MEMBERS ONLY

SHARP REBOUND IN BOND YIELDS CONTRIBUTES TO ROTATION INTO VALUE STOCKS -- WITH SMALL CAP VALUE ISHARES IN THE LEAD -- STRONGER FINANCIALS AND INDUSTRIALS ARE MAIN REASONS WHY

by John Murphy,

Chief Technical Analyst, StockCharts.com

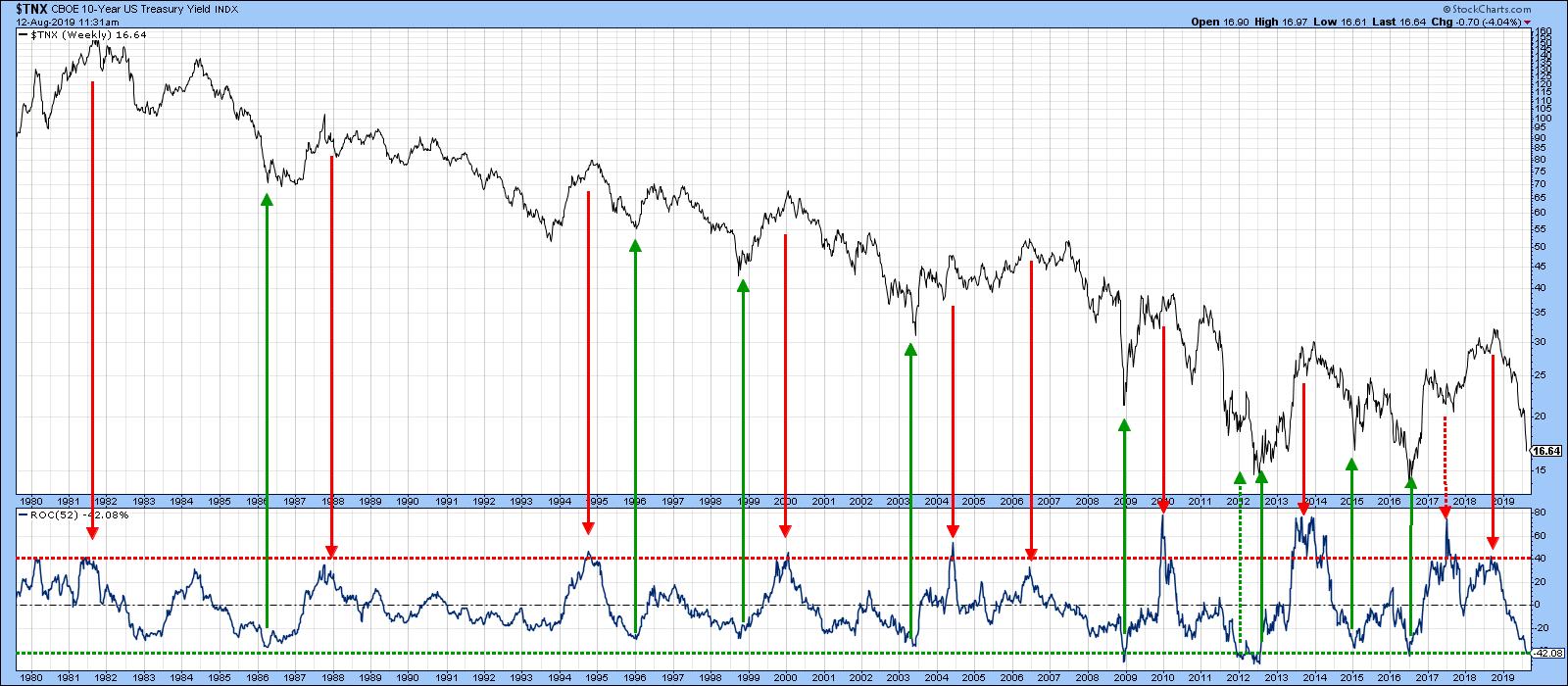

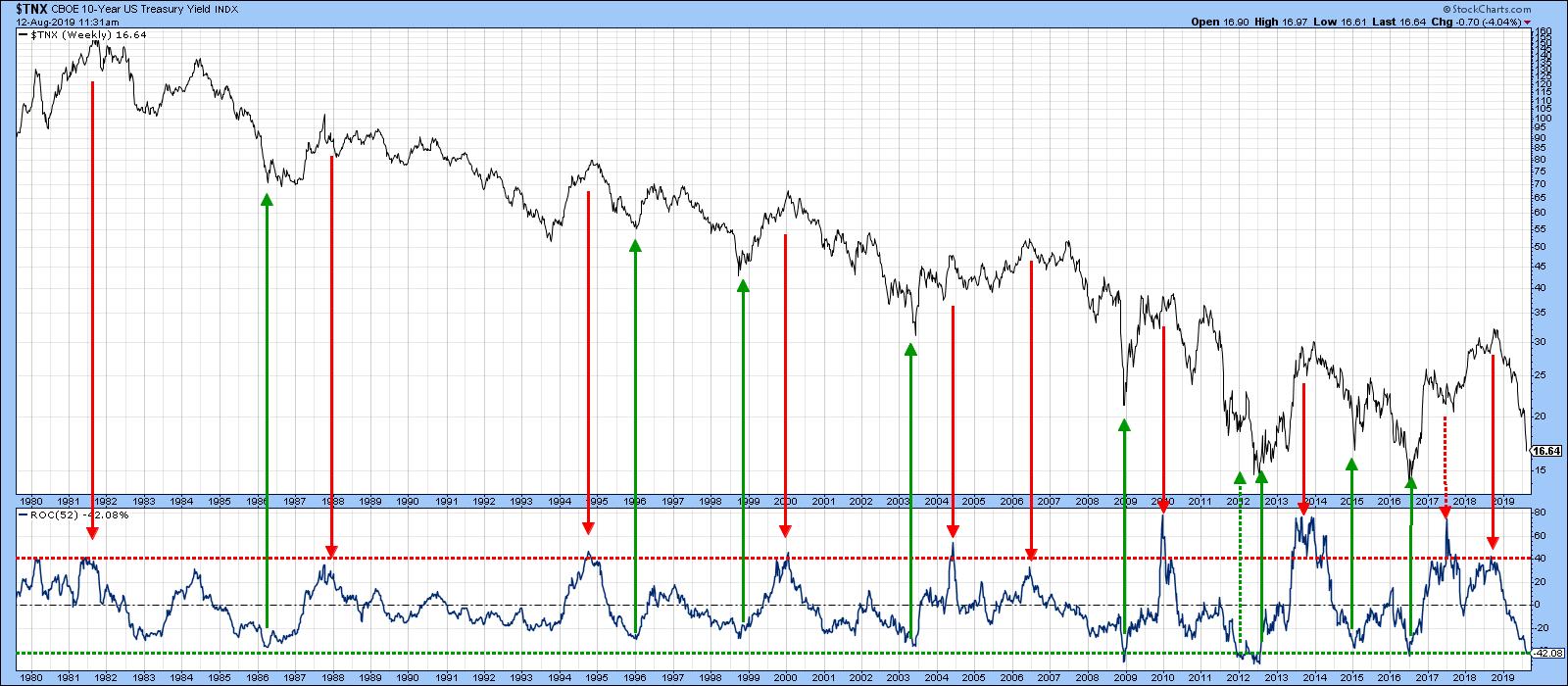

TEN-YEAR TREASURY YIELD BOUNCES OFF MAJOR CHART SUPPORT... My Wednesday message showed the 10-Year Treasury yield bouncing off major chart support at its 2012 and 2016 lows and in a very oversold condition. That made a rebound in bond yields more likely. The weekly bars in Chart 1 show the...

READ MORE

MEMBERS ONLY

STOCK RALLY RESUMES AS MAJOR STOCK INDEXES DRAW CLOSER TO SUMMER HIGH -- BOEING, APPLE, AND CATERPILLAR LEAD DOW HIGHER -- THE INDUSTRIAL SPDR IS NEARING A MAJOR UPSIDE BREAKOUT TO RECORD HIGHS -- SMALL CAPS WERE THE DAY'S BIGGEST GAINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN MORE GROUND... The stock upturn that started last week when major stock indexes cleared their August trading range and 50-day averages gained momentum today. All three major indexes hit the highest level in more than a month. Chart 1 shows the Dow Industrials gaining 227 points (+0....

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD IS BOUNCING OFF MAJOR SUPPORT -- BOND/STOCK RATIO ALSO RUNS INTO RESISTANCE AND HAS STARTED TO WEAKEN -- THAT WOULD FAVOR STOCKS OVER BONDS -- RECENT SECTOR ROTATIONS SHOW A SHIFT TO MORE ECONOMICALLY-SENSITIVE STOCK GROUPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD IS TESTING MAJOR SUPPORT...Bond yields have been falling all over the world since the end of last year. Several foreign government bond yields have fallen deeply into negative territory and have helped pull Treasury yields lower. The 30-Year Treasury Yield recently fell to a new record...

READ MORE

MEMBERS ONLY

TRANSPORTATION STOCKS MOVE INTO HIGHER GEAR -- DOW TRANSPORTS NEAR TEST OF MAJOR RESISTANCE LINE -- CH ROBINSON AND JB HUNT ARE TRUCK LEADERS -- KIRBY CORP IS MARINE TRANSPORTATION LEADER -- UTILITIES AND REITS LOSE GROUND ON RISING BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS NEAR TEST OF OVERHEAD RESISTANCE...After lagging behind the rest of the market for most of the past year, transportation stocks are starting to show new life. Chart 1 shows the Dow Jones Transportation Average surging more than 1% today to the highest level in more than a...

READ MORE

MEMBERS ONLY

ENERGY AND FINANCIALS JUMP ON FLAT MARKET DAY -- RISING OIL PRICE LIFTS OIL SERVICE STOCKS -- HIGHER BOND YIELDS PUSH BANK STOCKS SHARPLY HIGHER -- STRONGER FINANCIAL STOCKS HELP BOOST SMALL CAPS -- RUSSELL 2000 INDEX CLOSES ABOVE ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING OIL PRICE BOOSTS ENERGY STOCKS...A jump in crude oil helped make energy the strongest sector on a generally flat market day. Chart 1 shows the Energy SPDR (XLE) climbing 2% to the highest level in a month (on rising volume), and showing upside leadership for the the first...

READ MORE

MEMBERS ONLY

Commodities May Be Down, But Are They Out?

by Martin Pring,

President, Pring Research

* Long-Term Commodity Technicals are Finely Balanced

* Gold Leads Commodities

* Commodities Rise and Fall with Confidence

* Short-Term Technicals are Encouraging

* Platinum Breaking Out

Commodities have been losing ground recently, but the latest data suggest that they may be in the process of turning around. If so, that could be important for...

READ MORE

MEMBERS ONLY

STOCK INDEXES BREAK OUT OF AUGUST TRADING RANGE TO THE UPSIDE -- LED BY FINANCIALS, TECH, AND INDUSTRIALS -- RISING BOND YIELDS ARE BOOSTING BANKS AND FINANCIALS WHILE BOND PROXIES WEAKEN -- SEMICONDUCTORS LEAD TECH SECTOR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ACHIEVE UPSIDE BREAKOUTS...A rally in global stocks has taken a turn for the better with major stock indexes clearing some upside resistance barriers. The three major stock indexes shown below have all cleared their August highs and 50-day moving averages. At the same time, their 14-day...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-09-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for September is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Four More Short-Term Indicators Turn Bullish for Equities

by Martin Pring,

President, Pring Research

* Breadth Acting Positively

* Four Short-Term Indicators Turn Bullish

* Stocks Could Be Breaking Against Gold

The mood on Wall Street is turning ever more cautious as the economic numbers continue to soften. We need to remember, though, that the stock market is a forward-looking indicator, as it looks through the foggy...

READ MORE

MEMBERS ONLY

STOCKS START SEPTEMBER ON A WEAK NOTE -- MAJOR STOCK INDEXES BACK OFF FROM OVERHEAD RESISTANCE -- INDUSTRIALS, FINANCIALS, AND TECH ARE WEAKEST SECTORS -- UTILITIES AND REITS HIT NEW HIGHS -- TEN-YEAR BOND YIELD DROPS TO THREE-YEAR LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES BACK OFF FROM OVERHEAD RESISTANCE...Stocks are only halfway through one of the year's weakest seasonal stretches between August and September. And September is usually the weaker of the two. And they're starting the month on a weak note. Another round of tariffs...

READ MORE

MEMBERS ONLY

STOCKS CONTINUE TO STRENGTHEN AS SUPPORT LEVELS HOLD -- THE DOW SURVIVES TEST OF 200-DAY AVERAGE -- AS DO SEVERAL SECTOR SPDRS -- TRANSPORTATION REBOUND HELPS LIFT XLI -- SMALL CAP REBOUND IS ALSO HELPING SUPPORT RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW HOLDS ITS RED LINE...A lot of underlying support levels have held this week, and stocks are now approaching overhead resistance.Tuesday's message showed the Dow Industrials testing its 200-day moving average for the third time since the start of August. Sometimes the third time is...

READ MORE

MEMBERS ONLY

WEAKER GROUPS ARE TESTING IMPORTANT SUPPORT LEVELS -- THAT INCLUDES SMALL CAPS AND TRANSPORTS WHICH ARE TESTING THEIR SPRING LOWS -- AND FINANCIALS -- HOW THEY HANDLE THAT TEST OF SUPPORT COULD EFFECT MARKET DIRECTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALLER STOCKS TEST IMPORTANT SUPPORT LEVEL...Yesterday's message showed the Dow Industrials and a handful of sector SPDRS testing potential support at their 200-day moving averages. Today's message will show three stock groups that are testing even more important support along their spring lows. Starting with...

READ MORE

MEMBERS ONLY

When The Crowd Screams Recession, Technicians Should Prepare For A Bull Market

by Martin Pring,

President, Pring Research

* Support Holds in an Oversold Market

* Most Sectors Still Experiencing Rising Peaks and Troughs

Last week, I pointed out that the stock market faced a challenge at its recent lows. This was because I saw that a breach of the solid red trend lines in Charts 1 and 2 would...

READ MORE

MEMBERS ONLY

A LOT OF 200-DAY MOVING AVERAGES ARE BEING TESTED -- STARTING WITH THE DOW -- AND SOME SECTOR SPDRS -- AND EAFE ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STARTING WITH THE DOW...Chart 1 shows the Dow Industrials finding support at its 200-day moving average for the third time this month. That's an encouraging sign. In addition, its daily MACD lines are close to turning positive (lower box); while its 14-day RSI line (top box) is...

READ MORE

MEMBERS ONLY

If It's Trick Or Treat In The Equity Market, I'll Take The Treat

by Martin Pring,

President, Pring Research

* Trick or Treat for Global Equities?

* Several Reliable US Short-Term Indicators Turning Bullish

During my many decades in this business, I have never heard of a recession so well-advertised as the one we are witnessing currently. It's a fact that financial market events that are widely expected rarely...

READ MORE

MEMBERS ONLY

The Truth About the Yield Curve, The Economy and The Stock Market

by Martin Pring,

President, Pring Research

* Yield Curve Inversion and Recessions

* Using the Economy to Forecast the Economy

* What Happens to the Stock Market after an Initial Inversion?

* Yield Curve Conclusion

* Catch a Falling Knife, Anyone?

By now, everyone and his dog is aware that the yield curve has inverted. An event such as this is...

READ MORE

MEMBERS ONLY

COMMODITY DECLINE SHOWS DEFLATIONARY TREND -- PREVIOUS BOND YIELD INVERSIONS SAW RISING COMMODITIES -- THIS TIME IS DIFFERENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DEFLATIONARY COMMODITY TREND... My earlier message today showed that bond yields and stocks have been trending in the same direction for most of the last two decades. It further explained that deflationary tendencies around the start of the new century changed the bond-stock relationship that existed prior to that. Plunging...

READ MORE

MEMBERS ONLY

BOND YIELDS AND STOCKS TRENDED IN OPPOSITE DIRECTIONS PRIOR TO 2000 -- BUT THEY'VE BEEN TRENDING IN THE SAME DIRECTION SINCE THEN ... THE EMERGENCE OF DEFLATION AROUND THE TURN OF THE CENTURY CHANGED THE BOND-STOCK RELATIONSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS AND STOCKS BEFORE 2000...A lot of attention is being given to what falling bond yields mean for the U.S. economy and stock market. I've written several books on intermarket analysis that explain the impact that bond yields have on the stock market (and eventually...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS UNDER HEAVY SELLING PRESSURE -- TEN-YEAR YIELD FALLS BELOW 2-YEAR -- RETEST OF 200-DAY AVERAGES APPEARS LIKELY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE HEAVY STOCK SELLING...Global stocks are under heavy selling pressure again today. Bond yields continue to drop around the world. The ten-year Treasury yield dropped below the 2-year yield for the first time since 2007 which has created a second inversion of the yield curve. The 10-year yield fell...

READ MORE

MEMBERS ONLY

Thinking the Unthinkable - Bonds are Peaking

by Martin Pring,

President, Pring Research

* Long-Term Bond Oscillators Almost Fully Stretched

* Key Reversal Bars and Other Evidence Suggests Bonds are Exhausted on the Upside

* The Trend is Your Friend.... Until It Isn't

About a month ago, I wrote an article entitled "Bond Yields May Not Be Headed Lower After All". In...

READ MORE

MEMBERS ONLY

STOCKS END MODESTLY LOWER AFTER VOLATILE WEEK -- REITS AND UTILITIES WERE THE WEEK'S STRONGEST SECTORS -- ENERGY AND FINANCIALS THE WEAKEST -- MATERIALS ARE BEING LED HIGHER BY GOLD MINERS -- WHILE COPPER MINERS REMAIN WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS END MODESTLY LOWER AS BOND YIELDS WEAKEN...After a week of wild swings, stocks ended only modestly lower on the week. The devaluation of the Chinese yuan to the lowest level in more than a decade set the tone for a volatile week in financial markets. The 10-year Treasury...

READ MORE

MEMBERS ONLY

TRANSPORTS CONTINUE TO LAG BEHIND THE DOW INDUSTRIALS WHICH IS A DOW THEORY WARNING -- THE FACT THAT UTILITIES ARE THE STRONGEST OF THE THREE DOW AVERAGES MAY BE ANOTHER WARNING

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRADITIONAL DOW THEORY DIVERGENCE...I was asked during an interview on Stockcharts TV yesterday whether I was concerned about the Dow Theory divergence between the Dow Industrials and the Dow Transports. I responded that I was. But with an additional twist to that theory which is also giving a warning...

READ MORE

MEMBERS ONLY

STOCKS BUILD ON YESTERDAY'S UPSIDE INTRA-DAY REVERSAL -- THE DOW CONTINUES REBOUND OFF 200-DAY AVERAGE -- SO DO INDUSTRIALS AND FINANCIALS -- BANKS BOUNCE OFF SUPPORT -- SO DO SMALL CAPS AND TRANSPORTS -- VIX FALLS BACK BELOW 20 LEVEL

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CONTINUE REBOUND...Yesterday's impressive intra-day rebound in stocks is continuing into today's trading.Chart 1 shows the Dow Industrials surviving a test of its 200-day moving average yesterday; and building on that today. That's an encouraging sign. But it still needs to...

READ MORE

MEMBERS ONLY

Seven Lucky Indicators Starting To Look Bullish

by Martin Pring,

President, Pring Research

* Three Short-Term Oscillators Positioned for a Rally

* Two Psychological Indicators Looking Bullish

* Just When You Thought Bonds Would Go Up Forever

Usually, it takes a long time for some of the indicators to reach what we might call "deep fear" levels, points from which important rallies can be...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS TEST THEIR 200-DAY LINE -- BANKS FALL BELOW THEIR RED LINE BUT ARE TESTING SUPPORT -- SMALL CAPS AND TRANSPORTS DO THE SAME -- VIX INDEX IS TESTING ITS MAY HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TESTS 200-DAY AVERAGE...Chart 1 shows the Dow Industrials testing their 200-day moving average (red line). The 14-day RSI line has dipped below 30 signalling a short-term oversold condition. That's the first important test of support for the Dow.

BANKS HAVE A BAD DAY...Falling bond yields...

READ MORE

MEMBERS ONLY

STOCKS DROP EVEN FURTHER AS BOND YIELDS PLUNGE -- THREE MORE CENTRAL BANKS LOWER RATES -- MONEY CONTINUES TO FLOW INTO SAFE HAVEN GOLD AND JAPANESE YEN -- U.S. STOCKS LOOK MORE VULNERABLE -- 200-DAY MOVING AVERAGES ARE BEING THREATENED

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 STILL LOOKS VULNERABLE...U.S. stocks are under pressure again today. Another plunge in global bond yields is undermining confidence in the global economy. Three more foreign central banks lowered rates today in New Zealand, India, and Thailand. That's feeding the "race to...

READ MORE

MEMBERS ONLY

STOCK MARKET NEEDS BROADER SECTOR PARTICIPATION -- SIX MARKET SECTORS HAVE YET TO HIT A NEW HIGH-- THREE THAT HAVE ARE DEFENSIVE IN NATURE -- ENERGY IS THE YEAR'S WEAKEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR BREADTH ISN'T BROAD ENOUGH...One of the ways to measure the strength of the stock market's uptrend is to see how many of its eleven sectors have hit new highs with the major stock indexes. In a strong uptrend, most market sectors should be confirming...

READ MORE

MEMBERS ONLY

CHINESE YUAN TUMBLES TO LOWEST LEVEL SINCE 2008 -- STOCKS DROP AROUND THE WORLD -- MAJOR U.S. STOCK INDEXES MAY BE HEADED TOWARD THEIR 200-DAY AVERAGES -- EMERGING MARKETS ISHARES ARE THREATENING THEIR MAY REACTION LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINA DEVALUES YUAN IN RESPONSE TO NEW TARIFFS...It didn't take long for China to retaliate against last Thursday's announcement of a new U.S. tariffs on Chinese imports starting on September 1. Those tariffs are a tax on Chinese imports which raises their price. Today&...

READ MORE

MEMBERS ONLY

Is It A Short-Term Correction or The Start of a Bear Market?

by Martin Pring,

President, Pring Research

* Two Indicators That are Not Yet Oversold

* Several Confidence Ratios are at the Brink

* Global Equities Probably Need to Test Their 200-day MA

In the third week of July, I wrote an article entitled "Is It Time For A Contra Trend Correction?" (currently unavailable). Initially, the market thumbed...

READ MORE

MEMBERS ONLY

S&P 500 STILL NEAR RECORD TERRITORY BUT LOOKING VULNERABLE -- WEEKLY INDICATORS SHOW LOSS OF UPSIDE MOMENTUM -- ALL COUNTRY WORLD INDEX IS MEETING RESISTANCE AT ITS EARLY 2018 PEAK -- WHILE FOREIGN STOCK INDEX IS STALLING AT ITS 62% RETRACEMENT LEVEL

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 UPTREND MAY BE TESTED...Global weakness has become a major theme for financial markets. Even the Fed's so-called "data dependence" relies more on developments in foreign economies and markets. That includes falling foreign interest rates which are pulling bond yields down in...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-08-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for August is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

FALLING COMMODITIES ARE HURTING THE AUSSIE AND CANADIAN DOLLARS -- THAT'S HELPING BOOST THE DOLLAR -- BOND YIELDS AND COMMODITIES ARE LINKED -- AND ARE FALLING TOGETHER -- THAT WARNS OF GLOBAL ECONOMIC WEAKNESS WITH CONTINUED LOW INFLATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUSSIE AND CANADIAN DOLLARS ARE TIED TO COMMODITIES...Two major events this past week have highlighted the need to view things from a global perspective. Mr. Powell on Wednesday emphasized that the Fed was lowering its short-term rate to partially offset weakness in foreign markets. President Trump yesterday announced new...

READ MORE

MEMBERS ONLY

BOND YIELDS PLUNGE TO NEW LOWS -- STOCK RALLY FADES ON CHINA TARIFF THREAT -- DOLLAR WEAKENS AS YEN AND GOLD REBOUND -- CRUDE OIL TUMBLES 7% -- FALLING YIELDS HURT FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS PLUNGE...A threat of new tariffs on China starting September 1 is contributing to this afternoon's plunge in bond yields. And lower stock prices. Chart 1 shows the 10-Year Treasury yield plunging 13 basis points to the lowest level since 2016. Even more surprising is a...

READ MORE

MEMBERS ONLY

A RISING DOLLAR LOWERS U.S. INFLATION BY PUSHING COMMODITY PRICES LOWER -- FALLING EUROPEAN CURRENCIES ARE PUSHING THE DOLLAR HIGHER -- FALLING BOND YIELDS IN THE UK AND EUROZONE ARE PULLING TREASURY YIELDS DOWN -- 10-YEAR BOND YIELD DROPS BELOW 2.00%

by John Murphy,

Chief Technical Analyst, StockCharts.com

A RISING DOLLAR IS KEEPING COMMODITY INFLATION DOWN...One of the reasons given by the Fed for lowering rates yesterday was to boost inflation. But the dollar hit the highest level in a year right after the rate cut. That's because foreign central bankers in Asia and Europe...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF AFTER QUARTER POINT RATE CUT -- DOLLAR INDEX HITS NEW HIGH FOR THE YEAR WHICH PUSHED GOLD LOWER -- A RISING DOLLAR MAKES IT HARDER FOR THE FED TO BOOST INFLATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS WEAKEN...Stocks sold off on today's Fed accouncement. Or, more accurately, during the press conference afterwards based on some confusing responses from Jerome Powell regarding the reasons for today's rate cut, or whether more cuts are coming. The first three charts show three major stock...

READ MORE

MEMBERS ONLY

Tricky Dollar Is Still In A Bull Market

by Martin Pring,

President, Pring Research

* Defining a Bull or Bear Market Using a Two-Way Test

* Applying the Test to the Dollar

* The Euro and the Pound

Defining a Bull or Bear Market Using a Two-Way Test

Technical Analysis is an art form, one in which we put together several reasonably reliable indicators and form a...

READ MORE

MEMBERS ONLY

NASDAQ AND S&P 500 HIT NEW RECORDS -- SMALLER STOCKS AND TRANSPORTS HAVE A STRONG WEEK -- COMMUNICATIONS WERE WEEK'S TOP SECTOR -- BANKS LED FINANCIALS HIGHER -- KBW BANK INDEX MAY BE NEARING UPSIDE BREAKOUT -- EURO AND BRITISH POUND TOUCH TWO-YEAR LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND S&P 500 HIT NEW RECORDS... SMALLER STOCKS AND TRANSPORTS STRENGTHEN... Stocks ended the week on a strong note. Charts 1 and 2 show the Nasdaq Composite Index and the S&P 500 closing at record highs on Friday. A report showing 2.1% GDP growth...

READ MORE

MEMBERS ONLY

THE MSCI ALL-WORLD STOCK INDEX IS TESTING ITS EARLY 2018 HIGH -- ITS FOREIGN STOCK INDEX IS LAGGING WAY BEHIND -- AND IS TESTING RESISTANCE OF ITS OWN -- GLOBAL CENTRAL BANKERS ARE IN A NEW RACE TO PUSH HISTORICALLY LOW RATES EVEN LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALL COUNTRY WORLD INDEX TESTS PREVIOUS HIGH...Global stock indexes are once again testing overhead resistance barriers. The weekly bars in Chart 1 show the MSCI All Country World Index iShares (ACWI) in the process of testing its previous high set at the start of 2018 (see red circle). Any...

READ MORE

MEMBERS ONLY

UPS IS LEADING TRANSPORTS HIGHER TODAY -- SO ARE CH ROBINSON AND AMERICAN AIRLINES -- SMALL AND MIDSIZE STOCKS ARE ATTRACTING NEW BUYING -- SEMICONDUCTOR ISHARES HIT A NEW RECORD -- SO ARE TEXAS INSTRUMENTS AND LAM RESEARCH

by John Murphy,

Chief Technical Analyst, StockCharts.com

UPS GIVES BIG BOOST TO TRANSPORTS...The recent upturn in transportation stocks is starting to gain more traction. Chart 1 shows the Dow Transports rebounding nicely from last week's late selloff; that's helping to restore the bullish upturn that occurred at the start of last week....

READ MORE

MEMBERS ONLY

BANKS HAVE A STRONG DAY -- KBW BANK INDEX REACHES THREE MONTH HIGH -- REGIONAL BANK LEADERS ARE FIFTH THIRD, KEYCORP, AND REGIONS FINANCIAL -- JPM NEARS A NEW RECORD -- GOLDMAN SACHS RESUMES UPTREND -- BAC REACHES THREE MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANK INDEX TURNS UP...Stocks are having another strong day, with sector leadership coming from materials (led by commodity chemicals) and industrials (with help from airlines). Semiconductors continue to lead technology higher. Financials are also having a strong day, led by banks. We're going to focus on banks...

READ MORE