MEMBERS ONLY

MARKET GIVES SHORT-TERM SELL SIGNAL AT TOP OF 2005 TRADING RANGE -- USING %B TO ENHANCE VALUE OF BOLLINGER BANDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE MARKET ISN'T READY FOR $60 OIL... On Wednesday I suggested a more cautious view of the market due to the fact that several stock market indexes were up against resistance at their 2005 highs and in short-term overbought conditions. That's why Thursday's high-volume...

READ MORE

MEMBERS ONLY

FEDEX LEADS TRANSPORTS LOWER -- FALLING TRANSPORTS THREATEN RALLY IN INDUSTRIALS -- RISING OIL AND FALLING TRANSPORTS ARE A BAD COMBINATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW THEORISTS WON'T LIKE DROP IN TRANSPORTS ... Not too long ago I showed the Dow Transports dropping under their 200-day moving average and suggested that was a negative sign for Dow Theorists. Today's drop in the transports makes that situation even worse. Chart 1 shows the...

READ MORE

MEMBERS ONLY

GOLD RALLIES TO THREE-MONTH HIGH -- ENERGY ETFS BOUNCE OFF BREAKOUT POINTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD JUMPS $4... The rally in gold continues. In today's trading, bullion has risen $4.00 and is trading at a new three-month high. Chart 1 shows the Gold ETF (GLD) having broken its eight-month down trendline and moving to up to test its March high. I think...

READ MORE

MEMBERS ONLY

A LOT OF MARKET INDEXES ARE TESTING 2005 HIGHS WHILE IN OVERBOUGHT TERRITORY -- WHY I USE A 9-DAY RSI LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

A KEY TEST IS GOING ON IN A LOT OF INDEXES... While most market observers are watching the Dow and the S&P 500, it's important to recognize that several market indexes have already reached their 2005 highs and are undergoing an important test of that resistance...

READ MORE

MEMBERS ONLY

RETURNING TO VALUE -- FIVE YEAR RUN OF VALUE DOMINANCE CONTINUES

by John Murphy,

Chief Technical Analyst, StockCharts.com

VALUE IS STILL IN THE LEAD ... One of the battles going on in the market is the one between large cap value versus growth. Charts 1 and 2 show a six-month comparison of two ETFs that reflect those two market segments. Chart 1 shows the S&P 500 Value...

READ MORE

MEMBERS ONLY

DOLLAR NEARS OVERHEAD RESISTANCE ZONE AS EURO NEARS POTENTIAL SUPPORT -- EURO DROP HAS WIPED OUT EUROPEAN GAINS FOR AMERICAN INVESTORS -- US BOND YIELDS FALL ON WEAKER EUROPE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR IS STILL IN RALLY PHASE OFF 1995 LOW... Near the start of 2005, I showed a monthly chart of the Dollar Index similar to the one shown in Chart 1. The point of the earlier chart was to warn dollar bears that the USD was nearing a major support...

READ MORE

MEMBERS ONLY

CHARTING SOME BIOTECH LEADERS -- WHY THE TWO BIOTECH ETFS LOOK SO DIFFERENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIOTECH INDEX TESTS EARLY 2004 HIGH ... On Friday I showed the Biotechnology Index breaking out to new 52-week high. It's hitting another new high today and very close to challenging its early 2004 high. There are several ways to participate in the biotech rally. One is buy some...

READ MORE

MEMBERS ONLY

HEALTHCARE ETF HITS 52-WEEK HIGH --- BIOTECH BREAKOUT -- ENERGY ETFS BREAKOUT -- HOW WILL THE MARKET ADJUST TO $70 OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE ETF HITS 52-WEEK HIGH ... While a lot of attention has been paid to rising energy and basic material stocks this week, not much has been written about healthcare. It's time to correct that. Chart 1 shows the Health Care Sector SPDR (XLV) closing the week at a...

READ MORE

MEMBERS ONLY

NASDAQ PULLBACK MAY BE OVER -- FIRMER TECHNOLOGY SECTOR COULD EXTEND SUMMER RALLY -- ENERGY BREAKOUTS, HOWEVER, SHOULD CAP SUMMER GAINS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 CORRECTION MAY BE ENDING ... I wrote earlier in the week that the market would have a hard time resuming its uptrend unless the Nasdaq started to move higher as well. That may very well be happening. One of the things I was looking for was a test of...

READ MORE

MEMBERS ONLY

HIGHER COMMODITY PRICES ARE PULLING BASIC MATERIAL STOCKS HIGHER -- COPPER AND GOLD ARE LEADING THE WAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONEY IS FLOWING BACK INTO COMMODITY STOCKS... With commodity prices climbing again, it was just a matter of time until basic material stocks started to climb as well. Thanks to jumps in the price of copper and gold, the Materials Select SPDR (XLB) is the day's strongest sector....

READ MORE

MEMBERS ONLY

MIDCAP INDEX HITS NEW HIGH -- S&P 500 RESUMES UPTREND -- RUSSELL 2000 BREAKS DOWN TRENDLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MIDCAP INDEX REACHES NEW HIGH ... I recently showed the S&P 400 Mid Cap Index testing its early March high and suggested that what it did at that resistance barrier held an important clue to market direction. Chart 1 shows that the Mid Cap Index breaking through its 2005...

READ MORE

MEMBERS ONLY

NASDAQ PULLBACK WEIGHS ON MARKET -- THE SEMICONDUCTOR (SOX) AND OIL SERVICE (OSX) INDEXES ARE TESTING 2005 HIGH -- WHICHEVER BREAKS OUT FIRST COULD DETERMINE MARKET DIRECTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 HOLDING THE MARKET BACK ... Ever since the Nasdaq market backed off from its spring high a couple of weeks ago, the rest of the market rally has stalled. That's because the market needs Nasdaq leadership to continue its summer rally. Last week I showed the Nasdaq...

READ MORE

MEMBERS ONLY

CNBC INTERVIEW TODAY AT 2:45 -- BEST BUY LEADS RETAIL HOLDERS HIGHER -- LOWES, TARGET, AND WALGREEN ARE CLOSE TO NEW HIGHS -- WAL-MART IS REBOUNDING

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAIL HOLDERS NEAR 2005 HIGH... Retail stocks are the day's strongest group. Chart 1 shows the Retail Holders (RTH) very close to reaching a new 2005 high. The better performance by the retail group has actually been going on since early May when its relative strength line bottomed...

READ MORE

MEMBERS ONLY

FALLING EURO IS HURTING EUROPEAN ETFS BUT IS HELPING GOLD -- BULLION BREAKS OUT AGAINST THE EURO AND THE YEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHY EUROPE ISHARES HAVE BEEN FALLING ... While the major European stock indexes are at or close to new 52-week highs, it may seem puzzling to see European stock ETFs falling since March. Chart 1 shows the Europe 350 iShares (IEV) peaking in March and declining toward its 200-day moving average....

READ MORE

MEMBERS ONLY

MARKET REMAINS STUCK IN TRADING RANGE -- OIL SERVICE INDEX IS TESTING ALL-TIME HIGH -- ENERGY STRENGTH AND TECHNOLOGY WEAKNESS KEEPS MARKET ON DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE AND DOW ARE STUCK BELOW RESISTANCE ... So far this week I've shown three market leaders -- the Nasdaq Composite, the S&P 400 Midcap, and the Semiconductor (SOX) Index -- all backing off from chart resistance near their spring highs. That loss of leadership has prevented...

READ MORE

MEMBERS ONLY

SEMICONDUCTORS BACK OFF FROM RESISTANCE -- FALLING SOX PULLS NASDAQ AND REST OF MARKET LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SELLING INTEL ON THE NEWS ... Yesterday I showed the S&P 400 Mid Cap Index testing its 2005 high, and suggested that it held an important key to short-term market direction. The same is true for the semiconductor group. A positive mid-quarter report from Intel last evening was greeted...

READ MORE

MEMBERS ONLY

CRUDE OIL BREAKS OUT TO SUPPORT BREAKOUT IN ENERGY STOCKS -- WIDENING BOLLINGER BAND WIDTH IS BULLISH FOR OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL HITS NEW RECOVERY HIGH... Earlier today I wrote about the bullish breakout in the energy sector. That strong action in energy stocks was confirmed by equally bullish action in the commodity. Crude oil surged over 5% today to reach the highest level in nearly two months. Crude appears...

READ MORE

MEMBERS ONLY

MIDCAP INDEX IS TESTING ITS 2005 HIGH AND MAY HOLD KEY TO MARKET DIRECTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

MIDCAPS HAVE BEEN THE STRONGEST ... Earlier in the week I showed the S&P 400 Mid Cap Index (MID) having already reached its March high. It's the first index to reach that important chart point. The MID/SPX ratio has been rising since the start of the...

READ MORE

MEMBERS ONLY

ENERGY ETFs ARE BREAKING OUT ALONG WITH SEVERAL ENERGY STOCKS -- ENERGY BULLISH PERCENT INDEX GIVES BUY SIGNAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETFs ARE BREAKING OUT ... Yesterday I showed the two Energy ETFs that I track closely challenging their late April highs. A late drop in the price of oil yesterday prevented an upside breakout. With oil trading a dollar higher this afternoon, it looks like the bullish breakouts are taking...

READ MORE

MEMBERS ONLY

NASDAQ CORRECTING FROM RESISTANCE BARRIER -- BOLLINGER BANDS CONTRACT

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ PULLS BACK FROM 2100 ... One of the reasons that the market rally remains stalled has to do with the inability of the Nasdaq Composite to get through its February/March highs at 2100. With the Nasdaq having moved into a short-term overbought condition, that was a logical spot to...

READ MORE

MEMBERS ONLY

DIVIDEND PAYING ETF DOES BETTER WHEN BOND YIELDS ARE FALLING

by John Murphy,

Chief Technical Analyst, StockCharts.com

SELECT DIVIDEND ETF IS DOING RELATIVELY WELL... Earlier in the year I wrote that one of the places that I thought would do well this year were large-cap dividend paying stocks. That was based partially on my general negative view of the stock market. Large-cap dividend stocks provide a market...

READ MORE

MEMBERS ONLY

ENERGY STOCKS GAIN -- TRANPORTS FALL

by John Murphy,

Chief Technical Analyst, StockCharts.com

DROP IN INVENTORIES BOOSTS OIL BY A DOLLAR ... A big drop in oil inventories reported today is pushing crude oil nearly a dollar higher today. Crude has been consolidating over the last week within its recent uptrend. It still looks like like crude is going to test its March high...

READ MORE

MEMBERS ONLY

NYSE BULLISH PERCENT INDEX TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

BPI BOUNCES OFF SUPPORT ... On May 25, I wrote a message about the NYSE Bullish Percent Index bouncing off support near 50, which kept the cyclical bull market intact (May 25, 2005). Chart 1 is an updated version of the chart in that earlier piece. To refresh your memory, the...

READ MORE

MEMBERS ONLY

LOWER BOND YIELDS BOOST MARKET -- RATE- SENSITIVE STOCKS GAIN THE MOST -- MID-CAP INDEX CHALLENGES 2005 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS RESUME DECLINE ... Last week the yields on the 10-year T-note fell below 4% to the lowest level in a year. That gave a boost to the stock market and especially to stocks tied to interest rates. After bouncing back to the 4% level on Monday, yields are falling...

READ MORE

MEMBERS ONLY

GOLD MAY BE DRAWING STRENGTH FROM THE YEN WHICH MAY BE REPLACING THE EURO AS THE DOMINANT FOREIGN CURRENCY

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD IS ATTRACTING NEW ATTENTION... Over the last week I've shown the Gold & Silver (XAU) Index starting to bounce from potential chart support at its spring 2004 low, and the price of bullion bouncing off its February 2005 low. Last Friday I suggested it might be a...

READ MORE

MEMBERS ONLY

RISING OIL MAY BE STARTING TO WORRY THE MARKET -- FALLING BOND YIELDS MAY BE THE REASON WHY GOLD AND GOLD STOCKS ARE BOUNCING OFF SUPPORT LEVELS

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL ISN'T DEAD YET ... A lot of recent optimism on the stock market and the economy has been predicated on the view that the historic rise in oil prices has probably ended. A lot of economists have also declared the major bull market in commodities over. Both of...

READ MORE

MEMBERS ONLY

OIL SURGES 5% TO BOOST ENERGY SECTOR -- PLUNGING BOND YIELDS SUPPORT MARKET RALLY LED BY RATE-SENSITIVE SHARES -- NASDAQ INDEXES REACH INITIAL TARGETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL SURGES 5% ... After surviving a recent test of its 200-day moving average, crude oil surged $2.63 (5%) today. That puts the key commodity back over its 50-day average, its early May high, and breaks a two-month down trendline. That strong price action puts crude in position to...

READ MORE

MEMBERS ONLY

MAY DATA PUSHES BOND YIELDS BELOW 4% AND SPARKS BOND AND STOCK BUYING

by John Murphy,

Chief Technical Analyst, StockCharts.com

PLUNGE IN PRICE DATA PUSHES YIELDS LOWER... This morning's report that prices paid by manufacturers during May saw the biggest drop since the early 1970's helped push bond yields well below 4% and to the lowest level in a year. Chart 1 shows the 10-year T-note...

READ MORE

MEMBERS ONLY

EURO PLUNGES TO SEVEN-MONTH LOW -- GOLD AND OIL RECOVER MOST OF EARLY LOSSES -- OVERBOUGHT MARKET PULLS BACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO FALLS ON FRENCH VOTE... The Euro tumbled to the lowest level in seven months after the French voted against the European constitution over the weekend. Needless to say, that gave the dollar a big boost, but pushed gold prices lower. By day's end, however, gold regained some...

READ MORE

MEMBERS ONLY

NASDAQ APPROACHES NEXT TARGET AT 2100 -- LIGHT VOLUME IS A CONCERN -- UPTURN IN ENERGY PATCH MAY CAUSE SOME SHORT-TERM PROFIT-TAKING NEXT WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

LACK OF VOLUME IS A CONCERN ... The last time I showed the Nasdaq Composite market I wrote that it's next upside target was its spring high at 2100. Friday's close put it very close to that initial upside target. It's daily oscillators also show...

READ MORE

MEMBERS ONLY

SEMICONDUCTOR HOLDERS PULLED HIGHER BY INTEL AND TEXAS INSTRUMENTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR HOLDERS NEAR 2005 HIGH ... As a follow-up to my earlier message on the improving performance by the semiconductor group, I'm going to focus this report on the Semiconductor Holders and a couple of big stocks pulling it higher. Chart 1 shows the Semiconductor Holders (SMH) trading within...

READ MORE

MEMBERS ONLY

SEMICONDUCTORS CONTINUE TO SHOW NEW LEADERSHIP -- WHY THAT'S GOOD FOR THE REST OF THE MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE SOX IS NEARING TEST OF MAJOR RESISTANCE ... On May 16 I wrote about new signs of leadership coming from the semiconductor group. That was predicated on the move by the SOX Index back over its moving average lines and, more importantly, an upturn in its relative strength line. That...

READ MORE

MEMBERS ONLY

NYSE BULLISH PERCENT INDEX IS HOLDING AT SUPPORT, BUT HASN'T BOUNCED MUCH

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE NYSE BULLISH PERCENT INDEX... I've written about using the Bullish Percent Indexes with point & figure charts. As useful as that is, you can also produce line charts on the various Bullish Percent Indexes. And they can yield some interesting market information. Chart 1 shows the NYSE...

READ MORE

MEMBERS ONLY

LONG-TERM RATES ARE TESTING 4.00% LEVEL -- HOLDERS OF REITS AND HOUSING STOCKS MIGHT WANT TO PAY CLOSE ATTENTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR T-NOTE TESTS FEBRUARY LOW ... After spiking higher from mid-February to mid-March, long-term rates have been dropping. No one is sure exactly why they've been dropping, but they have. Chart 1 shows, however, that the yield on the 10-year T-note (TNX) has reached an important chart point. The...

READ MORE

MEMBERS ONLY

OIL CLIMBS BACK OVER $51 -- OIL SERVICE LEADS ENERGY SECTOR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL BOUNCES OFF 200-DAY AVERAGE... Today's $1.58 gain in crude oil pushes it more than a dollar over the psychological $50 level and may represent a successful test of its 200-day moving average. That's giving a boost to energy stocks which have also been...

READ MORE

MEMBERS ONLY

A LOOK AT BOLLINGER BANDS IN THREE DIFFERENT TIME DIMENSIONS

by John Murphy,

Chief Technical Analyst, StockCharts.com

A TRIBUTE TO JOHN BOLLINGER ... In honor of John Bollinger's having received the MTA Annual Award this past weekend, I thought it an appropriate time to write about his greatest invention which are aptly called Bollinger bands. Chart 1 shows the bands applied to a daily chart of...

READ MORE

MEMBERS ONLY

THOUGHTS AND IMPRESSIONS FROM THE MARKET TECHNICIANS WEEKEND MEETING -- JOHN BOLLINGER GETS MTA AWARD

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHAT TOP TECHNICIANS ARE THINKING ... The Market Technicians Associations annual seminar held this past weekend in New York gave me a great opportunity to get a glimpse of what some of the top technical analysts are thinking right now. I was relieved that they were also a little puzzled by...

READ MORE

MEMBERS ONLY

GOLD AND OIL STOCKS ARE TESTING MAJOR SUPPORT LEVELS -- THEIR RECENT WEAKNESS HAS BEEN DUE TO A RISING DOLLAR AND HAS HELPED STOCKS RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL SERVICE INDEX TESTING 200-DAY AVERAGE... Oil service stocks, which have corrected downward with the price of crude oil, continue to test important chart support. Chart 1 shows the OSX trying to bounce off its 200-day moving average. The Commodity Channel (CCI) Index shows that the OSX is in oversold...

READ MORE

MEMBERS ONLY

SECTOR ROTATIONS INDICATE A COMPRESSED CYCLE -- WHY SECTOR ROTATIONS HAVE TURNED POSITIVE -- MARKET INDEXES NOW JUSTIFY NEW LONGS

by John Murphy,

Chief Technical Analyst, StockCharts.com

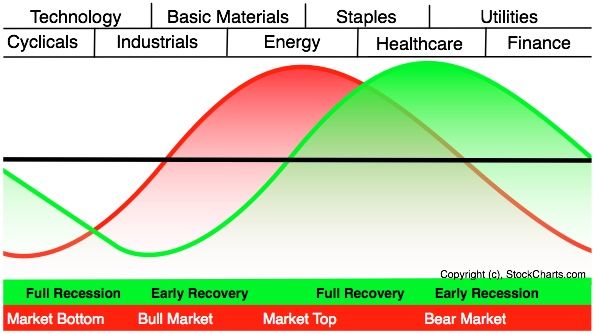

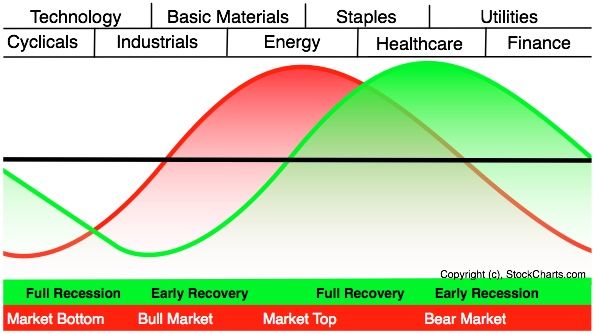

SECTOR ROTATION MODEL... The diagram in chart 1 shows the sector rotations that normally occur at different stages of a market (red line) and business cycle (green line). When we talk about a business cycle, we're normally talking about the traditional four-year cycle. That means that these shifts...

READ MORE

MEMBERS ONLY

MARKET TAKES TURN FOR THE BETTER -- FINANCIALS, RETAILERS, AND TECHS LEAD MARKET HIGHER -- MAJOR INDEXES EXCEED MOVING AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR ROTATIONS TURN POSITIVE ... Over the last couple of days, I've been writing about sector rotations that normally take place in a market upturn that's often accompanied by falling energy prices. Earlier in the week I wrote about how semiconductors were leading the technology-dominated Nasdaq market...

READ MORE