MEMBERS ONLY

Equities Continue to Show Long-term Deterioration

by Martin Pring,

President, Pring Research

* Value Line Arithmetic violates key uptrend line.

* Introducing the Bottom Fisher, but unfortunately not the bottom!

* Stock/bond ratio at the brink.

* 5-year yield between two key converging trend lines.

* Gold/stock ratio on the verge of an upside breakout.

US Equities

The bullish seasonal end of the month period...

READ MORE

MEMBERS ONLY

FINANCE SPDR TESTS THE MAY BREAKOUT -- MORGAN STANLEY AND JP MORGAN TESTS KEY SUPPORTS -- THREE IMPROVING INDUSTRY GROUPS ON RRG -- REGIONAL BANK SPDR HEADS FOR MAJOR SUPPORT TEST -- METALS & MINERS SPDR FORMS BIG BULLISH CONTINUATION PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCE SPDR TESTS THE MAY BREAKOUT... Link for today's video. The Finance SPDR (XLF) got slammed last week and broke first support in the 22.50 area. Will it continue lower and drag the market down? Or, will XLF firm and resume the bigger uptrend. Here's...

READ MORE

MEMBERS ONLY

GERMANY LEADS REST OF THE WORLD INTO DOWNSIDE CORRECTION -- A LOT OF MOVING AVERAGES HAVE BEEN BROKEN -- BOND YIELDS FALL AT WEEK'S END -- RISING DOLLAR HAS CONTRIBUTED TO COMMODITY SELLOFF -- % NYSE STOCKS ABOVE 50 AND 200-DAY AVERAGES PLUNGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

GERMAN DAX FALLS BELOW 200-DAY AVERAGE... My last two messages warned that weakness in the Eurozone threatened the global rally in stocks, including the U.S. Not surprisingly, this week's plunge in Europe finally had a negative impact on most other developed markets. Chart 1 shows EMU iShares...

READ MORE

MEMBERS ONLY

USING RSI TO TIME A BOUNCE IN THE S&P 500 -- KEY LEVELS FOR SMALL AND MID-CAP ETFS -- AUGUST SEASONAL PATTERNS ARE NEGATIVE FOR STOCKS -- SEASONAL PATTERNS DO FAVOR A STOCK ALTERNATIVE THOUGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

USING RSI TO TIME A BOUNCE IN THE S&P 500... Link for today's video. The S&P 500 finally came under selling pressure to join small-caps and mid-caps with a pullback. The S&P 500 was down 2% on Thursday, which was the sharpest...

READ MORE

MEMBERS ONLY

Can a Weakening Stock Market take Advantage of the Bullish End-of-the-month Seasonal? (video)

by Martin Pring,

President, Pring Research

Click here for the printed version of this article....

READ MORE

MEMBERS ONLY

THE DOW ENDS THE MONTH ON A WEAK NOTE -- $SPX FALLS STRAIGHT THROUGH ITS 50 DMA -- THE RUSSELL 2000 ($RUT) TOUCHES THE 200 DMA AGAIN -- RUSSELL 2000 ($RUT) SHOWS SIMILARITIES TO 2011 -- TECH NAMES FAIL TO MAKE PROGRESS AFTER EARNINGS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW ENDS THE MONTH ON A WEAK NOTE... The Dow Jones Industrial Average ($INDU) tested the 50 DMA yesterday on Chart 1. Today it failed to hold above it and spent all day below the commonly watched average and closed on the low of the day, week and month....

READ MORE

MEMBERS ONLY

Can a Weakening Stock Market Take Advantage of the Bullish End-of-the-month Seasonal?

by Martin Pring,

President, Pring Research

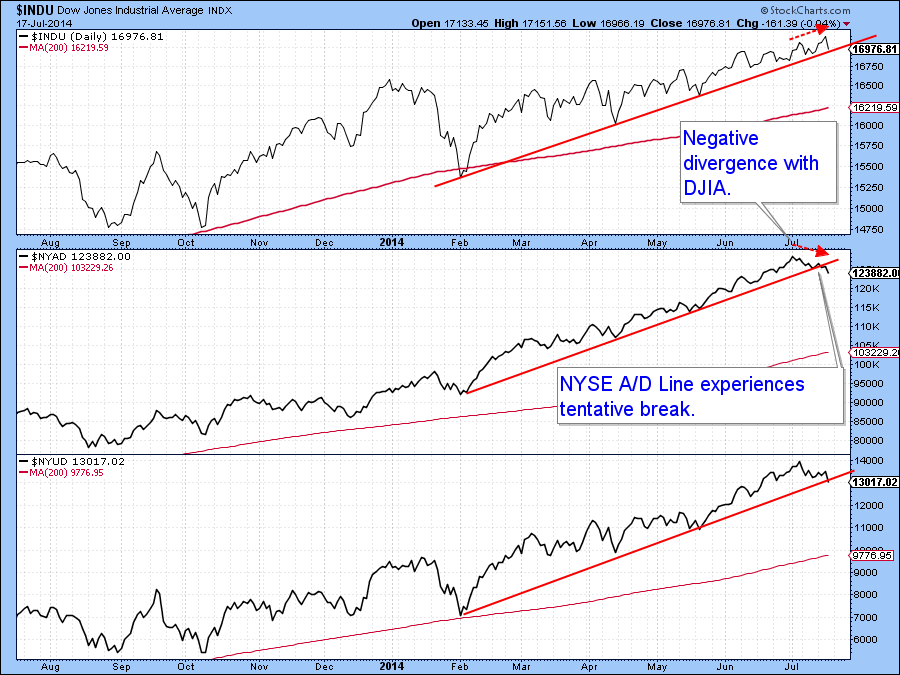

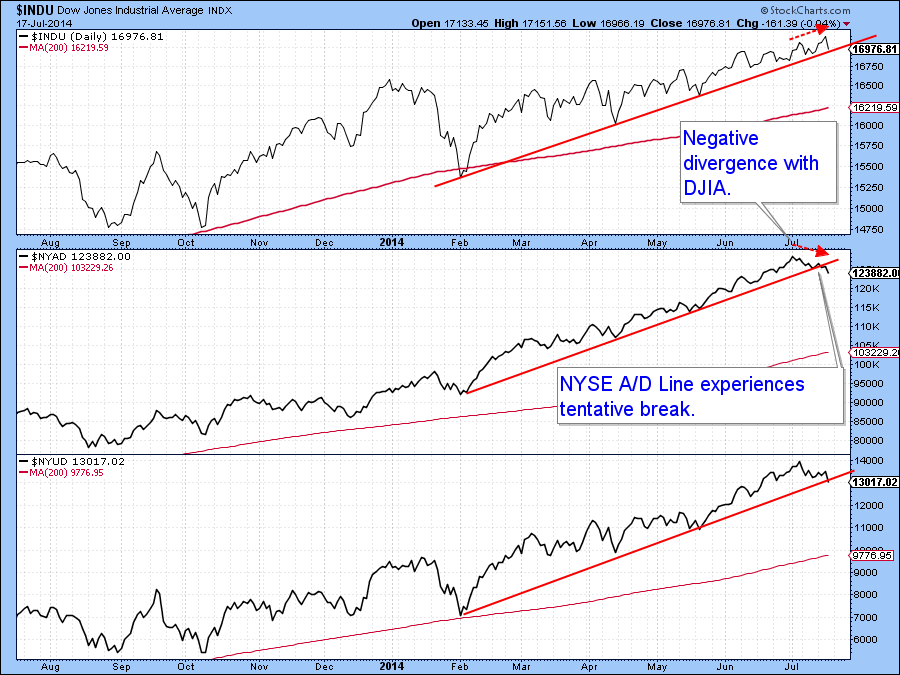

* Breadth continues to deteriorate following Special K sell signal for the NYSE Composite.

* Bonds are likely to violate an important up trendline.

* Gold and commodities may be about to reverse their recent declines.

(Click here for the video version of this article.)

US Equities

The US equity market has not...

READ MORE

MEMBERS ONLY

EUZOZONE CURRENCY AND STOCKS REMAIN UNDER PRESSURE -- GERMAN ISHARES SLIP BELOW 200-DAY LINE -- RECORD LOW BOND YIELDS IN EUROPE ARE PULLING TREASURY YIELDS LOWER -- UPTURN IN DOLLAR SHOULD LIMIT GAINS IN GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

EUROZONE REMAINS UNDER PRESSURE... The Eurozone has been under a lot of pressure lately as reflected in the falling Euro and stock prices. That downside pressure may increase with this week's announcement of more sanctions imposed on Russia. Eurozone countries are the most vulnerable to growing tensions in...

READ MORE

MEMBERS ONLY

SECTORS REFLECT MIXED MARKET -- XLI AND XLY FORM CORRECTIVE PATTERNS -- BROKER-DEALER INDEX EXCEEDS PRIOR HIGH -- SCHWAB LEADS ETRADE AND TD AMERITRADE -- A BIG WEEK FOR TREASURY BONDS AND YIELDS -- 10-YR TREASURY YIELD STALLS NEAR OCTOBER LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

SECTORS REFLECT MIXED MARKET... Link for today's video. The stock market as a whole has been quite mixed over the past month. Note that the S&P 500 SPDR (+1%) and Nasdaq 100 ETF (+3.3%) are up month-to-date, but the Russell 2000 iShares (-3.5%) and...

READ MORE

MEMBERS ONLY

RETAIL ETFS TEST IMPORTANT SUPPORT LEVELS -- COAL AND STRATEGIC METALS FOLLOW CHINESE STOCKS HIGHER -- MAJORITY OF SMALL AND MID CAPS ARE BELOW THEIR 50-DAY EMAS -- BUT THE MAJORITY OF LARGE CAPS ARE ABOVE THEIR 50-EMAS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAIL ETFS TEST IMPORTANT SUPPORT LEVELS... Link for today's video. The Retail SPDR (XRT) and the MarketVectors Retail ETF (RTH) are still in uptrends, but both are testing important support levels that hold the key to these uptrends. Chartists should watch these two closely because breakdowns would be...

READ MORE

MEMBERS ONLY

Birth of the Cool: A New Bull Market for Chinese Equities?

by Martin Pring,

President, Pring Research

* Shanghai breaks bear market trendline and takes the FXI with it.

* Long-term relative action suggests the FXI is no longer a world laggard, but a leader instead.

* Shanghai correlation with commodities argues for higher commodity prices in general.

* Chinese materials, real estate and energy ETF’s break to the upside....

READ MORE

MEMBERS ONLY

SMALL CAP/ LARGE CAP DIVERGENCE IS WORST IN THREE YEARS -- HIGH YIELD BOND WEAKNESS MAY ALSO BE CAUTION SIGNAL FOR STOCKS -- CHINA LEADS EMERGING MARKET BREAKOUT WHICH BOOSTS BASE METALS -- EUROZONE WEAKENS ON GLOBAL TENSIONS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAP DIVERGENCE IS TROUBLING... Although the U.S. stock market has shown impressive resilience over the past few months, there are some troubling signs beneath the surface. One is the negative divergence between small caps and large caps. Since March 5, the S&P 500 Large Cap Index...

READ MORE

MEMBERS ONLY

LARGE-CAPS DO THEIR PART -- HERE'S WHAT TO WATCH IN SMALL AND MID CAPS -- BROAD MARKET HIGH-LOW LINE CONTINUES HIGHER -- SMALL-CAP HIGH-LOW INDICATOR REMAINS IN CORRECTIVE MODE -- SEMICONDUCTOR ETF BREAKS DOWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

LARGE-CAPS CONTINUE TO DO THEIR PART... Link for today's video. The S&P 500 SPDR (SPY) continued its uptrend with a move above the upper trend line of a pennant and a new high this week. Technically, a pennant within an uptrend is a bullish continuation pattern...

READ MORE

MEMBERS ONLY

$SPX MAKES ANOTHER NEW CLOSING HIGH -- $COMPQ TESTS AT NEW HIGHS EARLY IN TRADE -- $COMPQ APPROACHES THE HIGHEST MONTHLY CLOSE OF THE YEAR 2000 -- $INDU TRADES SIDEWAYS THROUGH EARNINGS -- WILSHIRE 5000 ($WLSH) SHOWS BROAD SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

$SPX MAKES ANOTHER NEW CLOSING HIGH ... With the S&P 500 ($SPX) hitting new highs (1991) again today, the index is only 27 points from the 2014 level in the year 2014. That is a little more than 1% from today's high. On Chart 1 we can...

READ MORE

MEMBERS ONLY

Homebuilders may be on the Verge of a Major Breakdown

by Martin Pring,

President, Pring Research

* General correction in US equities not over despite a higher S&P.

* Dollar Index breaks to the upside.

* Gold likely to experience more base building before moving higher.

* CRB meets downside objective, now we will see how it can handle a rally.

US Equities

Last week I pointed out...

READ MORE

MEMBERS ONLY

THREE STYLES AND THREE DEGREES OF CORRECTION -- USING THE RAFF CHANNEL TO DEFINE A MOVE -- SOLAR ENERGY ETF TESTS TWO KEY MOVING AVERAGES -- SUNPOWER AND SOLAR CITY LEAD THE GROUP -- URANIUM ETF SURGES OFF SUPPORT -- CAMECO AND DENISON LEAD URANIUM STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THREE STYLES AND THREE DEGREES OF CORRECTION... Link for today's video. A style index or ETF is one that groups stocks by market cap. This is sometimes taken further by subdividing these groupings into value and growth components. For example, we have the S&P 500 (large-cap)...

READ MORE

MEMBERS ONLY

STOCKS END THE WEEK ON A HIGH NOTE -- BUT SMALL CAPS STILL LAG -- BIOTECH AND INTERNET STOCKS LEAD FRIDAY'S BOUNCE -- GOOGLE AND FACEBOOK LEAD INTERNET GROUP HIGHER -- GOLD MINERS ARE DOING BETTER THAN BULLION -- SILVER STOCKS ARE EVEN STRONGER

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES END WEEK HIGHER... A strong rebound on Friday helped U.S. large cap stock indexes end the week higher. That kept their uptrends intact. The week's strongest gainers were the Dow Industrials (+0.92%). Chart 1 shows the Dow Industrials ending the week above...

READ MORE

MEMBERS ONLY

KEY BREADTH INDICATOR STILL BULLISH -- REVISITING THE 2007 TOP -- NO MAJOR TOPPING PATTERN FOR IWV -- HOME CONSTRUCTION ISHARES FAILS TO HOLD SUPPORT -- REGIONAL BANK ETF BREAKS DOWN -- AROON SIGNAL TRIGGERS IN BIOTECH ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

KEY BREADTH INDICATOR STILL BULLISH ... Link for today's video. While there are certainly a few negatives regarding the stock market, the bulk of the evidence remains bullish. Among the negatives, the Russell 2000 iShares is down around 7% from its early July high and shows relative weakness since...

READ MORE

MEMBERS ONLY

DOW JONES INDUSTRIAL AVERAGE MAKES NEW HIGH -- $SPX TRADES ON HIGHER THAN AVERAGE VOLUME -- $INDU:$RUT RATIO ACCELERATES WITH A PACE UNMATCHED SINCE QE3 STARTED -- VALUE LINE INDEX $VLE STARTS TO UNDER PERFORM

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES INDUSTRIAL AVERAGE MAKES NEW HIGH... The Dow Jones Industrial Average ($INDU) broke out to new highs on Thursday morning in Chart 1. At the close on Wednesday, the Dow had pushed and closed above 17100. This morning, we made an intraday high of 17151 before selling off to...

READ MORE

MEMBERS ONLY

New Highs in the Dow Don't Translate Elsewhere

by Martin Pring,

President, Pring Research

* Less than 50% of NASDAQ stocks are above their 200-day MA’s.

* Bond market confidence ratio on the verge of a major breakdown.

* US Dollar Index could be about to break to the upside.

Click here for video version

US Equities

The Dow touched an all-time high this week but...

READ MORE

MEMBERS ONLY

COMMODITY PRICES TAKE A DIVE -- AGRICULTURAL MARKETS ARE MAIN REASON WHY -- INDUSTRIAL METALS REMAIN FIRM -- A BOUNCING DOLLAR MAY HAVE CONTRIBUTED TO PROFIT-TAKING IN PRECIOUS METALS -- MOST OF THE DOLLAR STRENGTH IS COMING FROM A WEAK EURO

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES TAKE A SLIDE... Commodities were the strongest asset class during the first half of the year. That's no longer the case. Chart 1 shows the DB Commodities Tracking ETF (DBC) tumbling since mid-June to the lowest level in five months. It has also fallen below its 200-day...

READ MORE

MEMBERS ONLY

TIMBER ETF FORMS CLASSIC CORRECTIVE PATTERN -- AEROSPACE & DEFENSE ETF BOUNCES OFF SUPPORT -- RETAIL SPDR PULLS BACK FROM NEW HIGH -- MARKETVECTORS RETAIL ETF STALLS ABOVE BREAKOUT -- DEATH-CROSS HANGS OVER THE COAL ETF

by John Murphy,

Chief Technical Analyst, StockCharts.com

TIMBER ETF FORMS CLASSIC CORRECTIVE PATTERN ... Link for today's video. Chart 1 shows the Timber ETF (CUT) with a corrective wedge taking shape over the last few weeks. Overall, the ETF hit a new high in early March and then fell sharply into mid April. With the rebound...

READ MORE

MEMBERS ONLY

SELLING PRESSURE IS STILL QUITE LIMITED -- RUSSELL 2000 ISHARES NEARS FIRST SUPPORT ZONE -- FINANCE SPDR BOUNCES OFF SUPPORT -- REGIONAL BANK SPDR FAILS AT FLAG, BUT HOLDS SUPPORT -- YIELD SPREAD CONTINUES TO NARROW

by John Murphy,

Chief Technical Analyst, StockCharts.com

SELLING PRESSURE IS STILL QUITE LIMITED... Link for today's video. Last week was rough for small-caps and micro-caps as they bore the brunt of selling pressure. There are concerns with relative weakness in small-caps and July-August seasonal patterns, but recent selling pressure was lopsided and confined to a...

READ MORE

MEMBERS ONLY

Sectors and Industry Groups to Avoid or Embrace

by Martin Pring,

President, Pring Research

* Fading Sectors/Industries: Financial, Homebuilders, Consumer, Biotech, Small Cap, Industrial

* Emerging Sectors/Industries: Energy, Mines, Basic Materials, Gold Miners

Sector rotation is a continual process, but recently several old favorites have started to lose favor, and several previously discarded ones are coming to the fore. I am going to run...

READ MORE

MEMBERS ONLY

HOME CONSTRUCTION ISHARES TESTS KEY SUPPORT -- DJ AIRLINE INDEX BOUNCES FROM OVERSOLD TERRITORY -- THE KEY LEVEL TO WATCH ON THE GOLD BREAKOUT -- EURO TESTS A MAJOR SUPPORT ZONE -- BANDWIDTH HITS 52-WEEK LOW FOR YEN INDEX -- NIKKEI 225 IGNORES A FIRM YEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOME CONSTRUCTION ISHARES TESTS KEY SUPPORT... Link for today's video. Chart 1 shows the Home Construction iShares (ITB) breaking out with a move in late May and early June, but then falling back to support this week. The sharpness of this week's decline is a concern...

READ MORE

MEMBERS ONLY

MARKETS OPEN DOWN 1% THEN RALLY OFF SUPPORT -- $RUT LEADS TO THE DOWNSIDE AGAIN -- C, GS, JPM STALL AT 40 WMA -- BROKER DEALER INDEX IS WEAKENING AS WELL -- THE BANKING ETF SHOWS MORE WEAKNESS FOR THE BANKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS OPEN DOWN 1% THEN RALLY OFF SUPPORT.... The S&P500 ($SPX) opened 1% lower in the first few minutes this morning and rallied throughout the day. It bounced off the support provided by the June 9 high and the June 26th low. From Chart 1 we can see...

READ MORE

MEMBERS ONLY

Gold Shares Break to the Upside

by Martin Pring,

President, Pring Research

* Brokers are leading the market lower

* NASDAQ Composite leaves a lot to be desired

* The balance of evidence suggests lower near-term bond prices

* Commodities complete a short-term top

US Equities

The correction we have been talking about in the last couple of Market Roundups is likely to continue.

As Art...

READ MORE

MEMBERS ONLY

BRAZIL STOCKS BOUNCE BACK FROM BIG SOCCER LOSS -- METAL STOCKS CONTINUE TO SHINE -- FREEPORT MCMORAN COPPER & GOLD BREAKS OUT -- ALCOA HITS THREE-YEAR HIGH -- NEWMONT MINING HELPS LEAD GOLD SHARES HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

BRAZIL IS GAINING ON GERMANY ... No, that's not a comment on a soccer game. It's a comment on the fact that Brazil stocks are doing better than Germany's this year (unlike their soccer team). That's a reversal of trends seen since 2011....

READ MORE

MEMBERS ONLY

RUSSELL 2000 PLUNGES FROM RANGE RESISTANCE -- INTERNET ETF REVERSES AT KEY RETRACEMENT -- AMAZON TESTS SUPPORT AS FACEBOOK AND LINKEDIN BREAK DOWN -- DOG DAYS OF SUMMER REFLECTED IN SEASONALITY CHART -- FIRST SUPPORTS TO WATCH FOR S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 PLUNGES FROM RANGE RESISTANCE... Link for today's video. Small-caps are leading the market lower with sharp declines the last two days. Chart 1 shows the Russell 2000 surging to its March high last week, stalling for a couple days and felling over 3% the last few...

READ MORE

MEMBERS ONLY

STOCKS MOVE INTO OFFENSIVE MODE -- CONSUMER DISCRETIONARY AND TECH JOIN THE LEADERSHIP CIRCLE -- SPY ZEROS IN ON 200 AS S&P 500 TARGETS 2000 -- INFLATION IS EDGING HIGHER, BUT STILL CONTAINED -- TREASURY BOND ETFS BACK OFF LONG-TERM RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS MOVE INTO OFFENSIVE MODE... Link for today's video. The stock market stepped it up another gear with big gains and new highs. Most of the major index ETFs recorded new highs this month already. The Russell 2000 iShares (IWM) hit an intraday new high last week and...

READ MORE

MEMBERS ONLY

GOOD NEWS ON EMPLOYMENT CONTINUES GLOBAL MARKETS SURGE -- $SPX ONLY 1% AWAY FROM 2000 -- $INDU POWERS THROUGH 17000 -- $RUT REACHES TOP OF TRADING RANGE -- $USD CONTINUES SIDEWAYS RANGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOOD NEWS ON EMPLOYMENT CONTINUES GLOBAL MARKETS SURGE... The month of July has continued the positive push that June had going. With the big surge on July 1, the Wednesday market closed with a small consolidation candle. Today's shortened trading session pushed up to new highs on the...

READ MORE

MEMBERS ONLY

Dollar Index Faces Important Technical Test

by Martin Pring,

President, Pring Research

Click here for a written version of this article....

READ MORE

MEMBERS ONLY

STRONG DATA FROM CHINA BOOSTS COPPER -- FREEPORT MCMORAN COPPER & GOLD IS BREAKING OUT -- STRONG AUTOS ARE GOOD FOR COPPER -- GM AND TOYOTA LEAD AUTO RALLY -- AUTO DEMAND IS ALSO HELPING PLATINUM AND PALLADIUM

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER PRICES HIT FIVE-MONTH HIGH... Copper prices are turning in a strong performance. Chart 1 shows the September 2014 futures contract (^HGU14) climbing sharply to reach a five-month high (see arrow). The industrial metal has also climbed over its 200-day moving average. Chart 2 shows that rise also being reflected...

READ MORE

MEMBERS ONLY

SMALL AND MID CAP ETFS HIT NEW HIGHS -- AS DOES HALF OF THE RUSSELL 2000 -- CONSUMER DISCRETIONARY SECTOR CHALLENGES PRIOR HIGH -- RETAILERS LIFT CONSUMER DISCRETIONARY SECTOR -- USING THE SECTOR SUMMARY TO FIND STOCKS IN A GROUP

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL AND MID CAP ETFS HIT NEW HIGHS... Link for today's video. The S&P MidCap 400 (MDY) and S&P SmallCap iShares (IJR) were lagging the S&P 500 SPDR and Nasdaq 100 ETF in late May, but started playing catch up in June...

READ MORE

MEMBERS ONLY

REGIONAL BANK SPDR STALLS AFTER BIG MOVE -- REGIONS AND FNB FORM FLAG PATTERNS -- HOME CONSTRUCTION ISHARES BOUNCES AND HOLDS BREAKOUT -- NEW HOME SALES HIT MULTI-YEAR HIGH -- NETWORKING ISHARES BREAKS FLAG RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

REGIONAL BANK SPDR STALLS AFTER BIG MOVE... Link for today's video. Chart 1 shows the Regional Bank SPDR (KRE) holding support near the 37 area and surging above 39 in early June. Overall, the trend on the weekly chart is up because the ETF hit a new high...

READ MORE

MEMBERS ONLY

COMMODITIES ARE THE BIGGEST FIRST HALF WINNERS -- LONG-TERM TREND FAVORS STOCKS OVER BONDS -- RISING COMMODITIES MAY HELP STOCKS, BUT ARE BAD FOR BONDS -- RISING COMMODITIES BOOST ENERGY AND MATERIAL STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMMODITIES AND STOCKS WERE TOP FIRST HALF PERFORMERS... With the first half of the year coming to a close, it's a good time to study the relative performances of the various asset classes. Chart 1 shows that commodities and stocks were the two biggest gainers -- and in...

READ MORE

MEMBERS ONLY

STOCKS STALL, BUT SELLING PRESSURE REMAINS SUBDUED -- SMALL DIVERGENCES APPEAR IN AD LINES -- GLOBAL AUTO ETF HITS A NEW HIGH -- FORD, GM AND TESLA POWER CARZ -- AUTO PARTS INDEX BREAKS TO NEW HIGH -- AMERICAN AXLE BOUNCES OF SUPPORT ZONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS STALL, BUT SELLING PRESSURE REMAINS SUBDUED... Link for today's video. After hitting a new high last week, the Russell 1000 iShares (IWB) was hit with sudden selling pressure on Tuesday afternoon. This reversal day certainly looked negative on an intraday or candlestick chart, but it was not...

READ MORE

MEMBERS ONLY

OLD TECH LEADERS RESUME PUSH TO TRY FOR HIGHER HIGHS -- THE FINAL READING ON Q1 GDP MAKES Q2 GDP VERY IMPORTANT -- 30 YEAR BOND TURNS UP AGAIN -- IEF - 7 TO 10 YEAR BOND FUND IS PUSHING HIGHER -- HYG IS SOARING TO NEW HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

OLD TECH LEADERS RESUME PUSH TO TRY FOR HIGHER HIGHS... While the Nasdaq 100 ($NDX) shown in Chart 1 has pushed above the March 6th highs, some of the high momentum leaders like Amazon (AMZN) have remained well back as shown on Chart 2. AMZN is still struggling with the...

READ MORE

MEMBERS ONLY

SEASONAL LOWS MAY BE SETTING UP IN CORN AND WHEAT -- LONG TERM VIEW OF CORN VOLATILITY FOR JUNE/JULY PERIOD -- CORN IS HIGHLY CORRELATED WITH WHEAT AND SOYABEANS -- INVESTING DIRECTLY IN CORN OR WHEAT THROUGH TRACKING FUNDS -- DEERE AND CO TEST RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEASONAL LOWS SETTING UP IN CORN AND WHEAT... Corn ($CORN) has a six month cyclical pattern where it marks significant sudden reversals as shown in Chart 1. The July 1 period is extremely volatile. The June 30 release of the crop report is one of the main reasons for the...

READ MORE