MEMBERS ONLY

Market Indicators: Swear By Them, or Swear At Them?

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry walks viewers through what he considers to be the best indicators, including technical and fundamental ones alike. Larry discusses their limitations and explains why they have them, then shows you the best ways that you can use them in...

READ MORE

MEMBERS ONLY

STOCKS SURGE ON VACCINE OPTIMISM -- MAJOR INDEXES NEAR TEST OF RECENT HIGHS -- SMALL STOCKS SURGE AS WELL -- CONSUMER CYCLICALS CLEAR 200-DAY LINE -- MODERNA SURGES ON VACCINE NEWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SURGE ON VACCINE OPTIMISM... A report that a vaccine developed by Moderna is showing positive results helped push stocks sharply higher today. Charts 1 and 2 show the Dow Industrials and S&P 500 gapping higher and in position to test their recent highs. The SPX may also...

READ MORE

MEMBERS ONLY

STOCK INDEXES STABILIZE -- FINANCIALS REBOUND -- BANK INDEX TESTS MARCH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES STABILIZE NEAR SUPPORT... After a weak start this morning, major stock indexes are stabilizing near some short-term support levels. Chart 1 shows the Dow Industrials finding support at its 50-day moving average and its mid-April intraday low at 22900. Chart 2 shows the S&P 500 holding...

READ MORE

MEMBERS ONLY

S&P Struggling Below Its 200-Day MA; Watch Those Financials!

by Martin Pring,

President, Pring Research

Last week, I pointed out that the S&P Composite, despite the strong rally off the March low, had failed to touch an overbought condition. That presented a problem, since a security that is unable to reach an overstretched reading is usually suffering from some kind of a bear...

READ MORE

MEMBERS ONLY

STOCKS START THE DAY UNDER PRESSURE -- SMALL CAPS ARE LEADING THE DECLINE -- SO ARE FINANCIALS AND INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 WEAKEN... Stock prices are continuing the pullback that began yesterday afternoon. And some short-term support levels may soon be tested. Chart 1 shows the Dow Industrials slipping below their 20-day average (green line) and in position to test their early May low at 23400....

READ MORE

MEMBERS ONLY

NASDAQ TURNS POSITIVE FOR YEAR -- S&P 500 MAY RETEST APRIL HIGH -- USING SCTR LINES TO RANK SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS RALLY ON BAD ECONOMIC NEWS... Last weekend's message suggested that the spring rally in stocks may have peaked. Judging from this week's strong price action, that doesn't appear to be the case. Stock prices have shown remarkable resilience in the face of very...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR MAY BE NEXT TO CHALLENGE 200-DAY LINE -- EBAY IS ONE OF ITS BEST PERFORMERS -- SO ARE CHIPOTLE, TRACTOR SUPPLY, AND ROLLINS -- AND HOME IMPROVEMENT STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR NEARS 200-DAY LINE... Yesterday's message showed the Communication Services SPDR (XLC) trying to clear its 200-day moving average which it has done. The next in line may be consumer cyclicals. Chart 1 shows the Consumer Discretionary SPDR (XLY) nearing a test of its red line....

READ MORE

MEMBERS ONLY

This Reliable Long-Term Indicator Could Go Bullish at the End of the Month

by Martin Pring,

President, Pring Research

Sixty-Five Year Record of Success

One of my favorite long-term indicators involves the 12-month ROC of the S&P Composite falling below the -5% level and subsequently rallying back above zero. This approach is shown in Chart 1, which illustrates the period from 1995 through April 30 of this...

READ MORE

MEMBERS ONLY

COMMUNICATION SPDR STILL TESTING 200-DAY LINE -- INTERNET STOCKS ARE LEADING IT HIGHER -- USING SCTR RANKINGS TO FIND STOCK LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

XLC CONTINUES TO TEST 200-DAY LINE... Tuesday's message showed the Communication Services SPDR (XLC) challenging its 200-day moving average. Chart 1 shows that test still in progress. Its relative strength line in the lower box has also been rising. Internet stocks are the main driver behind recent XLC...

READ MORE

MEMBERS ONLY

STOCKS OPEN HIGHER -- NASDAQ CONTINUES TO LEAD -- CHIPS REGAIN 200-DAY LINE -- MICROSOFT AND APPLE REMAIN STRONG -- ALHPABET AND FACEBOOK LEAD COMMUNICATION SERVICES SPDR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS OPEN ON A STRONG NOTE... Stock prices opened much higher this morning. And all three major stock indexes are bouncing off some moving average lines. Chart 1 shows the Dow Industrials bouncing off their 20- and 50-day moving averages which is usually their first line of support. Chart 2...

READ MORE

MEMBERS ONLY

STOCK INDEXES MAY HAVE PEAKED -- THE QUESTION IS HOW MUCH WILL THEY RETRACE -- FALLING CHIP STOCKS THREATEN NASDAQ UPTREND -- AMAZON IS THE FIRST OF BIG FIVE TO BE SOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK RALLY MAY HAVE PEAKED... A number of short-term technical indicators suggest that the spring rebound in stocks may have peaked this past week. The daily bars in Chart 1 show the S&P 500 selling off on Thursday and Friday after touching its 62% Fibonnaci retracement line (purple...

READ MORE

MEMBERS ONLY

AMAZON WEIGHS ON CONSUMER CYCLICALS -- LAM RESEARCH LEADS SEMIS LOWER -- EXCEPT FOR AMAZON, BIG TECH STOCKS ARE HAVING A RELATIVELY STRONG WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

AMAZON SELLOFF HURTS CONSUMER CYCLICALS... Stocks in general are undergoing some profit-taking today. And consumer cyclicals are one of the day's weakest groups. A big reason for that is today's big drop in Amazon.com (AMZN). Chart 1 shows that influential stock dropping -7% today on...

READ MORE

MEMBERS ONLY

Is It Time For a Commodity Rally?

by Martin Pring,

President, Pring Research

Commodities have been badly beaten up in the last few months, but no market goes down for ever, so it's natural to ask the question of whether it's time for an upside reversal. The evidence for that is not conclusive yet, but there are some very...

READ MORE

MEMBERS ONLY

STOCKS CLIMB ON ENCOURAGING DRUG NEWS -- S&P 500 APPROACHES 200-DAY AVERAGE -- GOOGLE AND FACEBOOK LEAD XLC HIGHER -- XLY NEARS ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 NEARS TEST OF 200-DAY AVERAGE...A positive report by Gilead Sciences on its Covid-19 drug helped stocks get off to a strong start today. The biotech stock is up 3% this morning on that report. Chart 1 shows the S&P 500 gaining more than...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 CLEAR 50-DAY LINES -- SMALL CAPS HAVE A STRONG DAY -- FALLING VIX ALSO SUPPORTS HIGHER STOCK PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 CLEAR 50-DAY LINES...Stocks spent Monday extending the rebound that started two months ago. And they continue to overcome some overhead resistance barriers. Chart 1 shows the Dow Industrials trading back above its 50-average for the first time since February. While Chart 2 shows...

READ MORE

MEMBERS ONLY

STOCK REBOUND REMAINS INTACT --BUT LONGER-TERM TREND REMAINS IN DOUBT -- HEALTHCARE AND TECH ACCOUNT FOR THIRD OF SPX -- EQUAL-WEIGHT S&P 500 ETF LAGS BEHIND

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES END WEEK SLIGHTLY LOWER...After an unusually volatile week which included a plunge in the price of oil below zero, major stock indexes ended the week with small losses. Which leaves their overall trend patterns little changed. Chart 1 shows the Dow Industrials ending the week just...

READ MORE

MEMBERS ONLY

GOLD MINERS FINALLY BREAK OUT TO THE UPSIDE -- GOLD MINERS ARE STARTING TO DO BETTER THAN GOLD -- AND THE STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD MINERS ACHIEVE UPSIDE BREAKOUT... The price of gold continues to rise. Chart 1 shows the Gold Shares SPDR (GLD) trading higher and nearing another seven-year high. Gold miners, however, are doing even better. The daily bars in Chart 2 show the VanEck Vectors Gold Miners ETF (GDX) jumping more...

READ MORE

MEMBERS ONLY

Trendline Violations Suggest The Rally Is Losing Momentum

by Martin Pring,

President, Pring Research

In recent articles, I have pointed out that quite a few of the short-term indicators reached well beyond their normal oversold readings at the March lows. Historically, this is has been a very bullish characteristic, often signaling the end of a bear market. The difference between now and most of...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF AS OIL PRICE PLUNGES -- DOW AND S&P 500 PULL BACK FROM 50-DAY AVERAGES -- THE NASDAQ FALLS BELOW ITS 200-DAY LINE ON TECHNOLOGY SELLING

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ARE UNDER HEAVY SELLING PRESSURE...The plunge in the price of the May crude oil contract below zero this week, and the continuing plunge in oil prices in general, is taking a toll on stock market sentiment and trading. All three major stock indexes are under heavy...

READ MORE

MEMBERS ONLY

NASDAQ IS FIRST INDEX TO CLEAR ITS 200-DAY LINE -- STRONG BIOTECH GROUP LEADS HEALTHCARE HIGHER-- AMAZON.COM LEADS CONSUMER CYCLICALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS EXTEND APRIL RALLY...Stocks ended the week on a strong note to extend their April rally. The daily bars in Chart 1 show the S&P 500 climbing 2.6% on Friday to close just above its 50-day average at 2863; and slightly above its late February broken...

READ MORE

MEMBERS ONLY

STOCKS OFF TO A STRONG START -- WITH ENERGY, FINANCIALS, INDUSTRIALS, AND MATERIALS LEADING IT HIGHER -- GOLD IS EXPERIENCING SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES TEST SOME MOVING AVERAGE LINES... Today's strong price action suggests that stock indexes are trying to extend their April rebound. All major stocks got off to strong start. Chart 1 shows the Dow Industrials rising more than 2% today and nearing a test of its 50-day...

READ MORE

MEMBERS ONLY

A Rising Gold Market Says It May Soon Be Time to Cover Those Commodity Shorts

by Martin Pring,

President, Pring Research

History tells us that, at major turning points for commodities, there is a strong, albeit imprecise, tendency for the gold price to have preceded that reversal. Gold generally leads because a rising price anticipates inflation, while a falling one anticipates deflation. This idea is represented by the rightward sloping solid...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF ON WEAK ECONOMIC NEWS -- BANKS DROP ON WEAK EARNINGS -- ENERGY AND FINANCIALS ARE DAY'S WEAKEST SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEAK ECONOMIC DATA CAUSES PROFIT-TAKING IN STOCKS... A lot of weak economic reports today are causing profit-taking in stock prices. Weak bank earnings are making that group one of the day's weakest. A 10 basis point drop by the 10-year Treasury yield to 0.64% may also be...

READ MORE

MEMBERS ONLY

GOLD REACHES HIGHEST LEVEL IN SEVEN YEARS -- WHILE ITS MINERS MAY ALSO BE BREAKING OUT -- GOLD MINERS ETF IS ALSO SHOWING RELATIVE STRENGTH AGAINST THE METAL AND STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD REACHES SEVEN-YEAR HIGH... Gold seems to have everything moving in its favor. Low global interest rates, a softer dollar, and fears of global economic recession. And most of all, a bullish chart pattern both for the yellow metal and its miners. A lot of bullish articles on gold have...

READ MORE

MEMBERS ONLY

Are We On the Eve of Destruction?

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry addresses the impact the virus has had on the economy and the markets. Where does he see things going from here? Are we looking at a continued bear market or a bull move to the upside? Watch to find...

READ MORE

MEMBERS ONLY

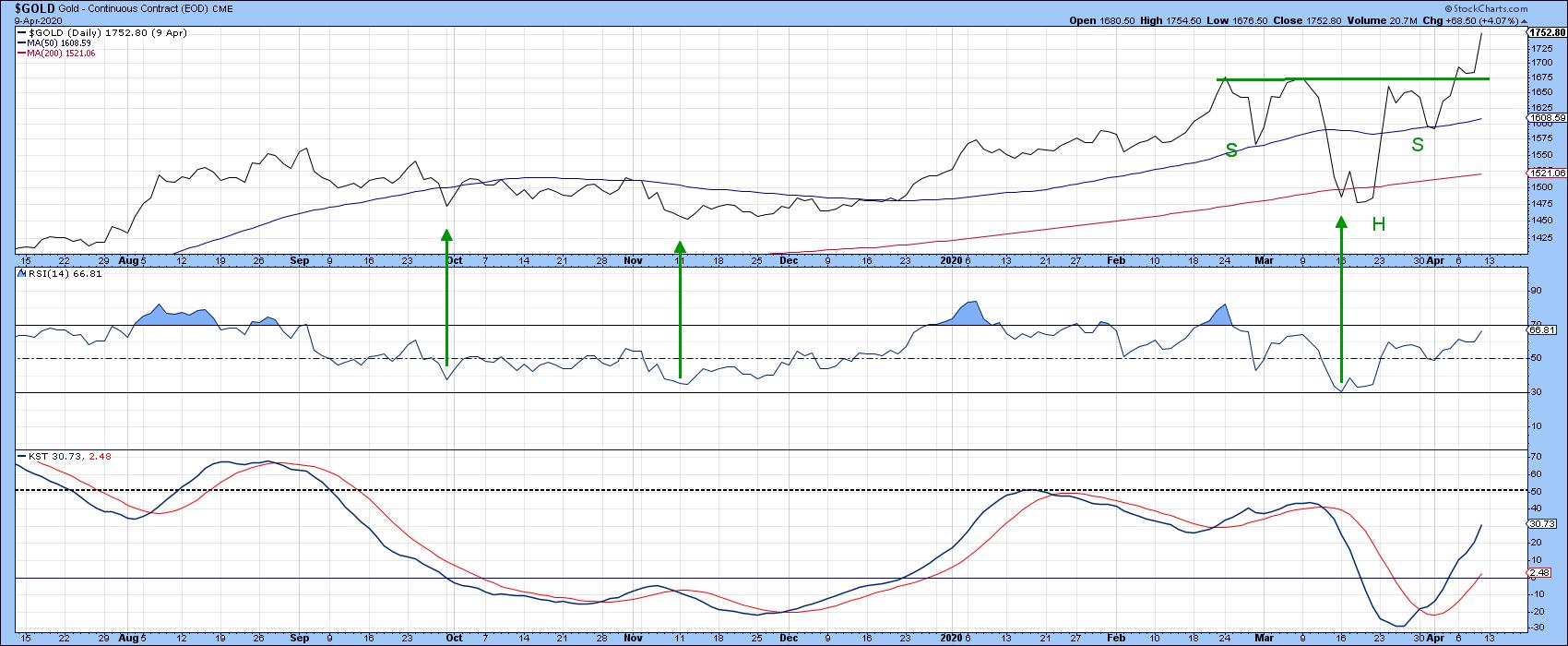

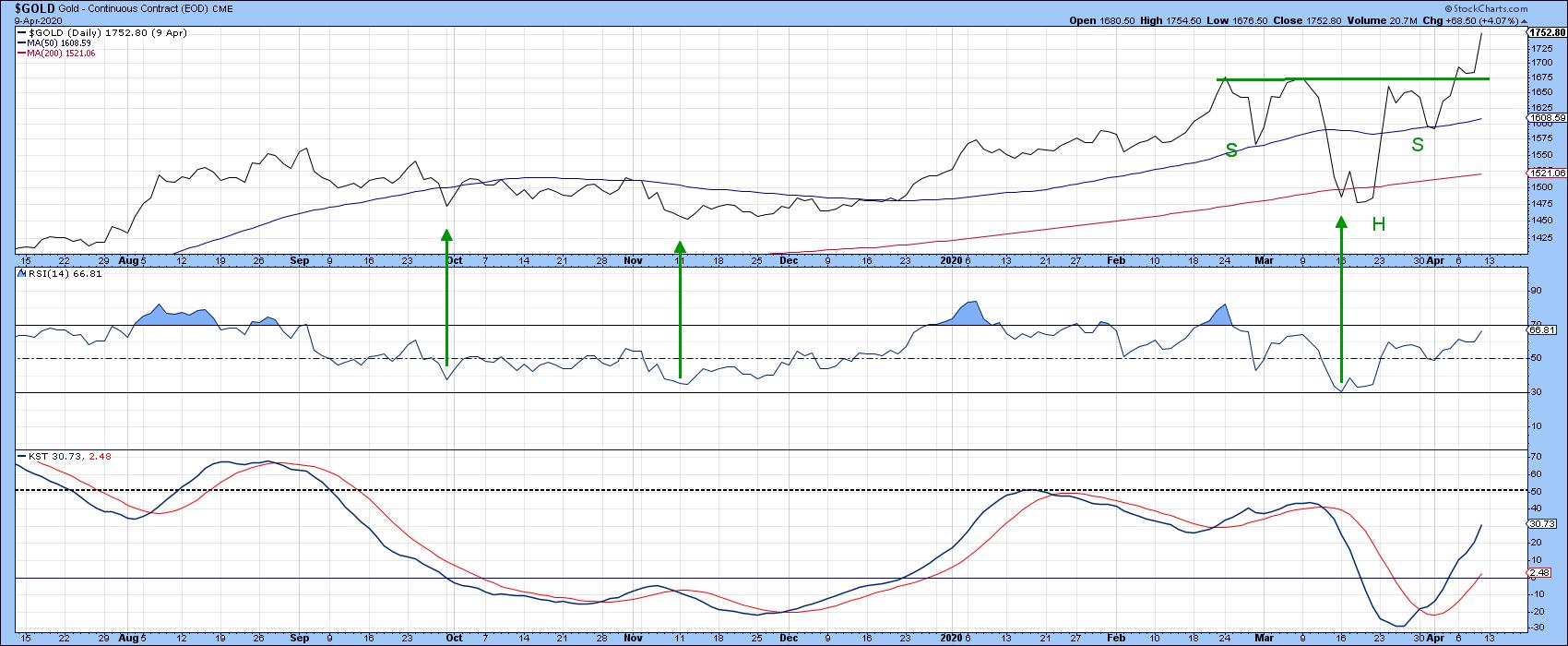

Gold is Breaking to the Upside - What Does That Mean for the Stock Market?

by Martin Pring,

President, Pring Research

Chart 1 shows that last week, based on daily data, the gold price quietly broke out from a reverse head-and-shoulders pattern. It's certainly a little overstretched on a short-term basis and may need to pause for a couple of sessions or so, but the longer-term indicators are pointing...

READ MORE

MEMBERS ONLY

WEEKLY AND MONTHLY CHARTS SHOW IMPROVEMENT -- BUT IDENTIFY POTENTIAL OVERHEAD RESISTANCE -- THE STAYING POWER OF THE CURRENT STOCK REBOUND MAY SOON BE TESTED

by John Murphy,

Chief Technical Analyst, StockCharts.com

POTENTIAL OVERHEAD RESISTANCE ON WEEKLY CHART... Stock prices are trading higher again today following a Fed injection of $2.3 trillion dollars into the economy. The question is how far can the rally carry, and are there still risks on the downside. For that, we're going to look...

READ MORE

MEMBERS ONLY

Tuesday's Bearish Key Reversals May Have Trouble Working

by Martin Pring,

President, Pring Research

Whenever a specific technical event is repeated widely in many different stocks, it gets my attention, as it often signals a reversal in the prevailing trend. We call it the principle of commonality. Alternatively, you could think of it as the principle of strength in numbers.

Tuesday's Action...

READ MORE

MEMBERS ONLY

STOCKS GAIN MORE GROUND -- DOW AND S&P 500 MAY TEST 50% RETRACEMENT LINES -- THE QQQ IS TRYING AGAIN TO CLEAR ITS 200-DAY LINE -- ALL SECTORS ARE UP WITH REAL ESTATE, ENERGY, UTILITIES, MATERIALS, AND FINANCIALS LEADING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS REGAIN UPSIDE MOMENTUM... Stocks are gaining ground today following yesterday's late selloff. Chart 1 shows the Dow Industrials gaining 3% today. Today's price gain has kept the Dow above its lower 38% Fibonnaci retracement line; and may be signalling a test of its 50% retracement...

READ MORE

MEMBERS ONLY

TECH SPDR FALLS BACK BELOW ITS 200-DAY AVERAGE -- SO DO THE QQQ AND SEMICONDUCTOR ISHARES -- LATE STOCK SELLING MIGHT SIGNAL MORE TO COME

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 QQQ CLOSES BELOW 200-DAY LINE...Today's two earlier messages focused on three technology-dominated ETFs that were trying to clear their 200-day averages. All three failed that initial test by closing lower today. Chart 1 shows the Invesco QQQ Trust giving up its earlier gains and ending...

READ MORE

MEMBERS ONLY

NASDAQ 100 QQQ TRADING ABOVE ITS 200-DAY LINE -- AMAZON, INTEL, AND MICROSOFT HELP LEAD IT HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ TRADES ABOVE 200-DAY LINE...This morning's message showed the Technology SPDR (XLK) and Semiconductor iShares (SOXX) testing their 200-day moving averages. This message focuses on the Nasdaq 100 QQQ which is also trying to clear its 200-day line. Chart 1 shows the Invesco QQQ Trust trading above...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES CLEAR LATE-MARCH HIGH -- ALL SECTORS ARE IN THE GREEN -- ENERGY AND MATERIALS ARE LEADING -- TECH SPDR IS TESTING ITS 200-DAY AVERAGE -- SO ARE SEMICONDUCTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CLEAR LATE-MARCH HIGH...The stock market is building on yesterday's strong gain to improve its short- to intermediate trend picture. The daily bars in Chart 1 show the S&P 500 rising above its late-March intra-day peak at 2641 after clearing its green 20-day average...

READ MORE

MEMBERS ONLY

STOCKS START WEEK ON THE UPSIDE -- ALL STOCK SECTORS ARE GAINING -- BIOTECHS LEAD HEALTHCARE HIGHER -- TREASURY YIELD BOUNCES AS TREASURIES DIP -- CORPORATE BONDS ARE ACTING BETTER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 MAY BE HEADED FOR TEST OF LATE-MARCH HIGH...Global stocks are starting the week higher. The daily bars in Chart 1, for example, show the S&P 500 gapping higher this morning and clearing its green 2o-day average. The green circle shows the SPX leaving...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES ARE TRYING TO STABILIZE -- LONG-TERM CHARTS, HOWEVER, REMAIN A CONCERN -- WEEKLY AND MONTHY CHARTS OF THE S&P 500 SUGGEST CONTINUED STOCK MARKET RISK

by John Murphy,

Chief Technical Analyst, StockCharts.com

DAILY S&P 500 CHART CONTINUES TO STABILIZE...Major U.S. stock indexes continue to probe for a short-term bottom. The daily bars in Chart 1 show the S&P 500 regaining some lost ground over the last two weeks after falling to the lowest level in three...

READ MORE

MEMBERS ONLY

Is It Nineteen Twenty-Nine or Nineteen Eighty-Seven? Which Sectors are Out-Perfoming?

by Martin Pring,

President, Pring Research

In my monthly Intermarket Review this month, I pointed out that, using a 6-week ROC for perspective, the DJIA dropped by 36% on March 20 -before then, there had only been two other instances where the market had fallen by a similar amount from an all-time-high. Based on the DJIA...

READ MORE

MEMBERS ONLY

Can the Fed Stop the Bear?

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry presents an in-depth discussion of the Federal Reserve System. In addition to walking you through the history of the Fed and describing its primary functions, Larry shares how and why he changed his stance from anti-Fed to a strong...

READ MORE

MEMBERS ONLY

Lots of Short-Term Indicators Reversing from Bearish Extremes - What Does It Mean? (UPDATED)

by Martin Pring,

President, Pring Research

Editor's Note: This is an expansion of a previous Market Roundup article written on Tuesday, March 24th, now with updated charts and commentary. For the original article, click here.

I wrote earlier in the week that, whenever the market rallies by 8-9%, it's obvious that some...

READ MORE

MEMBERS ONLY

Lots of Short-Term Indicators Reversing from Bearish Extremes - What Does It Mean?

by Martin Pring,

President, Pring Research

* Indicators Start to Flash Buy Signals

* What Happened in the 1929-32 Bear Market?

* Longer-Term Perspective

Whenever the market rallies by 8-9%, it's obvious that some form of bottom has taken place (however fleeting), so I don't want to state the obvious. It is apparent, though, that...

READ MORE

MEMBERS ONLY

DOW BREAKS 2018 LOW AND SIGNALS LOWER PRICES -- THE S&P 500 IS TESTING SUPPORT LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

LOWER TARGET FOR THE DOW... My weekend message showed the Dow Industrials testing important chart support along its late 2018 low. The weekly bars in Chart 1 show the Dow falling below that important support line this week. That raises the likelihood of even lower prices. The question is how...

READ MORE

MEMBERS ONLY

Bullish at a Time of Extreme Panic

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry explains why he believes the bull is about to roar back and put the bears to sleep. Based on nearly 60 years of market analysis and trading experience, Larry showcases the charts and indicators he's watching most...

READ MORE