MEMBERS ONLY

10-YEAR BOND YIELD HOLDS ABOVE 200-DAY AVERAGE -- BANKS BENEFIT FROM HIGHER YIELDS -- BANK ETF HITS NEW SEVEN YEAR HIGH -- PERCENTAGE LEADERS ARE KEYCORP, COMERICA, AND FIFTH THIRD BANCORP -- FALLING DOLLAR IS BOOSTING PRECIOUS METALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY NOTE HOLDS FIRM ... The recent jump in bond yields has shown no sign of ending. The daily bars in Chart 1 show the 10-Year Treasury Note Yield trading back above its 200-day average (after dipping back below it last Friday). The TNX is also testing its March peak...

READ MORE

MEMBERS ONLY

RISING YIELDS, THE YIELD CURVE, BANKING STOCKS, KEY LEVELS FOR BREADTH, HOUSING-RETAIL-SEMI ETFS CORRECT, BIOTECH ETFS HOLD GAPS, OIL EXTENDS UPTREND, GOLD FLOUNDERS, AIRLINES CORRECT, STOCKS OF INTEREST

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE KEY LINES IN THE SAND... There are certainly some concerns in the stock market right now, but I have yet to get a bearish signal to confirm these concerns. The bond market imploded over the last few weeks, long-term Treasury yields surged, small-caps have been lagging since early April...

READ MORE

MEMBERS ONLY

Will the Giant Trading Range for the Emerging Markets ETF be Resolved on the Upside or Downside?

by Martin Pring,

President, Pring Research

* China, Taiwan and South Korea digesting gains following upside breakouts.

* India, Russia, and Brazil face technical challenges.

* The counter-cyclical commodity rally may well be over.

Emerging Markets

The MSCI Emerging Markets ETF, the EEM, has been in a large trading range during the last few years, as you can see...

READ MORE

MEMBERS ONLY

LARGE AND GROWTH LEAD, DIA CHALLENGES HIGHS, IWM BOUNCES, SMALL-CAP BREADTH LAGS, TAIL VERSUS DOG, DEFENSE-AEROSPACE ETFS HIT SUPPORT, FOUR DEFENSE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

LARGE-CAPS AND GROWTH SHOW RELATIVE STRENGTH... Link for today's video. Stocks surged on Friday, but small-caps and mid-caps lagged with smaller gains. In fact, looking at one-month performance for several major index ETFs, we can see that large-caps are leading and small-caps are lagging. Chart 1 shows a...

READ MORE

MEMBERS ONLY

LATE WEEK STOCK RALLY IS BASED ON MORE THAN A JOBS REPORT -- SPIKE IN BOND YIELDS PEAKED ON THURSDAY WHICH BOOSTED DIVIDEND ISHARES -- THE DJ COMPOSITE AVERAGE BOUNCES OFF 200-DAY AVERAGE -- BRITISH MARKETS BOUNCE ON ELECTION RESULTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD BACK BELOW 200-DAY AVERAGE... The report of 223,000 jobs created in April (and a drop in the unemployment rate to 5.4%) helped spark a strong stock rally on Friday. It's not that the report was so strong. In fact, it barely met expectations....

READ MORE

MEMBERS ONLY

SLOW AND STEADY IS STILL WINNING, SMALL-CAPS AND MID-CAPS ARE NOT BROKEN, XLY SURGES OFF SUPPORT, XLF RENEWS BREAKOUT, IAI CONSOLIDATES, CLOUD-INTERNET-SOFTWARE ETFS SPORT STRONG SCTRS, XLI BREAKS TRIANGLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SLOW AND STEADY IS STILL WINNING... Link for today's video. Stocks fell back from late April to early May and and this might have been enough to turn short-term bearish, but these declines did not affect the medium-term uptrends. In fact, the S&P 500 was never...

READ MORE

MEMBERS ONLY

SELLOFF IN ENERGY SHARES MAY SUGGEST OIL PEAK -- THAT'S HELPING AIRLINES AND TRANPORTS -- 10-YEAR BOND YIELD BACKS OFF FROM MARCH HIGH -- THAT'S HELPING RATE-SENSITIVE REITS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY STOCKS BACK OFF FROM 200-DAY AVERAGE... While stocks in general are rebounding from yesterday's selloff, some interesting rotations are going on beneath the surface. One of the has to do with a pullback in energy shares and the price of crude. Energy stocks are the day'...

READ MORE

MEMBERS ONLY

STOCK MARKET CONTINUES TO RETREAT -- A LOT OF SHORT-TERM SUPPORTS ARE BEING BROKEN -- FALLING APPLE HURTS NASDAQ -- BOND ETFS FALL BELOW 200-DAY AVERAGES -- SO DO UTILITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK AVERAGES BREAK 50-DAY LINES... Stock selling that started yesterday has spilled over to today as the market's short-term trend continues to weaken. Trading volume over the last week has also taken on a negative pattern, with heavier trading on down days and lighter volume on bounces....

READ MORE

MEMBERS ONLY

Will Last Month's NYSE Breakout Hold?

by Martin Pring,

President, Pring Research

* McClellan Summation gives a sell for the Wilshire 5000.

* Bond confidence ratios turn positive.

* Inflation ratios break to the upside. Trick or treat?

* Bonds complete a head and shoulders top.

US Equities

The NYSE Composite ($NYA) has been doing its best to break to the upside but continues to vacillate...

READ MORE

MEMBERS ONLY

STOCKS AND TREASURIES DIVERGE, KEY GROUPS AND BREADTH WEAKENING, FINANCE HOLDS STRONG, MATERIALS START TO LEAD, ENERGY ETFS EXTEND UPTRENDS, COPPER AND ALUMINUM LEAD BASE METALS, USING THE CHANDELIER EXIT

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR ... Stocks came under selling pressure on Tuesday with techs and small-caps leading the way lower. The overall picture for stocks remains largely unchanged. The major index ETFs are in slow and steady uptrends this year, but we are seeing some weakness in a few key groups and some breadth...

READ MORE

MEMBERS ONLY

PUTTING THE BIOTECH DECLINE INTO PERSPECTIVE, GILEAD SURGES ON BIG VOLUME, MANAGING THE UPSWINGS IN OIL AND ENERGY, SEASONAL TENDENCIES FOR OIL, DOLLAR HITS SUPPORT ZONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

PUTTING THE BIOTECH DECLINE INTO PERSPECTIVE... Link for today's video. It has been a rough ride for biotechs since mid March, but I am not ready to throw in the towel on the long-term uptrend. Chart 1 shows the Biotech iShares (IBB) with two sharp declines over the...

READ MORE

MEMBERS ONLY

THIS WEEK'S JUMP IN COPPER AND BOND YIELDS MAY BE LINKED -- SO IS THE BIG JUMP IN THE GERMAN 10-YEAR BUND YIELD -- TREASURY YIELD CURVE APPEARS TO BE BOTTOMING -- RISING BOND YIELDS HELP BANKS AND INSURERS WHICH GAINED ON THE WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER AND YIELDS ARE WEEK'S BIGGEST GAINERS ... Two of the most significant events of the past week were the sharp rally in copper and Treasury bond yields. The two may be linked. Chart 1 shows the price of copper (red line) and the 10-Year Treasury Note Yield (green...

READ MORE

MEMBERS ONLY

SPY MAINTAINS UPTREND, BREADTH WANES, SMALL AND MID-CAP ETFS BREAK SUPPORT, QQQ IS STILL THE LEADER, A BIG WEEK FOR MATERIALS, TECH AND CONSUMER DISCRETIONARY HOLD STRONG, NOOSE TIGHTENS FOR FINANCE AND INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY MAINTAINS UPTREND, BUT BREADTH WANES ... Link for today's video. There are clearly some signs of underlying weakness in the stock market and this could foreshadow a correction over the coming weeks. Today's market message will start with four major index ETFs. We will look at...

READ MORE

MEMBERS ONLY

BOND YIELDS CONTINUE TO RISE AS BOND PRICES FALL -- THAT'S HURTING BOND PROXIES LIKE REITS AND UTILITIES -- RISING RATES PUSH GOLD SHARPLY LOWER -- RISING OIL PRICES ARE HURTING TRANSPORTS -- SMALL STOCKS BREAK 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CONTINUE TO MOVE HIGHER... After jumping sharply yesterday, Treasury bond yields are climbing again today. [Yesterday's jump followed big gains in Eurozone bond yields]. Chart 1 shows the 10-Year Treasury Note yield trading at the highest level since mid-March. The jump in bond yields is obviously...

READ MORE

MEMBERS ONLY

With Recent Breakouts Lacking Strong Conviction, "Sell in May?" Could Be A Legitimate Question

by Martin Pring,

President, Pring Research

* Global equities starting to get overbought.

* Dollar Index and related relationships break to new correction lows.

* Commodities tentatively break to the upside.

US Equities

From now until next Tuesday the market will be under the spell of the bullish end of the month seasonal. That condition, combined with the fact...

READ MORE

MEMBERS ONLY

JUMP IN GERMAN BUND YIELD HELPS BOOST TREASURY BOND YIELDS -- THAT'S GOOD FOR BANK AND INSURANCE STOCKS WHICH ARE TRADING HIGHER TODAY -- THE DOLLAR DROP IS PUSHING COMMODITY PRICES HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

GERMAN BUND YIELDS ARE RISING AS MANAGERS SELL... Something unusual is happening in Europe. For the first time in awhile, money managers are selling eurozone sovereign bonds which is pushing their yields higher. The best example is Germany. Chart 1 shows the 10-Year German Treasury yield jumping to 0.28%...

READ MORE

MEMBERS ONLY

SPY GETS NOISY, IWM ESTABLISHES SUPPORT, T-BONDS AND UTILITIES BRACE FOR BIG WEEK, CHEMICAL STOCKS LIFT MATERIALS SPDR, EW S&P 500 LAGS, SMALL-CAPS AND CONSUMER DISCRETIONARY START UNDERPERFORMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS... The charts below represent some of those featured in today's Webinar. The big trends are clearly up for the major index ETFs, but I am seeing some signs of weakness in a few key groups. It is not a major concern right now, however, it is...

READ MORE

MEMBERS ONLY

RCD CHALLENGES RESISTANCE, HEALTHCARE IS THE STRONGEST, MRK, GILD AND JNJ LAG, ABBV AND BMY LEAD, BASE METALS ETF CHALLENGES RESISTANCE, XME EXTENDS UPSWING, STEEL ETF BREAKS OUT, GOLD SURGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

EQUAL-WEIGHT CONSUMER DISCRETIONARY CHALLENGES RESISTANCE... Link for today's video. A funny thing happened on the way to new highs last week. The S&P 500 recorded a new high last week, but only one sector SPDR recorded a new high and only one equal-weight sector ETF hit...

READ MORE

MEMBERS ONLY

RISING STOCK MARKET IS BAD FOR GOLD -- COPPER LOOKS LIKE A BETTER ALTERNATIVE -- GLOBAL X COPPER MINERS ETF HITS FIVE-MONTH HIGH -- FREEPORT MCMORAN FLATTENS OUT -- SOUTHERN COPPER BREAKS NECKLINE RESISTANCE -- HUDBAY MINERALS ALSO TURNS UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING STOCKS ARE BAD FOR GOLD... During last Saturday's webinar, one of the attendees asked what I thought of gold. I responded that I didn't like gold and haven't liked it for at least two years. The main reason for that view is the...

READ MORE

MEMBERS ONLY

AMAZON AND MICROSOFT POWER QQQ, BROAD INDICES-TECHS-ASIA DOMINATE NEW HIGHS, NEW HIGH-NEW LOW SCAN, RRG SHOWS BIFURCATION IN FINANCE, XLF AND RYF LAG, REGIONAL BANK AND BROKER ETFS CONSOLIDATE NEAR HIGHS, JAPANESE FINANCIALS MAKE A MOVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ SURGES TO NEW HIGH... Link for today's video. Large-cap techs took charge on Friday and powered the Nasdaq 100 ETF (QQQ) to a new high. The underlying index, Nasdaq 100, is now around 6% from its all time high, which was recorded in March 2000. Chart 1...

READ MORE

MEMBERS ONLY

SOUTH KOREA RALLIES AS TAIWAN ETF EXPLODES TO RECORD HIGH -- EFA AND EEM HIT NEW RECOVERY HIGHS -- BOUNCING COMMODITIES AND A WEAKER DOLLAR ARE BOOSTING CANADA ISHARES -- NYSE INDEX HITS NEW RECORD -- NASDAQ TRADES ABOVE ITS MARCH 2000 CLOSING HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

SOUTH KOREA RISES -- TAIWAN ETF HITS NEW HIGH... China and Japan aren't the only Asian countries that are hitting new highs. Two of today's strongest performers are South Korea and Taiwan. Chart 1 shows South Korea iShares (EWY) climbing nearly 2% to the highest level...

READ MORE

MEMBERS ONLY

CSX AND RAILS LEAD TRANSPORTS HIGHER -- DOW ENDS BACK OVER 50-DAY AVERAGE -- NASDAQ 100 NEARS TEST OF HIGH AND LEADS MARKET HIGHER -- BROADCOM LEADS TECHNOLOGY AND SEMICONDUCTOR ETFS HIGHER -- S&P 500 IS AGAIN TESTING TOP OF SYMMETRICAL TRIANGLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS HIT NEW MONTHLY HIGH... The chart picture for the Dow Transports continues to improve. I recently showed the transports finding support at their 200-day moving average and chart support along first quarter lows. Chart 1 shows the TRAN rising today to the highest level in a month. It&...

READ MORE

MEMBERS ONLY

HIGH-LOW PERCENT SIGNALS, AD LINE CONFIRMATION, TREND MOVEMENTS, FINANCE SECTOR WEAKENS, MATERIALS SECTOR WOBBLES, TWO LEADING HEALTHCARE GROUPS, WATCH SWINGS IN OIL AND XLE, 10-YR YIELD LACKS CATALYST, UTILITIES WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS... Below are some of the charts highlighted in today's Webinar. There was also a tutorial on Bollinger Bands using Apple as the example. Lots of stocks and ETFs show narrowing ranges and this is a great time to brush up on a classic indicator. I also...

READ MORE

MEMBERS ONLY

Does Friday's Sell-off Negate the NYSE Upside Breakout?

by Martin Pring,

President, Pring Research

* -Some short-term momentum indicators weaken but are not yet bearish.

* -Dollar related relationships close to an upside breakout

* -Gold and silver under pressure

US Equities

They say that the most critical points of a flight are takeoff and landing. The same is true in technical analysis where the most critical...

READ MORE

MEMBERS ONLY

SPY FILLS THE GAP, TECHS AND UTILITIES LEAD, AIRLINES AND TRUCKERS LOOK BETTER THAN RAILS AND DELIVERY, AIRLINE SCTRS ARE STRONG, AMERICAN TESTS SUPPORT, DELTA AND UNITED CORRECT, ALASKA AND SOUTHWEST CONSOLIDATE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY FILLS THE GAP AND CHALLENGES RESISTANCE ... Link for today's video. Stocks got a big bounce on Monday morning as the major index ETFs erased most of the losses from Friday. Chart 1 shows the S&P 500 SPDR (SPY) moving back above 209 in early trading...

READ MORE

MEMBERS ONLY

CHINA AND GREECE LEAD FRIDAY SELLOFF -- FOREIGN UPTRENDS, HOWEVER, REMAIN INTACT -- THAT KEPT U.S. STOCK INDEXES IN TRADING RANGE AND NEGATED UPSIDE BREAKOUT IN NYSE INDEX -- FALLING GERMAN YIELDS (AND RISING PRICES) MAKE TREASURIES A RELATIVE BARGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE ETFS DROP 5% ON FRIDAY... Chinese stocks have been on a tear over the last year. Mainland stocks are up 25% just this year. They were probably due for a pullback and they got one on Friday. Chinese authorities tightened rules on margin buying (and made it easier to...

READ MORE

MEMBERS ONLY

SMALL AND MID-CAP ETFS FALL BACK WITHIN CHANNELS, SECTOR LEADERS AND LAGGARDS, EW FINANCE BREAKS, EW CONSUMER DISCRETIONARY TESTS SUPPORT, EW TECH ETF CORRECTS, EW ENERGY ETF NEARS RESISTANCE -- HOUSING AND RETAIL LAG IN APRIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY EXTENDS CONSOLIDATION ... Link for today's video. Stocks were down sharply in early trading on Friday. I think it is because there were more sellers than buyers, but media outlets seem to be blaming Europe and China. The Eurotop 100 ($EUR) fell 1.54% on Friday, but is...

READ MORE

MEMBERS ONLY

CRB INDEX IS FINDING SUPPORT ALONG ITS 2009 LOW AS DOLLAR INDEX BACKS OFF FROM RESISTANCE -- ENERGY SPDR AND CRUDE OIL ACHIEVE UPSIDE BREAKOUTS -- ENERGY STRENGTH IS HELPING THE STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX IS WEAKENING... For the first time in nearly a year, the U.S. Dollar is showing signs of weakness. The daily bars in Chart 1 show the PowerShares US Dollar Index Bullish Fund (UUP) trading lower after forming two declining peaks since mid-March. It's now headed...

READ MORE

MEMBERS ONLY

NYSE COMPOSITE INDEX HITS RECORD HIGH -- IT'S THE FIRST U.S. INDEX TO REACH A NEW RECORD -- THE OTHERS AREN'T FAR BEHIND -- THE NYSE BULLISH PERCENT INDEX IS ALSO IN UPTREND -- SO IS THE % OF NYSE STOCKS OVER 200-DAY MOVING AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

NYSE INDEX TRADES AT NEW RECORD... Last Saturday's message showed the NYSE Composite Index ($NYA) testing its all-time highs formed over the last year. Chart 1 shows the NYA trading above those highs in record territory in morning trading. I take that as a positive sign for the...

READ MORE

MEMBERS ONLY

WEBINAR CHARTS, 3 LEADING SECTORS, COPPER TURNS BACK, BASE METALS WEIGH ON XME, GOLD BACKS OFF RETRACEMENT, GOLD MINER AD LINE WARNS, OIL EXTENDS TO RANGE RESISTANCE, UTILITIES AND BONDS BOUNCE, STOCKS OF INTEREST

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS AND NOTES... The following charts come from the Webinar on Tuesday, April 14th, featuring myself and Julius de Kempenaer of Relative Rotation Graphs (RRGs). Julius used a top-down analytical approach by starting with the big sectors, drilling down into the industry groups and then highlighting interesting stocks in...

READ MORE

MEMBERS ONLY

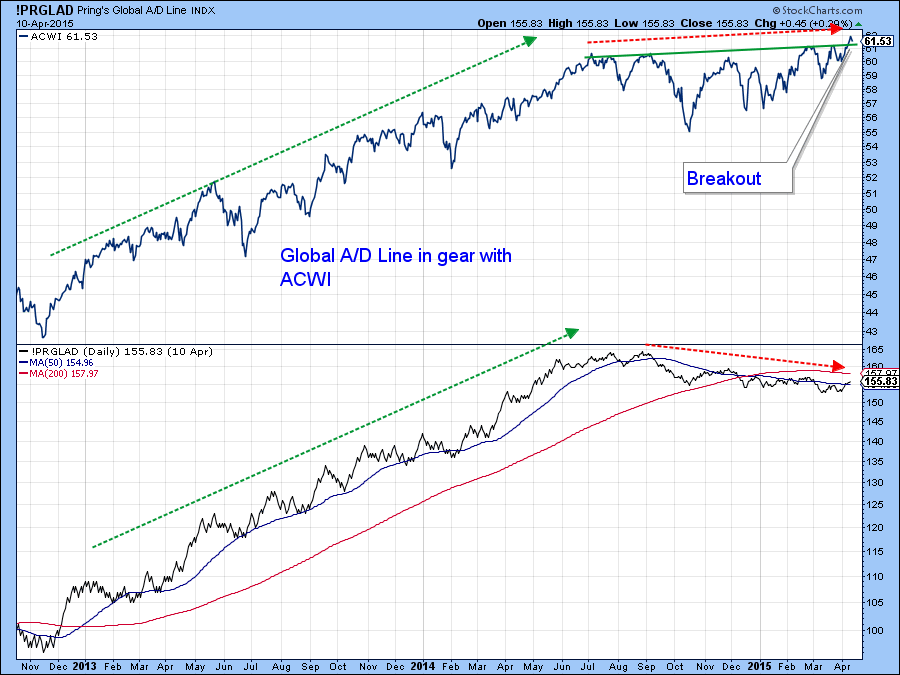

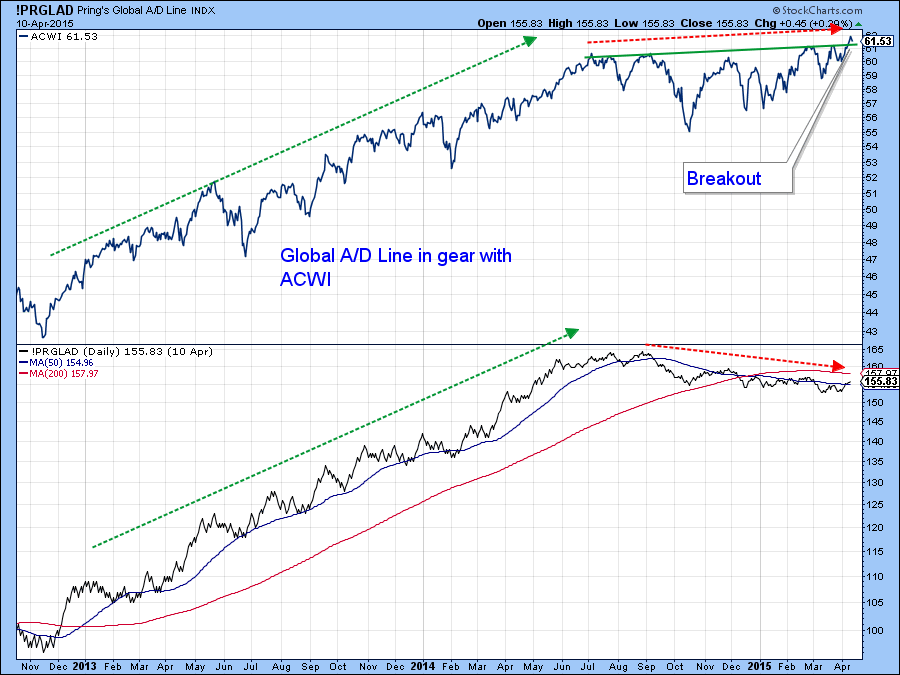

Global A/D Line Breaks above Key Resistance

by Martin Pring,

President, Pring Research

* - Confidence trying to improve in the bond market so that it can support higher equities.

* - Oil trying to form a base.

* - Declining peaks and troughs still in force for the Bloomberg Commodity ETN.

Global Equities

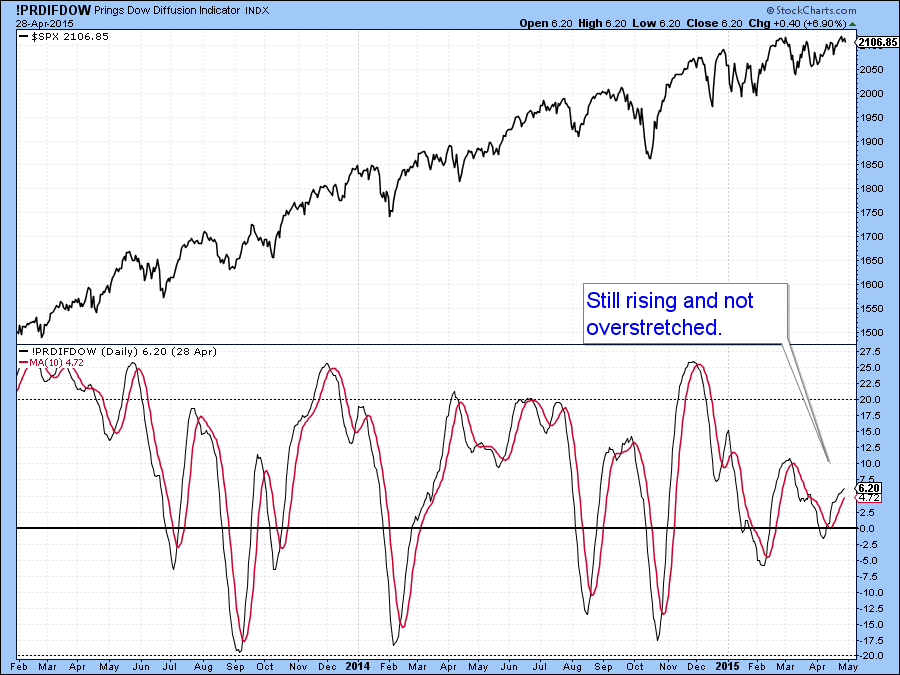

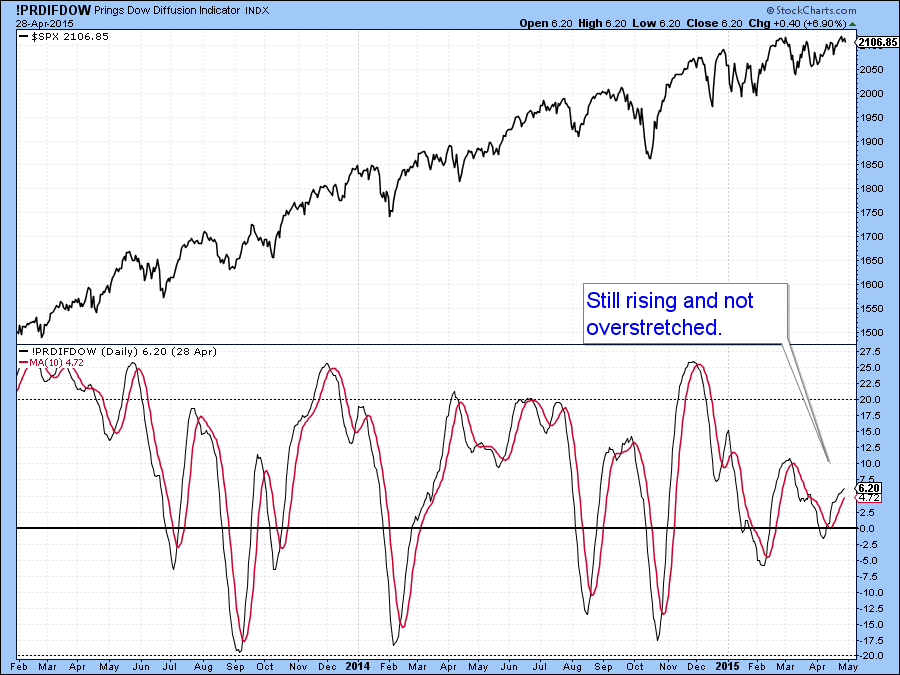

Throughout most of the bull market my Global A/D Line, comprising...

READ MORE

MEMBERS ONLY

A THROWBACK FOR THE MATERIALS ETF, XLI BREAKS OUT AS RGI CONSOLIDATES, XLF GETS A LITTLE BREAKOUT, REGIONAL BANK AND BROKER-DEALER ETFS GET BREAKOUTS, INSURANCE AND MORTGAGE REIT ETFS NEAR HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS ETF FIRMS IN RETRACEMENT ZONE... Link for today's video. The materials sector is at an interesting juncture because the long-term trend is up and it is trading near broken resistance after a throwback. Chart 1 shows the Equal-weight Materials ETF (RTM) within a long-term uptrend over the...

READ MORE

MEMBERS ONLY

STOXX EUROPE 600 INDEX HITS RECORD HIGH -- SO DOES THE FTSE ALL WORLD INDEX -- THAT BODES WELL FOR GLOBAL STOCKS, INCLUDING THE U.S. -- SMALL CAP LEADERSHIP IS POSITIVE -- SO IS THE OEX BOUNCE OFF SUPPORT -- TRANSPORTS REGAIN 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DJ STOXX EUROPE 600 AND FTSE ALL WORLD INDEX HIT RECORD HIGHS ... The major uptrend in foreign stocks took another big step to the upside this week. That was especially true in Europe and Asia. The monthly bars in Chart 1 show the Dow Jones STOXX Europe 600 Index ending...

READ MORE

MEMBERS ONLY

QQQ SURGES, MDY AND IJR CONTINUE TO LEAD, FOUR TECH ETFS WITH BULLISH SETUPS AND MACDS, XLU STALLS AT 200-DAY, TLT TESTS KEY SUPPORT, 10-YR YIELD HITS KEY RETRACEMENT, WHY USE RETRACEMENT ZONES?

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ SURGES OFF SUPPORT ZONE... Link for today's video. Chart 1 shows the Nasdaq 100 ETF (QQQ) getting another bounce off support this week and leading the major index ETFs over the last five days. Note that QQQ is up over 2% this week, which is more than...

READ MORE

MEMBERS ONLY

HONG KONG STOCKS SURGE TO SEVEN-YEAR HIGHS AND LOOK UNDERVALUED VERSUS SHANGHAI -- CHINA ISHARES BUILD ON LAST WEEK'S BULLISH BREAKOUT -- FOREIGN STOCKS CONTINUE TO ADVANCE WHILE THE U.S. IS STALLED

by John Murphy,

Chief Technical Analyst, StockCharts.com

HONG KONG MARKET HITS SEVEN-YEAR HIGH... China has been the strongest stock market in the world over the last year. The launch of the Shanghai-Hong Kong Stock Connect last November allowed Chinese investors to buy Chinese stocks traded on both exchanges. It also opened up Chinese shares to foreign investors....

READ MORE

MEMBERS ONLY

US Equities are Very Close to an Upside Breakout. Can they do It?

by Martin Pring,

President, Pring Research

* World Stock ETF looks set for an upside breakout if it can get a small push in that direction

* Treasury yield curve begins to steepen

* Gold shares and silver caught in an important trading range.

Equities

Last week’s headline addressed the question of whether Chinese equities would drag US...

READ MORE

MEMBERS ONLY

LONG-TERM TIMING, SMALL-CAP BREADTH, SECTOR AD LINES, FINANCE ETFS BATTLE SUPPORT, XLI AND XLK WORK HIGHER, GOLD, OIL, DOLLAR, STOCK SETUPS, Q&A CHARTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SPDR BOUNCES OFF SUPPORT ZONE... The following charts and commentary come from the webinar on Tuesday, April 7th. I am leading off with a long-term monthly chart to emphasize two things: markets trend and long-term timing is possible. While past signals are not guaranteed to work...

READ MORE

MEMBERS ONLY

S&P 500 SPDR BOUNCES, SMALL AND MID-CAPS HOLD STRONG, CONSUMER STAPLES AND UTILITIES LEAD, TREASURY YIELDS SHOW RISK AVERSION, TLT HITS KEY RETRACEMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SPDR BOUNCES OFF SUPPORT ZONE... Link for today's video. Chart 1 shows the S&P 500 SPDR (SPY) falling to the top of its support zone last week and surging on Monday. This surge is most interesting because stock futures were down Friday...

READ MORE

MEMBERS ONLY

NOTES FROM THE MTA SYMPOSIUM, TREND FACTOR APPROACH, POSITION SIZING MATTERS, TREND FOLLOWING IS TOUGH, PAPER BEATS ROCK, MIND THE CENTRAL BANKS, RIDE THE TREND TO THE END, FOCUS ON WHAT IS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NOTES FROM THE MTA SYMPOSIUM... As John Murphy pointed out on Friday, Stock futures were down sharply after weaker-than-expected non-farm payrolls. The S&P 500 and Nasdaq were down around 1%. Treasury bonds moved sharply higher as the 10-YR Treasury Yield ($TNX) fell below 1.85%, and to its...

READ MORE

MEMBERS ONLY

WEAK JOBS REPORT SENDS STOCK FUTURES AND BOND YIELDS LOWER -- DOLLAR WEAKENS AGAINST THE EURO -- DOW INDUSTRIALS MAY CHALLENGE MARCH LOW AS DOW TRANSPORTS SLIP BENEATH 200-DAY LINE -- HOMEBUILDER ETF HITS EIGHT-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARCH JOBS REPORT IS THE WEAKEST SINCE DECEMBER 2013... The March jobs report released this morning showed only 126,000 new jobs created, which was nearly half what most economists were expecting (245,000). In addition, jobs created for January and February were revised downward. The unemployment rate remained unchanged...

READ MORE