MEMBERS ONLY

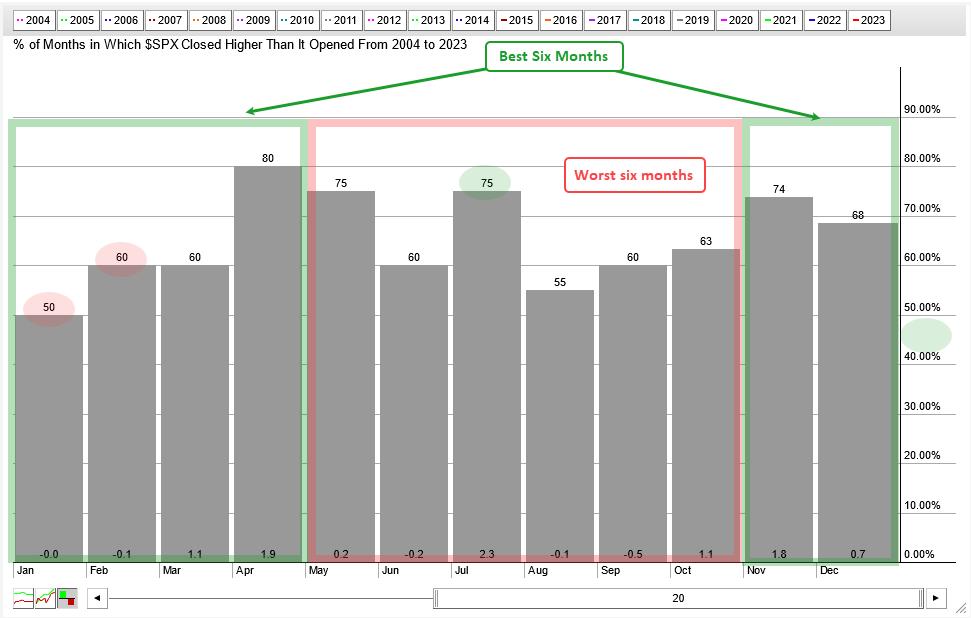

Seasonality versus Simply Market Timing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

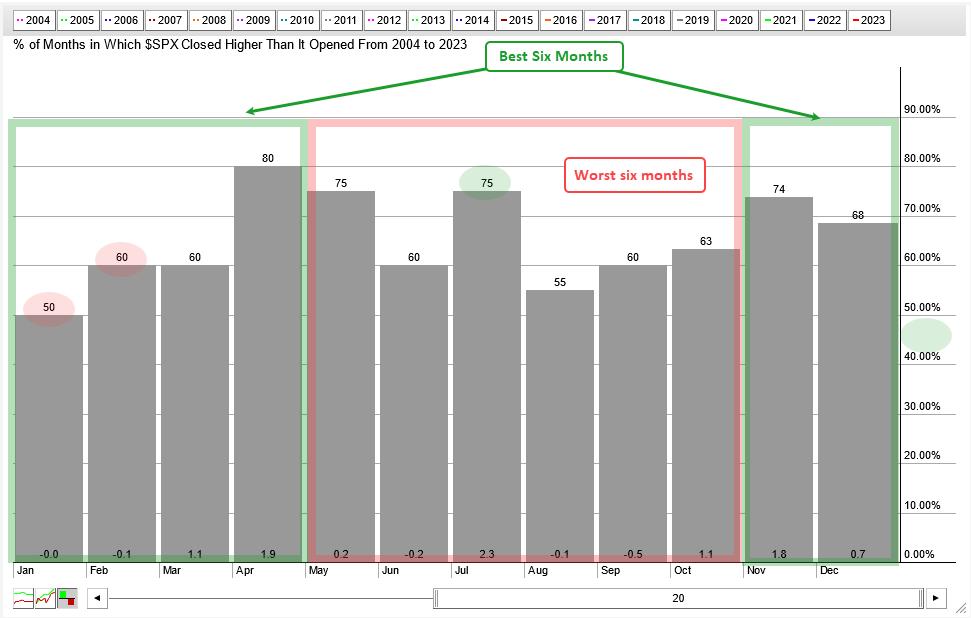

There is some validity to the best six months strategy, but investors would probably be better off with a simple timing tool. According to the Stock Trader's Almanac, the best six-month period runs from November to April. The worst six-month period runs from May to October. This is...

READ MORE

MEMBERS ONLY

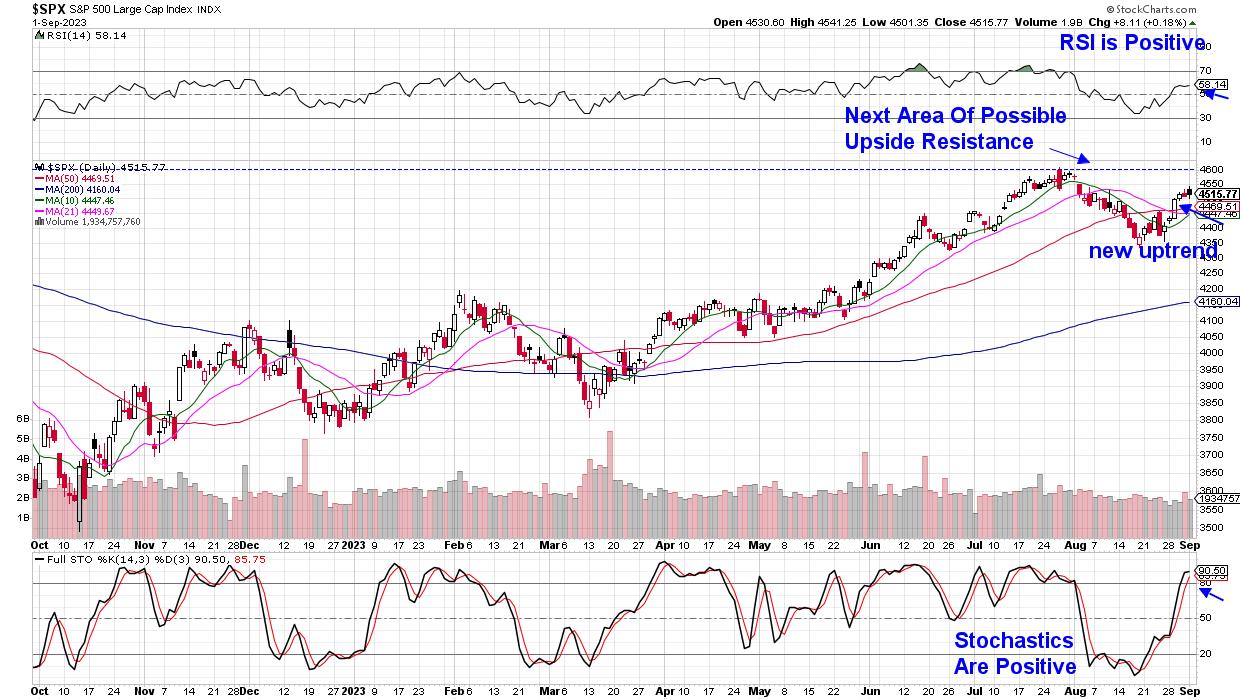

Plenty of Setups Emerge as Bulls Regain Control

by Mary Ellen McGonagle,

President, MEM Investment Research

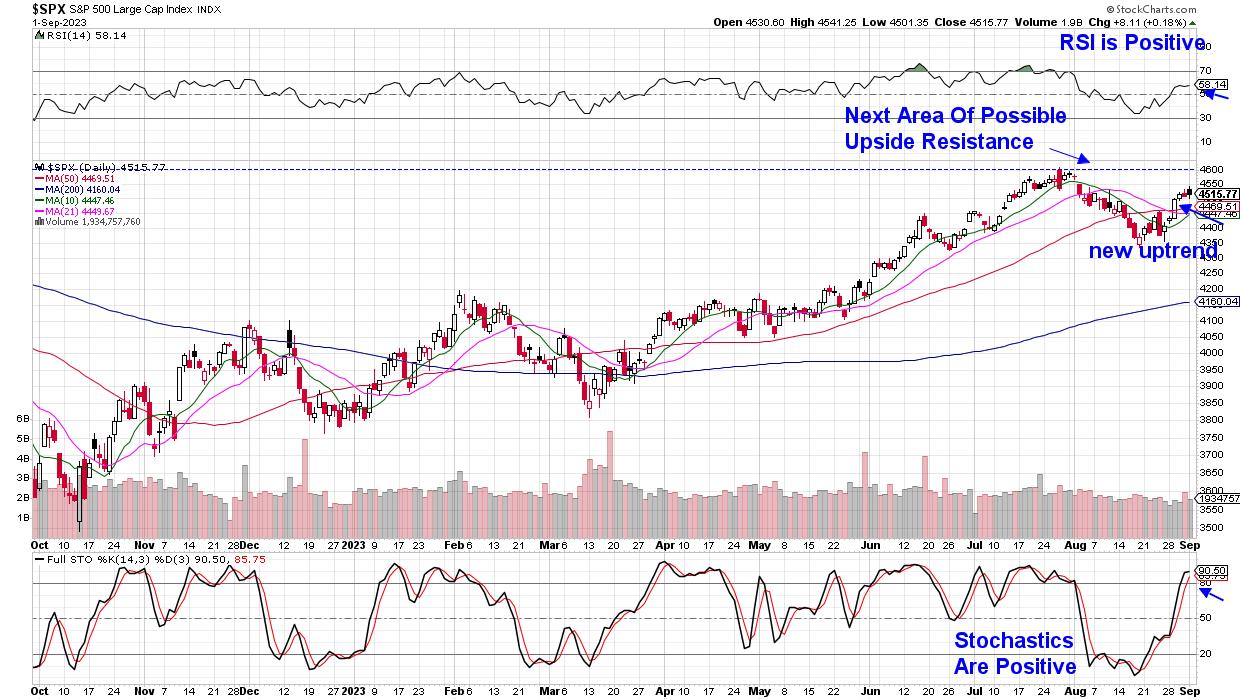

Last week, the broader markets regained their uptrend, with the S&P 500 and Nasdaq Indexes both closing above their key 50-day moving averages on Tuesday. In addition, the RSI and Stochastics turned positive as well. This price action indicates that the 3-week pullback which began in late July...

READ MORE

MEMBERS ONLY

MEM TV: Bullish Week Provides Perfect Setups!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the new uptrend in the markets and shares where the current strength is, as well as the best ways for you to participate. She also highlights the move back into earnings winners from last month as the...

READ MORE

MEMBERS ONLY

Yields, Oil, US Dollar Rise, Equities Tepid: Stock Market Starts the Month With Mixed Signals

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Overall, the stock market has managed to hold on to its upward rally even in spite of a pullback

* Crude oil prices rose on news of production cuts

* Treasury yields rose on the jobs report data

The much-awaited August jobs report was released on Friday. While it came...

READ MORE

MEMBERS ONLY

Typical Tesla STALLS Out at 50-Day Moving Average

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave wraps the market week with a discussion of higher interest rates, their implication for growth stocks, and why charts like TSLA shouldn't get an "all clear" until they break above the 50-day moving average. He...

READ MORE

MEMBERS ONLY

GNG TV: Examining MAJOR Pullbacks within Secular "Go" Trends

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

GoNoGo Charts help investors retain an objective evidence-based view on what is actually happening in the markets, and this week has shown the weight of the evidence on the side of the bulls. In this edition of the GoNoGo Charts show, Alex and Tyler examine the fade of US Dollar...

READ MORE

MEMBERS ONLY

Focus on Stocks: September 2023

by Larry Williams,

Veteran Investor and Author

Cycle Deep Dive

At times, it seems there are as many cycles as there are traders. I have been focusing on the shorter-term ones, those ranging from 2 to 5 years.

Recently, I pondered on the clear fact that cycle forecasts work far better to spot market bottoms than tops....

READ MORE

MEMBERS ONLY

Every One of These Breadth Conditions are SCREAMING Risk On!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, TG Watkins of Simpler Trading shows how breadth conditions are very similar to previous bull market pullbacks. Dave focuses in on constructive setups in gold and crude oil, then highlights one semiconductor stock featuring a symmetrical triangle pattern.

This video...

READ MORE

MEMBERS ONLY

How to Spot the Early Signs of a Reversal Using ADX and DI Lines

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the importance of the DI lines when looking at the ADX indicator. He discusses how we can determine who is in control and when to be on the lookout for a reversal. Joe then analyses the...

READ MORE

MEMBERS ONLY

The Long-Term Bull Case for Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Adrien Zduńczyk of TheBirbNest charts Bitcoin's bounce off support at $25K and relates bullish Bitcoin trends to a broader risk appetite for investors. Host David Keller, CMT highlights the McClellan Oscillator breaking back above the crucial zero level...

READ MORE

MEMBERS ONLY

Positive Confidence Ratios Argue for Higher Stocks

by Martin Pring,

President, Pring Research

KEY TAKEAWAYS

* Comparing risky asskets with more conservative ones can reflect investor confidence

* Negative divergences offer subtle indications of a deterioration of a stock market rally

* An upward trend indicates that investor confidence is positive

Traders and investors pay a lot of attention to surveys to assess swings in sentiment,...

READ MORE

MEMBERS ONLY

Find Reliable Entry Points With the Williams Insider Accumulation Index

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Get a macro view of the market by analyzing the broader indexes

* Identify stocks which show a divergence between price and the Williams Insider Accumulation Index

* If accumulation is increasing and the stock price starts moving higher, it could be an ideal entry point

Whether you're...

READ MORE

MEMBERS ONLY

The GDP PCE ADP Waltz

Conference Board Economic Forecast:

Looking into 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish. In the second half of 2024, we forecast that overall growth will return to more stable pre-pandemic rates, inflation will drift closer to 2 percent, and the Fed...

READ MORE

MEMBERS ONLY

Growth Stocks Shine in Short-Covering Rally

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, Danielle Shay of Simpler Trading breaks down the current short-covering rally and walks through her current setups for QQQ, NVDA, MSFT, and TSLA. Host Dave tracks the recent drop in interest rates and shows how Bitcoin has bounced off...

READ MORE

MEMBERS ONLY

The Halftime Show: Deciphering the Fed After Jackson Hole

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete reexamines the chart he posted before the Jackson Hole meeting; Chairman Powell validated his thinking that the Fed Policy will remain tight until the unemployment rate increases. He then gives a quick review of the SPX and the...

READ MORE

MEMBERS ONLY

Predicting Tomorrow's Price Movements Today: Introducing the Williams Cycle Forecast

by Karl Montevirgen,

The StockCharts Insider

What if you had access to a forecasting tool capable of predicting the most likely path prices may take roughly in the next three months? The caveat here is that it can't accurately pinpoint the peaks and troughs, but it can approximate them with relative accuracy.

This is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Three Takeaways from Seasonal Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In August's last regular episode of StockCharts TV's Sector Spotlight, I address the seasonal patterns in sector rotation and looks to find alignment with the current rotations as they are playing out on the Relative Rotation Graph. September is not the strongest month in terms of...

READ MORE

MEMBERS ONLY

Will the Rotation to Small Caps Hold and Last THIS TIME?

In this special edition of StockCharts TV'sThe Final Bar, guest host Mish Schneider (MarketGauge) steps in for Dave. Mish puts her own spin on the Market Recap, starting with the indices and exploring sectors using her "Economic Modern Family" analysis.

Mish then sits down with Keith...

READ MORE

MEMBERS ONLY

Bonds, Secular Bear Market, and the Impact on Small Caps

Bonds have had one of the worst years in modern times and one of the fastest rates of interest rate rises.

The good news is the market has absorbed the bond's performance. A better risk-on environment is when the SPY outperforms the long bonds. The same is true...

READ MORE

MEMBERS ONLY

DP Trading Room: New Market Bias Assessment Table

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl introduces viewers to the new Market Bias table now included in the DecisionPoint Alert. This table covers all the major indexes, sectors, and select industry groups. He goes over how we determine the bias in the intermediate and...

READ MORE

MEMBERS ONLY

Watch These Four Horrible Charts in the Dow Jones Industrials Index

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* $INDU chart resting at double support and likely to bounce higher

* Outperform the index by avoiding four stocks

The Relative Rotation Graph above, which shows the rotations inside the DJ Industrials index, exhibits an evenly-spread-out universe of stocks. This is primarily the result of $INDU being a price-weighted...

READ MORE

MEMBERS ONLY

Can Small Caps Lead the Market Higher? A Video Analysis

Small caps, as measured by IWM, are key for the fall and heading into 2024. You can also look at the S&P 600 (SML).

IWM could be forming an inverted head-and-shoulders bottom, going back from the start of 2023. (See the rectangle area of the IWM chart). SPY...

READ MORE

MEMBERS ONLY

What FIRST STEPS You Need to Take When Things Get "Iffy"

by Dave Landry,

Founder, Sentive Trading, LLC

With the market potentially topping out, now's the time to review what to do when the market gets "iffy." In this week's edition of Trading Simplified, Dave walks you through how he handles the inevitable drawdowns and shares some of his favorite performance-based metrics....

READ MORE

MEMBERS ONLY

SELL The News! NVDA Trades Lower After Strong Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Sean McLaughlin of All Star Charts shares best practices for trading options during periods of price consolidation. Host Dave highlights bearish engulfing patterns for the SPY and QQQ, as well as leading growth stocks like MSFT and META.

This...

READ MORE

MEMBERS ONLY

GNG TV: On the Lookout for LOVE with GoNoGo Charts

by Tyler Wood,

Co-founder, GoNoGo Charts®

As all eyes watch the Fed in anticipation of this week's Jackson Hole Summit, GoNoGo Charts help investors retain an objective, evidence-based view on what is actually happening in markets. In this edition of the GoNoGo Charts show, Tyler examines US Dollar strength (UUP) and the rally in...

READ MORE