MEMBERS ONLY

A COMPARISON OF GLOBAL STOCKS SHOWS UNUSUAL DIVERGENCES -- MONEY MAY BE STARTING TO ROTATE OUT OF THE U.S. INTO FOREIGN STOCKS, ESPECIALLY EMERGING MARKETS -- EMERGING MARKETS ISHARES MAY BE BREAKING OUT TO THE UPSIDE

by John Murphy,

Chief Technical Analyst, StockCharts.com

COMPARISON OF GLOBAL STOCK INDEXES ... While U.S. stocks are starting to struggle on fears of high valuation, some money is starting to flow into foreign stocks that show better value. Chart 1 shows the S&P 500 doing better than foreign developed and emerging markets since the October...

READ MORE

MEMBERS ONLY

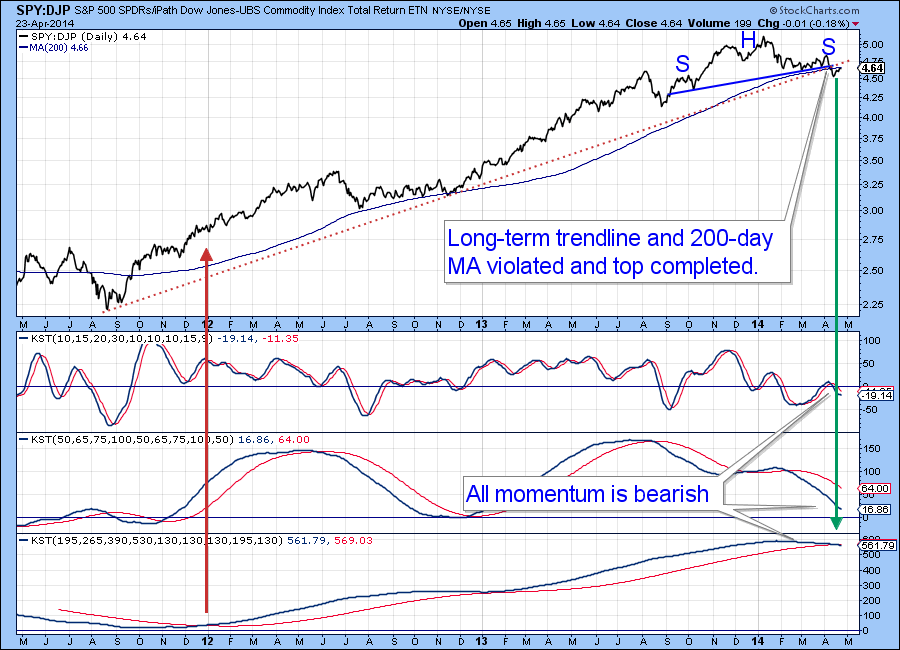

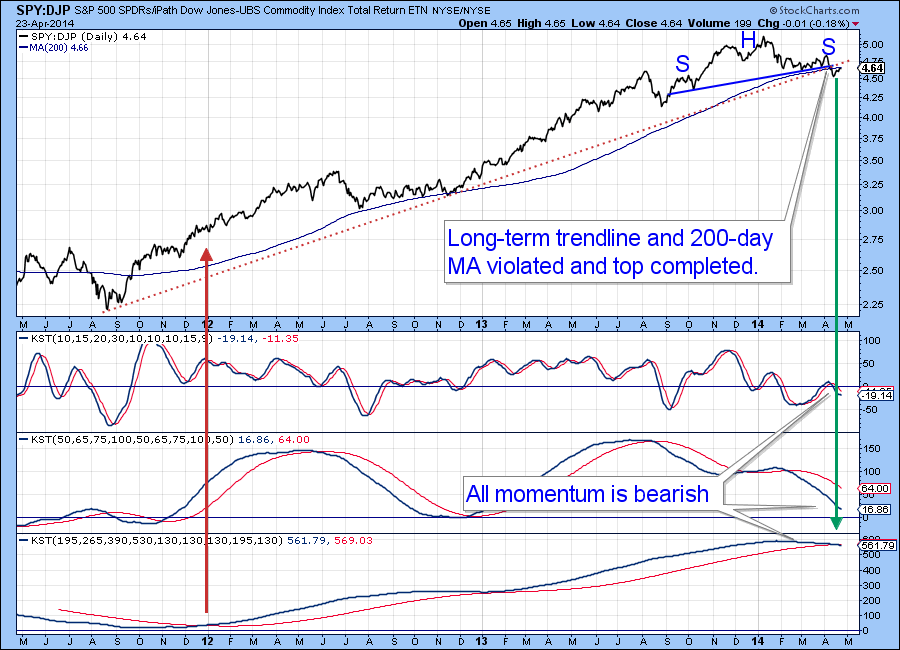

Are Japanese Equities Topping Out? If so, Will US Equities be Far Behind?

by Martin Pring,

President, Pring Research

* Japanese Equities May be on the Verge of a Major Breakdown.

* Yen Close to an Unexpected Upside breakout?

* Nikkei has led Every US Stock Market Peak Since 1990.

Normally Martin Pring's Market Roundup, the PMR, will give you a short-term synopsis of the US equity and bond markets...

READ MORE

MEMBERS ONLY

QQQ AND MDY FORM BEARISH CONTINUATION PATTERNS -- HOUSING STARTS AND BUILDING PERMITS TICK HIGHER -- A VOLATILITY SQUEEZE HITS THE HOME CONSTRUCTION ISHARES -- PLUNGE IN YIELDS WEIGHS ON REGIONAL BANKS AND BROKERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ AND MDY FORM BEARISH CONTINUATION PATTERNS... Bearish wedges are appearing on some key charts and chartists should watch these closely for directional clues. A bearish wedge is typically a continuation pattern that forms after a decline. Like a bear flag, bearish wedges slope up and represent a corrective bounce...

READ MORE

MEMBERS ONLY

DOW JONES INDUSTRIAL AVERAGE FAILS TO HOLD BREAKOUT LEVEL -- S&P 500 FALLS BELOW SUPPORT AS WELL -- THE NASDAQ FINDS RESISTANCE AT THE 50 DMA -- NASDAQ COMPOSITE IS PART WAY THROUGH A POTENTIAL TOPPING STRUCTURE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES INDUSTRIAL AVERAGE FAILS TO HOLD BREAKOUT LEVEL... The Dow Jones Industrial Average ($DJIA) has been the strongest of the 4 main indexes recently. On Thursday, the Dow was unable to hold its breakout level. It pushed down to the 50 Day Moving Average (50 DMA). The rally which...

READ MORE

MEMBERS ONLY

10-YEAR T-NOTE YIELD FALLS TO SEVEN MONTH LOW -- THAT'S ANOTHER NEGATIVE DIVERGENCE FOR STOCKS -- ANOTHER NEGATIVE WARNING IS THAT HIGH YIELD BONDS ARE UNDERPERFORMING TREASURIES -- SMALL CAP WEAKNESS CONTINUES TO WEIGH ON MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELDS FALL TO SEVEN-MONTH LOW... Chart 1 shows the 10-Year Treasury Note Yield (TNX) falling below its early February low in today's trading. That puts the TNX at the lowest level since last October. Normally, a falling bond yield signals that investors are turning more pessimistic...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SECTOR REMAINS THE WEAKEST LINK -- EW CONSUMER DISCRETIONARY ETF BOUNCES OFF TREND LINE -- RETAIL ETFS SURGE TO ESTABLISH KEY SUPPORT LEVELS -- RAILROAD INDEX CONSOLIDATES WITHIN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SECTOR REMAINS THE WEAKEST LINK... Link for today's video. Weakness in retailers and homebuilders weighed on the consumer discretionary sector and caused it to be the worst performing sector over the last three months. PerfChart 1 shows performance for the nine sectors since February 12th (three...

READ MORE

MEMBERS ONLY

QQQ CHALLENGES RESISTANCE AS IWM SURGES OFF SUPPORT -- REGIONAL BANK SPDR PLOWS THROUGH TREND LINE -- INTERNET ETF SURGES TOWARDS TREND LINE RESISTANCE -- BIOTECH ISHARES GETS A BULLISH AROON SIGNAL -- COPPER MINERS ETF FORMS BULLISH REVERSAL PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ CHALLENGES RESISTANCE AS IWM SURGES OFF SUPPORT... Link for today's video. The market surged on Monday with the Dow Industrials hitting a new high and the S&P 500 challenging its early April high. Despite a new high in the Dow, today's big story...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 END WEEK NEAR OLD HIGHS -- WHILE WEAKER NASDAQ AND SMALL CAP INDEXES TRY TO STAY ABOVE CHART SUPPORT -- STRONGER HOMEBUILDERS WOULD MAKE MS. YELLEN FEEL BETTER -- TREASURY YIELDS AND THE DOLLAR BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 END WEEK NEAR OLD HIGHS ... Today's message reads like a tale of two markets. Large cap blue chip indexes turned in a good week and are near record highs. Chart 1 shows the Dow Industrials bouncing off their 50-day average on Wednesday...

READ MORE

MEMBERS ONLY

S&P 500 AD LINE HITS NEW HIGH -- S&P MIDCAP SPDR STALLS WITH RISING WEDGE -- S&P SMALLCAP ISHARES CHANNELS LOWER -- FINANCE SECTOR BULLISH PERCENT INDEX SURGES -- PRUDENTIAL TRIGGERS P&F BUY SIGNAL -- THE YIELD CURVE REMAINS POSITIVE AND STEEP

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 AD LINE HITS NEW HIGH... Link for today's video. The market remains split with large-caps holding up well since early March and small gaps moving lower the last two months. Mid-caps are caught somewhere in the middle and may ultimately tip the balance. Chart...

READ MORE

MEMBERS ONLY

$NDX BULLISH PERCENT TURNS UP -- OTHER INTERNAL NASDAQ INDICATORS REACH SELLING REVERSAL LEVELS -- THE 50:200 RATIO ALSO SUGGESTS WE ARE NEAR THE LOWS -- TIME SPAN FOR MARKET PULLBACK IS SIMILAR -- THE HIGH FLYERS ARE STILL DRIFTING

by John Murphy,

Chief Technical Analyst, StockCharts.com

$NDX BULLISH PERCENT TURNS UP... The Nasdaq Exchange has been one of the hardest hit in the latest downturn. While the Dow Jones Industrial Average ($INDU) was hitting new highs and the S&P 500 ($SPX) kept retesting the 1885 level, the Nasdaq Composite ($COMPQ) kept dropping as shown...

READ MORE

MEMBERS ONLY

FALLING TREASURY YIELDS AND A WEAKER DOLLAR ARE HELPING BOOST EMERGING MARKET BONDS, CURRENCIES, AND STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELD AND DOLLAR REMAIN WEAK... Treasury bond yields continue to weaken. Chart 1 shows the 10-Year Treasury Note Yield ($TNX) trading below its 50- and 200-day moving averages and just a couple of tics above its early February low. A drop below that earlier level would put the TNX...

READ MORE

MEMBERS ONLY

SEMICONDUCTOR SPDR TESTS SUPPORT AS QQQ HITS RESISTANCE -- CONSUMER DISCRETIONARY SPDR STALLS AT RESISTANCE -- MATERIALS SPDR GOES FOR DIAMOND BREAKOUT -- HEALTHCARE PROVIDERS ETF BOUNCES NEAR KEY RETRACEMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR SPDR TESTS SUPPORT AS QQQ HITS RESISTANCE... Link for today's video. As noted in prior commentaries, there is a certain dichotomy at work among the ETFs and indices in the stock market. For example, the Nasdaq and Russell 2000 are bouncing off support, but the S&...

READ MORE

MEMBERS ONLY

S&P 500 AND DOW CONSOLIDATE AT RESISTANCE -- RUSSELL 2000 AND THE NASDAQ TRIANGULATE NEAR SUPPORT -- JP MORGAN FOLLOWS BANK OF AMERICA WITH A GAP DOWN -- FINANCE SECTOR TESTS WEDGE TREND LINE -- INSURANCE ROCKS, WHILE REGIONAL BANKS FAIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 AND DOW CONSOLIDATE AT RESISTANCE... Link for today's video. The S&P 500 and Dow Industrials are the two strongest indices in the stock market, but both are hitting resistance and stalling the last few days. Chart 1 shows the S&P...

READ MORE

MEMBERS ONLY

HOMEBUILDERS MAY BE GETTING A LIFT FROM STRONGER LUMBER PRICE AND FALLING BOND YIELDS -- A DOLLAR BREAKDOWN WOULD FAVOR FOREIGN MARKETS RELATIVE TO THE U.S. -- EURO IS TESTING MAJOR TRENDLINE RESISTANCE WHILE THE POUND HITS FIVE-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOUNCE IN LUMBER MAY HELP HOMEBUILDERS... My April 23 message showed the Dow Jones U.S. Home Construction iShares (ITB) testing support at its 200-day moving average. The homebuilding ETF bounced off that support line this week (see circle). A weak housing sector has been a drag on the economy...

READ MORE

MEMBERS ONLY

EQUAL-WEIGHT S&P 500 ETF CONSOLIDATES WITHIN UPTREND -- HOME CONSTRUCTION ISHARES BOUNCES WITHIN WEDGE -- DR HORTON, LENNAR AND US GYPSUM LIFT HOMEBUILDER GROUP -- DEFINING THE SECULAR TRENDS FOR THE S&P 500 AND NASDAQ 100

by John Murphy,

Chief Technical Analyst, StockCharts.com

EQUAL-WEIGHT S&P 500 ETF CONSOLIDATES WITHIN UPTREND... Link for today's video. What a boring week. The Fed policy statement came and went. The bulk of earnings have come and gone. A slew of economic reports hit the wires. The employment report has come and gone. We...

READ MORE

MEMBERS ONLY

MARKETS PAUSE AFTER DOWS NEW CLOSING HIGH ON WEDNESDAY -- $SPX CLOSES WITH A SPINNING TOP -- 30 YEAR BOND YIELD CONTINUES TO MOVE LOWER -- THE TEN YEAR YIELD IS STILL IN A TRADING RANGE -- EUROPE TOP 100 CLOSES ON THE HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS PAUSE AFTER DOWS NEW CLOSING HIGH ON WEDNESDAY... While it is possible to come out of the fed meetings with a quiet market result, today was very quiet on the equity markets. This could be due to many nations having a holiday today, or investors still analyzing their positions....

READ MORE

MEMBERS ONLY

FED CONTINUES ITS TAPERING WITH NO SURPRISES -- DOW AND S&P 500 NEAR RECORD HIGHS -- VALUE STOCKS CONTINUE TO LEAD, BUT GROWTH STOCKS ARE STARTING TO RECOVER -- BIOTECHS, INTERNET, AND DISCRETIONARY INDEXES ARE FINDING SUPPORT NEAR 200-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 NEAR RECORD HIGHS... Today's Fed announcement slashed another 10 billion from its monthly bond purchases as expected, and contained no surprises. In addition, first quarter GDP growth was basically flat. Despite that, stocks continued their recent bounce. Charts 1 and 2 show...

READ MORE

MEMBERS ONLY

SLIGHT BULLISH DIVERGENCE FORMS IN AD LINE FOR XLY -- HOME CONSTRUCTION AND RETAIL HOLD THE KEY TO XLY -- BOLLINGER BAND CONTRACTION HITS COAL ETF -- BTU, CNX AND JOYG LEAD COAL INDUSTRY -- METALS & MINERS SPDR FORMS BULLISH CONTINUATION PATTERN

by John Murphy,

Chief Technical Analyst, StockCharts.com

SLIGHT BULLISH DIVERGENCE FORMS IN AD LINE FOR XLY... Link for today's video. The Consumer Discretionary SPDR (XLY) led the way lower from early March to mid April and underperformed the broader market during this timeframe. Relative weakness in the most economically sensitive sector is negative overall, but...

READ MORE

MEMBERS ONLY

AN INFLECTION POINT FOR TREASURIES (AND MAYBE STOCKS) -- GOLD TRACES OUT A BIG CONTINUATION PATTERN -- SILVER WALLOWS NEAR SUPPORT ZONE -- GOLD AND SILVER MINING ETFS BOUNCE NEAR KEY RETRACEMENTS -- SHANGHAI COMPOSITE EXTENDS SERIES OF LOWER HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

AN INFLECTION POINT FOR TREASURIES (AND MAYBE STOCKS)... Link for today's video. This week could mark an inflection point for Treasury bonds because the Fed makes its policy statement on Wednesday and the economic docket is overflowing with reports. The fundamentals alone do not make for the inflection...

READ MORE

MEMBERS ONLY

NASDAQ LEADS THE MARKET LOWER -- BIOTECH AND INTERNET STOCKS NEAR TEST OF 200-DAY AVERAGES -- MARKET VECTORS SEMICONDUCTOR ETF PLUNGES 3% ON FRIDAY TO LEAD TECH DECLINE -- SECTOR ALIGNMENT REMAINS DEFENSIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ RALLY ATTEMPT MAY BE FAILING... The Nasdaq lost -1.75% on Friday to lead the market lower once again. The relative strength line (top of Chart 1) shows the Nasdaq/S&P 500 ratio peaking at the start of March and falling to the lowest level in eight...

READ MORE

MEMBERS ONLY

LOWER HIGHS EXTEND FOR IWM AND QQQ -- HOW IS THE S&P 500 EVEN UP THIS YEAR? -- CHARTING THE RELATIVE BULLISH PERCENT INDEX -- RELATIVE BPI'S FOR UTILITIES AND STAPLES REMAIN STRONG -- RELATIVE BPI'S BREAK DOWN IN TECH AND CONSUMER DISCRETIONARY

by John Murphy,

Chief Technical Analyst, StockCharts.com

LOWER HIGHS EXTEND FOR IWM AND QQQ... Link for today's video. Selling pressure hit small-caps and techs hard in early trading on Friday. With further weakness over the last few days, the Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQ) are poised to extend their string of...

READ MORE

MEMBERS ONLY

$SPX AND $INDU TEST RESISTANCE AGAIN -- $COMPQ CREATES A GARDEN HOSE PATTERN -- $NIKK AND $TNX CONTINUE TO TRACK -- CONSUMER STAPLES ETF MAKES NEW 52 WEEK HIGHS -- AAPL GRAPPLES WITH CASH MOUNTAIN, SPLITS SHARES -- FB CONTINUES MOBILE AD REVENUE GROWTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

$SPX AND $INDU TEST RESISTANCE AGAIN... The $SPX shown in the 60 minute view on Chart 1 pushed above 1884 this week and settled back on Wednesday. This morning the market surged higher on the back of great numbers from AAPL and FB. This is an extremely important place on...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS ARE BOOSTING REITS, BUT HAVEN'T HELPED HOMEBUILDERS -- FALLING PRICE OF LUMBER SUGGESTS WANING DEMAND FOR NEW HOMES AND MAY EXPLAIN HOMEBUILDER WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

REITS BENEFIT FROM FALLING BOND YIELDS... Previous messages have shown falling bond yields benefiting dividend-paying stocks like utilities. REITS fall under the same category, and are getting the same lift from falling bond yields. The brown bars in Chart 1 show the MSCI US REIT Index ($RMX) trading it the...

READ MORE

MEMBERS ONLY

Stocks Breakdown Big Time vs Commodities

by Martin Pring,

President, Pring Research

Today's Market Roundup Headlines:

* Stocks break down big time against commodities

* IGE/XLP (Inflation/deflation ratio) breaks in favor of IGE

* Brent Crude close to a major breakout

* Industrial metals with the exception of copper break to the upside.

* Spider Metals and Mining (XME) close to major upside...

READ MORE

MEMBERS ONLY

DOW INDUSTRIALS TRACES OUT BULLISH CONTINUATION PATTERN -- TRANSPORTS CONFIRM NEW HIGH IN INDUSTRIALS -- FEDEX AND UPS POWER THE TRANSPORTS -- EXPEDITORS BOUNCES OFF VOLUME-BY-PRICE ZONE -- HOME CONSTRUCTION ISHARES HITS SUPPORT AGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW INDUSTRIALS TRACES OUT BULLISH CONTINUATION PATTERN... Link for today's video. The Dow Industrials has been quite choppy over the last seven weeks, but the overall pattern looks like a cup-with-handle. Popularized by William O'Neil of Investors Business Daily, the cup-with-handle is a bullish continuation pattern,...

READ MORE

MEMBERS ONLY

QQQ AND IWM BOUNCE OFF SUPPORT ZONES -- REGIONAL BANK SPDR HITS A REVERSAL ZONE -- RETAIL SPDR FIRMS AT KEY RETRACEMENT -- HIGH-LOW PERCENT TRIGGERS A BULLISH SIGNAL -- 10-YR TREASURY YIELD SURGES OFF SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

QQQ AND IWM BOUNCE OFF SUPPORT ZONES... Link for today's video. The Nasdaq 100 ETF (QQQ) and Russell 2000 ETF (IWM) started underperforming the S&P 500 SPDR (SPY) in March and led the market lower over the last three-to-four weeks. While relative weakness in large tech...

READ MORE

MEMBERS ONLY

DOW BACK TO RESISTANCE -- OPTIONS EXPIRATION BEHAVIOUR -- STOCKS CONTINUED THE DEFENSIVE POSTURE UNTIL TODAY -- ENERGY ENERGY ENERGY ENERGY -- $NATGAS SOARS ON INVENTORY DATA -- $WTIC TESTS RECENT HIGHS -- $BRENT BREAKS ABOVE A DOWN SLOPING TREND LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW BACK TO RESISTANCE... The Dow continued to move higher but stalled at resistance. This is our first test of resistance since the bounce. We have seen the $INDU become the strongest index which is not abnormal during a correction. We would like to see the $INDU break out to...

READ MORE

MEMBERS ONLY

NASDAQ BOUNCES OFF 200-DAY AVERAGE AND HELPS STABILIZE MARKET -- SO DO SMALL CAPS AND CONSUMER DISCRETIONARY STOCKS -- UTILITY LEADERSHIP IS A CAUTION SIGN -- SO ARE UPSIDE BREAKOUTS IN CONSUMER STAPLES AND ENERGY SHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ BOUNCES OFF SUPPORT LEVELS... My last message suggested that the direction of the Nasdaq market held the key to overall market direction. That's because it led the spring selloff and was the first to test important support levels. So far those supports have held. Chart 1 shows...

READ MORE

MEMBERS ONLY

NASDAQ BOUNCES SOLIDLY AT 200 DMA -- SOME DRILLERS ROCK, OTHER DRILLERS SINK -- GOLD HOLDS 1300 -- COPPER GAPS DOWN OUT OF CONSOLIDATION -- TWITTER FINALLY MAKES A REVERSAL CANDLE

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ BOUNCES SOLIDLY AT 200 DMA ... We need to spend some time here on the Nasdaq. The Nasdaq Composite bounced off the 200 DMA. After falling almost 10% exactly, the bounce off the lows was a full 2.3% reversal. For many reasons, this is a strong place to expect...

READ MORE

MEMBERS ONLY

MARKETS BUILD A SMALL BASE -- COAL STARTS TO LEAD AS $NATGAS RISES -- ARCH COAL STARTS TO HEAD HIGHER -- BEBE STORES BUCKS THE CYCLICAL SECTOR TREND -- EDWARDS LIFE SCIENCES CREATES A GAP BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKETS BUILD A SMALL BASE... As I prepared my notes for today's message at 3 PM, the Nasdaq had fallen back into the red and the Dow had lost 120 points from the high. By the time the market closed, the $INDU closed near the highs. That is...

READ MORE

MEMBERS ONLY

NOTES FROM TOP ANALYSTS, TRADERS, PORTFOLIO MANAGERS AND STRATEGISTS -- DEALING WITH OUR BIASES -- FORECASTING VERSUS REACTING -- PECKING ORDER FOR FIVE KEY ECONOMIC INDICATORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MTA TIDBITS... Today's Market Message will provide tidbits from the Market Technicians Association's annual symposium, which was held in NYC on April 3rd and 4th. The Symposium focused on the fusion of technical analysis with fundamental valuation, behavioral finance, macroeconomics and quantitative methods. It was truly...

READ MORE

MEMBERS ONLY

NASDAQ AND SMALL CAPS LEAD MARKET INTO BEARISH WEEK -- DOW AND S&P 500 TURN DOWN IN HEAVY TRADING -- SECTOR ROTATION REMAINS DEFENSIVE -- CONSUMER CYCLICALS AND FINANCIALS SHOW RELATIVE WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ LEADS WEEKLY LOSSES -- DOW HOLDS UP BEST... The relative performance of U.S. stock indexes reflects the bearish tone of the past week's action. Chart 1 shows the two biggest losers since March 1 being the Nasdaq Composite Index (-6.4%) and the Russell 2000 Small...

READ MORE

MEMBERS ONLY

PRICE AND VOLUME ACTION PUSH STOCK MARKET DEEPER INTO CORRECTION -- DOW AND S&P 500 BREAK 50-DAY AVERAGES -- NASDAQ BEARS DOWN ON 200-DAY LINE AND MAY DETERMINE DEPTH OF DOWNTURN -- WEEKLY NASDAQ INDICATORS AREN'T ENCOURAGING

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 FALL BELOW 50-DAY LINES... [Note: Although this message was posted earlier this afternoon, charts have been udpated to reflect closing prices]. The week's combination of falling prices in heavy trading is a bad combination. With small caps and the Nasdaq turning down...

READ MORE

MEMBERS ONLY

SPECIAL SITUATION -- $COMPQ CONFIRMS TREND LINE BREAK -- THE $SPX CLOSES ON THE LOWER BOLLINGER BAND -- $USB 30 YEAR TREASURY IS BACK ABOVE 200 DMA

by John Murphy,

Chief Technical Analyst, StockCharts.com

$COMPQ CONFIRMS TREND LINE BREAK... The $COMPQ has broken the long trend line off the Dec 2012 low. After yesterdays strong push up, it backtested the trend line from the underside. From there it pushed straight down. A 3% down day is very uncommon over the last few years so...

READ MORE

MEMBERS ONLY

UTILITIES AND CONSUMER STAPLES START THE MORNING -- BANKS DON'T BOUNCE -- PRECIOUS METALS TRY TO MOVE HIGHER -- $WTIC TAKES OFF FROM THE 200 DMA PLATFORM

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES AND CONSUMER STAPLES START THE MORNING... After a big up day like yesterday, we would like to see follow through in the growth sectors. Unfortunately, Thursday started off with more upside for utilities and consumer staples. Chart 1 from the sector summary page shows the leaders in green.

While...

READ MORE

MEMBERS ONLY

INVESTORS ARE ROTATING FROM GROWTH TO VALUE -- MONEY IS LEAVING SOCIAL MEDIA, CONSUMER DISCRETIONARY, AND BIOTECHS INTO BANKS, ENERGY, STAPLES, TELECOM, AND TECH DIVIDEND-PAYERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOW TO DEAL WITH AN OVERBOUGHT MARKET... The stock market rally that started in March 2009 recently passed its fifth anniversary. That makes this a mature bull move in need of a period of consolidation or correction. The market is also in its most overbought region since 2007. Chart 1...

READ MORE

MEMBERS ONLY

A DRILL DOWN OF FINANCIALS -- THE LARGE BANK AND REGIONAL BANK ETFS LOOK STRONG -- JPM & WFC LOOK HIGHER AS BAC BREAKS A BIG TREND LINE -- CITI COMPLETES A ROUNDED TOP -- VISUAL CLUES FROM GOLDMAN SACHS AND MORGAN STANLEY

by John Murphy,

Chief Technical Analyst, StockCharts.com

A DRILL DOWN OF FINANCIALS... The financials are a critical component of the market. Ned Davis uses the phrase that financials will show the trouble before other sectors. So we have now had a 3% correction on the $SPX and it seems to have found support at the very important...

READ MORE

MEMBERS ONLY

STOCKS SUFFER ANOTHER BAD CHART DAY -- WEAK RETAILERS WEIGH HEAVILY ON CONSUMER DISCRETIONARY SECTOR -- MONEY FLOWS INTO CONSUMER STAPLES -- DEFENSIVE ROTATONS, AND WEAK CHART ACTION, RAISE RISKS FOR A SPRING TOP

by John Murphy,

Chief Technical Analyst, StockCharts.com

ANOTHER DOWN DAY IN HEAVIER TRADING ... The Nasdaq market continues to lead the rest of the market lower. Chart 1 shows the Power Shares QQQ Trust falling to another two-month low after falling below its 50-day line on Friday. Relative weakness by the Nasdaq (and small caps) is usually bad...

READ MORE

MEMBERS ONLY

$INDU MAKES A DOUBLE TOP (SO FAR) -- COMPARING THE 2000 AND 2007 TOPS -- THE $COMPQ AND $SPX ARE WELL ABOVE THE 200 DMA -- $LUMBER GETS STUCK BELOW 40 WMA -- BUILDING AND CONSTRUCTION TEST THE UPTREND -- $BRENT DIPPED BELOW THE SUPPORT LINE LAST WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

$INDU MAKES A DOUBLE TOP (SO FAR)... The Dow has made a double top so far as seen on Chart 1. Does this seem important? Here we sit with a potential $INDU double top and only 3 days from the high. Google, the big market leader is down almost 14%...

READ MORE

MEMBERS ONLY

NOTES FROM TOP ANALYSTS, TRADERS, PORTFOLIO MANAGERS AND STRATEGISTS -- CHINA AND NUCLEAR ENERGY -- RELATIVE PERFORMANCE OF INDUSTRIALS -- MONETARY CONDITIONS MATTER

by John Murphy,

Chief Technical Analyst, StockCharts.com

NOTES FROM TOP ANALYSTS, TRADERS, PORTFOLIO MANAGERS AND STRATEGISTS... I am on vacation the next two weeks, but would like to share my notes from the recent MTA symposium. Today's Market Message will provide tidbits from the Market Technicians Association's annual symposium, which was held in...

READ MORE