MEMBERS ONLY

Find Great Trading Ideas By Combining SCTR Rankings and RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Combing Top SCTR rankings with Relative Rotation Graphs provides a powerful combination

* Confirmation between weekly and daily RRG tails sends strong signals

* PLTR, DKNG, COIN, ADBE, NVDA showing strong set-ups

One of the several widgets/panels I have on my dashboard is SCTR Reports. To visualize the group...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Believe Everything the Analysts Say, It's Dangerous!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

After TLT hit Pete's downside target, it had a violent move higher. On this week's edition ofStockCharts TV'sHalftime, Pete illustrates that the recent rally might be weakening.

A look at WTIC crude shows a pullback right on the level Pete uses as a pivot...

READ MORE

MEMBERS ONLY

This Relative Strength Signal Can Provide Early Warning Signs

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to use comparative relative strength to identify important shifts in trend, sometimes well in advance of price. He explains what the line means, plus how to use it to provide early warning signals and for...

READ MORE

MEMBERS ONLY

Long-Term Bond Rally On the Way

by Carl Swenlin,

President and Founder, DecisionPoint.com

After making a major low in 1981, bonds entered a rising trend that lasted nearly 40 years. During that period, new rules and expectations were constructed and acquired that still influence decision making today -- which is unfortunate, because the game has changed.

In 2022, the long-term rising trend line...

READ MORE

MEMBERS ONLY

Stock Indexes Continue Winning Streak: Growth Stocks Still In the Lead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 and Nasdaq Composite continue their winning streak

* Crude oil continues to slide as it trades below its 200-day moving average

If there were one thing that was surprising about the stock market, it would be how quickly the charts changed in November. Equities...

READ MORE

MEMBERS ONLY

The Best Traders ALWAYS Cherry-Pick Their Setups

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with two open trades, explaining why you must "cherry-pick" all setups and see subsequent positions through their fruition, even during less-than-ideal conditions. He also shows the recent TFM 10% sell signal and discusses...

READ MORE

MEMBERS ONLY

Sector Spotlight: Unleash The Power of Sector Analysis by Plotting Ratio Symbols on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I take a look at current sector rotation while comparing cap-weighted sectors with equal weight sectors, trying to find areas of the market where either one of these is dominating. I then demonstrate how to use ratio symbols on Relative...

READ MORE

MEMBERS ONLY

Why are Higher Interest Rates a Big Deal?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mike Singleton of Invictus Research describes the impact of higher interest rates on consumer spending and growth stock valuations. Host David Keller, CMT charts the breakout for the QQQ and reviews stocks reporting earnings, including DKNG, UBER, and more....

READ MORE

MEMBERS ONLY

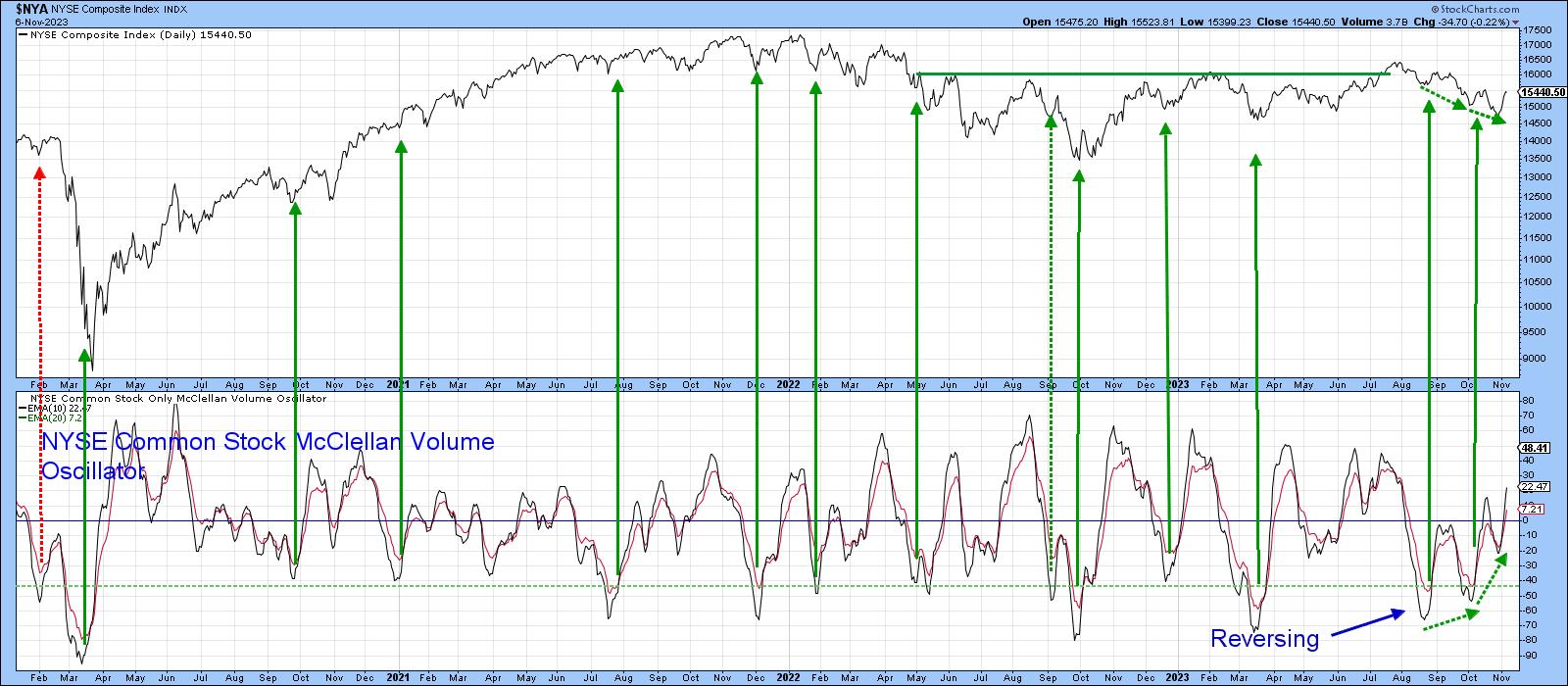

Market is UP After 10% Correction; Is a V Bottom in Place?

by TG Watkins,

Director of Stocks, Simpler Trading

The market has been signalling over-sold in multiple ways over the last 3 months, but we finally got a trigger, right around the 10% correction market plus FOMC. Powell was pretty neutral, but whatever it was, the market decided it liked it. So a V bottom appears to be in...

READ MORE

MEMBERS ONLY

Benchmarks that Will Tell Us this Market Has Legs

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote an upbeat article on the market, pointing out the fact that many short- and intermediate-term indicators were in a potentially bullish position at a time when stocks seemed impervious to bad news. I concluded "That does not mean the market will go...

READ MORE

MEMBERS ONLY

This Key Resistance Level is Crucial for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the charts of the S&P 500 and Nasdaq 100 with a focus on the downtrend channel for the QQQ and key resistance at 4400 for the S&P 500. He answers viewer questions on...

READ MORE

MEMBERS ONLY

DP Trading Room: This Powerful Scan Finds Stocks Showing NEW Momentum

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl covers the major markets as well as the Dollar, Gold, yields, and Bitcoin. Erin runs her "Momentum Sleepers Scan" to find stocks that are showing new momentum under the surface. She uncovers a few stocks for...

READ MORE

MEMBERS ONLY

Bonds Got Clipped. Now What?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Last week's sharp upward reversal in the bond market followed the FOMC Interest Rate decision. A decision to not change the Fed Funds Interest Rate target. Unlike the prior meeting ‘non-action', this decision inspired robust bond and stock buying by the investment community. The downward stride of...

READ MORE

MEMBERS ONLY

Skip the Noise and Focus on the Signal by Effectively Using the 200-day SMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is battling the 200-day SMA with four crosses over the last eleven days. We are also seeing a rise in volatility as this market benchmark plunged 5.86% in nine days (18-27 October) and then surged 5.85% the last five days. With such conditions,...

READ MORE

MEMBERS ONLY

Week Ahead: Broader Markets Set to Relatively Underperform; Watch These Nifty Levels Closely

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, during our analysis of the patterns of the NIFTY's weekly chart, it was mentioned that the Index has achieved a full throwback. This occurs when the instrument gives up the breakout gains entirely and retests the original breakout point which acts as a...

READ MORE

MEMBERS ONLY

Trading the QQQ in Three Timeframes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The short-term trend for the QQQ is positive after this week's rally, but price is now at the upper edge of a downtrend channel.

* On the medium-term timeframe, the downtrend channel is still intact, and the momentum reading is still in line with a bearish phase....

READ MORE

MEMBERS ONLY

GNG TV: S&P Rallies Back to 4300 - Is It a Go?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as equities rally right on seasonal cue, Alex and Tyler take a look across asset classes, sectors and review a few of the magnificent 7 that are holding up the broad cap-weighted indices. All that can be determined from this week'...

READ MORE

MEMBERS ONLY

New PMO Crossover BUY Signals Across All Major Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, the SPX (SPY), OEX (OEF) and Dow Industrials (DIA) all saw new PMO Crossover BUY Signals. Today, they were joined by the remainder of the major indexes. The market is clicking; now we need to determine how long this rally will stick around.

Seeing so many oversold PMO BUY...

READ MORE

MEMBERS ONLY

MEM TV: New BULLISH THRUST in the S&P 500

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the new uptrend in the markets and the areas that are best positioned to benefit. She also highlights how to use different timeframe charts to tell if a stock will continue to trend higher after gapping up...

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch in November 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they break down the trends for the top ten stocks and ETF charts for November 2023. Watch as they identify key levels and signals to keep an eye out for using the power of StockCharts&...

READ MORE

MEMBERS ONLY

An Incredible Stock Market Rally Closes the Week on a Strong Note: The Best Week This Year, So Far

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite rally into the close

* Fed Chairman Jerome Powell's comments eased investor fears of further interest rate hikes

* Lower Treasury yields helped the banks, including regional banks

Five up days in a row for the...

READ MORE

MEMBERS ONLY

Shopify Stock Shatters Expectations: What You Need to Know About Its Rise

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Shopify saw a significant surge of over 20% following a robust earnings report and guidance

* The daily price chart shows a breakaway gap from a prevailing near-term downtrend

* Breakaway gaps don't often fill, so if you are considering entering a position the stock has room to...

READ MORE

MEMBERS ONLY

What Can the VIX Reveal To Us In November 2023?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tim Hayes of Ned Davis Research shares an outlook for interest rates in 2024, and explains why a VIX over 28.5 could mean disaster for risk assets. Host David Keller, CMT updates charts of stocks reporting earnings including SBUX,...

READ MORE

MEMBERS ONLY

Start Trading Like a Pro with These RSI Divergence Signals!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe presents a few examples in different timeframes of how to use the RSI indicator for divergences. He explains what to look for when finding counter trend plays, as well as divergence with the trend. Joe then analyses...

READ MORE

MEMBERS ONLY

This Country ETF Rallies Sharply After War Breaks Out

by Martin Pring,

President, Pring Research

Understandably, most Middle Eastern country ETFs have performed poorly since the war broke out, but there is one noticeable exception, which I will get to later.

Israel

First, as might be expected, the iShares Israel ETF (EIS) has moved lower and completed what looks to be a massive top. The...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts Suggest Downside Risk is Limited

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the completed monthly charts for October and assess the condition of the long term trends, along with whether they are still in play or have shifted. As usual, I start with the long-term rotation and trends in asset...

READ MORE

MEMBERS ONLY

Signs of Top in Rates As Fed Says NO CHANGE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Katie Stockton, CMT of Fairlead Strategies shares her weekly charts of the S&P 500, VIX, and XLK and identifies three areas of opportunity through year-end 2023. Dave breaks down this week's Fed meeting from a technical...

READ MORE

MEMBERS ONLY

Focus on Stocks: November 2023

by Larry Williams,

Veteran Investor and Author

The Million Dollar Stock Market Bet

Warren Buffett proved his point in 2016 when he bet $1,000,000 that the S&P 500 Stock Index would outperform hedge funds. His bet was that active investment management by professionals would under-perform the returns of people who were passively investing....

READ MORE

MEMBERS ONLY

Stock Market Hinges on the Ten Year Interest Rate

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity breaks down four charts that speak to a potential tactical rally for the S&P 500, and explains why this market is still all about interest rates. Meanwhile, Dave charts the downtrend channel for...

READ MORE

MEMBERS ONLY

The Halftime Show: Harness The Strength of Power Gauge on ACP Platform

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete starts the show with a review of the Chaikin Power Gauge and demonstrates how to access to the tool on the ACP platform. Pete then reviews a few names that are moving big today, like Amgen (AMGN) and...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality is Dropping Big Bomb on Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the seasonality patterns that are likely to affect stock market and sector performance in the coming month. November is one of the strongest months in the year based on seasonality, but the Real Estate Sector looks to be...

READ MORE

MEMBERS ONLY

Countertrend Rally in the Works for SPX? What the Charts Reveal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave discusses implications for this week's earnings releases, the November Fed meeting, and geopolitical events. He answers live viewer questions on volume-based indicators, downside targets for the S&P 500 chart, possibilities for a countertrend rally for...

READ MORE

MEMBERS ONLY

DP Trading Room: Bad News for Buyers Weighing Hefty Mortgage Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a look at a very bearish market BIAS Table. He examines how the latest mortgage rates are squeezing buyers and sellers alike by comparing today's mortgage payments versus payments at the lows;...

READ MORE

MEMBERS ONLY

MEM TV: Are the Magnificent Seven Ready to Rally?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's negative price action in the markets while sharing key areas of possible support for the Nasdaq and S&P 500. She also highlights the relative strength in defensive areas of the market...

READ MORE

MEMBERS ONLY

My Downside Targets for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 has almost reached the minimum downside objective based on the head and shoulders topping pattern.

* SPX 3800 would mean represent a 38.2% retracement level of the March 2020 to January 2022 bull market phase.

If you've been fighting the mounting...

READ MORE

MEMBERS ONLY

29 MUST SEE Charts You Can Start Using Today!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson gives viewers 29 of the most important charts straight out of his own personal account. He'll review his weekly "Market Evaluation" ChartList and discuss all of the advanced charts within. This entire...

READ MORE

MEMBERS ONLY

Where to Find Stock Opportunities in Bear Territory

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host Dave wraps a bearish week with a discussion on downtrend conditions, trendline resistance, deteriorating breadth, and finding opportunities in a bearish landscape. He answers viewer questions on inverted yield curves, recessionary periods, and leading vs. lagging technical indicators.

This...

READ MORE

MEMBERS ONLY

GNG TV: Charts Flash Warning Signs of Further Risk to the Downside

by Alex Cole,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, with US Equities delivering a streak of daily gains this week, Alex takes a top down approach to see what the GoNoGo Charts are saying about markets. With U.S. domestic equities in a "NoGo" trend, the charts warn that...

READ MORE

MEMBERS ONLY

Stock Market Indexes Shatter Critical Support Levels. Watch the March Lows.

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow, S&P 500, and Nasdaq Composite are trading below their 200-day moving averages

* US Treasury yields are taking a breather now but their near-term action could impact equities, especially big tech stocks

* Investors are anxiously awaiting to hear if Fed Chairman Jerome Powell will lean...

READ MORE

MEMBERS ONLY

Bonds Now Beating Stocks While NVDA Goes into Tailspin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The Stock/Bond ratio is changing course

* SPY:IEF complets top formation

* NVDA completes large H&S formation unlocking 20% downside risk

SPY:IEF completes top formation

One of the metrics I keep a close eye on is the ratio between stocks and bonds. Most of the...

READ MORE