MEMBERS ONLY

COPPER PRICES ARE RISING -- SO IS THE GLOBAL X COPPER MINERS ETF -- S&P METALS & MINING ETF IS BEING HELD BACK BY GOLD, SILVER, AND STEEL STOCKS -- MSCI GLOBAL METALS AND MINING ETF OFFERS EXPOSURE TO STRONGER FOREIGN MINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER PRICES ARE REBOUNDING ... After rising to the highest level in three years a month ago, the price of copper experienced a modest correction during September. Chart 1 shows the metal pulling back to initial chart support along its August low and its 50-day moving average. But it's...

READ MORE

MEMBERS ONLY

Market Roundup Video Recording With Martin Pring 2017-10-04

by Martin Pring,

President, Pring Research

The Market Round Up Video Recording for October is available. Use the HD button for better clarity when viewing.

Market Round Up Live With Martin Pring 2017-10-04 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the...

READ MORE

MEMBERS ONLY

AIRLINES LEAD TRANSPORTS AND INDUSTRIAL SPDR TO NEW RECORDS -- DELTA AND AMERICAN AIRLINES RISE ABOVE 200-DAY LINES -- AUTOS AND HOMEBUILDERS LEAD CYCLICALS HIGHER -- HOME CONSTRUCTION ISHARES HIT NEW HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

AIRLINES TAKE OFF... Airlines stock are finally gaining some altitude. Previous messages have shown rails, truckers, and delivery service stocks leading the Dow Transports to record highs. My September 20 message described airlines as the weakest part of that sector, but showed them in an oversold condition and trying to...

READ MORE

MEMBERS ONLY

RISING RATES CONTRIBUTE TO ROTATIONS -- FINANCIAL SPDR HITS ANOTHER RECORD -- FAANG STOCKS ARE STILL LAGGING BEHIND -- SO IS THE TECHNOLOGY SECTOR -- S&P 500 VALUE ISHARES SHOW NEW LEADERSHIP -- S&P 400 MID CAP INDEX HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS CONTINUE TO LEAD ... Financial stocks continue to build on their strong September gains. Chart 1 shows the Financial Sector SPDR (XLF) hitting a new record high again today. Rising interest rates are the main force driving money into banks, brokers, and insurers. The black line just above the price...

READ MORE

MEMBERS ONLY

Four Implications Of A US Dollar Rally

by Martin Pring,

President, Pring Research

* Two bullish dollar charts

* Several dollar sympathy relationships are likely to reverse

In a couple of September articles on the dollar I suggested that the potential for a short-term rally existed, as bearish sentiment and other indicators appeared to have moved to an extreme. A rally of some kind does...

READ MORE

MEMBERS ONLY

COMPARISON OF BOND CATEGORIES SUPPORTS THE CASE FOR HIGHER BOND YIELDS -- HIGH YIELD BONDS ARE OUTPERFORMING INVESTMENT GRADE CORPORATES -- CORPORATE BONDS AND TIPS ARE OUTPERFORMING TREASURIES -- SHORTER-MATURITY BONDS ARE OUTPERFORMING LONGER MATURITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

HIGH YIELD BONDS ARE OUTPERFORMING INVESTMENT GRADE BONDS... One of the ways that we can tell which way interest rates are expected to trend is to compare the relative performance of various bond categories. Let's start with corporate bonds. Chart 1 is a ratio of the iBoxx High...

READ MORE

MEMBERS ONLY

BIG JUMP IN BOND YIELDS IS PUSHING FINANCIAL SECTOR TO A RECORD HIGH -- BANKS AND BROKERAGE ETFS ARE ALSO ACHIEVING BULLISH BREAKOUTS -- UTILITIES ARE REITS ARE FALLING WITH BOND PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD SURGES TO TWO-MONTH HIGH... The green bars in Chart 1 show the 10-Year Treasury Yield ($TNX) jumping 8 basis points today to reach the highest level since the end of July. The chart also shows the TNX having risen above a falling trendline drawn along its March/...

READ MORE

MEMBERS ONLY

SMALL CAP VALUE ETF LEADS RUSSELL 2000 TO RECORD HIGH -- INDUSTRIAL SPDR HITS NEW RECORD -- SO DO THE DOW TRANSPORTS -- RYDER NEARS UPSIDE BREAKOUT -- BANKS CONTINUE TO RISE -- FINANCIAL SPDR NEARS A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES LEAD SMALL CAPS TO RECORD HIGHS... The S&P Small Cap Index ($SML) and the Russell 2000 Small Cap Index ($RUT) are hitting record highs today. Small cap value stocks are the main driver behind the breakout. Chart 1 shows the Russell 2000 Value iShares (IWN)...

READ MORE

MEMBERS ONLY

Staples And Materials: Which Sector To Hold And Which One To Fold?

by Martin Pring,

President, Pring Research

The relationship between Staples and Materials

* Long-term relative trends

* Breakouts and breakdowns

* Which of the materials sub-components are breaking out?

* Euro looks short-term toppy

The relationship between Staples and Materials

Most of the time I concentrate on the trend of the overall market, but some sector charts for Consumer Staples...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS MAY BE PULLING MONEY OUT OF TECHNOLOGY INTO CHEAPER PARTS OF THE MARKET -- APPLE, AMAZON, AND GOOGLE LOSE GROUND -- RISING OIL PRICES MAY CONTRIBUTE TO HIGHER BOND YIELDS -- RISING YIELDS ARE BOOSTING SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE, AMAZON, AND GOOGLE WEIGH ON TECH SECTOR... While the stock market is holding up okay, some rotations are going on beneath the surface. One is the rotation out of large cap tech stocks, former market leaders, into cheaper parts of the market like financials, small caps, and transports. Let&...

READ MORE

MEMBERS ONLY

Fed Unwinding Triggers Rates To Rise, A Dollar Reversal And A Boost To Financials

by Martin Pring,

President, Pring Research

* Dollar begins a short-term rally

* Fed action boosts rates

* Financials set to move higher

Fed action on Wednesday had the effect of boosting rates, thereby causing short-term reversals in several markets and relationships. These inflexion points in the markets are expected to influence prices over the next few weeks.

Dollar...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS RISE TO HIGHEST LEVEL IN TWO MONTHS -- FEDEX AND UNITED PARCEL SERVICE HIT NEW RECORDS -- NORFOLK SOUTHERN AND UNION PACIFIC LEAD DOW JONES US RAILROAD INDEX TO RECORD -- TRUCKING INDEX ALSO HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS RISE TO TWO-MONTH HIGH... Recent messages have described the gradual improvement in transportation stocks since mid-August. It started with their ability to reclaim their 200-day average in late August, followed by a move back above their 50-day average earlier this month. Chart 1 shows the Dow Jones Transportation...

READ MORE

MEMBERS ONLY

DOW JONES INTEGRATED OIL & GAS INDEX IS TRADING OVER ITS 200-DAY AVERAGE AND MAY BE ON VERGE OF UPSIDE BREAKOUT -- CHEVRON TOUCHES THREE-YEAR HIGH -- PHILLIPS 66 NEARS ALL-TIME HIGH -- CONOCOPHILLIPS RISES TO HIGHEST LEVEL IN FOUR MONTHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES US INTEGRATED OIL & GAS INDEX MAY BE BREAKING OUT... Energy stocks have been the market's weakest performers during 2017. They're starting, however, to take a turn for the better, both in absolute and relative terms. Energy has been the market's strongest...

READ MORE

MEMBERS ONLY

BANKS ARE LEADING FINANCIAL SECTOR HIGHER -- BANK LEADERS INCLUDE CITIGROUP, BANK OF AMERICA, AND JP MORGAN -- FIVE-YEAR TREASURY YIELD CLEARS 50-DAY AVERAGE -- 7-10 YEAR TREASURY BOND ISHARES ARE TESTING SUPPORT -- UTILITIES WEAKEN ALONG WITH BONDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR CLEARS 50-DAY AVERAGE... Financial stocks are helping lead the market higher today. Chart 1 shows the Financial Sector SPDR (XLF) trading at the highest level in five weeks after clearing its 50-day average. Its relative strength ratio (top of chart) continues its September rebound. Banks are leading the...

READ MORE

MEMBERS ONLY

RISING ENERGY PRICES HELP BOOST AUGUST CPI -- ENERGY ETF REACHES HIGHEST LEVEL IN FIVE MONTHS -- THAT'S HELPING BOOST BOND YIELDS -- SO ARE RISING YIELDS IN THE UK -- THE POUNG SURGES TO HIGHEST LEVEL IN A YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETF REACHES FIVE-MONTH HIGH ... It was reported yesterday that the headline CPI for August rose 0.4% from the previous month, which was its biggest monthly gain since January. That boosted its year-over-year comparison to 1.9%, which is just shy of the Fed's target of 2%...

READ MORE

MEMBERS ONLY

Is It Time To Buy The US Dollar?

by Martin Pring,

President, Pring Research

* A few words on sentiment

* The long-term technical remains bearish but…

* Short-term is almost bullish

* What about the euro?

* Conclusion

A few words on sentiment

The Dollar Index has been in a virtual free fall since the end of last year. No market goes down forever, because traders exhaust their...

READ MORE

MEMBERS ONLY

It's Steady As She Goes For Global And US Equities

by Martin Pring,

President, Pring Research

* Many positive indicators

* Strong showing outside the US as well

The last time I focused on the US stock market I pointed out that I liked the fact that the market was shrugging off bad news in the form of numerous widely circulated articles calling for a correction. While not...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE DRAWING SUPPORT FROM WEAKER PARTS OF THE MARKET -- THAT INCLUDES ENERGY, FINANCIALS, RETAILERS, SMALL CAPS, AND TRANSPORTS -- GOLD PULLS BACK FROM OVERBOUGHT CONDITION, BUT REMAINS ABOVE BREAKOUT POINT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS ARE RISING AGAIN ... With the three major stock indexes hitting record highs yesterday, attention remains focused on market leaders. To me, the bigger story may be the resurgence of weaker parts of the market that have been holding it back. Small caps are at the top of the...

READ MORE

MEMBERS ONLY

DOLLAR INDEX DROPS TO TWO--YEAR LOW -- EURO IS TRADING OVER 120 -- WHILE CANADIAN DOLLAR HITS TWO-YEAR HIGH -- GOLD IS RISING EVEN FASTER -- GOLD SPDR MAY BE NEARING A MAJOR UPSIDE BREAKOUT -- THAT WOULDN'T BE GOOD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX FALLS TO TWO-YEAR LOW... The weekly bars in Chart 1 show the PowerShares U.S. Dollar Index ETF (UUP) falling below its 2016 bottom to the lowest level since the start of 2015. Some of that has to do with the fact that bond yields in the states...

READ MORE

MEMBERS ONLY

Market Roundup Live With Martin Pring September 2017

by Martin Pring,

President, Pring Research

Here is the link to the Market Roundup Video Recording for September 2017.

Market Round Up Live With Martin Pring September 2017 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily...

READ MORE

MEMBERS ONLY

STOCKS ENDING ON A STRONG NOTE -- AND REMAIN ABOVE MOVING AVERAGE LINES -- SAFE HAVENS LIKE BONDS, GOLD, AND YEN PULL BACK -- THREE-MONTH EXTENSION OF DEBT CEILING HELPS BOOST STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS REMAIN ABOVE 50-DAY LINES... Stocks are ending the day on a strong note. Chart 1 shows the Dow Jones Industrial SPDR (DIA) remaining above its 50-day average. Chart 2 shows the S&P 500 SPDR (SPY) bouncing off its 50-day line as well. Chart 3 shows the PowerShares...

READ MORE

MEMBERS ONLY

Gold And Silver Getting Close To A Major Breakout

by Martin Pring,

President, Pring Research

* Long-term technical structure looks solid

* Gold shares are solid

* Hail silver!

Back at the end of July in an article entitled Has $GOLD Got What It Takes For A Major Rally? I pointed out that gold was sporting some bullish characteristics to the extent that we would probably see a...

READ MORE

MEMBERS ONLY

GOLD IS OUTPERFORMING BOND PRICES -- THAT INCLUDES ALL BOND CATEGORIES -- GOLD/BOND RATIOS ARE BREAKING OUT TO THE UPSIDE OR ARE CLOSE TO DOING SO -- THAT SUGGESTS THAT INVESTORS ARE BUYING GOLD ASSETS AS A HEDGE AGAINST EXPENSIVE BOND AND STOCK MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALL BOND CATEGORIES ARE UNDERFORMING GOLD IN 2017... During the week, I wrote about gold (and gold miners) achieving upside breakouts and outperforming stocks for the first time since 2011. Gold, however, is also doing better than bonds for the first time in six years. Not just some bond categories,...

READ MORE

MEMBERS ONLY

Growth Breaks Out Against Value As The NASDAQ Top Fails To Complete

by Martin Pring,

President, Pring Research

* NASDAQ is leading on the upside again

* The Technology/Staples ratio continues to signal the all-clear for the whole market

* Growth versus value is tipping towards growth

NASDAQ is leading on the upside again

Back in July the NASDAQ Composite was the epicenter for the coming market weakness, as it...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE ENDING AUGUST ON A STRONG NOTE -- WITH THE NASDAQ BACK IN THE LEAD -- TECHNOLOGY AND BIOTECH ETFS HIT NEW HIGHS -- HEALTHCARE IS WEEK'S STRONGEST SECTOR -- SMALL CAPS AND TRANSPORTS ARE REBOUNDING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS ARE ENDING THE MONTH ON A STRONG NOTE ... Although the month of August will still go down as the weakest month of the year, stock indexes appear to be ending the month on a strong note. And all of them are showing short-term technical improvement. Chart 1, for example,...

READ MORE

MEMBERS ONLY

TWO-YEAR LOW IN THE DOLLAR CONTRIBUTES TO UPSIDE BREAKOUT IN GOLD -- GOLD IS OUTPERFORMING STOCKS FOR THE FIRST TIME SINCE 2011 -- BUT NOT ENOUGH TO POSE A SERIOUS THREAT TO STOCKS -- RISING EURO IS HURTING STOXX 50

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD ACHIEVES BULLISH BREAKOUT ... After trading sideways for the past five months, gold finally achieved a bullish breakout yesterday. Chart 1 shows the price of gold breaking the $1300 barrier which had turned back previous rallies in April and early June. Gold is adding to that gain today. The flight...

READ MORE

MEMBERS ONLY

Balance Of Equity Power Continues To Shift Away From The US

by Martin Pring,

President, Pring Research

* Contrary opinion argues against being too bearish on US equities

* US equities are breaking down against the world

* Emerging markets are emerging

* Metals driving north

Contrary opinion argues against being too bearish on US equities

The majority of the shorter-term indicators monitoring trends lasting between 4-6 weeks argue for an...

READ MORE

MEMBERS ONLY

Is Housing Headed Towards The Basement?

by Martin Pring,

President, Pring Research

* Housing and housing stocks are vulnerable

* Equal weight ETF’s are becoming less equal

* Gold short-term vulnerable

Housing and housing stocks are vulnerable

New data for residential new single family home sales ($$HSNG1FAM) was released this morning and it is starting to look a little shaky. Chart 1 does not...

READ MORE

MEMBERS ONLY

A Take On The Utilities In An On-going Correction

by Martin Pring,

President, Pring Research

* Bearish short-term charts suggest there is more to come on the downside

* Consumer Discretionary—not so discreet

* Energy—out of gas

* Utilities—a place to hide?

Bearish short-term charts suggest there is more to come on the downside

For the last two weeks, I have been zeroing in on a...

READ MORE

MEMBERS ONLY

STOCKS HAVE A BAD DAY -- S&P 500 FALLS TO LOWEST LEVEL IN A MONTH -- THE RUSSELL 2000 CLOSES BELOW 200-DAY AVERAGE -- SO DO THE TRANSPORTS -- VOLATILITY MEASURES SPIKE HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 FALLS TO SIX-WEEK LOW... Selling pressure resumed with a vengeance today. And a lot of support levels have been broken. Chart 1 shows the S&P 500 falling back below its 50-day average to the lowest level in more than a month. Volume was higher....

READ MORE

MEMBERS ONLY

RUSSELL 2000 FINDS SUPPORT AT 200-DAY AVERAGE -- SO HAVE THE DOW TRANSPORTS -- TWO-YEAR COPPER HIGH BOOSTS COPPER MINER ETF -- FREEPORT MCMORAN IS BIGGEST PERCENTAGE GAINER IN THE S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

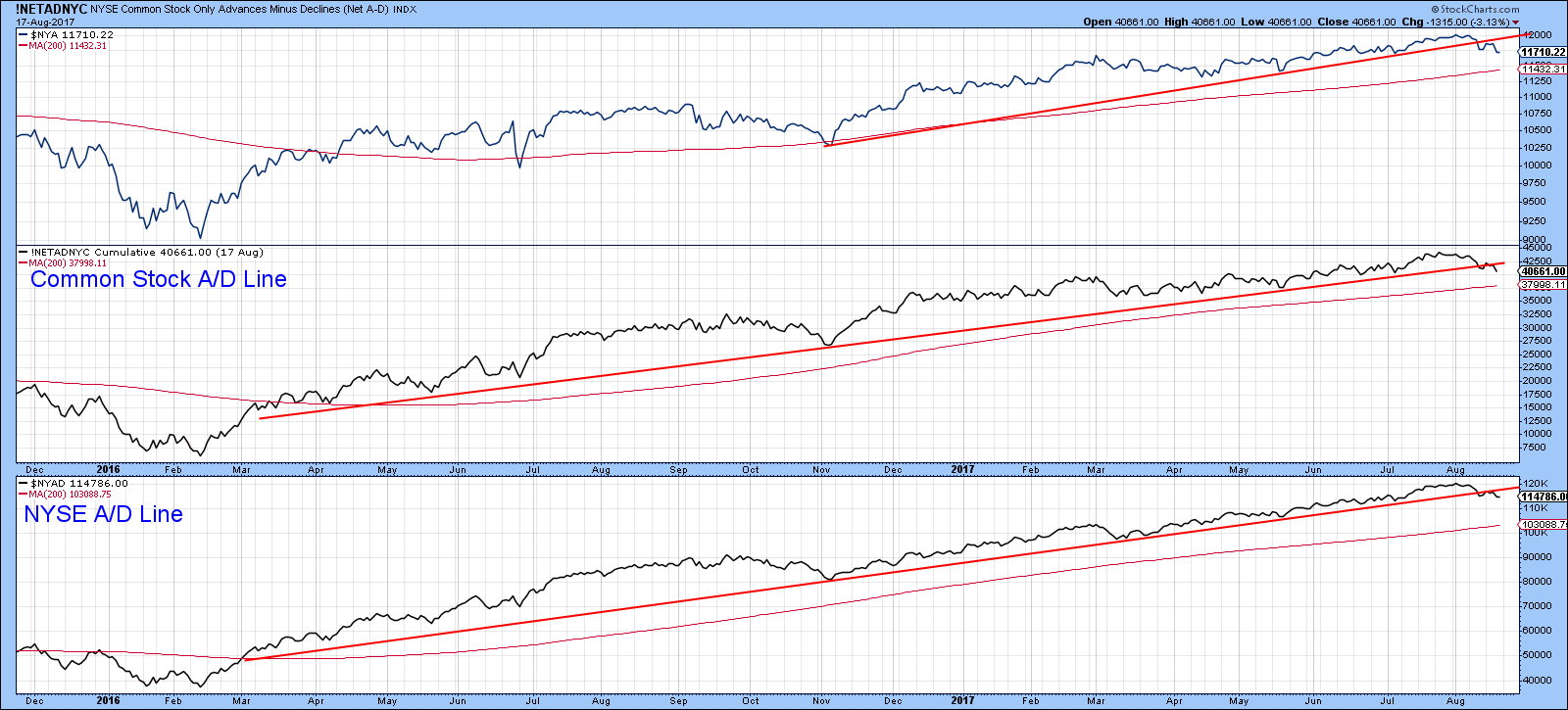

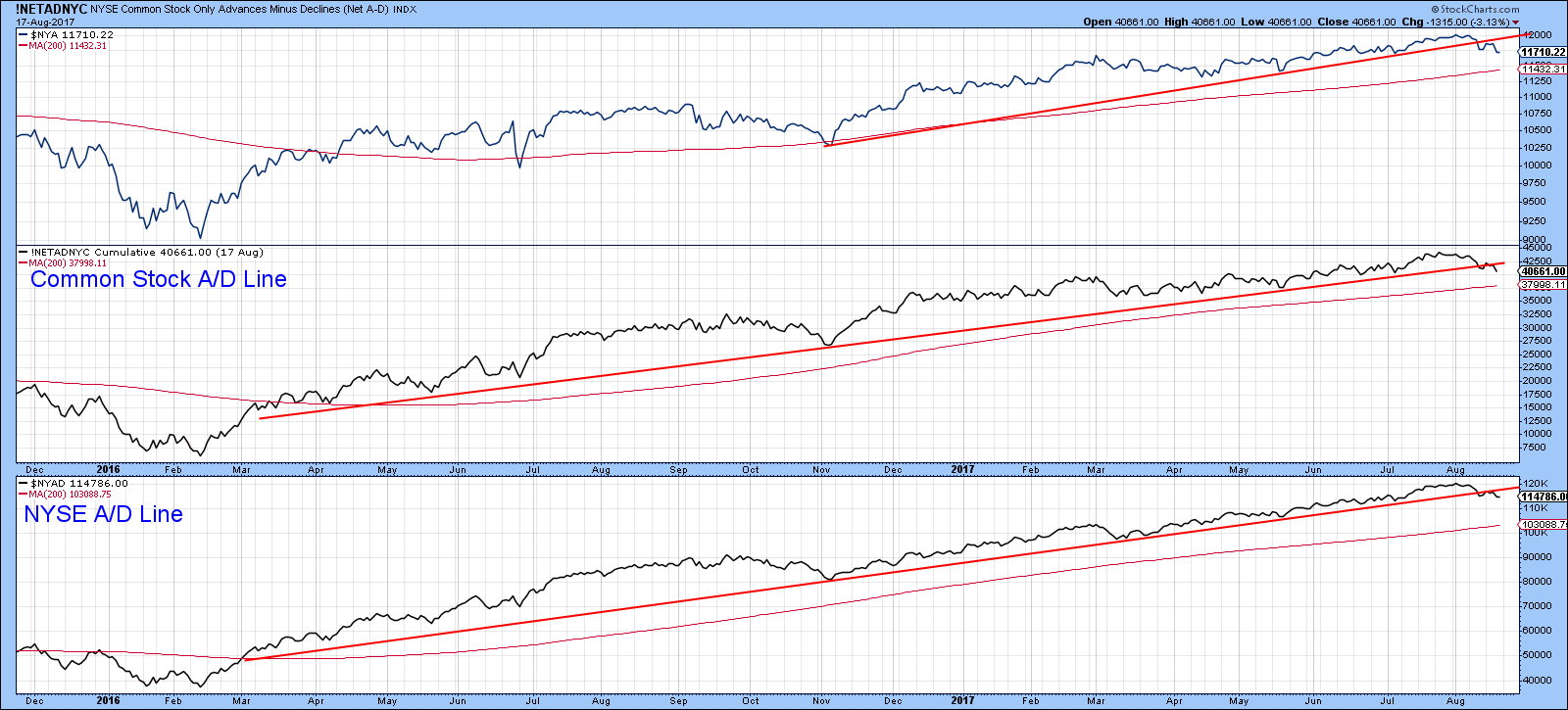

WHY IT'S IMPORTANT TO TRACK THE PERFORMANCE OF SMALLER STOCKS... One of the concerns expressed recently by several technical analysts (including myself) has been the relatively weak performance by small stocks. That's because they often tell us more about the true state of the stock market...

READ MORE

MEMBERS ONLY

HOME IMPROVEMENT STOCKS LEAD CYCLICALS LOWER -- AMAZON HAS ALSO WEAKENED -- CONSUMER DISCRETIONARY SPDR IS UNDERPERFORMING THE MARKET -- IT'S ALSO UNDERPERFORMING CONSUMER STAPLES WHICH ARE GAINING GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOME DEPOT AND LOWES TUMBLE... Heavy selling in retail stocks is weighing on cyclical stocks which are the one of the day's weakest sectors. Home improvement stocks are the day's weakest group in that sector. Chart 1 shows Home Depot (HD) losing nearly -3% and falling...

READ MORE

MEMBERS ONLY

US Stock Market Showing More Near-term Weakness

by Martin Pring,

President, Pring Research

* More stock market indicators showing weakness

* Bonds close to a breakout

* Commodity rally over?

* Dollar bottoming or about to break down?

More stock market indicators showing weakness

Last week I made the case for a correction in the market based on some specific indicators that has started to flash some...

READ MORE

MEMBERS ONLY

VOLATILITY SPIKES AS MARKET SELLOFF CONTINUES -- VIX INDEX CLIMBS TO THREE-MONTH HIGH AND PLAYS CATCH-UP TO RISING NASDAQ 100 VOLATILITY INDEX -- MAJOR AVERAGES LOSE MORE GROUND -- THE S&P 500 AND NASDAQ 100 DROP TOWARD 50-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL AND MID SIZE STOCK INDEXES BREAK SUPPORT... Yesterday's message showed small and midcap stock indexes testing support at their July lows, and warned that any further weakness would be bad for them and the rest of the market. Both indexes have broken support levels and are now...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS TRADE LOWER ON HEIGHTENED TENSIONS -- MACD LINES FOR S&P 500 TURN NEGATIVE -- SMALL AND MIDSIZE STOCKS ARE DAY'S BIGGEST LOSERS -- VIX INDEX GAINS 8% -- RECENT GAINS IN THE NASDAQ 100 VOLATILITY INDEX ARE OF MORE CONCERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 PULLS BACK ... Global stocks are in the red today, which continues the profit-taking that started yesterday afternoon. Yesterday's downside reversal day in U.S. stock indexes on rising volume signaled the likelihood of more profit-taking. Foreign stocks in Europe and Asia are falling more...

READ MORE

MEMBERS ONLY

Dow 22,000 Mission Accomplished. Oh Yeah?

by Martin Pring,

President, Pring Research

* Bullish percent indicators are starting to deteriorate

* Short-term confidence may be turning

* Small caps getting smaller?

* Oversold Dollar Index bounces from support

Bullish Percent Index indicators are starting to deteriorate

This week we saw the financial media and President Trump glorify the fact that the DJIA had exceeded 22,000...

READ MORE

MEMBERS ONLY

STOCKS END THE WEEK ON A STRONG NOTE WITH THE DOW STILL IN THE LEAD -- SMALL CAPS REBOUND AS TRANSPORTS HOLD 200-DAY LINE -- JUMP IN BOND YIELDS KEEPS FINANCIALS IN THE LEAD -- OVERSOLD DOLLAR BOUNCES OFF MAJOR CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW HITS NEW RECORD WHILE NASDAQ HOLDS BACK ... The Dow Industrials continue to lead the market higher. Chart 1 shows the Dow ending the week at a new record. Its weekly gain of 1.2% led all other market indexes. Its 14-day RSI line, however, shows the Dow now in...

READ MORE

MEMBERS ONLY

AFTER FALLING DURING THE FIRST HALF OF THE YEAR, CRUDE OIL AND GASOLINE PRICES ROSE DURING JULY -- THAT SHOULD BOOST INFLATION NUMBERS FOR THAT MONTH -- THE FED SHOULD LIKE THAT

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY PRICES ROSE DURING JULY... A report on Tuesday covered economic conditions during the second quarter. One of the things it showed was continuing low inflation, which remains well below the Fed's target of 2%. One of the factors mentioned was falling energy prices. Naturally, the media reported...

READ MORE

MEMBERS ONLY

A FEW CRACKS ARE SHOWING IN THE STOCK UPTREND -- THE FIRST ONE IS DOW OUTPERFORMANCE -- THE SECOND IS TRANSPORTATION SELLING -- A THIRD IS SMALL CAP WEAKNESS -- AND STOCKS HAVE ENTERED A SEASONALLY A WEAK PERIOD BEWEEN AUGUST AND SEPTEMBER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW OUTPERFORMANCE MAY NOT BE A SIGN OF MARKET STRENGTH... It seems everyone in the media has been transfixed on the Dow Industrials hitting 22K this week. And they cite that as proof that the stock rally is alive and well. That recent Dow strength, however, is coming from a...

READ MORE

MEMBERS ONLY

Market Round Up Video Recording With Martin Pring 2017-08-01

by Martin Pring,

President, Pring Research

The Market Round Up Video Recording for August is available. Use the HD button for better clarity when viewing.

Market Round Up Live With Martin Pring 2017-08-01 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the...

READ MORE