MEMBERS ONLY

CONSUMER CYCLICALS SPDR TESTS JANUARY HIGH -- HEALTHCARE SPDR NEARS AN UPSIDE BREAKOUT -- FINANCIALS ARE BOUNCING OFF 200-DAY AVERAGE AND LEADING TODAY'S RALLY -- GROWTH STOCKS CONTINUE TO OUTPACE VALUE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER CYCLICALS NEAR NEW RECORD ... My message from Thursday, May 24 wrote about consumer cyclical stocks continuing to show relative strength. That earlier message attributed that mostly to strong leadership from apparel retailers. That's been the story again this week with retailers continuing to rally. Chart 1 shows...

READ MORE

MEMBERS ONLY

Market Round Up June 2018

by Martin Pring,

President, Pring Research

Here is the link for the June 2018 Market Round Up.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Equities At A Make-Or-Break Level What To Look Out For

by Martin Pring,

President, Pring Research

* CPI adjusted S&P is just above a long-term make-or-break point

* The rest of the world is at the brink

* US market looks stronger

CPI Adjusted S&P is just above a long-term make-or-break point

Last week I pointed out that US equities were experiencing a marginal upside...

READ MORE

MEMBERS ONLY

Market Roundup Live May 2018

by Martin Pring,

President, Pring Research

This is the Market Roundup for May 2018.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS STOCKS -- S&P 500 NEARS MAY HIGH -- QQQ REACHES TWO-MONTH HIGH -- INTEL AND ALPHABET ARE LEADING IT HIGHER -- AMGEN LEADS UPTURN IN BIOTECH ISHARES -- HEALTHCARE SPDR APPEARS TO BE BASING

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 NEARS MAY HIGH... A stronger than expected jobs report for May is giving a boost to stocks today. So is the fact that European stocks are rising (as well as Italy's bond and stock markets). In addition, yesterday's stock selling in response...

READ MORE

MEMBERS ONLY

STOCKS ARE REBOUNDING FROM YESTERDAY'S SELLING -- THE DOW AND S&P 500 BOUNCE OFF 50-DAY LINES -- SMALL CAPS HIT NEW HIGHS WHILE NASDAQ TESTS TOP OF TRADING RANGE -- FINANCIALS REBOUND TODAY WITH BOND YIELDS -- THE EURO IS TESTING IMPORTANT CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 ARE BOUNCING OFF 50-DAY AVERAGES ... Stocks around the world sold off sharply yesterday (Tuesday) in a global flight from risk resulting mainly from a political crisis in Italy and, to a lesser extent, renewed threats of sanctions against China. A surge in Italian bond...

READ MORE

MEMBERS ONLY

US Equities Are Breaking Out Against The World

by Martin Pring,

President, Pring Research

* SPY experiences important relative breakouts

* World A/D Line unexpectedly breaks trend

* European and Emerging markets ETF’s experience major breakdowns

SPY experiences important relative breakouts

Earlier this morning I had the idea of writing about the relationship between the US and international markets, as this ratio usually does well...

READ MORE

MEMBERS ONLY

STOCKS TRADE SIDEWAYS BUT END WEEK SLIGHTLY HIGHER -- FALLING CRUDE OIL MADE ENERGY THE WEAKEST SECTOR -- WHILE FALLING BOND YIELDS MADE UTILITIES THE STRONGEST -- INTERMARKET ANALYSIS SUGGESTS THOSE TWO TRENDS ARE LINKED

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES WERE WEEK'S STRONGEST SECTOR WHILE ENERGY WAS THE WEAKEST... Stocks ended the week with small gains while continuing to trade in a sideways consolidation pattern. Technology stocks showed relative strength thanks to a strong semiconductor group. So did consumer cyclicals which were led higher by apparel retailers....

READ MORE

MEMBERS ONLY

Two Markets Close To Basket Case Status

by Martin Pring,

President, Pring Research

* Commodities looking short-term toppy

* Copper close to a bear market signal that it may escape

* Oil trend is still positive but vulnerable

* Two markets close to a major breakdown

In a global stock market of predominantly long-term bullish charts, two country funds stand out as being on the verge of...

READ MORE

MEMBERS ONLY

APPAREL RETAILERS ARE HAVING A STRONG DAY -- TODAY'S RETAIL LEADERS ARE GAP, FOOT LOCKER, AND KOHLS -- CONSUMER DISCRETIONARY SPDR CONTINUES TO SHOW RELATIVE STRENGTH -- SO DO THE TRANSPORTS -- MICRON TECHNOLOGY LEADS CHIP STOCKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPAREL RETAILERS ARE GETTING MORE EXPENSIVE... My message on Wednesday of last week showed the S&P Retail SPDR (XRT) hitting a four-month high and becoming a new market leader. Yesterday's message showed the XRT rebounding enough to stay above its recent breakout point. Retailers are continuing...

READ MORE

MEMBERS ONLY

STOCK INDEXES END HIGHER AFTER HOLDING CHART SUPPORT -- DOW LEADERS ARE BOEING, INTEL, AND MICROSOFT -- RETAILERS LEAD S&P 500 HIGHER -- NASDAQ 100 IS DAY'S STRONGEST INDEX -- NETFLIX HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW BOUNCES OFF SHORT-TERM CHART SUPPORT... An early morning pullback for the Dow found support along the lows of last week before ending the day higher. That was the same story for the other major stock indexes. The black line in Chart 1 shows the Dow Industrials staying above that...

READ MORE

MEMBERS ONLY

BOEING AND CATERPILLAR LEAD INDUSTRIAL SPDR HIGHER -- THE DOW INDUSTRIALS ARE BREAKING OUT TO THE UPSIDE -- SO ARE THE TRANSPORTS -- THAT SIGNALS A DOW THEORY BUY SIGNAL IN THE MAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR IS BREAKING OUT ... Good news on the tariff dispute with China is giving a big lift to stocks today. While all sectors are gaining ground, the day's leader is the industrial sector. Chart 1 shows the Industrial SPDR (XLI) rising pretty decisively above a falling four-month...

READ MORE

MEMBERS ONLY

MORTGAGE RATES HIT A SEVEN-YEAR HIGH ALONG WITH TEN-YEAR TREASURY YIELD -- RISING MORTGAGE RATES MAY BE CONTRIBUTING TO SELLING OF HOMEBUILDING STOCKS -- A RECORD HIGH IN THE PRICE OF LUMBER ALSO RAISES THE COSTS OF BUILDING A NEW HOUSE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING MORTGAGE RATES ARE WEIGHING ON HOMEBUILDERS ... The first page of today's Wall Street Journal carries the headline: "Era of Ultracheap Mortgages Ends as Rates Hit 7-Year HIgh". The article goes on to point out that rising mortgage rates might make it harder for prospective home...

READ MORE

MEMBERS ONLY

Steady As She Goes: Several Indicators Say The Market Is Headed Higher

by Martin Pring,

President, Pring Research

Volume is offering a mixed picture

Last week I pointed out that several short-term indicators, including breadth and net new high indicators, were still pointing north. One area that was not showing any strength of note was volume, in the form of the PVO for the NYSE. Chart 1 shows...

READ MORE

MEMBERS ONLY

RETAIL SPDR JUMPS TO A FOUR-MONTH HIGH AND HAS BECOME A NEW MARKET LEADER -- RETAIL LEADERS INCLUDE MACYS, UNDER ARMOUR, AND NIKE -- RISING BOND YIELDS BOOST THE DOLLAR WHICH HELPS SMALL CAP STOCKS -- RUSSELL 2000 HITS A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P RETAIL SPDR GOES FROM LAGGARD TO LEADER... A strong April retail report yesterday was credited with helping push bond yields to the highest level in seven years. That's because it showed strong consumer spending which is two-thirds of the U.S. economy. Retail stocks must...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD RISES TO SEVEN-YEAR HIGH -- REGIONAL BANKS GAIN ON HIGHER YIELDS -- WHILE RATE SENSITIVE REITS TUMBLE -- S&P 500 SUFFERS MODEST PULLBACK -- DOLLAR JUMPS TO SIX-MONTH HIGH WHICH HURTS GOLD BUT SUPPORTS SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY REACHES 3.08%... The 10-year Treasury yield rose 8 basis points today to 3.08% which pushed it above its late 2013 peak near 3.03%. The monthly bars in Chart 1 shows the TNX now trading at the highest level since the summer of 2011. That'...

READ MORE

MEMBERS ONLY

CHARTS SUGGEST THAT STOCKS HAVE TAKEN A TURN FOR THE BETTER -- VANGUARD TOTAL STOCK MARKET ETF BREAKS THROUGH RESISTANCE BARRIERS -- FOREIGN STOCK ETFS ARE ALSO BOUNCING -- HONG KONG LEADS EMERGING MARKET REBOUND -- DON'T GET COMPLACENT ON INFLATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS APPEAR TO HAVE TURNED THE CORNER ... Stocks had a very good week. Major U.S. stock indexes had their best week in two months, with all of them gaining more than 2%. Small caps and the Nasdaq led the market higher. The S&P 600 Small Cap Index...

READ MORE

MEMBERS ONLY

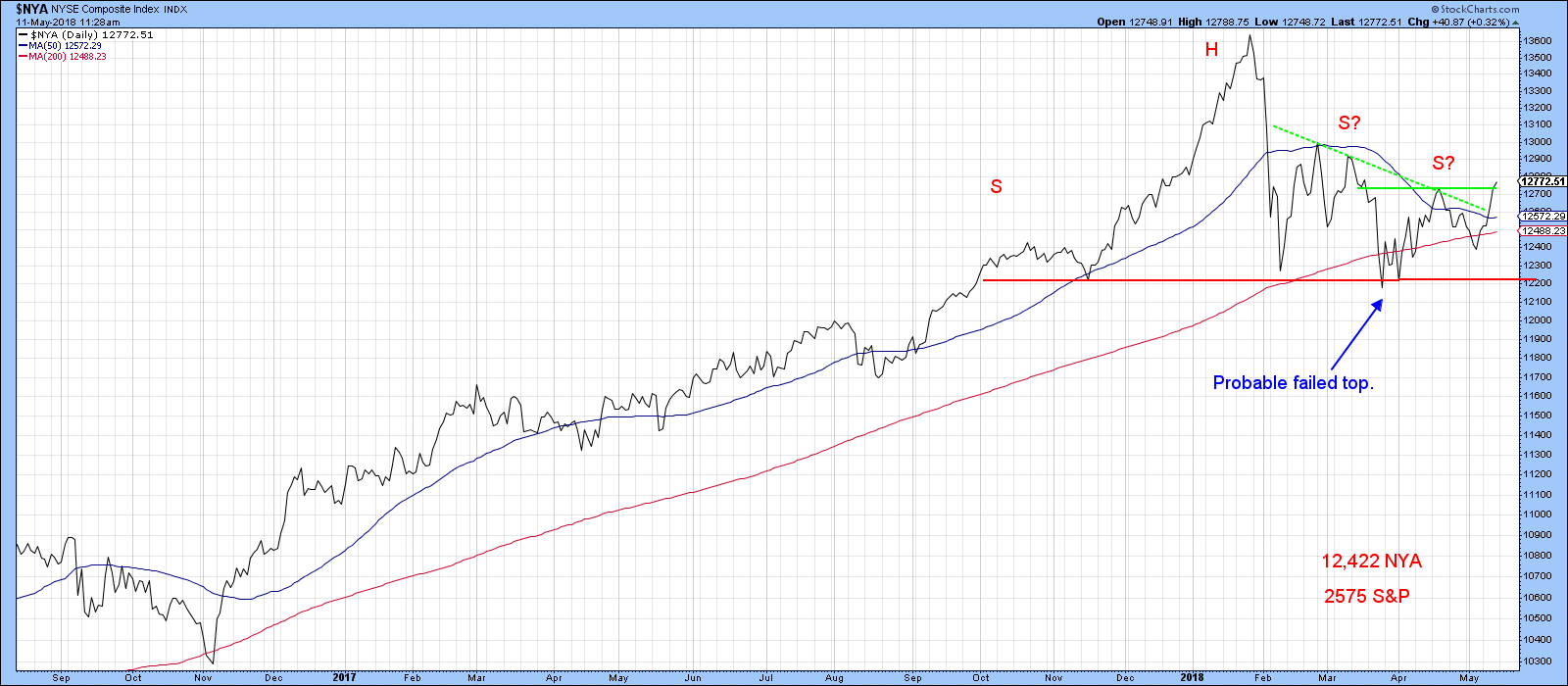

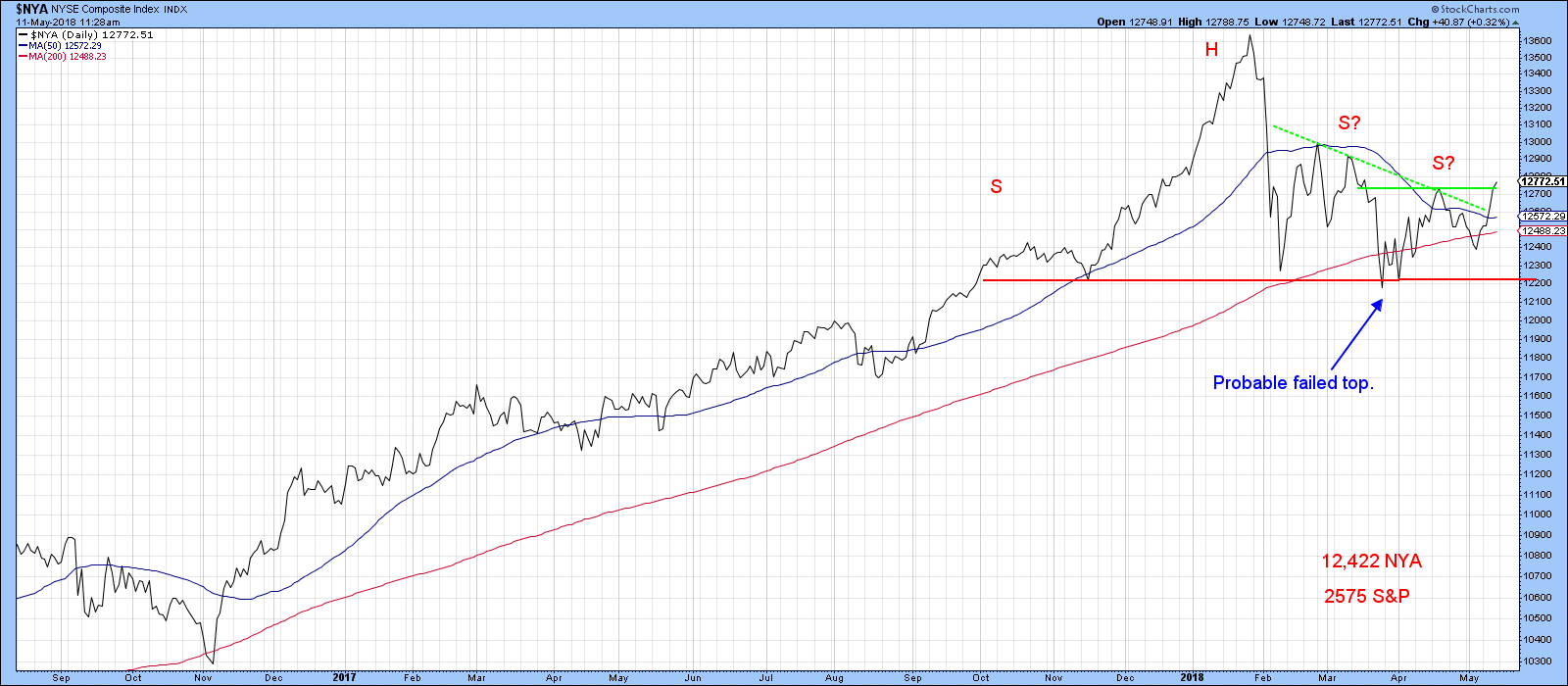

This Rally Looks Like It Has Legs

by Martin Pring,

President, Pring Research

* When a top is not a top

* The rally is broadly based

* Is the US about to out-perform the world again?

When a top is not a top

Last week I pointed out that several indicators were positioned for a nice rally. However, one of the lingering questions related to...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS NEAR UPSIDE BREAKOUT -- TRANSPORTS ARE ALSO NEARING APRIL HIGH -- BANKS AND FINANCIALS SHOW MARKET LEADERSHIP -- % OF NYSE STOCKS ABOVE 200-DAY MOVING AVERAGE TURNS UP -- COMMON STOCK ONLY AD LINE HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

LOOKING FOR A DOW THEORY BUY SIGNAL ... It's always a good sign to see the Dow Industrials and Transports rising together, as they're doing today. The price bars in the upper chart show the Dow Industrials testing their mid-April peak at 24,900. An upside breakout...

READ MORE

MEMBERS ONLY

THE NASDAQ 100 IS LEADING THE MARKET HIGHER -- SO IS THE TECHNOLOGY SECTOR -- THE S&P 600 SMALL CAP INDEX IS BREAKING OUT TO A NEW RECORD -- THE RUSSELL 2000 ISN'T FAR BEHIND -- THAT'S PULLING LARGE CAPS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 AND TECHNOLOGY SECTOR ACHIEVE BULLISH BREAKOUTS ... The technical picture for the stock market continues to improve on a lot of fronts. One of them is this week's upside breakout in Nasdaq market. Chart 1 shows the PowerShares Nasdaq 100 (QQQ) climbing above its mid-April high to...

READ MORE

MEMBERS ONLY

THREE-YEAR HIGH IN OIL MAKES ENERGY MARKET LEADERS -- S&P OIL & GAS EXPLORATION & PRODUCTION SPDR BREAKS OUT -- OCCIDENTAL AND EOG ARE XOP LEADERS -- RISING OIL AND BOND YIELDS EXPLAIN WHY ENERGY SHARES ARE DOING BETTER THAN UTILITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SHARES HAVE BECOME MARKET LEADERS... This shouldn't come as news to readers of this website. Articles written by myself and my colleagues at Stockcharts.com have been bullish on crude oil and energy stocks since the first quarter. So this is just an update of an ongoing...

READ MORE

MEMBERS ONLY

Buy In May And Say Hooray?

by Martin Pring,

President, Pring Research

* Sell in May does not have a great track record

* Technology continues to outpace staples, and that’s bullish

* Technology, consumer cyclicals and REITS are well positioned for a rally

Sell in May does not have a great track record

If there is a seasonal saying that seems ubiquitous at...

READ MORE

MEMBERS ONLY

MESSAGE FROM FEBRUARY PUT CURRENT TRIANGULAR FORMATION IN ELLIOTT WAVE CONTEXT -- TRIANGLES NORMALLY HAVE FIVE WAVES WITH THREE PULLBACKS -- THIS PAST WEEK'S PULLBACK WAS THE THIRD ONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

FEBRUARY MESSAGE SUGGESTED THAT TRIANGULAR FORMATION WAS LIKELY... Everyone is talking about the triangular formation that the stock market has been forming over the last three months. It's important that the situation leading up to that formation be understood, as well as its meaning. My February 21 Market...

READ MORE

MEMBERS ONLY

STOCKS ARE ENDING THE WEEK ON A STRONG NOTE -- NASDAQ 100 CLEARS 50-DAY AVERAGE -- SO DOES THE RUSSELL 2000 -- THE THIRD SUCCESSFUL TEST OF 200-DAY MOVING AVERAGES IS A GOOD SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS REBOUND OFF 200-DAY LINES... Stocks are ending the week on a strong note. Chart 1 shows the Dow surging more than 300 points after surviving another test of its 200-day average yesterday. Chart 2 shows the S&P 500 doing just as well. Both indexes still need to...

READ MORE

MEMBERS ONLY

MARKET TEST CONTINUES -- THE DOW AND S&P 500 DIPPED BELOW THEIR 200-DAY AVERAGES -- THAT PUTS THE MARKET IN DANGER OF RESTESTING ITS 2018 LOWS -- INDUSTRIAL AND FINANCIAL SPDRS LED MARKET LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 DIP BELOW 200-DAY LINES... Stocks started the day under pressure. Chart 1 shows the Dow Jones Industrial Average trading below its 200-day moving average this morning (before recovering later in the day). A close below the red line would signal that a test of...

READ MORE

MEMBERS ONLY

Dollar Breakout Starts To Infect Other Markets

by Martin Pring,

President, Pring Research

* Dollar Index breaks to the upside

* Dollar sympathy relationships

* The Aussie Dollar close to a mega signal for itself and commodities

Dollar Index breaks to the upside

Chart 1 shows that the Dollar Index falsely broke to the downside at the very beginning of the year. In the last couple...

READ MORE

MEMBERS ONLY

DOLLAR INDEX RISES TO NEW HIGH FOR THE YEAR -- THAT'S HURTING U.S. LARGE CAP PERFORMANCE -- THE DOLLAR IS GETTING A BOOST FROM RISING SPREAD BETWEEN US AND GERMAN YIELDS -- THE S&P 500 IS HEADED FOR ANOTHER TEST OF ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX HITS NEW 2018 HIGH... Chart 1 shows the PowerShares Dollar Index (UUP) rising today to the highest level since last December. It's also climbed back above its 200-day moving average and a falling trendline extending back to the start of 2017. The UUP may now be...

READ MORE

MEMBERS ONLY

NASDAQ 100 LEADS MARKET REBOUND -- FACEBOOK LEADS TECH SECTOR HIGHER -- VISA, HOME DEPOT, AND MICROSOFT ARE DOW LEADERS -- S&P 500 SURVIVES ANOTHER TEST OF ITS 200-DAY AVERAGE -- RISING DOLLAR CAUSES PULLBACK IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 LEADS MARKET REBOUND... Stocks are enjoying a rebound today off chart support near 200-day moving average lines. And the Nasdaq is leading it higher. Chart 1 shows the PowerShares Nasdaq 100 (QQQ) rising 2% today to outpace other stock indexes. After finding support from just above its 200-day...

READ MORE

MEMBERS ONLY

Who's Afraid Of The Big Bad 3%?

by Martin Pring,

President, Pring Research

* Technical position for yields still looks bullish

* International rates look higher

* Dollar breaks out, but will it hold?

* Finely balanced Gold picture needs some guidance from the Dollar

If you have punched up the symbol $TNX, you will know that the 10-year yield has recently hit 3%. Chances are that...

READ MORE

MEMBERS ONLY

INDUSTRIALS, MATERIALS, AND TECHNOLOGY PULL MARKET LOWER AS TEN-YEAR TREASURY YIELD TOUCHES 3% -- MAJOR STOCK INDEXES ARE ALSO HEADING INTO ANOTHER TEST OF SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR ETFS TAKE A BIG HIT ... The three stock ETFs shown below are leading the stock market sharply lower. Chart 1 shows the Industrial SPDR (XLI) losing more than 3% and once again threatening its 200-day average. Caterpillar (CAT) is one of its biggest losers with a drop of -6%...

READ MORE

MEMBERS ONLY

Is The Breakout In The Dollar For Real?

by Martin Pring,

President, Pring Research

* The primary trend

* The short-term picture

* The Dollar, Copper and Gold

The Dollar Index showed some green shoots at the end of the week that might lead to greater things. That’s important in its own right, but since the dollar often moves inversely with commodities and gold its direction...

READ MORE

MEMBERS ONLY

BLOOMBERG COMMODITY INDEX IS TESTING ITS 2018 HIGH -- AN UPSIDE COMMODITY BREAKOUT WOULD SIGNAL HIGHER INFLATION -- RISING COMMODITY PRICES ARE PUSHING BOND YIELDS HIGHER -- TEN YEAR TREASURY YIELD MAY BE HEADING TO 3%

by John Murphy,

Chief Technical Analyst, StockCharts.com

BLOOMBERG COMMODITY INDEX IS NEAR AN UPSIDE BREAKOUT... This week's surge in commodity prices is starting to attract a lot of attention. That's because rising commodity prices are a leading indicator of inflation. Rising commodity prices have a lot of intermarket implications. For one thing, rising...

READ MORE

MEMBERS ONLY

CSX AND UNITED AIRLINES LEAD TRANSPORTS HIGHER -- AND BOOST THE INDUSTRIAL SPDR -- FREEPORT MCMORAN LEADS MATERIALS HIGHER -- SIX-YEAR HIGH IN ALUMINUM PUSHES ALCOA TO NEW RECORD -- ENERGY AND METALS LEAD COMMODITIES SHARPLY HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS NEAR UPSIDE BREAKOUT ... Monday's message showed the Dow Transports rising above their 50-day average to turn their trend higher. Chart 1 shows the Dow Transports on the verge of breaking through overhead resistance formed in late February and mid-March. While rails and truckers (and FedEx) were Monday&...

READ MORE

MEMBERS ONLY

More Indicators Are Flashing The All Clear

by Martin Pring,

President, Pring Research

* Bearish engulfing pattern and outside day are cancelled

* Breath indicators are firming up

Bearish engulfing pattern and outside day are cancelled

Last week I wrote that many of the short-term indicators were flashing buy signals and that we should expect the US equity market to work its way higher. I...

READ MORE

MEMBERS ONLY

NASDAQ 100 LEADS MARKET HIGHER ALONG WITH THE TECHNOLOGY SECTOR -- TWITTER AND ALPHABET LEAD INTERNET STOCKS HIGHER -- INTEL AND MICROSOFT NEAR RECORD HIGHS -- THE DOW CLEARS 50-DAY LINE AND DOWN TRENDLINE -- ITS P&F CHART SHOWS AN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 LEADS MARKET HIGHER ... Stocks are having another good chart day. All major stock indexes are trading well above their 50-day averages. The Nasdaq market is in the lead. Chart 1 shows the PowerShares Nasdaq 100 (QQQ) gapping over its 50-day line today. The rising red line is a...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS CLEAR THEIR 50-DAY AVERAGE -- JB HUNT AND CH ROBINSON ARE LEADING -- KANSAS CITY SOUTHERN, CSX, AND UNION PACIFIC ARE ALSO STRONG -- FEDEX CLEARS ITS 50-DAY AVERAGE -- THE DOW INDUSTRIALS ARE TESTING THEIR 50-DAY LINE AGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS EXCEED 50-DAY AVERAGE ... Stocks are opening the new week on a positive note. Transportation stocks are having an especially strong day. The daily bars in Chart 1 show the Dow Transports climbing 2% this morning. More importantly, the $TRAN is trading above its 50-day moving average (blue circle)...

READ MORE

MEMBERS ONLY

DJIA Engulfing Pattern Suggests A Pause Before Higher Prices

by Martin Pring,

President, Pring Research

* A small correction ahead?

* Short-term oscillators are primed for a rally

* Bitcoin is breaking out again

A small correction ahead?

If you want to be bullish, Friday’s technical action was somewhat disappointing. That’s because it represented an engulfing pattern for the DIA, as shown in Chart 1.

Chart...

READ MORE

MEMBERS ONLY

BANKS SUFFER BIG SELLOFF AFTER REPORTING STRONG EARNINGS -- JP MORGAN CHASE SUFFERS DOWNSIDE REVERSAL DAY -- FINANCIAL SPDR FAILS TEST OF 50-DAY AVERAGE -- STOCK INDEXES PULL BACK FROM 50-DAY AVERAGES BUT ON LIGHTEST TRADING OF THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

JP MORGAN CHASE SUFFERS DOWNSIDE REVERSAL ON FRIDAY... Friday had to be a very discouraging day for investors in bank stocks. After reporting first quarter earnings that were much higher than expected, bank stocks opened higher before plunging in heavy trading. Chart 1 shows JP Morgan Chase (JPM) suffering a...

READ MORE

MEMBERS ONLY

BOND YIELDS MAY BE TURNING BACK UP AGAIN -- THAT'S BOOSTING FINANCIALS AND HURTING UTILITIES -- JP MORGAN AND GOLDMAN SACHS CLEAR 50-DAY AVERAGES -- BOEING AND INTEL LEAD DOW HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN YEAR BOND YIELD MAY BE TURNING BACK UP AGAIN... After hitting a four-year high during January, the 10-Year Treasury Yield saw a modest decline from mid-February until the end of March. Some of that decline in yields was probably based on safe haven buying of Treasuries during the first...

READ MORE

MEMBERS ONLY

Small Caps May Be Breaking Out But Not All Are Created Equal

by Martin Pring,

President, Pring Research

* The technical position of small caps in general

* Small cap sectors

The technical position of small caps in general

Small caps, as represented by the Russell 2000 ETF (IWM), have outperformed the market since late March and have now broken out in their own right. We can see this from...

READ MORE