MEMBERS ONLY

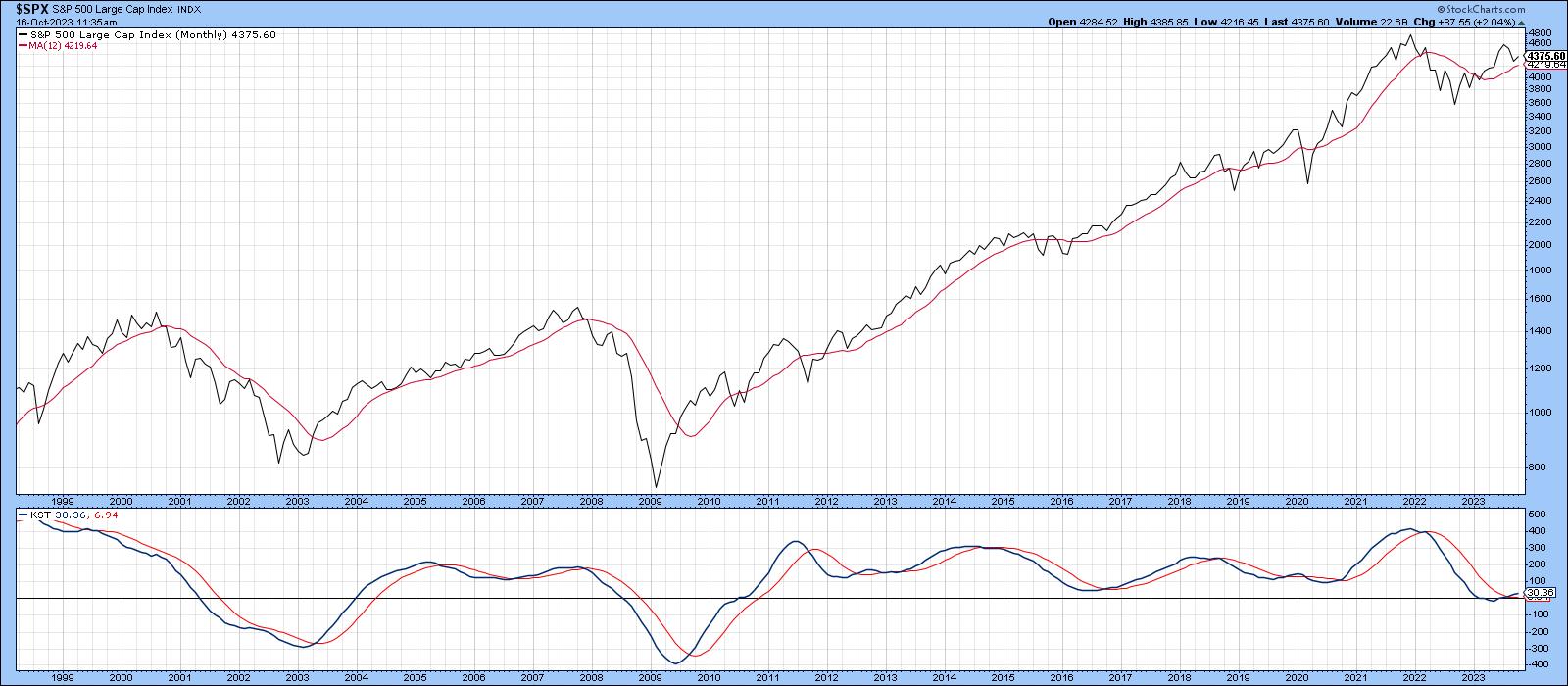

Prepare for 2024: Martin Pring's Expert Insights on the Equity Market

by Martin Pring,

President, Pring Research

In this must-see once a year special, Martin breaks down his comprehensive equity market outlook for 2024, accompanied by Bruce Fraser.

Encompassing a secular (multi-business cycle) perspective of the forces that are likely to influence stocks and bonds over the coming years, Martin presents a look ahead at what'...

READ MORE

MEMBERS ONLY

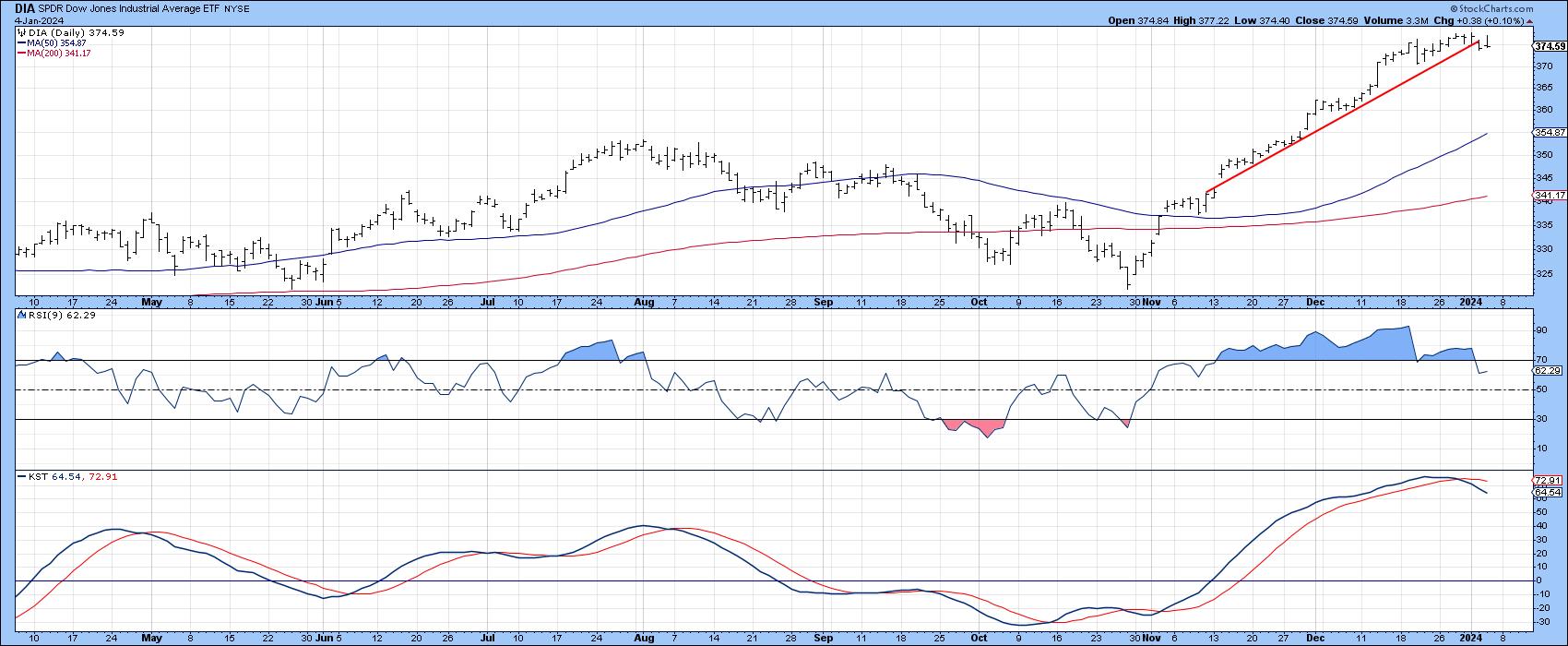

Three Intermarket Relationships to Watch in Early 2024

by Martin Pring,

President, Pring Research

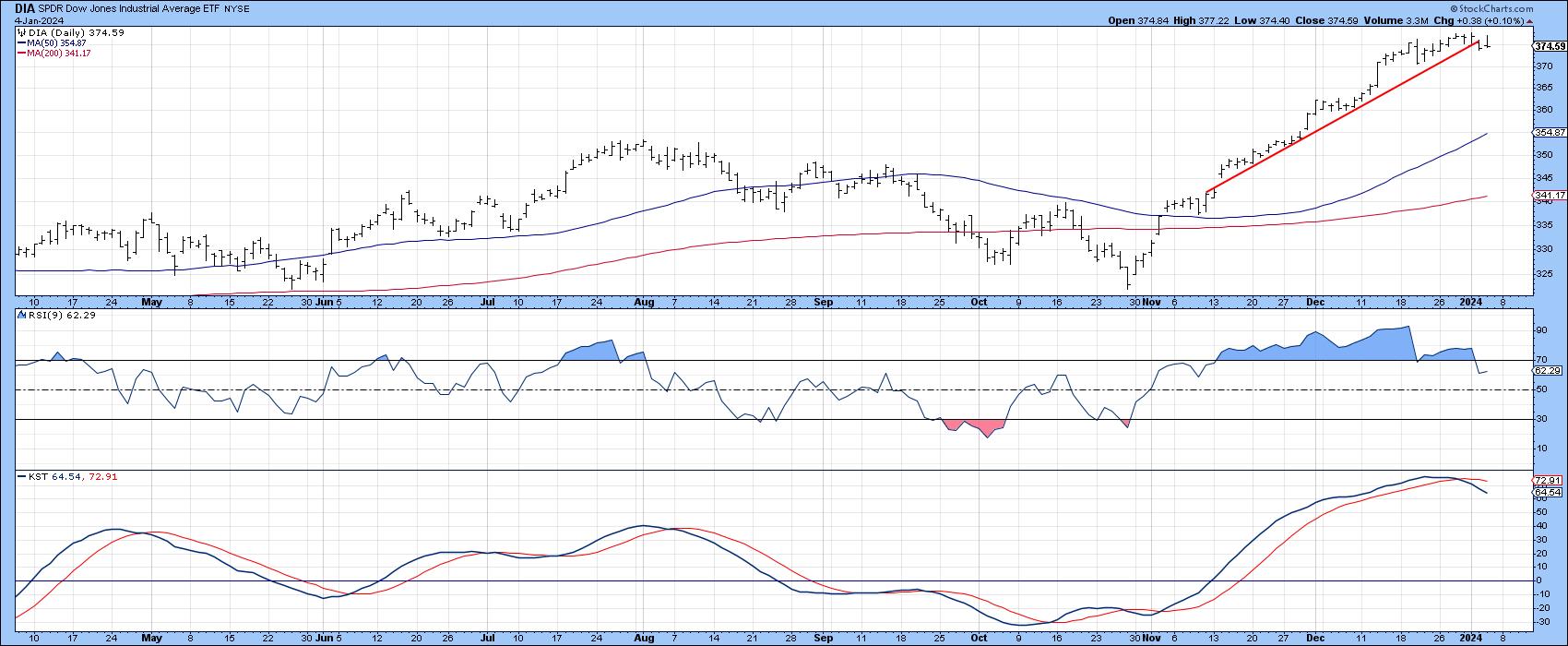

It has been a great rally, but this week has seen the DJIA violate its post November up trendline. In addition, the 9-day RSI has retreated below its 70 overbought zone for the first time since early November, and the daily KST has triggered a sell signal. Is it time...

READ MORE

MEMBERS ONLY

Guidelines for 2024 | Focus on Stocks: January 2024

by Larry Williams,

Veteran Investor and Author

Let's Get This Out of The Way Right Now

For the last 18 years, I've had a love affair with my annual forecast report. Until I began writing this letter, it was the only thing I did. Many of you purchased it last year, and some...

READ MORE

MEMBERS ONLY

OVERBOUGHT SPX TESTS OLD HIGH -- SMALLER STOCKS HAVE BROKEN OUT -- HEALTHCARE LOOKS PROMISING IN NEW YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TESTS OLD HIGH... A lot of attention is being paid to the S&P 500 which is in the process of testing its record high. That can be seen in Chart 1. In addition, its 14-day RSI line is in a very overbought condition. That...

READ MORE

MEMBERS ONLY

What Would It Take for Emerging Markets to Emerge?

by Martin Pring,

President, Pring Research

Over the years, emerging markets as a group have experienced huge swings in relative performance. The latest one, which began in 2010, has been quite bearish. When such linear trends dominate the scene, reliable cyclical indicators, such as the long-term KST or monthly MACD, often give premature buy signals and...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" December 14, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry presents his forecast for FANG stocks, including an analysis of the stock selloff for META. He then digs into the cycle of debt and why he's bothered about credit card writeoffs. After that, he examines the weekly economic index and GDP and how they...

READ MORE

MEMBERS ONLY

FED PIVOT ON RATES BOOSTS BONDS AND STOCKS -- GOLD AND ITS MINERS BENEFIT FROM FALLING RATES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SPX RALLY BROADENS OUT... Two inflation reports this week showed consumer and producer price inflation cooling off. Then on Wednesday afternoon the Fed suggested that it may be ending its rate hikes, and might even lower rates three times in the coming year. That combination resulted in a big drop...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

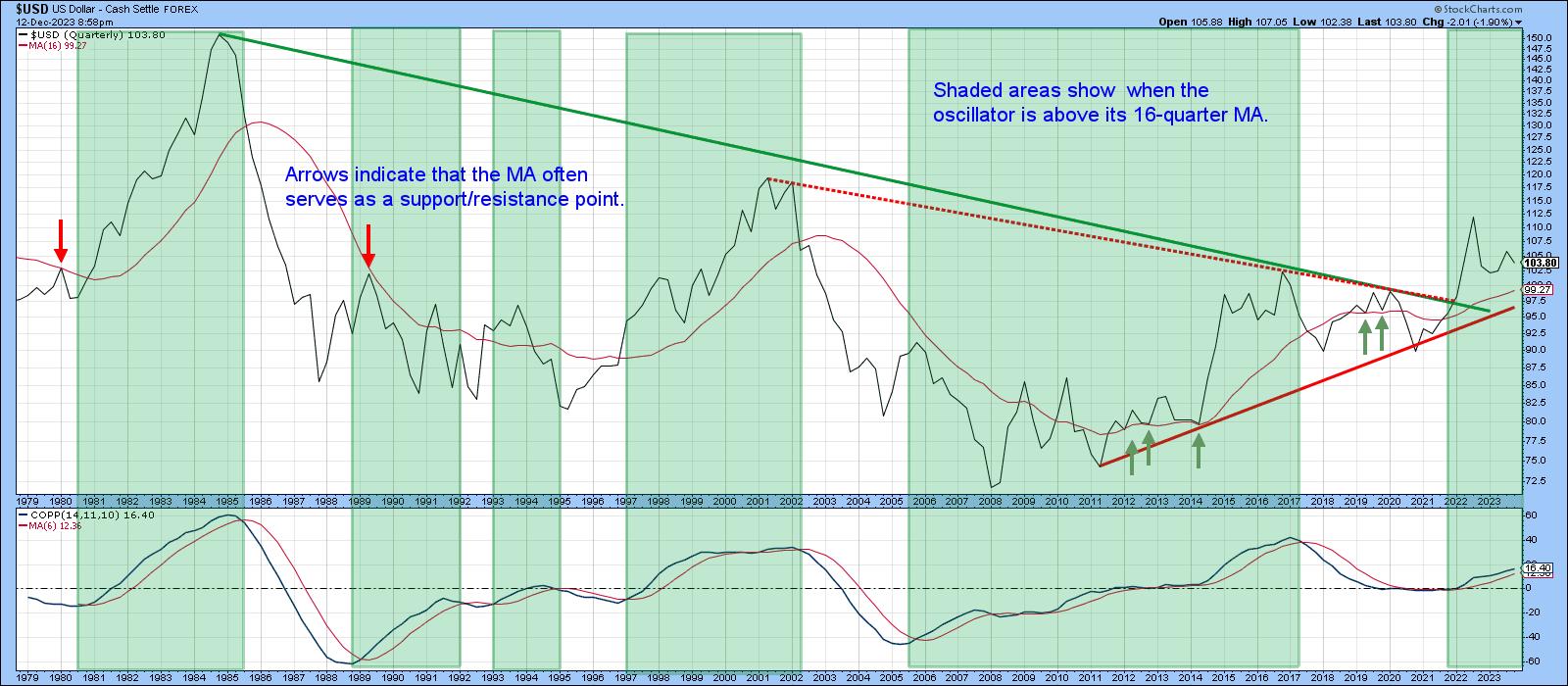

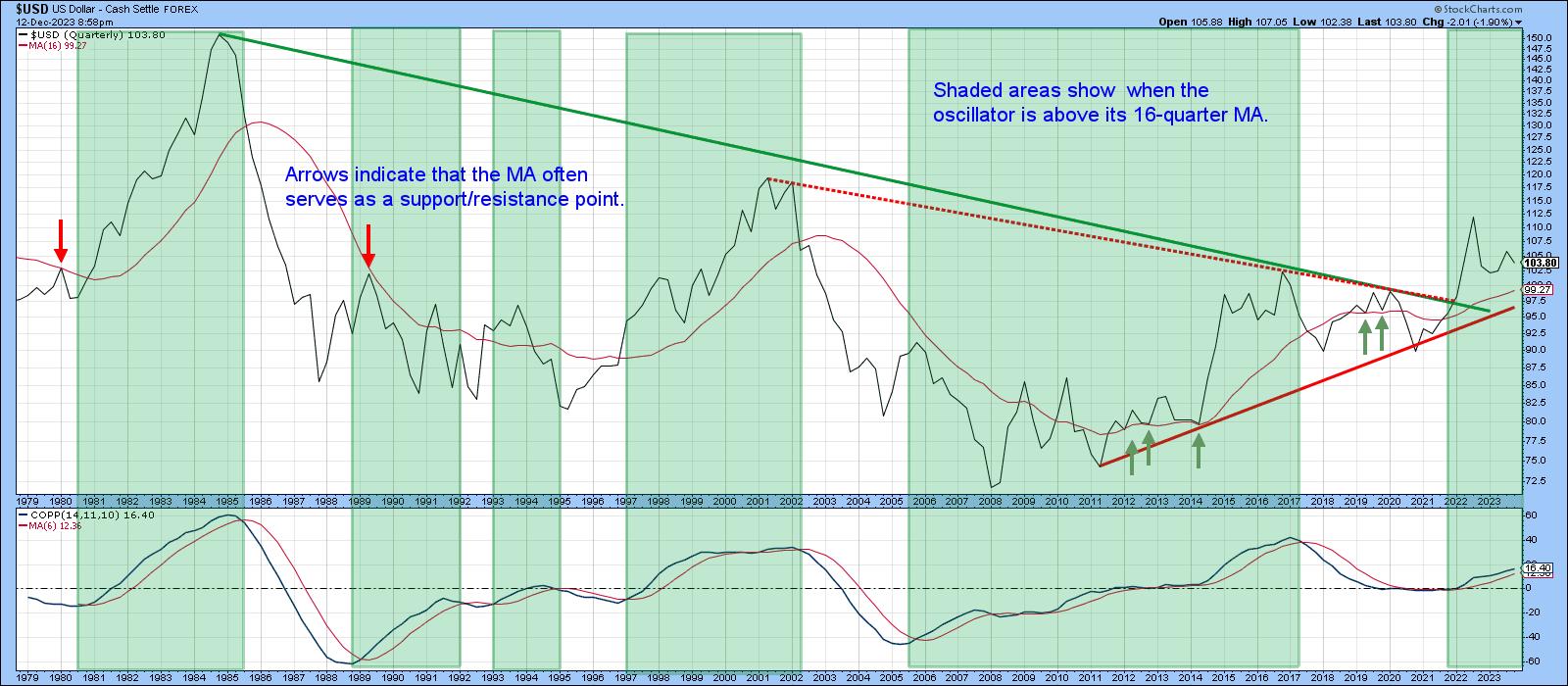

Maybe It's Time for a Santa Claus Rally... in the Dollar

by Martin Pring,

President, Pring Research

I like to start off my approach to any market by taking a look at the long-term trend. That's because a rising tide not only lifts all boats, but the direction of the long-term trend determines the characteristics of those below it. For example, if the primary trend...

READ MORE

MEMBERS ONLY

Larry's Final LIVE "Family Gathering" Webinar of 2023 Airs THIS WEEK - Thursday, December 14th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, December 14 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

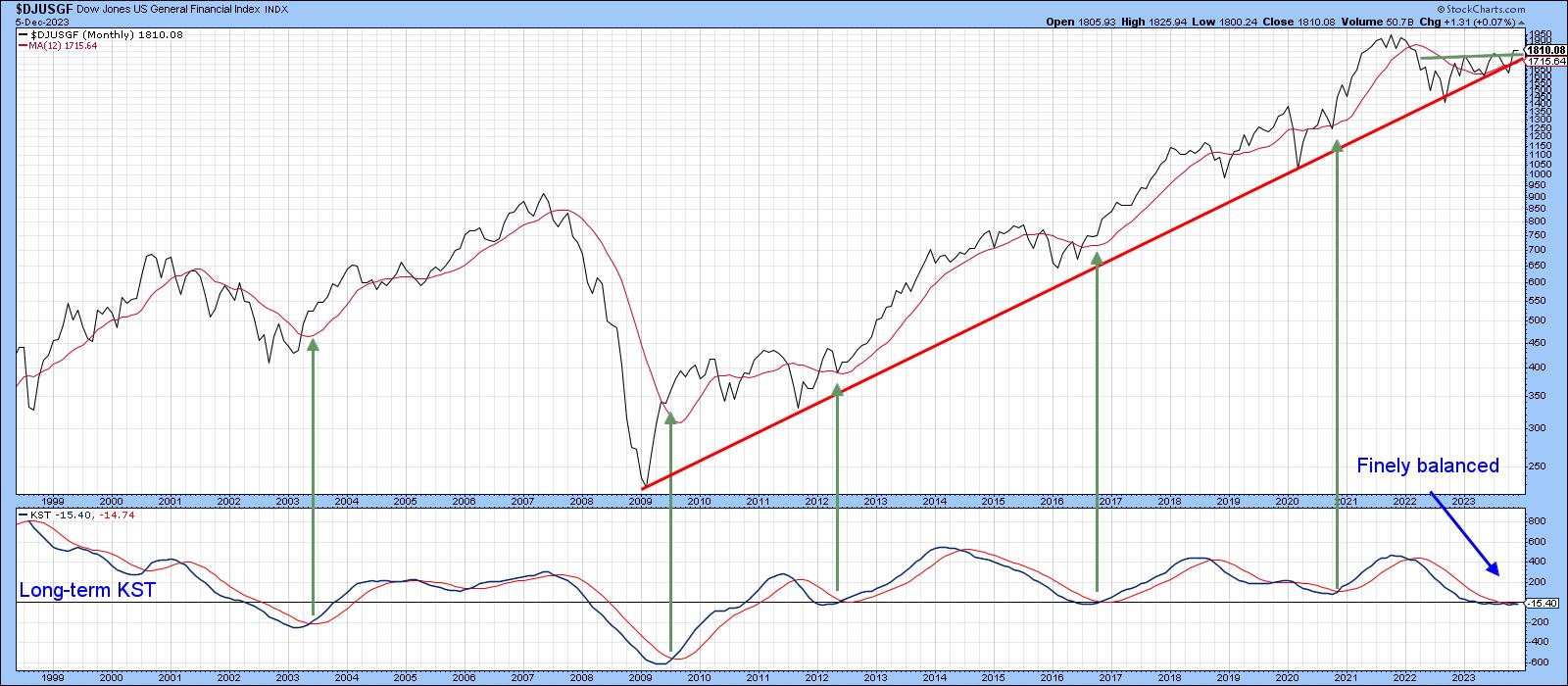

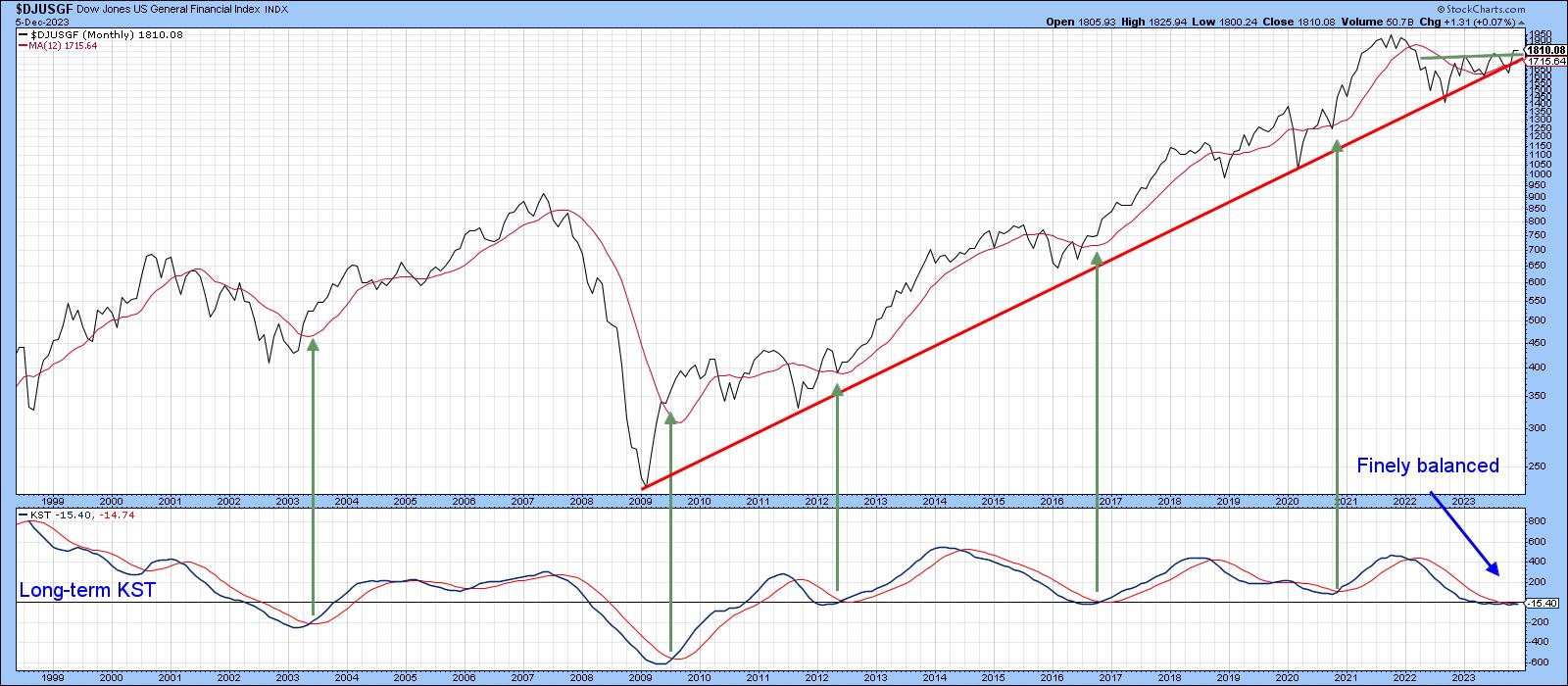

Are Financials Ready to Extend their Leadership?

by Martin Pring,

President, Pring Research

Technology (XLK) and Communications Services (XLC) have been the leaders since the bull market began in October of last year. However, they may need to look over their shoulders, as financials have been creeping up since the October 27 intermediate low. The short answer to the question posed by the...

READ MORE

MEMBERS ONLY

Santa Comes to Wall Street | Focus on Stocks: December 2023

by Larry Williams,

Veteran Investor and Author

Santa Comes to Wall Street

Maybe St. Nick gets into the eggnog before he visits Wall Street each year, because the trading pattern has been a step up, then a stumble down before recovering at the end of the year. I first noticed this Up-Down-Up pattern back in the early...

READ MORE

MEMBERS ONLY

REITS, FINANCIALS, INDUSTRIALS, AND MATERIALS SHOW NOVEMBER RELATIVE STRENGTH -- S&P 500 TESTS SUMMER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTOR SPDRS IN UPTRENDS... The number of sectors in rally mode has broadened out which is a positive sign for stocks. You may recall concerns in recent months that the market rally was too concentrated in large growth stocks and lacked market breadth. That's no longer the case....

READ MORE

MEMBERS ONLY

Three Markets That are Right At Significant Breakout Points

by Martin Pring,

President, Pring Research

A lot of the time, I write articles that focus on markets or technical situations that should be monitored for a potential turn. This one is no different, except to say that these markets are not close to breakout points, but right at them. In short, it's fish-or-cut-bait...

READ MORE

MEMBERS ONLY

These Three Intermarket Relationships are at Key Juncture Points

by Martin Pring,

President, Pring Research

We spend a lot of time analyzing sector rotation, but there are also other relationships that can offer useful insights to internal market dynamics. One aspect of this is the relationship between market averages.

NASDAQ vs. the DJIA

As an example, Chart 1 plots the relationship between the NASDAQ Composite...

READ MORE

MEMBERS ONLY

FALLING OIL HELPS BOOST STOCKS -- XLE TESTS 200-DAY LINE -- QQQ TESTS RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

PEAK IN OIL LED TO PEAK IN BOND YIELDS... Previous messages have shown a drop in bond yields starting a month ago coinciding with the fourth quarter rally in stocks. But there's another element in that story which is a sharp drop in the price of oil. That&...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" November 16, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins with a followup on the October rally kickoff. He then covers stocks like CRWD, META, NVDA, LULU, and DKNG. Larry answers questions about seasonal and cyclical differences, his personal indicators, and what retailers rely most on for the Christmas season. He highlights some trades that...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, November 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, November 16 at 2:00pm EST.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

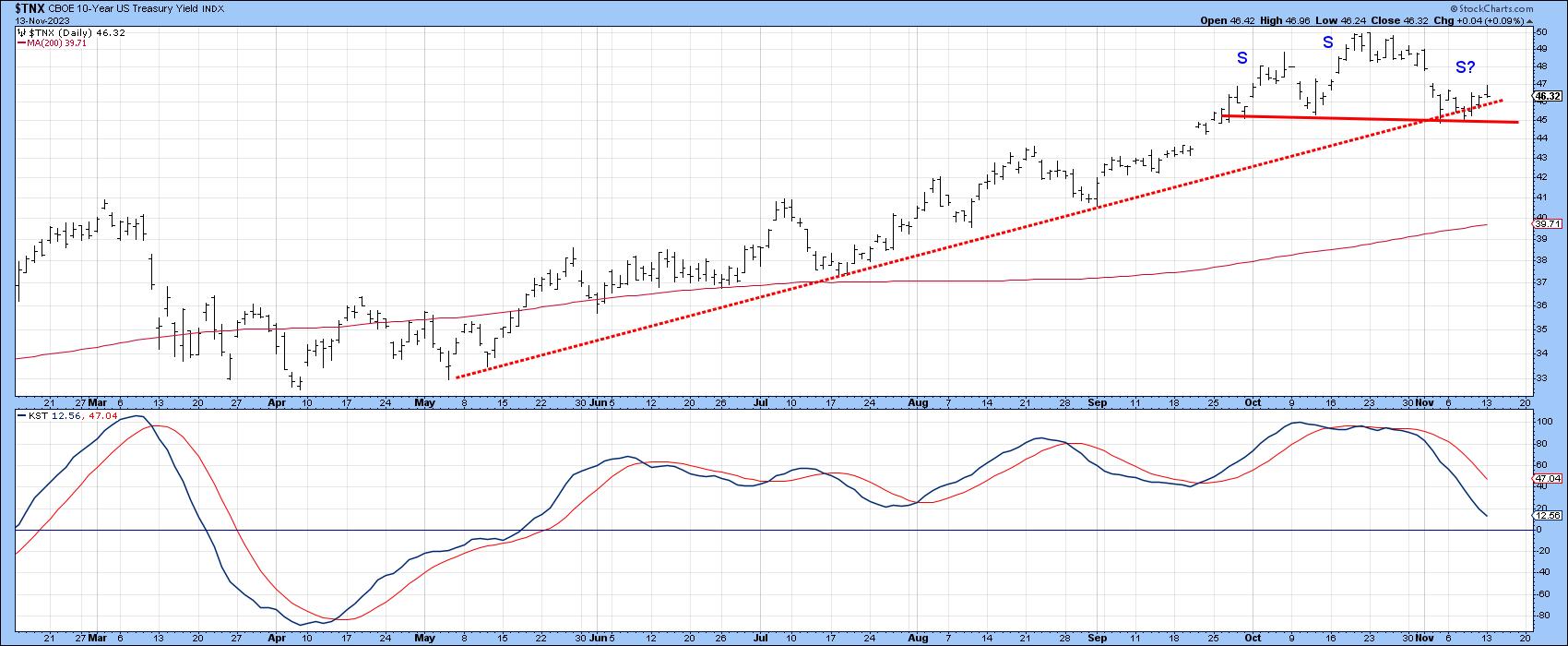

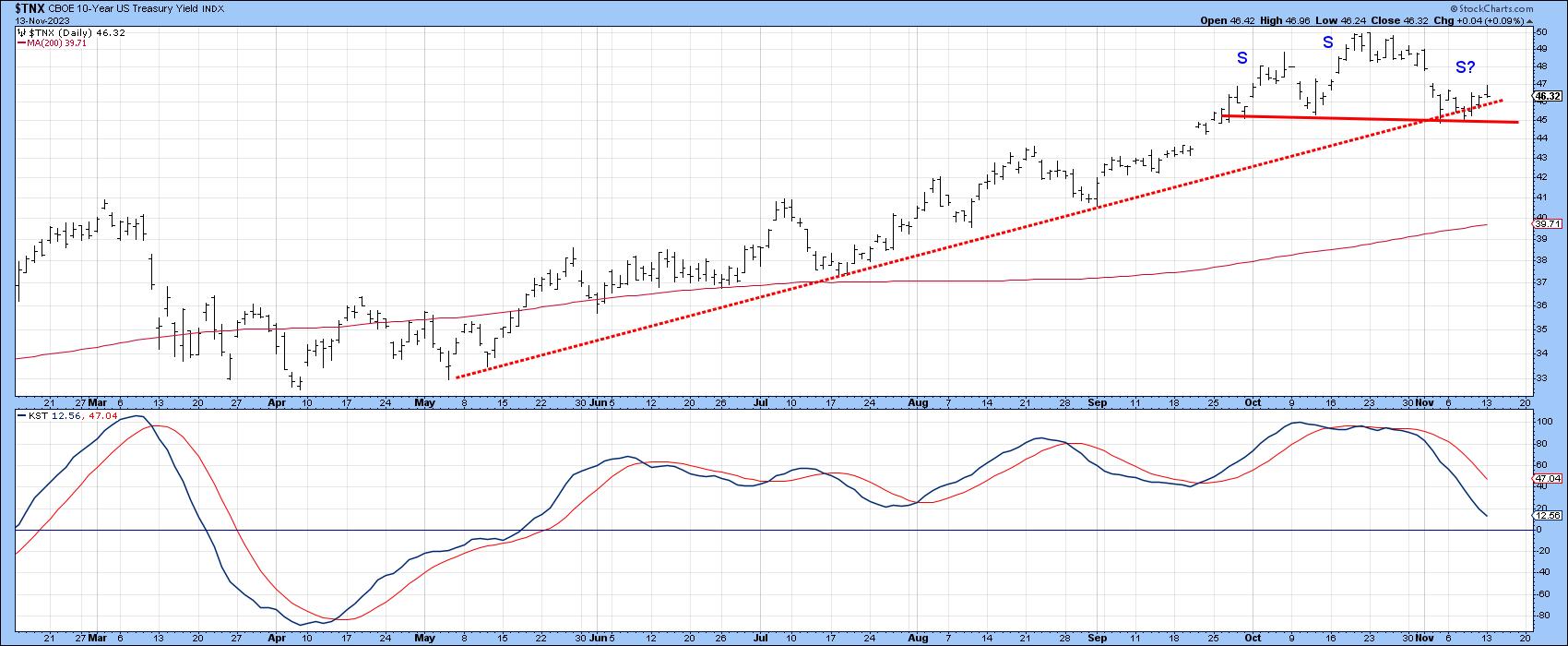

Is It Time for Interest Rates to Fall?

by Martin Pring,

President, Pring Research

I last wrote about bonds and interest rates in August, as they were in the process of challenging their October 2022 highs. My conclusion at the time was that they were likely to go through, but that upside potential would be limited due to what seemed at the time to...

READ MORE

MEMBERS ONLY

NASDAQ LEADS MARKET HIGHER -- SPX MAY BE BREAKING OUT -- SEMIS LEAD TECH STOCKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ CLEARS OCTOBER HIGH.. .After spending the week in a holding pattern, stocks are ending the week on a strong note and appear poised to continue their fourth quarter uptrend. Chart 1 shows the S&P 500 testing its mid-October high and nearing an upside breakout. Odds for an...

READ MORE

MEMBERS ONLY

Benchmarks that Will Tell Us this Market Has Legs

by Martin Pring,

President, Pring Research

A couple of weeks ago, I wrote an upbeat article on the market, pointing out the fact that many short- and intermediate-term indicators were in a potentially bullish position at a time when stocks seemed impervious to bad news. I concluded "That does not mean the market will go...

READ MORE

MEMBERS ONLY

STOCKS SURGE ON FALLING BOND YIELDS -- REITS AND HOMEBUILDERS AMONG WEEKLY LEADERS --VIX TUMBLES AS STOCKS RISE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN YEAR BOND YIELD MEETS RESISTANCE AT 5%... The 10-Year Treasury yield backed off sharply this week from long-term resistance near 5.00%. The upper box in Chart 1 also shows its 14-day RSI line peaking from overbought territory over 70 and falling to the lowest level in several months....

READ MORE

MEMBERS ONLY

This Country ETF Rallies Sharply After War Breaks Out

by Martin Pring,

President, Pring Research

Understandably, most Middle Eastern country ETFs have performed poorly since the war broke out, but there is one noticeable exception, which I will get to later.

Israel

First, as might be expected, the iShares Israel ETF (EIS) has moved lower and completed what looks to be a massive top. The...

READ MORE

MEMBERS ONLY

Focus on Stocks: November 2023

by Larry Williams,

Veteran Investor and Author

The Million Dollar Stock Market Bet

Warren Buffett proved his point in 2016 when he bet $1,000,000 that the S&P 500 Stock Index would outperform hedge funds. His bet was that active investment management by professionals would under-perform the returns of people who were passively investing....

READ MORE

MEMBERS ONLY

IMPORTANT SUPPORT LEVELS ARE BEING BROKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 BREAKS 200-DAY LINE...Last week's message showed the S&P 500 testing important support lines which included its 200-day moving average. Those support levels are being broken to the downside. The daily bars in Chart 1 show the SPX falling below its 200-...

READ MORE

MEMBERS ONLY

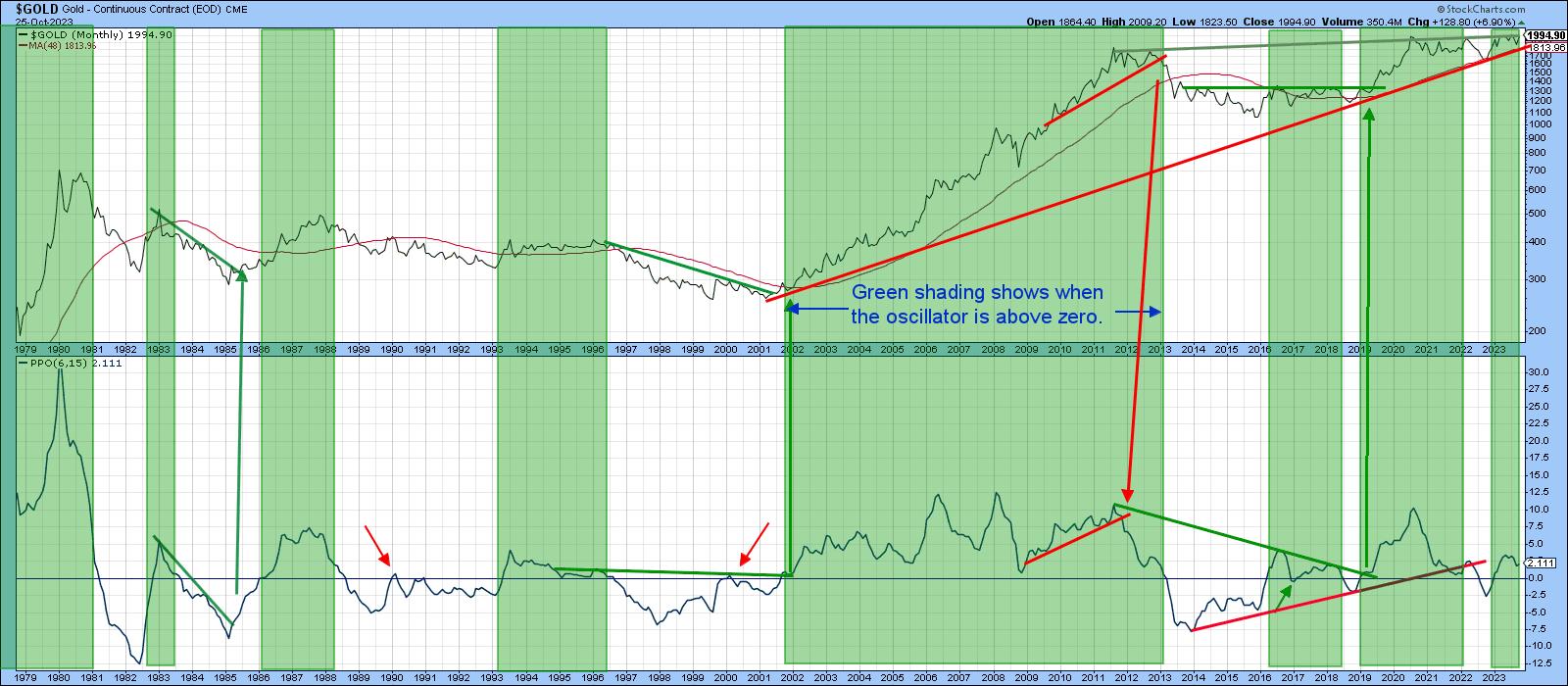

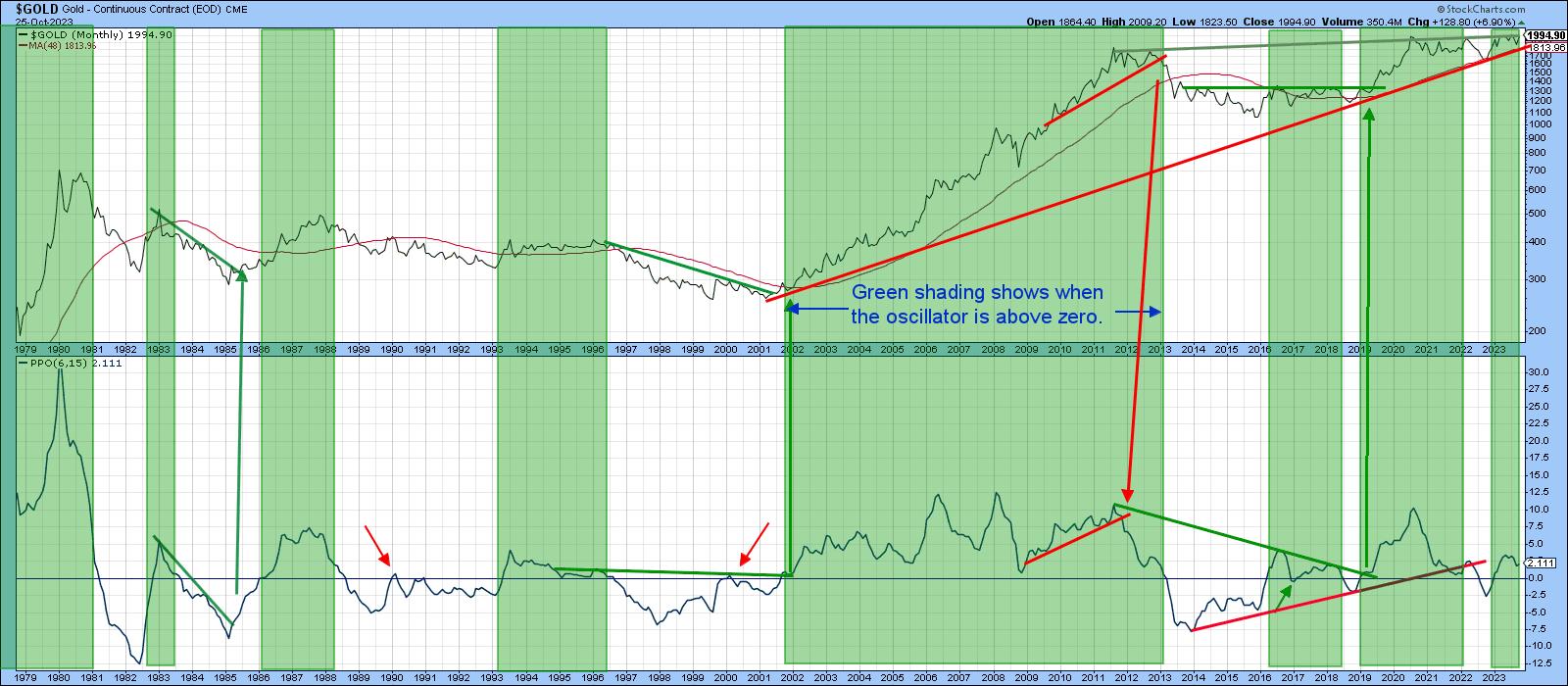

Some Gold Indicators Approach Critical Chart Points

by Martin Pring,

President, Pring Research

When Anwar Sadat, President of Egypt was assassinated in 1981, gold rallied sharply over the near-term, but the advance soon petered out. The reason was that gold was in a primary bear market, so the advance merely represented a counter-cyclical move. Gold has rallied sharply since the Middle East crisis...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" October 20, 2023 Recording

by Larry Williams,

Veteran Investor and Author

October is a significant month in the stock market, and in this pre-election year, there's a lot of uncertainty among investors, which makes the stock market more volatile. In this video, Larry discusses the October Seasonality and talks about stocks that generally perform well during the month. You&...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today At 2:00 PM Eastern

Today, we will be having a "Family Gathering" meeting at 11 AM Pacific/2:00 PM Eastern. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to join Webinar

https://stockcharts.zoom.us/j/85377769524...

READ MORE

MEMBERS ONLY

TEN-YEAR YIELD NEARS 5% -- S&P 500 CONTINUES TO TEST MAJOR SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

NEARLY AT 5%... Previous messages have mentioned 5% as the next major upside target for the 10-Year Treasury yield. The TNX hit 4.99% today. Chart 1 shows the next potential target at 5.25% which was the closing high formed sixteen years ago. That previous peak may provide some...

READ MORE

MEMBERS ONLY

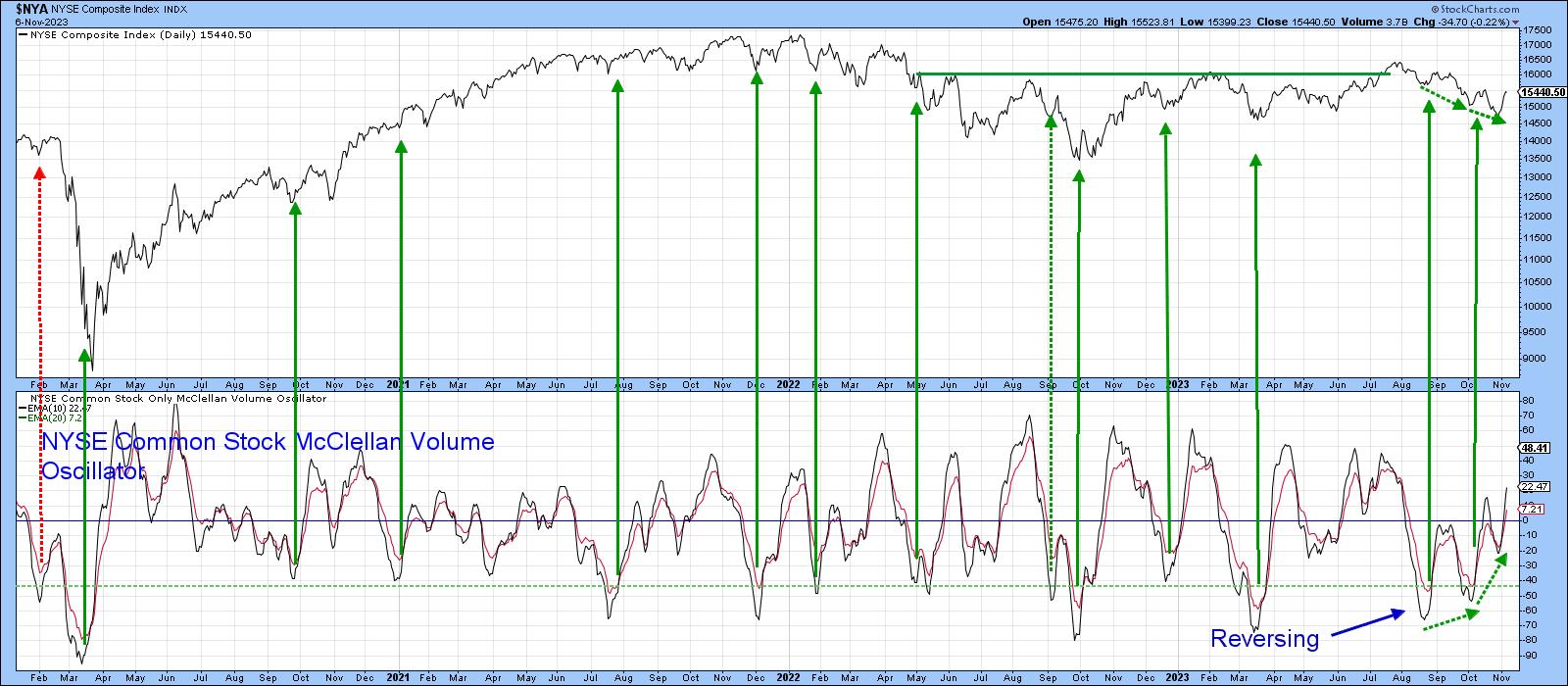

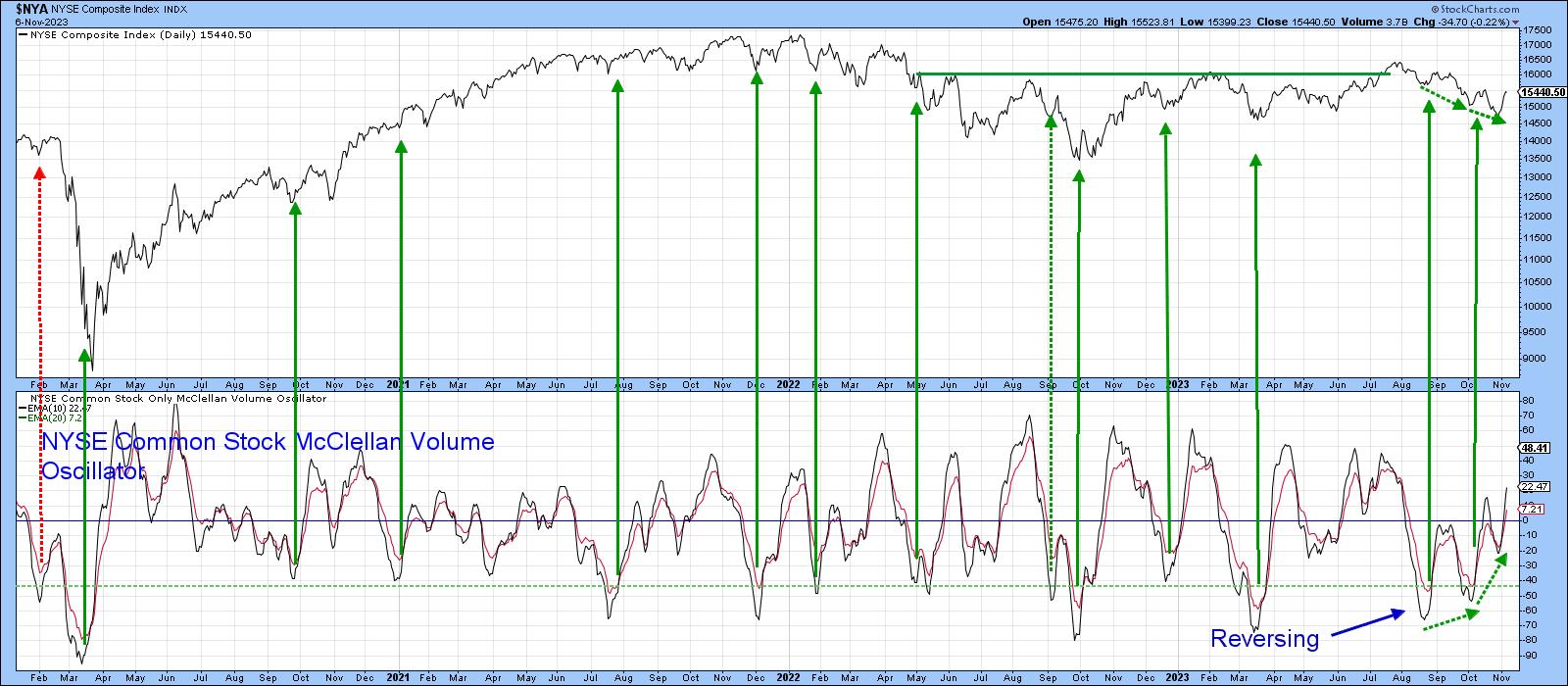

If War in the Middle East Won't Push this Market Down, What Will?

by Martin Pring,

President, Pring Research

I must say, I was surprised that the outbreak of war in the Middle East and a 4% rise in oil sent the market higher, not lower by the close of business last Monday. Typically, a market that does not respond to bad news in a negative way is one...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Friday, October 20th at 2:00pm EDT!

by Larry Williams,

Veteran Investor and Author

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Friday, October 20th at 2:00pm EDT.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

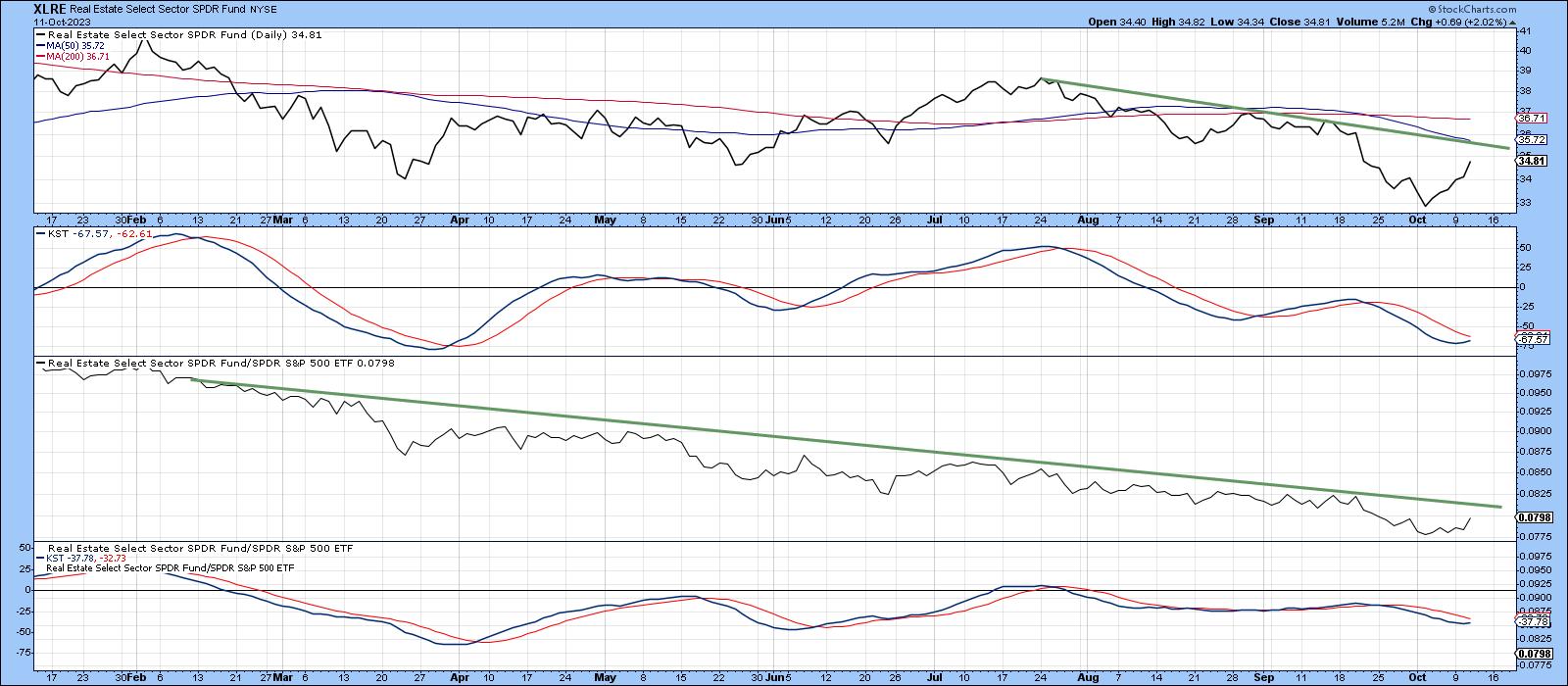

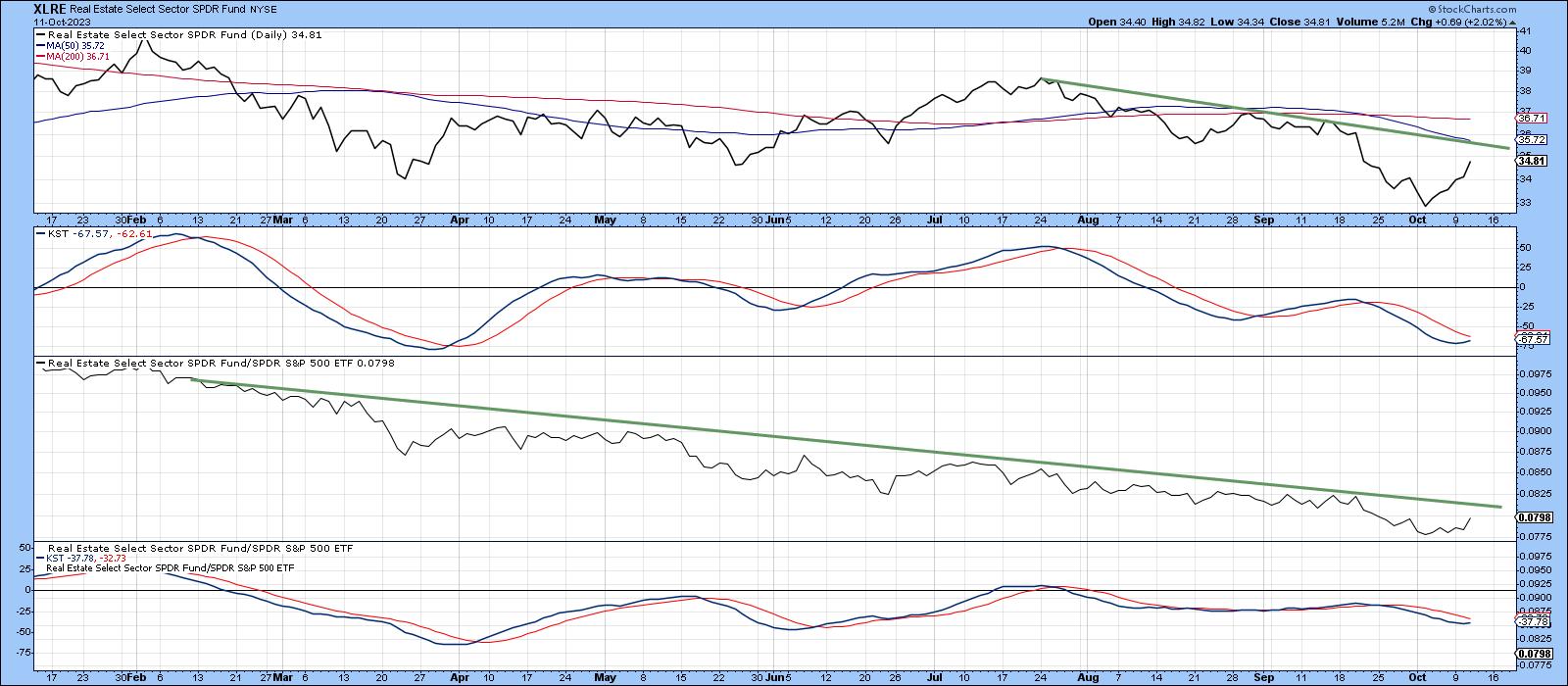

REITS Getting Ready to Rally, But What Happens After That?

by Martin Pring,

President, Pring Research

Several short-term charts suggest the SPDR Real Estate ETF (XLRE) is getting ready to rock and roll, thereby indicating an extension to this week's rebound is in the cards. It's possible that the expected rally could result in shifting some of the longer-term indicators towards a...

READ MORE

MEMBERS ONLY

BOTH VERSIONS OF S&P 500 TRY TO HOLD SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S$P 500 TESTS TRENDLINE SUPPORT AND 200-DAY AVERAGE... Last week's message suggested that the S&P 500 was headed for a test of its 200-day moving average (red line) and a rising trendline drawn under its October/March lows. Chart 1 shows that test taking place...

READ MORE

MEMBERS ONLY

When the Dollar Stops Going Up, Will These Markets Stop Going Down?

by Martin Pring,

President, Pring Research

The Dollar Index

I last wrote an article on the dollar in August, The Dollar Index Goes to Missouri. In it, I pointed out that the Index had reached crucial resistance, which, if surpassed, would signal a new primary bull market and a likely fourth up leg to the secular...

READ MORE

MEMBERS ONLY

Focus on Stocks: October 2023

by Larry Williams,

Veteran Investor and Author

First & Foremost

I want to personally thank you for subscribing to "Focus on Stocks". I will do all I can to earn the confidence you have placed in me. -- Larry Williams

Is it a Different World?

"I have to pay attention to the implications of...

READ MORE

MEMBERS ONLY

FALLING BOND PRICES ARE HURTING BOND PROXIES LIKE UTILITIES, REITS, AND CONSUMER STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEPTEMBER SECTOR RANKING... September has lived up to its reputation of being the year's weakest month. All major stock indexes have fallen during the month. And so have most S&P sectors -- except for one. Chart 1 shows energy being the only sector to end the...

READ MORE

MEMBERS ONLY

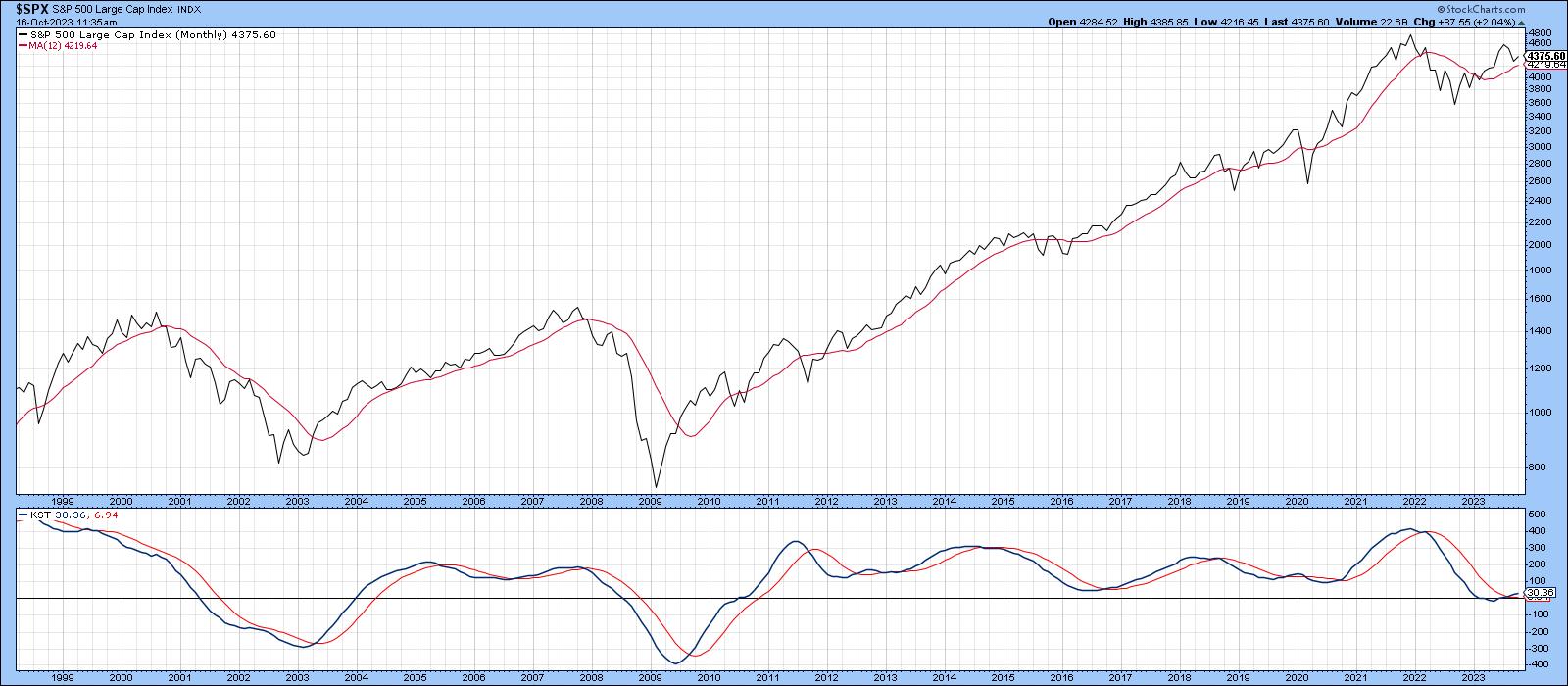

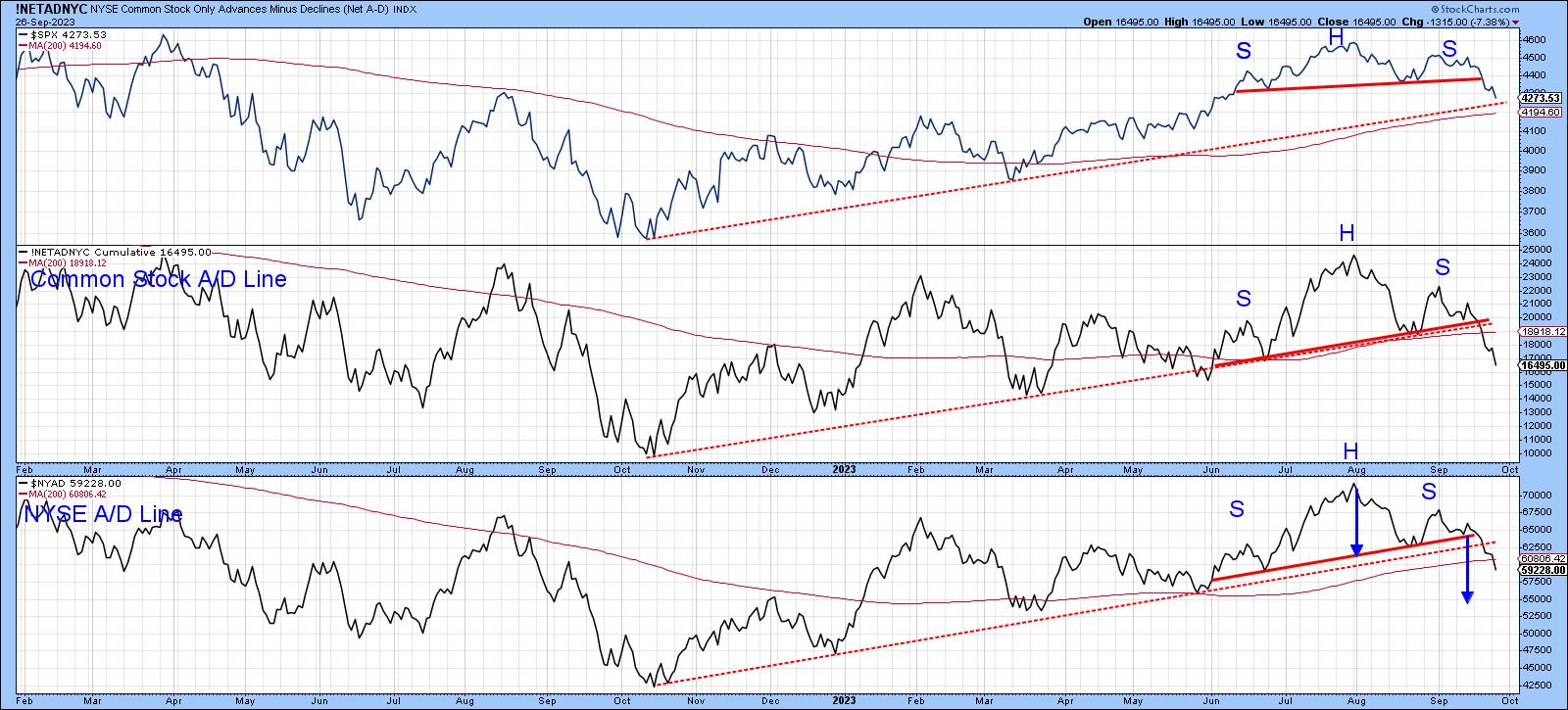

This Stock Market Looks Horrible... But...

by Martin Pring,

President, Pring Research

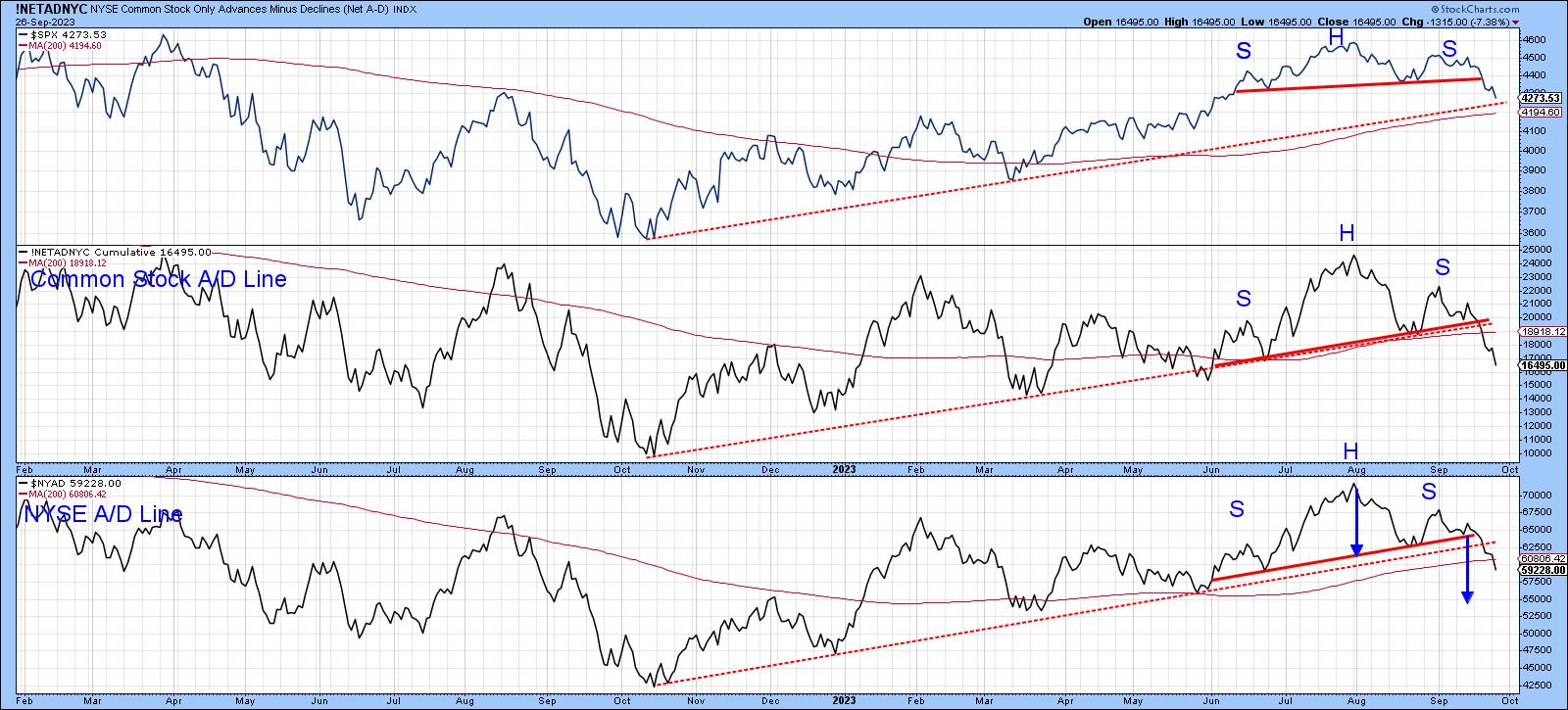

Chart 1 shows that the S&P Composite, like both A/D Lines, has completed and decisively broken down from a head-and-shoulders top. The two breadth indicators have also violated their bull market up trendlines. On the surface, things look pretty grim, with three seasonally weak September days left...

READ MORE

MEMBERS ONLY

SPIKE IN TEN-YEAR YIELD PUSHES STOCKS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR BOND YIELD HITS 16-YEAR HIGH...Recent market messages have been focusing on the upturn in energy prices which threatened to boost inflation pressures and put upward pressure on bond yields. Those same messages have shown the 10-year Treasury yield nearing an upside breakout. That breakout took place this week...

READ MORE

MEMBERS ONLY

It's Time to Get Long

by Larry Williams,

Veteran Investor and Author

As a follower of my "Focus on Stocks" blog, you know we had a signal to sell on the opening Sunday night (10th day left).

That was forecast last month... now I think it's time to start to get long.

Where? At the August lows.

When?...

READ MORE