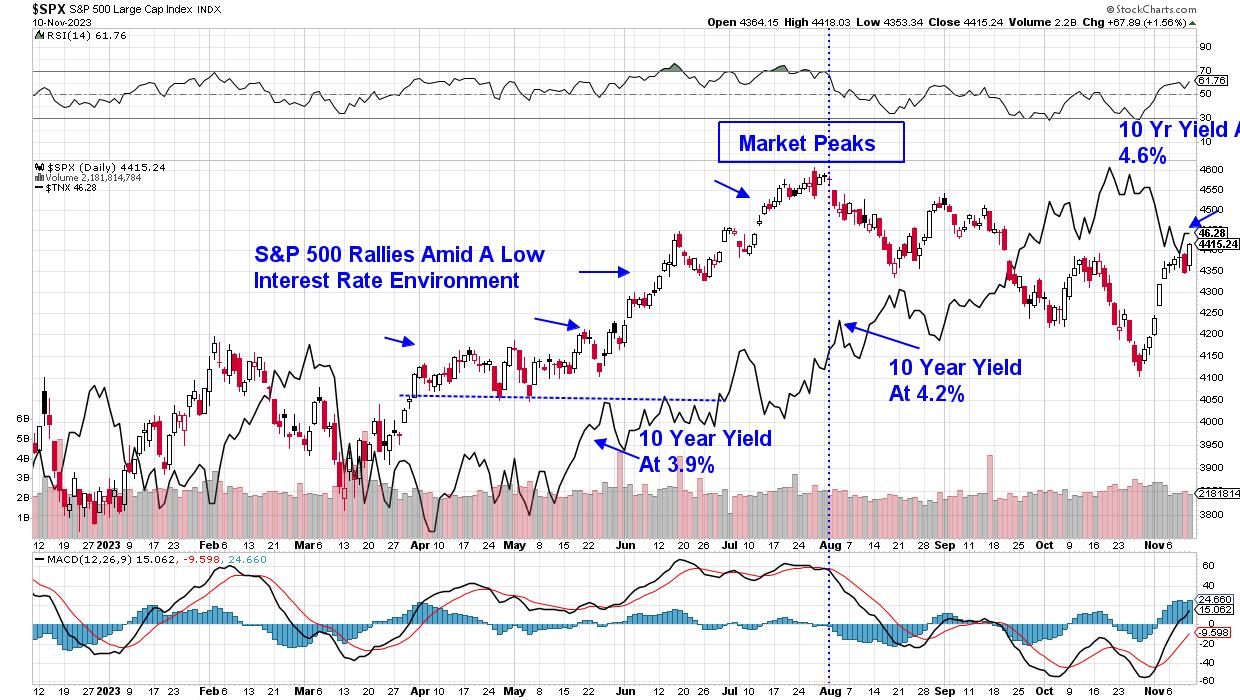

The Stock Market In 3 Charts: Market Breadth, Bonds, Sentiment

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market breadth is widening which is an indication that market internals are strong

* Falling treasury yields suggest that inflation expectations are declining

* Investors are more complacent than in October which is bullish for equities

Stocks are having a good November, which aligns with typical stock market behavior....

READ MORE

MEMBERS ONLY

A NEW ERA of Growth Leadership?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ann Bartels of Sanctuary Wealth describes how falling interest rates could pave the way for another leadership by mega-cap growth stocks, including semiconductors. Host David Keller, CMT breaks down two market breadth indicators to watch into December and...

READ MORE

MEMBERS ONLY

HUGE NEWS! New SharpCharts Workbench Updates + Black Friday Week MEGA SALE

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson kicks off the BIGGEST week of the year here at StockCharts with two exciting announcements: our Black Friday Week sale and a fresh round of updates on the new SharpCharts Workbench. He'll show you...

READ MORE

MEMBERS ONLY

Sector Spotlight: S&P 500 - Consumer Discretionary Sector Holds the Key

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I dive deep into rotations for asset classes and sectors. Bitcoin, as a proxy for crypto currencies as an asset class, is shooting off into the leading quadrant, while commodities are losing strength and stocks are back in the lead....

READ MORE

MEMBERS ONLY

Equity and Inflation Outlook -- Watch These Videos!

On Monday the 20th, I gave 2 interviews. The first is the clip below is from Yahoo Finance where we focus on oil and agricultural commodities.

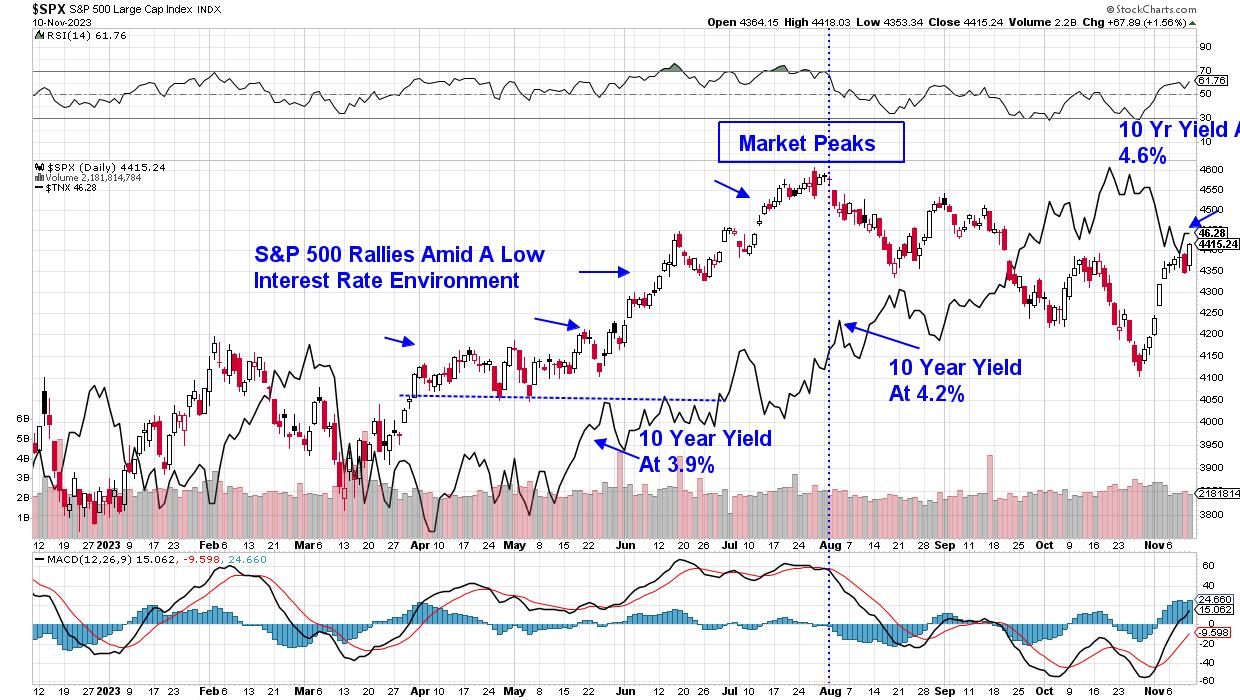

The second interview is the Daily Briefing with Maggie Lake on Real Vision. This chart above is featured, along with:

1. Inflation thesis

2....

READ MORE

MEMBERS ONLY

Magnificent 7 Stocks Testing HUGE Resistance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the technical setups on all of the Magnificent 7 stocks, addressing the balance between strong trends and overbought conditions. He answers viewer questions on investor sentiment, trailing stops, potential upside for TSLA, and the latest thinking on...

READ MORE

MEMBERS ONLY

Check These Out: Buyable Pullbacks Under the Surface!

by TG Watkins,

Director of Stocks, Simpler Trading

In the previous episode, TG explained that we needed to wait for the right opportunities to buy pullbacks from when the market shot up. The mega-caps and the major indexes did one small day of pulling back, but underneath that, many individual stocks have pulled back and come into buyable...

READ MORE

MEMBERS ONLY

EB Weekly Market Report - Monday, November 20, 2023

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sample Report

Below is our latest Weekly Market Report (WMR), which is published on Sunday/Monday of every trading week. It's unlike our Daily Market Report (DMR) as the WMR focuses almost exclusively on the Big Picture and is more designed for those with longer-term investing/trading horizons....

READ MORE

MEMBERS ONLY

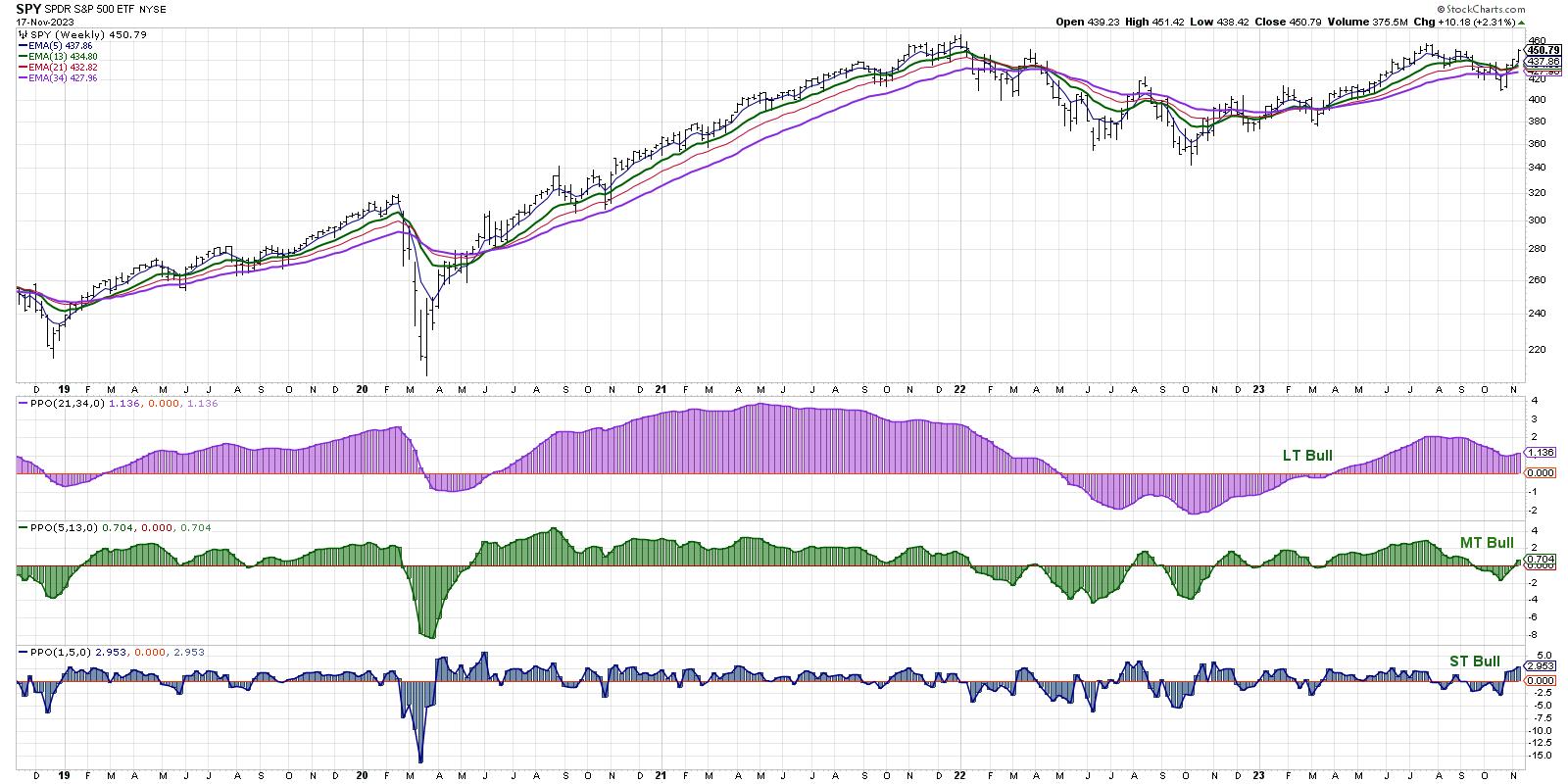

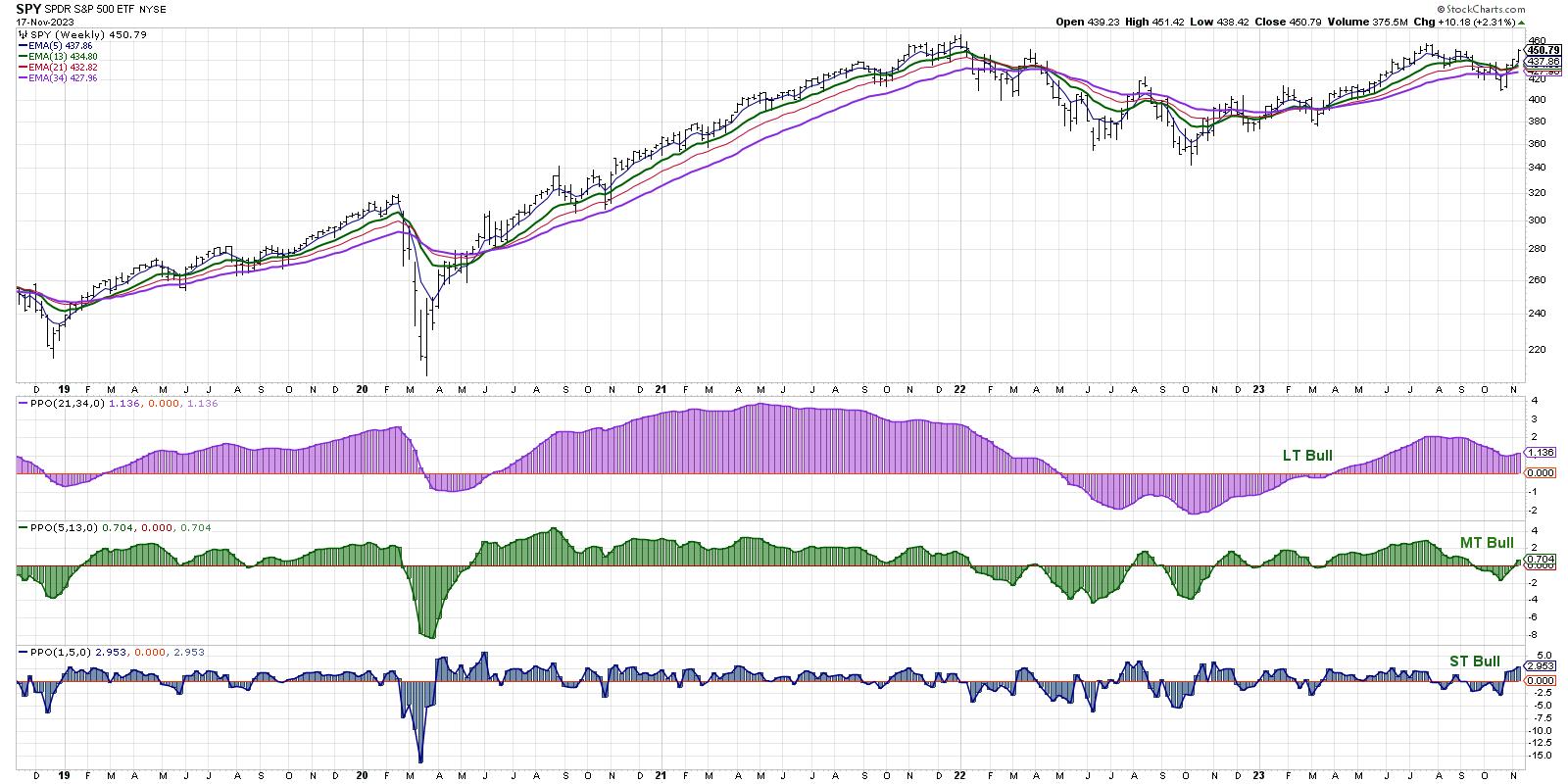

My Market Trend Model is Pretty Bulled Up

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* We use a series of weekly exponential moving averages to define the trend on three time frames.

* The medium-term model just turned bullish, suggesting a risk-on environment for stocks.

* Our Market Trend Model had a similar setup in March 2022, before a downturn eliminated the bullish configuration.

Am...

READ MORE

MEMBERS ONLY

Cap-Weighted Leadership Is Unhealthy

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

Below is a reprint of an article written Thursday in the subscriber-only DecisionPoint Alert:

One of the things we keep track of is the performance of the S&P 500 Index (SPY), which is cap-weighted, versus the S&P 500 Equal Weight Index (RSP). In a healthy bull...

READ MORE

MEMBERS ONLY

MEM TV: Easy Way To Uncover Best Candidates for These Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reveals areas of the market that are reversing lengthy downtrends and the best way to participate. She also highlights where the strength is in the markets as the uptrend remains firmly in place.

This video originally premiered November...

READ MORE

MEMBERS ONLY

Recap and Action Plan: Small Caps, Beans, Oil

Since we came back from vacation, I've written 3 Dailys. The first of these was on the Economic Modern Family and how it opened its loving arms to the bulls.

I was particularly keen on small caps or the Russell 2000 (IWM). I wrote, "Beginning with Granddad...

READ MORE

MEMBERS ONLY

Cutting-Edge Seasonality Insights & Bitcoin 2024 Halving Impact

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, guest Adrien Zduńczyk, CMT, of The Birb Nest shares a groundbreaking seasonality study he created with Jeff Hirsch ofStock Trader's Almanac. Adrien and Dave explain how November and December tend to be seasonably strong for Bitcoin, why...

READ MORE

MEMBERS ONLY

The Bull Has Left the Bear in the Dust: It's Time To Add Small Caps To Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite notched a three week winning streak.

* Small-cap stocks are showing signs of rallying to the upside

* Overall, the economy looks to be chugging along, investor sentiment is bullish, and we coudl see a year-end rally

The...

READ MORE

MEMBERS ONLY

Oil the New Gold -- Buy When There's Blood in the Streets

A weaker labor market, manufacturing production slowing, new home prices falling and crude oil inventories rising more than expected are all to blame for the big drop in oil prices. US also eased sanctions on Venezuelan oil.

That's the nature of commodities; fresh news can supersede older headlines...

READ MORE

MEMBERS ONLY

The Case for Small-Caps as Major Indexes Test Overbought Conditions

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Craig Johnson, CFA CMT of Piper Sandler shares his long-term charts of the S&P 500 and 10-Year Treasury Yield and makes the case for small caps through year-end 2023. Dave shares one breadth indicator reaching a bearish extreme...

READ MORE

MEMBERS ONLY

Capitalizing on Market Momentum: The Art of Pullback Swing Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use multiple timeframes to trade a pullback. He shows the reasons why the setup looked attractive on the daily chart, then goes down to the hourly chart to evaluate the quality of the pullback...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" November 16, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins with a followup on the October rally kickoff. He then covers stocks like CRWD, META, NVDA, LULU, and DKNG. Larry answers questions about seasonal and cyclical differences, his personal indicators, and what retailers rely most on for the Christmas season. He highlights some trades that...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Soybeans Could be the Next Parabolic Runner

Brazil planted a record soybean crop only to see unusually dry and hot weather create concerns for the harvest. Furthermore, Argentina had an extreme shortfall of soybean meal crops. Meanwhile, the USDA numbers were bearish for corn and soybeans, as U.S. crops came in larger than expected. However, China...

READ MORE

MEMBERS ONLY

Three Ways to Stay on the Right Side of the Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Dave Landry of DaveLandry.com reveals his three charts to define the market trend, limit losses, and stay on the right side of the market. Host David Keller, CMT targets names trading higher and testing key resistance, including TGT,...

READ MORE

MEMBERS ONLY

Stock Market Welcomes Us Home in a Big Way

The Economic Modern Family has opened its loving arms to the bulls and to us after our 2 weeks away.

Beginning with Granddad Russell 2000 (IWM), Monday began with a gap up over the 50-DMA (blue). We will watch for a phase change confirmation. Furthermore, the monthly chart shows IWM...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, November 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, November 16 at 2:00pm EST.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

A Supercharged Stock Market Rally: Catch These Stocks Before They Get Away

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling CPI data sends equities roaring higher

* The 10-year Treasury yield fell below 4.5%, a critical support level

* Small-cap stocks were clearly the biggest winners today

October's unchanged headline US CPI and lower-than-expected core CPI were reasons for investors to celebrate. The broader stock market...

READ MORE

MEMBERS ONLY

Stocks and Bonds SOAR After October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Pete Carmasino of Chaikin Analytics puts this week's action into long-term perspective using his charts of bond prices, interest rates, unemployment, and regional banks. Dave highlights three stocks with actionable signals this week: ROST, FSLR, and MCK....

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation and Macro Insights for the Economic Cycle!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I update the current rotation in sectors and the positioning of macroeconomic variables to make an assessment of the positioning of the stock market within the economic cycle.

This video was originally broadcast on November 14, 2023. Click anywhere on...

READ MORE

MEMBERS ONLY

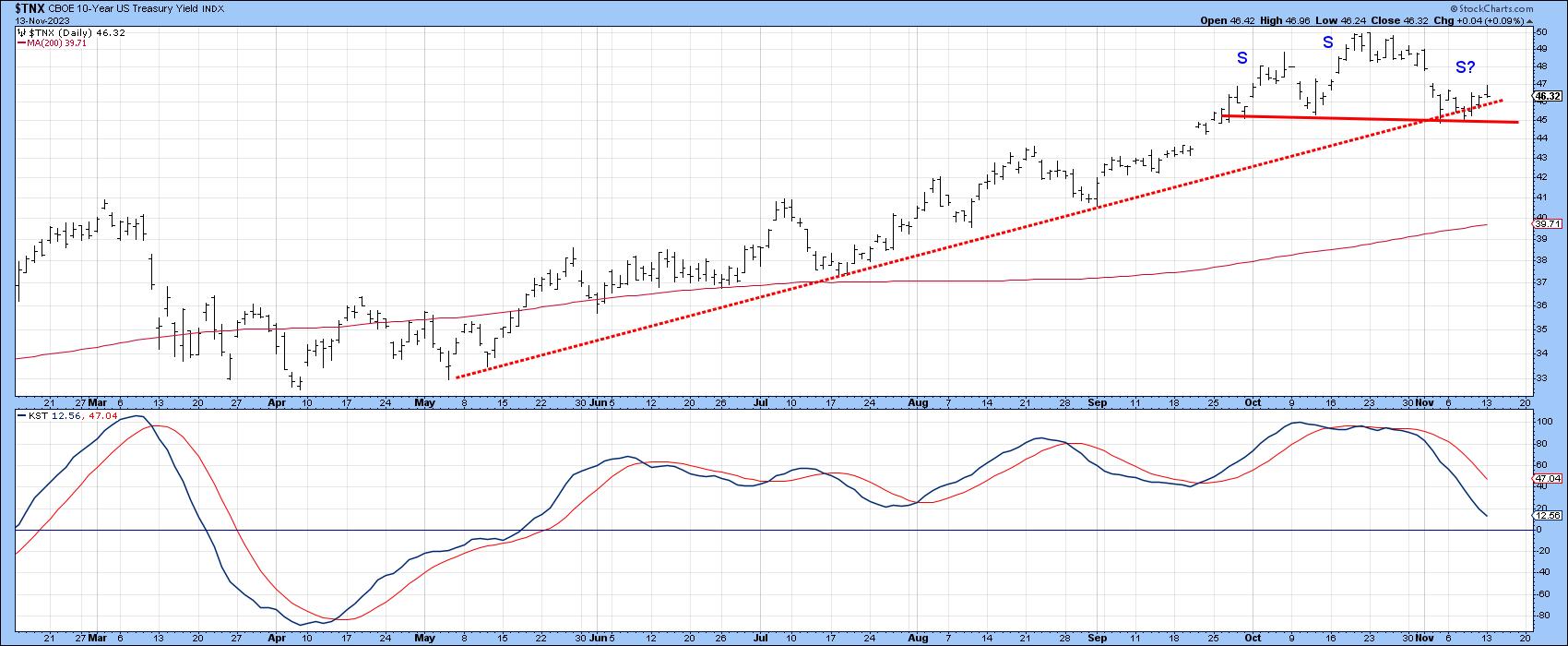

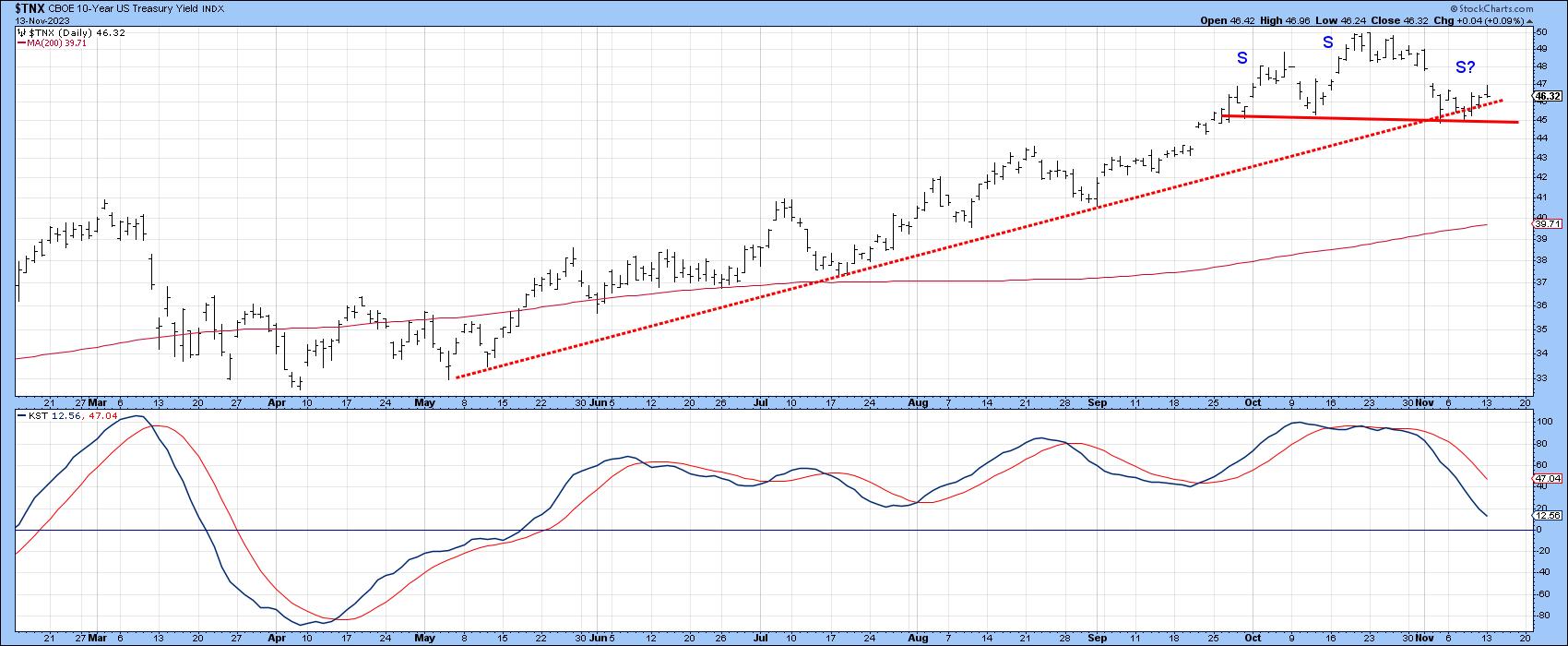

Is It Time for Interest Rates to Fall?

by Martin Pring,

President, Pring Research

I last wrote about bonds and interest rates in August, as they were in the process of challenging their October 2022 highs. My conclusion at the time was that they were likely to go through, but that upside potential would be limited due to what seemed at the time to...

READ MORE

MEMBERS ONLY

Finding Setups as Markets Wait for October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies bullish and bearish momentum divergences as the equity and bond markets await the October CPI reading on Tuesday morning. He answers questions covering Brent crude oil prices, uranium stocks, inverse head and shoulders patterns, and upside potential for...

READ MORE

MEMBERS ONLY

DP Trading Room: Is Your Portfolio OUTDATED? The Truth About The 60/40 Mix

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a discussion about the typical 60/40 Portfolio (60% US Stocks/40% US Bonds) and whether it will continue to serve you well given the decline in Bonds. Is this portfolio blend obsolete? Both...

READ MORE

MEMBERS ONLY

The Zweig Breadth Thrust Triggers, but the Indicator is Missing Something

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's report features the Zweig Breadth Thrust, which was developed by the late, and great, Marty Zweig. Zweig appeared regularly on Wall Street Week, contributed to Barrons, published The Zweig Forecast and wrote Winning on Wall Street in 1986. Among other things, his timeless book shows us how...

READ MORE

MEMBERS ONLY

Why is S&P 4400 So Important Right Now?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Charles Dow first popularized the concept of trends as defined by the pattern of peaks and valleys in price action.

* We can create shaded areas on a chart based on traditional support and resistance levels to create a "stoplight" effect to better define the market phase....

READ MORE

MEMBERS ONLY

Focused Market Leadership Ahead Of Core Inflation Data - Here's What Investors Need To Look Out For

by Mary Ellen McGonagle,

President, MEM Investment Research

On Friday, the Nasdaq Composite posted its best day in more than five months, with a 2% rally that pushed this Index further into an uptrend. The S&P 500 had a good day as well, with all eleven sectors advancing higher. The sharp gain in the Nasdaq was...

READ MORE

MEMBERS ONLY

MEM TV: Will The Markets to Continue Trading Higher? This Needs to Happen First

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets higher last week. She also shares what needs to take place in order for a sustained uptrend to materialize. Last up, she presents a review of the weaker areas as defensive stocks pull...

READ MORE

MEMBERS ONLY

Two EASY But INSANELY POWERFUL Ways to See Stocks in the S&P 500, NASDAQ & Dow

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson demonstrates two easy ways to take the individual stocks in key indexes like the S&P 500, NASDAQ 100, Dow Industrials and more, save those to a ChartList in your own account, and then review...

READ MORE

MEMBERS ONLY

Decoding Bear Markets, Divergences, & More! A Q&A with David Keller, CMT

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave dives deep into the world of market dynamics and technical analysis to answer YOUR burning questions! He talks topics like point and figure charts, moving averages, Nomura Holdings (NMR), Arthur J. Gallagher & Co. (AJG), and more!

This video...

READ MORE

MEMBERS ONLY

Moxie Indicator Alerts: Predicting Yesterday's Market Pullback!

by TG Watkins,

Director of Stocks, Simpler Trading

We had been patiently waiting for the action that happened yesterday, even though it was down. In this week's edition of Moxie Indicator Minutes, TG shows you real alerts from the Moxie Indicator Trading room that called the pullback before it happened, and presents how you too can...

READ MORE

MEMBERS ONLY

Stock Market Still Has Legs, Bitcoin Sees a Breakthrough Rally: Is the Market On the Mend?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market makes major gains with the S&P 500 and Nasdaq Composite closing above previous highs

* The 10-Year Treasury yield retested its 4.5% level and reversed to the upside

* Bitcoin rallied to close the week above 37,000

It was quite the week in...

READ MORE