MEMBERS ONLY

Are We Seeing The Early Sign Of A Change In Market Leadership?

by Martin Pring,

President, Pring Research

* The Inflation/Deflation ratio

* Lagging sectors

* Defensive sectors

The Inflation/Deflation ratio

Last week I charted my Inflation/deflation ratio for the first time in a while and was surprised to see that it had broken to the downside. For those unfamiliar with the concept, the Inflation Ratio (!PRII) consists...

READ MORE

MEMBERS ONLY

DEFENSIVE STOCKS ARE LEADING THE MARKET HIGHER -- CONSUMER STAPLES SPDR TURNS UP AND SHOWS MARKET LEADERSHIP -- SO DO UTILITIES AND REITS -- PHARMA IS LEADING HEALTHCARE SECTOR HIGHER -- ALL OF WHICH SUGGESTS INVESTORS MAY BE TURNING MORE DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES TURN UP... Although the stock market continued to climb this week, it's a little surprising to see defensive stocks leading it higher. The four strongest sectors this past week were REITs (+3.3%), healthcare (+2.1%), consumer staples (+1.7%), and utilities (+1.2%). All did...

READ MORE

MEMBERS ONLY

Bond Yields Hit Mega Resistance. Will They Go Through?

by Martin Pring,

President, Pring Research

* 3- and 10-year series challenging their secular down trendlines

* Three indicators that suggest lower bond yields

* The Crunch Chart

3- and 10-year series challenging their secular down trend lines

US government bond yields have reached very important resistance, at a time when they are overextended on a long-term momentum basis....

READ MORE

MEMBERS ONLY

SELLING IN CHINA UNSETTLES GLOBAL STOCKS THIS MORNING ON TARIFF THREATS -- BUT US STOCK INDEXES ARE RECOVERING FROM EARLY SELLING -- MATERIAL STOCKS ARE DAY'S WEAKEST SECTOR -- TECHNOLOGY SPDR AND QQQ BOUNCE OFF 50-DAY LINES TO LEAD MARKET RECOVERY

by John Murphy,

Chief Technical Analyst, StockCharts.com

TARIFF THREATS PUSH CHINESE MARKETS LOWER ... Threats of higher tariffs on Chinese imports, combined with Chinese threats of retaliation, put international markets on the defensive today. It started in Asia, spread to Europe, and caused a lower stock opening here. China took the biggest hit. The red line in Chart...

READ MORE

MEMBERS ONLY

August Market Round Up With Martin Pring Video 2018-08-01

by Martin Pring,

President, Pring Research

This month, the Market Roundup carries a lot of information about how acute the current market position is in globally.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring...

READ MORE

MEMBERS ONLY

INDUSTRIAL SPDR ACHIEVES BULLISH BREAKOUT TO LEAD MARKET HIGHER -- XLI LEADERS INCLUDE XYLEM, HARRIS, AND EATON -- THE DOW TRANSPORTS ARE CHALLENGING THEIR JUNE HIGH -- TRAN LEADERS INCLUDE FEDEX AND RYDER -- PFIZER SURGES TO NEW RECORD TO LEAD DOW HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR REACHES FOUR-MONTH HIGH ... While media attention seems to be focused on struggling FANG stocks, investors are putting their money elsewhere. Chart 1 shows the Industrial Sector SPDR (XLI) rising above its June high to reach the highest level in four months. That's a healthy sign for...

READ MORE

MEMBERS ONLY

SMALL CAPS LOOK TOPPY AND ARE STARTING TO WEAKEN -- WHILE THE S&P 500 SPDR IS TESTING OVERHEAD RESISTANCE AT ITS JANUARY HIGH -- THAT COULD LEAD TO A CHOPPY AUGUST

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS ROLL OVER WHILE SPY TESTS JANUARY HIGH ... Stocks are beginning to look a little toppy. That's especially true of small caps. Chart 1 shows the Russell 2000 Small Cap Index ($RUT) ending the week below its 50-day moving average (blue circle). The RUT has been losing...

READ MORE

MEMBERS ONLY

AIRLINES LEAD TRANSPORTS AND INDUSTRIAL SPDR HIGHER -- UAL IS AIRLINE LEADER -- ALASKA AIR, SOUTHWEST, AND DELTA HAVE A STRONG DAY -- INDUSTRIAL SPDR ALSO TURNS UP -- KANSAS CITY SOUTHERN AND L3 TECHNOLGIES HELP LEAD XLI HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS CONTINUE TO GAIN GROUND ... The Dow Transports continue to gain altitude. Chart 1 shows the Dow Transports trading at the highest level in a month and nearing a challenge of its June high. Yesterday's message showed the TRAN being driven higher by United Parcel Service (UPS)...

READ MORE

MEMBERS ONLY

UPS LEADS TRANSPORTS HIGHER TODAY -- CSX AND NORFOLK SOUTHERN LEAD STRONG RAIL GROUP -- TRUCKERS RYDER AND CH ROBINSON ARE ALSO LEADING -- RISING OIL PRICES HAVE HURT AIRLINE PERFORMANCE -- BUT ARE BOOSTING ENERGY SHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS REGAIN 50-DAY AVERAGE... The Dow Jones Transportation Average has been trying to gain altitude after successfully bouncing off its 200-day moving average over the past month. But it's been a choppy advance. Chart 1 shows the Dow Transports regaining its 50-day average today after being pulled...

READ MORE

MEMBERS ONLY

This Week's NASDAQ High Was A Lonely Place

by Martin Pring,

President, Pring Research

* Tuesday was a Key Reversal Day

* Breadth fails to confirm Tuesday’s high

* Primary uptrend is intact, but will it be threatened?

Tuesday was a Key Reversal Day

This week the NASDAQ Composite registered a new all-time-high, but the quality of that rally leaves a lot to be desired. That...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD KEEPS CLIMBING -- THAT PUSHES BOND PRICES FURTHER BELOW RESISTANCE -- THAT'S LIFTING FINANCIALS AND BANKS IN PARTICULAR -- BANK LEADERS ARE BANK OF AMERICA, JP MORGAN, AND SUNTRUST -- NORTHERN TRUST NEARS UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD CLEARS 50-DAY AVERAGE AS BOND PRICES DROP... The upturn in Treasury yields that started on Friday is gaining more momentum today. Chart 1 shows the 10-Year Treasury yield ($TNX) climbing 5 basis points to the highest level in more than a month. It's also climbed...

READ MORE

MEMBERS ONLY

CHART ANALYSIS STILL FAVORS A HIGHER TEN-YEAR TREASURY YIELD -- WEAKER FOREIGN YIELDS HAVE HELD THE TNX BACK -- RISING RATES HURT CONSUMER STAPLES WHILE FAVORING CYCLICALS -- FALLING COMMODITY PRICES HAVE BOOSTED BOND PRICES -- OVERBOUGHT DOLLAR WEAKENS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE MAJOR TREND STILL FAVORS HIGHER BOND YIELDS... Yesterday's message showed the 7-10 Year T-bond iShares (IEF) testing important overhead resistance at its spring highs and 200-day moving average, and the impact bond direction usually has on rate-sensitive sectors like financials, utilities, and REITS. Rising rates usually favor...

READ MORE

MEMBERS ONLY

TREASURY PRICES ARE TESTING OVERHEAD RESISTANCE -- RISING BOND PRICES ARE BOOSTING UTILITIES AND REITS AT THE EXPENSE OF FINANCIALS -- FINANCIAL/UTILITY RATIO HAS BEEN FALLING THIS YEAR -- BUT IS TESTING TRENDLINE SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND ETF IS TESTING OVERHEAD RESISTANCE ... Treasury bond prices have been climbing since the middle of May. And they've reached an important chart point. Chart 1 shows the 7-10 Year Treasury Bond iShares (IEF) in the process of testing overhead resistance along their early April/late May peaks,...

READ MORE

MEMBERS ONLY

Is Gold In A Bear Market Or A Buying Opportunity?

by Martin Pring,

President, Pring Research

* Long-term trends rolling over to the downside

* A rising dollar does not help gold

* Gold Under-performing stocks is not a good thing….for gold

* Gold showing bear market characteristics

Long-term trends rolling over to the downside

The recent sell off in the price of gold has quite frankly surprised me....

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE STILL CLIMBING -- NASDAQ HITS NEW RECORD -- S&P 500 TRADES AT FIVE-MONTH HIGH -- CHIP STOCKS FINDING SUPPORT ABOVE 200-DAY LINE -- FINANCIALS ARE BOUNCING AGAIN -- BANK OF AMERICA LEADS BANKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ARE STILL CLIMBING ... All three of the major U.S. stock indexes are building on last week's gains. Chart 1 shows the Dow Industrials moving further above 25K and nearing a test of its June high. The Dow is being led higher by Johnson &...

READ MORE

MEMBERS ONLY

STOCKS ARE HAVING A POSITIVE WEEK -- THE DOW IS TRYING TO CLOSE OVER 25K -- THE S&P 500 IS CHALLENGING ITS MARCH HIGH - UNITED TECHNOLOGIES, ROCKWELL COLLINS, AND BOEING LEAD A STRONG AEROSPACE GROUP HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS CHALLENGING MARCH HIGH ... Stocks are ending the week on a positive note. The Nasdaq hit a new record high yesterday. Today's rally is being led by the Dow and S&P 500. Chart 1 shows the Dow Industrials trying to end above...

READ MORE

MEMBERS ONLY

Bond Yields Showing Some Vulnerability

by Martin Pring,

President, Pring Research

* A look at the primary and secular trends

* Interesting momentum study points to lower bond yields

* Bond Net New Highs set to pounce in either direction

* Slight softening in confidence hints at lower yields

In the June and July editions of my Market Roundup webinars I pointed out the possibility...

READ MORE

MEMBERS ONLY

DROP IN CHINESE MARKET STARTED WITH JUNE 15 TARIFFS -- SINCE THEN CHINESE STOCKS AND CURRENCY HAVE FALLEN TOGETHER -- AGRICULTURAL COMMODITIES AND BASE METALS PEAKED IN JUNE WITH CHINESE MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

MOST COMMODITIES ARE IN THE RED ... Commodity prices have been falling sharply over the last month. And Chart 1 shows where most of the selling has taken place. The black line shows the Invesco Commodity Tracking Fund (DBC) still 4% higher since the start of the year. That's...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD THE MARKET HIGHER -- FINANCIAL SPDR BOUNCES OFF CHART SUPPORT -- BANK ETFS DO THE SAME WITH REGIONALS IN THE LEAD -- DOW INDUSTRIALS CLEAR THEIR 50-DAY LINE TO LEAD MAJOR STOCK INDEXES HIGHER -- TRANSPORTS ARE ALSO HAVING A STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS ARE THE DAY'S STRONGEST SECTOR ... My June 30 message suggested that the market needed more help from financial stocks and industrials if it was going to gain ground during the second half of the year. It's getting help from both today. Let's start...

READ MORE

MEMBERS ONLY

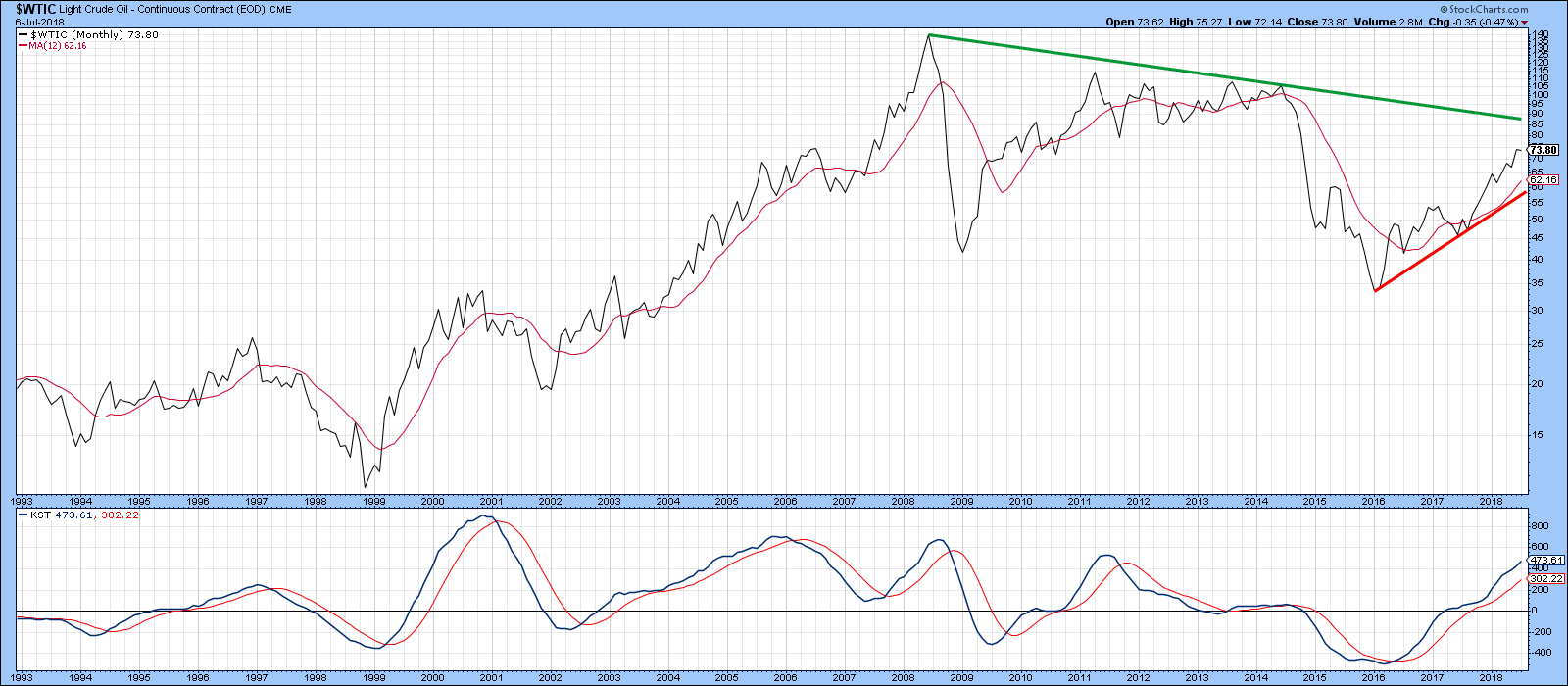

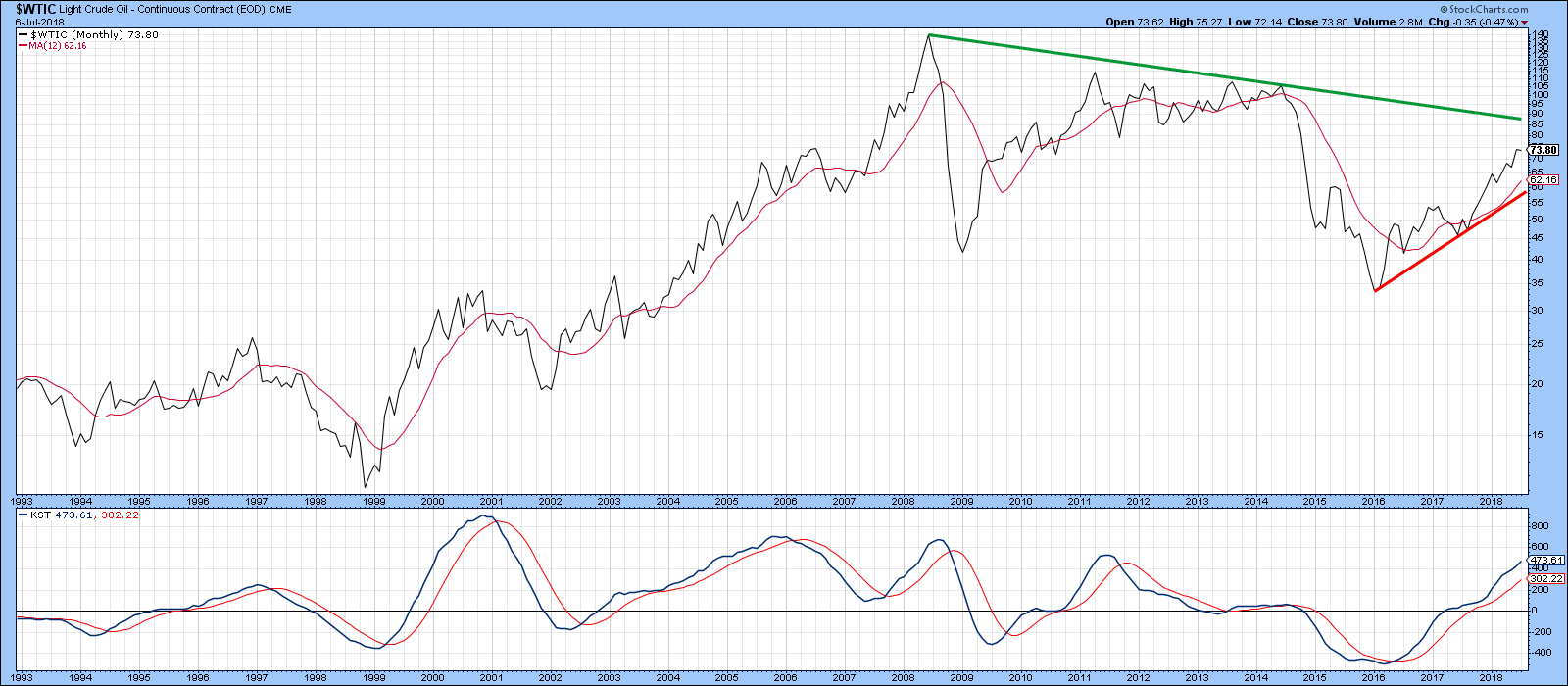

What Would It Take For The Charts To Signal A Top In Oil?

by Martin Pring,

President, Pring Research

* Technical picture is ripe for a turn, but the main trend is up right now

* Tuesday’s outside day could be the first domino

* Negative divergences between several energy components

Technical picture is ripe for a turn, but the main trend is up right now

The oil price remains in...

READ MORE

MEMBERS ONLY

STOCKS START SECOND HALF ON AN UP NOTE -- HEALTHCARE SPDR ACHIEVES BULLISH BREAKOUT -- BIOGEN LEADS BIOTECH RALLY -- BUT A LOT OF OTHER BIOTECHS ARE RISING AS WELL -- PHARMACEUTICAL ISHARES ALSO BREAK OUT -- MERCK, ELI LILLY, AND PFIZER LEAD DRUG RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS START SECOND HALF ON A STRONG NOTE ... After a shaky month of June, stocks started the second half of the year on a positive note. And moving average lines continue to play an important role in that stronger start. Chart 1 shows the Dow Industrials ending the week on...

READ MORE

MEMBERS ONLY

HEALTH CARE SPDR ACHIEVES BULLISH BREAKOUT -- BIOTECH ISHARES REACH HIGHEST LEVEL IN SIX MONTHS -- STOCKS END WEEK ON STRONG NOTE WITH ALL ELEVEN SECTORS GAINING GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR ACHIEVES BULLISH BREAKOUT... On a day when stocks are rising, and all eleven market sectors are in the black, healthcare is the standout performer. Chart 1 shows the Health Care SPDR (XLV) rising to the highest level since the middle of March. The bottom box shows the XLV/...

READ MORE

MEMBERS ONLY

THE DOW ENDS JUST ABOVE ITS 200-DAY AVERAGE -- WHILE THE S&P 500 REGAINS ITS 50-DAY LINE -- THE RUSSELL 2000 AND NASDAQ 100 LEAD MARKET HIGHER -- SEMICONDUCTOR ISHARES BOUNCE OFF THEIR 200-DAY AVERAGE TO LEAD TECH SECTOR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MOVING AVERAGE LINES ARE STILL HOLDING... Major stock index continue to find support around moving average lines. Chart 1 shows the Dow Industrials rising 181 points (+0.75%) to close at 24356. That was enough to put it just above its 200-day moving average. Other stock indexes did even better....

READ MORE

MEMBERS ONLY

Wider Implications For A Sick Looking Dr. Copper?

by Martin Pring,

President, Pring Research

* Copper signals a primary bear market

* Copper’s influence on commodities in general

* Copper and bond yields

It’s often said that Copper has a PHD in economics because it is used widely in many economic sectors. As a result, long-term reversals in its price trend often foreshadow general swings...

READ MORE

MEMBERS ONLY

July Market Round Up With Martin Pring 2018-07-01

by Martin Pring,

President, Pring Research

Here is the link to my current thoughts about the global markets.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its...

READ MORE

MEMBERS ONLY

STOCKS GAINED GROUND DURING SECOND QUARTER -- SECTOR LEADERS WERE ENERGY, TECHNOLOGY, REITS, AND UTILITIES -- INDUSTRIALS AND FINANCIALS WERE THE WEAKEST -- FINANCIALS REMAIN IN DOWNTREND -- BANKS ETFS REMAIN UNDER PRESSURE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 GIVE UP SOME OF FRIDAY'S GAINS... First a quick update on Friday's price action. The Dow and S&P 500 gave up some of their gains on Friday afternoon. The Dow gained 55 points (+0.23%) but ended slightly...

READ MORE

MEMBERS ONLY

STOCKS ARE OFF TO A STRONG START -- THE DOW AND S&P 500 REGAIN MOVING AVERAGE LINES -- THE NASDAQ HOLDS 50-DAY LINE -- ENERGY, FINANCIALS, MATERIALS, AND INDUSTRIALS LEAD THE MARKET HIGHER -- CHINA LEADS REBOUND IN EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW REGAINS ITS 200-DAY MOVING AVERAGE... Stocks are off to a strong start today. Wednesday's late selloff pushed the Dow below its 200-day average. Chart 1, however, shows the Dow Industrials regaining that long-term support line this morning. Chart 2 shows the S&P 500 regaining its...

READ MORE

MEMBERS ONLY

EARLY RALLY FADES AS STOCKS SUFFER DOWNSIDE REVERSAL DAY -- THE DOW AND S&P 500 CLOSE BELOW MOVING AVERAGE LINES -- THE NASDAQ FOLLOWS TECHNOLOGY STOCKS LOWER -- ENERGY SHARES FOLLOWED CRUDE OIL HIGHER -- UTILITIES RALLIED WITH BONDS AS YIELDS DROPPED

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOWNSIDE REVERSAL DAY ENDS RALLY ATTEMPT ... This morning's market rebound didn't last for long. By day's end the market had suffered a downside reversal day. And some support levels were broken. Chart 1 shows the Dow Industrials falling 165 points (-.68%) and ending...

READ MORE

MEMBERS ONLY

Global and US Equity Markets On A Knife Edge

by Martin Pring,

President, Pring Research

* The US on a knife edge

* Global markets are also on the edge

* Individual regions largely around key support

Last week I wrote about the important upside breakout in the US market vis a vis the rest-of-the-world, and a previous article pointed out that the S&P had also...

READ MORE

MEMBERS ONLY

OVERSOLD DOW BOUNCES OFF 200-DAY AVERAGE -- INDUSTRIALS AND MATERIALS ARE ALSO GAINING -- CRUDE OIL NEARS ANOTHER YEARLY HIGH -- THAT'S MAKING ENERGY THE DAY'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS LEADING TODAY'S RALLY ... After weighing on the rest of the market all month, the Dow is leading today's rebound. And it couldn't come at a better time. Chart 1 shows the Dow Industrials bouncing off chart support near their late-May low...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR LEADS NASDAQ LOWER -- SEMICONDUCTORS ARE LEADING THE TECH RETREAT -- MICRON AND NVIDIA ARE BIG LOSERS -- THE DOW AND S&P 500 ARE TESTING MOVING AVERAGE LINES -- THE VIX INDEX JUMPS TO ONE-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND TECHS LEAD MARKET LOWER ... Tech stocks and the Nasdaq are leading the rest of the market lower. Chart 1 shows the Nasdaq 100 (QQQ) falling more than 2% today and bearing down on its 50-day average. The Nasdaq is the weakest of the major market indexes. Falling technology...

READ MORE

MEMBERS ONLY

OVERSOLD DOW IS BOUNCING FROM CHART SUPPORT -- SO ARE BOEING AND CATERPILLAR -- OPEC AGREEMENT BOOSTS CRUDE OIL AND ENERGY SHARES -- CHEVRON AND EXXON MOBIL LEAD DOW HIGHER -- TECHNOLOGY SHARES EXPERIENCE SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS BOUNCING OFF CHART SUPPORT ... The Dow Industrials have been the weakest part of the U.S. stock market over the last month. That's been due primarily to its heavier exposure to stocks with more vulnerability to any Chinese trade tariffs like Boeing and Caterpillar. Those...

READ MORE

MEMBERS ONLY

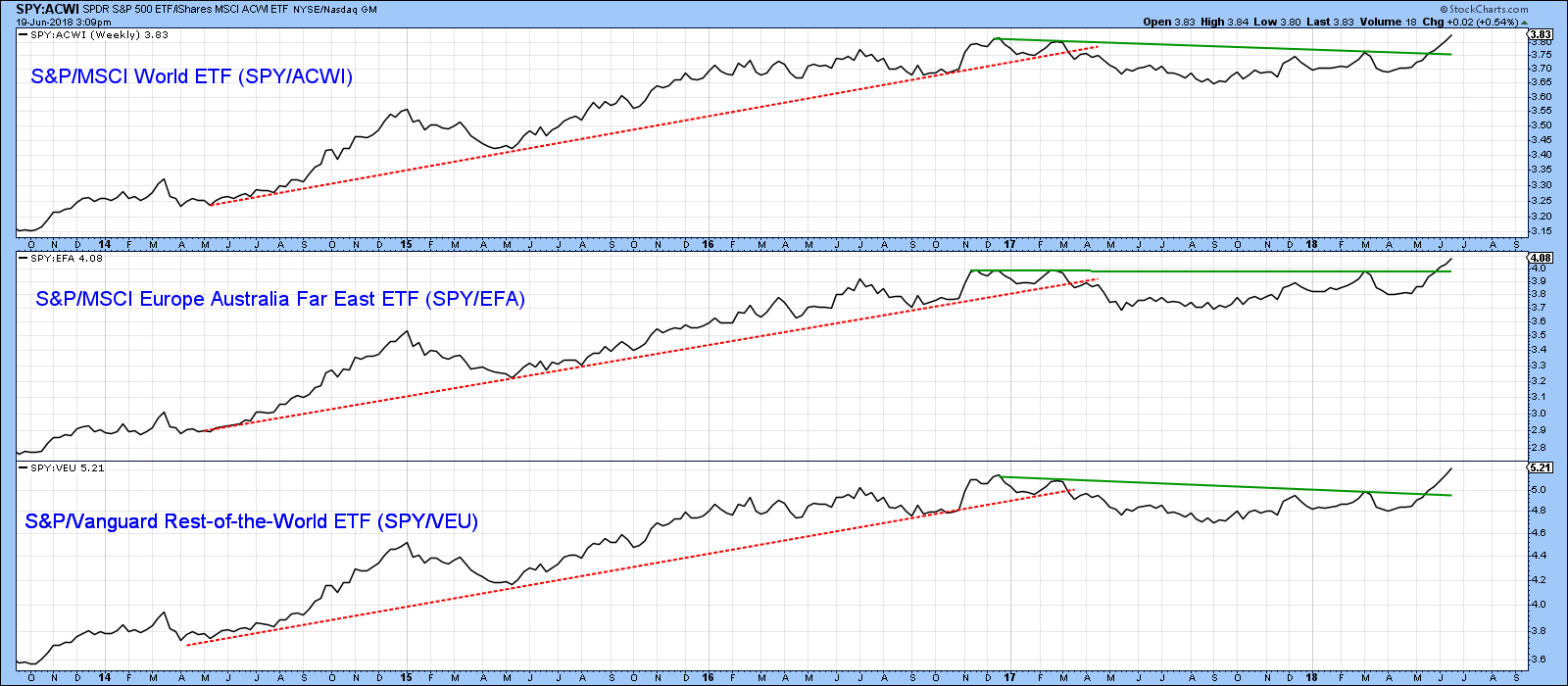

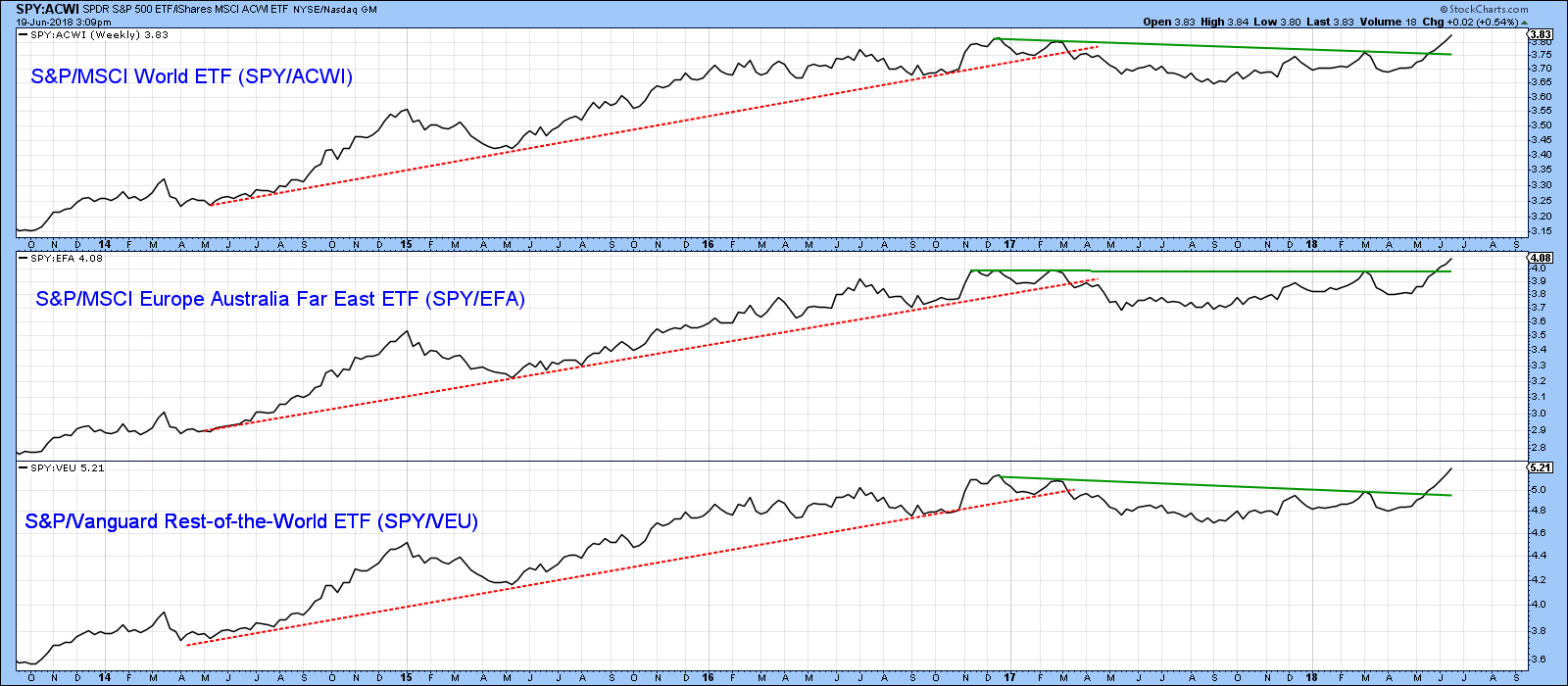

RISING DOLLAR IS CAUSING FOREIGN STOCKS TO UNDERPERFORM THE U.S -- BUT THE U.S. USUALLY DOES BETTER WHEN FOREIGN STOCKS ARE ALSO RISING -- THE VANGUARD EX-USA ETF IS TESTING ITS FEBRUARY LOW -- WHILE EMERGING MARKETS ISHARES TEST LONG-TERM SUPPORT LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR HAS BIG IMPACT ON GLOBAL MONEY FLOWS ... The direction of the U.S dollar has a big impact on how U.S. stocks perform relative to foreign stocks. As a rule, a stronger dollar favors U.S. stocks, while a weak dollar favors foreign stocks. Chart 1 shows how...

READ MORE

MEMBERS ONLY

Global Equities Are Falling Apart But It's MAGA For US Relative Action

by Martin Pring,

President, Pring Research

* New bull market high for US equity relative action

* International markets are breaking down

* Commodities lose some upside momentum

US equities have been hit hard so far this week, but that’s nothing compared to China, Emerging Markets, Europe and other markets around the globe. As a result, we are...

READ MORE

MEMBERS ONLY

DOVISH ECB OFFSETS HAWKISH FED -- DROP IN EURO BOOSTS DOLLAR -- GOLD AND DOLLAR WON'T BOUNCE TOGETHER FOR LONG -- FINANCIALS FAIL TO RESPOND TO FED RATE HIKE -- REITS TRY TO HOLD 200-DAY LINE -- S&P 500 NEARS TEST OF ITS MARCH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECB WON'T RAISE RATES FOR ANOTHER YEAR ... The Fed raised its short-term rate by a quarter point yesterday as expected. But it also added a fourth rate hike this year which gave its announcement a more hawkish tilt. That had the immediate effect of boosting Treasury bond yields...

READ MORE

MEMBERS ONLY

What Is The Gold Price Telling Us About The Stock Market?

by Martin Pring,

President, Pring Research

* Stocks are rising against gold and that’s bullish

* The long-term trend points to gold under-performing stocks

* Stock/Gold ratio breaks out from a right-angled broadening formation

The price of gold, over the short-term, typically rises and falls on global tensions or lack thereof. Longer-term trends though, are more influenced...

READ MORE

MEMBERS ONLY

NYSE Breakout Is Supported By Eight Sectors

by Martin Pring,

President, Pring Research

* NYSE breakout

* Multi-sector breakouts

* Green shoots coming through for Europe and emerging markets

NYSE breakout

Monday’s action has seen the NYSE Composite, the $NYA complete a 4-month reverse head and shoulders pattern. If that breakout holds, and there are few grounds for suspecting that it won’t, it’s...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS RESUME UPTREND -- WHILE UTILITIES CONTINUE TO WEAKEN -- TRANSPORTATION/UTILITIES RATIO RISES TO NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS REACH FIVE-MONTH HIGH -- WHILE UTILITIES FALL ... The Dow Industrials exceeded their May high last week to reach the highest level in three months. And are higher again today. But today it's the transports' turn to lead the Dow family of stocks higher. Chart 1 shows...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR TURNS UP -- PHARMA IS LEADING -- PHARMACEUTICALS SPDR REACHES THREE-MONTH HIGH -- PHARMA LEADERS ARE ABBOTT LABS, LILLY, AND PFIZER -- ZOETIS HITS NEW RECORD -- SOME MONEY MAY BE ROTATING FROM TECHS INTO CHEAPER DRUG STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR TURNS UP... Last Friday's message suggested that the healthcare sector appeared to be basing. But it needed a close over its April/May highs to turn its trend from "sideways" to "up". Chart 1 shows the Health Care SPDR (XLV) exceeding those...

READ MORE

MEMBERS ONLY

EURO CONTINUES TO REBOUND FROM IMPORTANT CHART SUPPORT -- IT'S BEING SUPPORTED BY RISING EUROZONE BOND YIELDS -- A WEAKER DOLLAR MAY BE GIVING A BOOST TO COPPER AND OIL -- ENERGY IS DAY'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO CONTINUES TO REBOUND FROM IMPORTANT CHART SUPPORT ... Global stocks fell on Tuesday May 29 on concerns that a new election in Italy might provide a threat to the eurozone. My message on the following day (May 30) wrote about global stocks starting to recover from that scare. Included in...

READ MORE