MEMBERS ONLY

Nail Biting Time For Equities, Green Shoots For Agricultural Commodities

by Martin Pring,

President, Pring Research

* Top or Consolidation for Equities?

* Agricultural Commodities Perking Up Following a Severe Sell-Off

* Grains Fully Supporting Price Action in the DBA

Top or Consolidation for Equities?

The S&P, like the other market averages, has been in a trading range since March. We will have to see how it...

READ MORE

MEMBERS ONLY

WEEKLY SECTOR RANKINGS SHOW A DEFENSIVE MARKET -- SAFE HAVENS WERE MARKET LEADERS -- WHILE TRADE SENSITIVE GROUPS FELL THE MOST -- FINANCIALS WERE THE WEEK'S WORST PERFORMERS -- FALLING BOND YIELDS HAVE HURT BANKS WHILE BOOSTING HOMEBUILDERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEEKLY SECTOR RANKINGS SHOW DEFENSIVE MARKET ... The table in Chart 1 plots the relative performance of the eleven market sectors for the week. And they show a generally defensive market. That can be seen by the fact that REITs, utilities, and consumer staples are the three top sectors for the...

READ MORE

MEMBERS ONLY

AMAZON.COM AND LENNAR LEAD CONSUMER DISCRETIONARY SECTOR HIGHER -- ADOBE AND CISCO LEAD TECHNOLOGY -- DRUG STOCKS BOOST HEALTHCARE -- MERCK IS LEADING -- NASDAQ AND S&P 500 REGAIN 50-DAY LINES AS ALL ELEVEN SECTORS GAIN GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR REGAINS 50-DAY LINE... Stocks are having another strong day today with all eleven market sectors in the red. Cyclical stocks are helping lead it higher. Chart 1 shows the Consumer Discretionary SPDR (XLY) trading back over its 50-day average (blue line). Two of its biggest gainers are...

READ MORE

MEMBERS ONLY

SEMICONDUCTOR ISHARES BOUNCE OFF CHART SUPPORT -- WITH APPLIED MATERIALS AND LAM RESEARCH IN THE LEAD -- INTERNET STOCKS LEAD COMMUNICATION SECTOR HIGHER -- FACEBOOK AND GOOGLE ARE HOLDING MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR ISHARES BOUNCE OFF CHART SUPPORT... Technology stocks are helping lead today's stock rebound. With help from semiconductors. Chart 1 shows the PHLX Semiconductor iShares (SOXX) bouncing off potential chart support along its August/September highs near 190. Its 9-day RSI line (upper box) is also bouncing from...

READ MORE

MEMBERS ONLY

Gold Breaks Out Against Stocks; What Does That Mean, Apart From The Obvious?

by Martin Pring,

President, Pring Research

* Gold Breaks Out against Stocks

* Gold Itself is about to Test Mega-Resistance

* When Gold Beats Stocks, that’s usually Bullish for Gold - and Bearish for Stocks

* Gold Leads Commodities

Gold Breaks Out against Stocks

Monday saw the gold/stock ratio break decisively above its 2019 downtrend line. The line...

READ MORE

MEMBERS ONLY

CHINESE RETALIATORY TARIFFS SEND GLOBAL STOCKS LOWER AGAIN -- TRADE-SENSITIVE ASSETS LEAD TODAY'S RETREAT WHILE SAFE HAVENS CONTINUE TO GAIN -- ARE DRUG STOCKS THAT DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK SELLING CONTINUES ... Stock prices fell sharply again today and are continuing the trade-inspired selling that started last week. Retaliatory tariffs announced by China appear to be the main catalyst pushing global stocks lower. As a result, markets with the most exposure to trade tensions and Chinese tariffs are falling...

READ MORE

MEMBERS ONLY

TRADE TENSIONS LEAD TO BAD WEEK FOR GLOBAL STOCKS -- CHINESE STOCKS LEAD GLOBAL RETREAT -- TRADE SENSITIVE SECTORS DROP THE MOST WHILE SAFE HAVENS LEAD -- A LATE FRIDAY REBOUND KEPT STOCK INDEXES ABOVE MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCKS LEAD WEEKLY RETREAT ... An escalation in trade tensions between the U.S. and China pushed global stocks lower this past week. The S&P 500 lost -2.2% which was its biggest weekly drop this year. Canadian and U.S. stocks are meeting resistance at their 2018...

READ MORE

MEMBERS ONLY

HEALTHCARE IS ONE OF THE DAY'S WEAKEST SECTORS AND NOT ACTING LIKE A SAFE HAVEN -- BIOTECHS ARE LEADNG THEM LOWER -- STAPLES, UTILITIES, AND REITS ARE THE REAL HAVENS -- SECTOR SUMMARY TABLE SHOWS A MORE DEFENSIVE SECTOR ALIGNMENT AS STOCK PRICES WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SECTOR DOESN'T LOOK VERY DEFENSIVE... During a guest appearance yesterday on StockChartsTV with Erin Swenlin and Tom Bowley, one of our viewers asked if healthcare was considered a defensive sector, and was it a good sector to hold in the current environment. My response was that some...

READ MORE

MEMBERS ONLY

The China Trade Talks And The Technical Position Of The Equity Market

by Martin Pring,

President, Pring Research

* Long-Term Divergences

* Some Short-Term Technical Sell Signals Triggered in the Last Few Days

* Prices May Be Falling, But Bond Spreads (Confidence) are Holding in There

Long-Term Divergences

My first reaction to this week’s stock market tantrum (in response to the China trade talks) was to brush it off as...

READ MORE

MEMBERS ONLY

WORLD STOCK INDEXES ARE TESTING OVERHEAD RESISTANCE AND LOOKING OVER-EXTENDED -- THAT MAY EXPLAIN THEIR BAD REACTION TO TRADE TENSIONS -- WORLD STOCKS HAVE TO CLEAR RESISTANCE LEVELS TO RESUME THEIR 2019 UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRADE TENSIONS RATTLE OVEREXTENDED GLOBAL STOCKS ... Renewed trade tensions between the U.S. and China rattled global stocks this week. Stock prices are rising and falling with each news report. After falling sharply yesterday (Tuesday), stocks are rebounding today on more optimistic news reports about the meeting between U.S....

READ MORE

MEMBERS ONLY

STOCK PULLBACK CONTINUES -- ALL MAJOR STOCK INDEXES ARE BACK BELOW LAST YEAR'S PEAK -- MOVING AVERAGE LINES ARE BEING TESTED -- ENERGY, MATERIALS, AND INDUSTRIALS ARE AMONG BIGGEST SECTOR LOSERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES LOSE MORE GROUND ... The stock market pullback that started yesterday is continuing again today. And all three major stock indexes appear headed for a test of underlying moving average lines. First and foremost, it's where this pullback is starting from that's most concerning....

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS STOCKS -- TRANSPORTS CONTINUE TO SHOW NEW LEADERSHIP -- S&P 500 NEARS ANOTHER RECORD -- INSURANCE STOCKS LEAD FINANCIALS HIGHER -- METLIFE NEARS MAJOR UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TRIES TO REGAIN RECORD HIGH ... A surprisingly strong jobs report this morning has given stocks a big boost today. All major indexes are having a strong day with the Nasdaq and small caps in the lead (more on that shortly). Transports are also having an especially...

READ MORE

MEMBERS ONLY

Commodities: Down Now, Up Later?

by Martin Pring,

President, Pring Research

* Two Key Commodity Benchmarks Violated Trend Lines

* Commodity Sector ETFs Breaking as Well

* Longer-Term Picture May be Reversing

In early April, I tacked on a couple of commodity charts at the end of an article that commented on global equities breaking out. There, I noticed that some commodity indexes were...

READ MORE

MEMBERS ONLY

WEAK INFLATION ISN'T TRANSITORY -- COMMODITY PRICES HAVE BEEN FALLING FOR A DECADE -- A RISING DOLLAR IS ONE REASON WHY -- STOCKS REACT BADLY TO LESS DOVISH FED -- RISING BOND YIELDS BOOST THE DOLLAR -- CRUDE OIL LEADS COMMODITIES LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES HAVE BEEN FALLING FOR A DECADE ... Yesterday's message suggested that weaker commodity prices should provide some comfort to the Fed since subdued inflation would allow the Fed to keep rates on hold and prolong the decade-long economic recovery. It turns out the Fed is more worried than...

READ MORE

MEMBERS ONLY

Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

Here is the link to this month's Market Roundup video. There are a significant number of long-term charts that are starting to turn higher suggesting, that the brief economic slowdown in late 2018 is behind us and we are starting the next major leg higher. Market Roundup with...

READ MORE

MEMBERS ONLY

RECENT WEAKNESS IN COMMODITY MARKETS MAY BE GOOD NEWS FOR THE FED -- THE BLOOMBERG COMMODITY INDEX HAS WEAKENED ALONG WITH MOST COMMODITY GROUPS -- THE UPTREND IN OIL MAY ALSO BE WEAKENING -- ENERGY SPDR HAS ALREADY FALLEN BELOW ITS MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITY PRICES WEAKEN ... One of the factors the Fed is now considering to help formulate its monetary policy for the rest of the year is the question of inflation. Rising inflation puts pressure on the Fed to raise rates. Flat or falling inflation allows the Fed to stick with its...

READ MORE

MEMBERS ONLY

SMALL CAPS MAY BE GETTING A LIFT FROM RISING FINANCIAL SHARES -- FINANCIALS ARE THE BIGGEST SECTOR IN THE RUSSELL 2000 -- AND HAVE BEEN THIS MONTH'S STRONGEST SECTOR -- WHILE HEALTHCARE WEAKNESS MAY BE HOLDING SMALL CAPS BACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

APRIL REBOUND IN FINANCIALS IS GIVING A BIG BOOST TO SMALL CAPS... I've been writing about the recent upturn in financial stocks and, to a lesser extent, small cap stocks. I also suggested that a stronger dollar might be helping smaller stocks. That's because a rising...

READ MORE

MEMBERS ONLY

MMM AND UPS WEIGH INDUSTRIALS DOWN -- AMERICAN EXPRESS BREAKS OUT TO NEW RECORD -- BANK INDEX TRIES TO CLEAR ITS 200-DAY LINE -- S&P 500 CONTINUES TO CHALLENGE ITS 2018 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR GAPS LOWER ... In a mixed market day, industrials are the weakest sector. Chart 1 shows the Industrial Sector SPDR (XLI) gapping lower today. That hasn't caused any serious chart damage with the XLI still trading well above its blue 50-day average. It is worth noting, however,...

READ MORE

MEMBERS ONLY

US Equities Break Out Against The Rest Of The World

by Martin Pring,

President, Pring Research

* The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

* SPY/EFA Breakout also Bullish for the Dollar

* The Euro, Swiss Franc and Yen

* China Bucks the Flow

The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

Yesterday’s all-time new high in the S&P was well documented by the media,...

READ MORE

MEMBERS ONLY

RUSSELL 2000 IS TRADING OVER ITS 200-DAY LINE -- A STRONGER DOLLAR MAY BE HELPING -- MAJOR U.S. STOCK INDEXES NEAR THEIR 2018 HIGHS -- CORPORATE BOND ISHARES ARE ALREADY IN NEW HIGH GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 TRADES ABOVE ITS 200-DAY AVERAGE... In the midst of a strong market day, small caps are showing a bigger percentage gain than large caps. Chart 1 shows the Russell 2000 Small Cap Index ($RUT) trading above its (red) 200-day moving average today. The RUT still needs to clear...

READ MORE

MEMBERS ONLY

RAILROAD STOCKS LEAD THE TRANSPORTS AND INDUSTRIAL SECTOR HIGHER -- WIDENING SPREAD BETWEEN 10-YEAR TREASURY AND GERMAN YIELD FAVORS THE DOLLAR -- A RISING DOLLAR IS HURTING GOLD MORE THAN COPPER -- A RISING COPPER/GOLD RATIO IS A SIGN OF CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RAILROAD STOCKS HAVE BECOME MARKET LEADERS... Two stock groups did better than the rest of the market this week. Transportation stocks had another strong week. As did the Industrial Sector SPDR (XLI) which was the week's strongest sector. Both have one group to thank for their strong performance....

READ MORE

MEMBERS ONLY

BANKS, ENERGY, AND SMALL CAPS TEST 200-DAY LINES -- DOLLAR HITS TWO-YEAR HIGH AS EURO WEAKENS -- THE RISING DOLLAR IS PUSHING GOLD MINERS LOWER -- WISDOM TREE EUROPE HEDGED EQUITY FUND COMPENSATES FOR WEAKER EURO

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS, ENERGY, AND SMALL CAPS STRUGGLE WITH THEIR 200-DAY LINES... Three stock groups are still struggling to clear their 200-day lines. Chart 1 shows the KBW Bank Index sitting just below its red line. Lower bond yields today may be holding it back. But the Financial Sector SPDR (XLF) has...

READ MORE

MEMBERS ONLY

Gold Starts To Break Down - But Is It For Real?

by Martin Pring,

President, Pring Research

* The Long-Term Picture Looks Positive

* Gold’s Tuesday Downside Breakout Could Be the Spoiler

* Platinum is Trying to Break Out Against Gold - Why That’s Important for the Economy

The Long-Term Picture Looks Positive

Over the last 6 years, it appears that the gold price has been trying to...

READ MORE

MEMBERS ONLY

ASSET MANAGERS LEAD FINANCIALS HIGHER -- LED BY BLACKROCK, INVESCO, AND T ROWE PRICE -- HEALTHCARE SPDR FALLS BELOW 200-DAY AVERAGE -- LED LOWER BY HEALTH CARE PROVIDERS -- HCA TUMBLES, WHILE CIGNA, AND HUMANA HIT 52-WEEK LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ASSET MANAGERS LEAD FINANCIALS HIGHER ... Financials are the day's strongest sector. Chart 1 shows the Financial Sector SPDR (XLF) trading today at the highest level since last October. The solid gray line is a relative strength ratio of the XLF divided by the S&P 500; and...

READ MORE

MEMBERS ONLY

BANKS LEAD FINANCIALS AND THE MARKET HIGHER -- FINANCIAL SPDR HITS NEW 2019 HIGH -- WHILE S&P BANK ISHARES CLEAR THEIR 200-DAY LINE -- BANK LEADERS INCLUDE JPM, BAC, AND PNC -- S&P 500 NEARS TEST OF LAST SEPTEMBER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS LEAD FINANCIALS HIGHER ... Strong earnings from three banks this morning have helped push that group sharply higher; and they're leading the financial sector and the market higher. Chart 1 shows the Financial Sector SPDR (XLF) gapping up to the highest level of the year (after regaining its...

READ MORE

MEMBERS ONLY

RUSSELL 2000 IS TRYING TO CLEAR ITS 200-DAY AVERAGE -- SO ARE AIRLINES AND ENERGY STOCKS -- BANKS ARE HOLDING FINANCIALS BACK -- WHILE MORTGAGE FINANCE STOCKS ARE LEADING THEM HIGHER -- MEXICO AND SOUTH KOREA ETFS CLEAR THEIR 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 SMALL CAP INDEX IS TRYING TO CLEAR ITS 200-DAY AVERAGE... Last Wednesday's message showed the S&P 400 Mid Cap Index clearing its 200-day average; and suggested that left only the small caps to join the market rally. That may be about to happen. Chart...

READ MORE

MEMBERS ONLY

Global Stocks and Bitcoin are Breaking to the Upside

by Martin Pring,

President, Pring Research

* Global Stocks Join Global A/D Line Above Key Trend Lines

* Bitcoin Looking Better After an 80% Drop

* Inflation vs. Deflation

Global Stocks Join Global A/D Line Above Key Trend Lines

Global stocks, represented in the form of the MSCI World Stock ETF (ACWI), peaked in January of last...

READ MORE

MEMBERS ONLY

RISING CHINESE STOCK MARKET IS BOOSTING INDUSTRIAL METALS AND STOCKS TIED TO THEM - THE GLOBAL METALS AND MINING PRODUCERS ISHARES HAVE TURNED UP -- RISING COMMODITY PRICES HELPED MAKE MATERIALS THE WEEK'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

POSITIVE IMPLICATIONS FROM A STRONGER CHINA... My Thursday message showed an index of foreign stocks turning higher, which relieved concerns that weaker foreign stocks could start to weigh on U.S. stocks (as they did near the end of last year). To the contrary, rising foreign stocks are now supporting...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS ARE NOW RISING -- CHINESE STOCKS HAVE RISEN TWICE AS FAST AS THE U.S. THIS YEAR -- THAT'S BOOSTING STOCKS IN ASIA AND AUSTRALIA -- ALONG WITH COPPER PRICES AND SEMICONDUCTORS -- EUROZONE STOCKS ARE ALSO LOOKING STRONGER

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCKS ARE RISING ... Much of the concerns over the past year have centered around weakness in foreign stocks, and whether that would eventually pull U.S. stocks lower. The general feeling seemed to be that sooner or later the discrepancy between strong U.S. stocks and weak foreign stocks...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES NEAR TEST OF 2018 HIGHS -- TRANSPORTS CLEAR THEIR 200-DAY AVERAGE -- DELTA AIR LINES TURNS UP -- THE TRANSPORTS ARE STARTING TO GAIN GROUND ON THE DOW INDUSTRIALS AND UTILITIES -- S&P 400 MID CAP INDEX CLEARS ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES HEADING TOWARD TEST OF LAST YEAR'S HIGH... Major stock indexes in the U.S. appear on track to test their all-time highs reached during the second half of 2018. Chart 1 shows the Nasdaq Composite Index trading today at the highest level since early...

READ MORE

MEMBERS ONLY

Are US Equities About to Break Out Against The Rest of The World?

by Martin Pring,

President, Pring Research

* S&P Relative Action Edging Through Resistance

* British Pound Going Wobbly Before Brexit?

* Mega Buy Signal Could be in Store for the Shanghai Composite

* Gold at a Momentum Downtrend Line as Well

S&P Relative Action Edging Through Resistance

We have all heard about the US economy being...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-04-01

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for April is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

STOCKS ARE ENDING WEEK AND QUARTER ON A FIRM NOTE -- ALL THREE MAJOR STOCK INDEXES HAVE KEPT THEIR 2019 UPTRENDS INTACT -- THE DOW TRANSPORTS MAY MAKE ANOTHER RUN AT THEIR 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES MAINTAIN THEIR 2019 UPTRENDS ... Major U.S. stock indexes appear on track to end the week and quarter with their 2019 uptrends intact. Chart 1 shows the Dow Industrials in a sideways trading pattern over the last month. This week's pullback bounced off its (blue)...

READ MORE

MEMBERS ONLY

DROP IN BOND YIELDS HERE AND IN GERMANY WEIGH ON STOCKS -- MAJOR STOCK INDEXES MAY RETEST THEIR 200-DAY AVERAGES -- THE BOND/STOCK RATIO IS RISING AGAIN WHICH SUGGESTS THAT INVESTORS ARE HEDGING THEIR BETS ON A STRONGER ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS FOLLOW BUNDS LOWER ... German 10-year bunds were sold below zero at today's auction which is keeping downside pressure on Treasury yields. The daily bars in Chart 1 show the 10-Year Treasury yield falling today to the lowest level since the end of 2017. That's...

READ MORE

MEMBERS ONLY

US Stocks Looking Vulnerable Again

by Martin Pring,

President, Pring Research

* Long-Term Picture Remains Finely Balanced

* Short-Term Indicators Still Showing Weakness

* Confidence is Starting to Erode Again

* Financials Break Down from a Broadening Wedge

Earlier in the month, I wrote about the Ides of March and the fact that the market looked overstretched, apparently in need of some mean reversal corrective...

READ MORE

MEMBERS ONLY

PLUNGE IN GLOBAL BOND YIELDS AND INVERTED YIELD CURVE PUSHES BOND PRICES HIGHER AND STOCKS LOWER -- FALLING BOND YIELDS REWARD UTILITIES WHILE HURTING BANKS -- WEAKNESS IN SMALL CAPS AND TRANSPORTS MAY BE WARNING OF MORE PROFIT-TAKING TO COME

by John Murphy,

Chief Technical Analyst, StockCharts.com

PLUNGE IN BOND YIELDS CAUSES YIELD CURVE TO INVERT ... Weak economic numbers from the eurozone and the U.S. on Friday pushed bond yields here and in Europe sharply lower and caused heavy profit-taking in global stocks. The 10-Year German bond yield fell into negative territory (below zero) for the...

READ MORE

MEMBERS ONLY

Deflation Sensitive Stocks Are At A New All-Time High

by Martin Pring,

President, Pring Research

* Deflation Index Leading the Market Higher

* Inflation/Deflation Ratio Starting to Break in a Deflationary Direction

* Several Deflation-Sensitive Industry Groups Looking Stronger

Deflation Index Leading the Market Higher

Last week, I wrote about the possibility of an upside price move in the bond market. So far, most areas remain below...

READ MORE

MEMBERS ONLY

TECH-DOMINATED NASDAQ LEADS MARKET HIGHER -- THE NASDAQ AND S&P 500 ARE CLEARING THEIR NOVEMBER HIGHS -- FALLING BOND YIELDS HAVE HELPED BOOST STOCK AND BOND PRICES -- HIGH YIELD AND INVESTMENT GRADE BONDS ARE OUTPACING TREASURIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND S&P 500 HAVE CLEARED THEIR NOVEMBER HIGH... Just a week after slipping below their 200-day averages, the Nasdaq Composite Index in Chart 1 and the S&P 500 in Chart 2 appear to be ending the week above their November highs. That's the...

READ MORE

MEMBERS ONLY

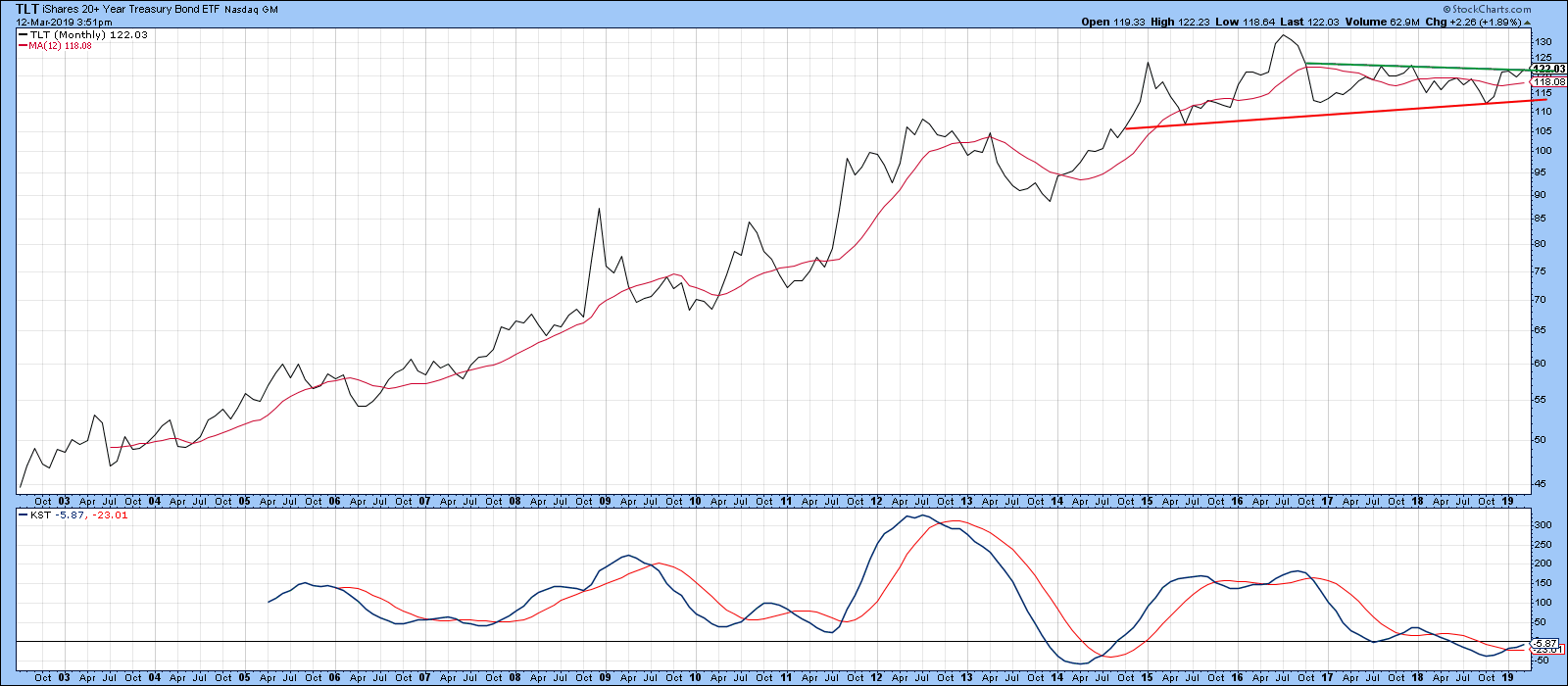

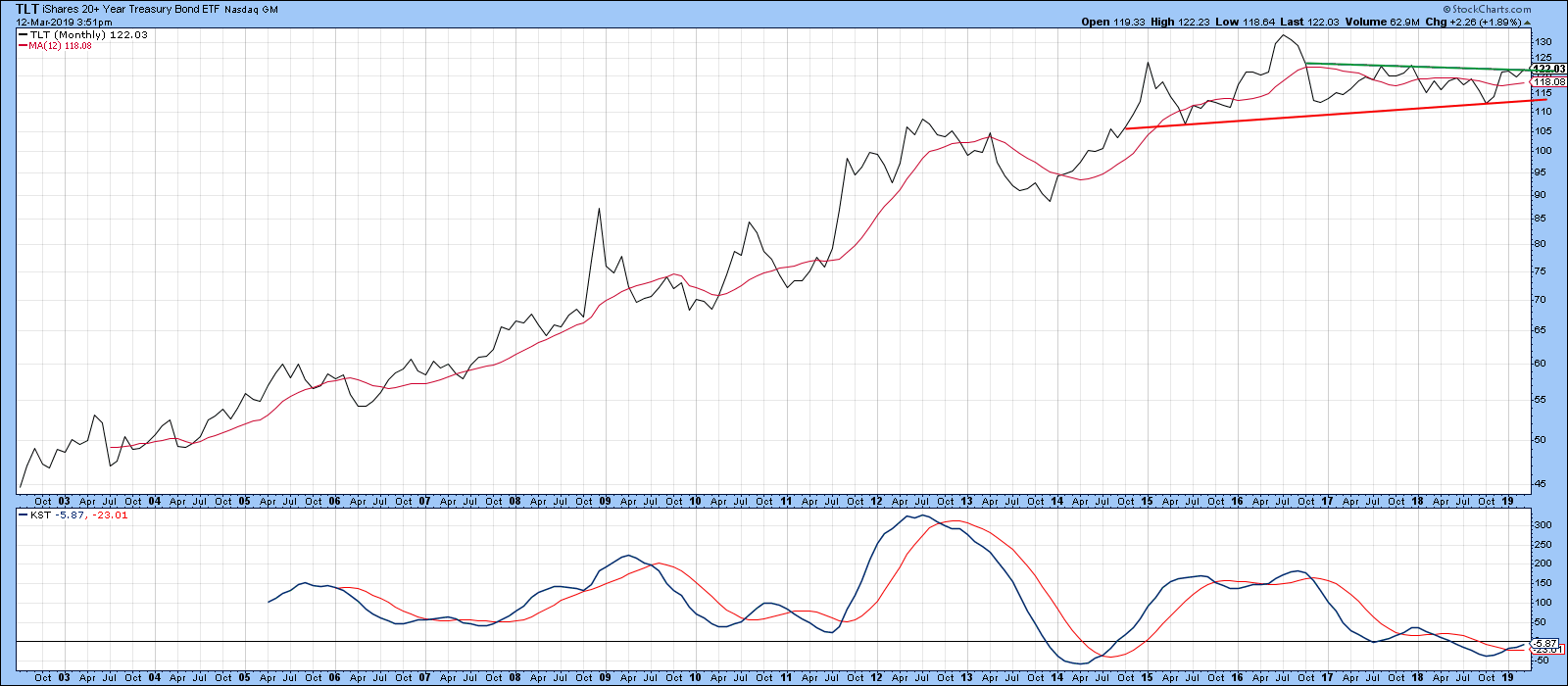

Bond Prices Poised For A Major Breakout, But Will They?

by Martin Pring,

President, Pring Research

* Adjusted vs. Unadjusted Prices

* Bonds Reflect the Fine Current Balance Between Inflationary and Deflationary Forces

Adjusted vs. Unadjusted Prices

Chart 1 shows that the iShares 20-year Trust ETF, the TLT, has been in a trading range since late 2014. Currently, the price is above its 12-month MA and the long-term...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR LEADS TODAY'S REBOUND AND HOLDS ITS 200-DAY LINE -- SEMICONDUCTORS ARE HAVING AN EVEN STRONGER DAY -- THE NASDAQ AND S&P 500 REGAIN THEIR 200-DAY LINES -- THE DOW SHRUGS OFF BIG BOEING LOSS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR HOLDS ITS 200-DAY LINE ... Stocks are off to a strong start for the week. All stock sectors are in the green today led by technology, energy, communications, financials, and cyclicals. All stocks sectors are also in the green with the technology-dominated Nasdaq in the lead. The Dow Industrials...

READ MORE