MEMBERS ONLY

FALLING DOLLAR CONTRIBUTES TO RISING EMERGING MARKET CURRENCIES AND STOCKS -- MEXICAN PESO AND STOCK ETF ALSO GAIN GROUND -- A RISING YUAN IS HELPING BOOST CHINESE STOCKS -- STOCK GAINS EVAPORATE ON POSTPONEMENT OF HEALTHCARE VOTE

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKET CURRENCIES SUPPORT RISING STOCKS... Previous messages have shown the rise in emerging market stocks, partially owing to the drop in the U.S. dollar. The same can be said of EM currencies. The red line in Chart 1 shows Emerging Markets iShares (EEM) rising to the highest level...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES SUFFER BIGGEST DROP THIS YEAR -- SMALL CAPS AND TRANSPORTS LOOK EVEN WORSE -- BANKS LEAD FINANCIALS LOWER ON FALLING BOND YIELDS -- FALLING DOLLAR BOOSTS GOLD -- EURO NEARS TEST OF FEBRUARY HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK ETFS SELLOFF... The market is suffering its worst day this year. Chart 1 show the PowerShares Nasdaq QQQ experiencing a downside reversal day after hitting a record high this morning. Its 14-day RSI has fallen out of overbought territory over 70 for the first time since December which shows...

READ MORE

MEMBERS ONLY

Five Markets That Are Approaching Critical Junctures

by Martin Pring,

President, Pring Research

* US Dollar completes a head and shoulders top

* Dollar right at key up trendline against the rest of the world

* Gold caught in a tight trading range

* West Texas oil also restrained in a tight trading range

* Mexico---a chance to jump over the wall?

* Emerging markets to the rescue

It...

READ MORE

MEMBERS ONLY

ALL-WORLD INDEX HITS NEW RECORD -- FOREIGN STOCKS CONTINUE TO RALLY -- ASIA LEADS EMERGING MARKETS HIGHER -- EUROPE ALSO LOOKS STRONG -- THAT INCLUDES IRELAND

by John Murphy,

Chief Technical Analyst, StockCharts.com

FTSE ALL-WORLD INDEX HITS NEW RECORD... Chart 1 shows the FTSE All-World Stock Index ($FAW) trading at a new record high. The FAW includes stocks from 47 developed and emerging markets. It just recently cleared its 2015 high which resumed its major uptrend. That's a positive sign because...

READ MORE

MEMBERS ONLY

STOCKS AND BONDS RALLY ON FED ANNOUNCEMENT -- PULLBACK IN YIELDS BOOSTS REITS AND UTILITIES, WHILE BANKS LAG -- DOLLAR DROP BOOSTS GOLD -- STOCK INDEXES REACT POSITIVELY -- EMERGING MARKETS LEAD FOREIGN STOCK ETFS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED MOVE VIEWED AS DOVISH... The Fed hiked rates today as expected, with expectations for two more hikes this year. Judging from immediate market reactions, the Fed announcement is being viewed as somewhat dovish. For one thing, bond yields are dropping. Chart 1 shows the 10-Year Treasury Yield falling sharply....

READ MORE

MEMBERS ONLY

When Will Rising Rates Hit The Stock Market?

by Martin Pring,

President, Pring Research

* No consistent relationship between rates and equity prices

* Three step and a stumble

* Combining interest rate movements with equity trends

No consistent relationship between rates and equity prices

A lot of prognosticators have recently raised concerns that rising rates will soon affect equities in an adverse way. Last week at...

READ MORE

MEMBERS ONLY

SMALL CAPS AND TRANSPORTS CONTINUE TO WEAKEN -- ENERGY STOCKS CONTINUE TO DROP ON FALLING OIL PRICE -- COMMODITY SELLOFF WEAKENS INFLATION TRADE -- HIGH YIELD BONDS SELL OFF ON COMMODITY WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS AND TRANSPORTS WEAKEN ... Bond yields are hitting multi-year highs in anticipation of a Fed rate hike tomorrow. Stocks remain in an uptrend, but weakness in some stock groups is sending short-term caution signals. Small caps and transports continue to weaken. So do energy shares along with falling oil...

READ MORE

MEMBERS ONLY

INTEREST RATES CLIMB ALONG WITH THE DOLLAR -- INVESTMENT GRADE CORPORATES WEAKEN -- DROP IN JUNK BONDS MAY BE SHORT-TERM WARNING FOR STOCKS -- SMALL CAPS THREATEN 50-DAY LINE -- ENERGY SPDR PLUNGES ON FALLING CRUDE OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CONTINUE TO CLIMB... Chart 1 shows the 10-Year Treasury Yield (TNX) climbing to 2.55% which is the highest level this year. The 2-Year Treasury yield (most sensitive to a Fed rate hike) has climbed to 1.35% which is the highest level in seven years. Odds for...

READ MORE

MEMBERS ONLY

Is The Global Bull Market In Interest Rates Resuming?

by Martin Pring,

President, Pring Research

* The global picture

* Short-term rates

* Longer-term rates

* International rates

The Global Picture

When I talk about interest rates I am referring to a general advance that takes place at both ends of the yield spectrum. I make this reference because in many situations certain maturities and credit qualities do not...

READ MORE

MEMBERS ONLY

HOMEBUILDING LEADERS ARE DR HORTON, LENNAR, AND PULTEGROUP -- HEALTH CARE INSURERS LED HIGHER BY HUMANA, CIGNA, AND UNITEDHEALTH GROUP -- BIOTECH AND DRUG ETFS MEET RESISTANCE -- HEALTHCARE SPDR TESTS OLD HIGHS -- BAXTER INTL RECOVERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DR HORTON, LENNAR, AND PULTE LOOK STRONG... Recent messages have shown bullish breakouts in a couple of ETFs tied to housing. The stronger of the two is the U.S. Home Construction iShares (ITB) which is the purest play on homebuilders. That's because its five biggest stocks are...

READ MORE

MEMBERS ONLY

TWO-YEAR TREASURY YIELD HITS SEVEN -YEAR HIGH ON INCREASED ODDS FOR MARCH RATE HIKE -- THAT'S BOOSTING THE DOLLAR WHICH MAY BE ENDING ITS 2017 CORRECTION -- GOLD ETF STALLS AT 200-DAY LINE -- GOLD MINERS ARE EVEN WEAKER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TWO-YEAR TREASURY YIELD REACHES SEVEN-YEAR HIGH... Chart 1 shows the 2-Year Treasury yield climbing above 1.30% today for the first time in seven years. That shorter term yield is more sensitive to the potential for a rate hike than longer-range maturities. That suggests that fixed income traders are taking...

READ MORE

MEMBERS ONLY

STOCKS HIT NEW RECORDS AS BOND YIELDS AND THE DOLLAR CLIMB -- FINANCIALS, INDUSTRIALS, AND MATERIALS LEAD RALLY -- SO DO SMALL CAPS AND TRANSPORTS -- GOLD AND OTHER SAFE HAVENS WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SURGE TO NEW RECORDS ... Last night's presidential speech appears to have re-energized the reflation trade that favors stocks over bonds, and economically-sensitive stocks in particular. The first three charts show ETFs of the three major U.S. stock indexes gapping into new highs. Their RSI lines remain...

READ MORE

MEMBERS ONLY

$GOLD : A Bear Market Rally Or A New Bull Market?

by Martin Pring,

President, Pring Research

* The all-important trading range

* The short-term trend for Gold

* What’s going on with those Gold shares?

* Hail Silver?

$GOLD has been rallying of late and the question naturally arises as to whether this advance is for real or is a normal bear market counter-cyclical advance. The answer is not...

READ MORE

MEMBERS ONLY

BIOTECH ISHARES NEAR UPSIDE BREAKOUT -- TWO SMALLER BIOTECH ETFS HAVE ALREADY BROKEN OUT -- TEN YEAR TREASURY YIELD THREATENS 2017 LOW -- SMALL CAPS ARE STARTING TO WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIOTECH ISHARES NEAR SEPTEMBER HIGH... I've been writing about the recent upturn in the healthcare sector. And that the rally was being led higher medical device and equipment stocks, as well as health insurers. Biotechs and pharmaceuticals have lagged behind. Chart 1, however, shows the Nasdaq Biotechnology iShares...

READ MORE

MEMBERS ONLY

A Funny Thing May Be Happening On The Way To The Secular Bull Market In Interest Rates

by Martin Pring,

President, Pring Research

* How to spot a secular reversal

* Not all maturities are created equal

* The near-term technical picture

How to spot a secular reversal

A secular, or very long-term, trend is one that exists over many business cycles or what are usually called primary bull and bear markets. They vary in length...

READ MORE

MEMBERS ONLY

TRANSPORTS DIVERGE FROM INDUSTRIALS -- UTILITY SURGE MAY ALSO SIGNAL DEFENSIVE SHIFT -- UTILITY/TRANSPORTATION RATIO TURNS UP -- CONSUMER STAPLES SPDR NEARS NEW RECORD -- THAT MAY ALSO SIGNAL A MORE DEFENSIVE TONE IN AN OVERBOUGHT MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS START TO WEAKEN ... A number of short-term caution signals are showing up for stocks which might be hinting that the current rally is due for a pullback. Some of those caution signals are coming from relationships between the three Dow Averages. Let's start with the transports. Chart...

READ MORE

MEMBERS ONLY

HOMEBUILDERS ARE HAVING A STRONG DAY -- USING RATIO ANALYSIS TO CHOOSE THE STRONGEST HOUSING ETF -- AMAZON, HOME DEPOT, AND WAL-MART LEAD VANECK RETAIL ETF HIGHER -- S&P 500 VALUE/GROWTH RATIO MAY BE JUST PAUSING IN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. HOME CONSTRUCTION ISHARES HIT NEW HIGHS... Add housing stocks to parts of the stock market that still offer value and are attracting new money. Chart 1 shows the U.S. Home Construction iShares (ITB) climbing today to the highest level in nearly a decade. That's following...

READ MORE

MEMBERS ONLY

Is The Dollar Getting Ready To Make A Big Move?

by Martin Pring,

President, Pring Research

* The Dollar Index -- primary trend

* The Dollar Index viewed from the short-term trend

* The euro

* The yen

* The Canadian dollar

* Emerging market currencies

Expectations were high for the US Dollar ($USD) following the election and indeed, the currency did rally for a while. However, the trend for most of...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR TURNS UP -- HEALTH CARE EQUIPMENT AND MEDICAL DEVICE ETFS HIT NEW RECORDS -- HEALTHCARE PROVIDERS ETF TOUCHES 52-WEEK HIGH -- BIOTECHS AND PHARMACEUTAL ETFS SHOW IMPROVEMENT BUT ARE HEALTHCARE LAGGARDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR TURNS UP... In case you haven't noticed, the Health Care SPDR (XLV) has taken a bullish turn. Chart 1 shows the XLV breaking out of a bullish "ascending triangle" that I described in my February 4 message. At the same time, the XLV/...

READ MORE

MEMBERS ONLY

BOND YIELDS CLEAR 50-DAY LINE ON YELLEN TESTIMONY -- THAT HELPS FINANCIALS AND HURTS UTILITIES -- FINANCIALS/UTILITIES RATIO TURNS BACK UP -- RISING YIELDS BOOST DOLLAR AND WHICH HURTS GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CLEAR 50-DAY LINE... Previous messages have described Treasury bond yields as consolidating within a major uptrend since mid-December . Today's jump in yields supports that view. In testimomy before Congress today, Janet Yellen warned about the danger of the Fed falling behind the inflation curve. That more...

READ MORE

MEMBERS ONLY

Market Extends Gains As Breadth Surprisingly Improves

by Martin Pring,

President, Pring Research

More stocks trading above their 150-day MA’s

Last week I pointed out that many indicators were overstretched, thereby indicating the probability of a correction. I also stated that during a bull market, surprises typically develop on the upside. Consequently, if the market was able to shrug off its overbought...

READ MORE

MEMBERS ONLY

COPPER AND STEEL STOCKS RESUME UPTRENDS -- CRUDE OIL BOUNCE BOOSTS ENERGY SECTOR -- OIL SERVICE STOCKS ARE ENERGY LEADERS -- CANADIAN STOCKS HIT NEW RECORD ON COMMODITY RALLY -- AUSSIE AND CANADIAN DOLLARS ALSO TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER AND STEEL STOCKS RESUME UPTRENDS... Economically-sensitive industrial metals are rising again, along with stocks tied to them. The price of copper is up 3.5% today to the highest level in nearly two years. So are copper shares. Chart 1 shows the Global X Copper Miners ETF (COPX) resuming...

READ MORE

MEMBERS ONLY

New Highs In The Market ... But Fewer Stocks Are Participating

by Martin Pring,

President, Pring Research

* Market still overstretched

* Greater selectivity as the market moves higher

* Whatever happened to China?

Last week, I pointed out that several indicators were pointing to a short-term correction. I also said that counter-cyclical corrections are difficult to play, essentially because they are usually over before you realize it. To quote...

READ MORE

MEMBERS ONLY

GOLD CONTINUES RALLY BUT NEARS RESISTANCE -- SO DO GOLD MINERS -- EURO STAYS FLAT -- PULLBACK IN BOND YIELDS ARE HELPING GOLD BUT MAYBE NOT FOR LONG -- REBOUND IN SAFE HAVEN BONDS AND THE YEN NOT THAT IMPRESSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD REACHES THREE-MONTH HIGH... The price of gold continues to rise. Chart 1 shows the Gold Shares SPDR (GLD) trading at the highest level in three months. It has reached a point, however, where some overhead resistance may appear. For one thing, it has retraced 62% of its November/December...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD FRIDAY'S STOCK BOUNCE -- SO DO SMALL CAPS AND TRANSPORTS -- HEALTCHARE IS WEEK'S STRONGEST SECTOR -- HCA HOLDINGS ACHIEVES BULLISH BREAKOUT -- AMGEN SURGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 END WEEK ON A STRONG NOTE ... What started off as a soft week for stocks ended on a strong note. Friday's gain was enough to keep stock indexes basically flat for the entire week. But there was some improvement on the charts....

READ MORE

MEMBERS ONLY

Are Housing Stocks Topping Out?

by Martin Pring,

President, Pring Research

* Housing economic data is finely balanced

* The long-term technicals for housing equities are also evenly matched

* The bearish short-term picture could be the domino that tips everything

Housing economic data is finely balanced

The housing industry has not exactly been on a roll since the last recession, but it has...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR REACHES OVERBOUGHT TERRITORY -- BIG TECH STOCKS ARE UP AGAINST RESISTANCE OR PULLING BACK -- HEALTHCARE WINNERS INCUDE IDEXX LABS, BOSTON SCIENTIFIC, AND MERCK -- HCA HOLDINGS MAY BE NEAR BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR FINALLY REACHES OVERBOUGHT TERRITORY ... One of the trends supporting the stock market rally has been a strong technology sector. That group, however, has reached overbought territory for the first time in six months and is starting to weaken. Chart 1 shows the 14-day RSI for the Technology SPDR...

READ MORE

MEMBERS ONLY

DOLLAR STILL UNDER PRESSURE -- BUT EURO AND YEN ARE STILL IN DOWNTRENDS -- GOLD'S TREND MAY DEPEND ON THE EURO -- DOW MAY RETEST 50-DAY LINE -- TRANSPORTS FAIL TO REACH NEW HIGHS -- UTILITIES WEAKEN AT 200-DAY LINE -- APPLE NEARS RECORD HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR BREAKS SHORT-TERM SUPPORT... I keep writing about prospects for a bounce in the U.S. Dollar, and it keeps dropping. My last message showed the PowerShares Dollar Index Fund (UUP) testing chart support at its early December low. The red circle in Chart 1 shows the UUP slipping below...

READ MORE

MEMBERS ONLY

The Main Trend Is Still Positive But The Consensus Says?

by Martin Pring,

President, Pring Research

* One reliable long-term indicator is bullish

* What are the short-term indicators saying?

* Bottom fisher to the rescue?

The long-term indicators for equities have been pointing north for quite a while. Quite often I’ll include one of those indicators in my articles as testimony to the bull, but hedge my...

READ MORE

MEMBERS ONLY

STOXX EUROPE 600 STOCK INDEX REACHES HIGHEST LEVEL IN A YEAR -- EUROPEAN BOND YIELDS ARE ALSO RISING -- A WEAK EURO MAKES EURO COMMODITY INFLATION EVEN HIGHER -- DOLLAR IS TRYING TO BOUNCE OFF CHART SUPPORT -- GOLD STRUGGLES WITH RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOXX EUROPE 600 HITS 52-WEEK HIGH... My last message focused on the idea that foreign stocks were also turning up which has strengthened the global rally. My main focus was on Europe which I'm returning to today. First, the rally the stocks. Chart 1 shows the STOXX Europe...

READ MORE

MEMBERS ONLY

World Equities Surging to New Highs

by Martin Pring,

President, Pring Research

* Global A/D Line breaks to the upside

* Post-election trends

* US equities

* The 10-year Yield

* Gold

* The Dollar Index

* Commodities

Global A/D Line breaks to the upside

This week has seen an important breakout for equities. I am not referring to Dow 20,000 but to my Global A/...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS RALLY AS DOW CROSSES 20K -- ALL COUNTRY WORLD STOCK INDEX HITS NEW RECORD -- FOREIGN STOCK INDEX ACHIEVES BULLISH BREAKOUT -- DO DOES EUROPE -- RISING BOND YIELDS DRIVE MONEY OUT OF BONDS AND INTO STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALL COUNTRY WORLD INDEX HITS NEW RECORD ... The Dow Industrials finally exceeded the 20K threshold that everyone in the media has been focused on. That's puts all major U.S. stock indexes in record highs. What's also impressive is that the current stock rally is global...

READ MORE

MEMBERS ONLY

MATERIALS SPDR HITS NEW HIGH -- LEADERS ARE CENTURY ALUMINUM, FREEPORT MCMORAN, INTERNATIONAL PAPER, AND DOW CHEMICAL -- DR HORTON LEADS HOMEBUILDERS HIGHER -- CONSUMER DISCRETIONARY SPDR REACHES NEW HIGH -- S&P 500 IS CLOSE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS SPDR HITS NEW RECORD ... Chart 1 shows the Materials Sector SPDR (XLB) surging to a record high. Equally impressive is that the fact that the XLB/SPX ratio (top of chart) has turned up as well. The XLB/SPX ratio has risen to the highest level in eighteen months...

READ MORE

MEMBERS ONLY

Some Country ETF's To Watch If The Rest Of The World Starts To Out Perform The US

by Martin Pring,

President, Pring Research

* The current status of the US versus the rest of the world

* Europe

* Asia

* Latin America

The current status of the US versus the rest of the world

Earlier in the week I pointed out that the trend of superior performance by the US against the "rest of the...

READ MORE

MEMBERS ONLY

10-YEAR TREASURY YIELD IS BOUNCING OFF ITS 50-DAY AVERAGE -- DOLLAR INDEX ALSO BOUNCES OFF SUPPORT -- GOLD MARKET MEETS RESISTANCE -- DOW REMAINS FLAT -- STOCK/ BOND RATIO STILL FAVORS STOCKS -- UPTREND IN JUNK BONDS IS ALSO STRETCHED

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD BOUNCES OFF 50-DAY AVERAGE ... The pullback in Treasury yields (coinciding with an oversold bounce in Treasury prices) may have run its course. Chart 1 shows the 10-Year Treasury Yield ($TNX) bouncing sharply off its 50-day moving average. The two momentum indicators above Chart 1 are also supportive....

READ MORE

MEMBERS ONLY

ALUMINUM, COPPER, AND STEEL STOCKS HAVE A STRONG DAY -- LEADERS ARE CENTURY ALUMINUM, SOUTHERN COPPER, NUCOR AND US STEEL -- THAT'S A POSITIVE SIGN FOR STOCKS AND NEGATIVE FOR BONDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CENTURY ALUMINUM LEADS THAT GROUP HIGHER... Aluminum stocks are leading a rally in the materials group. Chart 1 shows the Dow Jones US Aluminum Index surging to the highest level in eighteen months. Chart 2 shows Century Aluminum (CENX) looking pretty much the same. Alcoa (AA) is also having a...

READ MORE

MEMBERS ONLY

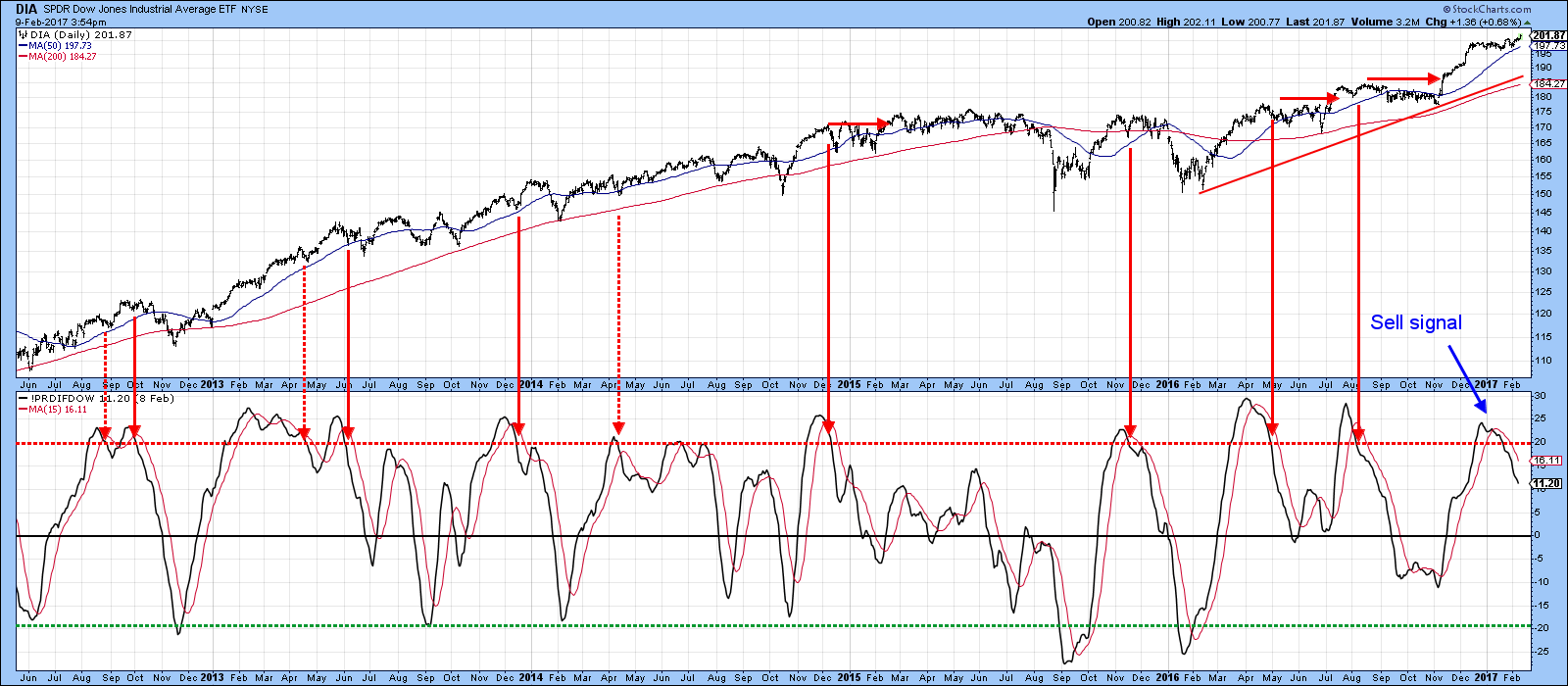

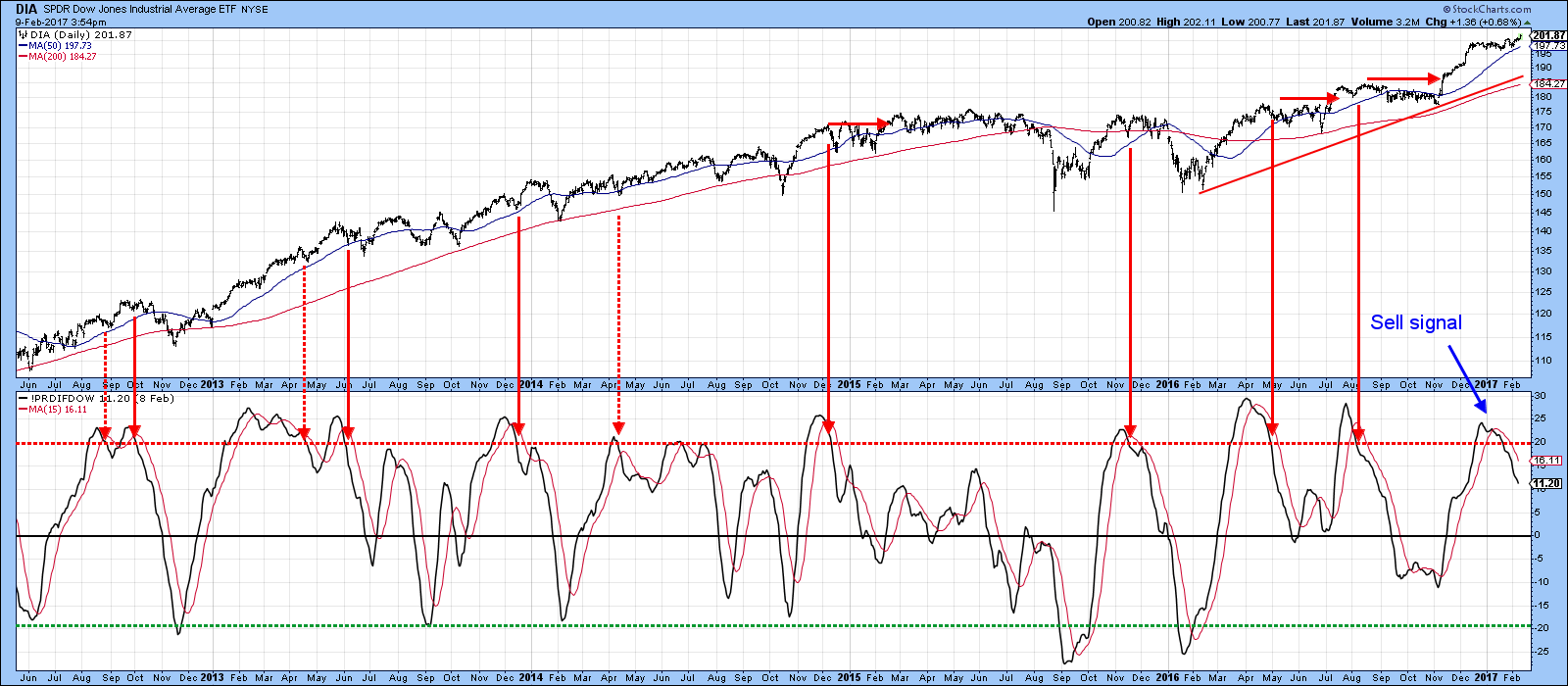

Is It Time To Emphasize Overseas Equities?

by Martin Pring,

President, Pring Research

* Gauging the trend between the US and the rest of the world

* Relative performance of the US is largely dependent on the direction of the Dollar

* Special K is close to a relative sell signal for the US

* What does “The rest of the world” look like?

* A few comments...

READ MORE

MEMBERS ONLY

SMALL CAPS RECOVER FROM THURSDAY SELLOFF TO KEEP SIDEWAYS TRADING RANGE INTACT -- NASDAQ RISES TO NEW RECORDS -- AN HOURLY LOOK AT FOUR SECTORS THAT SHOW IMPROVEMENT -- BOND YIELDS PULL BACK TO SUPPORT AND ARE STILL IN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS SURVIVE TEST OF SUPPORT... The stock market continues to trade sideways within the context of an overall uptrend. The fact that small caps stabilized at week's end is an encouraging sign (because they often lead larger stocks). At one point Thursday morning, the Russell 2000 iShares...

READ MORE

MEMBERS ONLY

SMALL CAPS LEAD MARKET LOWER -- S&P SHOWS NEGATIVE DIVERGENCE -- THAT INCREASES THE ODDS THAT THE DOW WON'T REACH 20K ON THIS ATTEMPT -- HEALTHCARE SPDR SELLS OFF ON TRUMP DRUG COMMENTS -- BUT HEALTH CARE PROVIDERS ANTHEM AND CIGNA LOOK STRONG

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM MARKET TREND WEAKENS... It looks like the Dow probably won't reach the 20K on this attempt. That's because of weaker market action in other stock indexes. Chart 1 shows the S&P 500 SPDR (SPY) starting to roll over to the downside after touching...

READ MORE

MEMBERS ONLY

FINDING THE RIGHT LONG-TERM TRENDLINE FOR THE 10-YEAR TREASURY YIELD -- NEXT UPSIDE TARGET FOR THE 10-YEAR YIELD IS 3% -- 10-YEAR BOND PRICE IS BOUNCING FROM SHORT-TERM OVERSOLD CONDITION -- RELATIVE STRENGTH TREND STILL FAVORS TRANSPORTS OVER UTILITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHICH TRENDLINE IS BILL GROSS REFERRING TO... I've heard a lot this week about Bill Gross' prediction that a move by the 10-Year Treasury yield above 2.6% would end the secular bull market in bonds. Part of his reasoning is that a rise above 2.6%...

READ MORE