MEMBERS ONLY

Is it Time to Buy Gold?

by Martin Pring,

President, Pring Research

The gold price peaked last August and has been zig-zagging down ever since. The approximate loss from the high has so far been just north of 15%. During that period, sentiment numbers have been slowly eroding, but not to bearish extremes, so is now a good time to buy? It...

READ MORE

MEMBERS ONLY

APPLE AND AMAZON MAY BE BOTTOMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE MAY BE BOTTOMING... Chart 1 shows Apple (AAPL) in a downside correction since late January. That correction has taken the stock back down to its 200-day moving average which has acted as a long-term support line. Assuming that its long-term trend is still up, this would be a logical...

READ MORE

MEMBERS ONLY

PERCENT OF S&P 500 STOCKS ABOVE THEIR MOVING AVERAGES LOOKS STRETCHED

by John Murphy,

Chief Technical Analyst, StockCharts.com

% OF S&P 500 STOCKS ABOVE 50-DAY AVERAGE IS HIGH... Market breadth figures for the stock market remain quite strong. A couple of them, however, suggest that the market may be stretched on the upside. Chart 1 shows the percent of S&P 500 stocks above their 50-day...

READ MORE

MEMBERS ONLY

CONSUMER DISRETIONARY AND TECH STOCKS LEAD MARKET HIGHER -- SOME BIG TECH BREAKOUTS --- QQQ TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISRETIONARY SPDR NEARS OLD HIGH...Stocks are trading sharply higher today following a strong jobs report on Friday and news today of a stronger service economy. The Dow and S&P 500 are trading in record territory and the Nasdaq isn't far behind. Nine of the...

READ MORE

MEMBERS ONLY

Trolling the StockCharts Economic Database for Useful Stock Market Indicators

by Martin Pring,

President, Pring Research

Many of you may be unaware of the fact that StockCharts has a small database of economic indicators. (You can find them by searching for symbols that begin with $$.) This week, I ran through a number of series to see if any could be useful from a long-term stock market...

READ MORE

MEMBERS ONLY

STRONGER TECH STOCKS BOOST NASDAQ -- SEMIS TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHS ARE HAVING A STRONG DAY... Technology stocks are the day's strongest sector which is helping boost the Nasdaq market. As a result, the Nasdaq is leading today's rally. Chart 1 show the Invesco QQQ Trust trading 1.8% higher today and nearing a test of...

READ MORE

MEMBERS ONLY

SOUTHWEST AIRLINES ACHIEVES BULLISH BREAKOUT -- ALASKA AIR AND JETBLUE MIGHT BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SOUTHWEST AIRLINES CLEARS OVERHEAD RESISTANCE... Airlines stocks continue to gain more ground. Although the entire group is rising, three in particular caught my eye. The weekly bars in Chart 1 show Southwest Airlines (LUV) having cleared resistance along its early 2020 peak and reaching the highest level in more than...

READ MORE

MEMBERS ONLY

ALUMINUM AND STEEL STOCKS BOOST MATERIALS -- HOMEBUILDERS CONTINUE TO BREAK OUT -- CHIP LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS NEAR RECORD... In a generally positive market day, materials are one of the days strongest sectors. Chart 1 shows the Materials Sector SPDR (XLB) gapping higher and nearing a new record. It's being led higher by aluminum and steel stocks which are also having a strong day....

READ MORE

MEMBERS ONLY

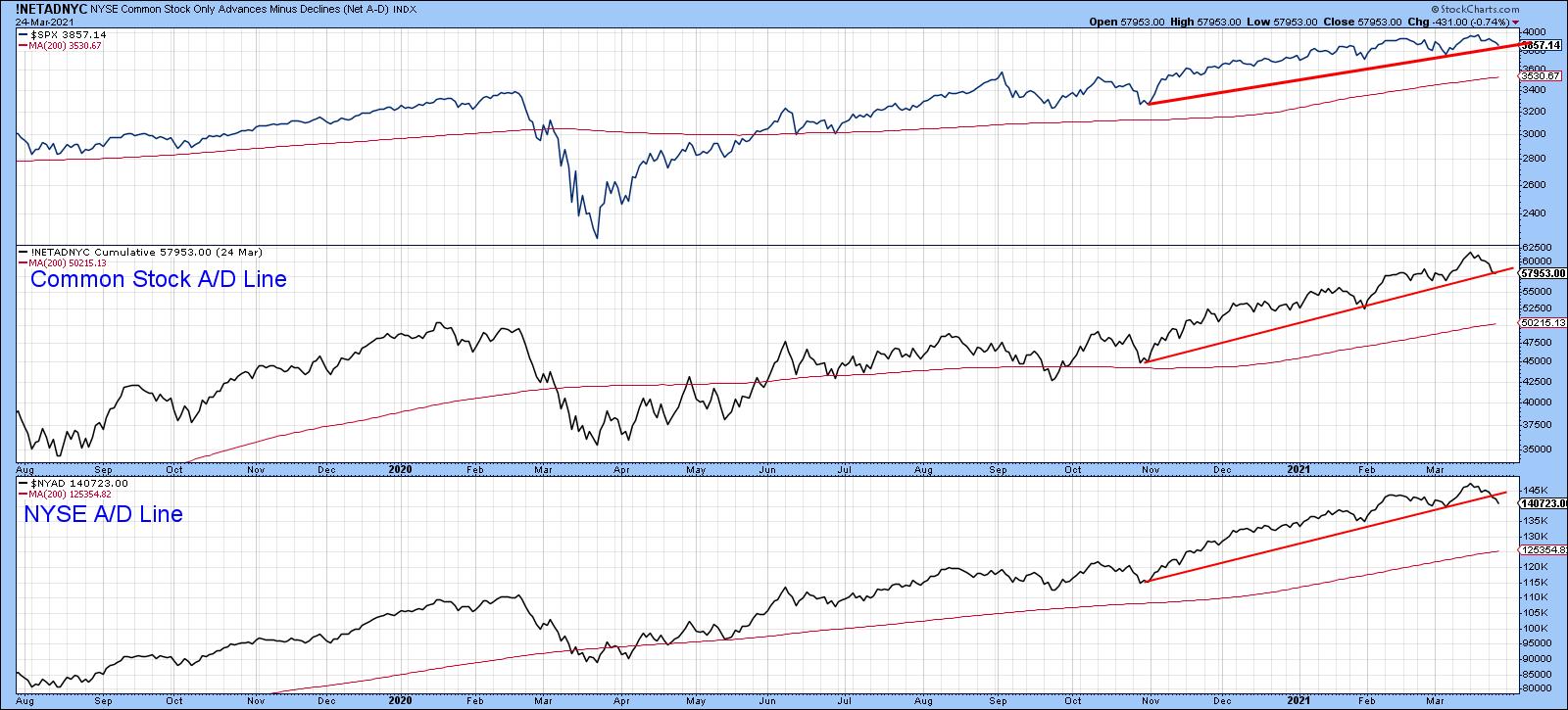

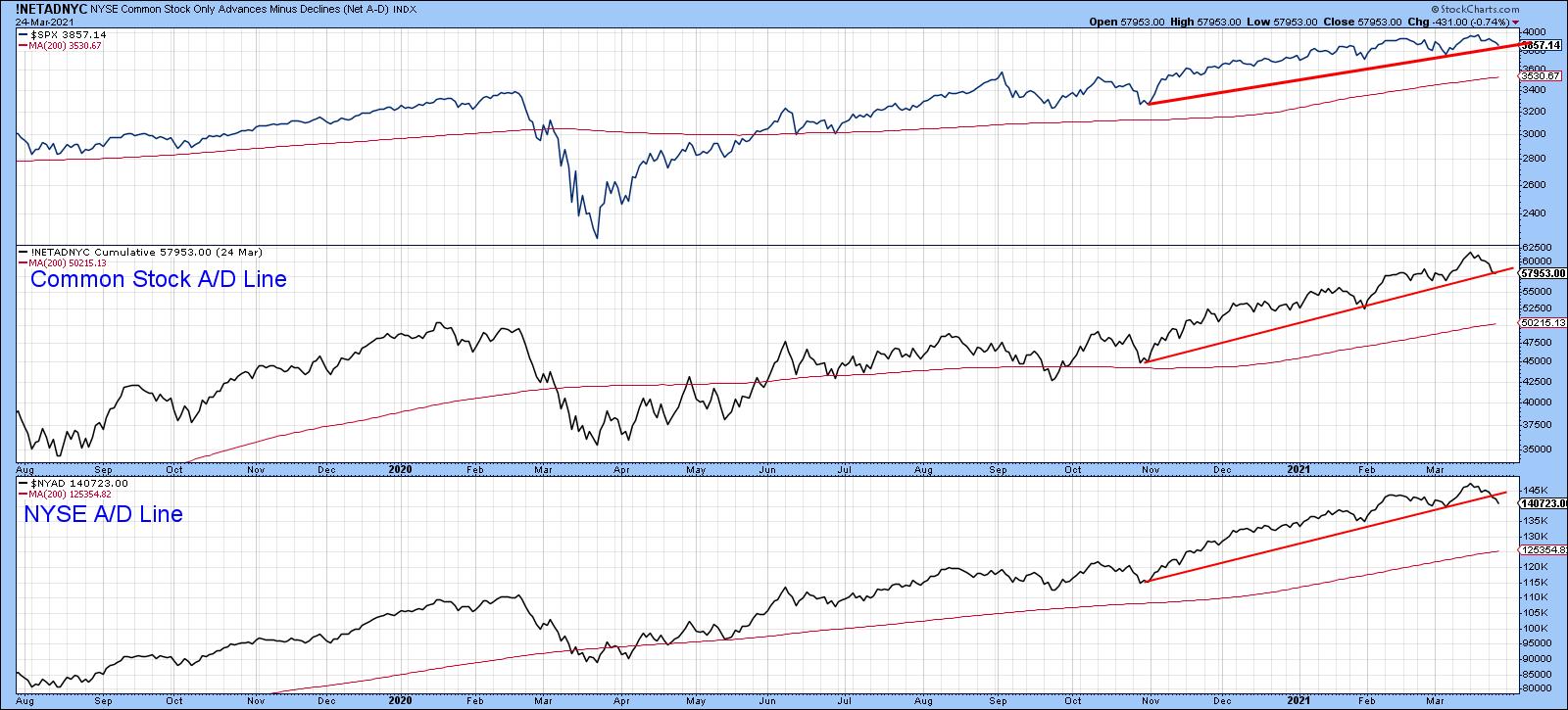

Out on a Limb: Market Top is Coming!

by Larry Williams,

Veteran Investor and Author

In this special presentation, Larry goes "way out on a limb" and gives a market forecast based on the tools he trusts and wants to share with you. So how can we see the future? Through seasonals, cycles, intermarket relationships, technical strength/weakness and, economic data.

This video...

READ MORE

MEMBERS ONLY

Several Key Indexes Testing Important Support

by Martin Pring,

President, Pring Research

It's never a good idea to try and predict contra-trend moves in a strong equity bull market, because the benefit of the doubt always goes with the prevailing trend. If false moves develop, they have a strong tendency to develop on the downside. That said, several key indexes...

READ MORE

MEMBERS ONLY

NASDAQ AND TECH STOCKS REMAIN ON THE DEFENSIVE -- SEMICONDUCTOR ETF REMAINS BELOW 50-DAY LINE -- SMALL CAPS WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE NASDAQ MARKET REMAINS ON THE DEFENSIVE...The Nasdaq market remains on the defensive. Chart 1 shows the Invesco QQQ Trust meeting resistance at its 50-day average. That's mainly because of weaker tech stocks. Chart 2 shows the Technology SPDR (XLK) trading below its 50-day line as well....

READ MORE

MEMBERS ONLY

10-YEAR YIELD JUMPS TO 14-MONTH HIGH -- WEAK TECH STOCKS WEIGH ON REST OF MARKET -- QQQ LOSES ITS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR YIELD SPIKES HIGER... Bond yields continue to spike higher. Chart 1 shows the 10-Year Treasury yield jumping 9 basis points to 1.73% which is the highest level in fourteen months. That's helping lift financial shares, but weighing heavily on technology stocks. As a result, the Nasdaq...

READ MORE

MEMBERS ONLY

STOCKS REBOUND ON DOVISH FED STANCE -- CONSUMER DISCRETIONARY LOOKS STRONGER -- HOMEBUILDERS HIT NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS REBOUND... Stocks rebounded following today's dovish Fed statement. In addition, the 10-Year Treasury yield pared some of its earlier gains. Charts 1 and 2 show the Dow and S&P 500 touching new records. Chart 3 shows the Nasdaq Composite trading back above its 50-day moving...

READ MORE

MEMBERS ONLY

The Idea of Rising Bond Yields May be Getting Too Popular

by Martin Pring,

President, Pring Research

The longer-term indicators have been bullish on bond yields (bearish on prices) for a while now. However, they are now being joined by a number of commentators offering a similar view, which makes me uncomfortable. Don't get me wrong, the indicators are still pointing to a primary yield...

READ MORE

MEMBERS ONLY

10-YEAR YIELD IS SPIKING OVER 1.60% AND MAY BE HEADING TOWARD 2.00%

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR YIELD EXCEEDS 1.60%...After a modest consolidation, bond yields are spiking again. The daily bars in Chart 1 show the 10-Year Treasury yield climbing 10 basis points to 1.63% which puts it at the highest level in more than a year. The weekly bars in Chart 2...

READ MORE

MEMBERS ONLY

NASDAQ LEADS TODAY'S RALLY -- TECHNOLOGY SPDR REGAINS 50-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND TECH SPDR REGAIN 50-DAY AVERAGE...The tech-dominated Nasdaq market led a broad rally in stocks today. Chart 1 shows the Nasdaq Composite Index gaining 2.5% and trading back above its 50-day moving average. It was the strongest of the three major stock indexes. The Dow Industrials and...

READ MORE

MEMBERS ONLY

DOW HITS NEW RECORD WHILE TECHNOLOGY LAGS -- SEMIS RUN INTO RESISTANCE -- DIP IN 10-YEAR YIELD MAY BE BOOSTING STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECH NEARS OVERHEAD RESISTANCE... While the Dow and S&P 500 are trading higher today, with the Dow in record territory, the tech-dominated Nasdaq market continues to lag behind the rest of the market. Chart 1 shows the Technology SPDR (XLK) nearing a test of its 50-day moving average...

READ MORE

MEMBERS ONLY

US Breaking Out Against the World, But the Stocks Doing it May Surprise You!

by Martin Pring,

President, Pring Research

Back in the opening week of the yearl I wrote an article entitled Four Charts and Four Themes of the First Half of 2021. Three of them - higher stocks, higher commodities and value starting to outperform growth - are so far on track, but my negative analysis concerning US...

READ MORE

MEMBERS ONLY

SECTOR RANKINGS SHOW ENERGY, FINANCIALS, AND INDUSTRIALS IN THE LEAD -- WHILE CONSUMER DISCRETIONARY AND TECHNOLOGY LAG BEHIND -- A CHART LOOK AT ENERGY

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY STILL IN THE LEAD... After a hectic week when a rise in bond yields caused some profit-taking in technology stocks and the Nasdaq market, a strong jobs report on Friday helped stocks end the week on a strong note. One of the factors driving bond yields higher is expectations...

READ MORE

MEMBERS ONLY

JUMP IN BOND YIELDS WEIGH ON STOCKS -- S&P 500 TRADES BELOW ITS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELD JUMPS... Bond yields are spiking higher again today following dovish remarks from Jerome Powell. Chart 1 shows the 10-Year Treasury yield jumping 7 basis points to 1.54% and putting in on track for the highest close in more than a year. As a result, stocks are coming...

READ MORE

MEMBERS ONLY

NASDAQ 100 LEADS MARKET LOWER AND FALLS FURTHER BELOW ITS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 FALLS BACK BELOW 50-DAY LINE... Chart 1 shows the Invesco QQQ Trust losing -2.8% today and falling further below its 50-day moving average. Technology was the day's weakest sector along with consumer discretionary stocks. Eight of the eleven market sectors ended lower. More cyclical parts...

READ MORE

MEMBERS ONLY

After 13 Years, a Key Multi-Year Sector Relationship May be Reversing - and Could Have Enormous Implications

by Martin Pring,

President, Pring Research

Technology, as reflected in the tech-dominated NASDAQ Composite, peaked as a group in 2000 and sank in popularity for the next 3 years. Since then, as shown by the relative graph in Chart 1, it has recaptured all of that lost ground. Now, its long-term KST may have started to...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS ARE WEIGHING ON GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SPDR CONTINUES TO WEAKEN...With all the talk about rising inflation and rising commodity prices, it may seem strange to see the gold market still in a downtrend. But it is. The daily bars in Chart 1 shows the Gold SPDR (GLD) falling to the lowest level since last...

READ MORE

MEMBERS ONLY

SPIKE IN BOND YIELDS PUSHES STOCKS LOWER -- QQQ TRADES BELOW 50-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR YIELD REACHES 1.50%... The 10-Year Treasury yield is spiking above 1.50% today for the first time in a year. The size and speed of the yield advance is putting downside pressure on stocks, and technology stocks in particular. Chart 1 shows the Invesco QQQ Trust trading below...

READ MORE

MEMBERS ONLY

ROTATION FROM GROWTH TO VALUE CONTINUES AS TREASURY YIELDS HIT ANOTHER HIGH FOR THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

ROTATION FROM GROWTH TO VALUE... One of the side-effects of rising bond yields has been a rotation out of technology-dominated growth shares into more cyclical value shares. Chart 1 shows the S&P 500 Growth iShares (IVW) pulling back over the last week and trying to stay above its...

READ MORE

MEMBERS ONLY

Five Confidence Relationships Hit Multi-Year Resistance; Breakout Would Signal Much Higher Stock Prices

by Martin Pring,

President, Pring Research

Many confidence relationships I follow have been confined to multi-year trading ranges, as investors have consistently swung between optimism and fear. The latest data show that many have rallied sharply and reached the upper region of this rangebound activity. That either means it's time to regroup and launch...

READ MORE

MEMBERS ONLY

TRANSPORTS HIT NEW HIGHS -- WHILE UTILITIES REMAIN WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS HIT NEW RECORD...While looking through today's sector charts, I was struck by the differing performance between transportation stocks and utilities. And that difference should carry good news for stocks in general. Chart 1 shows the Dow Jones Transportation Average rising into record territory today. It&...

READ MORE

MEMBERS ONLY

10-YEAR TREASURY YIELD IS NEARING SOME OVERHEAD RESISTANCE BARRIERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

POTENTIAL BOND YIELD RESISTANCE...The recent upmove in bond yields is attracting the attention of bond and stock holders. It's obviously negative for bond prices. But it could lead to some selling of stocks if bond yields were to climb too far too fast. So let's...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS BOOST FINANCIALS -- BANK SPDRS TOUCH NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR HITS NEW RECORD...Energy and financials are the day's two strongest sectors. Freezing temperatures across the U.S. are pushing energy prices higher today and energy stocks along with them. Financials are also having a strong day courtesy of another jump in Treasury bond yields. Chart...

READ MORE

MEMBERS ONLY

Forget the Speculation and Uncertainty as these Short-Term Indicators are Bullish

by Martin Pring,

President, Pring Research

A few weeks ago I wrote an article entitled "Only a Fool Tries to Call a Correction in a Bull Market, So Here Goes!" Okay, so we did get a 4% drop in the Dow over a seven day period, but hardly anything worth worrying about. It reiterated...

READ MORE

MEMBERS ONLY

BOND YIELDS CONTINUE TO CLIMB -- THAT'S HELPING BANK STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR YIELD EXTENDS UPTREND... The uptrend in bond yields is continuing. The daily bars in Chart 1 show the 10-Year Treasury yield touching a new recovery high in today's trading. That puts the TNX at the highest level since last March. The horizontal line in Chart 2 shows...

READ MORE

MEMBERS ONLY

COMMODITY PRICES CONTINUE TO RISE WHICH SUGGESTS MORE INFLATION -- RISING COMMODITIES ARE BOOSTING BOND YIELDS AND THE YIELD CURVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRB INDEX BREAKS TRENDLINE RESISTANCE... The current rally in commodity markets is attracting a lot of attention. Not just because commodities represent an asset class that's been attracting a lot of money over the last year. But also because of their intermarket implications. Stronger commodity markets are usually...

READ MORE

MEMBERS ONLY

Using Short-Term Momentum to Define the Primary Trend Direction of Stocks, Bonds and the Dollar

by Martin Pring,

President, Pring Research

They say that a rising tide lifts all boats, and so it is with freely traded markets. In the boating world, you can spot a rising tide with a steadily rising boat, but, with markets, the simplest approach is to observe a series of rising peaks and troughs. However, there...

READ MORE

MEMBERS ONLY

ENERGY SPDR NEARS TEST OF JUNE HIGH -- A NUMBER OF INDIVIDUAL STOCKS ARE ALSO TESTING THAT CHART BARRIER -- CRUDE OIL PRICES CONTINUE TO CLIMB

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SPDR NEARS TEST OF JUNE HIGH...Energy stocks continue to show both absolute and relative strength. They're leading the market higher today, and have been the market's strongest sector over the last three months. And they're approaching an important test. The daily bars...

READ MORE

MEMBERS ONLY

RUSSELL 2000 HITS NEW RECORD AS SMALL CAP LEADERSHIP CONTINUES -- SMALL CAP LEADERSHIP IS THE STRONGEST IN DECADE -- RISING BOND YIELDS HELP SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES HIT NEW RECORD... Stocks are ending the week on a firm note with the S&P 500 and Nasdaq trading in record territory. The Dow isn't far behind. Small cap stocks, however, continue to lead the market higher. The daily bars in Chart 1...

READ MORE

MEMBERS ONLY

TAKING ANOTHER LOOK AT BITCOIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

BITCOIN BOUNCES OFF ITS 50-DAY AVERAGE... A couple of recent messages took a look at Bitcoin as it underwent a downside correction. We'll take another look today. The main message is that it's starting to look stronger. Chart 1 shows Bitcoin in what looks like a...

READ MORE

MEMBERS ONLY

Key Interasset Relationships are Bullish for Stocks and Commodities but Bearish for Bonds

by Martin Pring,

President, Pring Research

The business cycle approximates 41-months between the low points of slowdowns or recessions. For the record, a slowdown develops when the growth path of the economy declines, but not sufficiently to result in an actual recession, when economic momentum goes negative. The important point to bear in mind is that...

READ MORE

MEMBERS ONLY

GAMESTOP AND AMC GAP LOWER -- SO DOES SILVER AND ITS MINERS -- DOW REGAINS 50-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GAMESTOP AND AMC GAP SHARPLY LOWER... The recent short-squeeze mania may have finally run its course. Charts 1 and 2 show GameStop And AMC gapping sharply lower today. Other stocks caught up in the short squeeze are trading sharply lower as well. To the extent that last week's...

READ MORE

MEMBERS ONLY

TECHNOLOGY LEADING MARKET HIGHER -- A LOOK AT THE BIGGEST TECHS -- SILVER SQUEEZE?

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY STOCKS LEAD MARKET HIGHER ... Technology stocks are the strongest sector in a strong market day. The Technology SPDR (XLK) is trading nearly 3% higher today. The biggest tech stocks are also having a strong day. Chart 1 shows Apple gaining nearly 2% while keeping its uptrend intact. Chart 2...

READ MORE

MEMBERS ONLY

WEEKLY SECTOR RANKING SHOWS MORE CAUTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS TURN MORE DEFENSIVE...With stocks under pressure this week, it makes sense to see its eleven market sectors taking a more defensive turn as well. Chart 1 ranks the eleven market sectors from the strongest at the top to the weakest on the bottom. The first thing to notice...

READ MORE