MEMBERS ONLY

HOMEBUILDERS HAVE A STRONG WEEK -- LENNAR GAPS HIGHER -- BEAZER HOMES AND KB HOME ALSO HAVE A STRONG WEEK -- RISING BOND YIELDS CONTINUE TO HELP BANKS AND INSURERS WHILE HURTING UTILITIES AND REITS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOMEBUILDERS HAVE A STRONG WEEK... The daily bars in Chart 1 show the Dow Jones U.S. Home Construction iShares (ITB) ending the week at the highest level in two months. Interestingly, that came in the face of rising bond yields. Earlier in the year, rising bond yields appeared to...

READ MORE

MEMBERS ONLY

MICRO-CAPS LEAD MIXED MARKET, SMALL-CAP ETF AND QQQ HIT NEW HIGHS, EW S&P 500 CONTINUES TO LAG, TREND SORTING WITH THE PPO (DEMO), FOUR KEY SECTOR ETFS ARE STILL TRENDING UP, INDUSTRIALS BREAK DOWN, OIL WEIGHT ON ENERGY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MICRO-CAPS LEAD MIXED MARKET ... Link for today's video. The stock market is not clicking on all cylinders right now, but the majority of cylinders are still in uptrends, even after some selling pressure this month. Today I will look at some key uptrends and show what it would...

READ MORE

MEMBERS ONLY

Oversold Short-term Indicators Suggest Another Attempt At New Highs Is In The Cards

by Martin Pring,

President, Pring Research

* Pring Dow Diffusion indicator triggers a tentative buy signal.

* Net new high bond indicator is deeply oversold.

* Aussie and Canadian dollars experience bullish KST.

US Stocks

Action this week has been somewhat disappointing since several averages and sectors experienced reversal characteristics on Tuesday. This suggests that, over the next few...

READ MORE

MEMBERS ONLY

TRANSPORTS AND UTILITIES STILL IN DOWNTRENDS AND MAY BE PREVENTING UPSIDE BREAKOUT IN THE DOW -- DOW JONES COMPOSITE AVERAGE STILL IN A DOWNTREND AS WELL -- THAT'S A CAUTION SIGN FOR THE DOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS AND UTILITIES ARE 2015 LAGGARDS... Chart 1 shows the divergence by the Dow Industrials (which are close to a new record) and the Dow Transports and Utilities which are both in downtrends. Since the start of the year, the industrials have gained 1.6%, while the transports and utilities...

READ MORE

MEMBERS ONLY

SMALL-CAP, MID-CAP AND NASDAQ ETFS LEAD, GROWTH CONTINUES TO LEAD VALUE, CONSUMER DISCRETIONARY ETFS BREAK OUT, HOUSING AND RETAIL LEAD CONSUMER DISCRETIONARY, WEBINAR EXCLUSIVES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL-CAPS, MID-CAPS AND NASDAQ SHOW LEADERSHIP... Note that the charts below are part of the webinar, which was at 1PM on Tuesday, June 23rd (Click here for recording). It is hard to argue against the bulls with the Russell 2000 iShares (IWM), S&P MidCap SPDR (MDY) and Nasdaq...

READ MORE

MEMBERS ONLY

UNIQUE SECTOR BREADTH INDICATORS, LONG-TERM VERSUS MEDIUM-TERM, SECTOR TRENDS, FINANCE AND HEALTHCARE TOP RANKS, ENERGY AND UTILITIES SEE RED, INDUSTRIALS SECTOR RANKS THIRD

by John Murphy,

Chief Technical Analyst, StockCharts.com

SLICING AND DICING THE SECTORS WITH UNIQUE INDICATORS... Link for today's video.. As promised, I am showing a breadth and trend table for the nine sectors today. Using the unique indicators available at StockCharts, chartists can slice and dice a sector by analyzing sector-specific breadth indicators, the cap-weighted...

READ MORE

MEMBERS ONLY

IWM AND XLI FOLLOW UP, BULK OF THE EVIDENCE, SMALL-CAP BULLISHNESS, FINDING SHORT-TERM PULLBACKS, CRUDE FLAGS, XES RELATIVE WEAKNESS, AEROSPACE & DEFENSE ETF BREAKS AND MORE

by John Murphy,

Chief Technical Analyst, StockCharts.com

IWM AND XLI STRATEGY FOLLOW UP... Link for today's video.. Today I am going to step back and focus a little on strategy. The first part will show a basic chart strategy to identify the bigger trend and find pullbacks within this chart. The second part will show...

READ MORE

MEMBERS ONLY

US STOCKS LEAD GLOBAL RALLY -- SMALL CAP INDEXES HIT NEW RECORDS -- MIDCAPS BREAK THROUGH RESISTANCE -- NASDAQ ALSO HITS NEW RECORD -- DOW AND S&P BREAK OUT TO UPSIDE -- RETAILERS LEAD CONSUMER DISCRETIONARY STOCKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS HIT NEW RECORD HIGHS... Let's start off today where we started yesterday -- with small cap stocks which continue to lead the market higher. Charts 1 and 2 show the S&P 600 and the Russell 2000 Small Cap Indexes hitting new record highs. As...

READ MORE

MEMBERS ONLY

STOCKS BOUNCE ON FED'S INTENTION TO RAISE RATES GRADUALLY -- BONDS BOUNCE ALONG WITH REITS AND UTILITIES -- CONSUMER STAPLES SPDR BOUNCES OFF 200-DAY LINE -- DOLLAR DROP BOOSTS GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS EXPERIENCE MODEST BOUNCE... Large cap stocks experienced a modest bounce on today's Fed statement about raising rates very gradually. Chart 1 shows the S&P 500 gaining four points (+0.20%) and ending just below its 50-day average. Small caps, which had been testing spring highs,...

READ MORE

MEMBERS ONLY

SMALL CAP INDEXES TEST OLD HIGHS -- GROWTH LEADS VALUE -- MIDCAPS EXCEED 50-DAY AVERAGE -- S&P 500 BOUNCES OFF CHART SUPPORT -- DOW SURVIVES TEST OF 200-DAY LINE WHILE NASDAQ HOLDS UP MUCH BETTER -- WATCHING THE FED AND GREECE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAP INDEXES TEST OLD HIGHS... Small cap stocks remain the strongest part of the stock market, and continue to lead the rest of the market higher. Charts 1 and 2 show the S&P 600 Small Cap Index ($SML) and the Russell 2000 Small Cap Index (RUT) in...

READ MORE

MEMBERS ONLY

Is The Greek Stock Market About To Collapse Or Explode?

by Martin Pring,

President, Pring Research

* HYG/IEF bond confidence indicator may be peaking.

* Cyclicals and financials have the ability to break to the upside.

* Spider Metal and Mining and Materials less favored.

US Equities

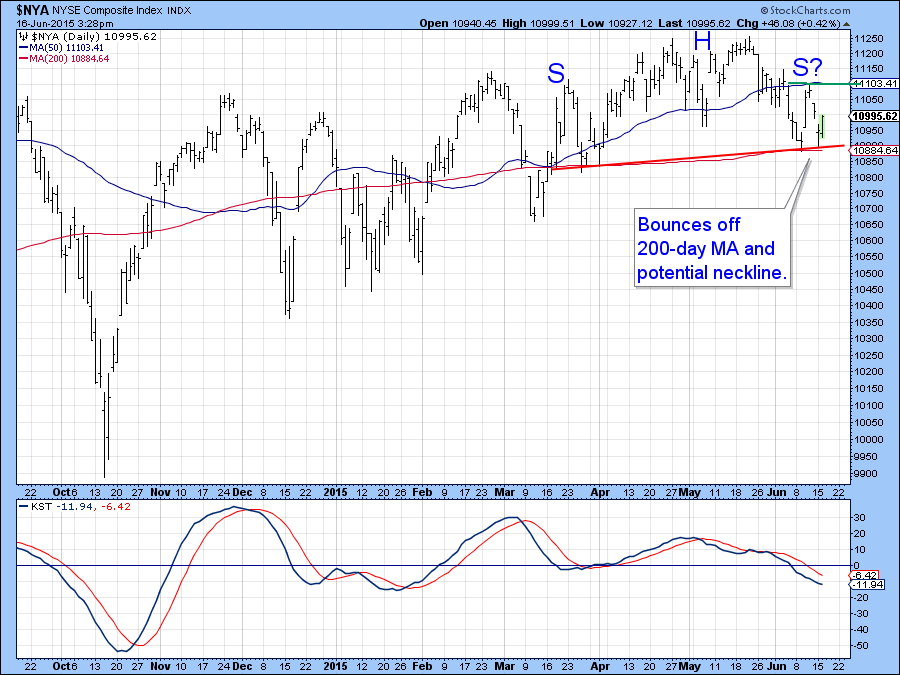

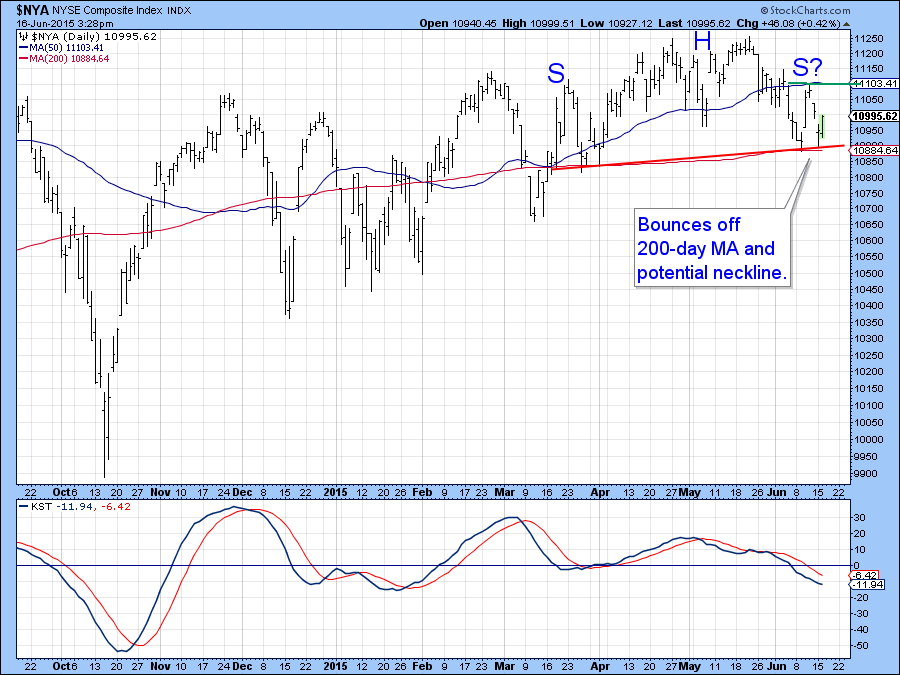

The NYSE Composite ($NYA) continues to trade in a narrow range frustrating bull and bear alike. The 200-day MA often acts...

READ MORE

MEMBERS ONLY

RRG FAVORS SMALL-CAPS, IJR CONSOLIDATES NEAR HIGHS, HEALTHCARE SPDR STALLS AFTER BREAKOUT, MEDICAL SUPPLIES AND MEDICAL EQUIPMENT INDEXES, XLB CORRECTS WITHIN UPTREND, COMMODITY CHEMICALS AND STEEL INDEXES, WEBINAR DETAILS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RRG FAVORS SMALL AND MID CAPS... Note that Julius de Kempenaer and Arthur Hill (moi) recorded a webinar on Tuesday, June 16th. The following charts and commentary come from this webinar. More charts and detailed explanations can be found on webinar recording.

(from Julius de Kempenaer) Chart 1 shows a...

READ MORE

MEMBERS ONLY

3 GAPS DOMINATE SPY, IWM HOLDS SUPPORT, ITB BOUNCES OFF CHANNEL, 6 HOMEBUILDER STOCKS, RETAIL SHOWS RELATIVE STRENGTH, RCD GETS A BAND SQUEEZE, SMALL AND MID CAP BREADTH STRENGTHENS, LARGE-CAP BREADTH WEAKENS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THREE GAPS DOMINATE THE SHORT-TERM TREND FOR SPY... It is currently a tale of two markets. The S&P 500 SPDR (SPY) has been trending lower since late May, but the Russell 2000 iShares (IWM) has been trending higher over this same timeframe. The broader market is likely to...

READ MORE

MEMBERS ONLY

If You Are Bullish On US Equities Try Looking At China For A Signal

by Martin Pring,

President, Pring Research

* - Special K for the NYSE Composite breaks support

* - Emerging markets getting oversold

* - Commodities are about to resolve their recent trading range

A Chinese leading Indicator?

It’s a well-known fact that the Chinese market has been the hottest on earth in recent months. What’s not so...

READ MORE

MEMBERS ONLY

BORING UPTREND, EQUAL-WEIGHT SPX WEAKNESS, IWM FOLLOW UP, INDUSTRIALS SPDR BOUNCES OFF SUPPORT, GE, HON AND UTX STALL, FEDEX HITS NEW HIGH, WILL UPS FOLLOW?, VIDEO EXTRAS

by John Murphy,

Chief Technical Analyst, StockCharts.com

A PERSISTENT AND BORING UPTREND... Link for today's video. The stock market, as measured by the S&P 500, remains in a boring uptrend. Better a boring uptrend than a boring downtrend. As noted in Tuesday's webinar, the 5-day Rate-of-Change has been between +3.5%...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS BOUNCE SHARPLY ON POSSIBLE GREEK COMPROMISE -- DOW AND S&P 500 BOUNCE OFF INITIAL CHART SUPPORT -- NASDAQ HOLDS 50-DAY LINE -- SMALL CAPS LEAD ON THE UPSIDE -- RISING BOND YIELDS KEEP BANKS AND INSURANCE STOCKS RISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS BOUNCE SHARPLY OFF CHART SUPPORT... Reports of a compromise between the Germans and Greeks to prevent a default later this month appears to be contributing to a strong global stock rally. European stocks are up 2% on average. U.S. stocks are having a strong day of their own....

READ MORE

MEMBERS ONLY

WEBINAR DETAILS, LARGE-CAPS WEAKEN, SMALL-CAPS HANG TOUGHER, $NDX AND $SPX BREADTH BREAKS, SECTOR BREADTH LINES TURN MIXED, KEY EQUAL-WEIGHT SECTORS HOLD SUPPORT, SCANNING FOR YEAR-TO-DATE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR RECORDING AND TIMELINE... The charts and commentary below come from the webinar recording. Note that not all webinar charts are included. Overall, the market remains boring on the outside and mixed up on the inside. The S&P 500 is flat for the year, but some key sectors...

READ MORE

MEMBERS ONLY

What Are The Implications Of Rising World Interest Rates?

by Martin Pring,

President, Pring Research

* -World Bond Index completes a major top.

* -US short-term bonds on the verge of a breakout.

* -Stocks now being threatened by rising rates.

World Bond Index

Global bond markets have really been taking it on the chin recently without that usual push they get from rising commodity prices. Monetary policy...

READ MORE

MEMBERS ONLY

USO TRACKING ERROR, LIGHT CRUDE AND BRENT FORM FLAGS, XES TESTS BREAK, FIVE HORSEMEN OF TECH, FB GETS BREAKOUT, GOOGLE HOLDS BREAKOUT AND AIRLINES WEIGH ON PEJ

by John Murphy,

Chief Technical Analyst, StockCharts.com

USO AND THE LONG-TERM TRACKING ERROR ... Oil surged at the end of May, but fell back last week and remains in a short-term downtrend. For a different perspective, I am going to analyze the August futures contracts for Light Crude and Brent Crude. The USO Oil Fund (USO) and US...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 LOSE GROUND WHILE NASDAQ HOLDS FIRM -- STRONG JOBS REPORT AND BOUNCING DOLLAR BOOST SMALL CAPS -- 10-YEAR TREASURY YIELD SURGES TO EIGHT-MONTH HIGH AND BREAKS DOWNTREND LINE -- 2-YEAR YIELD NEARS FOUR YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 SLIP WHILE NASDAQ HOLDS FIRM... U.S. stocks lost ground during the week, but not enough to do any serious chart damage. Chart 1 shows the Dow Industrials falling to the lowest level in a month and sliding below its 50-day moving average (in...

READ MORE

MEMBERS ONLY

MACD HOLDS FOR IWM, QQQ FORMS CUP-HANDLE, FINANCE LEADS SMALL-CAPS, BROKERS LEAD FINANCE, TREASURY YIELDS SURGE, BUT DOES IT MATTER?, YIELD CURVE STEEPENS FURTHER, GOLD AND PALLADIUM BREAK DOWN, MINERS FOLLOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

MACD HOLDS BULLISH FOR IWM... Link for today's video. Chart 1 shows the Russell 2000 iShares (IWM) exceeding the late May high this week and keeping the uptrend alive. Even though IWM has yet to exceed its April highs, the chart is more bullish than bearish right now....

READ MORE

MEMBERS ONLY

Is Thursday's Negative Action The Start Of Something More Serious?

by Martin Pring,

President, Pring Research

* -Brokers experience a bearish two bar reversal.

* -Dollar diffusion indicator ticks up for the first time in many weeks.

* -Gold in dollars experiencing a short-term breakdown.

* -Gold in yen and euro at crucial support levels.

US Equities

The market has been working its way irregularly higher over the last few...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS LEAD THE U.S. LOWER -- EMERGING MARKETS FALL THE HARDEST -- FALLING COMMODITY PRICES WEIGH ON CANADIAN STOCKS -- WEAK ENERGY SHARES LEAD OIL LOWER AS MOST COMMODITIES WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCKS SHOW NEW WEAKNESS... The global stock market rally is running into trouble. That can be seen more clearly in foreign markets. Chart 1 shows MSCI EAFE iShares (EFA) falling below its 50-day average after backing off from overhead resistance formed last June. Its daily MACD lines (top of...

READ MORE

MEMBERS ONLY

BOND YIELDS SURGE TO NEW 2015 HIGH AS BOND PRICES PLUNGE -- UTILITIES AND REITS FALL WITH BOND PRICES -- BANKS AND LIFE INSURERS RISE WITH BOND YIELDS -- INSURANCE LEADERS ARE UNUM, METLIFE, AND PRUDENTIAL -- BANK SPDR HITS NEW SEVEN YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS REACH NEW 2015 HIGH... The surge in bond yields that started a month ago is accelerating to the upside. Chart 1 shows the 10-Year Treasury Note Yield climbing to the highest level since last November. Chart 2 shows the 30-Year T-Bond Yield doing the same. The driving force...

READ MORE

MEMBERS ONLY

FOUR KEY SECTORS IN HOLDING PATTERNS, TIMING ITB AND XHB, REGIONAL BANKS AND BROKER STAY STRONG, WATER BREAKS, OIL FORMS BULL FLAG, XES SURGES WITHIN WEDGE, MACD DIVERGENCES AND CHANDELIERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

50% OF S&P 500 REMAINS IN HOLDING PATTERN... The following charts and brief commentary come from Click here for Tuesday's webinar. The broader market continues to grind higher and we can point the finger at four sectors. Technology and healthcare are doing their part for the...

READ MORE

MEMBERS ONLY

TECHNICAL SUMMATION FOR IWM, SIX STOCKS KEY TO QQQ, RANKING THE 18 SECTORS, BIOTECHS LEAD HEALTHCARE, GILEAD AND REGENERON LEAD IBB, MERCK HOLDS THE GAP, METALS-MINING-STEEL WEAKEN FURTHER, CATERPILLAR AND US STEEL

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNICAL EVIDENCE REMAINS BULLISH FOR IWM ... Link for today's video. The Russell 2000 iShares (IWM) has been lagging the broader market since mid April, but the bulk of the evidence remains bullish. Chart 1 shows IWM with four bullish factors and two bearish factors at work. Working from...

READ MORE

MEMBERS ONLY

DOW JONES COMPOSITE AVERAGE CLOSES BELOW ITS 200-DAY LINE AS THE DOW INDUSTRIALS ENDS BELOW 50-DAY LINE -- THE DOW INDUSTRIALS ARE SHOWING NEGATIVE DIVERGENCES OF THEIR OWN -- INDUSTRIALS SPDR APPEARS TO BE FORMING HEAD AND SHOULDERS TOP

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES COMPOSITE AVERAGE CLOSES BELOW 200-DAY AVERAGE ... I've been writing about the growing negative divergence between the transportation and industrial stocks which has gotten even worse. The Dow Transports fell -2.1% during the week and ended at the lowest level in seven months. It was just...

READ MORE

MEMBERS ONLY

SPY GRINDS HIGHER, QQQ LEADS, IWM LAGS, HEALTHCARE-FINANCE-TECH LEAD, CONSUMER DISCRETIONARY STALLS, INDUSTRIALS TAKE A HIT, XRT FAILS AT RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 CONTINUES TO GRIND HIGHER... Link for today's video. Price action has been rather boring in the major index ETFs since March, but there is a clear upward bias in price action and the trends remain up. Chart 1 shows the Equal-Weight S&P...

READ MORE

MEMBERS ONLY

TRANSPORTS STILL DIVERGE FROM INDUSTRIALS -- DJ COMPOSITE AVERAGE IS TESTING 200-DAY AVERAGE AND IS GOING TO NEED HELP FROM THE TRANSPORTS AND UTILITIES TO RESUME ITS UPTREND -- DOLLAR UPTURN INCREASES NEED TO HEDGE FOREIGN CURRENCY RISK

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIALS NEED SOME HELP FROM THE TRANSPORTS... I remain concerned about the negative divergence between the Dow Industrials (black bars) and the Dow Transports (red bars). The discrepancy between the two Dow Averages is the biggest in three years. That may not pull the Industrials lower, but it may prevent...

READ MORE

MEMBERS ONLY

Is It Too Late To Sell In May?

by Martin Pring,

President, Pring Research

* World Stock ETF falls to important support.

* Key bond confidence indicator at a key level.

* Dollar offering stronger signals that the correction is over.

Global Stocks

A couple of weeks ago I drew your attention to the $61 area on the MSCI World Stock ETF, the ACWI, as I felt...

READ MORE

MEMBERS ONLY

MEDIUM TERM TRENDS FOR SPY AND MDY, HEALTHCARE PROVIDERS REMAIN STRONG, WEAK YEN AND EURO PROPEL DOLLAR, OIL AND ENERGY GET HIT, GOLD TESTS WEDGE TREND LINE, VIDEO EXTRAS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR INDEX ETFS PULLBACK WITHIN UPTRENDS... Link for today's video. Stocks came under selling pressure on Tuesday with small-caps, mid-caps and large-techs leading the way. At this point, today's decline is just a little noise within a bigger uptrend. The stock market has been working its...

READ MORE

MEMBERS ONLY

MID-CAP BREADTH LEADS, EQUAL-WEIGHT CONFIRMS CAP-WEIGHT, IWM SIGNAL FOLLOW UP, GE LEADS INDUSTRIALS, HEALTHCARE AND TECH LEAD SCTRS, FOUR TECH STOCKS WITH A 3-STEP SETUP

by John Murphy,

Chief Technical Analyst, StockCharts.com

INTERNAL STRENGTH CONFIRMS EXTERNAL STRENGTH... Link for today's video. The weight of the evidence is still bullish for stocks in general. As detailed below, several key index ETFs hit new highs and we are seeing leadership in three big sectors that account for almost half of the S&...

READ MORE

MEMBERS ONLY

Is it Time for the Dollar Bull Market to Resume?

by Martin Pring,

President, Pring Research

* Dollar Index ETF experiences a 38% Fibonacci correction and bounces.

* Key dollar relationships either at or just above major support.

* One way or another individual major currencies look vulnerable.

The Dollar Index ($USD) has been correcting for the last 9 weeks causing some observers to question the legitimacy of the...

READ MORE

MEMBERS ONLY

AIRLINES LEAD DOW TRANSPORTS TO SEVEN MONTH LOW -- SEVERAL AIRLINE STOCKS BREAK 200-DAY AVERAGES IN HEAVY TRADING -- RAILS AND TRUCKERS ARE ALSO IN DOWNTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS FALL TO SEVEN-MONTH LOW... The chart picture for the Dow Tranports continues to weaken. Chart 1 shows the Dow Jones Transportation Average falling nearly 2% today and dropping to the lowest level since last October. It also fell further below its 200-day moving average. Although the rails and...

READ MORE

MEMBERS ONLY

WEBINAR, MDY AND SPY BREADTH, MARKETS ZIGZAG, OVERVIEW OF 9 SECTOR SPDRS, FIVE LEADING INDUSTRY GROUP ETFS, DOLLAR CORRELATION WITH COPPER-GOLD-OIL, BONDS HIT KEY LEVEL, SIX STOCK SETUPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

AD LINES CONFIRM NEW HIGHS IN SPY AND MDY... When the major stock indices hit new highs, the first thing I do is check corresponding breadth indicators for confirmation. Breadth indicators tell us what is happening within the underlying indices. So far, the S&P 500 SPDR (SPY), the...

READ MORE

MEMBERS ONLY

EW S&P 500 STALLS NEAR HIGHS, SEMI SPDR BREAKS OUT, THREE SEMICONDUCTOR STOCK BREAKOUTS, AIRLINE INDEX CORRECTION, THREE AIRLINE STOCKS, THE REAL COMMODITY LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

EQUAL-WEIGHT S&P 500 CONSOLIDATES NEAR HIGHS... Link for today's video. The EW S&P 500 ETF (RSP) has yet to confirm the new high in the S&P 500 SPDR (SPY), but RSP is close to a new high and the current uptrend favors...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS HIT THREE-MONTH HIGH -- WEAKER TRANSPORTS AND UTILITIES SHOW SOME IMPROVEMENT -- BOND YIELDS TURN DOWN AS BOND PRICES BOUNCE OFF CHART SUPPORT -- THAT HELPS HOMEBUILDERS, REITS, AND TELECOM ETFS STAY ABOVE 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS AND UTILITIES ARE HOLDING MARKET BACK ... I've been writing about the continuing discrepancy between three Dow Averages. But things may be starting to improve. Chart 1 shows the Dow Industrials closing at a three-month high and just shy of its early March peak. [The S&P...

READ MORE

MEMBERS ONLY

OEX LEADS, IWM TRIGGERS BULLISH SIGNAL, INDUSTRIALS PERK UP, CONSUMER DISCRETIONARY LAGS, 5 BOLLINGER BAND BREAKOUTS, OIL WEAKENS DESPITE EURO STRENGTH, XLE WEAKENS BELOW KEY MOVING AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

OEX LEADS WITH FIRST NEW HIGH... Link for today's video. The S&P 100 ($OEX) represents large-caps and this index is the first to hit a new high here in May. The S&P 500 reached a closing high on Thursday, but fell short of a...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS REACH THREE MONTH HIGH -- TWO OF ITS BIGGEST GAINERS ARE MICROSOFT AND VISA -- S&P 500 EXCEEDS LAST FRIDAY'S HIGH -- MIDCAPS EXCEED 50-DAY LINE -- SMALL CAPS MAY BE NEXT -- FACEBOOK AND ADOBE LEAD QQQ HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW INDUSTRIALS NEAR 2015 HIGH ... Stocks are having a strong day. More importantly, several stock indexes are breaking through overhead resistance barriers, or are very close to doing so. Chart 1 shows the Dow Jones Industrial Average trading at the highest level in nearly three months. That puts it in...

READ MORE

MEMBERS ONLY

Why Is $61 Such An Important Number?

by Martin Pring,

President, Pring Research

* Key levels for the MSCI World Stock ETF.

* Asia Ex Japan and Japan ETF’s can support higher prices.

* Latin America and the Middle East look the most vulnerable.

Occasionally a specific price can show up as a pivotal number that provides a valuable clue as to the probable direction...

READ MORE