MEMBERS ONLY

One Rule to Drastically Improve Your Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe uses a chart of AAPL to demonstrate how properly using a MACD and ADX indicator combo increases your chances of success. He analyzes 10-Year Yields, Bitcoin, Tesla, Datadog, and ServiceNow. Going through all the sectors, Joe explains...

READ MORE

MEMBERS ONLY

Technology Shares SOAR to New All-Time Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave recaps a shortened trading session marked by strength in the technology sector, potential breakouts in gold stocks, and key levels to watch as the S&P 500 index makes a new closing high on...

READ MORE

MEMBERS ONLY

Has Housing Topped Out for the Cycle?

by Martin Pring,

President, Pring Research

Residential housing is not important for its size relative to GDP, which, according to Copilot, is about 3-5%. Rather, due to its interest rate sensitivity, housing is significant because it is the first sector of the economy to turn at the end of a recession, and the first to turn...

READ MORE

MEMBERS ONLY

Market Breadth is Narrowing - Should You Be Worried?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses the long-term trends as they are playing out on the monthly S&P 500 sector charts. He takes a look into the future using the expected seasonal trends for the month of July. Markets are still going higher, but the path...

READ MORE

MEMBERS ONLY

S&P 500 Earnings Results Are In for 2024 Q1 and Market Is Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q1, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

DP Trading Room: Deflation...a Possibility?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's DP Trading Room was jam packed! The lead story is definitely the fact that deflation is another possibility that many are not talking about. We don't know if it will be the final outcome, but we have a link that discusses this possibility: https://hoisington....

READ MORE

MEMBERS ONLY

Week Ahead: Nifty Creates Resistance In This Zone; Continue Guarding Profits At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating in the week prior, the markets resumed their up move and have ended the present week on a strong note. The markets also navigated weekly derivatives expiry, showing some signs of fatigue and impending consolidation on the last trading day after rising for four trading sessions in a...

READ MORE

MEMBERS ONLY

2 NEW AREAS Are on the Move - Don't Miss Them!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen recaps last week's market activity and the factors influencing market movements. She highlights two names, PANW and ADSK, as two bright spots in an otherwise rough preview of earnings season.

This video originally premiered June 28, 2024. You can watch it...

READ MORE

MEMBERS ONLY

Mastering GoNoGo Charting: Scanning Securities on StockCharts.com

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning

* screening

* Idea Generation

* Market Breadth

Join Tyler Wood, CMT, in this insightful tutorial where he demonstrates how to effectively scan for GoNoGo conditions using StockCharts.com. GoNoGo Charts, a powerful method developed by Alex Cole and Tyler Wood, blend foundational tools in technical analysis into a powerful...

READ MORE

MEMBERS ONLY

Bank Stress Tests: What They Mean for Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The 2024 bank stress results show that all participating banks are able to withstand an economic collapse

* In spite of the banks passing the stress test, the XLF didn't see much movement

* Look for XLF to reverse at its 50% Fibonacci retracement level and start gaining...

READ MORE

MEMBERS ONLY

Large-Cap Growth Threatens the S&P Rally

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at rotation among growth/value and size segments, followed by a look at current sector rotation. He detects an intraday sector rotation he has never seen before, which could be the prelude for a larger move.

This video was originally...

READ MORE

MEMBERS ONLY

Nvidia Plunges Over 6% to Mark the End of the AI Trade?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the rapid and concerning deterioration in semiconductors, with stocks like NVDA and AVGO pushing lower after last week's bearish candle patterns. He then dives into the downturn in Bitcoin, the impressive recovery for energy stocks, and...

READ MORE

MEMBERS ONLY

DP Trading Room: Carl's Grab Bag! - Chipotle (CMG), NVDA, Bahnsen & Hussman

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl brings out his "Grab Bag" during today's free DecisionPoint Trading Room! He gives us a read on Chipotle's (CMG) 50:1 split. He talks about NVDA's strangle hold on the market and gives us homework to read recent articles from David...

READ MORE

MEMBERS ONLY

Dow Stocks Outperform! Here's Why

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, takes a close look at NVDA and other year-to-date winners that sold off last week, and shares top candidates in the Consumer Discretionary sector.

This video originally premiered June 21, 2024. You can watch it on our dedicated page...

READ MORE

MEMBERS ONLY

Tech Stocks Take a Breather: Is Now the Best Time To Buy the Chip Dip?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Technology stocks end the week lower, breaking their winning streak

* Semiconductor stocks sell off and take the S&P 500 and Nasdaq Composite lower for the week

* Micron Technology announces earnings next week, which could mean the pullback may present an opportunity to load up on some...

READ MORE

MEMBERS ONLY

Bearish Engulfing Patterns Forming on NVDA & MU

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a day where technology shares struggles, with leading names like NVDA and MU dropping bearish engulfing patterns to indicate short-term distributions. He also addresses the ongoing divergence between large caps and small caps, the upside potential for energy...

READ MORE

MEMBERS ONLY

Price Pays... But For How Long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The number of new 52-week highs is declining

* The percentages of stocks trading above 200-,50-, and 20-day Exp Moving Averages are declining

* Despiote narrowing breadth, the S&P continues higher

While the S&P 500 continues to move higher, the number of stocks participating to...

READ MORE

MEMBERS ONLY

Seasonality Suggests a Massive Energy Market Shift This Summer—Are You Ready?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Crude, Brent, gasoline, and natural gas tend to dip and peak in the summer months

* Although seasonality plays are attractive, they're not always reliable

* If you're looking to take advantage of seasonality trends, here are some technical levels to watch

We're heading...

READ MORE

MEMBERS ONLY

Market Stumbles Near The Edge of a CLIFF

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius shares a rare RRG rotational pattern that he's never seen before! He then follows up with a breakdown of the current sector rotation into offensive, defensive, and sensitive, and finds that only one sector is on a positive relative trajectory... which...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Bearish Again?

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin return to the trading room showing you the charts you need to see to start your week!

Carl covered the market trends and condition to start the program. He also covers Bitcoin, Dollar, Gold, Silver, Gold Miners, Bonds, Yields and Crude Oil.

Carl also gave us a...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Tentative; Look For Stocks With Strong Relative Strength

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was in stark contrast to the week before that, as the markets remained in an extremely narrow range before closing with modest gains. The markets demonstrated a peculiar feature over the past five sessions; on four out of five trading days, the Nifty 50 came...

READ MORE

MEMBERS ONLY

GET IN EARLY! These Tech Stocks Are Just Taking Off

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the overbought condition in the markets after last week's move to a new high in price. She highlights select areas that pushed the markets higher and covers NVDA, AAPL, and more. She also discusses the anatomy of a true downtrend...

READ MORE

MEMBERS ONLY

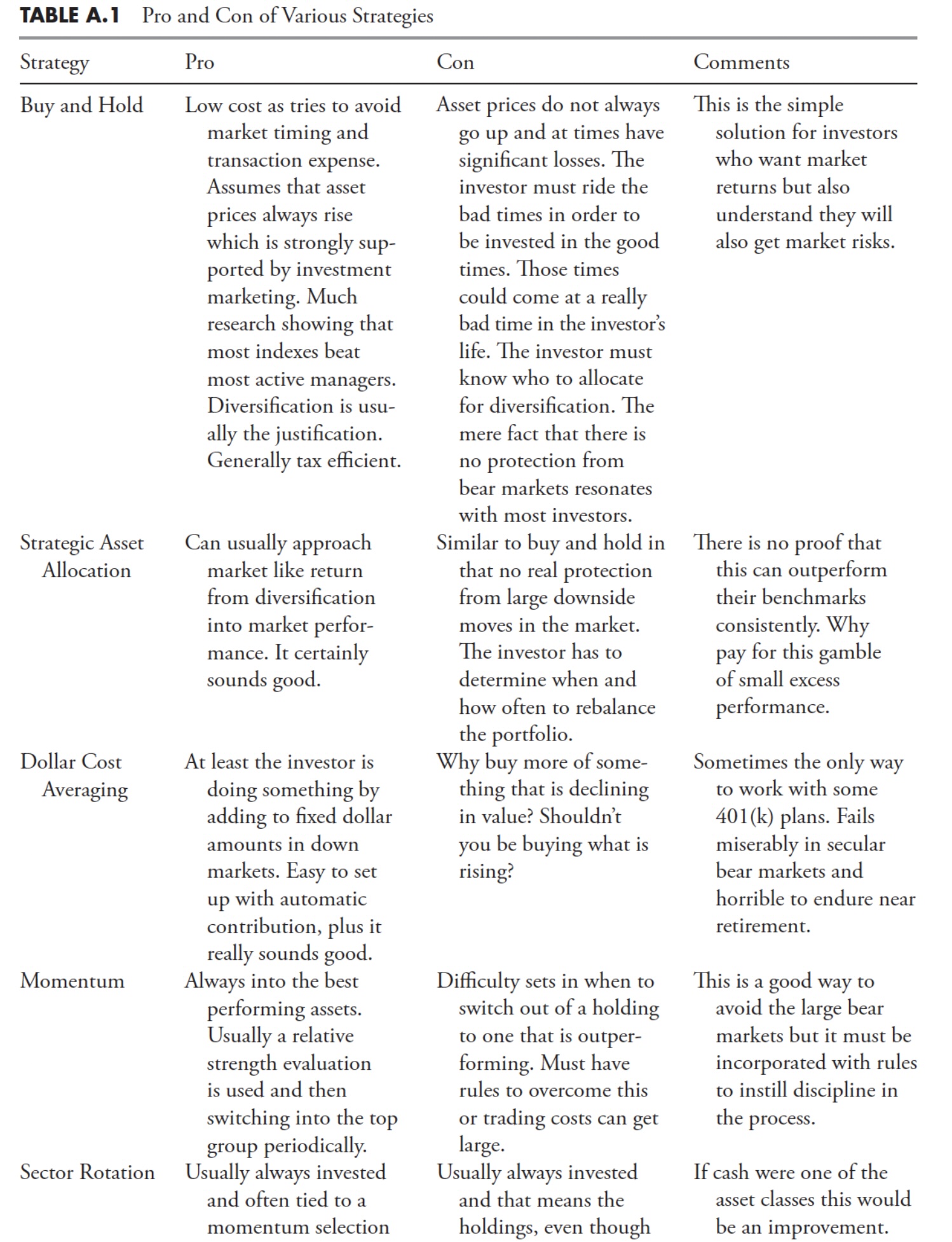

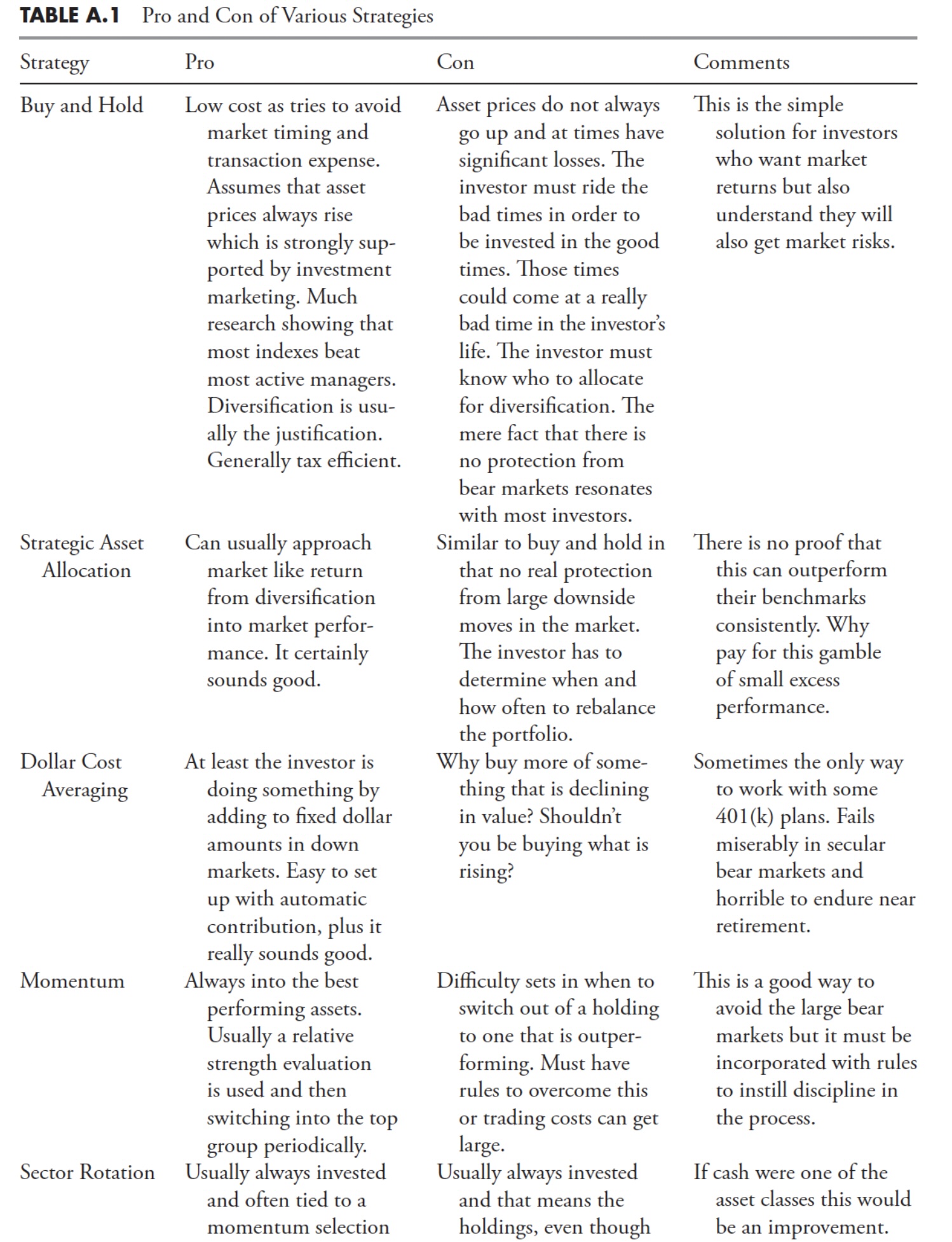

Investing with the Trend: Appendix

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is a set of appendices for a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

5 Simple and Powerful Uses for Moving Averages

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the five ways to use the Moving Average lines to help with decision making. He discusses how these lines can help to define trend reversals and confirmed trends, when to be on the alert for a...

READ MORE

MEMBERS ONLY

Sector Rotation Model Flashes WARNING Signals

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius examines the theoretical sector rotation model and aligns it with current state of sector rotation on Relative Rotation Graphs, and the phase of the economy. He makes some interesting observations and highlights some flashing warning signals.

Check out Julius' Macroeconomic Variables/Metrics...

READ MORE

MEMBERS ONLY

NVDA Stock Split Launches S&P 500 Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps a bullish day for stocks, with 8 out of 11 S&P 500 sectors finishing higher. He breaks down the charts of NVDA, ENPH, FSLR, and AMD, and reviews a potential upside reversal in gold.

See Dave&...

READ MORE

MEMBERS ONLY

DP Trading Room: Equal-Weight Losing Against Cap-Weight SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

Did you know that the equally-weighted RSP is seriously underperforming the cap-weighted SPY? It is losing considerable ground against the SPY and that suggests that if mega-caps fail, so will go the market. Carl shows us charts to prove his point.

Next up Carl covers the market in general followed...

READ MORE

MEMBERS ONLY

META, AMZN and MSFT On The Move! Here's How to Pinpoint Entry

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews what drove the markets to new highs. She highlights S&P 500 sectors, plus stocks that have reversed their downtrends, pointing out good entry points. Mary Ellen also takes a close look at why stocks did not respond to today'...

READ MORE

MEMBERS ONLY

Only One Pocket of Strength Left in US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Only Large-Cap Growth is on a positive RRG-Heading

* No segment, except LC Growth, has managed to take out its late March high

* $DJUSGL setting up for negative divergences

Breaking Down Into Growth / Value

Using Relative Rotation Graphs to help break down the US stock market into various segments...

READ MORE

MEMBERS ONLY

These SURPRISING Sectors are Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius uses the S&P 500 Sector Indexes to assess the long term price trends on the completed monthly charts for May, then discusses the long-term relative trends on a monthly RRG. Julius highlights the continued relative strength for Technology, Communication Services and...

READ MORE

MEMBERS ONLY

DP Trading Room: Upside Initiation Climax (Should We Trust It?)

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode Carl and Erin discuss Friday's "Upside Initiation Climax" and whether it can be trusted. With market follow through tepid, they discuss the implications of this very bullish signal.

Carl reveals his sentiment of the overall market and covers...

READ MORE

MEMBERS ONLY

Week Ahead: Markets' Reaction to Exit Poll and General Election Results

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities experienced a notably eventful previous week, marked by a fresh lifetime high and a subsequent decline of over 400 points within the same week. Over the past five sessions, the Nifty 50 index fluctuated within a 693.80-point range before closing with a net weekly loss of...

READ MORE

MEMBERS ONLY

Tech Stocks Sell Off, But AI Shines!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish close in the markets while highlighting areas to stay away from. She also shares why AI-related areas of Tech remain positive and what drove the Retail sector into a new uptrend. The potential downtrend reversal...

READ MORE

MEMBERS ONLY

Stock Market Shows Its Magic: An Exciting Finish

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market has wrapped the week on a positive note

* Consumer Staples stocks may start to show strength in the near future

* More macro data is on deck for next week

What a turnaround! Today's PCE data, which was in line with expectations, initially sent...

READ MORE

MEMBERS ONLY

S&P 500 Sinks on Software and Semiconductor SELLOFF

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Jonathan Krinsky, CMT of BTIG. Jonathan speaks to the weakness in market breadth conditions and the software group as a key space to watch for relative strength weakness. David breaks down the relationship between the S&P...

READ MORE

MEMBERS ONLY

Market Analysis: Top Stock Picks and Sector Insights

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As we approach the highly anticipated results of India's general elections on Tuesday, June 4, market volatility is expected to be at its peak. Exit polls, scheduled for Saturday, June 1, will likely add to the market's uncertainty, causing significant fluctuations in the Nifty and BankNifty...

READ MORE

MEMBERS ONLY

What Happens to GOOGL When This Negative Divergence Executes

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at the differences in rotation between cap-weighted and equal-weighted sectors and sees a warning signal for GOOGL. He also examines the Communications Sector vs. the Equal-Weighted ETF.

This video was originally broadcast on May 28, 2024. Click anywhere on the...

READ MORE

MEMBERS ONLY

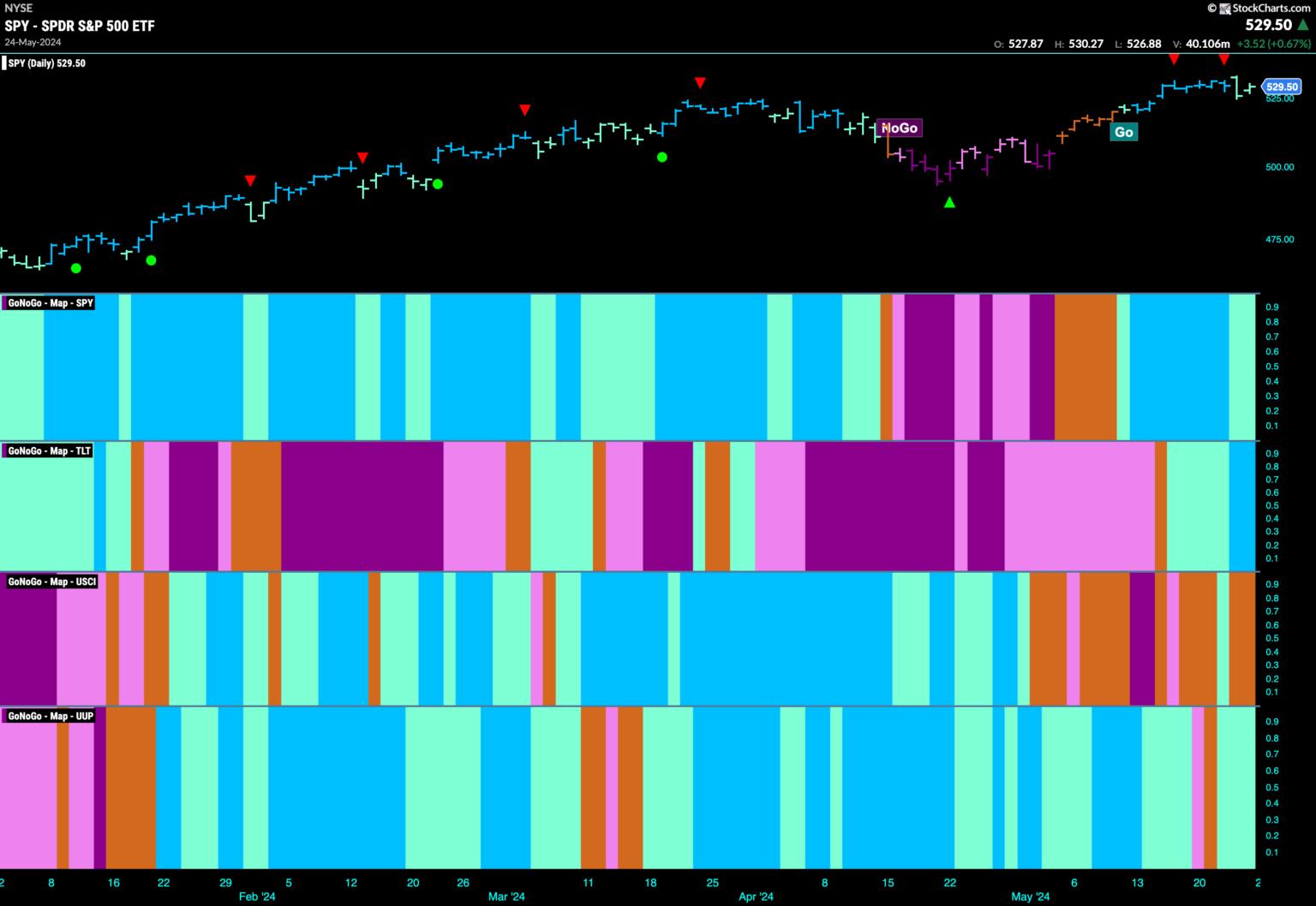

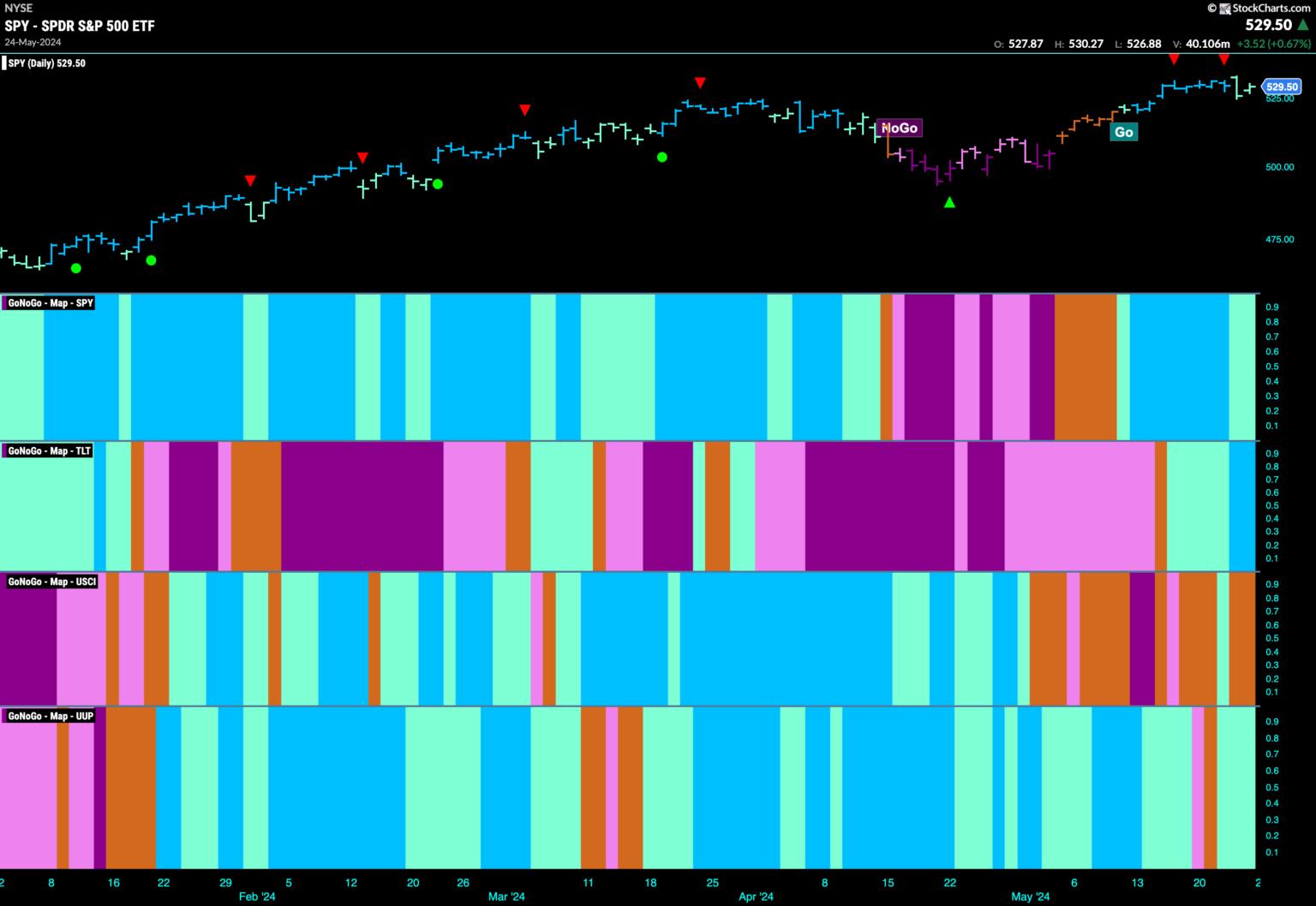

EQUITIES REMAIN IN "GO" TREND WITH SPARSE LEADERSHIP FROM TECH AND UTILITIES

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Relative Strength

* Market Trend

* Narrow Breadth

Good morning and welcome to this week's Flight Path. We saw some weakness this week as price pulled back a little from all time highs. Momentum cooled, we saw this in the form of Go Countertrend Correction Icons (red arrows)...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set to Move Within This Volatile Range; Curtailing Leveraged Exposures is Recommended

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

It was a truncated day for the markets; over the past four trading sessions, the Indian equities continued to edge higher and ended on a fresh lifetime high. The volatility, too, remained at elevated levels. As mentioned in the previous technical note, the markets are building up ahead of the...

READ MORE

MEMBERS ONLY

MEM TV: How to Trade Nvidia After Its 15% Gain

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets and the rotation that's taking place amid a rise in interest rates. She also takes a close look at NVDA and shares how you should handle the stock after last week'...

READ MORE