MEMBERS ONLY

QQQ LAGS WITH LOWER HIGH -- PERFCHART AND RRG FOR MAJOR INDEX ETFS -- MICROSOFT, INTEL AND AMGEN WEIGH -- GOOGLE STALLS AT RESISTANCE -- FACEBOOK NEARS SUPPORT -- AMGEN CORRECTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ LAGS WITH LOWER HIGH... The Nasdaq 100 ETF (QQQ) is still lagging the broader market with a series of lower highs since December. Chart 1 shows QQQ breaking out in late October and hitting new highs throughout November. Relative weakness started in late December when QQQ failed to take...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT PUSHES INTEREST RATES SHARPLY HIGHER AND TREASURY BONDS LOWER -- HIGHER RATES BOOST BANKS AND BROKERS -- BUT HURT UTILITIES AND GOLD -- S&P 500 ENDS DAY LOWER WHICH KEEPS IT IN TRADING RANGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONG JOBS REPORT PUSH RATES HIGHER... A strong jobs report on Friday pushed interest rates sharply higher all across the yield curve. The daily bars in Chart 1 show the 10-Year Treasury Note yield jumping to the highest close in a month. [Bond prices fell sharply as a result]. Short-term...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT PUSHES FINANCIALS HIGHER -- BANKS AND BROKERS SURGE -- S&P 500 EXCEEDS JANUARY HIGH -- JUMP IN BOND YIELDS IS CAUSING PROFIT-TAKING IN REITS, UTILITIES, AND GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS LEAD MARKET RALLY ... A strong jobs report is pushing stock prices higher today. Chart 1 shows the Financials Sector SPDR (XLF) jumping above initial resistance at its late January peak (near 24.00) and climbing back over its 50-day line. Banks and brokers are leading the XLF higher. Chart...

READ MORE

MEMBERS ONLY

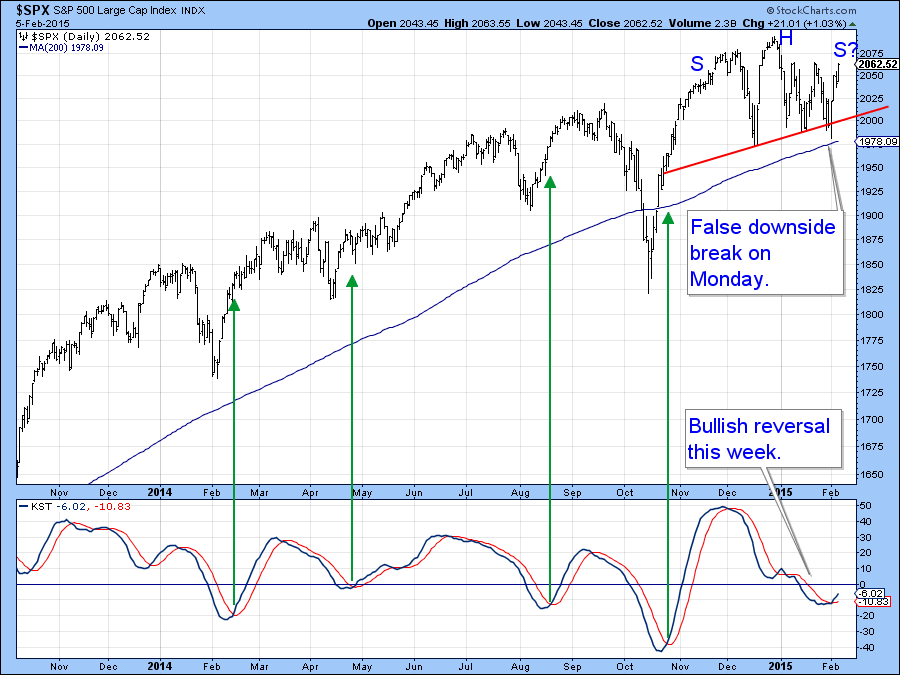

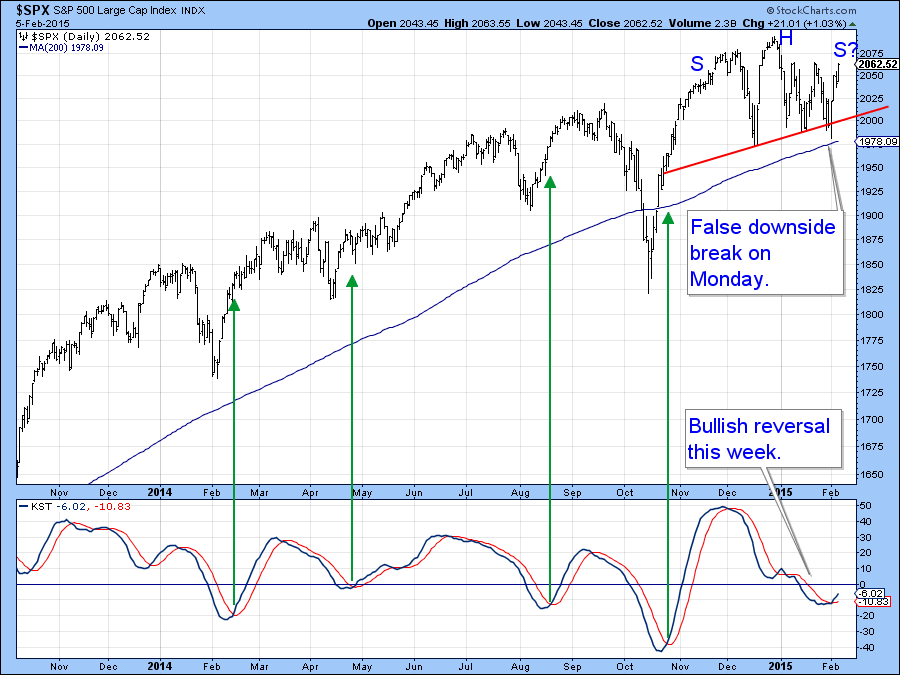

Moment of Truth Approaching for US Equities

by Martin Pring,

President, Pring Research

* Short-term oscillators turn bullish for equities

* EFA breaks above significant down trend line

* Gold short-term momentum reverses to the downside

US Equities

Last week the headline of my Market Roundup article read as follows, ”Will the end-of the month bullish seasonal for equities be enough to avoid a downside domino...

READ MORE

MEMBERS ONLY

DOW BREAKS THROUGH RESISTANCE -- SO DO MIDCAP AND SMALL CAPS -- S&P 500 SHOULD BE NEXT -- ENERGY SHARES ARE AT A LONG-TERM SUPPORT LEVEL AND MAY BE BOTTOMING -- THAT WOULD HINT AT A BOTTOM IN OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW EXCEEDS CHART RESISTANCE... A 211 point gain in the Dow Industrials was enough to push it through initial chart resistance at its mid-December. That's a strong sign that the sidways price pattern in effect since early December is being resolved on the upside. The Dow isn'...

READ MORE

MEMBERS ONLY

FALLING OIL BOOSTS CONSUMER DISCRETIONARY STOCKS -- LEADERS INCLUDE DISNEY, WHIRLPOOL, AND KOHLS -- AUTOS AND HOMEBUILDES ALSO CLIMB -- GENERAL ELECTRIC AND FORD HAVE GOOD DAY -- RYLAND AND TOLL BROTHERS TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR SHOWS RELATIVE STRENGTH... Consumer discretionary stocks have been among the biggest beneficiaries of falling oil prices. Today is no exception. With crude falling 8% during the day, consumer discretionary stocks are among the day's biggest gainers. The daily bars in Chart 1 show the Consumer...

READ MORE

MEMBERS ONLY

WEBINAR CHARTS AND LINK -- MARKET REMAINS STUCK, BUT NOT BROKEN -- RISK INDICATOR OVERVIEW -- SECTOR SPDRS AND THEIR SEVEN BREADTH INDICATORS -- 6 ETF CHARTS -- 9 STOCK CHARTS -- Q&A: CREATING SHADED BOXES, USING THE RAFF CHANNEL AND MORE

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS... The major index ETFs and key sector SDPDRs remain stuck in trading ranges, but we are seeing some promising signs over the last two days. As the charts in today's Webinar show, the Consumer Discretionary SPDR (XLY), Industrials SPDR (XLI) and Technology SPDR (XLK) all surged...

READ MORE

MEMBERS ONLY

DIA BREAKS TRIANGLE TREND LINE -- EQUAL-WEIGHT S&P 500 ETF TESTS KEY LEVEL -- FIVE SECTOR ETFS WITH REVERSAL PATTERNS -- BPI HITS MOMENT-OF-TRUTH FOR GOLD MINERS ETF -- GOLD TESTS BREAKOUT WITH A THROWBACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

DIA BREAKS TRIANGLE TREND LINE... Link for today's video. Stocks came under selling pressure last week as the major index ETFs gapped down on Tuesday and stayed down. Chart 1 shows the Dow SPDR (DIA) gapping below 175 and closing below the lower trend line of a triangle....

READ MORE

MEMBERS ONLY

WEAK GDP REPORT PUSHES STOCKS LOWER IN HEAVY TRADING AND THREATENS SUPPORT -- S&P 500 WEEKLY CHART SHOWS NEGATIVE DIVERGENCES -- BONDS ARE OUTPEFORMING STOCKS IN NEW YEAR -- DROP IN TWO-YEAR YIELD SHOWS SOME LOSS OF CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

FRIDAY SELLOFF IN HEAVY TRADING THREATENS CHART SUPPORT... Friday's disappointing fourth quarter GDP report of only 2.6% caused heavy selling of stocks and buying of bonds. The combination of falling stock prices and heavy volume gave the week's performance a negative look, and suggests tht...

READ MORE

MEMBERS ONLY

BATTLING SUPPORT AND CONSOLIDATING -- S&P MIDCAP CONSOLIDATES NEAR HIGHS -- SMALL AND MICRO CAPS PERK UP -- GROWTH OUTPERFORMS VALUE -- CONSUMER DISCRETIONARY HOLDING UP WELL, FINANCE NOT -- HOUSING AND RETAIL SPDRS BOUNCE ABOVE SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

STILL BATTLING SUPPORT AND CONSOLIDATING... Link for today's video. The major stock indices remain range bound since early November, but these ranges still look like consolidations or corrections within bigger uptrends. Chart 1 shows the S&P 500 breaking out in late October on its way to...

READ MORE

MEMBERS ONLY

NEW LOWS IN CRUDE OIL AND TREASURY YIELDS INCREASE DEFLATIONARY CONCERNS -- STOCKS SELLOFF IN AFTERNOON TRADING -- DOW HITS NEW JANUARY LOW -- NASDAQ AND S&P 500 MAY CHALLENGE THEIR JANUARY LOWS -- VIX JUMPS 18%

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY TUMBLES AS OIL HITS NEW LOW... Deflationary forces continue to push commodity prices and bond yields lower. Most commodities fell again today, with most attention on oil. The black line in Chart 1 shows the United States Oil ETF (USO) falling to a new low today. So did...

READ MORE

MEMBERS ONLY

Will The End-Of-The-Month Bullish Seasonal for Equities Be Enough To Avoid A Downside Domino Effect?

by Martin Pring,

President, Pring Research

* NYSE Composite is forming a head and shoulders top or is it a bottom?

* IWM experiences false upside breakout

* SPY/EFA ratio is signaling a dollar correction. Will the Index take the bait?

* Wisdom Tree Yuan fund right on a key up trend line

I last wrote about the US...

READ MORE

MEMBERS ONLY

WEBINAR CHARTS -- DOW DIAMONDS PLUNGES AND EW S&P 500 ETF STALLS -- LARGE-CAP TECHS LEAD THE MARKET LOWER -- WEEKLY CHARTS FOR PERSPECTIVE -- MID-CAP HIGH-LOW PERCENT LEADS -- HIGH-LOW PERCENT FOR XLY AND XLK LAGS -- OIL AND ENERGY ETFS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS... The major index ETFs have gone nowhere since mid November and continue to go nowhere during earnings season. For example, the S&P 500 SPDR (SPY) surged off support in the 2000 area with a 3% move last week and gave a chunk back with a decline...

READ MORE

MEMBERS ONLY

MID CAPS AND LARGE TECHS SHOW RELATIVE STRENGTH -- DR HORTON AND LENNAR LEAD ITB SUPPORT BOUNCE -- BIOTECHS SHOW BROAD STRENGTH -- CARZ BREAKS LATE DECEMBER HIGH -- TOYOTA AND DAIMLER LEAD -- GM HITS SUPPORT ZONE AS F CONSOLIDATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MID CAPS AND LARGE TECHS SHOW RELATIVE STRENGTH ... Link for today's video. The S&P MidCap SPDR (MDY) and the Nasdaq 100 ETF (QQQ) are starting to show relative strength, but in two different ways. Chart 1 shows QQQ with a breakout in late October and new...

READ MORE

MEMBERS ONLY

S&P 500 CONFIRMS KEY SUPPORT LEVEL -- $NDX FORMS BIG CONTINUATION PATTERN -- LARGE AND MID CAPS LEAD NEW HIGHS -- DEFENSIVE SECTORS LEAD RANKINGS -- XLU, XLP AND XLV HIT NEW HIGHS -- OFFENSIVE SECTORS SURGE OFF SUPPORT -- UPS SHOWS CHALLENGE OF EARNINGS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 SURGES TO CONFIRM KEY SUPPORT LEVEL... Link for today's video. Stocks bounced this week with broad strength that reinforced support areas for several key indices. Chart 1 shows the S&P 500 breaking above the 2000 area in November and successfully testing this...

READ MORE

MEMBERS ONLY

EUROPEAN STOCKS LEAD GLOBAL RALLY ON ECB ACTION -- GERMANY AND FRANCE LEAD EUROPE RALLY -- BUT EURO FALLS TO ELEVEN-YEAR LOW -- WEAK OIL BOOSTS RETAILERS AND TRANSPORTS AS U.S. STOCKS RALLY -- S&P 500 CLEARS 50-DAY LINE -- VIX PLUNGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECB COMES THROUGH ... The ECB gave the world's financial markets what they wanted, and a little bit more. Mario Draghi expanded the ECB asset-buying program to include sovereign bonds to the tune of 60 billion euros per month at least until the end of September 2016. That comes...

READ MORE

MEMBERS ONLY

ECB BOND BUYING MIGHT HELP EURO STOCKS, BUT NOT THE CURRENCY -- THE WISDOM TREE EUROPE HEDGED EQUITY FUND HEDGES OUT WEAK EURO -- CURRENCY VOLATILITY PUSHES MONEY INTO GOLD -- HOMEBUILDERS DROP BACK TO 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECB IS EXPECTED TO START QE TOMORROW... The ECB is expected to announce a quantitative easing program tomorrow (Thursday) which will involve buying sovereign bonds. [A leak today outlining some of the details of that program helped stabilize stocks here and in Europe]. Expectations for QE over the past few...

READ MORE

MEMBERS ONLY

WEBINAR CHARTS -- IWM AND IWC STILL HOLDING BREAKOUTS -- RSP AND SPY STALL AFTER BREAKOUTS -- SECTOR PERFORMANCE REFLECTS A MIXED MARKET -- RANKING 27 SECTORS -- QQQ AND TOP TECHS LAG -- AIRLINES CONTINUE TO LEAD

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEBINAR CHARTS ... Click here for the Webinar recording. These are the charts and commentary from Tuesday's Webinar (20-January). Trading remains quite choppy and we can see this in sector performance since early November. In fact, the stock market as a whole has gone nowhere since early November. Well,...

READ MORE

MEMBERS ONLY

The Rest of the World May be About to Beat US Equities for a While

by Martin Pring,

President, Pring Research

* Europe and Emerging Market equities positioned to move higher.

* Philippine ETF breaks to the upside.

* Silver breaks convincingly to the upside.

* Gold breaks out against US equities.

US versus the World

The trend favoring US equities over most of the rest of the world, may be in the process of...

READ MORE

MEMBERS ONLY

PUTTING THE PULLBACK INTO PERSPECTIVE -- RISK INDICATORS TURN NEGATIVE -- UTILITIES AND REITS CONTINUE TO ROCK -- WHY SO MANY NEW HIGHS IN XLF? -- XLY TESTS SUPPORT AS HIGH-LOW PERCENT TEETERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

PUTTING THE DECLINE INTO PERSPECTIVE... Link for today's video. The financial markets have been quite risk averse lately and the US stock market has been quite defensive over the last few weeks, but the S&P 500 is still less then 5% from an all time closing...

READ MORE

MEMBERS ONLY

COPPER PLUNGES TO SIX-YEAR LOW -- FREEPORT MCMORAN PLUNGES ALONG WITH IT -- 10-YEAR BOND YIELD FALLS TO 20-MONTH LOW ON DEFLATION -- FALLING BOND YIELDS HURT BANK STOCKS -- RISING VIX SUGGESTS PERIOD OF LOW VOLATILITY MAY BE ENDING

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER FALLS TO SIX-YEAR LOW... It seems all we've hearing about lately is the plunge in the price of oil. That has led to a debate as to whether the plunge in crude is just the result of increased supply, or a sign of a weakening global economy....

READ MORE

MEMBERS ONLY

WEBINAR CHARTS - KEEPING YOUR EYE ON THE TREND -- SMALL-CAPS AND MICRO-CAPS ARE STILL OK -- INDEX AD LINES HOLD SUPPORT -- HIGH-LOW PERCENT INDICATORS REMAIN BULLISH -- A NOT-SO-SURPRISING SMALL-CAP LEADER -- FOUR STRONG SMALL-CAP SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

KEEPING YOUR EYE ON THE TREND... Link for today's video. These are the charts and commentary from Tuesday's Webinar (13-January). Trading has turned choppy in the major index ETFs since mid November, but sideways price action is not enough to derail the bigger uptrends. There are...

READ MORE

MEMBERS ONLY

TRACKING 10 KEY INDUSTRY GROUP ETF'S -- BANKS POINT SOUTHWEST AS HOMEBUILDERS POINT NORTHEAST -- ENERGY SHARES LEAD MARKET LOWER -- FINANCE SPDR FILLS A PAIR OF GAPS -- REGIONAL BANKS WEIGH ON FINANCE SECTOR -- 5-YR YIELD AND STOCK MARKET CORRELATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRACKING 10 KEY INDUSTRY GROUP ETF'S... Link for today's video. PerfChart 1 shows year-to-date performance for 10 ETFs that represent different groups in the stock market. I normally use the Oil & Gas Equipment & Services SPDR (XES) and the Metals & Mining SPDR (XME) on...

READ MORE

MEMBERS ONLY

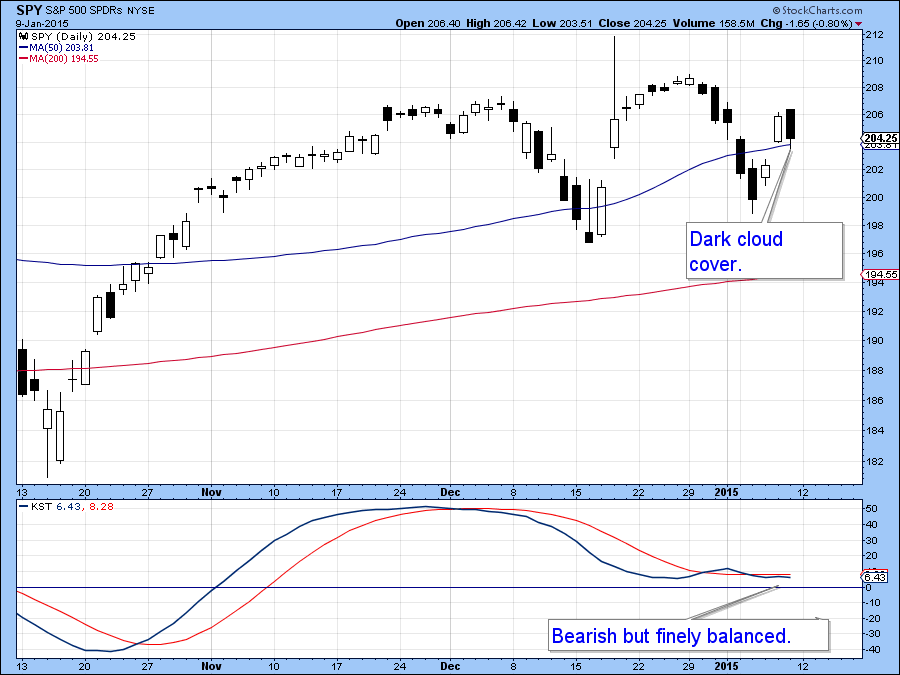

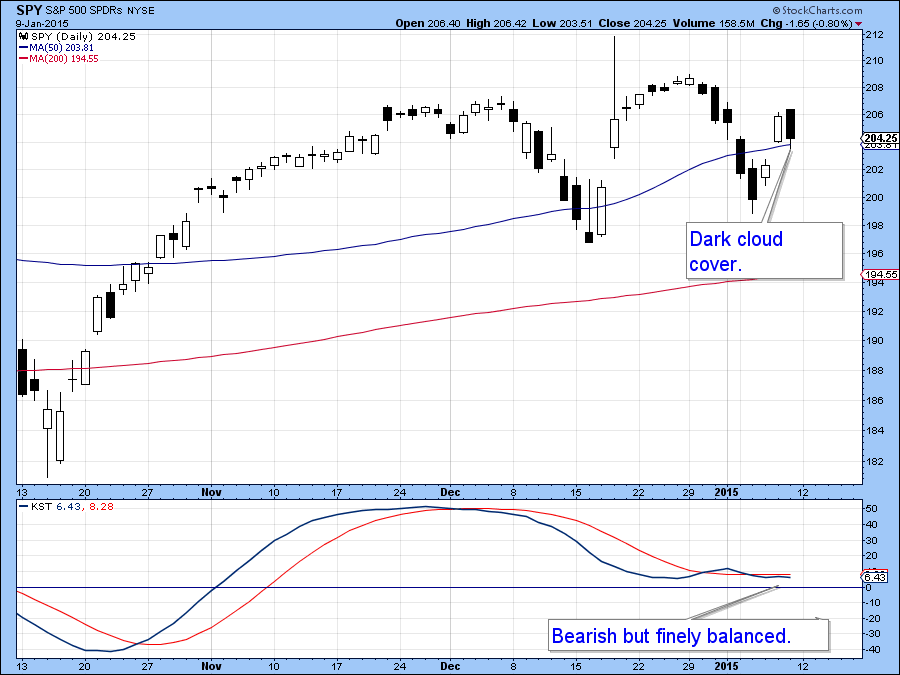

Friday's Stock Market Action Hints at Further Weakness to Come Near-term

by Martin Pring,

President, Pring Research

* World Stock ETF getting closer to completing a top.

* Gold in euro and yen build on recent breakouts.

* Dollar denominated gold close to an upside breakout.

US Equities

On Friday the S & P Composite ($SPX) experienced the second day of a dark cloud cover formation, a bearish candlestick pattern....

READ MORE

MEMBERS ONLY

MID-CAP SPDR TURNS CHOPPY, BUT MAINTAINS DIRECTIONAL BIAS -- KEY LEVELS TO WATCH FOR THE OFFENSIVE SECTOR ETFS -- DO SECTOR ROTATIONS SUPPORT THE BULLS? (RRG DEMO) -- ECONOMIC INDICATORS SHOW MORE STRENGTH THAN WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MID-CAP SPDR TURNS CHOPPY, BUT MAINTAINS DIRECTIONAL BIAS... Link for today's video. Establishing support and resistance levels for indices and ETFs with dozens of stocks is a challenge because there are so many moving parts (stocks). Instead of exact support-resistance levels based on one chart feature, I prefer...

READ MORE

MEMBERS ONLY

MARKET INDEXES SCORE BIG GAINS -- EUROPE GAINS EVEN MORE AND BOUNCES OFF CHART SUPPORT -- ENERGY SHARES REBOUND WITHIN MAJOR DOWNTREND -- HOMEBUILDER ETF RESUMES UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES SCORE BIG GAINS... Global stocks are experiencing a nice bounce today with major U.S. stock indexes experiencing gains of nearly 2%. Chart 1 shows the Dow Industrials climbing well above its 50-day average after holding above chart support at its mid-December low. Chart 2 shows a similar...

READ MORE

MEMBERS ONLY

NEXT DOWNSIDE TARGET FOR CRUDE OIL RANGES FROM $40 TO THE MID-$30S -- GLOBAL DEFLATIONARY PRESSURES PULL 10-YEAR TREASURY YIELD BELOW 2% -- FALLING FOREIGN CURRENCIES SHOW WEAKNESS ABROAD -- EMU ISHARES HAVE WEIGHED ON U.S. STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONGER RANGE VIEW OF CRUDE OIL ... The plunging price of oil is driving financial trends all over the world. Plunging oil is hurting energy companies that produce that commodity, as well as countries that are energy exporters. In addition, its deflationary effect is pulling global bond yields lower and contributing...

READ MORE

MEMBERS ONLY

SPY CORRECTS WITHIN WELL DEFINED UPTREND -- RISK INDICATORS TURNED MIXED -- JUNK BONDS GET SLAMMED AGAIN -- TREASURY YIELDS CONTINUE TO CONVERGE -- NEW HIGHS DRY UP, BUT BREADTH REMAIN BULLISH -- UTILITIES AND FINANCE STILL LEAD SECTOR BREADTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPY AND DIA CORRECT WITHIN WELL DEFINED UPTRENDS... Stocks were hit with intense selling pressure over the last few days, but these declines have yet to turn key breadth indicators bearish or even test major support levels. Today we will look at three major index charts, some key breadth charts,...

READ MORE

MEMBERS ONLY

MSCI World ETF and NYSE Composite Violate their 12-month Moving Averages. Is This the Start of a Primary Bear Market?

by Martin Pring,

President, Pring Research

* Much expected Santa Rally did not happen and that’s bearish.

* MSCI Europe Australia Far East ETF right on the brink of a major breakdown.

* Small caps may have experienced a false upside breakout.

* Chinese ETF breaks out big time on both an absolute and relative basis.

In my mid-December...

READ MORE

MEMBERS ONLY

OIL SINKS TO YET ANOTHER NEW LOW -- ENERGY SPDR REVERSES IN KEY RETRACEMENT ZONE -- STEEL STOCKS WEIGH ON METALS & MINING SPDR -- GOLD AND THE 2011 EUROPEAN CRISIS -- GOLD AND THE 2015 CHART -- GOLD, THE DOLLAR AND CORRELATION

by John Murphy,

Chief Technical Analyst, StockCharts.com

OIL SINKS TO YET ANOTHER NEW LOW... Link for today's video. Chart 1 shows the USO Oil Fund (USO) falling some 3% on Monday and hitting yet another new low. The pattern since August has been decline, consolidate, break down and repeat. Oil has not really bounced the...

READ MORE

MEMBERS ONLY

THE 18-YEAR REAL ESTATE CYCLE STILL HAS A LONG WAY TO GO BEFORE HITTING ANOTHER PEAK -- THE CASE-SHILLER HOME PRICE INDEX NEARS SIX-YEAR HIGH -- RISING REITS AND HOMEBUILDERS ARE LEADING INDICATORS -- WE'RE STILL IN EARLY STAGES OF REAL ESTATE UPTURN

by John Murphy,

Chief Technical Analyst, StockCharts.com

THERE IS AN 18-YEAR REAL ESTATE CYCLE ... My 2013 book entitled "Trading With Intermarket Analysis" described the existence of an 18-year real estate cycle. In other words, real estate tends to peak about every 18 years. This reliable pattern has been traced back to the 1800s. Credit for...

READ MORE

MEMBERS ONLY

An Important Move is Likely for Gold and Silver in Early 2015. Here are the Chart Points to Watch

by Martin Pring,

President, Pring Research

* Dollar based gold is in a bear market.

* Yen and euro denominated gold are in primary bull markets.

* Gold shares complete a massive top.

Last week we reviewed the technical picture of the major currencies. This week it is the turn of the precious metals because the finely balanced technical...

READ MORE

MEMBERS ONLY

CHINA AND INDIA ARE EMERGING MARKET WINNERS -- FALLING OIL HURTS BRAZIL AND RUSSIA -- SHANGHAI STOCKS END YEAR AT THREE YEAR HIGH -- NEW ETFS OFFER EXPOSURE TO SHANGHAI A-SHARES, BUT MAY NOT BE LIQUID ENOUGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BRIC DIVERGENCE... The year 2014 saw very diverging trends among the world's largest emerging market stocks. The lines in Chart 1 show those diverging trends among the four BRIC countries that are Brazil, Russia, India, and China. I'm using exchange traded funds here because they take...

READ MORE

MEMBERS ONLY

BROADCASTING AND ENTERTAINMENT INDEX HITS NEW HIGH -- MEDIA ETF BREAKS FROM MASSIVE WEDGE -- CARNIVAL AND ROYAL CARIBBEAN LIFT PEJ TO NEW HIGH -- IS CBS COMING OUT OF A BIG CORRECTION? -- BBT GETS BACK IN SYNC WITH SPY -- FITB FORMS BIG REVERSAL PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

BROADCASTING AND ENTERTAINMENT INDEX HITS NEW HIGH... Link for today's video. Chart 1 shows the DJ US Broadcasting and Entertainment Index ($DJUSBC) in the main window and the S&P 500 in the indicator window. Instead of using the price relative ($DJUSBC:$SPX ratio) to compare performance,...

READ MORE

MEMBERS ONLY

IWM AND IJR SCORE NEW HIGHS -- FINANCIALS LEAD SMALL-CAPS HIGHER -- SMALL AND MID CAP AD LINES LEAD -- SECTOR AD LINES SHOW BROAD STRENGTH -- UTILITIES AND FINANCE LEAD HIGH-LOW RANKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

IWM AND IJR SCORE NEW HIGHS... Link for today's video. Barring a big plunge the next few days, small-caps are going out with a bang this year. Small-caps lagged the broader market throughout 2014 because the Russell 2000 iShares (IWM) and the S&P SmallCap iShares (IJR)...

READ MORE

MEMBERS ONLY

End Of The Year Dollar Index Review

by Martin Pring,

President, Pring Research

* Long-term dollar rally likely to continue.

* Yuan on the edge of a breakdown.

* January is tied with November as the most bullish month for the dollar.

* Short-term dollar momentum overstretched but re-accelerating to the upside.

Currencies

At the end of August the US Dollar Index ($USD) broke out from a...

READ MORE

MEMBERS ONLY

SOME NEW AND CONTINUING THEMES FOR 2015 -- SHORT-TERM T-YIELDS RISE AND HALF NORMALIZE -- EURO MOVES CLOSER TO PARITY -- SMALL-CAPS LEAD THE MARKET -- XLF AND IAI TARGET 2007 HIGH -- XLE CONFIRMS LARGE REVERSAL PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

SOME NEW AND CONTINUING THEMES FOR 2015... Today's Webinar will look at long-term charts to extrapolate some themes to consider in 2015. This written commentary shows most of the Webinar charts with some brief notes. Tune into the Webinar for full details. Every so often we get a...

READ MORE

MEMBERS ONLY

S&P MIDCAP INDEX FORMS BIG CONTINUATION PATTERN -- EQUAL-WEIGHT STARTS OUTPERFORMING CAP-WEIGHT -- SMALL-CAP FINANCE AND TECH SECTORS HIT NEW HIGHS -- SEMICONDUCTOR SPDR EXTENDS STRONG UPTREND -- CAVIUM AND RF MICRO LEAD SEMIS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P MIDCAP INDEX FORMS BIG CONTINUATION PATTERN... Link for today's video. Chart 1 shows the S&P MidCap 400 hitting a new high at the beginning of July and then forming a large consolidation the last six months. Actually, the index hit another all time...

READ MORE

MEMBERS ONLY

ENERGY SHARES LEAD U.S. STOCKS HIGHER -- SMALL CAPS BREAKOUT -- FOREIGN STOCKS ALSO BOUNCE ON FIRMER CRUDE PRICE -- SO DO HIGH YIELD BONDS -- OIL SERVICE STOCKS BOUNCE FROM DEEP OVERSOLD CONDITION AND MAJOR SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

US STOCKS END WEEK ON A STRONG NOTE... A combination of factors pushed U.S. (and global) stocks sharply higher during the second half of the week. One big factor was the Wednesday Fed statement that it would be "patient" in raising rates next year. Another was a...

READ MORE

MEMBERS ONLY

MICRO-CAPS TAKE THE LEAD ON RELATIVE ROTATION GRAPH -- MICROCAP ETF BREAKS BIG CHANNEL -- HIGH-LOW PERCENT INDICATORS WHIP BACK TO BULLISH -- MINDING THE GAPS -- UTILITY ETFS BREAK OUT ACROSS THE BOARD -- SYMBOLS FOR SECTOR ETFS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MICRO-CAPS TAKE THE LEAD ON RELATIVE ROTATION GRAPH ... Link for today's video. Small-caps, mid-caps and micro-caps are starting to show some relative strength. John Murphy noted that the January effect was boosting small-caps as the Russell 2000 started outperforming the Russell 1000 recently. We can also see an...

READ MORE