MEMBERS ONLY

STRONG JOB REPORT PUSHES STOCKS AND BOND YIELDS HIGHER WITH FINANCIALS IN THE LEAD -- BANK, BROKER, AND INSURANCE ETFS STRENGHEN -- LEADERS INCLUDE BANK OF AMERICA, CHARLES SCHWAB, AND LINCOLN NATIONAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONG JOB REPORT PUSHES BOND YIELDS HIGHER... An unusually strong July job report is causing more optimism in financial markets. When that happens, stock prices usually rise and bond prices fall which is what's happening today. When bond prices fall, bond yields jump which is also happening. Chart...

READ MORE

MEMBERS ONLY

JUMP IN 10-YEAR JAPANESE BOND YIELD MAY BE HINTING AT TREASURY YIELD BOTTOM -- BOND PRICES ARE STARTING TO WEAKEN -- SO ARE BOND PROXIES -- BANKS AND FINANCIALS STRENGTHEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR JAPANESE YIELD SURGES TO FOUR MONTH HIGH... Chart 1 show the 10-Year Japanese Bond yield surging over the last week to the highest level since March. That's the biggest weekly jump in recent memory. Last Friday's disappointing BOJ bond buying program followed by yesterday'...

READ MORE

MEMBERS ONLY

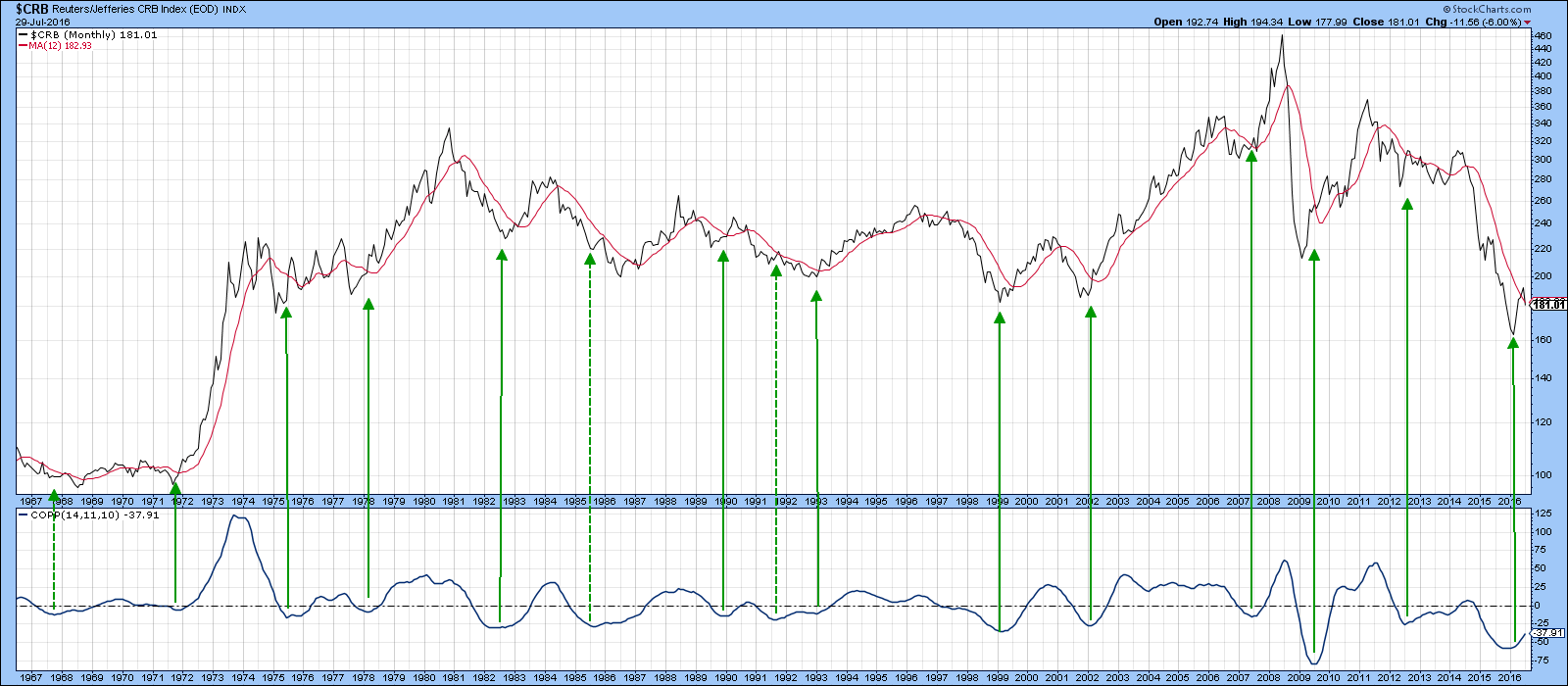

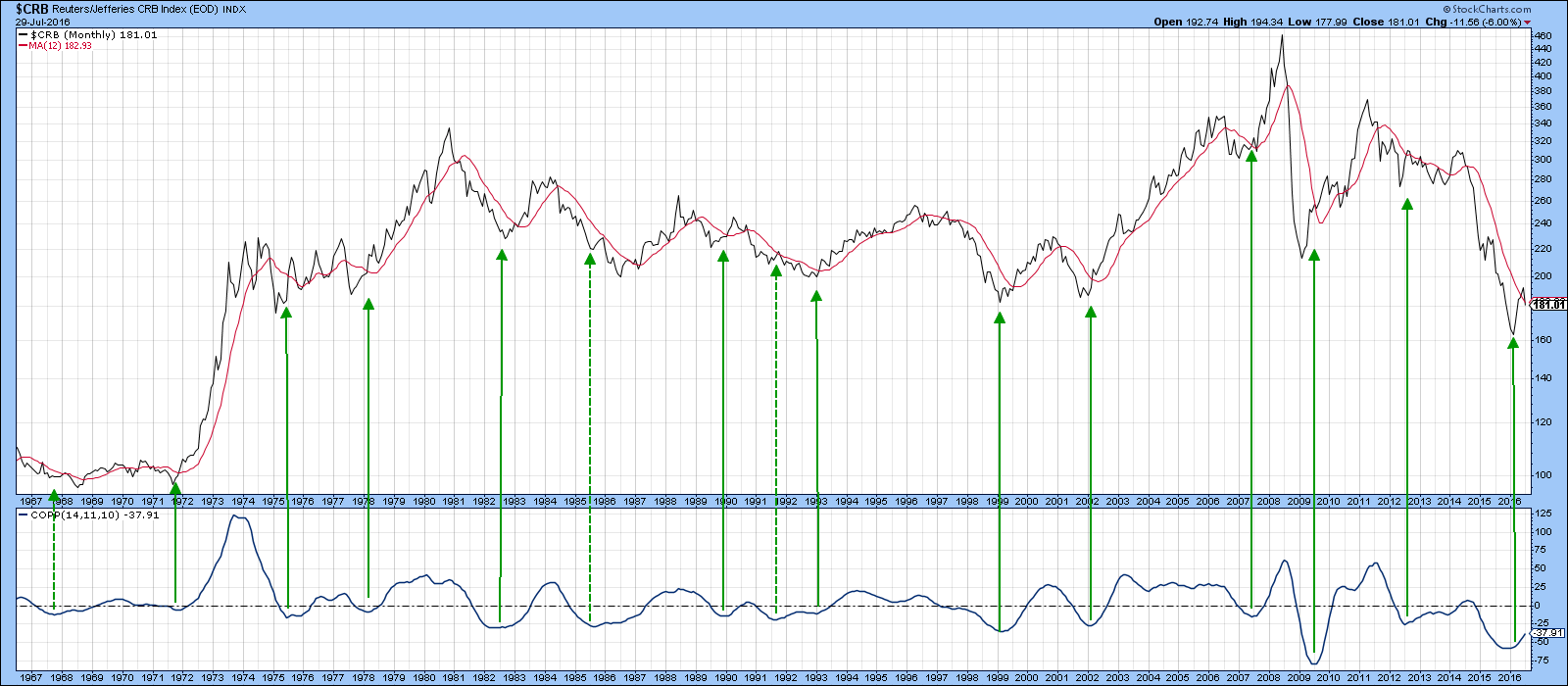

Are Commodities About To Take Off?

by Martin Pring,

President, Pring Research

* The long-term trend

* Shorter-term aspects

* The stock market’s view

Several weeks ago I suggested that commodity prices were likely to experience a correction of some kind. I also felt that any digestive process might well take the form of the right shoulder of an inverse head and shoulders pattern...

READ MORE

MEMBERS ONLY

DOLLAR DROPS ON WEAK GDP REPORT -- YEN SURGES ON BOJ DISAPPOINTMENT -- BLOOMBERG COMMODITY INDEX BOUNCES OFF TRENDLINE -- EMERGING MARKETS ISHARES HIT 12-MONTH HIGH -- EAFE ISHARES NEAR TEST OF SPRING HIGHS -- QQQ TOUCHES NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR DROPS AS YEN SURGES... A combination of factors are pushing the U.S. Dollar sharply lower. One is today's report of GDP growing only 1.2% in the second quarter. That pushed Treasury yields lower and bond prices higher and weakened the dollar. Chart 1 shows the...

READ MORE

MEMBERS ONLY

Better Days Lie Ahead

by Martin Pring,

President, Pring Research

* More long-term US Equity indicators turning bullish

* The case for a spirited rally

* Testing the theory

At my webinar last week I pointed out a couple of observations on the US equity market. First, that more and more indicators are signaling a bull market. Second, there are some characteristics that...

READ MORE

MEMBERS ONLY

NASDAQ GETS BOOST FROM APPLE AND BIOTECHS -- APPLE SURGES 7% HIGHER ON STRONG VOLUME -- TECH SPDR HITS NEW HIGH -- BIOTECH SPDR RISES TO SIX-MONTH HIGH AS AMGEN BUILDS ON BULLISH BREAKOUT -- PHARMACEUTAL ETF ALSO COMPLETES BASE

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES QQQ NEARS OLD HIGH... Chart 1 shows the PowerShares QQQ climbing again today and in the process of testing its early December high at 114.75. The QQQ achieved a bullish breakout earlier this month and has shown market leadership since then. That can be seen by the rising...

READ MORE

MEMBERS ONLY

TECHNOLOGY SHOWS NEW MARKET LEADERSHIP -- EBAY, MICROSOFT, AND QUALCOMM GAP HIGHER -- CISCO ACHIEVES BULLISH BREAKOUTS -- NASDAQ NEARS OLD HIGHS -- BIOGEN AND AMGEN LEAD BIOTECHS HIGHER -- HEALTHCARE PROVIDERS HAVE STRONG WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR SHOWS NEW LEADERSHIP... Stocks had another good week with the Dow and S&P 500 ending Friday at new records. One of the other positive developments was new upside leadership by technology which was the week's strongest sector. Chart 1 shows the Technology Sector SPDR...

READ MORE

MEMBERS ONLY

What's Up/Down With The Dollar?

by Martin Pring,

President, Pring Research

* The Dollar Index-too heavily weighted in favor of the Euro

* A closer look at the long-term cross Dollar relationships

* What are the Dollar sympathy indicators saying?

* Short-term technicals

The Dollar Index - Too heavily weighted in favor of the Euro

A few months ago I declared the Dollar Index to...

READ MORE

MEMBERS ONLY

HOMEBUILDERS LEAD ITB HIGHER -- LENNAR MAY BE NEXT HOMEBUILDER TO BREAK OUT -- THE XHB OFFERS BROADER EXPOSURE TO HOUSING-RELATED STOCKS -- OWENS CORNING IN STRONG UPTREND WHILE USG IS BREAKING OUT -- MOHAWK NEARS UPSIDE BREAKOUT AS WHIRLPOOL RALLIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

US HOME CONSTRUCTION ISHARES TURN UP ... Several of my recent messages have written about the upturn in homebuilding shares. A lot of that has been due to the drop in bond yields and mortgage rates. Improvement in the housing area is also an encouraging sign for the economy. Chart 1...

READ MORE

MEMBERS ONLY

Equity Markets Start To Broaden Their Appeal

by Martin Pring,

President, Pring Research

* Whipsaw leads to sharp rally

* Global equity markets starting to heat up

* Broad sector participation

* What’s going on with the yield curve?

Whipsaw leads to sharp rally

Chart 1 compares the Dow ETF (DIA) with my Dow Diffusion Indicator, an oscillator that monitors a basket of Dow Stocks above...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS RESUME UPTREND -- ALL WORLD STOCK INDEX EXTENDS BULLISH BREAKOUT -- ASIAN EX JAPAN ISHARES TURN UP -- WILSHIRE 5000 INDEX NEARS RECORD -- TRANSPORTS NEAR TEST OF APRIL HIGH -- RAILS COMPLETE BASING PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

MSCI ALL COUNTRY WORLD INDEX ISHARES BUILDS ON BULLISH BREAKOUT... Global stocks resumed their uptrend today in a replay of Tuesday's shift toward riskier assets. Chart 1 shows the MSCI All Country World Stock Index iShares (ACWI) building on its bullish breakout that took place on Tuesday when...

READ MORE

MEMBERS ONLY

REBOUND IN GLOBAL BOND YIELDS AND BRITISH POUND ACCELERATE RISK ON TRADE AS GOLD AND YEN SELL OFF -- EMERGING MARKETS ACHIEVE BULLISH BREAKOUT -- SO DO ALL COUNTRY WORLD INDEX ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS REBOUND ALONG WITH STERLING... A surge in global bond yields is contributing to a rotation out of safe havens and into riskier assets. Chart 1 shows the 10-Year Treasury Yield gapping 9 basis points higher to 1.52%. That puts the TNX back above its July 2012 closing...

READ MORE

MEMBERS ONLY

Breakout Or Fakeout

by Martin Pring,

President, Pring Research

* Take a deep 'breadth'

* Broadening formations

* Long-term indicators support an upside breakout

The recent breakout by the S&P and Dow to new high ground has caught the attention of market observers. Some say that the market is overvalued and that prices are unlikely to move higher....

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES NEAR RECORD HIGHS -- NYSE COMPOSITE INDEX NEARS UPSIDE BREAKOUT -- SMALL CAPS TURN HIGHER -- CONSUMER DISCRETIONARY AND INDUSTRIAL ETFS ACHIEVE BULLISH BREAKOUTS -- INTEL AND SEMICONDUCTRS LEAD NASDAQ HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES NEAR NEW RECORDS... A strong job report on Friday helped push stocks close to record highs. Chart 1 shows the Dow Jones Industrial Average jumping 250 points (1.4%) on Friday to reach a two-month high. A test of its April high is imminent. The S&...

READ MORE

MEMBERS ONLY

Why The June Employment Report Is Worth Closer Attention Than Usual

by Martin Pring,

President, Pring Research

* Labor market crystal ball

* What are the credit markets saying

* Commodities ripe for a correction?

Labor market crystal ball

The weakness of last month’s Employment Report was a surprise to just about everyone, including yours truly. One month doesn’t make a trend, but two months of bad data...

READ MORE

MEMBERS ONLY

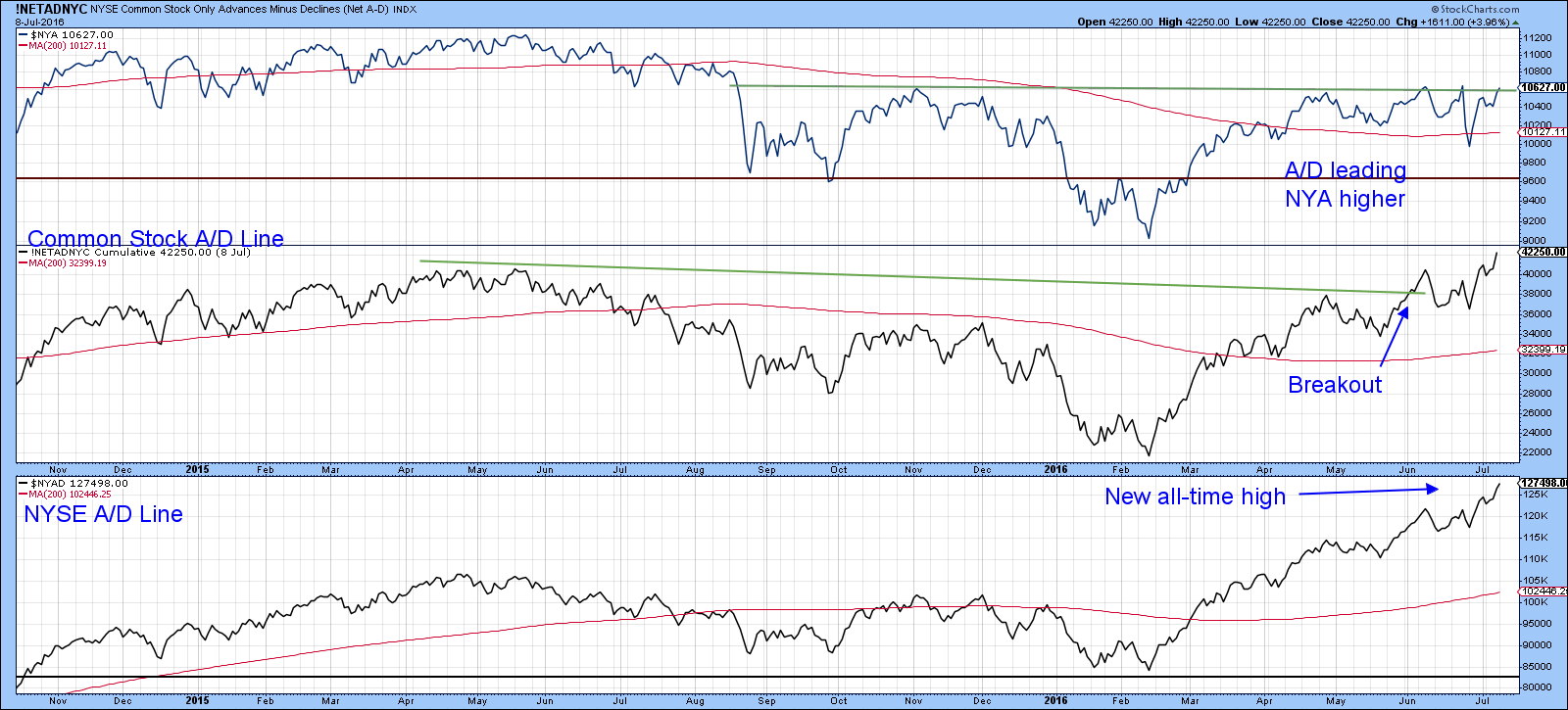

TECHNICAL ODDS FAVOR HIGHER STOCK PRICES -- ON BALANCE VOLUME FOR NYSE INDEX HITS NEW HIGH FOR THE YEAR -- BOTH VERSIONS OF THE NYSE ADVANCE DECLINE LINE HIT NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

UPSIDE BREAKOUT IN NYSE COMPOSITE INDEX STILL LOOKS LIKELY... My May 25 market message suggested that the stock market still had more work to do on the upside. That was based primarily on Elliott Wave Analysis which suggested that the market was still in a Wave 4 correction/consolidation pattern...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 BOUNCE OFF 50-DAY AVERAGES -- NASDAQ REGAINS 200-DAY LINE -- CELGENE AND MERCK LEAD HEALTHCARE SPDR TO HIGHEST LEVEL SINCE AUGUST -- HOMEBUILDERS LEAD CYLICALS HIGHER AS DR HORTON BREAKS OUT -- FACEBOOK HAS STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET HAS UPSIDE REVERSAL DAY ... After trading lower this morning, stocks rallied this afternoon to respectable gains. That upside reversal also helped the Dow Industrials and S&P 500 bounce off their 50-day moving averages as shown in Charts 1 and 2. Chart 3 shows the Nasdaq Composite Index...

READ MORE

MEMBERS ONLY

TREASURY YIELD FALLS TO FOUR-YEAR LOW -- LOWER MORTGAGE RATES ARE BOOSTING HOMEBUILDERS -- HOME CONSTRUCTION ETF NEARS UPSIDE BREAKOUT -- KBH HAS ALREADY BROKEN OUT -- OIL SERVICE ETF CONTINUES TO SHOW LEADERSHIP -- TRANSOCEAN CLEARS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD TESTING 2012 LOW... The plunge in global bond yields continues. Yesterday's statement from the Bank of England of its intention to lower rates sometime this summer pushed the British 2-year yield into negative territory for the first time, and its 10-Year to another record low...

READ MORE

MEMBERS ONLY

ALL COUNTRY WORLD INDEX REGAINS 200-DAY LINE -- EMERGING MARKETS LEAD GLOBAL REBOUND -- BRAZIL AND CHINESE ETFS STRENGTHEN -- ENERGY AND HEALTHCARE SPDRS CLEAR 50-DAY LINES -- OTHER SECTOR ETFS TURN BACK UP -- S&P 500 RETAKES 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MSCI ALL COUNTRY WORLD INDEX BACK OVER 200-DAY AVERAGE... Investor confidence is returning to global stocks after the short-term panic caused by last Friday's Brexit vote. Improvement is being seen in both developed and emerging markets. Chart 1 shows the MSCI All Country World Index (ACWI) climbing back...

READ MORE

MEMBERS ONLY

EUROPEAN MARKETS LEAD STOCK BOUNCE -- EUROPEAN STOCK INDEX TESTS FEBRUARY LOW -- YIELD ON BRITISH BOND FALLS BELOW 1% -- 10 YEAR TREASURY YIELD MAY TEST 2012 BOTTOM -- EURO DROP IS ALSO BOOSTING DOLLAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

EUROPEAN STOCKS LEAD GLOBAL BOUNCE ... A rebound in European stocks is leading a rebound in the states. Chart 1 shows the Dow Jones Europe Ex UK Index climbing 2.5%. France and Germany are up a similar amount. What may be significant from a charting standpoint is that the index...

READ MORE

MEMBERS ONLY

GLOBAL STOCK SELLOFF CONTINUES -- BRITISH POUND HITS NEW LOW -- EUROPEAN STOCKS HIT HARD AGAIN -- US STOCK INDEXES BREAK MAY LOW -- DOW AND S&P 500 FALL BELOW 200-DAY LINES -- TELECOM, UTILITIES, AND REITS BENEFIT FROM PLUNGING BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES BREAK CHART SUPPORT... The global selling of stocks that started on Friday continued into today. Big losses in Europe signaled another bad day. The British Pound fell to another 30-year low (Chart 1). Chart 2 shows London's FTSE 100 losing more than 2% and...

READ MORE

MEMBERS ONLY

Trend Of US Equities Slipping In A Southerly Direction

by Martin Pring,

President, Pring Research

* Low momentum close to price highs is often followed by above-average declines

* Failed patterns are often followed by above average price moves

* Those credit spreads are widening again

Last week I wrote that there were some positive short-term signs that suggested the reaction to Brexit might be overdone. Monday’s...

READ MORE

MEMBERS ONLY

BREXIT VOTE HAMMERS GLOBAL STOCKS -- BRITAIN AND EUROPE LEAD DECLINES -- GOLD, TREASURIES, AND THE YEN SOAR -- RISING DOLLAR PUNISHES OTHER COMMODITIES -- VIX SURGES TO 2016 HIGH -- US STOCK INDEXES HEAD TOWARD MAY LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WORLD MARKETS ARE SHOCKED AT BRITISH VOTE... Even though polls showed the British vote to be very close, a lot of money bet that the Brits would vote to stay in the European Union. That was true with London bookies and global investors. Strong currency and stock action on Wednesday...

READ MORE

MEMBERS ONLY

Brexit Or Bropportunity? What The Charts Are Saying

by Martin Pring,

President, Pring Research

* Selling climax at the opening

* UK versus European Monetary Union

* What are global equities saying?

* What’s up with the pound?

Selling climax at the opening

There is an old saying on Wall Street that the market does not discount the same thing twice. Back in early June, we saw...

READ MORE

MEMBERS ONLY

BRITISH POUND AND UK STOCKS STRENGTHEN -- UK ISHARES HIT SEVEN- MONTH HIGH -- EUROPEAN SHARES ARE ALSO RISING -- DOW JONES EUROPE INDEX LOOKS TO BE BOTTOMING -- WEEKLY CHART OF WILSHIRE 5000 COMPOSITE STOCK INDEX STILL LOOKS POSITIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STERLING SHOULD BE BOTTOMING... I'm going to take the chance of ignoring the British vote on Thursday and concentrate instead on the charts themselves. If it's true that markets have a way of discounting (or anticipating) events, that's the best we can do. The...

READ MORE

MEMBERS ONLY

BRITAIN LEADS GLOBAL STOCK RALLY -- POUND SURGES 2% -- SAFE HAVEN ASSETS LIKE BONDS AND GOLD SELL OFF -- WEAK DOLLAR BOOSTS COPPER AND OIL -- S&P 500 GIVES BACK HALF ITS GAINS BY THE CLOSE

by John Murphy,

Chief Technical Analyst, StockCharts.com

UK LEADS GLOBAL RALLY ... Stocks around the world started the week on a strong note which appears to be tied to shifting sentiment in Britain. Chart 1 shows the British Pound surging more than 2% for its biggest gain in years. British stocks are sharply higher as well. Chart 2...

READ MORE

MEMBERS ONLY

EUROPEAN MARKETS BOUNCE ON FRIDAY BUT REMAIN IN DOWNTRENDS -- GOLD AND YEN ARE RISING TOGETHER FOR A REASON -- SO IS THE VIX -- TELECOM ISHARES CLOSE AT NEW RECORD -- VERIZON NEARS UPSIDE BREAKOUT -- REITS ARE ALSO GAINING AS BOND YIELDS DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

A FRIDAY REBOUND IN BRITAIN AND EUROPE... All eyes are on the British Brexit vote this coming Thursday (June 23) on whether to stay in the European Union or leave. Latest polls show the "leave" vote in the lead. A relief bounce on Friday in Britain and Europe...

READ MORE

MEMBERS ONLY

Turnaround Thursday: Several Markets Reverse On The Day: What Are The Implications?

by Martin Pring,

President, Pring Research

* Stocks show signs of a near-term reversal

* What about those bonds?

* Gold showing signs of tiredness

Stocks show signs of near-term reversal

On Thursday, several markets started off strongly in one direction but by the end of the day, these same markets reversed course. Normally when one market or an...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS LEAD US STOCKS LOWER -- EUROPE ETFS TUMBLE -- TEN-YEAR TREASURY YIELD FALLS TO FOUR-YEAR LOW -- FALLING FOREIGN CURRENCIES BOOST DOLLAR -- BOUNCING DOLLAR HURTS OIL, WHILE FALLING YIELDS BOOST GOLD -- BANK STOCKS LEAD U.S. STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN SHARES TUMBLE... Foreign shares continue to fall sharply and are pulling U.S. shares lower. The biggest drops are being seen in developed markets. Chart 1 shows MSCI iShares (EFA) falling to the lowest level in early three months. The biggest losses are being seen in Europe and Japan....

READ MORE

MEMBERS ONLY

A Funny Thing Happened On The Way To The Rally

by Martin Pring,

President, Pring Research

* Some short-term equity market cracks are starting to appear

* Rates are starting to breakdown

* Keep watching those credit spreads

Some short-term equity market cracks are starting to appear

In my last article, I pointed out that most of the short-term oscillators were in a bullish configuration. Moreover, they were not...

READ MORE

MEMBERS ONLY

PLUNGE IN GLOBAL BOND YIELDS SPARKS FLIGHT TO SAFETY -- RECORD LOW FOREIGN YIELDS PULL 10-YEAR TREASURY YIELD TO THREE-YEAR LOW -- BREXIT FEARS HIT POUND AND EUROPE -- OVERBOUGHT OIL MARKET DUE FOR A PULLBACK -- SO IS THE S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING FOREIGN YIELDS PULL TREASURIES LOWER... The big story this week was the plunge in global bond yields, many of which fell to record lows and deeper into negative territory. Chart 1 compares 10-Year yields of the U.S. (green), Britain (red), Germany (blue), and Japan (orange). The last three...

READ MORE

MEMBERS ONLY

INDUSTRIAL SPDR NEARS NEW RECORD -- RAILS ARE BACK ON TRACK LED BY CSX AND UNION PACIFIC -- COMMODITY INDEXES REACH BULL MARKET THRESHOLD -- MATERIALS ALSO SHOW MARKET LEADERSHIP -- NUCOR LEADS STEEL STOCKS HIGHER -- FALLING BOND YIELDS HELP GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR NEARS RECORD ... One of the positive signs for the stock market is that it's being led higher by economically sensitive stock groups. Chart 1, for example, shows the Industrial Sector SPDR (XLI) testing its April high. The XLI scored a bullish breakout during March when it...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS CONTINUE RALLY -- OIL SERVICE STOCKS LEAD MARKET HIGHER ON RISING OIL -- S&P 500 ATTEMPTING NEW HIGH -- SMALL CAPS ARE ALSO LEADING

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL SERVICE STOCKS SURGE ... Strong buying in energy shares is helping lead global stocks higher. That's especially true of oil service stocks. Chart 1 shows the VanEck Vectors Oil Services ETF (OIH) surging near 7% today. Its relative strength ratio (top of chart) is surging as well. Crude...

READ MORE

MEMBERS ONLY

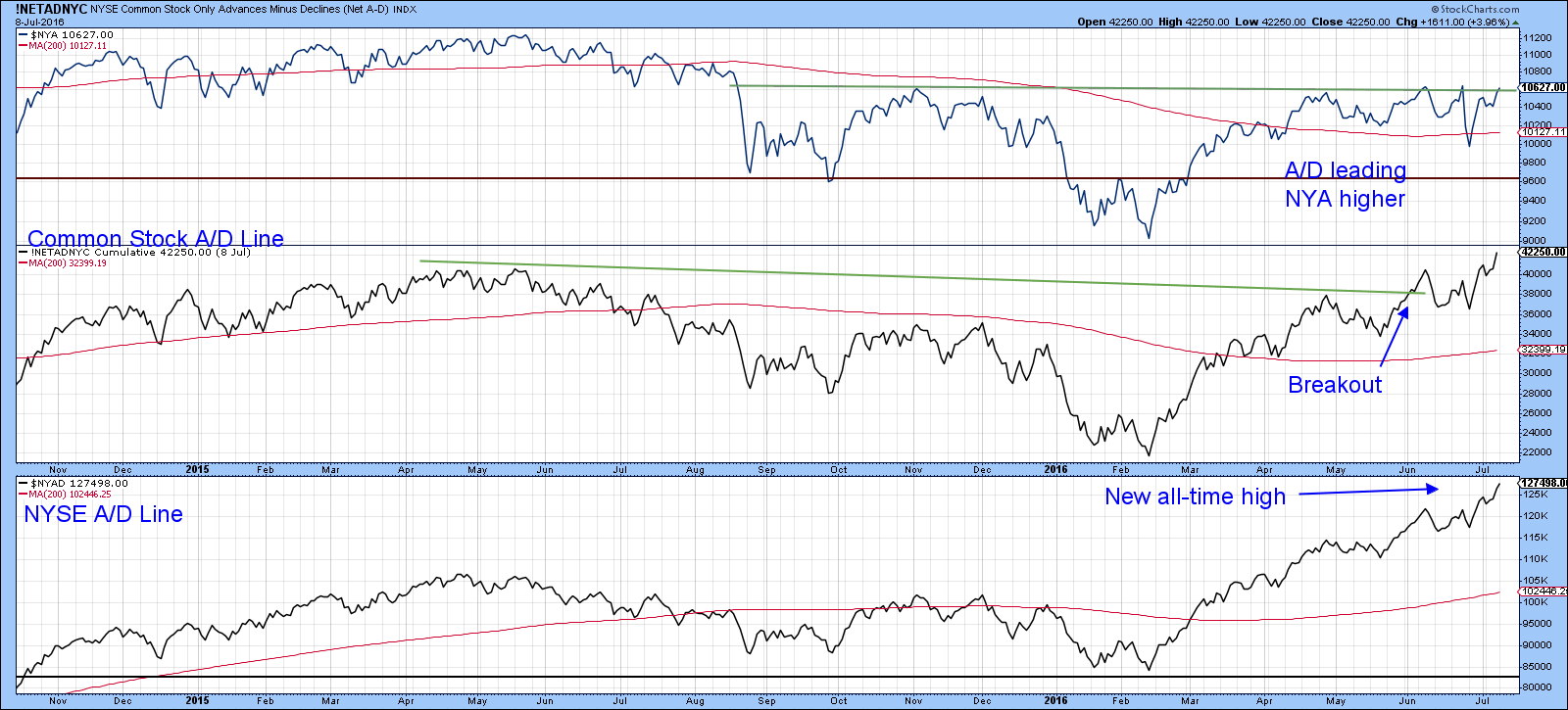

US Equities Primed To Move Higher

by Martin Pring,

President, Pring Research

* Market reacts to bad news with a nothing-burger and that’s bullish

* NYA Coppock goes bullish

* NYSE A/D Line at all-time high

* Pretty well all sectors pointing north

* Those interest rates

Market reacts to bad news with a nothing-burger and that’s bullish

In my book Investment Psychology Explained,...

READ MORE

MEMBERS ONLY

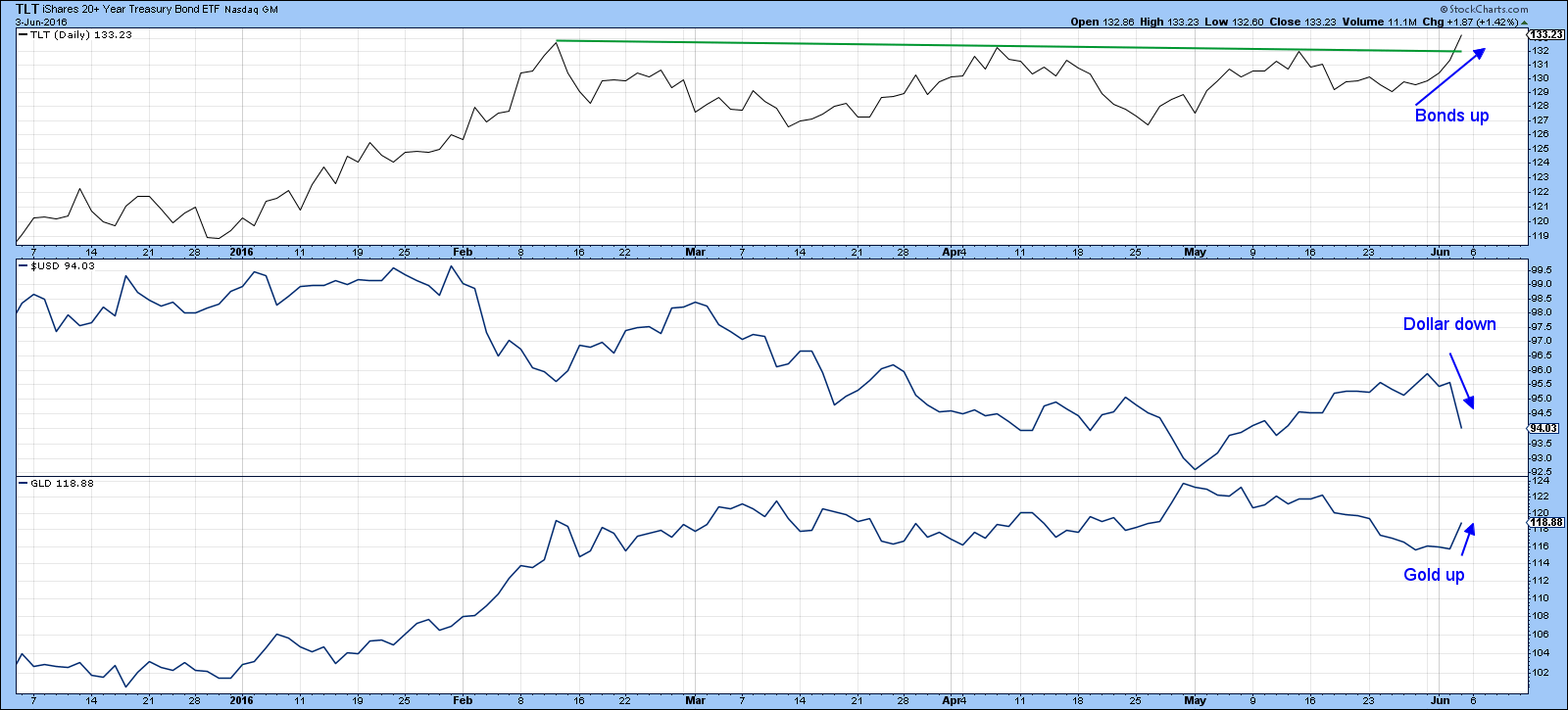

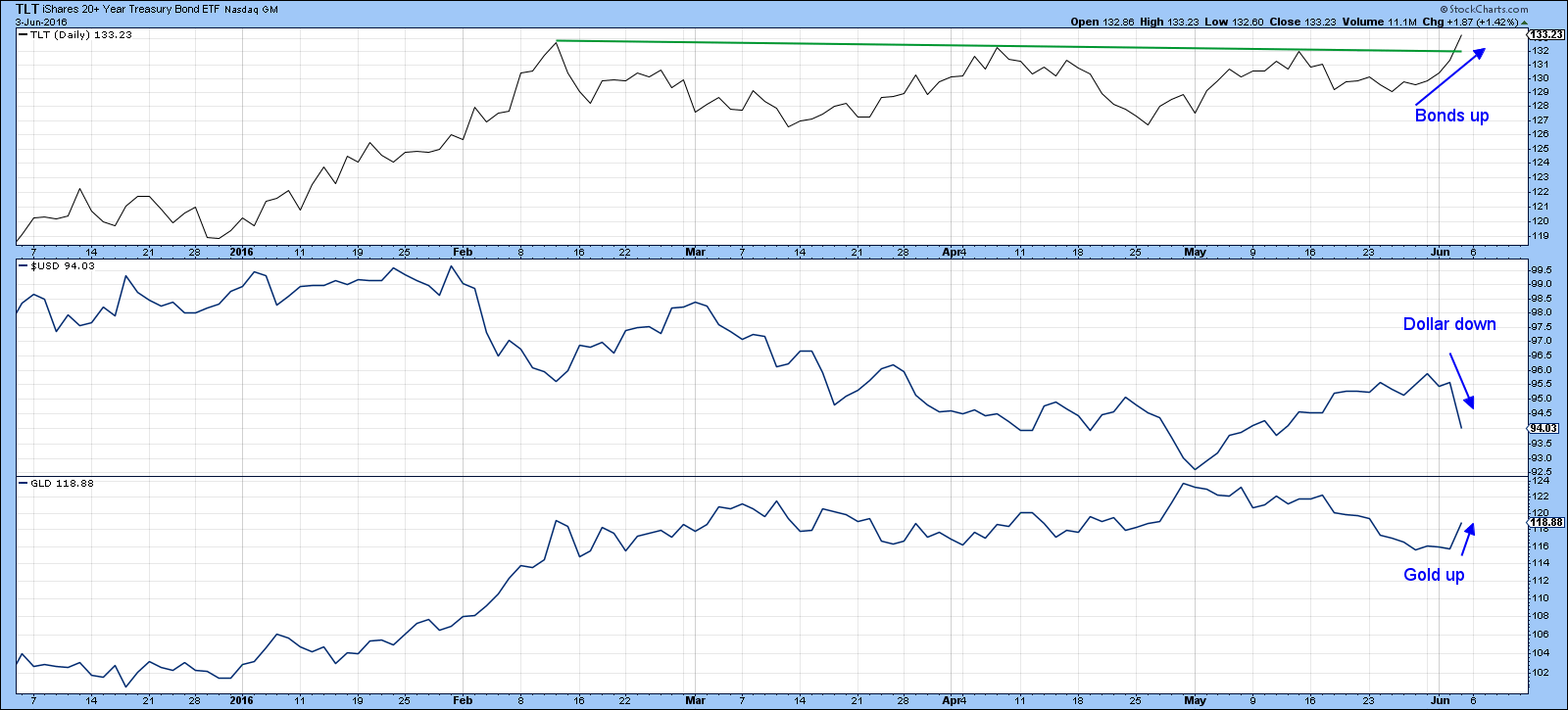

WEAK JOBS REPORT PUSHES BOND YIELDS AND DOLLAR SHARPLY LOWER -- WINNERS ARE BONDS, UTILITIES, AND GOLD -- BANKS ARE LOSERS -- FOREIGN MARKETS JUMP ALONG WITH CURRENCIES -- S&P 500 HOLDS UPTREND -- HEALTHCARE SECTOR TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEAKEST JOB REPORT IN FIVE YEARS SURPRISES EVERYONE... Friday's job report of only 38,000 jobs created in May was the weakest in more than five years. And it pretty much shocked everyone. Some of the market reactions, however, were reasonably predictable. Interest rate yields tumbled along the...

READ MORE

MEMBERS ONLY

HEALTHCARE ETFS THAT COVER HEALTHCARE PROVIDERS AND MEDICAL DEVICES AND EQUIPMENT GAIN GROUND -- MEDTRONIC SURGES TO NEW RECORD -- HEALTHCARE SPDR EXCEEDS APRIL HIGH -- ABBVIE SCORES BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. HEALTHCARE PROVIDERS ISHARES ... In my message posted earlier today, I showed a number of healthcare providers that are having a strong day, including Aetna (AET), Centene (CNC), Humana (HUM), and Unitedhealth Group (UNH). I want to point out here that an ETF is available to cover that group...

READ MORE

MEMBERS ONLY

HEALTH CARE SPDR NEARS TEST OF APRIL HIGH -- HEALTHCARE PROVIDERS ARE STRONGEST GROUP -- AETNA, CENTENE, AND HUMANA SCORE BIG GAINS -- UNITEDHEALTH GROUP HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR NEARS APRIL HIGH... Healthcare stocks continue to gain ground despite a generally soft stock market. Chart 1 shows the Health Care SPDR (XLV) trading higher today and nearing a test of its April high. The XLV/SPX ratio (top of chart) continues to gain ground as well....

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR SHOWS RELATIVE STRENGTH AND HAS POSITIVE CHART PATTERN -- WATERS NEARS UPSIDE BREAKOUT -- PATTERSON DENTAL TURNS UP -- BIOGEN IS BIOTECH LEADER -- BIG PHARMA LEADERS ARE JOHNSON & JOHNSON, BRISTOL MYERS SQUIBB, AND PFIZER

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR SHOWS RELATIVE STRENGTH ... With stocks encountering some selling at the start of June, healthcare stocks are showing more resilience. That may be due to the fact the heathcare stocks have defensive characteristics. It may also have to do with the fact that healthcare stocks are starting to...

READ MORE

MEMBERS ONLY

Why There Is A Good Chance That The Chinese Equity Market Has Bottomed

by Martin Pring,

President, Pring Research

* The bullish reverse dominos

* Chinese ETF’s

* PEK or FXI?

* What would a Chinese rally mean for US equities

* Chinese short interest

The Chinese equity market as reflected in the Shanghai Composite $SSEC has fallen by close to 50 % from the 5166 level on the June 2015 high to its...

READ MORE

MEMBERS ONLY

ELLIOTT WAVE ANALYSIS SUGGESTS THAT STOCKS HAVE BEEN IN A WAVE FOUR CORRECTION -- SINCE BULL MARKETS USUALLY HAVE FIVE WAVES, THAT MEANS THERE'S ANOTHER UPWAVE TO COME -- BOTH VERSIONS OF NYSE ADVANCE-DECLINE LINE LOOK STRONG

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS ARE ENDING WAVE FOUR CORRECTION... I find Elliott Wave Analysis very helpful in keeping the stock market's trend in proper perspective. I'm revisiting the subject here because I believe it may explain what's happening in global stocks. Here's a brief explanation....

READ MORE