MEMBERS ONLY

SMALL CAPS AND TRANSPORTS LEAD TODAY'S RALLY -- RUSSELL 2000 iSHARES NEAR TEST OF 2018 PEAK -- RUSSELL 2000 GROWTH ISHARES HIT NEW RECORD -- WITH HELP FROM BIOTECHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES NEAR NEW RECORD... Small cap stocks are having an unusually strong day today. And are nearing a potential new record. The weekly bars in Chart 1 show the Russell 2000 iShares (IWM) trading at the highest level in sixteen months; and nearing a test of its previous...

READ MORE

MEMBERS ONLY

U.S. AND CHINA SIGN PHASE ONE OF TRADE DEAL -- MAJOR STOCK INDEXES HIT NEW RECORDS -- LOWER BOND YIELDS BOOST UTILITIES AND REITS -- BANKS HIT OVERHEAD RESISTANCE -- HOME CONSTRUCTION ISHARES HIT NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

SIGNING OF TRADE DEAL BOOSTS STOCKS... Stocks celebrated the U.S. and China signing phase one of their historic trade deal today with the three major stock indexes hitting another record high. Despite some late selling this afternoon, stock indexes ended in positive territory. Stock indexes are still dealing with...

READ MORE

MEMBERS ONLY

Dollar Index Reaches a Crucial Technical Juncture Point

by Martin Pring,

President, Pring Research

The Dollar Index has been rising in the last few sessions following its December decline, which has put it at a crucial technical juncture. Whichever way it breaks will have implications for commodities, gold and the relative performance of international equities to the US. A rising currency would have negative...

READ MORE

MEMBERS ONLY

STOCKS LOOK VUNLERABLE TO SHORT-TERM PULLBACK -- DIVERGENCE FROM BOND YIELD MAY BE A WARNING -- LOWER TREASURY YIELD BOOSTS UTILITIES AND REITS -- BUT MAY CAUSE PROFIT-TAKING IN BANKS -- HOME CONSTRUCTION ISHARES TEST 2018 PEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM STOCK VIEW LOOKS OVER-EXTENDED...Despite geopolitical concerns at the start of the week between the U.S. and Iran, stocks ended the week higher. All three major stock indexes also hit new records before experiencing some minor-profit-taking on Friday. All trends remain solidly higher here and around the world....

READ MORE

MEMBERS ONLY

STOCKS RALLY ON REDUCED MIDEAST TENSIONS -- OIL DROPS SHARPLY -- ENERGY SHARES PULL BACK FROM CHART RESISTANCE -- VIX REMAINS WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS CLIMB ON CONCILIATORY REMARKS... After several tense days, some calm is being restored to global markets. The fact that last night's attack by Iran on allied bases in Iraq resulted in no casualties; plus a more conciliatory-sounding speech by President Trump shortly before noon appear to...

READ MORE

MEMBERS ONLY

RISING CANADIAN DOLLAR HELPS PUSH CANADA ISHARES TO NEW RECORD -- THAT'S BECAUSE THE EWC IS QUOTED IN U.S DOLLARS -- THAT'S TRUE OF ALL FOREIGN STOCK ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CANADIAN DOLLAR HITS NEW 52-WEEK HIGH... A couple of my messages posted during Christmas week wrote about a more bullish outlook for commodity markets this year. And the likelihood for a weaker U.S. dollar. One of the messages wrote about the Canadian Dollar being the strongest developed market currency...

READ MORE

MEMBERS ONLY

INCREASED MIDEAST TENSIONS CAUSE SOME PROFIT-TAKING IN STOCKS -- AND HIGHER CRUDE OIL PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

ATTACK ON IRAN'S TOP GENERAL PUSHES OIL PRICES HIGHER... Overnight news of the killing of Iran's top general by the U.S. is having a reasonably predictable effect on global markets. Global stocks are experiencing some profit-taking, while money is flowing into traditional safe havens like...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2020-01-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup videofor January is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Bull in a China Shop

by Martin Pring,

President, Pring Research

* Major Breakouts Coming Out of China

* Four Chinese ETFs

Major Breakouts Coming Out of China

Thursday's price action in China resulted in a powerful signal that Chinese equities are headed significantly higher. That should be bullish not only for China but for the world as a whole. In...

READ MORE

MEMBERS ONLY

WHY THE DOLLAR COULD WEAKEN IN 2020 -- SPREAD OVER FOREIGN YIELDS HAS NARROWED -- STRONGER FOREIGN STOCKS BOOST LOCAL CURRENCIES -- CANADIAN DOLLAR RISES WITH COMMODITIES -- EM CURRENCIES ARE TURNING UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHY A LOWER DOLLAR...Yesterday's message suggested that commodity prices may be bottoming; which could lead to a better 2020 for the first time in years. Part of that analysis, however, was based on expectations for a lower dollar. That's because a falling dollar is usually...

READ MORE

MEMBERS ONLY

WEAKER DOLLAR COULD MAKE 2020 A BETTER YEAR FOR COMMODITIES AND STOCKS TIED TO THEM -- MOST COMMODITY GROUPS ARE STRENGTHENING -- THAT INCLUDES ENERGY WHICH MAY BE BOTTOMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

A WEAKER DOLLAR COULD GIVE COMMODITIES A BETTER 2020... Commodities have become the forgotten asset class over the past several years. And for good reason. They've been the weakest part of the financial universe for nearly a decade. But that doesn't mean that they should continue...

READ MORE

MEMBERS ONLY

PRECIOUS METALS APPEAR TO BE TURNING UP -- BUT SILVER IS IN THE LEAD -- SO ARE ITS MINERS -- SINCE SILVER IS PART INDUSTRIAL METAL, IT SHOULD DO BETTER THAN GOLD IN A STRONGER ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD IS TURNING HIGHER... Money appears to be flowing back into precious metals. Chart 1 shows the GOLD SPDR (GLD) rising above a falling trendline extending back to early September which suggests that the four-month downside correction may have run its course. It's also trading at the highest...

READ MORE

MEMBERS ONLY

FOOTWEAR IS ANOTHER XLY LEADER -- THAT INCLUDES CROCS, NIKE, AND SKECHERS -- TESLA ACCOUNTS FOR AUTO STRENGTH -- ALL MAY BE TIED TO IMPROVEMENT IN CHINA -- THAT INCLUDES GAMBLING AND HOTEL STOCKS -- ROYAL CARIBBEAN CRUISES SAILS TO NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

ADD FOOTWEAR TO LIST OF XLY LEADERS... This week's messages have been focusing on the recent upside breakout in the Consumer Discretionary SPDR (XLY) and groups that are leading it higher. The last two messages showed gambling and hotel stocks taking the lead with some of them hitting...

READ MORE

MEMBERS ONLY

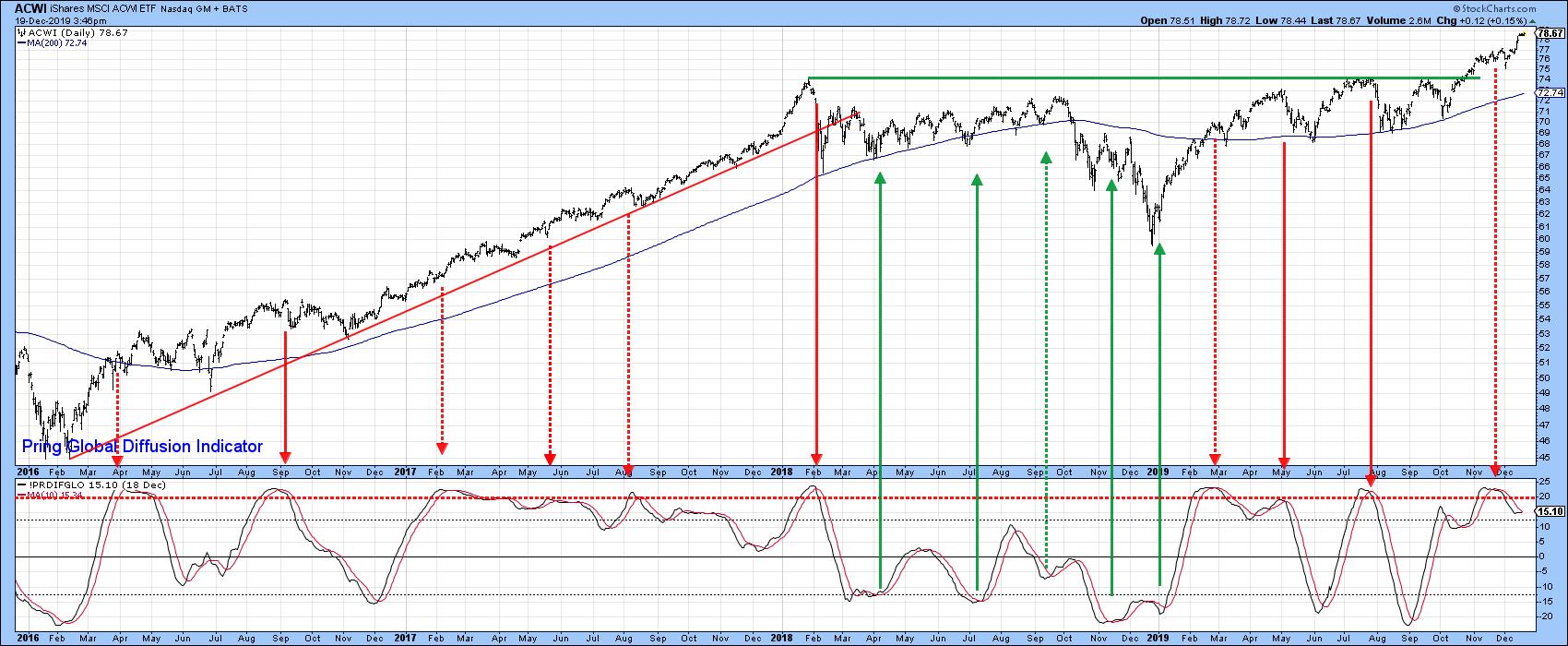

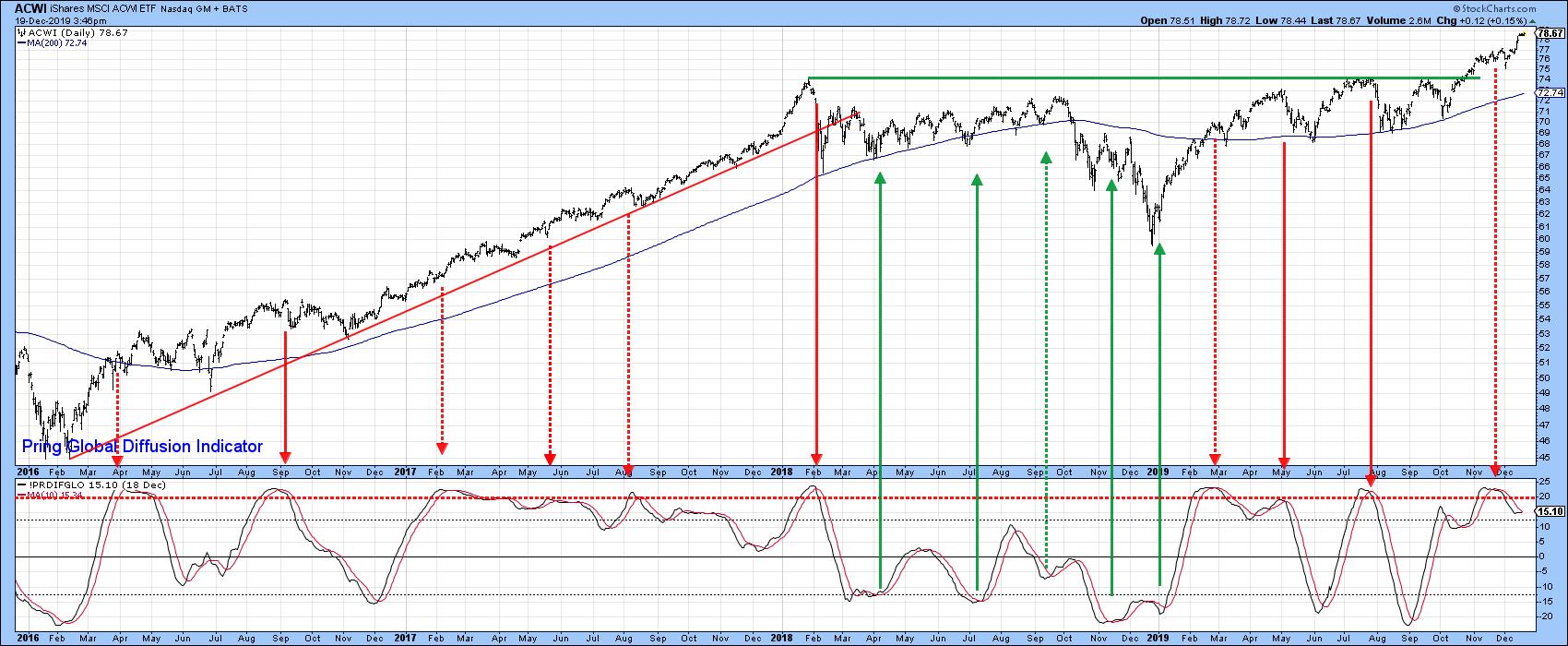

Stocks are Overdue for a Correction, But These Charts Say It Doesn't Matter

by Martin Pring,

President, Pring Research

* Confidence is Breaking Out All Over

* Alternative Risk Relationships are Starting to Get Riskier

Right now, stocks are very overextended and likely due for a correction. In Chart 1, for instance, you can see that my Global Diffusion indicator has just triggered a sell signal from an extreme level. The...

READ MORE

MEMBERS ONLY

And That's a Wrap

by Larry Williams,

Veteran Investor and Author

On the 12th and final regular episode of Real Trading with Larry Williams, Larry takes a look at Great Unknown Growth Stocks with a seasonal trade, including Diageo (DEO), Constellation (STZ) and Brown-Forman (BF/A). He also discusses the US Stock Market, Gold and Bonds, as well as his upcoming...

READ MORE

MEMBERS ONLY

HOTEL STOCKS ARE ALSO XLY LEADERS -- HILTON, HYATT, AND MARRIOTT HIT NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES HOTELS INDEX HITS NEW RECORD... Yesterday's message showed gambling stocks helping lead the Consumer Discretionary SPDR (XLY) into record territory this week. It also mentioned leadership from autos, footwear, and hotels. We're going to focus on hotels today. Chart 1 shows the Dow Jones...

READ MORE

MEMBERS ONLY

GAMBLING STOCKS LEAD XLY-- LAS VEGAS SANDS, MGM, AND WYNN GAIN -- STRONGER CHINESE STOCKS ARE HELPING -- AND CLOSE TIES TO MACAU

by John Murphy,

Chief Technical Analyst, StockCharts.com

GAMBLING STOCKS LEAD XLY TO RECORD...Chart 1 shows the Consumer Discretionary SPDR (XLY) hitting a new record high yesterday. The XLY closed above a flat trendline drawn over its July/September highs to complete a bullish "ascending triangle" formation. Assuming it can hold on to that upside...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS CONTINUE TO RALLY -- CONSUMER DISCRETIONARY SPDR IS TESTING UPPER PART OF TRIANGULAR FORMATION AND MAY BE NEARING AN UPSIDE BREAKOUT INTO RECORD TERRITORY

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS START THE WEEK ON A STRONG NOTE... Stocks around the world are starting the week on a strong note. That includes foreign developed and emerging markets in Europe and Asia. The three U.S. stock indexes are hitting new records. So are a number of sector SPDRS including...

READ MORE

MEMBERS ONLY

STOCK INDEXES HIT NEW RECORDS ON REPORT OF TRADE AGREEMENT -- SMALL CAPS HIT NEW 52-WEEK HIGH -- WHILE FINANCIALS, TECH, AND HEALTHCARE HIT NEW RECORDS -- BIG JUMP IN BOND YIELDS BOOSTS FINANCIALS BUT HURTS BOND PROXIES -- MATERIALS SPDR HITS ANOTHER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES HIT NEW RECORDS...Reports of a trade agreement between the U.S. and China pushed global stock prices sharply higher today. Chart 1 show the S&P 500 reaching record territory. So did the Nasdaq. Small cap stocks continued to show relative strength. Chart 2 shows the...

READ MORE

MEMBERS ONLY

Learn From Larry

by Larry Williams,

Veteran Investor and Author

Larry's goal is to tell you what is going to happen, not what's already taken place. In this episode of Real Trading with Larry Williams, Larry presents a new Great Unknown Growth Stock, Badger Meter (BMI), and discusses the Gold forecast, the US stock market and...

READ MORE

MEMBERS ONLY

INDEX OF STOCKS TIED TO COPPER REACHES EIGHT-MONTH HIGH -- FREEPORT MCMORAN IS ONE OF MARKET'S STRONGEST STOCKS -- RISING NUCOR STOCK REFLECTS STRONGER STEEL STOCKS -- GLOBAL METALS & MINING ISHARES RISE TO FIVE-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER STOCKS REACH EIGHT-MONTH HIGH... My weekend message suggested that copper and stocks tied to it might be bottoming. This week's strong action by both appears to be confirming that optimistic view. Copper closed at a five-month high yesterday (and is trading higher again today). Materials are today&...

READ MORE

MEMBERS ONLY

COPPER AND GOLD HAVE BEEN TRENDING IN OPPOSITE DIRECTIONS ALL YEAR -- FALLING BOND YIELDS EARLIER IN THE YEAR FAVORED GOLD -- THE RECENT RISE IN THE 10-YEAR TREASURY YIELD FAVORS COPPER -- COPPER AND ITS MINERS MAY BE FORMING BOTTOMS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONG JOBS REPORT ON FRIDAY BOOSTED COPPER BUT HURT GOLD...Friday's impressive jobs report took a lot of traders by surprise resulting in strong buying of stocks; which was accompanied by selling of Treasury bonds and other safe havens like gold. Riskier assets gained which included copper prices....

READ MORE

MEMBERS ONLY

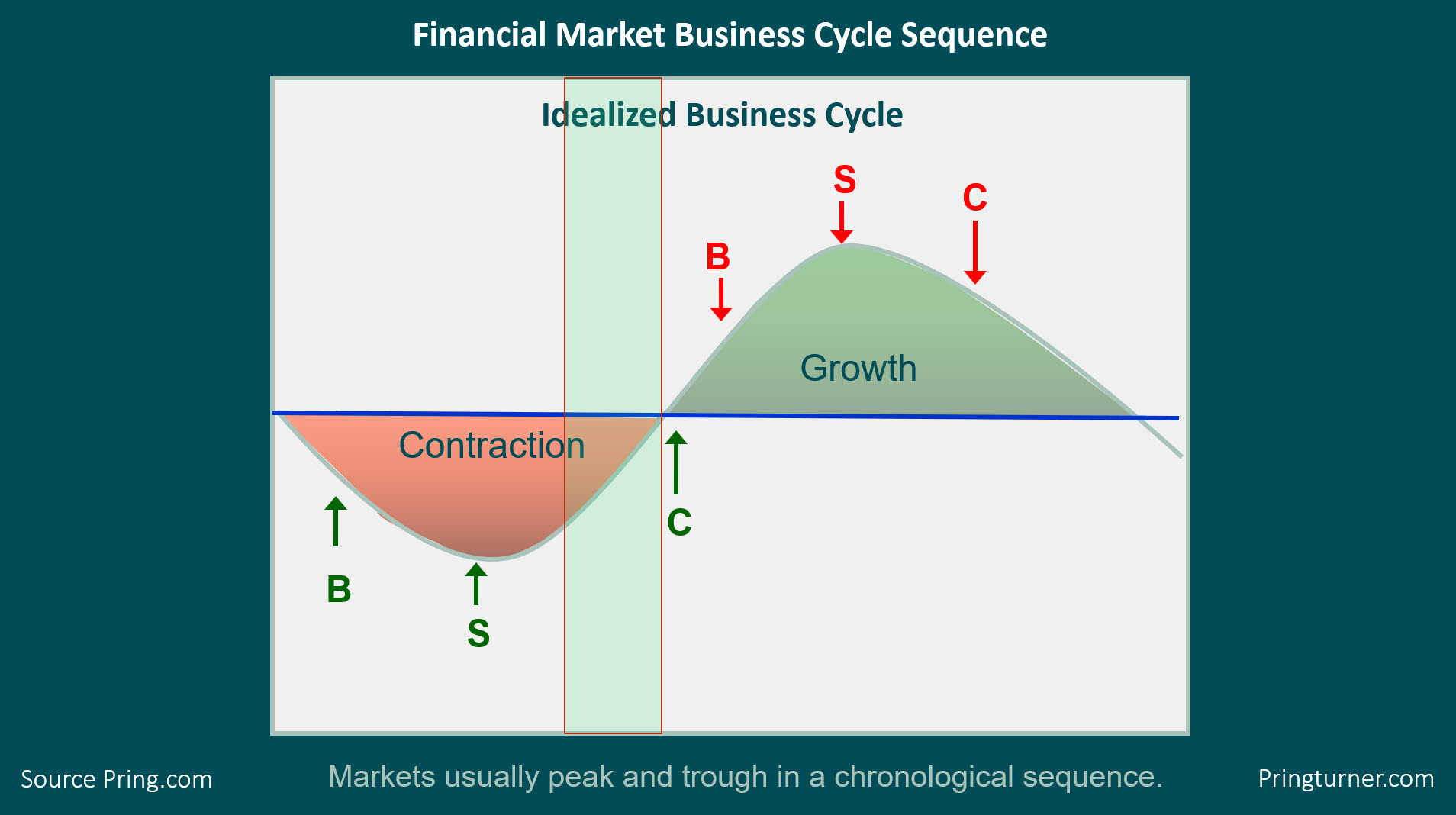

It's Time To Watch For A Bottom In Commodities

by Martin Pring,

President, Pring Research

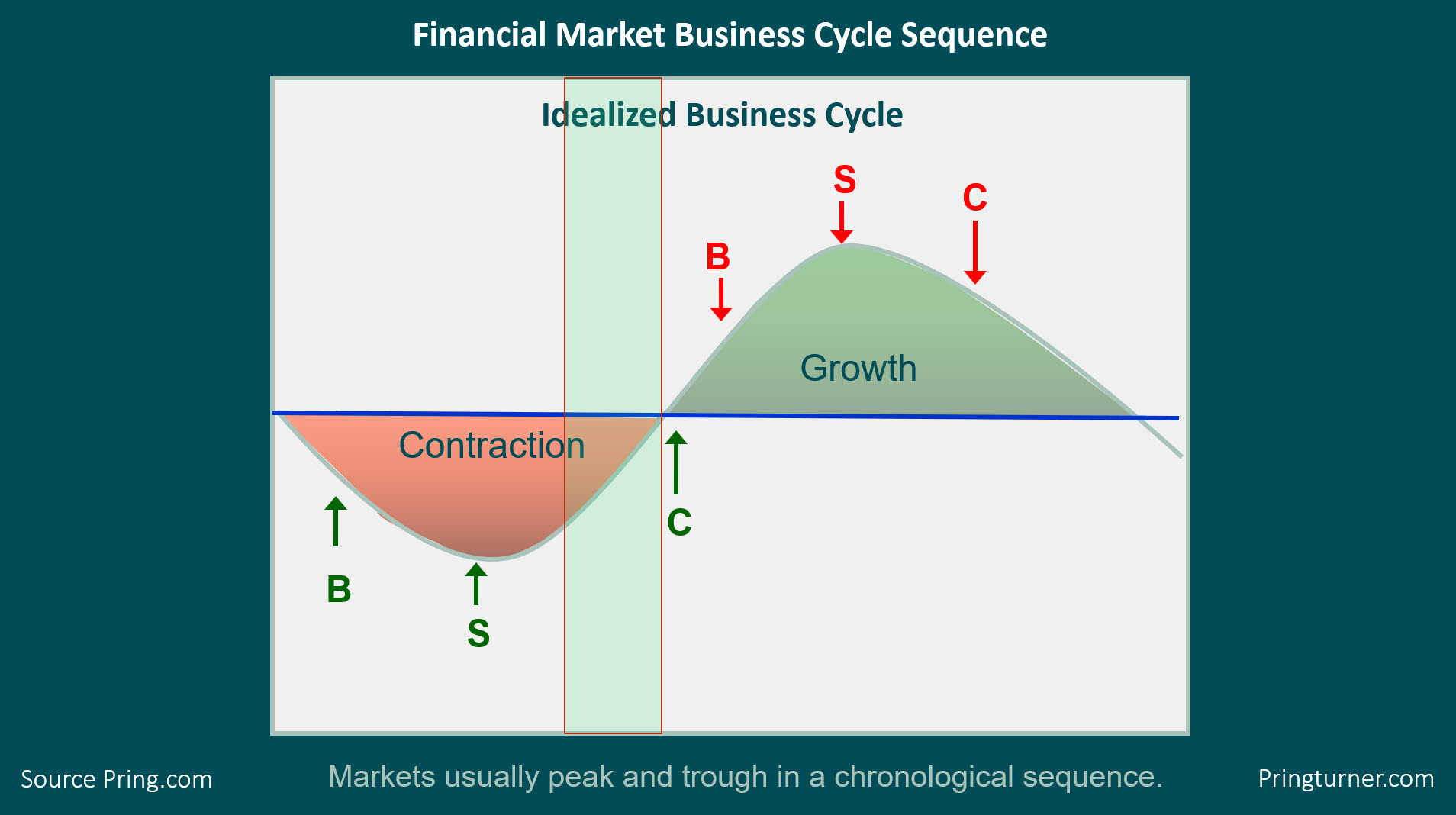

* The Markets and the Business Cycle

* Using Other Markets to Forecast Commodities

The Markets and the Business Cycle

In my Monthly Market Roundup last week, I repeated a talk that I recently gave at the CMT Summit in Mumbai. The talk in question began with an outline of the approach...

READ MORE

MEMBERS ONLY

STOCKS JUMP ON STRONG JOBS REPORT -- RUSSELL 2000 ISHARES HIT NEW 52-WEEK HIGH -- ENERGY STOCKS BOUNCE WITH CRUDE OIL ON OPEC CUTS -- ALL SECTORS ARE GAINING WITH FINANCIALS AND HEALTHCARE HITTING NEW RECORDS -- T. ROWE PRICE HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES JUMP ON STRONG JOBS REPORT... A strong November jobs report has stocks jumping today. The three charts below show the three major U.S stock indexes gapping higher today; and pushing them further above their 20-day moving averages. The erases the earlier setback seen on Tuesday. And the...

READ MORE

MEMBERS ONLY

ASSET MANAGERS LEAD FINANCIALS HIGHER -- THAT INCLUDES NORTHERN TRUST AND BLACKROCK -- MATERIALS SPDR BOUNCES OFF CHART SUPPORT -- NEWMONT GOLDCORP AND FREEPORT MCMORAN LEAD IT HIGHER -- A WEAKER DOLLAR MAY BE BOOSTING COMMODITY MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ASSET MANAGERS LEAD FINANCIALS HIGHER...Financials continue to show new market leadership. Most attention in that sector, however, is usually paid to bank stocks which are its biggest part. Some other financial groups are also doing well. Like asset managers which have been the strongest part of the financial sector...

READ MORE

MEMBERS ONLY

Christmas Trades

by Larry Williams,

Veteran Investor and Author

In this engaging episode of Real Trading with Larry Williams, Larry takes a look at the Christmas Influence, looking at how the largest retail event of the year influences the markets. In addition, Larry talks the US Stock Market, Gold, bonds and Bitcoin (BTCUSD), before capping off by answering a...

READ MORE

MEMBERS ONLY

STOCKS GAP HIGHER AND TRY TO REGAIN 20-DAY AVERAGE -- S&P 500 HAS ALSO BOUNCED OFF LOWER BOLLINGER BAND -- THOSE BANDS SHOW STOCKS PULLING BACK FROM OVERBOUGHT TERRITORY BUT STILL IN UPTRENDS -- LOWER BB VOLATILITY IS ALSO SUPPORTIVE TO STOCK PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAP HIGHER TODAY... After gapping lower yesterday, stocks are gapping higher today. The daily bars in Chart 1 show the S&P 500 also trying to regain its 20-day moving average (green line) that was violated yesterday. If this morning's gap to the upside holds...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF ON MORE TRADE TENSIONS -- SOME 20-DAY AVERAGES ARE BEING BROKEN -- DAY'S BIGGEST LOSERS ARE FINANCIALS, INDUSTRIALS, CYCLICALS, AND TECHS -- BIG DROP IN BOND YIELDS BOOSTS UTILITIES AND REITS -- BUT HURTS BANKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES UNDERGO PROFIT-TAKING... Increased trade tensions are contributing to profit-taking in stocks today. That and the fact that major stock indexes were already in overbought territory and vulnerable to short-term profit-taking. All three have fallen below their 20-day moving averages which could lead to a test of 50-day lines....

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-12-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup videofor December is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

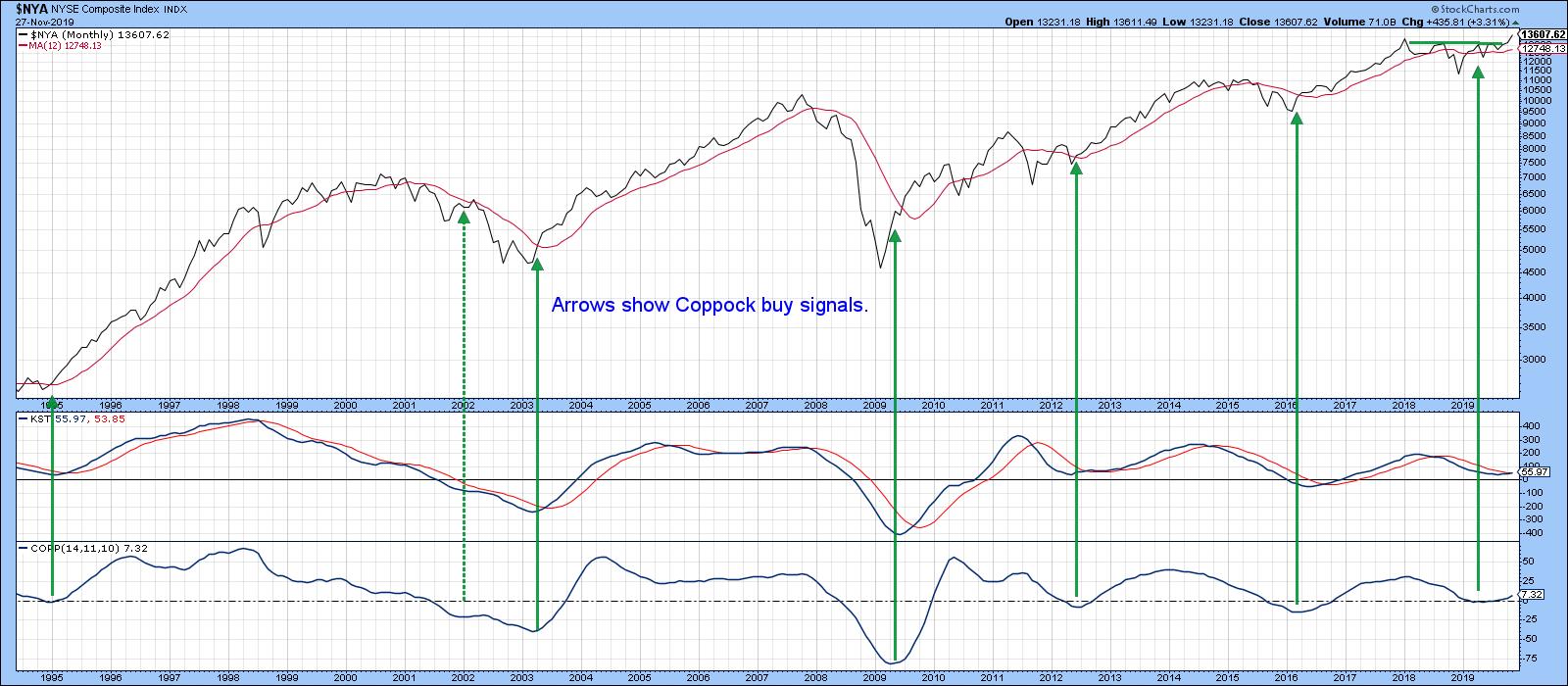

Three Good-Looking Sectors for the Ongoing Bull Market

by Martin Pring,

President, Pring Research

* The Game Has Just Begun

* Three Interesting Sectors

* Watch the DB Agriculture Fund

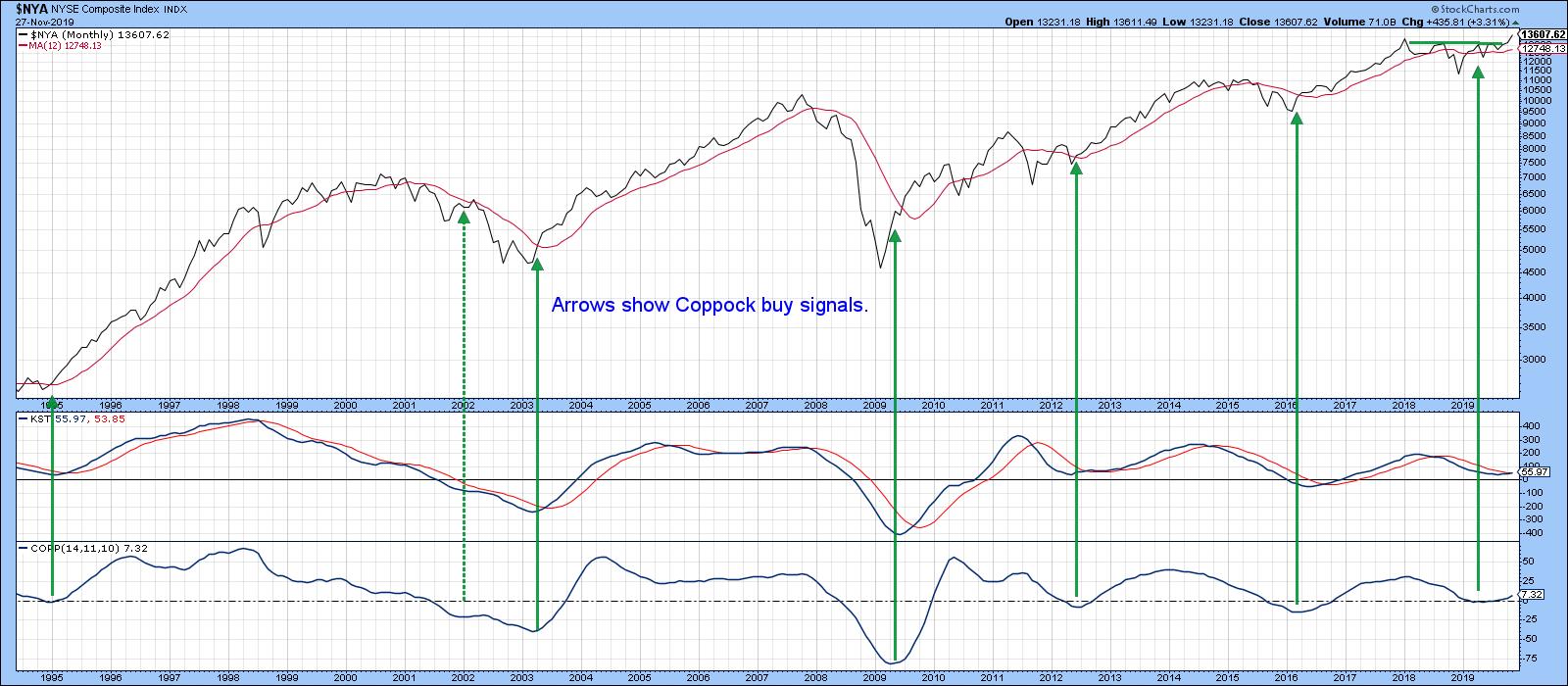

The Game Has Just Begun

It is fairly evident by now that the equity market has broken to the upside big time. Chart 1 sets the scene by demonstrating that first the Coppock Indicator and later the...

READ MORE

MEMBERS ONLY

RETAILERS HELP LEAD CONSUMER DISCRETIONARY SPDR HIGHER -- XLY IS NEARING TEST OF OVERHEAD RESISTANCE LINE IN BULLISH SYMMETRICAL TRIANGLE -- CLOTHING AND APPAREL RETAILERS ARE HELPING LEAD IT HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR SHOWS NEW LEADERSHIP... Chart 1 shows the Consumer Discretionary SPDR (XLY) rising today to the highest level in six weeks. That's setting up a possible test of its declining trendline drawn over its July/September peaks. The overall shape of its pattern since July looks...

READ MORE

MEMBERS ONLY

NASDAQ AND S&P 500 HIT NEW RECORDS -- RUSSELL 2000 ISHARES HIT 52-WEEK HIGH AND HAVE BREAKOUT DAY -- LED BY SMALL CAP GROWTH ISHARES THAT ARE DOING THE SAME -- STRONG HEALTHCARE SECTOR MAY HAVE A LOT TO DO WITH SMALL CAP BREAKOUTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 HAS BREAKOUT DAY...Stocks around the world are off to a strong start to the week. The Nasdaq and S&P 500 are hitting new records; while the Dow isn't far behind. Most stock sectors are also rising led by technology, healthcare, cyclicals, industrials, and...

READ MORE

MEMBERS ONLY

HEALTHCARE IS WEEK'S STRONGEST SECTOR -- PHARMA HAS BEEN A SECTOR LAGGARD -- BUT IS STARTING TO MOVE UP IN THE RANKINGS -- DOW JONES PHARMACEUTICALS INDEX IS RISING TO FIVE-MONTH HIGH -- PHARMA ISHARES ARE DOING THE SAME -- JNJ AND LLY MAY BE BREAKING OUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE CONTINUES TO GET STRONGER... Last Friday's message wrote about healthcare stocks going from one of the market's weakest sectors to one of the strongest. During the first eleven months of the year, healthcare was the market's second weakest sector (with only energy doing...

READ MORE

MEMBERS ONLY

How to Trade News

by Larry Williams,

Veteran Investor and Author

On this episode of Real Trading with Larry Williams, Larry presents an update on his stock market forecast and talks about how to account for the news when making trading decisions. In addition, this video includes an analysis of coffee and coffee stocks and a discussion of developments on Wall...

READ MORE

MEMBERS ONLY

STOCKS PULL BACK ON TRADE NEWS -- STOCK INDEXES REMAIN OVERBOUGHT BUT STILL IN UPTRENDS -- RETAILERS WEIGH ON CONSUMER DISCRETIONARY SECTOR -- ENERGY STOCKS REBOUND WITH CRUDE OIL -- DROP IN BOND YIELDS BOOST DEFENSIVE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES PULL BACK FROM OVERBOUGHT TERRITORY... News that a "phase one" trade deal may not be reached this year is contributing to selling in stocks today. That and the fact that stocks have reached overbought territory and are probably due for some profit-taking anyway. In fact, several...

READ MORE

MEMBERS ONLY

STOCK INDEXES HIT NEW RECORDS -- HEALTHCARE, COMMUNICATION, INDUSTRIALS, AND TECHNOLOGY ALSO HIT RECORDS -- INTERNET STOCKS LEAD XLC HIGHER -- SURGE IN HEALTH INSURERS LEADS HEALTHCARE SPDR TO NEW RECORD -- UNITEDHEALTH IS ONE OF DAY'S LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THREE MAJOR STOCK INDEXES HIT NEW RECORDS...Stocks are ending the week in record territory. The three charts below show the three major U.S. stock indexes closing at record highs on Friday. And the rally is pretty broad-based. Ten of the eleven market sectors gained on the day. Healthcare...

READ MORE

MEMBERS ONLY

US Stocks, Gold and Open Mic!

by Larry Williams,

Veteran Investor and Author

On this episode of Real Trading with Larry Williams, Larry presents his new Great Growth Stock, "Brad's Drink". He also gives his take on Disney (DIS), Copper (CPER), Lending Club (LC) and Bitcoin ($BTCUSD). This episode originally aired on November 14th, 2019.

New episodes of Real...

READ MORE

MEMBERS ONLY

STOCK INDEXES HOLD THEIR GAINS -- COMMUNICATION SERVICES SPDR NEARS RECORD HIGH -- GOOGLE, DISNEY, AND CHARTER COMMUNICATIONS HIT NEW RECORDS -- ENERGY SPDR MEETS SELLING AT 200-DAY LINE -- SO DOES CRUDE OIL AND DB COMMODITY INDEX

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES HOLD THEIR GAINS... The first three charts below show the major stock indexes holding onto their November gains. All three remain above their July highs which should now provide support on any pullbacks. [Broken overhead resistance becomes new support. That's why the red horizontal trendlines...

READ MORE

MEMBERS ONLY

ECONOMICALLY-SENSITIVE STOCKS CONTINUE TO SHOW MARKET LEADERSHIP -- WHILE DEFENSIVE STOCKS FALL BEHIND -- MATERIALS ARE BEING LED HIGHER BY COPPER SHARES -- WHILE GOLD MINERS ARE LOSING GROUND -- DOW JONES NONFERROUS METALS INDEX TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEEKLY SECTOR RANKINGS...Chart 1 lists the eleven stock market sectors in order of relative strength for the past week. There aren't any surprises there; but there is more confirmation of recent rotations within the stock market showing more confidence in the market and the global economy. Financials...

READ MORE

MEMBERS ONLY

COPPER AND GOLD HAVE BEEN TRENDING IN OPPOSITE DIRECTIONS FOR A YEAR -- BUT THEIR DIRECTION MAY BE CHANGING -- THE COPPER/GOLD RATIO IS BOUNCING OFF LONG-TERM SUPPORT -- RISING BOND YIELDS ALSO FAVOR COPPER OVER GOLD -- THAT'S A SIGN OF GROWING CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER AND GOLD HAVE BEEN TRENDING IN OPPOSITE DIRECTIONS... A lot of recent intermarket rotations in global markets have started to show more optimism; along with a willingness to favor economically-sensitive and riskier assets at the expense of safe haven defensive ones. That has included the buying of stocks and...

READ MORE