MEMBERS ONLY

DOLLAR DROP BOOSTS COMMODITIES -- AND STOCKS TIED TO THEM -- GOLD MOVES FURTHER ABOVE $2000 -- COPPER MINERS BREAK OUT -- SO DOES FREEPORT MCMORAN -- A STRONG COPPER MARKET IS A GOOD SIGN FOR THE GLOBAL ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER MINERS LEAD MATERIALS HIGHER... A falling dollar has been one of the big factors pushing commodity prices higher and stocks tied to them. Today's drop in the greenback to another two-year low is continuing the flow of money into commodity assets. Several messages over the last month...

READ MORE

MEMBERS ONLY

NASDAQ HITS ANOTHER RECORD -- MICROSOFT AND SEMIS LEAD TECH SECTOR -- JACOBS ENGINEERING AND QUANTA LEAD XLI

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHS AND NASDAQ CONTINUE TO LEAD THE WAY... Big techology stocks are leading the market higher today again. Chart 1 show the Nasdaq Composite Index reaching a new high as did the Technology SPDR (XLK). Its biggest percentage gainers were Microsoft and a number of chip stocks. Chart 2 shows...

READ MORE

MEMBERS ONLY

APPLE, AMAZON, AND FACEBOOK HAVE BIG DAY FOLLOWING STRONG EARNINGS -- MAJOR STOCK INDEXES MAINTAIN UPTRENDS -- EXPD AND UPS DELIVER NEW RECORDS -- DOW TRANSPORTS CONTINUE TO GAIN GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

THREE BIG TECHS LEAD FRIDAY REBOUND... Going into Thursday evening, most of the TV stock market commentary centered around the big tech stocks that were announcing quarterly earnings after the close. The consensus seemed to be that the big tech stocks had already seen huge gains for the year, and...

READ MORE

MEMBERS ONLY

Stocks in China to Get Body-Slammed

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry goes out on a limb to explain why he thinks stocks in China are ready for significant decline. You'll get a sneak peek of his unique indicators coming soon to StockChartsACP, as Larry demonstrates their functions and...

READ MORE

MEMBERS ONLY

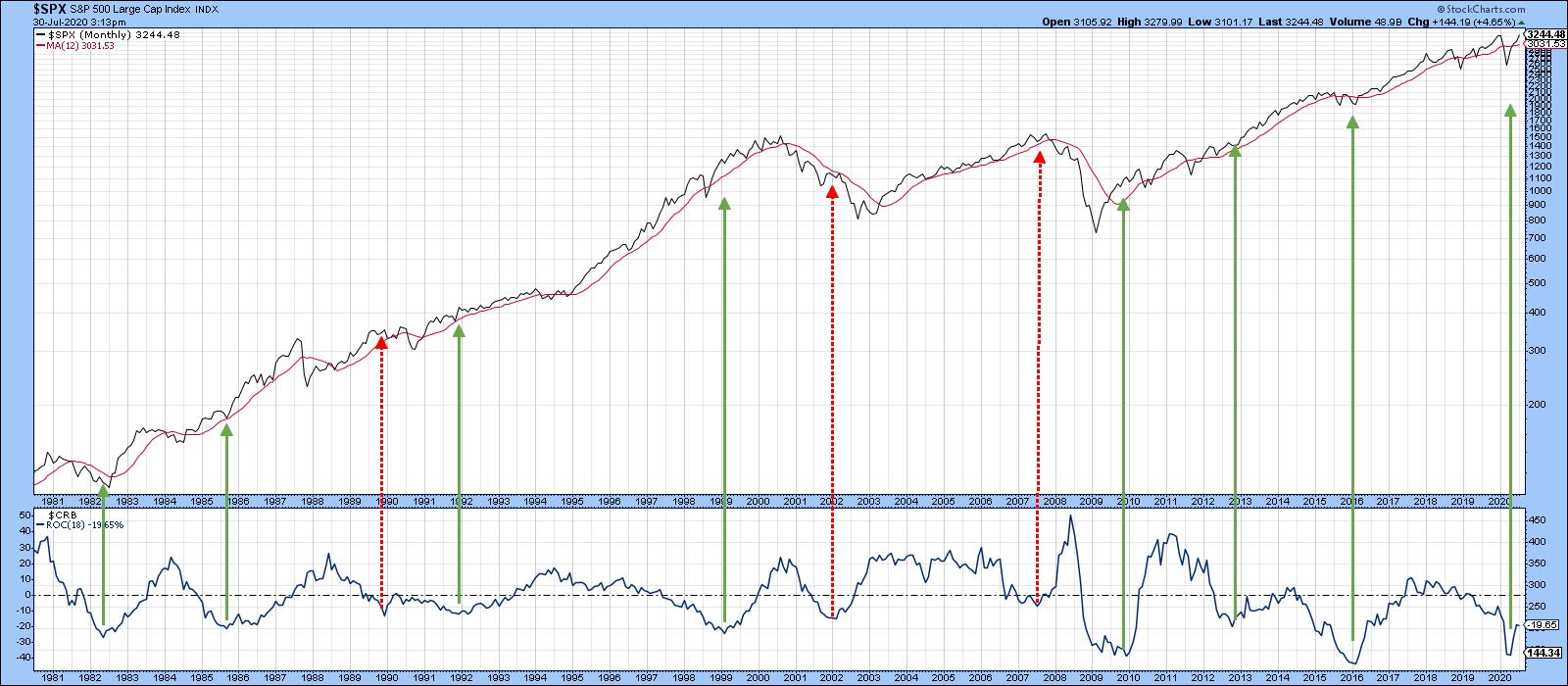

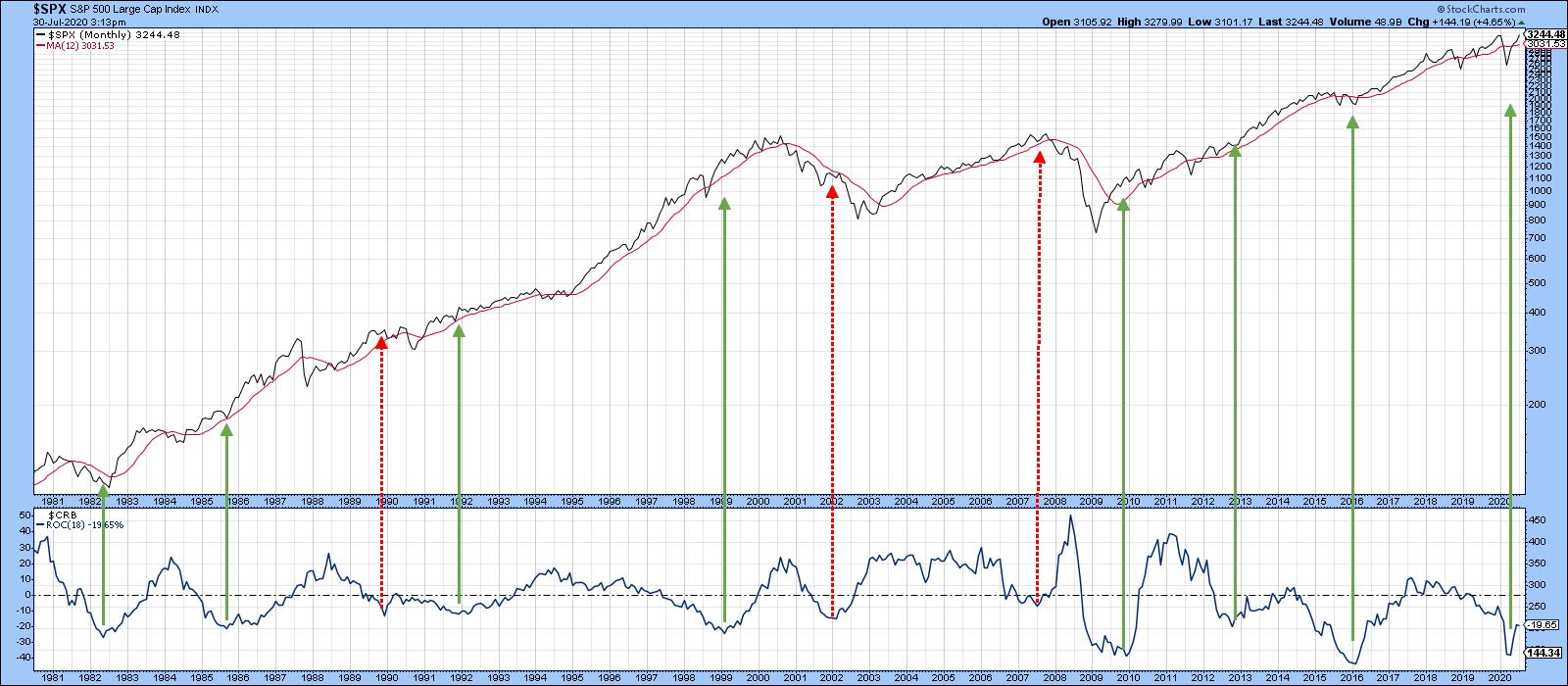

Copper Could Hold the Key for the Next Leg Up in the Stock Market Rally

by Martin Pring,

President, Pring Research

* Rising Commodity Momentum is Bullish for Stocks and the Economy

* Long-Term Technicals Look Promising for Copper

Swings in commodity prices are both a market and an economic indicator. There are certainly exceptions, but when the economy is in a recovery phase, commodity prices generally rise. During the early phase of...

READ MORE

MEMBERS ONLY

POINT & FIGURE CHARTS OF TRANSPORTATION LEADERS SHOW BULLISH BREAKOUTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

POINT & FIGURE CHARTS SHOW TRANSPORTATION BREAKOUTS...My morning message wrote about four transportation stocks that were achieving bullish breakouts. A glitch in the system, however, prevented me from showing their usual bar charts. So I've improvised a bit to bring their point & figure versions. Unlike bar...

READ MORE

MEMBERS ONLY

TRUCKERS LEAD TRANSPORTS HIGHER -- CHRW AND LANDSTAR SCORE BIG BREAKOUTS -- EXPEDITORS INTL HITS NEW RECORD -- TRANSPORTS LEAD XLI HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS MOVE FURTHER ABOVE 200-DAY LINE... Transportation stocks are one of today's strongest groups. Chart 1 shows the Dow Transports gaining 2% this morning and moving further above their 200-day moving average which is now acting as a line of support (see red arrow). My message on...

READ MORE

MEMBERS ONLY

TECH STOCKS REBOUND -- DOLLAR DROPS NEAR TWO-YEAR LOW AS PRECIOUS METALS SURGE -- FOREIGN ETFS REBOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

REBOUND IN NASDAQ 100 STEADIES MARKET... Stocks are opening the week on a firmer note. A rebound in tech stocks is one of the reasons why. Last Thursday's high-volume selloff in tech stocks caused some nervous profit-taking as the week ended. Chart 1 shows the Nasdaq 100 (QQQ)...

READ MORE

MEMBERS ONLY

BIG TECHS LEAD MARKET RETREAT -- NASDAQ 100 IS BIGGEST LOSER AND LOOKS VULNERABLE TO DEEPER PULLBACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 TESTS 20-DAY LINE... A selloff in the biggest tech stocks is putting downside pressure on stocks today; and is helping make the Nasdaq 100 the day's biggest percentage loser. And it looks technically vulnerable to a deeper pullback. The daily bars in Chart 1 show the...

READ MORE

MEMBERS ONLY

EURO CLIMBS TO TWO -YEAR HIGH -- THAT'S GOOD FOR EUROZONE ETFS -- GERMAN ISHARES NEAR BULLISH BREAKOUT -- WEAK DOLLAR BOOSTS EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO RALLIES TO TWO-YEAR HIGH... Yesterday's message showed the euro testing its March high. Chart 2 shows the eurozone currency trading above that level in today's trading. That puts the euro at the highest level in nearly two years. The rising euro is putting more downside...

READ MORE

MEMBERS ONLY

Where Do You Invest if the Trend Favoring the US Against the World Reverses?

by Martin Pring,

President, Pring Research

* The US versus the Rest of the World

* Europe

* Asia

The US versus the Rest of the World

Chart 1 shows that the up trend favoring the S&P Composite against the Vanguard All-World Ex-US ETF (the VEU) is intact. That's because the latest plot is above...

READ MORE

MEMBERS ONLY

RISING EURO PUSHES DOLLAR TO LOWEST LEVEL SINCE MARCH -- A WEAKER DOLLAR IS BOOSTING ENERGY AND METAL PRICES -- AND STOCKS TIED TO THEM

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING EURO PUSHES DOLLAR LOWER...Chart 1 show the Invesco Dollar Index Bullish Fund (UUP) declining today to the lowest level since March. The dollar surged during the first quarter in a flight to safety as stock prices plunged. Then fell from late March to July as stocks recovered. And...

READ MORE

MEMBERS ONLY

SILVER ISHARES REACH FOUR-YEAR HIGH -- SILVER CONTINUES TO OUTPACE GOLD --THE GOLD/SILVER RATIO AT ALL-TIME HIGH -- WHICH MAKES SILVER HISTORICALLY CHEAP

by John Murphy,

Chief Technical Analyst, StockCharts.com

SILVER ISHARES HIT FOUR-YEAR HIGH... Precious metals (and their mining ETFs) are rising again today with all of them hitting multi-year highs. As has been the case recently, however, silver (and its miners) are actually rising faster than gold (and its miners). The black daily bars in Chart 1 show...

READ MORE

MEMBERS ONLY

TRUCKERS LEAD TRANSPORTS HIGHER -- JB HUNT, OLD DOMINION, AND KNIGHT-SWIFT TRANSPORTATION HIT RECORD HIGHS -- C.H. ROBINSON IS TURNING UP...LANDSTAR MAY BE NEARING UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

RAILS AND TRUCKERS LEAD TRANSPORTS HIGHER... Wednesday's message showed the Dow Transports closing above their 200-day line for the first time since early June. Chart 1 shows them continuing to build on that upturn. Their relative strength ratio in the upper box has turned up as well, which...

READ MORE

MEMBERS ONLY

A Changing of the Guard? New Sector Leadership May Be Emerging

by Martin Pring,

President, Pring Research

* Technology About to Pause?

* New Blood is Starting to Emerge

* Two Fence Sitters

Technology About to Pause?

The undisputed king of sectors so far this year has been technology. This week's price action from the tech dominated NASDAQ Composite ($COMPQ), though, suggests that this leadership may be rotating...

READ MORE

MEMBERS ONLY

S&P 500 TESTS TOP OF RECENT RANGE -- RUSSELL 2000 AND DOW TRANSPORTS CLEAR 200-DAY LINES -- VALUE STOCKS GAIN GROUND -- HEALTHCARE HITS NEW RECORD -- MATERIAL STOCKS MAY BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TESTS JUNE HIGH... Stocks gained more ground today with ten of eleven sectors in the black. Chart 1 shows the S&P 500 ending the day just below its early June intra-day high at 3233. Also encouraging was better participation by value stocks which have...

READ MORE

MEMBERS ONLY

ENERGY, MATERIALS, INDUSTRIALS, AND HEALTHCARE LEAD STOCKS HIGHER -- CATERPILLAR AND DEERE ARE XLI LEADERS -- ALIGN TECH AND UNITEDHEALTH ARE XLV LEADERS -- STOCKS CLOSE STRONG

by John Murphy,

Chief Technical Analyst, StockCharts.com

CATERPILLAR AND DEERE HAVE A STRONG DAY...With technology stocks underperforming for the second day in a row, money flowed into cheaper parts of the market today. All eleven sectors closed higher with energy, materials, industrials and healthcare in the lead. Energy is benefiting from crude oil prices over $40,...

READ MORE

MEMBERS ONLY

HEALTHCARE IS DAY'S STRONGEST SECTOR -- AND MAY BE READY TO RESUME LEADERSHIP ROLE -- HEALTHCARE LEADERS ARE LAB CORP, QUEST DIAGNOSTICS AND PERKINELMER -- S&P 500 TESTS ITS JUNE HIGH -- WHILE THE DOW TRADES ABOVE ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BUYING HEALTHCARE AGAIN... After taking a leadership role during March and April, healthcare stocks have essentially moved sideways over the last couple of months while the rest of the market has gained ground. The sector's recent underperformance can be seen by the falling XLV/SPX relative strength ratio...

READ MORE

MEMBERS ONLY

LONG-TERM TREND SHIFTING IN FAVOR OF GOLD -- GOLD/DOW RATIO MAY BE BOTTOMING -- RATIO OF GOLD MINERS TO SPX IS EVEN STRONGER

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG-TERM TREND APPEARS TO BE SHIFTING TO GOLD OVER STOCKS... Recent messages showing the ongoing bull market in gold (and its miners) have stressed that a weaker dollar and historically low global interest rates have pushed the price of gold to the highest level in nearly nine years. Yesterday'...

READ MORE

MEMBERS ONLY

A WEAKER DOLLAR IS HELPING TO BOOST GOLD -- BUT GOLD IS ALSO RISING FASTER THAN MAJOR FOREIGN CURRENCIES ON CONCERNS ABOUT GLOBAL ECONOMY -- INVESTORS MAY ALSO BE BUYING GOLD TO HEDGE AGAINST AN UNCERTAIN STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD VERSUS THE DOLLAR... The generally inverse relationship between gold and the U.S. Dollar is one of the best known and reliable intermarket relationships. Part of the reason is that gold is traded in U.S. dollars. Another part is due to the fact that gold is often preferred...

READ MORE

MEMBERS ONLY

GOLD SPDR REACHES AN EIGHT-YEAR HIGH -- ITS MINERS ARE ALSO HITTING MULTI-YEAR HIGHS -- SILVER IS RALLYING AS WELL -- ITS MINERS ARE LEADING THE COMMODITY HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SPDR REACHES ANOTHER EIGHT-YEAR HIGH...Gold prices are on the rise again. The monthly bars in Chart 1 show the Gold Shares SPDR (GLD) rising to the highest level since 2012. The August gold contract has risen to $1820 and appears headed toward its 2011 peak at $1923. Gold...

READ MORE

MEMBERS ONLY

Silver May Be Close to a Major Breakout

by Martin Pring,

President, Pring Research

* Silver has been Range-Bound - But is That About to End?

* Silver Shares Starting to Perk Up

* Silver Bottoming Against Gold?

Silver has been Range-Bound - But is That About to End?

Gold has been in a strong bull market recently, which has eclipsed the performance of the gray metal....

READ MORE

MEMBERS ONLY

RISING CHINESE STOCKS PULL COPPER HIGHER -- ALONG WITH COPPER PRODUCERS -- FREEPORT MCMORAN IS DAY'S SPX LEADER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCKS AND COPPER HAVE BEEN RISING TOGETHER...This morning's message showed the Shanghai Stock Index surging to the highest level in two years; and mentioned that was also good for copper prices. This message elaborates a bit more on the relationship between the two. The red bars...

READ MORE

MEMBERS ONLY

CHINESE STOCKS LEAD GLOBAL STOCKS HIGHER -- CHINESE ETFS NEAR MAJOR UPSIDE BREAKOUTS -- ASIA LEADS EMERGING MARKETS HIGHER -- STRONGER CHINA BOOSTS COPPER PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCK SOAR... A huge rally in China is leading a rally in stock markets around the world. The red arrow in Chart 1 shows the Shanghai Composite Index surging 5.7% to close at the highest level in more than two years. The SSEC close at 3332 also puts...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS STOCKS -- NASDAQ HITS NEW HIGH -- WHILE DOW AND S&P 500 REMAIN IN TRADING RANGES -- AIRLINES AND FINANCIALS REMAIN WEAK -- SMALL CAPS LAG BEHIND -- A TALE OF TWO MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND SPX REMAIN IN TRADING RANGES...Despite gaining ground this past week, little has changed for the market's major stock indexes. Continued buying of technology growth stocks pushed the Nasdaq Composite to a new record (Chart 1). The rest of the market, however, continued to lag behind....

READ MORE

MEMBERS ONLY

The Shanghai Composite Experiences A Historic Breakout

by Martin Pring,

President, Pring Research

* Shanghai Composite Ruptures Mega Trendline

* Chinese ETFs Breaking as Well

* Interesting Chinese Sector ETFs

Back in March, I wrote about the Chinese stock market, as it had started to improve in terms of relative action against the S&P. Since then, Chinese equities have moved higher with no net...

READ MORE

MEMBERS ONLY

WEAK DOLLAR BOOSTS COMMODITY PRICES -- CRUDE OIL, COPPER, GOLD HAVE STRONG QUARTER -- SO DO STOCKS TIED TO THEM -- GOLD TOUCHES 11-YEAR HIGH -- WITH A LOT OF HELP FROM LOW INTEREST RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

US DOLLAR HAD WEAK SECOND QUARTER... After surging during March (as stock prices plunged), the U.S. Dollar peaked in late March and moved lower during the second quarter. Rising stock prices during that quarter reduced the appeal of the dollar as a haven currency. Rising foreign currencies also reflected...

READ MORE

MEMBERS ONLY

UPSIDE GAPS IN FEDEX AND UPS BOOST TRANSPORTS -- A REBOUND IN AIRLINE STOCKS IS ALSO HELPING -- BOTH GROUPS ARE ALSO CONTRIBUTING TO THE XLI

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS NEAR TEST OF 200-DAY AVERAGE...Transportation stocks are off to a strong start this morning. Chart 1 shows the Dow Transports rising to a two-week high after bouncing off their 50-day moving average last week. They may be headed for a test of their 200-day moving average. Tranportation...

READ MORE

MEMBERS ONLY

STOCKS OFF TO A STRONG START -- DOW AND S&P 500 HOLD CHART SUPPORT -- SMALL CAPS ARE HAVING A STRONG DAY -- BOEING AND SOUTHWEST AIR LEAD INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND SPX HOLD CHART SUPPORT... Stocks are off to a strong start for the week. And are holding some important support levels. Chart 1 shows the Dow Industrials bouncing off potential chart support at its 50-day average (blue line) and its early June intra-day low at 24,800. It&...

READ MORE

MEMBERS ONLY

STOCKS WEAKEN AS CORONAVIRUS CASES RISE -- NASDAQ PULLS BACK FROM OVERBOUGHT CONDITION -- WHILE S&P 500 ENDS BELOW ITS 200-DAY LINE -- SECTOR LEADERSHIP REMAINS THIN -- FINANCIALS HAVE A BAD WEEK -- FACEBOOK LEADS INTERNET STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES WEAKEN... Major stock indexes lost ground this week on a disturbing rise in coronavirus cases which could undermine the U.S. economy. Chart 1 shows the Nasdaq Composite pulling back from a record high set on Tuesday. Its 14-day RSI line in the upper box shows a...

READ MORE

MEMBERS ONLY

Gold Moves to a New High; Will the Breakout Hold?

by Martin Pring,

President, Pring Research

* Long-Term Gold Charts Give Perspective

* Gold vs. the Dollar

* Gold vs. Gold Shares

* Short-Term Gold Position

* Conclusion

Long-Term Gold Charts Give Perspective

Gold broke out to a new recovery high on Tuesday and looks set to gain more ground, all with a favorable background from the long-term trend.

Chart 1...

READ MORE

MEMBERS ONLY

Is Twenty-Twenty Nineteen-Eighty Déjà vu All Over Again?

by Martin Pring,

President, Pring Research

* The Decennial Cycle and Years Ending in a "0"

* 1980 and 2020 Both Experienced Recessions

* Further Out, Things are More Problematic

* China Technology Breaks to the Upside

The simple answer to the question posed in the title is "No!". However, there are a number of interesting...

READ MORE

MEMBERS ONLY

Market Action Confirms the Employment Report

by Martin Pring,

President, Pring Research

* Market Gets a New Lease on Life

* Ten-Day Breadth Ratio Hits Bullish Extreme

* S&P Stocks Above 50-day MA Also Hit a Bullish Extreme

* Can Small-Caps Extend their Sharp Rally?

Usually, when a market rallies sharply and experiences an overbought condition, the probabilities favor corrective activity of some kind....

READ MORE

MEMBERS ONLY

Did the May Employment Report Signal an End to the Recession?

by Martin Pring,

President, Pring Research

Part-Time Employees for Economic Reasons is a leading indicator of the labor market. That's because employers are more inclined to hire and fire temporary workers than permanent ones, where labor laws, contracts, pensions and other impediments get in the way. This indicator has been consistently useful in identifying...

READ MORE

MEMBERS ONLY

Commodities Reach Important Breakout Points, Part II

by Martin Pring,

President, Pring Research

* The Gold/CRB Ratio as a Commodity Indicator

* Close Correlation between Canadian/Australian Dollars and Commodities

* The Stock Market Votes for Commodities

* Short-Term Breakout Underway?

The Gold/CRB Ratio as a Commodity Indicator

A couple of weeks ago, I wrote an article on commodities suggesting that conditions were falling into...

READ MORE

MEMBERS ONLY

S&P Fails at its 200-Day MA and NASDAQ Closes a Major Gap

by Martin Pring,

President, Pring Research

* March Was a Really Strong Bottom

* NASDAQ Closes a Gap

* S&P Fails at its 200-Day MA

* Conclusion

March Was a Really Strong Bottom

Tuesday's action looks bullish on the surface, but may signal the end of the rally. I emphasized the word "may" not...

READ MORE

MEMBERS ONLY

Commodity Indexes Reach Important Breakout Points

by Martin Pring,

President, Pring Research

* Gold Has Done its Work as a Leading Commodity Indicator

* The Stock Market is Forecasting Higher Commodity Prices

* Commodities on the Verge of a Breakout

* Oil VIX Signals a Major Bottom in Oil Prices

Three weeks ago, I raised the question as to whether commodities had begun to embark on...

READ MORE

MEMBERS ONLY

APPAREL RETAILERS LEAD XLY HIGHER -- AIRLINES ARE HOLDING TRANSPORTS BACK -- STRONGER RAILS AND TRUCKERS ARE A VOTE OF CONFIDENCE IN THE U.S. ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPAREL RETAILERS LEAD XLY HIGHER... Chart 1 shows the Consumer Discretionary SPDR (XLY) trading at the highest level in three months and north of its 200-day average. The XLY/SPX relative strength ratio in the upper box is also rising. Apparel retailers are leading the XLY higher. Chart 2 shows...

READ MORE

MEMBERS ONLY

STOCKS HAVE ANOTHER STRONG DAY -- S&P 500 NEARS TEST OF 200-DAY AVERAGE -- ALL ELEVEN SECTORS ARE GAINING -- SMALLER STOCKS SHOW STRONG GAINS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS CONTINUE RALLY MODE... Stock prices are trading sharply higher again today. Chart 1 shows the Nasdaq Composite Index ($COMPQ) trading at a three month high. Chart 2 shows the S&P 500 nearing a test of its 200-day moving average. Chart 3 shows the Dow Industrials nearing a...

READ MORE

MEMBERS ONLY

SEMICONDUCTORS LEAD TECH SECTOR HIGHER -- CHIPS LEADERS ARE NVIDIA, SKYWORKS, AND INTEL

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMIS LEAD TECH SPDR HIGHER... Technology is the day's strongest sector. Chart 1 shows the Technology Sector SPDR (XLK) rising today to the highest level in nearly three months. It's being led higher by semiconductors . Chart 2 shows the PHLX Semiconductor iShares (SOXX) moving above its...

READ MORE