MEMBERS ONLY

Will Chinese Equities Drag up their US Counterparts?

by Martin Pring,

President, Pring Research

* Dow Jones Transports flirting with key support.

* Chinese ETF (FXI) experiences a long and short-term breakout.

* Emerging markets on the edge of a breakout.

US Equities

Since the middle of last year we have seen two different market characteristics develop. The first, as epitomized by the S&P 500...

READ MORE

MEMBERS ONLY

WEBINAR CHARTS, SPY MAINTAINS CHANNEL, UTILITIES AND THE 10-YR YIELD, NON-CONFIRMATIONS IN AD LINES, HIGH-LOW INDICATORS SOFTEN, RANKING THE SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ AFFIRMS SUPPORT... The charts today come from today's webinar. Not all charts, however, are featured here. See the last section of this Market Message for the symbosl and contecnt found exclusively in the webinar recording. Chart 1 shows the Nasdaq 100 ETF (QQQ) hitting support after a...

READ MORE

MEMBERS ONLY

FINANCE SECTOR LEADS MARKET, BIG WEEK FOR BONDS, DOLLAR BOUNCES OFF KEY RETRACEMENT, GOLD FAILS AT BROKEN SUPPORT, OIL STALLS WITHIN DOWNTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCE SECTOR LEADS MARKET HIGHER... Link for today's video. Stocks moved higher in early trading on Monday with the finance sector showing some leadership. Despite today's gains, it has been a rough year for this sector because the Finance SPDR (XLF) is down year-to-date, the Equal-weight...

READ MORE

MEMBERS ONLY

ALTERA AND INTEL LEAD CHIP BOUNCE ON FRIDAY -- BIOTECH ETF FINDS SUPPORT AT 50-DAY LINE -- TRANSPORTS HOLD 200-DAY LINE -- RAILS AND DELIVERY SERVICES ARE ALREADY IN DOWNTRENDS -- PULLBACK IN OIL BOOSTS AIRLINES ON FRIDAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALTERA AND INTEL LEAD CHIP BOUNCE... Semiconductors fell sharply on Wednesday and Thursday, and weighed heavily on the technology sector. Chart 1 shows the PHLX Semiconductor iShares (SOXX) falling all the way back to its 200-day moving average by Thursday. A big jump on Friday, however, pushed the SOXX up...

READ MORE

MEMBERS ONLY

QQQ AND SPY TEST SUPPORT, MID-CAPS AND SMALL-CAPS HOLD UP BETTER, CONCERNS WITH XLF, XLI AND XLK, HOUSING AND RETAIL REMAIN STRONG

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ AND SPY TEST SUPPORT... Programming note: Today's report will be brief, and there is no video, because I am on the road at the MTA symposium in NYC. Stocks were hit with selling pressure this week, but this was not enough to dislodge the bigger uptrends. Small-caps...

READ MORE

MEMBERS ONLY

Global Stocks And The NYSE Composite Are In Focus At The Top Of A Major Trading Range

by Martin Pring,

President, Pring Research

* The NYSE Composite breaks out against the S&P 500.

* The SPY/EFA (US against the world) ratio completes a top.

* The S&P Europe 350 (IEV) breaks out against the S&P 500.

* The DB Commodity ETF is close to an important down trend line violation....

READ MORE

MEMBERS ONLY

FOUR RISK RATIOS FOR STOCKS, MAJOR INDEX ETF OVERVIEW, MATERIALS ETF HITS SUPPORT, ITB HOLDS FLAG BREAK, BOND BREAKOUTS AND RATE SENSITIVE ETFS, STOCKS TO WATCH, LIVE DEMO

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOUR RISK RATIOS FOR THE STOCK MARKET... The following charts are from today's Webinar (click here). Chartists can enhance their broad stock market analysis by adding indicators that measure risk appetite. Today I am going to show four stock-specific ratios that will give us an idea of the...

READ MORE

MEMBERS ONLY

-- STEADY UPTREND FOR LARGE-CAPS, NEW UPTREND FOR SMALL-CAPS, XLE FIRMS, MEDIA ETF BREAKS OUT, CLOUD COMPUTING ETF LEADS, FDN BREAKS OUT, SOCL PERKS UP, REGIONAL BANK ETF HOLDS UP, SOLAR ETF BREAKS FREE, PLUS REM, IYZ AND PSCF --

by John Murphy,

Chief Technical Analyst, StockCharts.com

A MOST STEADY UPTREND FOR LARGE-CAPS... Link for today's video. There is definitely a lot of noise out there on a daily basis, but the uptrends in the S&P 500 SPDR (SPY) and Nasdaq 100 ETF (QQQ) are remarkably steady on the weekly charts. Chart 1...

READ MORE

MEMBERS ONLY

FED MESSAGE HAS BULLISH EFFECT ON BONDS AND GLOBAL STOCKS -- FALLING TREASURY YIELD PULLS DOLLAR LOWER AND COMMODITIES HIGHER -- UTILITIES, REITS, AND HOMEBUILDERS HAVE A STRONG WEEK -- MID AND SMALL CAP STOCKS HIT RECORD HIGHS -- S&P 500 MAY BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED EFFECT CONTINUES ON FRIDAY... After a brief pause on Thursday, global markets resumed the bullish tone that started after the Fed's dovish statement on Wednesday. With the Fed scaling back on its plans to hike short-term rates later this year, markets acted accordingly. Treasury yields plunged to...

READ MORE

MEMBERS ONLY

Beneficiaries Of A Rising US Dollar Are Beginning To Look Tired

by Martin Pring,

President, Pring Research

* The RS between US equities and the rest of the world could be about to break against the US.

* The GLD breaks above its intermediate down trendline.

* Silver experiences a false move to the downside, thereby leaving it free to move higher.

The Dollar and Related Markets. Has the US...

READ MORE

MEMBERS ONLY

SMALLCAP SECTOR PERFORMANCE SHARPCHART, ENERGY-MATERIALS HIT NEW RELATIVE LOWS, INDUSTRIALS-TECH SHOW CHART STRENGTH, LEADERS IN CONSUMER DISCRETIONARY, DRI AND FRGI POP, NEW HIGH PARADE --

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE AND CONSUMER DISCRETIONARY LEAD SMALL-CAPS ... Link for today's video. Small-caps led the market higher this week as the Russell 2000 and S&P Small-Cap 600 hit new highs. As with the S&P 500, the S&P Small-Cap 600 can be divided into nine...

READ MORE

MEMBERS ONLY

FED DROPS PATIENT STANCE, BUT LOWERS GUIDANCE FOR FUTURE RATE HIKES -- STOCKS SURGE AS YIELDS TUMBLE -- RATE SENSITIVE STOCKS LIKE UTILITIES JUMP WITH BONDS, BUT BANKS LAG -- WEAKER DOLLAR BOOSTS COMMODITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED TAKES MORE DOVISH TONE... Today's Fed statement dropped its "patient" stance, but lowered guidance for any future rate hikes. Ms. Yellen emphasized that while the Fed was dropping the word "patient", it wouldn't be "impatient" to raise rates. A...

READ MORE

MEMBERS ONLY

-- CHANNEL DEFINES SPY TREND, ITB, XHB AND FLAGS, REGIONAL BANK ETF, BIG TREND FOR TREASURIES, TLT HITS INFLECTION POINT, XLU FIRMS AT FIB LEVEL, CURRENCY ADJUSTMENTS FOR ETFS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHANNELS RULE FOR SPY, MDY AND IJR... Upside momentum has slowed since the October-November surge, but the major index ETFs remain in clear uptrends defined by rising channels over the last few months. Chart 1 shows the S&P 500 SPDR (SPY) with a surge from mid October to...

READ MORE

MEMBERS ONLY

-- MIND THE GAP AND THE RELATIVE PERFORMANCE, TRANSPORTS BOUNCE AT FIB RETRACEMENT, TRUCKING AND AIRLINES LEAD, 3 TRUCKING LEADERS, 2 AIRLINE LEADERS, 3 LEGACY AIRLINE STOCKS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

MIND THE SMALL CAP GAP AND RELATIVE PERFORMANCE... Link for today's video. The Russell 2000 iShares (IWM) and the S&P SmallCap iShares (IJR) both gapped up last week and these gaps are holding. Moreover, small-caps have been showing relative strength since mid October and their respective...

READ MORE

MEMBERS ONLY

-- LONG-TERM UPTREND AND SHORT-TERM DOWNTREND, FINANCE AD LINE, XLF BEAR TRAP, OIL BREAK DOWN, XLE NEAR NEW LOW, CORRELATIONS TO THE DOLLAR (OIL, STOCKS, BONDS, GOLD), KEY NEW HIGHS AND LOWS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG-TERM UPTREND AND SHORT-TERM DOWNTREND... Link for today's video. Stocks did the old pop and drop on Thursday and Friday. With Thursday's gain dissipating, this means the short-term trend is still down and stocks remain in corrective mode. Financials and healthcare showed some strength this week,...

READ MORE

MEMBERS ONLY

SMALL CAPS LEAD LARGE CAPS HIGHER -- FINANCIALS HAVE A STRONG DAY -- BANK AND BROKER ETFS NEAR UPSIDE BREAKOUTS -- PNC FINANCIAL HITS ALL-TIME HIGH -- WELLS FARGO MAY BE NEXT -- CHARLES SCHWAB NEARS UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS LEAD U.S. RALLY ... Yesterday's message suggested that small caps do better than large caps in a strong dollar environment. That may explain why small caps are trying hard to pull the U.S. stock market out of its recent pullback. Chart 1 shows the S&...

READ MORE

MEMBERS ONLY

DOLLAR INDEX REACHES 12-YEAR HIGH AS EURO TUMBLES -- USD BREAKS 30-YEAR RESISTANCE LINE -- WIDENING SPREAD BETWEEN 10-YEAR TREASURY AND GERMAN YIELD IS SUPPORTING DOLLAR RALLY -- FOREIGN CURRENCIES ARE ALL FALLING

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX REACHES 12-YEAR HIGH AS EURO PLUNGES... A lot of attention is being focused on the continuing surge in the U.S. Dollar, and the plunge in the Euro. The monthly bars in Chart 1 show the U.S. Dollar Index (green bars) rising to the highest level since...

READ MORE

MEMBERS ONLY

Stock Markets around the World Continue to Look Vulnerable

by Martin Pring,

President, Pring Research

* World stock ETF may have experienced a false upside breakout.

* Bonds likely to out-perform stocks in the immediate future.

* Emerging markets ETF right at critical support.

Global Equities

Global equities are starting to look sick. Chart 1, for instance shows that the MSCI World Stock ETF, the ACWI, has recently...

READ MORE

MEMBERS ONLY

-- WEBINAR WITH JDK OF RRG, S&P 500 EXTENDS DECLINE, IMPORTANCE OF FINANCE SECTOR, BREAKDOWN IN XLF, TARGET FOR XLY, TWO STRONG GROUPS AND FOUR STOCKS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR WITH RRG ... Today's Webinar features a top-down approach to selecting stocks using Relative Rotation Graphs (RRGs) and some classic chart analysis. Julius de Kempenaer, developer of RRG, kicks off the webinar by analyzing relative performance for the sector SPDRs, the industry groups in the consumer discretionary sector...

READ MORE

MEMBERS ONLY

-- MARKETCARPET TIPS AND TRICKS, 3 LEADING SECTORS, LEADING STOCKS IN LEADING SECTORS, ONE SEMICONDUCTOR ETF LAGS THE OTHER, INTEL MAKES A BREAK, TSM WEIGHS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

DRILLING DOWN INTO THE MARKETCARPET... Link for today's video. After hitting new highs in February, stocks weakened in March with selling pressure over the past week. The long-term trend for the S&P 500 remains up, but some sort of correction or pullback may be underway. Corrections...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT PUSHES INTEREST RATES SHARPLY HIGHER AND TREASURY BONDS LOWER -- HIGHER RATES BOOST BANKS AND BROKERS -- BUT HURT UTILITIES AND GOLD -- S&P 500 ENDS DAY LOWER...

by John Murphy,

Chief Technical Analyst, StockCharts.com

SOUND FAMILIAR? ... The above headline is actually taken from my February 7 Market Message which was written the day after that Friday's strong jobs report. Yesterday's surprisingly strong jobs report, and market reactions, were almost exactly the same as they were a month ago. It just...

READ MORE

MEMBERS ONLY

-- A WEAK MARCH FOR STOCKS, XLF STALLS, REGIONAL BANK SPDR CHALLENGES RESISTANCE, THREE REGIONAL BANKS, 10-YR YIELD BREAKS OUT, TLT BREAKS DOWN, ECONOMIC INDICATOR TABLE --

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS WEAKEN, BUT BIGGER UPTRENDS REMAIN... Link for today's video. Stocks weakened over the last few days, but this weakness does not affect the bigger uptrend. First, note that the S&P 500, S&P MidCap 400, S&P Small-Cap 600 and Nasdaq 100 all...

READ MORE

MEMBERS ONLY

Can the Stock Market Hold its Breakout?

by Martin Pring,

President, Pring Research

* NYSE Composite and MSCI World Stock ETF could be in the process of cancelling their recent breakouts.

* Stock/bond ratio at a critical juncture.

* Junk bonds violate up trend line.

* Dollar Index breaks to the upside.

* Gold and gold shares face important technical test.

Equities

Chart 1 suggests that the...

READ MORE

MEMBERS ONLY

STOCK INDEXES ENCOUNTER SELLING -- DOW TRANSPORTS HAVEN'T CONFIRMED INDUSTRIAL HIGH -- FALLING BONDS HAVE HURT UTILITIES -- STOCK/BOND RATIO, HOWEVER, LOOKS OVERBOUGHT -- FTSE WORLD INDEX BACKS OFF FROM RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS HAVEN'T CONFIRMED DOW HIGH ... U.S. stocks are experiencing some selling today. A pullback from recent highs isn't too surprising considering the fact that some short-term negative divergences have surfaced. First with short-term momentum indicators. Chart 1 shows the Dow Industrials in the red today....

READ MORE

MEMBERS ONLY

-- FIRST SUPPORT FOR QQQ, MICROSOFT HITS RESISTANCE, BANDS CONTRACT FOR ORACLE, GOOGLE LEADS, SMALL-CAP BREADTH LAGS, UTILITIES BREADTH TURNS BEARISH, SECTOR SCTR RANKINGS AND CORRELATIONS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS AND LINKS... Today's Webinar will start with a live demo showing how to find signals on PerfCharts. I will start with the major stock indices, drill down into the sectors and then look at twenty industry group ETFs in two separate PerfCharts. Even though there are...

READ MORE

MEMBERS ONLY

-- SEMIS POWER TECH SECTOR, THREE SEMI STOCKS WITH FRESH BREAKOUTS, THROWBACK ZONE FOR QQQ, SMALL-CAPS STRUGGLE, XLU BREAKS DOWN AS YIELDS RISE, TLT GETS COLD FEET --

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR ETF LEADS WITH NEW HIGH ... Link for today's video. Chart 1 shows the Semiconductor SPDR (XSD) surging over 1.5% and hitting yet another new high. The ETF surged in the second half of October and then embarked on a steady advance defined by the Raff Regression...

READ MORE

MEMBERS ONLY

-- SMALL-CAPS LEAD, NEW HIGH PARADE, FINANCE LAGS, BAC AND MS, XLE HITS RESISTANCE, XOM, CVX AND SLB, PALLADIUM PERKS UP, GOLD HITS FIB LEVEL, GDX HOLDS BREAK --

by John Murphy,

Chief Technical Analyst, StockCharts.com

LARGE-CAPS AND SMALL-CAPS LEAD FEBRUARY CHARGE... Link for today's video. Even though the stock market is not firing on all cylinders, the majority of cylinders are firing bullish and this is enough to support an uptrend in the broad indices. February may be a short month, but it...

READ MORE

MEMBERS ONLY

FALLING CONSUMER PRICES MAKE FED'S JOB MORE DIFFICULT -- SO DO FALLING COMMODITY PRICES -- A RISING DOLLAR IS PUSHING COMMODITY PRICES LOWER -- WEAK GERMAN YIELD WEIGHS ON TREASURY YIELD -- DOLLAR INDEX IS ON VERGE OF RESUMING ITS UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED NOW FOCUSED ON LOW INFLATION ... Today's announcement that consumer prices in the U.S. fell -0.7 in January, the biggest drop since late 2008 (and the first annual decline since 2009), is going to make the Fed's job harder. [The core CPI, excluding food...

READ MORE

MEMBERS ONLY

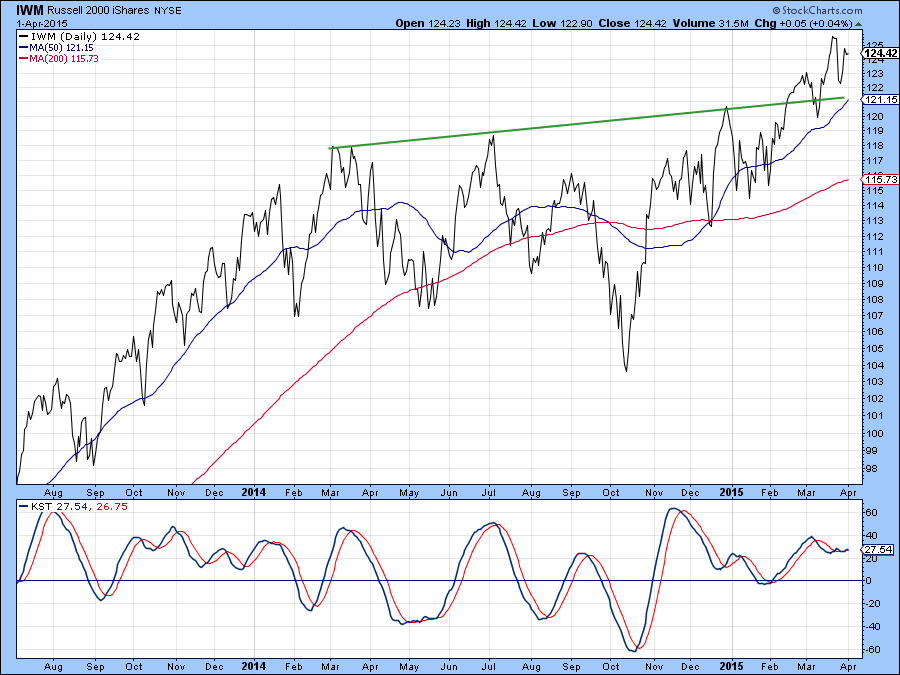

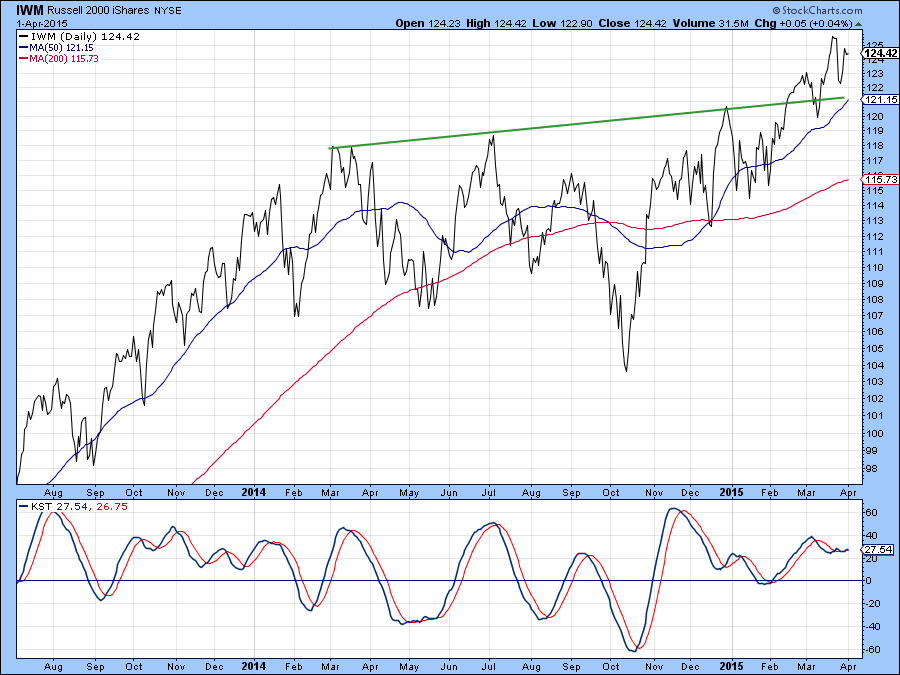

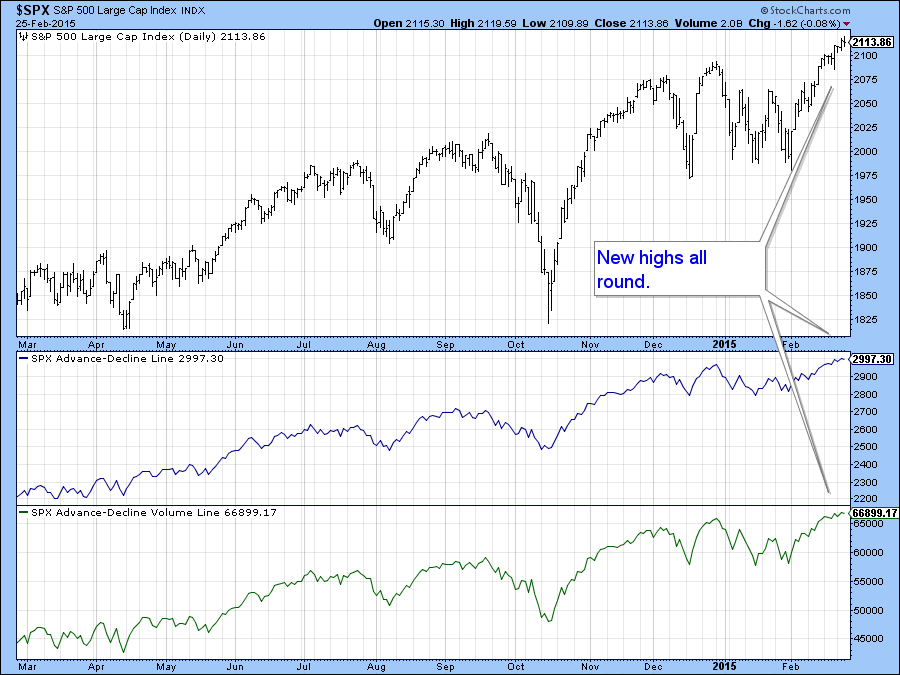

Equity Market Breakout is Broadly Based but Short-term Indicators are Becoming Overstretched

by Martin Pring,

President, Pring Research

* Emerging markets about to experience an important breakout.

* Yield curve continues to flatten.

* Confidence in the bond market faces an important technical test.

US Equities

We have seen some nice breakouts in the last few trading sessions, which have been pretty broadly based as you can see from Chart 1,...

READ MORE

MEMBERS ONLY

-- QQQ BREAKOUT, SPY TARGETS, BREADTH LINES CONFIRM, SECTOR AD LINES, T-YIELDS HIT INFLECTION, TLT SURGES OFF FIB ZONE, YIELD CURVE, UTILITIES FIRM AND REITS BREAK --

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS... Welcome to the Fed edition of the Market Message. No, I am not going to dissect Fed speak and analyze every word from the testimony of Fed Chair Janet Yellen. Instead, I am going to analyze the charts, which contain all available information. Before hitting Treasuries, I will...

READ MORE

MEMBERS ONLY

-- A BREAK FOR THE TRANSPORT ETF, AIRLINES, TRUCKERS, RAILROADS, DELIVERY SERVICES, 3 AIRLINE STOCKS, 2 TRUCKING STOCKS, OIL WEIGHS, OIL SERVICES HITS RESISTANCE --

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORT ISHARES BREAKS CHANNEL LINE... Some transportation-related industry groups and stocks are at interesting junctures right now. First, the broader market is in an uptrend as the S&P 500 hit an all time high last week. Second, oil prices remain weak and this is beneficial to several transport-related...

READ MORE

MEMBERS ONLY

DOW JOINS S&P 500 IN RECORD HIGH -- NASDAQ NEARS TEST OF ITS 2000 HIGH -- GERMAN DAX HITS NEW RECORD -- BRITAIN MAY BE NEXT -- JAPAN REACHES 15-YEAR HIGH -- DOLLAR INDEX TESTS 20-YEAR RESISTANCE LINE -- EAFE ISHARES BREAK OUT TO UPSIDE ON GOOD VOLUME

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JOINS REST OF THE MARKET IN NEW HIGHS. ... The chart picture for U.S. and global stocks brightened even further on Friday. [News that eurozone finance ministers offered Greece a four-month extension of its bailout package gave a late boost to global stocks]. All major U.S. stock hit...

READ MORE

MEMBERS ONLY

-- $SPX AND $NDX P&F CHARTS, AEROSPACE & DEFENSE ETF'S LEAD, 5 DEFENSE STOCKS, INTERNET ETF BREAKS OUT, 3 ISTOCKS CHALLENGING RESISTANCE, OIL STALLS, XLE GETS COLD FEET --

by John Murphy,

Chief Technical Analyst, StockCharts.com

REST AFTER BIG SURGE... Link for today's video. After big gains the first two weeks of February, stocks took a breather this week and consolidated. A rest after a sharp advance is perfectly normal at this stage. Among the groups, the Energy SPDR (XLE) fell back along with...

READ MORE

MEMBERS ONLY

JAPAN AND EUROPE LEAD EAFE ISHARES HIGHER -- GERMANY, FRANCE, AND THE UK LEAD EUROPE -- HOW TO HEDGE GERMAN ISHARES AGAINST WEAK EURO -- JAPANESE STOCKS NEAR 15-YEAR HIGH -- HEDGING AGAINST THE FALLING YEN HAS BEEN A GOOD IDEA

by John Murphy,

Chief Technical Analyst, StockCharts.com

EAFE ISHARES TURN UP ... Foreign stocks continue to show signs of strength. Chart 1 shows EAFE iShares (EFA) trading above its 200-day moving average after recently exceeding its late November peak. At the start of February, it also broke a declining resistance line drawn over June/September/November highs. That...

READ MORE

MEMBERS ONLY

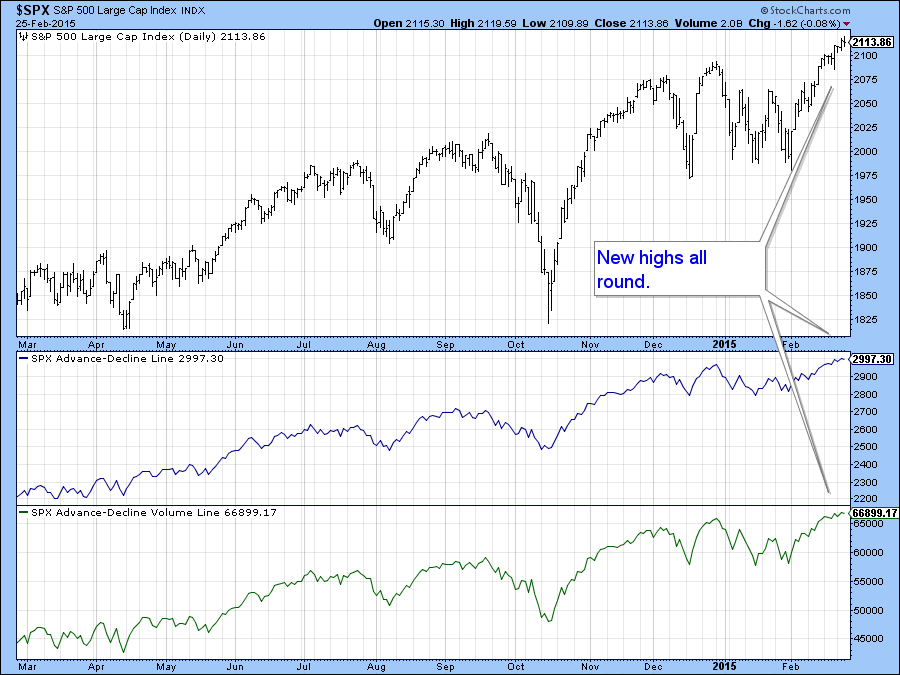

US Equity Upside Breakout So Far So Good

by Martin Pring,

President, Pring Research

* -NASDAQ Composite offers quality upside leadership.

* -Watch the 5-year yield for a clue as to future rate movements.

* -Gold starting to show bull market characteristics but can it confirm with some positive trend action?

In last week’s article I drew your attention to the fact that the technical picture...

READ MORE

MEMBERS ONLY

-- THE KEY TO THE BREAKOUTS, MATERIAL SECTOR LEADERSHIP, SHORT-TERM BREADTH INDICATORS, UTILITIES ETFS HIT SUPPORT, TLT HITS FIBONACCI CLUSTER, OIL, GOLD, URANIUM AND LOTS OF STOCKS --

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS AND LINK... Stocks are short-term overbought after big runs in February, but the breakouts are holding and these are bullish until proven otherwise. Today's Webinar will look at five stock indices, sector High-Low Percent, a short-term breadth indicator, the utilities sector, the long-term Treasury bond ETF,...

READ MORE

MEMBERS ONLY

-- SURGE AND FOLLOW THROUGH, GROWTH VERSUS VALUE, BREAKING DOWN XLY AND XLF, WATER ETF GETS INTERESTING, FIVE STOCKS IN STRONG GROUPS, NEW HIGH PARADE --

by John Murphy,

Chief Technical Analyst, StockCharts.com

SURGE AND FOLLOW THROUGH BODES WELL... The major stock indices surged off support levels last week and followed through with breakouts this week. Chart 1 shows five major index ETFs on one chart for easy reference. The top chart shows the S&P 1500 hitting new highs in November-December,...

READ MORE

MEMBERS ONLY

GLOBAL STOCK RALLY IS STARTING TO BROADEN OUT -- GERMANY AND FRANCE LEAD EUROPE HIGHER -- GREEK STOCKS ARE BOUNCING FROM SUPPORT -- THE HEDJ IS THE BEST WAY TO HEDGE NEGATIVE IMPACT OF FALLING EURO -- SMALLER STOCKS LEAD S&P 500 HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES GLOBAL INDEX HITS THREE-MONTH HIGH ... One of the major concerns in the new year has been fear that foreign markets would start to weigh on U.S. stocks. Although U.S. stocks have been the strongest in the world, they need some help from foreign markets. They'...

READ MORE

MEMBERS ONLY

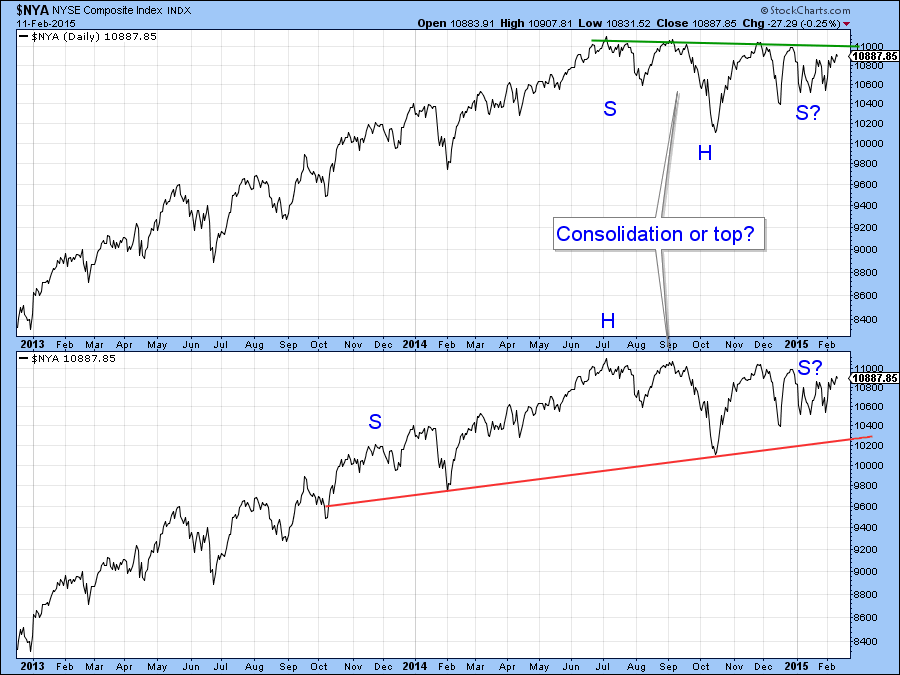

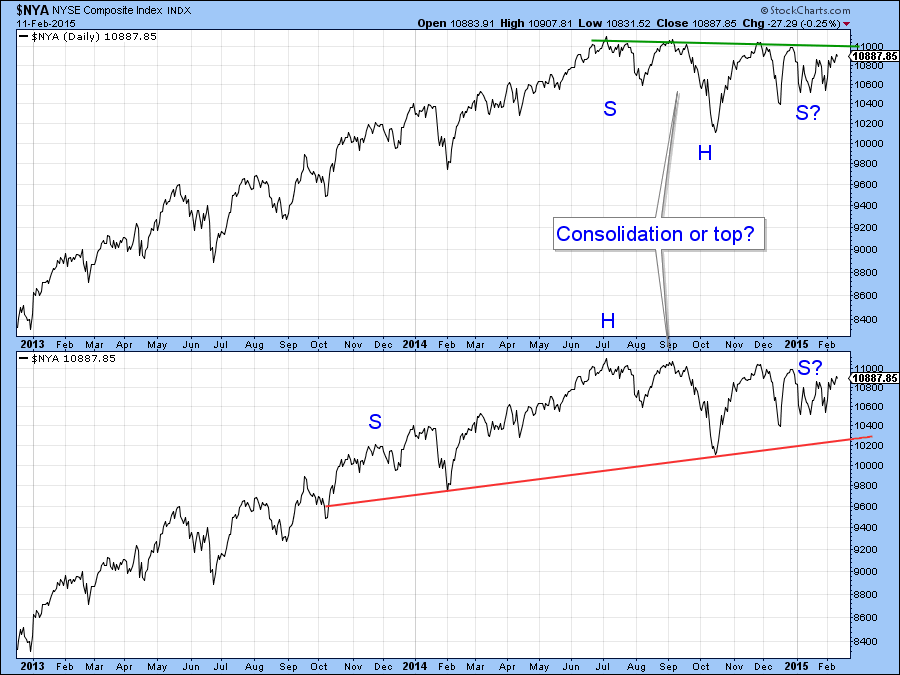

Forthcoming Big Move in Equities is Likely. The Question is Which Way will it Be?

by Martin Pring,

President, Pring Research

* The NYA starts to break down against the S&P again.

* Emerging markets ETF triggers some short-term sell signals.

* The EEM is resting above key long-term support.

US Equities

The market continues to frustrate both bull and bear alike as the major averages steadfastly refuse to break out from...

READ MORE

MEMBERS ONLY

INDEX OVERVIEW, RISK ON OR OFF?, XLF-XLK-XLY, HIGH-LOW INDICATORS, SECTOR RANKINGS, FOCUS ON UTILITIES, TWENTY STOCKS AND Q&A -- S&P 500 AND S&P MIDCAP 400 STALL AFTER BREAKOUTS -- IS RISK REALLY BACK ON? -- INDEX HIGH-LOW PERCENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS AND COMMENTARY... The market remains a mixed up beast over the last few months, but the bigger trend is still up and the bulk of the evidence is still bullish. Choppy trading over the last few months just means we had a consolidation within an uptrend. Major topping...

READ MORE