MEMBERS ONLY

Bullish Two-Bar Reversal Patterns Suggest a Temporary Bottom for Some Sectors -- and Maybe the Market Itself

by Martin Pring,

President, Pring Research

Thursday's action was quite positive for several sectors, as they experienced positive two-day price formations. These patterns are only of a short-term nature and usually have an effect for between 5- and 10-days, so they do not represent major signals. However, since this action is coming off an...

READ MORE

MEMBERS ONLY

STOCKS PLUNGE ON NEW COVID VARIANT -- ALL ELEVEN SECTORS LOSE GROUND -- TREASURY YIELDS ALSO PLUNGE IN FLIGHT TO SAFETY

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES PLUNGE... Reports of a new covid variant in South Africa pushed stocks sharply lower the day after Thanksgiving. As a result, all three major U.S. stock indexes suffered short-term technical damage. Chart 1 shows the Dow Industrials falling -904 points (-2.5%) and ending the day well...

READ MORE

MEMBERS ONLY

Key Index Experiences a Bearish Outside Day: Could There Be More Downside to Come?

by Martin Pring,

President, Pring Research

One piece of Monday's market action that really stood out to me was a bearish outside day in the NASDAQ, as shown in Chart 1. A classic outside day develops after a persistent short-term rally and signals a short-term reversal in sentiment. The outside part refers to the...

READ MORE

MEMBERS ONLY

BREADTH FIGURES WEAKEN -- MARKET MAY BE DUE FOR A PULLBACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SHOWS SOME NEGATIVE DIVERGENCE... Stocks are ending the week in a mixed fashion. The Dow Jones Industrials are weakening, while the Nasdaq 100 is hitting a new record. That being the case, this message will focus on the S&P 500 which is in the...

READ MORE

MEMBERS ONLY

After Seven Months of Consolidation Food Prices are Starting to Resume their Advance

by Martin Pring,

President, Pring Research

The Invesco DB Agricultural Fund (DBA) consists of grains (37%), softs (sugar, coffee and cocoa; 35%) and livestock (24%). A small allocation is also given to cotton. Chart 1 shows that this ETF began a bull market back in the spring of last year. Late 2020 also saw it break...

READ MORE

MEMBERS ONLY

STOCK INDEXES MAINTAIN UPTRENDS -- MATERIALS ARE WEEK'S STRONGEST SECTOR -- BOND YIELDS RISE ON INFLATION REPORT -- SO DOES GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES MAINTAIN UPTRENDS... Stocks are ending the week trying to make up some losses from Wednesday's sharp selloff after the CPI annual inflation report of 6.2% was the highest level in thirty years. Chart 1 shows the Dow Industrial staying above its 20-day moving average. Charts...

READ MORE

MEMBERS ONLY

Watch the Metal; It May Soon be Time to Pedal

by Martin Pring,

President, Pring Research

The gold price zig-zagged its way down between August of last year and April of this one. Since then, it's really been in a trading range and now looks poised to break out. Whether it will or not is another question that only the market can decide.

I&...

READ MORE

MEMBERS ONLY

AIRLINES LEAD INDUSTRIAL SPDR TO A NEW RECORD -- DELTA AND UAL LEAD AIRLINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR HITS NEW RECORD... A strong jobs report has boosted major stock indexes into record territory with most sectors also rising. Industrials are one of the day's strongest sectors. Chart 1 shows the Industrial Sector SPDR (XLI) moving into record territory today. It's being led...

READ MORE

MEMBERS ONLY

The S&P is at New Highs: Now What, Especially for Small Caps?

by Martin Pring,

President, Pring Research

The major averages have recently been scoring new highs for the year, strongly hinting that the post-May correction has run its course. So where do we go from here? Is the market overbought and likely to digest recent gains, or is a rally into the bullish year-end period a better...

READ MORE

MEMBERS ONLY

A LONGER TERM LOOK AT OIL -- ENERGY STOCKS TESTING MAJOR TRENDLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LONGER TERM LOOK AT OIL... Energy inflation is grabbing a lot of headlines these days and for good reason. Energy prices are hitting the highest level in years. That includes natural gas and crude oil. Today's message will focus on the next potential upside target for oil....

READ MORE

MEMBERS ONLY

Identifying Intermediate Buying Opportunities with the Hourly Special

by Martin Pring,

President, Pring Research

Sometimes, when I mess around with the charts, I discover an entirely new approach that I had not thought of before. Last week saw one of those breakthrough moments when, for the first time ever, I applied the Special K to hourly charts and came up with some interesting results....

READ MORE

MEMBERS ONLY

RAILS AND TRUCKERS LEAD THE TRANSPORTS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS CONTINUE TO RALLY... While the Dow Industrials continue to test their old highs, transportation stocks continue to act much stronger. Chart 1 shows the Dow Transports rising today to the highest level in nearly five months. That shouldn't be too surprising with companies dealing with supply...

READ MORE

MEMBERS ONLY

Which Asset Class is Likely to Outperform Going Forwards?

by Martin Pring,

President, Pring Research

The business cycle undergoes a set series of chronological sequences, just like the calendar year goes through seasons. Over the course of many decades, economists have recognized this phenomenon and devised composite indicators to follow this progression. By way of an example, the Conference Board publishes leading, coincident and lagging...

READ MORE

MEMBERS ONLY

Impending Super Cycle Commodity Signal Argues Against Transitory Inflation

by Martin Pring,

President, Pring Research

Aging demographics, technological innovation and an ever-expanding debt overhang are three reasons why inflation has been largely kept under wraps in the last three decades. They are still relevant, so why not extrapolate a benign inflation trend into the future?

One reason might lie in the Fed's extraordinary...

READ MORE

MEMBERS ONLY

There is a Pretty Good Chance the Correction is Over

by Martin Pring,

President, Pring Research

The S&P peaked in early September, but most other major averages and many internal indicators of breadth have been rangebound since March. Price action this week, though, suggests that there is a good chance this corrective process has run its course and we will see significant new highs...

READ MORE

MEMBERS ONLY

STOCK INDEXES END WEEK ON A STRONG NOTE -- CONSUMER DISCRETIONARY AND FINANCIALS ARE HITTING NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CLEAR 50-DAY LINES... Stocks are rising again today following yesterday's strong rally. And their technical condition is looking stronger. Chart 1 shows the Dow Industrials rising to the highest level in a month and moving back above its blue 50-day average. Chart 2 shows the S&...

READ MORE

MEMBERS ONLY

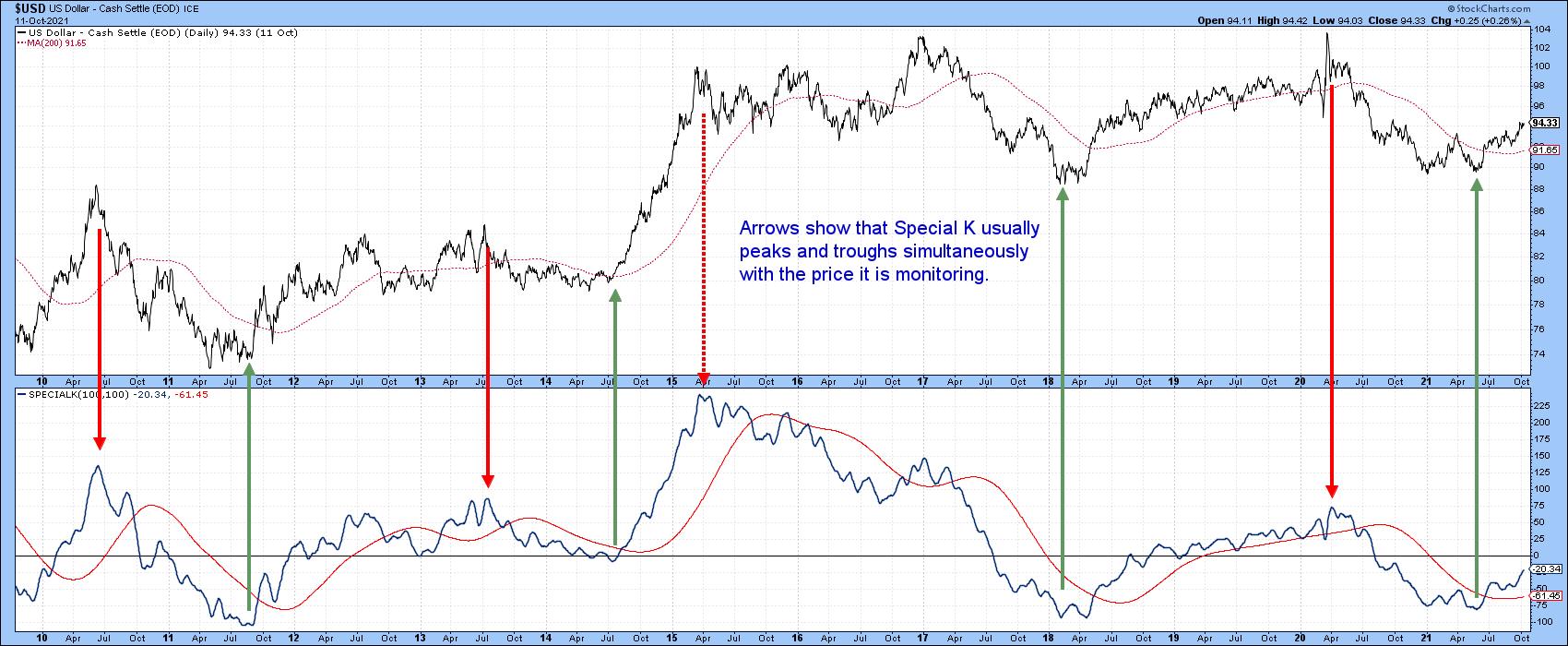

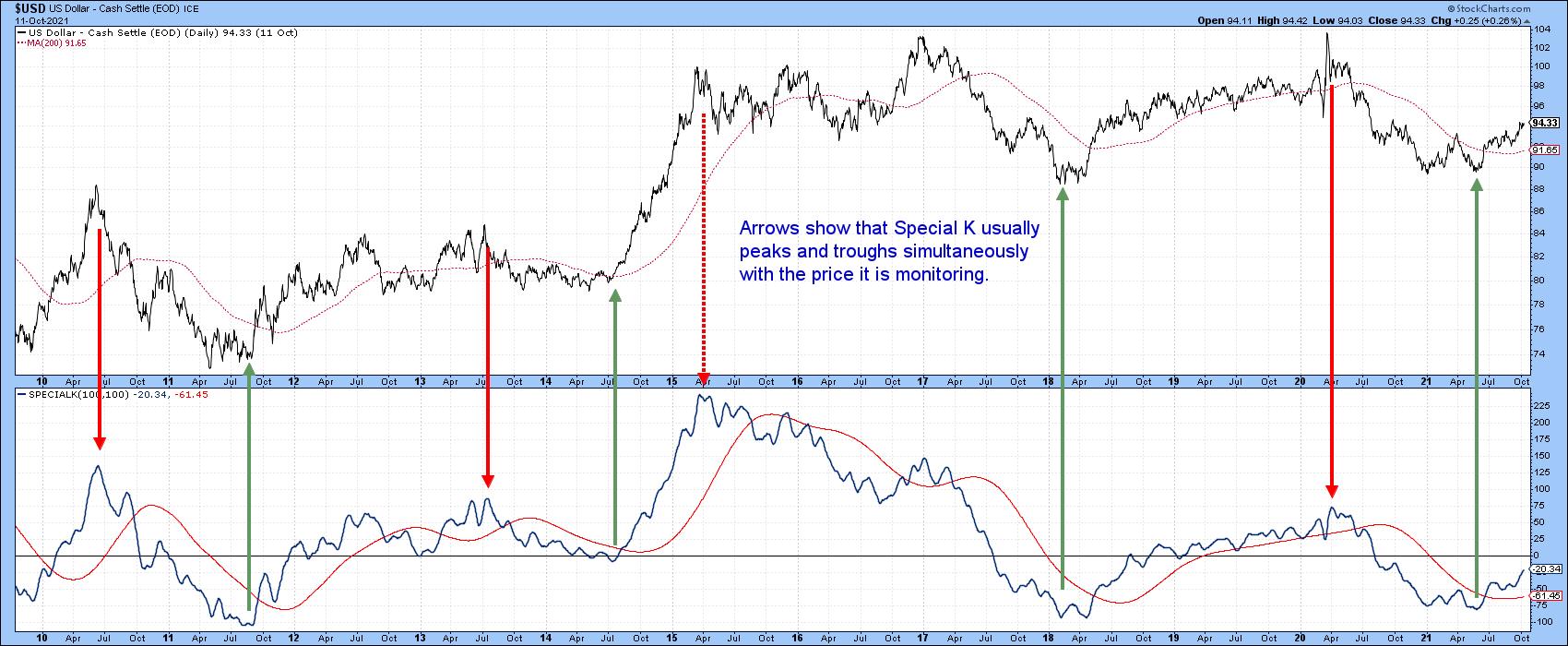

Using the Special K to Analyze the Dollar

by Martin Pring,

President, Pring Research

One of my favorite indicators is the Special K. It does not speak to us very often, but when it does, it's usually pretty reliable. I'll outline a few principles below, but for further reading, look hereandhere.

The Special K, or SPK, recognizes the fact that...

READ MORE

MEMBERS ONLY

Trick or Treat Comes to Wall Street

by Larry Williams,

Veteran Investor and Author

It's time for Halloween and Larry has some really nice treats for you in this new StockCharts TV special! One treat is in Gold and one is in the stock market itself, so grab your pens and get ready!

This video was originally broadcast on October 12, 2021....

READ MORE

MEMBERS ONLY

ENERGY AND FINANCIALS CONTINUE TO LEAD -- S&P 500 REGAINS ITS 100-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETFS ACHIEVE BULLISH BREAKOUTS... Rising energy prices continue to fuel a rally in energy shares which are the day's strongest sector. Crude oil and natural gas are trading at the highest level in several years and show no signs of slowing down. That's contributing to...

READ MORE

MEMBERS ONLY

STOCK INDEXES FALL BELOW 100-DAY AVERAGES -- FOUR SECTORS ARE TESTING THEIR 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

WATCHING 100-DAY AVERAGES...Stocks remain in a short- to intermediate term downturn that started during September. And moving average lines are being broken. It started with stock indexes falling below their 50-day moving averages. And then falling below their 100-day lines. Chart 1 shows the Dow Industrials trading below its...

READ MORE

MEMBERS ONLY

This Sector is Likely to Outperform the NASDAQ in a Major Way

by Martin Pring,

President, Pring Research

Back in AprilandMay, I wrote about the possibility that the tech-dominated NASDAQ had begun to lose its mojo. The argument was based more on relative action than the absolute price, as I was, and still am, bullish on the primary trend.

Recent NASDAQ Underperformance is Likely to Extend

Chart 1...

READ MORE

MEMBERS ONLY

RISE IN 10-YEAR TREASURY YIELD HURTS STOCKS -- TECH IS TAKING THE BIGGEST HIT -- ENERGY IS TOP SECTOR -- BANKS SHOULD BENEFIT FROM HIGHER YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD HITS 3-MONTH HIGH...The steep rise in Treasury yields that started last week continued again today. Chart 1 shows the 10-Year Treasury yield climbing 5 basis points today to 1.53%. That puts the TNX at the highest level in three months. Yields are being pushed higher...

READ MORE

MEMBERS ONLY

Step Aside Chairman Powell, Mr. Market is Tightening for You

by Martin Pring,

President, Pring Research

Last week, the Fed announced that tapering is likely to begin later in the year, to be later followed by a leisurely hike in rates. As usual, those pesky impatient markets have decided to raise rates now rather than wait for the clobbering they know they will get later. It...

READ MORE

MEMBERS ONLY

STOCK INDEXES REGAIN 50-DAY LINES -- ENERGY AND FINANCIALS ARE STRONGEST SECTORS -- INDUSTRIALS AND MATERIALS BOUNCE OFF 200-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS MAKE UP LOST GROUND...Two strong days in a row have more than made back losses suffered on Monday. In addition, some of the short-term technical damage has been repaired. More specifically, 50-day moving averages that were broken on Monday have been regained on the S&P 500...

READ MORE

MEMBERS ONLY

What You Need to Know to Trade Cryptos

by Larry Williams,

Veteran Investor and Author

Larry is back again! The topic du jour is "Trading Bitcoins & Cryptocurrencies." They have become really big markets with a huge following. Larry will share his insights on how to trade them, the problems with them and the opportunities. If you're a Bitcoin trader, you&...

READ MORE

MEMBERS ONLY

Commodities Experience a False Upside Breakout -- Or Did They?

by Martin Pring,

President, Pring Research

Earlier in the month, I pointed out that the long-term indicators for commodities were still bullish, but getting overbought. At the same time, several intermarket relationships were signaling danger, which suggested some degree of vulnerability. Prices have not moved very much since then, but, bearing in mind that overstretched technical...

READ MORE

MEMBERS ONLY

STOCKS SUFFER BIGGEST DROP SINCE THE SPRING -- 50-DAY MOVING AVERAGES HAVE BEEN BROKEN -- BREADTH MEASURE WEAKEN FURTHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEPTEMBER SELLING DEEPENS ON CHINA CONCERNS... Monday's heavy selling of stocks was the biggest drop since the spring. The selling started in China on concerns over its property market and spread to Europe and the U.S. Going into Monday, stocks were already pulling back on fears that...

READ MORE

MEMBERS ONLY

S&P 500 IS TESTING 50-DAY AVERAGE -- OTHER MEASURES OF MARKET BREADTH LOOK WEAKER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TESTS 50-DAY MOVING AVERAGE... Chart 1 shows the S&P 500 trying to find support at its 50-day moving average (blue arrow). Stocks have entered a seasonally weak period extending from September into October. And despite the general consensus that stocks are due for a...

READ MORE

MEMBERS ONLY

Several Indicators are Shaping Up for a Counter-Cyclical Correction

by Martin Pring,

President, Pring Research

Most of the time, the charts I plot are constructed from daily data. As a result, the necessary perspective provided by weekly ones often gets overlooked. By way of a remedy, I decided, some time ago, to create chartlists for key markets featuring weekly high low close and candlestick arrangements....

READ MORE

MEMBERS ONLY

Nine Country ETFs That are Starting to Emerge

by Martin Pring,

President, Pring Research

Chart 1 shows that the US stock market is in a long-term uptrend relative to the rest of the world. The upper window compares the S&P to the Vanguard All-World ex-US ETF and indicates a recent breakout from a consolidation reverse head-and-shoulders. The lower panel substitutes the S&...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships are Signaling Danger for Commodities

by Martin Pring,

President, Pring Research

When considered in their own right, commodities, as represented by the CRB Composite, are in a primary bull market. Chart 1, for instance, shows that the Index is above its 12- and 24-month moving averages and the long-term KST is also in a bullish trend. That said, this momentum indicator...

READ MORE

MEMBERS ONLY

Great Buy Point Coming for Stocks?

by Larry Williams,

Veteran Investor and Author

October has historically been a seasonal sweet spot for stocks to stage substantial rallies. But will that be the case this year? In this special presentation, Larry looks to answer this question with facts and figures.

This video was originally broadcast on August 26, 2021. Click anywhere on the Larry...

READ MORE

MEMBERS ONLY

Dollar Index Breakout Trick or Treat?

by Martin Pring,

President, Pring Research

Back in June, I wroteabout the possibility that a major reversal in the dollar could be underway, but that certain things had to happen before we could come to a firm conclusion. One of those conditions was a Dollar Index daily close above 93.5, as that would complete what...

READ MORE

MEMBERS ONLY

Michigan Consumer Sentiment Drops 13.5% in July; What Does that Mean for US Equities?

by Martin Pring,

President, Pring Research

Last Friday, the University of Michigan released the initial August response to their consumer sentiment survey. A sharp 13.5% retreat was recorded. The Expectations Index fared even worse with a 17.5% drop. According to the summary report, only six of these monthly surveys since the late 1970s have...

READ MORE

MEMBERS ONLY

Which of These Three Leading Commodity Indicators are Forecasting Higher Prices?

by Martin Pring,

President, Pring Research

We hear a lot about inflation these days and have certainly experienced rising grocery bills, as well as runaway used car and housing prices. Commodity prices are often, but certainly not always, a leading indicator for the CPI, but there are three markets that have a useful, though imperfect, record...

READ MORE

MEMBERS ONLY

BOND YIELDS BOUNCE ON STRONG JOBS REPORT -- FINANCIALS ARE HAVING A VERY STRONG DAY -- SO ARE BANKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD REBOUNDS... A strong July jobs report is helping boost bond yields today. Chart 1 shows the 10-Year Treasury yield bouncing 7 basis points to 1.29% on the day. A small double bottom on the daily bars suggests that a bottom may be forming. The TNX is...

READ MORE

MEMBERS ONLY

The Indicators are Mixed. What Does this Contradiction Mean for the Market?

by Martin Pring,

President, Pring Research

This morning, an interesting chart of the S&P Composite authored by Ed Clissold of NDR Research crossed my desk. It can be seen at @NDR_Research. It is a composite of 3 historic cycles: 1-year, 4-year (post-election) and 10-year decennial cycle with an average of years ending in...

READ MORE

MEMBERS ONLY

S&P 500 TOUCHES NEW RECORD -- SMALL AND MIDSIZE STOCKS ARE LOOKING STRONGER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TOUCHES NEW RECORD... Stocks continue to rise with major stock indexes at or near record highs. Chart 1 shows the S&P 500 touching new record territory. Smaller stocks have been lagging behind the large cap rally. But are starting to look stronger. That includes...

READ MORE

MEMBERS ONLY

Bitcoin and Chinese Equities Go their Separate Ways

by Martin Pring,

President, Pring Research

After months of quiet frustrating trading, Bitcoin finally broke out to the upside this week. It's too early to say whether this is the beginning of a move to new all-time highs, as lots more backing and filling is probably necessary in order for it to form a...

READ MORE

MEMBERS ONLY

STOCK REBOUND CONTINUES -- CYCLICAL SECTORS ARE LEADING -- 10-YEAR TREASURY YIELD REGAINS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET REBOUND CONTINUES... Stocks had another strong day today and have more than made back their sharp losses from Monday. Chart 1 shows the Dow Industrials closing above their 50-day average for the second day in row. Chart 2 shows the S&P 500 gaining more ground following Monday&...

READ MORE