MEMBERS ONLY

The Correction May Not Be as Bad as You Think

by Martin Pring,

President, Pring Research

The bad news is that a correction is underway and that many indicators and market averages have started to break through key support. The good news is that, internally, corrective activity has been underway for several months. Provided the bull market is still in existence (and there are few grounds...

READ MORE

MEMBERS ONLY

DOW LEADS MARKET SELLOFF -- SMALL CAPS BREAK CHART SUPPORT -- 10-YEAR YIELD BREAKS 200-DAY LINE -- ENERGY AND FINANCIALS LEAD DECLINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW SHATTERS 50-DAY LINE... Stocks are opening the week sharply lower and on the pace for one of the year's biggest losses. Although all market averages are under pressure, the Dow is leading the decline. Chart 1 shows the Dow Industrials plunging below their 50-day average. The next...

READ MORE

MEMBERS ONLY

US Breaks Out Against the World as Bonds Fail at 200-day Moving Average

by Martin Pring,

President, Pring Research

The US Breakout

The S&P has been in a secular or very long-term uptrend against the Dow Jones World Stock Index since the financial crisis. That trend is still intact, as the ratio remains above its 2011-2021 up trendline. The primary trend picture is a bit mixed as...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD MAY BE BOTTOMING -- THAT WOULD HELP BANKS AND OTHER FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD MAY BE BOTTOMING... A combination of technical factors suggests that the recent decline in bond yields may be at or near a bottom. Chart 1 shows the 10-Year Treasury yield starting to find support near its red 200-day moving average which usually acts as a support line...

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That are at a Critical Point

by Martin Pring,

President, Pring Research

When reviewing my charts last weekend, several jumped out as being at a pretty critical juncture, and therefore worthy of monitoring going forward. A couple of them involved the stock market, so I'll start there.

Two Stock Market Relationships

I have always been fascinated by the relationship between...

READ MORE

MEMBERS ONLY

APPLE MAY BE BREAKING OUT -- TECH SECTOR CONTINUES TO LEAD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECH SECTOR SHOWS RELATIVE STRENGTH... Stocks are trading higher again today on the back of a stronger than expected jobs report. Eight of eleven market sectors are rising with technology in the lead. Relative strength by the tech sector is something we've been seeing a lot of lately....

READ MORE

MEMBERS ONLY

What Does a Flattening Yield Curve Mean for Bonds, the Economy and Stocks

by Martin Pring,

President, Pring Research

In the last couple of weeks or so, US treasury yield curves have begun to flatten. That may sound unduly technical and boring, but it has implications for bonds stocks and the economy. I'll get to the investment implications later, but for now I'll quickly through...

READ MORE

MEMBERS ONLY

NASDAQ and S&P at a New High, But It's Very Lonely Up There

by Martin Pring,

President, Pring Research

This week saw the NASDAQ and S&P Composites rally to a new high, but not the DJIA, NYSE Composite, Unweighted S&P and Russell 2000. That's not necessarily the kiss of death, as these discrepancies can always be cleared up over time. In any case,...

READ MORE

MEMBERS ONLY

NASDAQ BREAKOUT LEADS MARKET HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ BREAKS OUT TO NEW RECORD... Stocks are having another strong day with the S&P 500 and Nasdaq indexes hitting new records. The Nasdaq breakout is especially impressive. Chart 1 shows the Nasdaq Composite Index having broken through its February/April highs to reach new record territory. In...

READ MORE

MEMBERS ONLY

DOW BREAKS SHORT-TERM SUPPORT -- FLATTENING YIELD CURVE HURTS FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW UNDERCUTS ITS MAY LOW... Some hawkish comments on interest rates by a member of the Fed this morning is taking a negative toll on stocks. The Dow is under the most pressure. Chart 1 shows the Dow Industrials trading below its May low to the lowest level in nearly...

READ MORE

MEMBERS ONLY

RISING DOLLAR PUNISHES GOLD -- SO DOES THE PROSPECT FOR HIGHER RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR JUMPS ON FED MESSAGE... The Fed's more hawkish tone yesterday set off a number of intermarket reactions. Stocks sold off (although not by that much), and bond yields rose. Prospects for higher rates in the U.S. also had a positive impact on the dollar. Chart 1...

READ MORE

MEMBERS ONLY

Can Positive Short & Intermediate Indicators for the Dollar Tip Long-Term Balance to the Bullish Side?

by Martin Pring,

President, Pring Research

Chart 1 shows that, since 2015, the Dollar Index has been in a narrowing trading range bounded by two converging trendlines. That period has also embraced the end part of the 2011-2016 bull market, a mini bear and bull market and the current bear. I use the term "bear&...

READ MORE

MEMBERS ONLY

QQQ HITS NEW RECORD WITH TECHNOLOGY IN THE LEAD -- APPLE AND AMAZON TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 HITS NEW RECORD... Chart 1 shows the Invesco QQQ Trust closing above its April high to achieve a new record. Technology was the day's strongest sector. Chart 2 shows the Technology SPDR (XLK) nearing a test of its April high. Semiconductors had another strong day as...

READ MORE

MEMBERS ONLY

Where Are We Now, What's Next?

by Larry Williams,

Veteran Investor and Author

In this special presentation, Larry shares his views about what is coming for stocks, gold, crude oil and bonds. He provides some of his secrets of cycles and fundamentals, with an alert on what you need to be following going forward. As an added bonus, Larry highlights a specific trade...

READ MORE

MEMBERS ONLY

Oil May Be on the Verge of a Major Breakout

by Martin Pring,

President, Pring Research

Last week, I featured three energy-related ETFs as part of an article on the bond market, as they had just broken out on a short-term basis. Chart 1 shows that those breakouts have held so far. This week, though, I'd like to take a deeper dive into the...

READ MORE

MEMBERS ONLY

TECH AND NASDAQ LEAD MARKET HIGHER -- SEMICONDUCTERS LEAD XLK HIGHER -- SMALL CAPS MAY BE TRIANGULATING -- BITCOIN MEETS 40K RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ LEADS MARKET HIGHER... Stocks are reacting positively to this morning's job report which came in weaker than expected but showed job growth during May. Bond yields weakened on the report which may be helping to boost stocks, and technology stocks in particular. Chart 1 shows the Invesco...

READ MORE

MEMBERS ONLY

Bonds at the Crossroad as Energy Breaks to the Upside

by Martin Pring,

President, Pring Research

The Dilemma Between the Long and Short-Ends

Last March, I wrote an articleopining that, while the primary trend was positive, the idea of rising bond yields may have been become too popular for the time being. In the intervening 2 ½-months, yields at the long end have backed off a...

READ MORE

MEMBERS ONLY

I Don't Know If the Correction Will Extend, But Here are Five Charts I'm Watching

by Martin Pring,

President, Pring Research

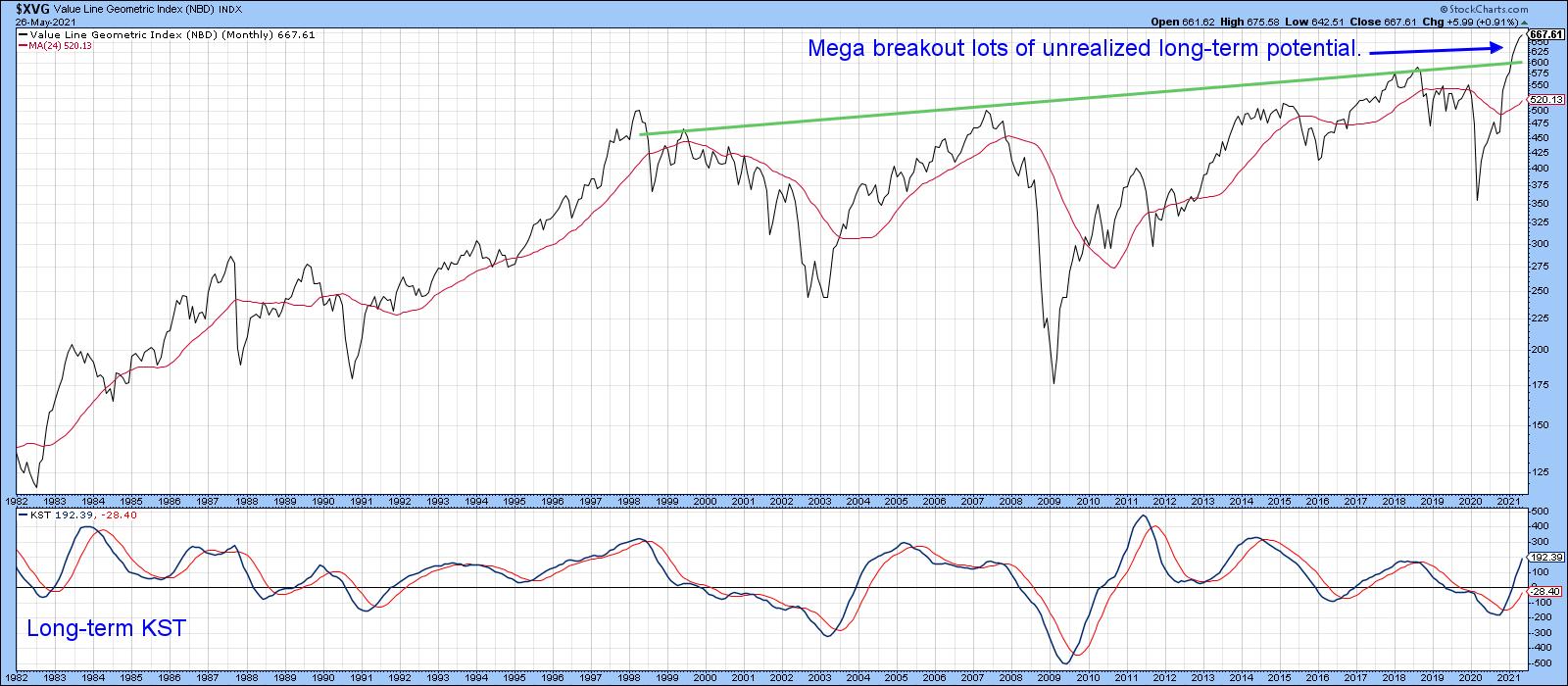

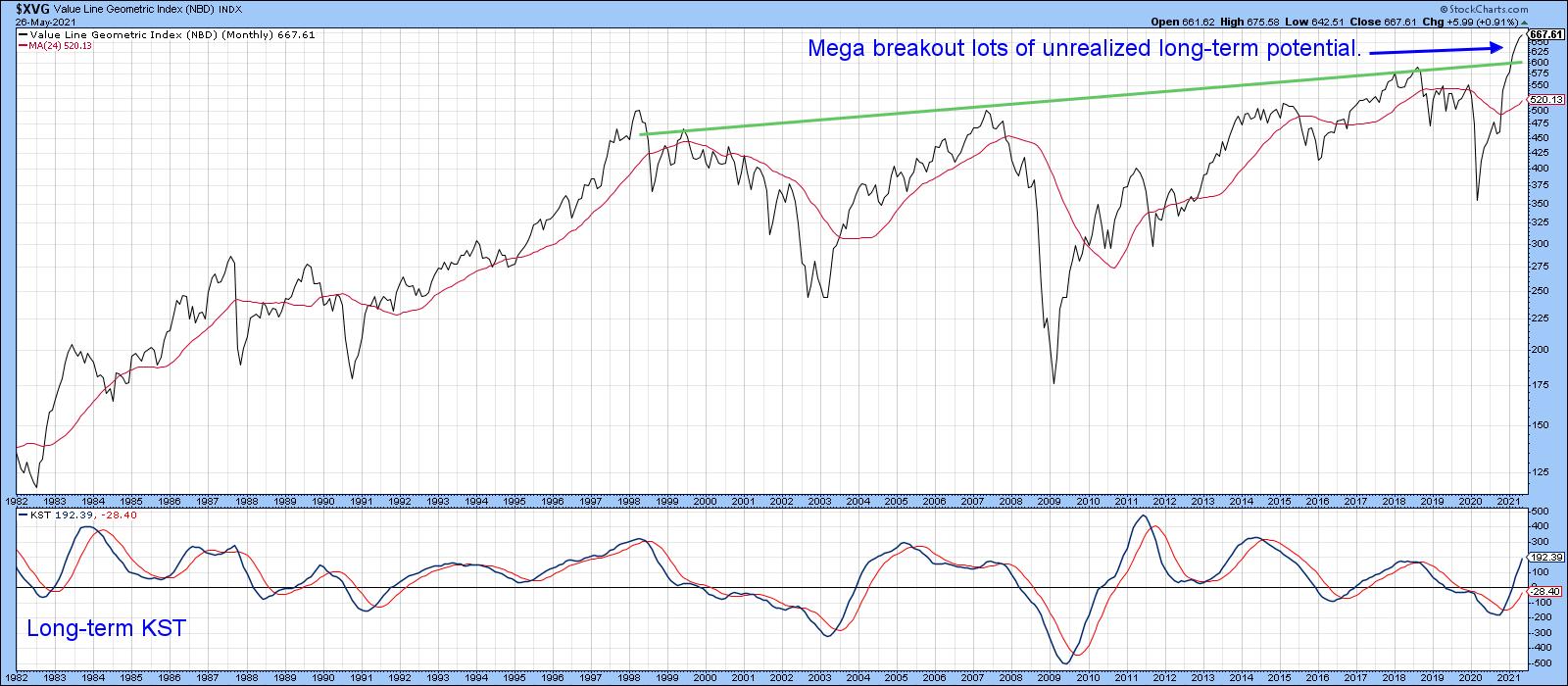

The Big Picture

Before we get into the subject of corrections, it's important to make sure that we do not lose focus on the big picture. For instance, take Chart 1, which features the Value Line Geometric Average. It reflects the performance of the average stock, as opposed...

READ MORE

MEMBERS ONLY

PULLBACK IN BOND YIELDS MAY BE BOOSTING TECH STOCKS AND NASDAQ -- YIELD PULLBACK, HOWEVER, MAY BE TEMPORARY

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR YIELD PULLS BACK... Despite all the talk about accelerating inflation, bond yields have been pulling back of late. The daily bars in Chart 1 show the 10-Year Treasury yield falling to the lowest level in three weeks and trading below its 50-day moving average. The TNX set a 52-week...

READ MORE

MEMBERS ONLY

MONTHLY AND WEEKLY SECTOR RANKINGS HELP FIND LEADERS AND LAGGARDS -- THE VALUE/GROWTH RATIO STILL FAVORS VALUE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONTHLY RANKINGS... Major stock indexes are ending the week with little change. The Dow and S&P 500 show a modest loss while the Nasdaq is showing a minor gain. To get a better sense of what's moving the market, a look at sector rankings can offer...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 RETEST 50-DAY LINES -- STOCKS CLOSE WELL OFF THEIR LOWS -- QQQ ENDS IN POSITIVE TERRITORY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 HOLD SHORT-TERM SUPPORT...Stocks opened sharply lower this morning but recovered most of their losses by day's end. One encouraging sign was that the Dow the S&P 500 found some support at their 50-day moving averages and potential chart at...

READ MORE

MEMBERS ONLY

Gold Starting to Look Interesting Again

by Martin Pring,

President, Pring Research

Gold has rallied nicely in the last few weeks, so the question naturally arises as to whether it's ready to resume its secular bull market. I'll get to that later, but first, a little perspective.

Longer-Term Perspective

Chart 1 plots the real price as adjusted by...

READ MORE

MEMBERS ONLY

GOLD AND SILVER ATTRACT NEW BUYING

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD AND ITS MINERS MAY BE TURNING UP... Precious metals have sat out the rally in most commodity markets. But money is starting to flow into the group and its miners. The daily bars in Chart 1 show the VanEck Gold Miners ETF (GDX) rising above its early 2021 peak...

READ MORE

MEMBERS ONLY

THE NASDAQ SHOWS RELATIVE WEAKNESS AND MAY HOLD KEY TO MARKET DIRECTION -- S&P 500 BOUNCES OFF 50-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE NASDAQ REMAINS IN SHORT-TERM DOWNTREND... The tech-dominated Nasdaq market continues to show relative weakness. Chart 1 shows the Nasdaq Composite trading well below its 50-day average and in a short-term downtrend. Prices are attempting a rebound today from yesterday's heavy selling. If that low doesn't...

READ MORE

MEMBERS ONLY

SPIKE IN APRIL INFLATION AND RISING BOND YIELDS PUSH STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

INFLATION SPIKE BOOSTS BOND YIELDS... A spike in April CPI and its inflationary implications is boosting bond yields and hurting stock prices. Chart 1 shows the 10-Year Treasury yield jumping nearly 6 basis points today to 1.68% and close to exceeding its late April peak. That's having...

READ MORE

MEMBERS ONLY

Monday's Falling Dominos May Be Enough to Tip the Short-term Trend to the Downside

by Martin Pring,

President, Pring Research

Many internal short-term indicators are overextended and starting to look vulnerable, but need some kind of a push to tip the near-term technical balance to the bearish side. That push may have been delivered with Monday's action, as several indexes gave the appearance of some selected short-term buyer...

READ MORE

MEMBERS ONLY

DOW AND S&P OPEN SHARPLY LOWER BUT REMAIN ABOVE SHORT-TERM SUPPORT -- THE NASDAQ 100 RECOVERS FROM EARLY LOSS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW NEARS SHORT-TERM SUPPORT... The Dow gapped sharply lower today and inflicted some short-term chart damage. Chart 1 shows its 14-day RSI backing off from overbought territory near 70; the red arrow shows its daily MACD lines forming a lower high than in April which shows some loss of upside...

READ MORE

MEMBERS ONLY

ECONOMICALLY-SENSITIVE STOCKS HAVE BEEN OUTPERFORMING TECHNOLOGY -- STOCKS RALLY TODAY ON WEAK JOBS REPORT -- NASDAQ 100 BOUNCES OFF CHART SUPPORT -- BOND YIELDS RECOVER FROM MORNING DECLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY HAS BEEN A MARKET LAGGARD... With the economy showing signs of strength, money has been rotating into more economically-sensitive sectors at the expense of technology stocks. The table in Chart 1 shows materials, energy, and financials being the three strongest sectors over the last month, while technology has been...

READ MORE

MEMBERS ONLY

Putting Forward a Candidate to Take Over from Tech Leadership

by Martin Pring,

President, Pring Research

A couple of weeks ago, I posted an article questioning whether the tech-dominated NASDAQ still had the mojo to lead the market higher. At the time, many sub-surface indicators, such as breadth, volume and relative action, looked weak. Several charts indicated that many of them had experienced multiple negative divergences,...

READ MORE

MEMBERS ONLY

TECH STOCKS LEAD MARKET LOWER -- TECH SPDR TESTS ITS 50-DAY AVERAGE -- SEMICONDUCTORS LOSE 50-DAY SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ BACKS OFF FROM PREVIOUS HIGH... Chart 1 shows the recent rally in the Nasdaq Composite meeting new selling near its mid-February peak which was the first warning that its uptrend might be losing upside momentum (red line). Today's lower gap confirms the idea that a short-term top...

READ MORE

MEMBERS ONLY

AMAZON TESTS OLD HIGH ON STRONG EARNINGS -- THE NASDAQ TESTING SEPTEMBER HIGH -- SLIGHT NEGATIVE DIVERGENCE FOR THE SPX -- SELL IN MAY?

by John Murphy,

Chief Technical Analyst, StockCharts.com

AMAZON RALLIES ON STRONG EARNINGS... Amazon was the last of the big five tech stocks that reported earnings this week. And it reported strong quarterly profits as did the other big tech stocks. Of those four, Facebook and Alphabet gained ground while Apple and Microsoft pulled back on the strong...

READ MORE

MEMBERS ONLY

TESLA DROPS AFTER RECORD EARNINGS -- BIG TECHS REPORT THIS WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

TESLA DROPS AFTER REPORTING RECORD EARNINGS... How stocks react to earnings reports often tells us something about their technical condition. Tesla (TSLA) is a good example. Two weeks ago I showed Tesla rising decisively above its 50-day moving average which suggested that the stock might be bottoming. That interpretation is...

READ MORE

MEMBERS ONLY

Commodities are Breaking Out All Over

by Martin Pring,

President, Pring Research

The Fed has pumped a lot of money into the system -- and that liquidity has to go somewhere. We know a lot of it has already been flowing into stocks. Now it looks like it's time for commodities to participate. So much money, combined with bottlenecks in...

READ MORE

MEMBERS ONLY

TEN-YEAR YIELD TESTS 50-DAY AVERAGE -- SMALL CAPS STABILIZE -- BITCOIN UNDER PRESSURE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD TESTS 50-DAY AVERAGE... The decline in bond yields over the last month has helped boost stock prices, and technology stocks in particular. Chart 1, however, shows the 10-Year Treasury Yield testing its 50-day moving average. The major trend of bond yields remains higher with expectations for higher...

READ MORE

MEMBERS ONLY

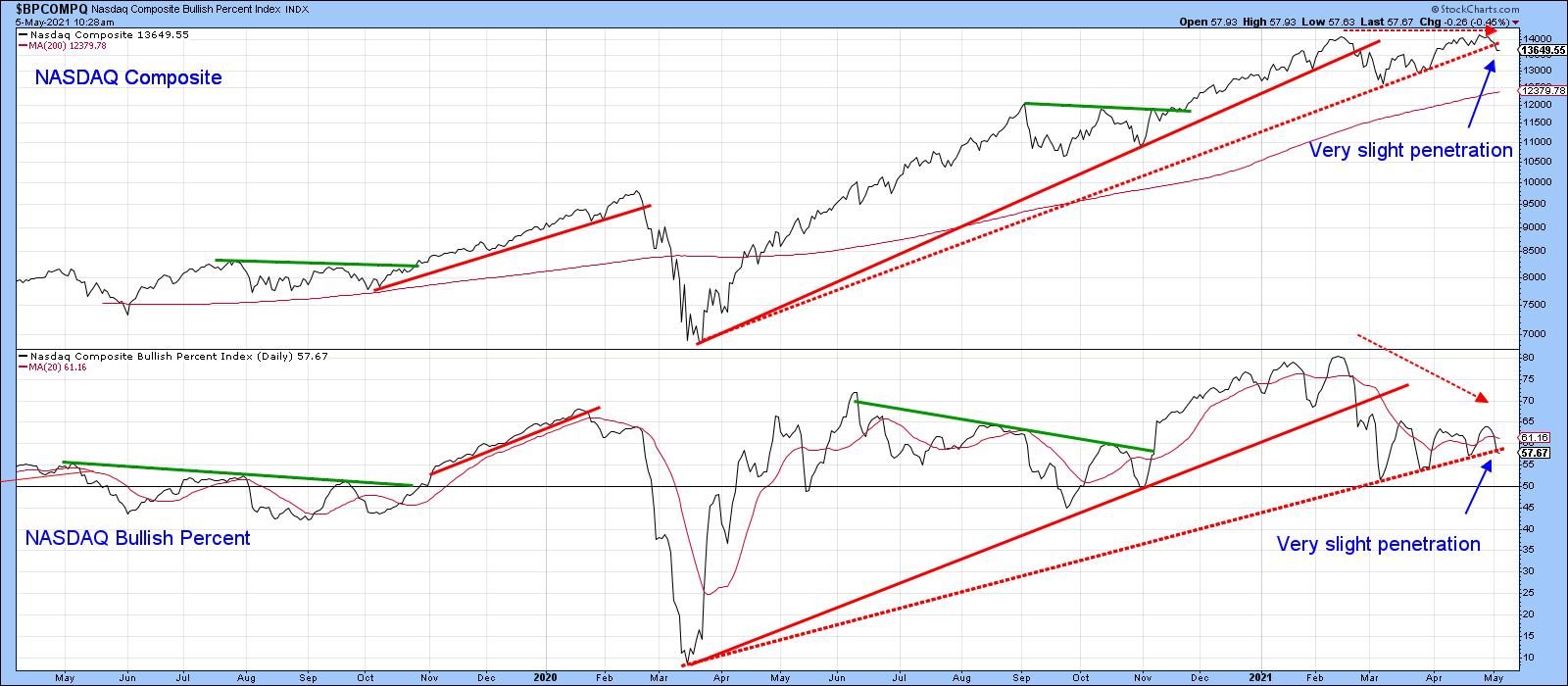

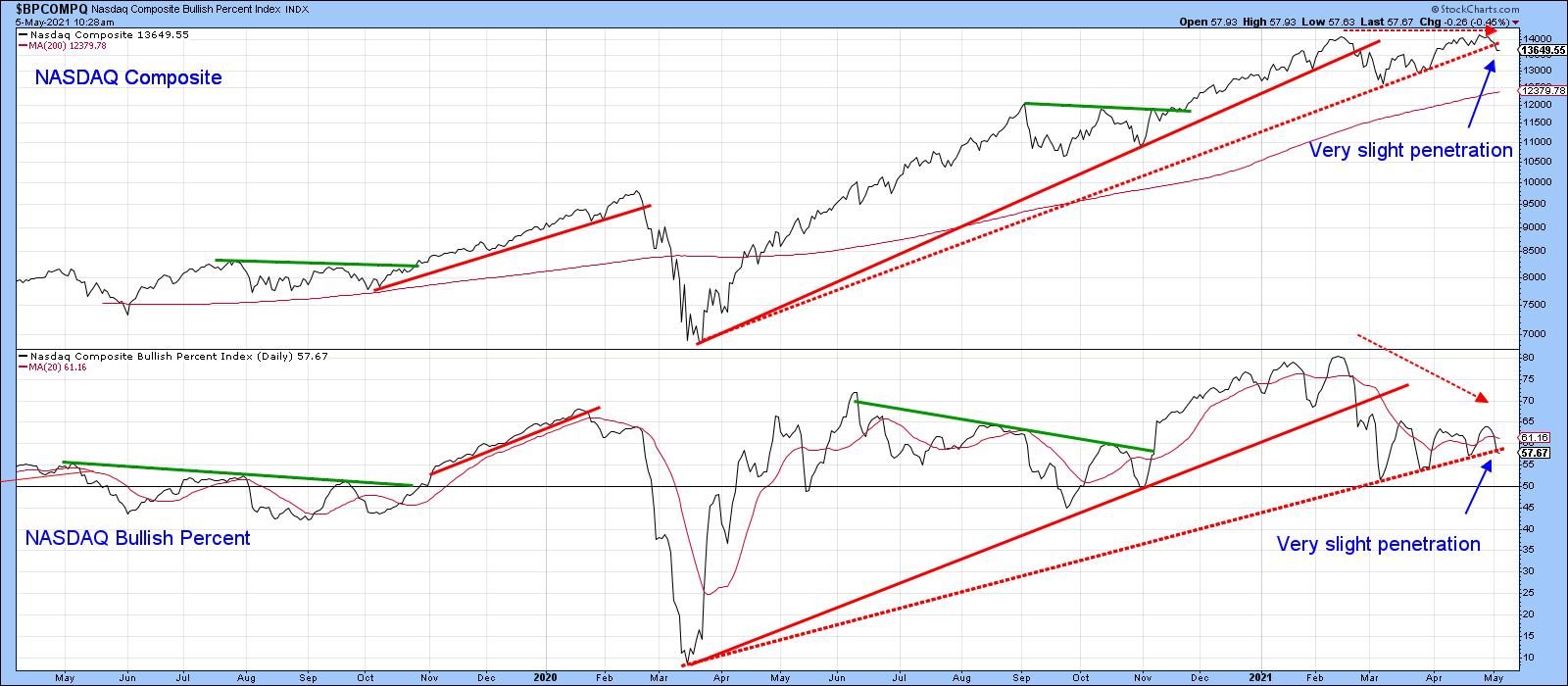

Has the NASDAQ Lost its Mojo?

by Martin Pring,

President, Pring Research

The NASDAQ Composite peaked on February 16, sold off and subsequently rallied back to the February high last week. Chart 1 shows that it just missed the earlier peak by a smidgen, whereas the NASDAQ 100 (in the lower window) did marginally take out its February high. Taken together, the...

READ MORE

MEMBERS ONLY

STOCKS MAINTAIN UPTRENDS -- THE NASDAQ COMPOSITE HAS HAS YET TO REACH A NEW HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 MAINTAIN UPTRENDS... Stocks snapped a two-day losing streak today and are maintaining their current uptrend. Chart 1 shows the Dow Industrials trading well above their 20-day moving average which keeps their short-term uptrend intact. Chart 2 shows the S&P 500 doing the...

READ MORE

MEMBERS ONLY

A LOOK AT WEEKLY SECTOR RANKING SHOWS UTILITIES IN THE LEAD -- OTHER DEFENSIVE SECTORS ALSO DID WELL

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES ARE WEEK'S STRONGEST SECTOR...Chart 1 ranks the week's eleven S&P 500 stock sectors and shows ten of them in the black for the week. Only Communication Services are seeing a small loss. Some other laggards include industrials, financials, and energy. What may...

READ MORE

MEMBERS ONLY

Dollar Hits a Crucial Fork in the Road

by Martin Pring,

President, Pring Research

The Dollar Index has been rangebound since 2015. During that period, it has experienced two mini bull and bear markets, as flagged by the dashed arrows in Chart 1. The latest bear has been in force for just over a year, as signaled by the Index trading below its 12-month...

READ MORE

MEMBERS ONLY

DOLLAR WEAKENS AS COMMODITIES REBOUND -- COMMODITY INDEX NEARS TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX BACKS OFF FROM 200-DAY LINE...A rebound in the dollar during the first quarter may have run its course. Chart 1 shows the Invesco Dollar Index Fund (UUP) falling back below its 200-day moving average and threatening its 50-day line. What the dollar does from here could have...

READ MORE

MEMBERS ONLY

TESLA CLEARS ITS 50-DAY AVERAGE AND MAY BE BOTTOMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TESLA TURNS UP... Tesla is the day's biggest percentage gainer in the S&P 500 and the Nasdaq 100. It's also the day's strongest stock in the Consumer Discretionary SPDR which is itself hitting a new record. And it's chart is...

READ MORE