MEMBERS ONLY

World Stock ETF Rallies Back To Its Bear Market Trendline And 200-day MA. Is The Bear Market Over?

by Martin Pring,

President, Pring Research

* World markets are just below key resistance

* Junk bonds break through their 200-day MA. Will the break hold?

* World Bond Index breaks to the upside

Last week I called for some corrective action in the US equity market based on what, at the time, appeared to be a couple of...

READ MORE

MEMBERS ONLY

COMMODITIES CONTINUE TO RALLY ON FALLING DOLLAR AND DOVISH FED -- SILVER WHEATON LEADS SILVER ETF HIGHER -- SOUTHERN COPPER CLEARS 200-DAY LINE -- FEDEX AND DOW TRANSPORTS CLEAR 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. DOLLAR FALLS TO FIVE-MONTH LOW ... Yesterday's dovish statement from the Fed that it was scaling back plans to raise short-term rates had the dual effect of pushing interest rates and the dollar lower. Chart 1 shows the Power Shares Dollar Index (UUP) falling to the lowest...

READ MORE

MEMBERS ONLY

FED TAKES MORE DOVISH TONE ON RATE HIKES -- SHORTER RATES LEAD YIELDS LOWER -- TIPS REBOUND ON INCREASED INFLATION EXPECTATIONS -- DROP IN DOLLAR BOOSTS COMMODITIES -- CANADIAN DOLLAR CLEARS 200-DAY LINE -- S&P 500 EXTENDS GAIN OVER 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED SCALES BACKS 2016 RATE CUTS... The Fed left rates unchanged as expected. However, it also scaled back any potential rate hikes for this year. Previous estimates of three or four possible hikes were lowered to two. It also sounded more cautious on the global economy. Initial market reactions were...

READ MORE

MEMBERS ONLY

MATERIALS AND DISCRETIONARY SPDRS CLEAR 200-DAY AVERAGES -- CHEMICAL LEADERS ARE DOW, DUPONT, AND EASTMAN -- WHIRLPOOL EXCEEDS 200-DAY LINE -- BROADCOM AND ASML LEAD SEMICOMDUCTORS HIGHER -- CORPORATE BONDS JUMP AS TREASURIES SLIDE

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LOT OF 200-DAY LINES ARE BEING TESTED OR EXCEEDED... Major stocks indexes in the U.S. are moving up to challenge their 200-day averages. Those are important tests because the 200-day line is the measure most used by chartists to distinguish uptrends from downtrends. A number of group indexes...

READ MORE

MEMBERS ONLY

PERCENT OF NYSE STOCKS ABOVE 50-DAY AVERAGE REACHES TWO-YEAR HIGH -- % OVER 200-DAY LINE TESTS FOURTH QUARTER HIGH -- NYSE ADVANCE-DECLINE LINE LOOKS STRONG -- NYSE BULLISH PERCENT INDEX CLEARS 50% -- BUYING OF CORPORATE AND JUNK BONDS SHOWS NEW OPTIMISM

by John Murphy,

Chief Technical Analyst, StockCharts.com

PERCENT OF NYSE STOCKS ABOVE 50-DAY AVERAGE REACHES TWO-YEAR HIGH... The debate continues about whether the stock market faces the likelihood of another downleg. Several technical indicators seem to suggest that a major selloff is unlikely. Here's the first one. I recently showed the NYSE percent of stocks...

READ MORE

MEMBERS ONLY

Contrarian Thinking Says The Equity, Oil And Junk Bonds Rally Is Over

by Martin Pring,

President, Pring Research

* Inflection point for junk bonds?

* Fake out rally a la 2008?

* Short-term oil rally over?

Inflection point for junk bonds?

It has been a feature of this bear market that stocks sell off in concert with junk bonds and oil prices as investors fret over potential energy company defaults. Not...

READ MORE

MEMBERS ONLY

MINERS HAVE ANOTHER BIG DAY -- ETFS TIED TO MINING AND PRECIOUS METALS CLEAR 200-DAY LINES -- STEEL STOCKS BENEFIT FROM RECORD JUMP IN IRON ORE -- ADD NUCOR TO LIST OF STEEL LEADERS -- PAN AMERICAN LEADS SILVER STOCKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

METALS AND MINING SPDR CLEARS 200-DAY AVERAGE ... Precious and base metal stocks are continuing their strong rally on the back of rising commodity prices. Chart 1 shows the S&P Metals and Mining SPDR (XME) trading above its 200-day average and at the highest level in five months. Its...

READ MORE

MEMBERS ONLY

COMMERCIAL VEHICLE AND TRUCK GROUP LEADS INDUSTRIAL SECTOR HIGHER -- DEERE, PACCAR, AND CATERPILLAR TEST 200-DAY AVERAGES -- GATX CLEARS ITS 200-DAY LINE TO LEAD TRANSPORTATION GROUP -- SO HAS JB HUNT

by John Murphy,

Chief Technical Analyst, StockCharts.com

LEAD INDUSTRIALS HIGHER... Economically-sensitive industrial stocks continue to show new strength. A leading industrial group is the Dow Jones US Commerical Vehicles and Trucks Index ($DJUSHR). Chart 1 shows that index climbing more than 2% today to a new three month high. It includes big percentage gainers like Joy Global...

READ MORE

MEMBERS ONLY

Three Indicators You Should Watch To Signal A New Bull Market

by Martin Pring,

President, Pring Research

* Credit spreads about to turn?

* A PPO that calls primary trends

* Record High Indicator

The market is now starting to respond positively to several bullish intermediate indicators. I still believe the main trend is down, but it seems like a good idea to look at three currently bearish indicators and...

READ MORE

MEMBERS ONLY

ALCOA AND FREEPORT MCMORAN CONTINUE TO RISE WITH INDUSTRIAL METALS -- SO DO STEEL STOCKS -- AKSTEEL, STEEL DYNAMICS, AND RELIANCE STEEL CLEAR 200-DAY AVERAGES -- AUSSIE AND CANADIAN DOLLARS ARE RISING WITH COMMODITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALCOA AND FREEPORT MCMORAN LEAD MARKET HIGHER ... A lot of attention is being paid to the recent upturn in the price of oil and energy shares, and its potentially positive influence on the global economy and stocks. An even more impressive upturn is taking place in industrial metals and their...

READ MORE

MEMBERS ONLY

MARKET RALLY PUSHES MAJOR INDEXES OVER 50-DAY AVERAGES TO STRENGTHEN SHORT-TERM TREND -- INDUSTRIAL AND TECHNOLOGY SPDRS CLEAR 200-DAY LINES -- BOUNCE IN BOND YIELD BOOSTS BANKS AND FINANCIALS -- EMERGING MARKETS LEAD GLOBAL RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ARE ABOVE 50-DAY AVERAGES ... The market's short-term trend continues to strengthen. Today's strong gains have pushed all major U.S. stock indexes above their 50-day moving averages. Chart 1 shows the Dow Industrials trading at a two-month high, with a good shot at...

READ MORE

MEMBERS ONLY

LOW BOND YIELDS CONTINUE TO BENEFIT DIVIDEND-PAYERS -- THAT INCLUDES STAPLES, REITS, UTILITIES, AND TELECOM -- DIVIDEND ISHARES TEST FOURTH QUARTER HIGH -- STAPLE AND UTILITY SPDRS HIT NEW HIGHS -- REITS AND TELECOM ETFS SHOW RELATIVE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS ARE STILL LOW... I recently showed the 10-Year Treasury Bond Yield ($TNX) bouncing off an "island reversal" bottom formed a couple of weeks ago (see circle), and pointed out that pattern usually signals a "short-term" change in direction. Chart 1 shows the TNX moving...

READ MORE

MEMBERS ONLY

STOCKS TRY TO STABILIZE WITH OIL -- SHORT-TERM TREND REMAINS NEUTRAL -- BANKS ALSO BOUNCE WITH OIL IN AFTERNOON TRADING -- KEEPING SHORT-TERM BUY SIGNALS IN PERSPECTIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM TREND STILL UNCERTAIN... Stocks opened lower with oil today, but are trying to stabilize with the commodity in afternoon trading. Chart 1, however, shows a somewhat neutral picture for the market's short-term trend. After successfully testing its January low earlier this month, the S&P 500...

READ MORE

MEMBERS ONLY

Bearish Two Bar Reversal Says Further Probing of Recent Lows Is Likely

by Martin Pring,

President, Pring Research

* Intermediate rally/consolidation for US equities still on the menu

* Test of the lows is likely first

* Emerging markets continue to look vulnerable

* Gold showing strong technical signs

The Intermediate Rally/trading range

The intermediate rally possibilities, which I have been discussing for several weeks, is still a probability. That’...

READ MORE

MEMBERS ONLY

RALLY PUSHES STOCK INDEXES INTO TEST OF OVERHEAD RESISTANCE -- RISING OIL AND BASE METALS BOOST ENERGY AND MINERS -- ALCOA AND FREEPORT MCMORAN LEAD MATERIALS HIGHER -- BRAZIL AND RUSSIA HAVE STRONG DAY ON BACK OF COMMODITY RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW IS THE FIRST TO CLEAR FEBRUARY HIGH ... A strong Monday stock rally pushed U.S. stock indexes right up against initial overhead barriers at their early February peak and 50-day averages. Chart 1 shows the Dow Industrials being the first to exceed its February high. It is still, however,...

READ MORE

MEMBERS ONLY

NYSE COMPOSITE INDEX TESTS OVERHEAD RESISTANCE -- IT'S ALSO IN A LONG-TERM SUPPORT ZONE -- NYSE BULLISH PERCENT INDEX GIVES P&F BUY SIGNAL -- % OF NYSE STOCKS ABOVE MOVING AVERAGES MAY BE BOTTOMING -- UAL AND DELTA BOOST INDUSTRIAL SPDR

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE COMPOSITE INDEX TESTS RESISTANCE... Stocks had their best week of the year. While that's encouraging, they'll have to do a lot more to signal that the global correction/bear market has run its course. I'm focusing on the NYSE Composite Index (NYA) today...

READ MORE

MEMBERS ONLY

Forget The Hindenburg Omen - Here's Another Possibility To Consider

by Martin Pring,

President, Pring Research

* Five days of Armageddon

* Does the British market still lead the US market

Five Days of Armageddon

For some time, I have been drawing your attention to the fact that many intermediate indicators have been flashing buy signals that even in primary bear markets have triggered some kind of a...

READ MORE

MEMBERS ONLY

MARKET RALLY CONTINUES AS OIL BOUNCES -- ENERGY AND MATERIAL STOCKS ARE MARKET LEADERS -- FREEPORT MCMORAN HAS BIG DAY -- CH ROBINSON LEADS TRUCKERS HIGHER -- SMALL CAP INDEX TESTS MAJOR SUPPORT IN OVERSOLD CONDITION

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 NEARS TEST OF FEBRUARY HIGH ... My weekend message suggested that stocks had put in a short-term bottom. We'll find out soon enough if last week's bottom was even more significant. Chart 1 shows the S&P 500 Index nearing a test...

READ MORE

MEMBERS ONLY

More Evidence Of An Intermediate Bear Market Rally Falls Into Place

by Martin Pring,

President, Pring Research

* World breadth series signal that global equities are ready to advance

* Dollar faces an important technical test

Sometimes when the market declines, things actually improve, and that’s what may have been happening this week. In my most recent article, Intermediate Indicators Signal a Rally but Remember It’s a...

READ MORE

MEMBERS ONLY

FRIDAY'S RALLY PREVENTS CHART BREAKDOWN -- OIL RALLY GIVES STOCKS A STRONG BOOST -- ENERGY SHARES ARE IN POTENTIAL SUPPORT ZONE -- BANK SHARES TEST LONG-TERM SUPPORT LINES -- FRIDAY'S JUMP IN BOND YIELDS ALSO HELPS STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET BENDS BUT DOESN'T BREAK... It looked on Thursday like the major U.S. stock indexes were on the verge of closing below their January lows. A Thursday afternoon rebound, however, followed by a 2% gain on Friday kept those support levels intact. Chart 1 shows the Dow...

READ MORE

MEMBERS ONLY

TREASURY YIELDS FALL TO THREE-YEAR LOW AS PRICES SURGE -- THAT'S REALLY HURTING BANKS AND LIFE INSURERS -- PRUDENTIAL TUMBLES -- MONEY CONTINUES TO FLOW INTO TREASURY BONDS, GOLD, AND THE JAPANESE YEN -- DOW ON VERGE OF BREAKDOWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

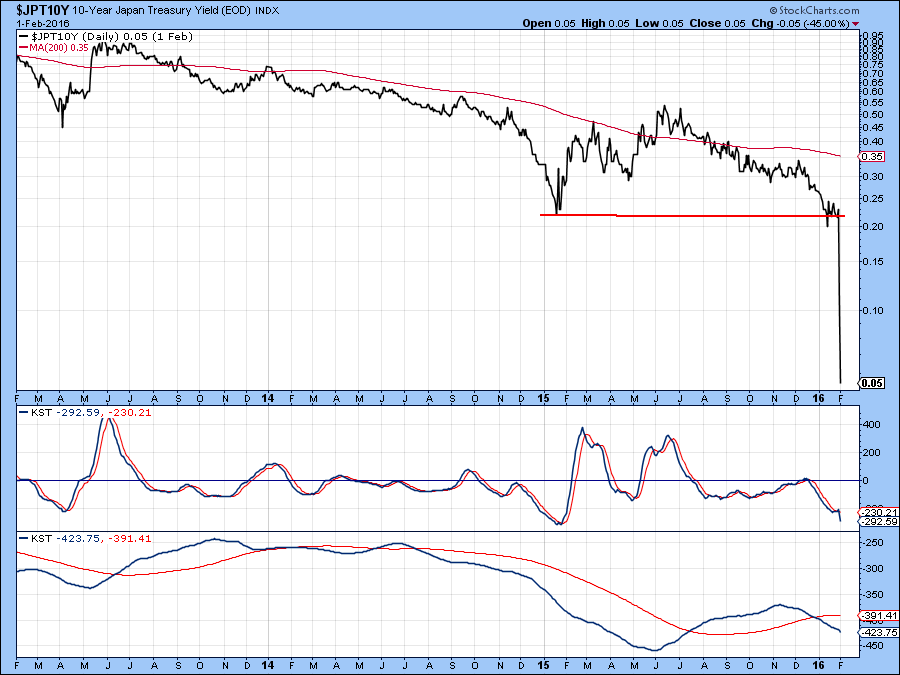

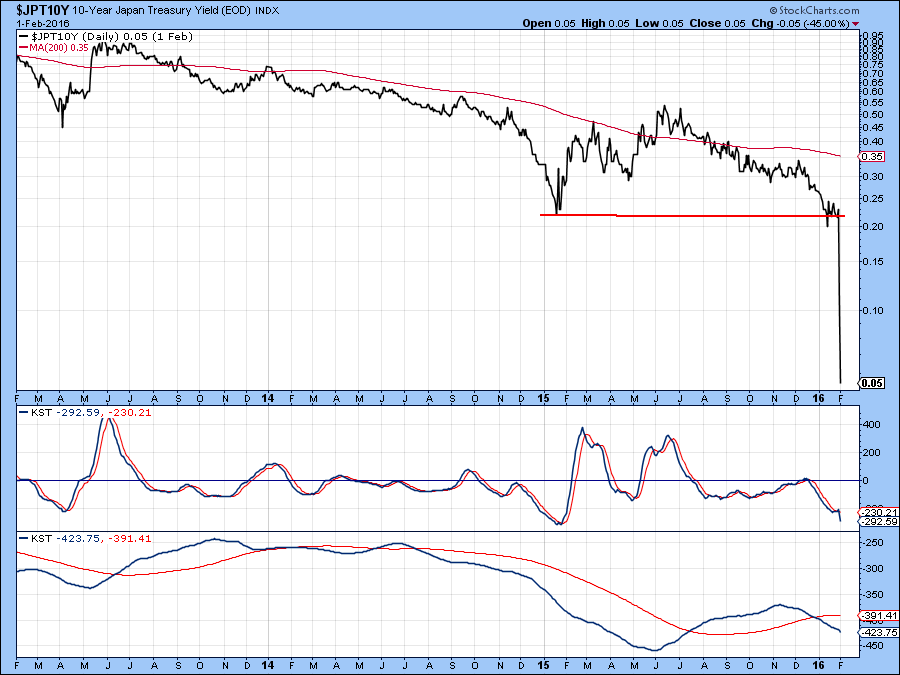

TREASURY YIELDS FALL TO THREE-YEAR ... The rapid descent in global bond yields continues uninterrupted. The 10-Year Japanese bond yield recently fell into negative territory for the first time in its history. That's helping drive sovereign bond yields lower everywhere else. Chart 1 shows the 10-Year Treasury Yield falling...

READ MORE

MEMBERS ONLY

TRANSPORTS TEST LONG-TERM SUPPORT LINES -- AIRLINES AND TRUCKERS ATTRACT SOME BUYING -- TRANSPORTATION/UTILITY RATIO IS OVERSOLD -- SO IS THE TRANSPORTATION/INDUSTRIAL RATIO -- THE DOW USUALLY HOLDS UP BETTER IN A WEAK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS START TO SHOW SOME BOUNCE... Transportation stocks have been one of the weakest parts of the stock market over the last year. In fact, the downtrend in that economically-sensitive group was cited several times last year as a negative warning for the economy and stock market. The daily bars...

READ MORE

MEMBERS ONLY

Intermediate Indicators Still Signal A Rally But Remember, It's A Bear Market

by Martin Pring,

President, Pring Research

* Monday may have been a successful test of the January low

* Five inter-market relationships break out

* The 5-year yield breaks down

For the last two weeks I have been pointing out that several intermediate type indicators that have traditionally signaled rallies were in a bullish mode. The problem is that...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY AND TECHNOLOLGY STOCKS LEAD MARKET LOWER -- NASDAQ UNDERPERFORMANCE IS A BAD SIGN -- GOLD STOCKS HAVE A STRONG WEEK -- MONEY ALSO FLOWS TO UTILITIES, TELECOM, AND FOOD -- TYSON FOODS HITS RECORD HIGH -- NETFLIX TUMBLES BELOW SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR LEADS MARKET LOWER... It's never a good sign to see economically-sensitive stocks leading the market lower. That's because they're most closely tied to investor confidence (or lack therof) in the U.S. economy. But that's what happened this week....

READ MORE

MEMBERS ONLY

NASDAQ LEADS MARKET INTO BAD END FOR THE WEEK -- INTERNET-RELATED STOCKS LEAD TECHNOLOGY SECTOR LOWER -- AMAZON.COM BREAKS 200-DAY AVERAGE -- THAT'S ALSO BAD FOR CONSUMER DISCRETIONARY STOCKS WHICH ARE BIG FRIDAY LOSERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ LEADS MARKET LOWER ... A 3% loss in the Nasdaq market is pulling the rest of the market lower. Chart 1 shows the Nasdaq Composite Index bearing down on last week's low. The Nasdaq/S&P 500 ratio (below chart) has plunged to the lowest level in...

READ MORE

MEMBERS ONLY

FALLING DOLLAR GIVES OIL AND GOLD A BOOST -- BARRICK GOLD AND NEWMONT LEAD GOLD MINERS HIGHER -- AMAZON.COM TESTS 200-DAY AVERAGE -- TESLA MOTORS FALLS TO TWO-YEAR LOW -- FINANCIAL STOCKS NEED A REBOUND IN BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR PLUNGES ... The dollar is having its worst day in months. Chart 1 shows the Power Shares Dollar Index (UUP) tumbling to the lowest level in three months. That's due partially to the recent drop in U.S. rates, falling stock prices, and weak economic news which have...

READ MORE

MEMBERS ONLY

The BOJ Did Not Start The Trend - They Are Following It

by Martin Pring,

President, Pring Research

* Global rates are in freefall

* Interest-sensitive sectors will continue to improve their relative action

* Two sectors that are likely to underperform

The recent move by the Bank of Japan (BOJ) confirmed what rates around the world have already been doing, i.e. moving lower. In Japan’s case, some rates...

READ MORE

MEMBERS ONLY

PLUNGE IN JAPANESE BOND YIELD PULLS TREASURY YIELD TO NINE-MONTH LOW -- THAT HELPS EXPLAIN WHY BONDS RALLIED WITH STOCKS ON FRIDAY -- FALLING BOND YIELD IS GOOD FOR UTILITIES AND OTHER DIVIDEND PAYERS, BUT BAD FOR BANKS AND INSURERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD FALLS TO NINE-MONTH LOW... A seemingly strange thing happened on Friday. The Bank of Japan surprised everyone by adopting a negative interest rate for the first time by pushing its short-term rate below zero. Not surprisingly, the Japanese yen plunged 2% and Japanese stocks jumped 2.8%...

READ MORE

MEMBERS ONLY

JAPANESE MOVE TO NEGATIVE RATES PUSHES YEN SHARPLY LOWER AND JAPANESE STOCKS HIGHER -- THAT FAVORS WISDOM TREE JAPAN HEDGED EQUITY ETF OVER JAPANESE ISHARES -- FTSE ALL WORLD STOCK INDEX IS AT POTENTIAL SUPPORT LEVEL AND OVERSOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

PLUNGE IN YEN... The Bank of Japan (BOJ) announced this morning a move to negative interest rates for the first time in its history. That pushed Japanese yields sharply lower and caused the yen to plunge. Chart 1 shows the Japanese yen plunging -2% today, which is its biggest drop...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS BOOST UTILITIES -- AT&T HITS RECORD HIGH -- FOOD STOCKS LEAD CONSUMER STAPLES -- DOLLAR WEAKENS WITH SHORT-TERM RATES -- DOW BOUNCES ON RISING CRUDE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BONDS AND UTILITIES ARE RISING TOGETHER... With the 10-Year Treasury yield slipping back below 2.00%, bond prices are rising. The daily bars in Chart 1 show the Barclays 7-10 Year iShares (IEF) nearing its January high. Rate-sensitive stocks like utilities usually rise right along with bonds. Chart 2 shows...

READ MORE

MEMBERS ONLY

STOCKS TURN DOWN AS BONDS BOUNCE -- APPLE WEIGHS ON TECHNOLOGY AS VERIZON HAS STRONG DAY -- WEAKER DOLLAR BOOSTS GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES TURN DOWN ... Stocks are weakening after the Fed statement. Chart 1 shows the DJ Industrial SPDR (DIA) reversing down in late afternoon trading. It may now retest last week's low. Chart 2 shows the S&P 500 SPDRS (SPY) doing the same. Chart 3 shows...

READ MORE

MEMBERS ONLY

DOLLAR DIRECTION IS IMPORTANT FOR GLOBAL STOCKS AND COMMODITIES -- SAFE HAVEN BUYING HAS PUSHED JAPANESE YEN HIGHER AND STOCKS LOWER -- U.S. STOCK INDEXES TRY TO BOUNCE OFF AUGUST LOWS -- TODAY'S FED ANNOUNCEMENT COULD BE IMPORTANT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR DIRECTION MAY HOLD KEY TO CRUDE OIL ... Everyone is waiting to hear what the Fed has to say today. Markets appear to hoping for a more dovish statement. Currency traders are also paying very close attention. That's because Fed policy has a big impact on dollar direction....

READ MORE

MEMBERS ONLY

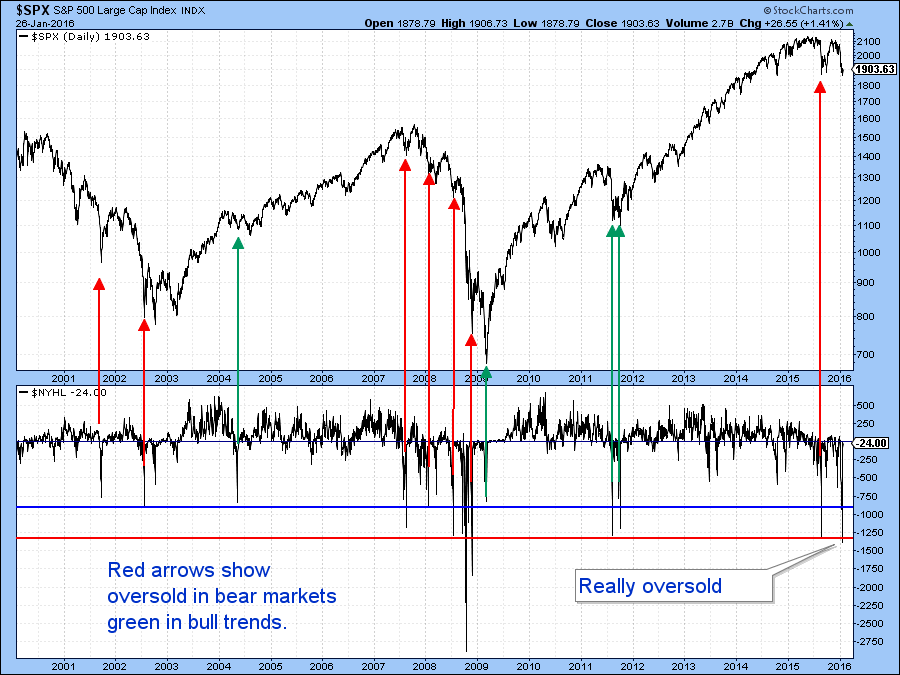

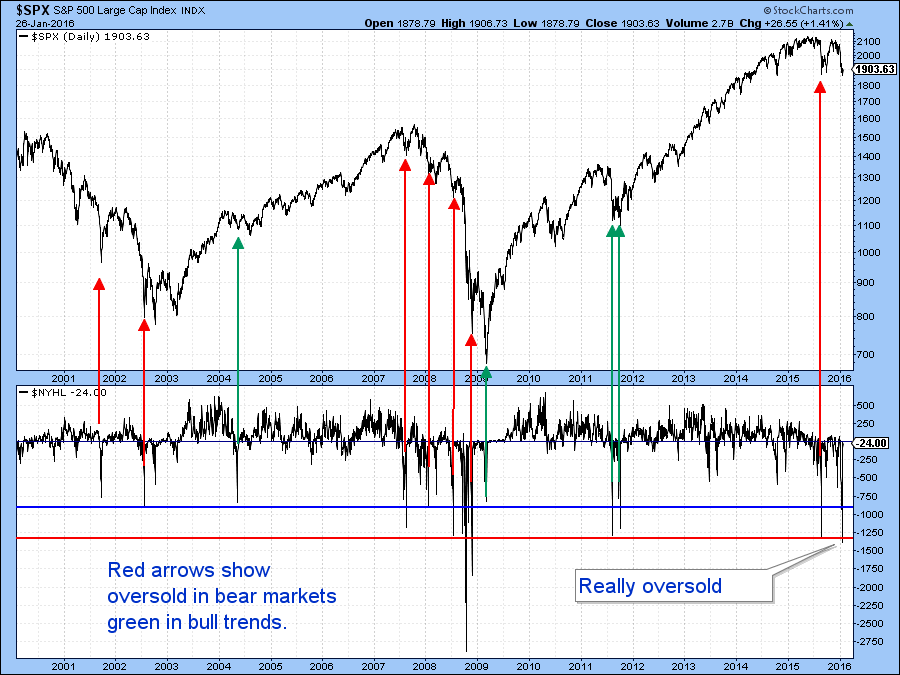

A Bear Market Rally Looks As If It Is Underway

by Martin Pring,

President, Pring Research

Several key short/intermediate indicators reverse from oversold conditions

Gold ETF very close to violating its bear market trendline

The intermediate Indicators are bottoming

Internal market action in the last week is starting to confirm the possibility of an intermediate low that I laid out last week. That’s because...

READ MORE

MEMBERS ONLY

Trolling For Bottom Fishing Indicators

by Martin Pring,

President, Pring Research

* Dow Jones Utility Average just above its secular up trendline

* 2-year yield probably gave a false upside breakout signal

* Three indicators to watch for an intermediate equity bottom

Yesterday at the webinar Greg asked me a question that was posed by one of the attendees relating to a potential reverse...

READ MORE

MEMBERS ONLY

GLOBAL SELLOFF CONTINUES -- CRUDE OIL NEARS $25 -- CRB INDEX DROPS TO LOWEST LEVEL SINCE EARLY 1970S WHICH IS DEFLATIONARY -- TREASURY ETF BREAKS OUT TO UPSIDE AS YIELD FALLS BELOW 2%

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG-TERM LOOK AT CRUDE... The price of crude oil continues to drop and is bringing global stocks down with it. The monthly bars in Chart 1 show how bad the decline has been and where it appears headed. The recent decline pushed WTIC Light Crude Oil below its early 2009...

READ MORE

MEMBERS ONLY

U.S. STOCK INDEXES THREATEN 2015 LOWS -- WHAT HAPPENS IF THEY DON'T HOLD -- THE S&P 500 COULD LOSE ANOTHER 10-12% AND DROP TOWARD 1600 -- NYSE ADVANCE DECLINE LINE TURNS DOWN -- INDEX OF FOREIGN STOCKS IS IN BEAR MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES THREATEN 2015 LOWS ... Another week of heavy selling has pushed major U.S. stock indexes into a critical test of their 2015 lows. The first three charts tell the story. Chart 1 shows the Dow Industrials ending the week just above its late September intra-day low...

READ MORE

MEMBERS ONLY

What Happens If The Fed Is Wrong

by Martin Pring,

President, Pring Research

* Erie comparisons to 1929

* Credit spreads worsen

* 30-year bond yields break down prices break out

When the fed raises interest rates after a long series of declines it usually signals a change in policy and the start of a new trend to higher rates. What happens, though, when the Fed...

READ MORE

MEMBERS ONLY

AUTO PARTS AND RAILS LEAD MARKET LOWER -- BORGWARNER HITS THREE-YEAR LOW -- CSX AND UAL LEAD TRANSPORTS LOWER -- TREASURIES CONTINUE TO GAIN AS STOCKS SINK -- FALLING YIELDS, HOWEVER, ARE HURTING BANKS -- S&P 500 NEARS TEST OF 2015 LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUTO PARTS LEAD CYCLICALS LOWER... A week ago Tuesday (January 5), I showed a chart of General Motors falling below its 200-day moving while autos were leading the Consumer Discretionary SPDR lower. Today, the main drag on that sector is auto parts. Chart 1 shows the Dow Jones US Auto...

READ MORE

MEMBERS ONLY

Please Show Me A Bullish Long-Term Equity Chart

by Martin Pring,

President, Pring Research

* Europe, Asia and Latin America all look bearish

I am not kidding. Today I went through pretty well all of the country ETF charts looking back a few years with the long-term KST. I could find only one bullish chart as displayed here as Chart 1. As you can see...

READ MORE

MEMBERS ONLY

MAJOR U.S. STOCK INDEXES ENTER CORRECTION TERRITORY -- A RETEST OF 2015 LOWS APPEARS LIKELY -- SMALL AND MIDSIZE STOCKS HAVE ALREADY BROKEN THAT SUPPORT -- DOW TRANSPORTS ENTER BEAR MARKET TERRITORY -- DEFENSIVE UTILITES SHOW RELATIVE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ENTER CORRECTION TERRITORY... After suffering the worst start to a new year in history, the U.S. stock market has entered correction territory which is defined by a drop of 10% from its old high. The charts pretty much speak for themselves. All three major stock indexes...

READ MORE