MEMBERS ONLY

Long-Term Top Looking More And More Likely

by Martin Pring,

President, Pring Research

* Several historically reliable indicators are saying “bear”

* World stocks looking extremely toppy

* Shanghai may be forming a head and shoulders top

At my first webinar of the year on Tuesday, it seemed a good idea to load the presentation with some longer-term charts, as they are all pointing to trouble...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS RESUME SELLING -- U.S. STOCK RALLY HAS BEEN TOO NARROW AND VULNERABLE TO A DOWNSIDE CORRECTION -- GAP BETWEEN SMALL AND LARGE CAPS IS A WARNING SIGN -- SO IS THE DROP TO 40% IN THE NYSE BULLISH PERCENT INDEX

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS ARE LEADING LARGE CAPS LOWER... Global stocks have started the year on a bad note. Most of that is being blamed on China. A plunge in Chinese stocks and a drop in the Chinese yuan to a five-year low are certainly causing a lot of worries in global...

READ MORE

MEMBERS ONLY

DEFENSIVE STOCKS CONTINUE TO SHOW LEADERHIP -- KIMBERLY CLARK LEADS STAPLES HIGHER -- UTILITIES AND REITS CONTINUE TO GAIN GROUND -- KIMCO REALTY JUMPS 3% -- AUTOS HELP PULL CONSUMER DISCRETIONARY SPDR LOWER -- GENERAL MOTORS BREAKS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES ARE HOLDING UP ... Last Wednesday's message showed that money was flowing toward defensive stocks, which meant that investors were ending the old year in a more cautious mood. That mood is continuing into the new year. With the stock market on the defensive during the first...

READ MORE

MEMBERS ONLY

Did The Market Go Up or Down In 2015?

by Martin Pring,

President, Pring Research

* This week’s bearish two-bar reversal threatens a bullish seasonal for equities

* Airlines may be set to join railroads and truckers on the downside

* Dollar Index keeps us guessing, which means the next move is likely to be worthwhile

* Pound completes a bearish long-term head and shoulders

The title of...

READ MORE

MEMBERS ONLY

SMALL AND MIDCAP STOCKS CONTINUE TO LAG BEHIND S&P 500 INDEX -- CONSUMER STAPLES AND UTILITIES ARE DECEMBER LEADERS -- WHILE CYCLICALS AND INDUSTRIALS LAG BEHIND -- ROTATION FROM CYCLICALS TO STAPLES IS A SIGN OF CAUTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALLER STOCKS STILL LAG BEHIND LARGE CAPS... A yearend stock rebound has boosted major stock indexes. Chart 1 shows the S&P 500 touching a three-week high yesterday. It still, however, remains below a falling resistance line drawn over its November/December highs, and is trying to stay above...

READ MORE

MEMBERS ONLY

Market Sectors: The Good The Bad And The Ugly

by Martin Pring,

President, Pring Research

* Home builders, KBW banks, consumer cyclicals and resources look vulnerable

* REIT's, utilities, and healthcare look promising

This week I am going to back off from the usual market commentary in order to focus on some industry groups and sectors that have the potential to lead the market higher...

READ MORE

MEMBERS ONLY

STOCKS ARE ENDING THE WEEK ON A DOWN NOTE -- ENERGY SECTOR SPDR TESTS SUMMER LOW -- MONEY FLOWS INTO TREASURIES AS CORPORATE BONDS UNDERPERFORM -- TREASURIES ARE HAVING A BETTER DECEMBER THAN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES UNDER HEAVY SELLING... Stocks have come under renewed selling pressure following Wednesday's Fed inspired bounce. And it looks like they're going to end the week on the downside. Chart 1 shows the Dow Industrials down nearly 200 points in late morning trading. It&...

READ MORE

MEMBERS ONLY

Bearish Two Bar Reversal Threatens The Pre-Christmas Rally

by Martin Pring,

President, Pring Research

* Two bar reversal brings the effect of the rate hike back to reality

* Broadly based dollar ETF breaks to new highs

* Gold closes at a new low on expanding volume

Earlier in the week I pointed out that many of the market averages had formed exhaustion days on Monday and...

READ MORE

MEMBERS ONLY

FED RAISES SHORT-TERM RATE A QUARTER POINT WITH DOVISH COMMENT -- DIVIDEND PAYING REITS AND UTILITIES LEAD REBOUND -- AT&T LEADS TELECOM HIGHER -- S&P CLEARS MOVING AVERAGE LINES -- VIX FALLS BACK BELOW 20

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES AND REITS JUMP... The Fed raised short-term rates a quarter point as expected, but softened the move with a dovish statement. Shorter-term yields in the two to five-year range are moving higher. Stocks are trading higher on the Fed move. The biggest gainers, however, are rate-sensitive stocks that pay...

READ MORE

MEMBERS ONLY

Small Caps Complete 12-year Top Relative To Large Caps

by Martin Pring,

President, Pring Research

* Bullish exhaustion on Monday suggests that last week’s lows will hold during 2015

* Longer-term indicators continue to point to an overall topping out process

* Small caps break down against large caps

* 30-year yield at a critical juncture

* Euro and yen-denominated gold complete large bearish (deflationary) formations

Small year-end rally...

READ MORE

MEMBERS ONLY

S&P 500 FALLS BELOW NOVEMBER LOW IN HIGHER TRADING -- NYSE ADVANCE-DECLINE LINE ALSO BREAKS SUPPORT -- SECTOR ROTATIONS TURN DEFENSIVE -- CRUDE NEARS TEST OF 2009 LOW -- TREASURY BOND/STOCK RATIO STRENGTHENS AS COMMODITY INDEX TUMBLES TO MULTI-YEAR LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 FALLS BELOW SEPTEMBER LOW... My Friday afternoon message showed small caps breaking their November lows, and wrote that the S&P 500 Index was in the process of testing that important level. Chart 1 shows the S&P 500 Large Cap Index ending the...

READ MORE

MEMBERS ONLY

STOCKS ARE UNDER HEAVY PRESSURE AS CRUDE OIL HITS NEW LOW -- S&P 500 THREATENS SUPPORT -- SMALL CAPS HAVE ALREADY BROKEN NOVEMBER LOW -- TREASURIES JUMP WHILE JUNK BONDS TUMBLE TO TWO-YEAR LOW -- EMERGING MARKETS LEAD GLOBAL DECLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS LEAD MARKET LOWER ... The drop in crude oil to another six-year low has undercut the recent bounce in energy shares, which are leading today's stock selloff. With all ten sectors in the red, energy stocks are down -3%. Commodity-related material stocks are right behind. The three...

READ MORE

MEMBERS ONLY

More Of The Santa Sell-Off To Come?

by Martin Pring,

President, Pring Research

* Volume starting to expand on the downside

* Half a Dow Theory sell signal on the weekly charts

* 30-year yield locked in a tight trading range

* Dollar Index facing important test

Expanding volume on the downside

This market continues to be plagued with volume problems. Initially, it was a lack of...

READ MORE

MEMBERS ONLY

OIL BOUNCE FADES -- BUT ENERGY STOCKS END HIGHER -- MATERIALS JUMP ON DUPONT AND DOW CHEMICAL MERGER -- STOCKS END LOWER -- VIX NEARS 20 BARRIER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET RECAP... A morning oil bounce on low inventory faded in afternoon trading and the testing of support continues. Even so, energy stocks held some of their gains. Chevron and Exxon Mobil helped support the Dow. Materials had a strong day on the merger of Dupont and Dow Chemical. The...

READ MORE

MEMBERS ONLY

CRUDE OIL TRIES TO REBOUND OFF AUGUST LOW -- ENERGY STOCKS ALSO REBOUND OFF CHART SUPPORT -- HIGH YIELD BONDS TEST OLD LOWS AS WELL -- TREASURIES SELL OFF -- DOLLAR DROP BOOSTS COMMODITIES -- S&P TRIES TO HOLD CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

WTIC CRUDE OIL STILL TESTING LONG-TERM SUPPORT... The recent drop in the price of oil has caused energy stocks to drop which, in turn, has caused nervous selling in the rest of the market. That has pushed a number of energy-related assets into tests of important support levels. The monthly...

READ MORE

MEMBERS ONLY

Did Friday's 370-Point Rally Change Anything For The Equity Market?

by Martin Pring,

President, Pring Research

* Friday’s rally fails to reel in new highs

* Guggenheim asset flows just above critical support

* 30-year yield caught between two converging trendlines

* Energy SPDR XLE completes a bearish head and shoulders

A couple of days ago I wrote that a bearish two-bar reversal that had developed in many averages...

READ MORE

MEMBERS ONLY

FRIDAY JUMP KEEPS STOCKS IN UPTREND -- PRICE PATTERN LOOKS POSITIVE -- GOLD STOCKS JUMP ON WEAK DOLLAR -- PROSPECTS FOR HIGHER RATES BOOST BANKS -- FALLING OIL HELPS AIRLINES RISE -- NASDAQ 100 NEARS NEW RECORD -- APPLE MAY BE TURNING UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM PATTERN LOOKS POSITIVE... A strong rally on Friday more than erased losses from Thursday and left the market in much better shape. Chart 1 shows the S&P 500 ending the week back above its 200-day average after bouncing off its 50-day line on Thursday. Chartwatchers will now...

READ MORE

MEMBERS ONLY

STOCKS HAVE A HUGE FRIDAY -- NEWMONT MINING LEADS GOLD STOCKS -- FINANCIAL LEADERS ARE CME GROUP, CHARLES SCHWAB, AND PNC FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN 2%... Stocks are having a huge day on Friday. Stock indexes are showing gains of 2%. Chart 1 shows the S&P 500 gaining 40 points nearing the close. Its ability to bounce back above its 200-day line is also impressive. That gives its recent pattern...

READ MORE

MEMBERS ONLY

ECB DISAPPOINTS MARKETS -- EURO JUMPS AS DOLLAR FALLS -- TREASURY YIELDS FOLLOW EUROPE HIGHER -- EUROPEAN STOCKS TUMBLE -- RISING RATES HURT UTILITIES, SUPPORT BANKS -- KROGER BREAKS OUT TO NEW HIGH -- ENERGY SECTOR WEAKENS -- S&P 500 RETESTS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DRAGHI DISAPPOINTS... Mario Draghi promised more stimulative measures to boost eurozone inflation and economic growth. The ECB today lowered its deposit rate 10 basis points to -0.3%. It also extended its QE bond buying program for an additional six months. Either those moves were already expected, or the markets...

READ MORE

MEMBERS ONLY

Volume Is About To Expand, But Which Way Will It Send Prices?

by Martin Pring,

President, Pring Research

* Two bar reversal for the S&P says the rally is over

* Volume is oversold. That means volume is likely to expand on the downside.

* Credit spreads challenging their bear market lows

* Commodities breaking down in a very big way

* This week's two-bar reversal says the market...

READ MORE

MEMBERS ONLY

TECHNOLOGY ETFS TEST NOVEMBER HIGHS -- ALTHOUGH BIG TECHS LEAD RALLY, EQUAL WEIGHT ETF SHOWS STRENGTH -- SEMICONDUCTOR ETF AT SIX-MONTH HIGH -- INTEL AND NVIDIA ARE CHIP LEADERS -- STRONG DOLLAR MAY HELP AIRLINES BY MAKING INTL TRAVEL CHEAPER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY STOCKS CONTINUE TO LEAD THE MARKET HIGHER... It's usually a good sign when the economically-sensitive technology sector is leading the market higher. And it is. Chart 1 shows the Technology Sector SPDR (XLK) in the process of testing its November high. Its relative strength ratio (above chart)...

READ MORE

MEMBERS ONLY

SMALL STOCKS START TO SHOW LEADERSHIP -- DOLLAR NEARS 13-YEAR HIGH AS EURO WEAKENS -- COMMODITY DEFLATION HOLDS BOND YIELDS DOWN -- SO DO NEGATIVE EUROZONE YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAP INDEXES TURN UP -- MIDCAPS ARE RIGHT BEHIND... Smaller stocks are not only catching up to larger stocks, they're starting to do better. That normally happens near yearend in anticipation of the "January Effect" when investors favor smaller stocks. Chart 1 shows the S&...

READ MORE

MEMBERS ONLY

Time To Watch Those Commodities Like A Hawk

by Martin Pring,

President, Pring Research

* CRB Composite touches a 40-year low but is deeply oversold

* Oil is also at critical support

* Short-term commodity picture finely balanced but narrowly favors the bears

* Dollar Index is back at its March 2015 high

* Some short-term dollar indicators starting to roll over

Long-term commodity picture

Chart 1 shows that...

READ MORE

MEMBERS ONLY

THANKSIVING WEEK IS USUALLY GOOD FOR THE MARKET -- SO IS THE MONTH OF DECEMBER -- THAT'S ESPECIALLY TRUE OF SMALLER STOCKS WHICH ARE TURNING UP -- CONSUMER DISCRETIONARY SPDR NEARS RECORD -- ALEXION AND AMGEN LEAD HEALTHCARE SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

THANKSGIVING TREAT ... Stocks are approaching the Thanksgiving holiday in an optimistic mood. That's not unusual. According to the Stock Trader's Almanac, the Wednesday before and the Friday after Thanksgiving are up days most of the time. Following that, stocks enter December which is usually the strongest...

READ MORE

MEMBERS ONLY

MORE STOCKS ARE TRADING ABOVE THEIR 200-DAY AVERAGES -- S&P 500 REGAINS 200-DAY AVERAGE -- ITS EQUAL WEIGHT VERSION STILL LAGS BEHIND -- SMALL CAPS MAY BE STARTING TO CATCH UP -- CYCLICALS, INDUSTRIALS, AND TECHNOLOGY ARE WEEK'S SECTOR LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE STOCKS CLEAR THEIR 200-DAY AVERAGES ... My Wednesday message showed that the percent of NYSE stocks above their 200-day average had declined during November to as low as 27% (about where it was at the same time in 2011). I suggested that the number needed to exceed its earlier peak...

READ MORE

MEMBERS ONLY

REGENERON, VERTEX, AND AMGEN LEAD BIOTECHS HIGHER -- AFLAC AND PRUDENTIAL ARE LIFE INSURANCE LEADERS -- STOCK INDEXES TRY TO RECLAIM 200-DAY AVERAGES -- SMALL CAPS NEED TO SHOW MORE BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIOTECH ISHARES TRIES TO REGAIN UPTREND... Chart 1 shows Biotech iShares (IBB) testing a falling trendline drawn over its July/September peaks. It has already regained its 50-day average, but remains below its 200-day line. Its relative strength ratio (top of chart) is also starting to recover from its September...

READ MORE

MEMBERS ONLY

Market Explodes On Bad News. Has The Year-End Rally Begun?

by Martin Pring,

President, Pring Research

* Two bar reversal says the market is going higher near-term

* Credit spreads at key juncture point

* Oil showing tentative sign of a short-term reversal but confirmation is required

They say that a market that does not decline on bad news is usually ready to reverse to the upside. Over the...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES FALL BELOW 200-DAY AVERAGES -- PLUNGING RETAILERS WEAKEN CONSUMER DISCRETIONARY SPDR -- CRUDE OIL HEADED FOR TEST OF AUGUST LOW -- RISING DOLLAR PUSHES CRB INDEX BELOW 2008 LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES FALL BELOW 200-DAY AVERAGES... The market suffered a setback this week when major U.S. stock indexes fell back below their 200-day averages. Chart 1 shows the Nasdaq Composite ending below that support line on Friday. Chart 2 shows the Dow Industrials spending Thursday and Friday below...

READ MORE

MEMBERS ONLY

CYCLICALS LOSE MARKET LEADERSHIP -- PLUNGING RETAILERS ARE A CAUTION SIGN FOR THE MARKET -- THE S&P 500 NEARS A TEST OF ITS SEPTEMBER HIGH -- SMALL CAPS LOSE MORE GROUND -- VIX CLIMBS BACK OVER 20

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR LOSES LEADERSHIP... One of the more positive signs throughout 2015 has been leadership by consumer discretionary stocks. In fact, cyclicals have been the market's strongest sector all year. That can be seen by its rising relative strength ratio on top of the chart. But not...

READ MORE

MEMBERS ONLY

RISING DOLLAR PUSHES COMMODITIES NEAR SIX-YEAR LOWS -- GOLD, COPPER, CORN, AND CRUDE TEST YEARLY LOWS -- WEAKNESS IN METAL AND ENERGY SHARES ARE STARTING TO WEIGH ON THE BROADER MARKET -- S&P 500 RETESTS SUPPORT AT ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING DOLLAR PUSHES CRB INDEX NEAR AUGUST LOW ... My previous message explained that one of the casualties of a rising U.S. Dollar would be weaker commodity markets. With the dollar having recently risen to a new seven-month high, commodity prices are in retreat. The brown line in Chart 1...

READ MORE

MEMBERS ONLY

Onward And Downward, The Correction Is Likely To Continue

by Martin Pring,

President, Pring Research

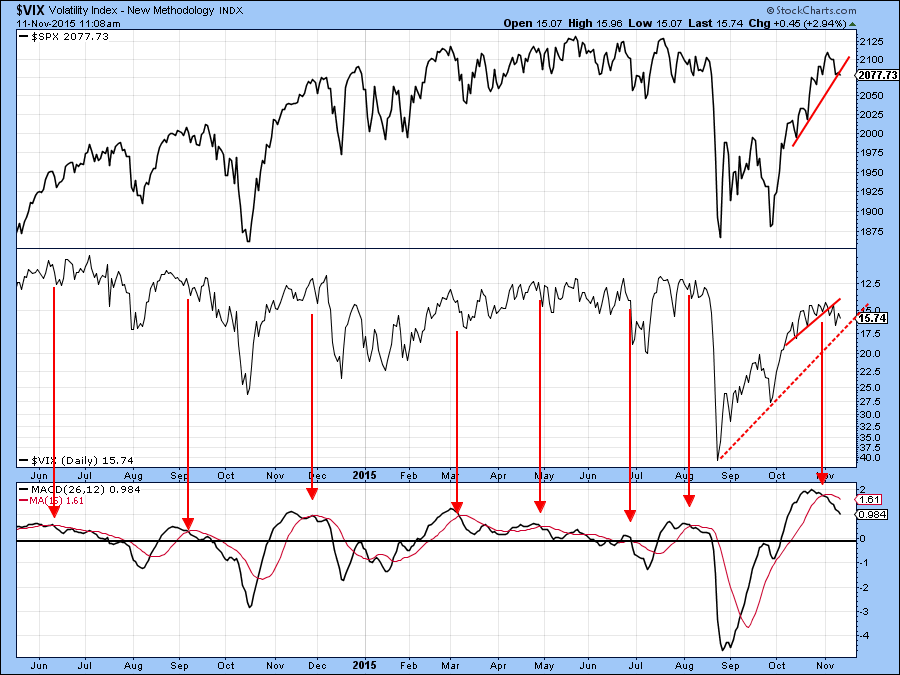

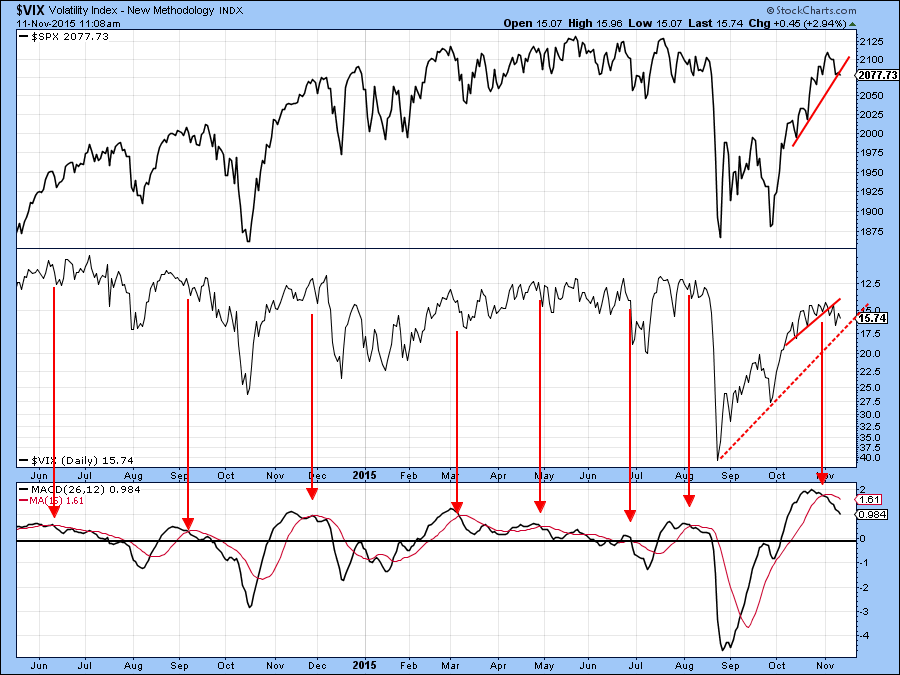

* KST for the VIX triggers a sell signal for equities in general

* Junk Bonds have reversed to the downside

* Dollar breaks to the upside on a broad basis

* Some commodities break to new lows

The corrective process we talked about last week is still underway. Sometimes the technical position improves...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT PUSHES BOND YIELDS AND DOLLAR HIGHER -- RISING DOLLAR MAY BE HELPING SMALL CAPS TO PLAY CATCHUP -- RISING RATES HELP BANKS, BROKERS, AND INSURERS -- BUT HURT UTILITIES AND REITS -- RISING BOND YIELDS FAVOR CYCLICALS OVER STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS END THE WEEK MIXED, BUT STILL IN UPTREND... Friday's jobs report caused some minor profit-taking in major stock indexes, but not enough to alter the current uptrend. Chart 1 shows the S&P 500 dropping slightly Wednesday through Friday (but closing up for the week). I&...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT PUSHES RATES SHARPLY HIGHER -- THAT HELPS BANKS, BROKERS, AND INSURERS -- BUT HURTS UTILITIES -- RISING DOLLAR PUSHES GOLD AND OTHER COMMODITIES LOWER -- EMERGING MARKETS SLIP ON RISING DOLLAR AND PROSPECTS FOR HIGHER BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SURPRISINGLY STRONG JOBS REPORT... Today's surprisingly strong jobs report took markets by surprise, but is having predictable intermaket results. First, it pushed Treasury yields sharply higher. That's based on the belief that the strong report increases the odds for a Fed rate hike in December. Chart...

READ MORE

MEMBERS ONLY

November Should Tell Us Whether US Equities Are In A Bull Or Bear Market

by Martin Pring,

President, Pring Research

Market pullback likely in November

* Rates rising across the yield maturity spectrum

* Dollar Index close to an upside breakout

* Commodities look weaker

The short-term condition of the market is very overstretched, to say the least. Even if we are still in a bull market some form of November correction appears...

READ MORE

MEMBERS ONLY

YIELDS RISE ON YELLEN OPTIMISM -- THAT PUSHED DOLLAR HIGHER AND GOLD AND OTHER COMMODITIES LOWER -- OVERBOUGHT STOCKS ARE TESTING OLD HIGHS AND MAY NEED A BREATHER -- FOREIGN STOCKS ALSO EXPERIENCE SELLING NEAR RESISTANCE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

YELLEN PUSHES YIELDS HIGHER... Janet Yellen sounded a hawkish tone again today about the possibility of a December rate hike. That pushed U.S. rates higher. Chart 1 shows the 10-Year Treasury Note Yield climbing to the highest level in two months. Shorter-term rates climbed even more. That caused selling...

READ MORE

MEMBERS ONLY

STOCKS HAVE STRONGEST OCTOBER IN FOUR YEARS -- S&P 500 ENDS NEAR TWO-MONTH HIGH BUT LOOKS OVER-EXTENDED -- EQUAL WEIGHT STOCK ETFS NEED TO CATCH UP -- JANUARY EFFECT SHOULD BOOST SMALL CAPS -- WEEKLY MACD LINES TURN POSITIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

HALLOWEEN INDICATOR ... Stocks had the best October since 2011. That bodes well for the rest of the fourth quarter and the next six months. The three months between November and January are traditionally the best three months of the year. As is the six-month period between November and April. As...

READ MORE

MEMBERS ONLY

Upside Breakout In The Dollar Index May Be Close At Hand

by Martin Pring,

President, Pring Research

* Market breadth on the rally not so hot

* Credit spreads are a likely bell weather for equities

* Dollar Index reaches critical resistance

The power of the recent rally has been a surprise to most observers including myself. The big question is whether it is part of a topping out process,...

READ MORE

MEMBERS ONLY

FED'S HAWKISH TONE BOOSTS BOND YIELDS -- THAT HELPS BANKS AND INSURERS, BUT HURTS UTILITIES -- DOLLAR RALLY HURTS GOLD -- ENERGY STOCKS REBOUND WITH CRUDE OIL -- S&P 500 HITS TWO-MONTH HIGH -- SMALL CAPS ACHIEVE BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS RISE ... Today's Fed statement had a slightly more hawkish tone than markets were expecting, and left the door open for a possible December rate hike. After a brief dip, stocks ended strong. Financials bounced sharply on the Fed statement, while rate-sensitive utilities sold off. A bounce...

READ MORE

MEMBERS ONLY

INDUSTRIALS LEAD STRONG STOCK RALLY -- INDUSTRIAL SPDR CLEARS 200-DAY AVERAGE -- BIG MOVES SEEN IN BOEING, MMM, SOUTHWEST AIRLINES, AND RAYTHEON -- SEMICONDUCTORS LEAD TECHNOLOGY HIGHER -- PLUNGING EURO BOOSTS EUROZONE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR TURNS UP ... Throughout the summer, I expressed concern about the weak performance in the economically-sensitive industrial sector. That situation has taken a dramatic turn for the better. Chart 1 shows the Industrials SPDR (XLI) leaping 3% today and trading above its 200-day average. The XLI has also broken...

READ MORE

MEMBERS ONLY

HOMEBUILDERS RISE ON GOOD NEWS -- FALLING BOND YIELDS PUSH REITS TO SIX MONTH HIGH -- NYSE ADVANCE-DECLINE LINE CLEARS 200-DAY AVERAGE -- NASDAQ TESTS 200-DAY LINE -- INTEL AND MICROSOFT SHOW TECHNOLOGY LEADERSHIP -- APPLE MAY BE TURNING UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOMEBUILDERS BUILD ON GOOD NEWS... Yesterday's announcement that homebuilding sentiment had jumped to a ten-year high was followed by today's report that September housing starts had the second biggest jump in eight years. Not surprisingly, homebuilders are having a strong day. The daily bars in Chart...

READ MORE