MEMBERS ONLY

Surprise! These Grocery Stocks are Crushing 2024 Targets

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Consumer Staples stocks offer stability and growth in a high inflation environment.

* Many consumer staples stocks have exceeded analyst price targets, revealing Wall Street's underestimation of their growth potential.

* Sometimes the next big stock is often found in a seemingly boring name, as Sprouts Farmers Market...

READ MORE

MEMBERS ONLY

This Semi is a ROCKET With MORE UPSIDE

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows a specific semiconductor stock that meets all the criteria that he looks for. He starts with the monthly chart and then works down to the daily explaining all the key aspects to the setup. He then...

READ MORE

MEMBERS ONLY

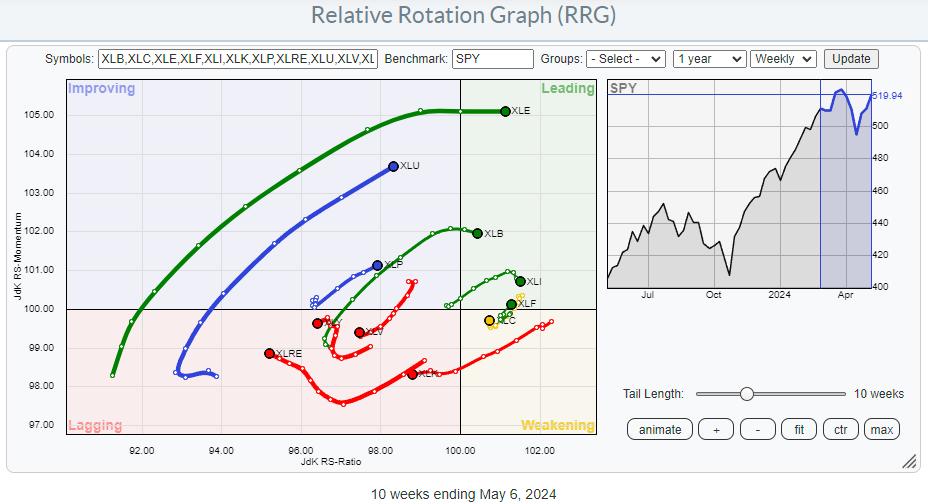

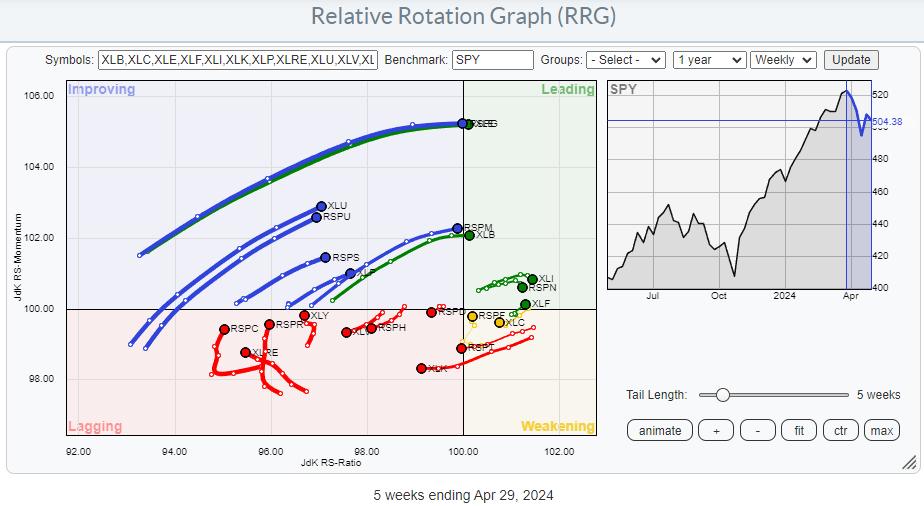

These Sectors are Showing Strength as S&P 500 Soars!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave is joined by special guest Julius de Kempenaer of RRG Research. Dave hits on the out-performance of traditionally defensive sectors and breaks down the charts of FSLR, NVDA, and more. Julius, meanwhile, is cautiously optimistic as the equity indexes...

READ MORE

MEMBERS ONLY

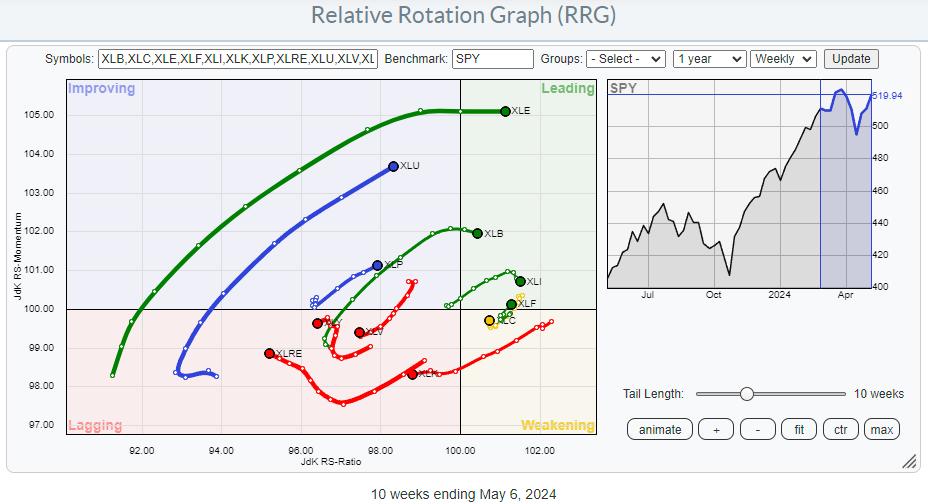

S&P 500 Breakout: Here to STAY or Heading for a FALL?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius assesses the quality of the breakout in the S&P 500, using sector rotation on Relative Rotation Graphs, the volume pattern in the S&P 500 and the relationship between stocks and bonds.

This video was originally broadcast on May 20,...

READ MORE

MEMBERS ONLY

DP Trading Room: What's Up With Semiconductors?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin takes a deep dive into the Semiconductors (SMH). She goes over the "under the hood" health of the industry group and then takes us within the industry group to find the leadership stocks in that area.

Carl shares his wisdom on the current conditions of the...

READ MORE

MEMBERS ONLY

MEM TV: Here's How to Trade Explosive Stocks After Earnings

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the current market conditions and key areas of growth that are in new uptrends. She then shares how to trade downtrend reversals and stocks that gap up after reporting strong earnings. She then reviews the decline in...

READ MORE

MEMBERS ONLY

Major Shifts Taking Place As Lower Rate Bets Increase

by Mary Ellen McGonagle,

President, MEM Investment Research

Both the S&P 500 and the NASDAQ are sitting at new highs as we wind down a very positive earning season. So far, almost 80% of S&P 500 companies have reported a positive earnings surprise, with the year-over-year earnings growth rate at the highest level since...

READ MORE

MEMBERS ONLY

Is This the Magic Upward Break Everybody Was Waiting For?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Sector rotation still pointing to defense

* Upward break in SPY not supported by volume

* Asset class rotation starting to rotate in favor of bonds

No Confirmation In Volume

This week, the S&P 500 is breaking out above its previous high, undeniably a bullish sign. After the...

READ MORE

MEMBERS ONLY

Larry Williams: Dow 40k, Cycle Analysis, and Lessons Learned

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave in the StockCharts TV studio. Larry shares his latest thoughts on Dow 40K, the resilient rise of gold and precious metals, cycle analysis on the S&P 500 and crude oil,...

READ MORE

MEMBERS ONLY

China Tariffs Drive Upside for Rare Earth Minerals

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge. Mish breaks down one materials name that could benefit from recently announced China tariffs, and describes how regional banks could benefit from Fed actions in 2024. David charts the S&P 500'...

READ MORE

MEMBERS ONLY

Watch for Higher Lows in These Three Tech Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

DP Trading Room: Bonds & Yields At An Inflection Point

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's focus was on the current and long-term conditions of Bonds and Yields which are at an inflection point. Yields are attempting to hold onto a rising trend and Bonds are plodding along to the upside for now. One reader asked if it is time to start dollar...

READ MORE

MEMBERS ONLY

Week Ahead: Markets to Stay Tentative; This Defensive Sector May Start Showing Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, we had expressed concerns over the Nifty and VIX rising in the same direction simultaneously. As mentioned earlier, in such circumstances, the VIX often ends up acting as a leading indicator and a precursor to an impending corrective move. The previous week had seen VIX...

READ MORE

MEMBERS ONLY

MEM TV: This Stealth AI Stock is Ready to EXPLODE Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias in the broader markets, along with the sector rotation into cyclical areas as growth areas languish. She then highlights the perils of buying, or holding, stocks around earnings releases, and shares a high-yielding stock...

READ MORE

MEMBERS ONLY

Relative Strength Screams Bullish for This Tech Stock

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator. He shares his favorite chart for analyzing relative strength ratios for leading stocks, and also answers viewer questions on price patterns for XLB and PYPL, plus best...

READ MORE

MEMBERS ONLY

Stocks Pop Higher as Defensive Sectors Thrive

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down an unusual day for stocks. The S&P 500 and Nasdaq closed higher, but the top sectors were defensive - real estate and utilities! He shares key levels to watch for NVDA, AAPL, TSLA, and more,...

READ MORE

MEMBERS ONLY

These Three Strong Financial Stocks Look Ready To Surge Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* XLF on strong RRG-Heading, rotating back into leading quadrant

* XLF price approaching overhead resistance after short setback

* Three major financial stocks ready for upward breaks to lead the sector higher

The Relative Rotation Graph for US sectors shows long tails for XLE and XLU. Both are on a...

READ MORE

MEMBERS ONLY

DP Trading Room: Two Industry Groups To Watch!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look "Under the Hood" to reveal participation and trends that are quite bullish.

Carl walks us through the market overall, covering not only the SPY, but also interest rates,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Vulnerable to Disruption of Primary Trend; Volatility Likely to Stay

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets traded in a much wider range in the past trading week. Over the past few days, we had seen the markets and the VIX inching higher, i.e. moving in the same direction. In the previous technical note, we had expressly mentioned this concern, as instances of VIX...

READ MORE

MEMBERS ONLY

MEM TV: NVIDA is Setting Up To SURGE

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

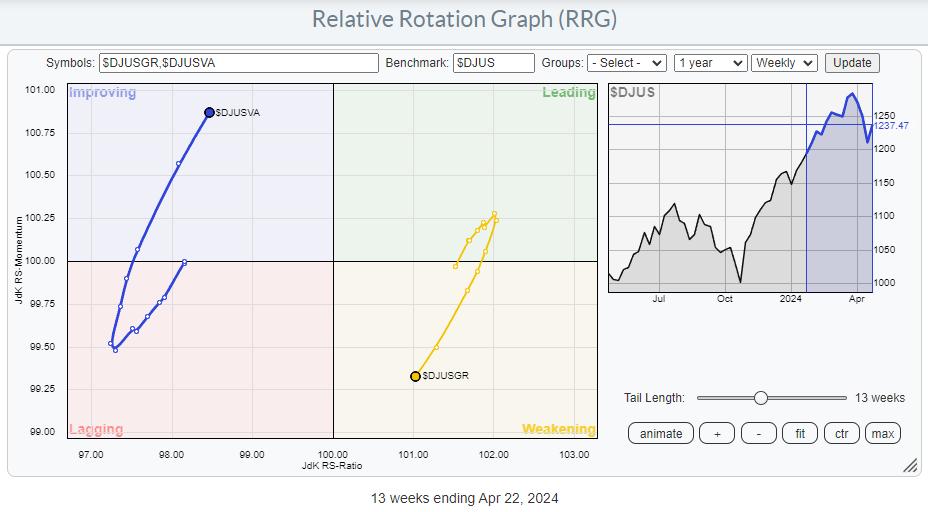

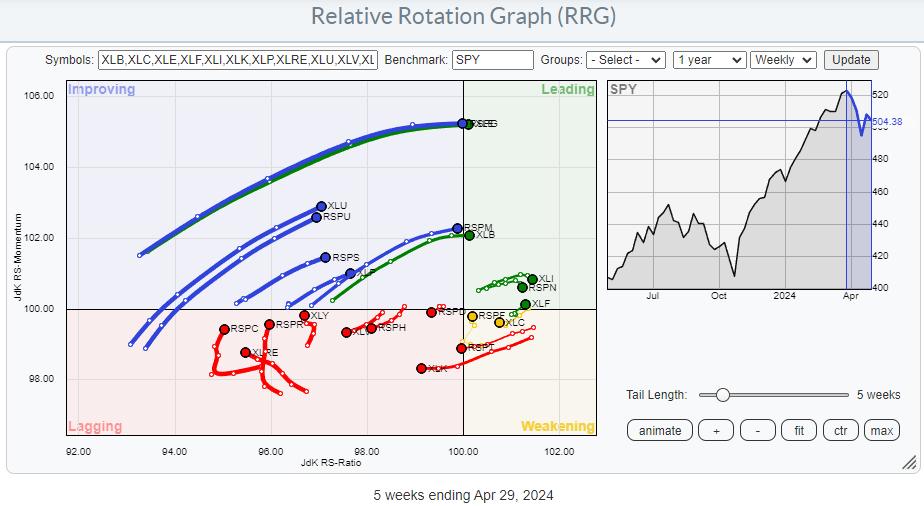

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

Gain AN EDGE Over Other Traders with ADX/DI

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe breaks down the differences between buyers and sellers, and shows how the ADX/DI can be used in three different ways: The action phase, low ADX period and an expansion phase. Understanding this indicator will give you...

READ MORE

MEMBERS ONLY

DP Trading Room: Intermediate-Term View of the Magnificent 7

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl puts the spotlight on the Magnificent 7 with a look at not only the daily charts, but also a review of the intermediate term using weekly charts. See where they are headed short-term and what are our expectations are in the intermediate term.

Carl also gave us his...

READ MORE

MEMBERS ONLY

Week Ahead: Upsides For NIFTY May Stay Capped; Sectoral Landscape Show These Changes

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past trading week, it was expected that, while technical pullbacks in the markets could get extended, NIFTY would likely remain under corrective pressure at higher levels. The past trading days witnessed this precise scenario. The markets initially extended their technical pullback and extended their upmove; however, at the...

READ MORE

MEMBERS ONLY

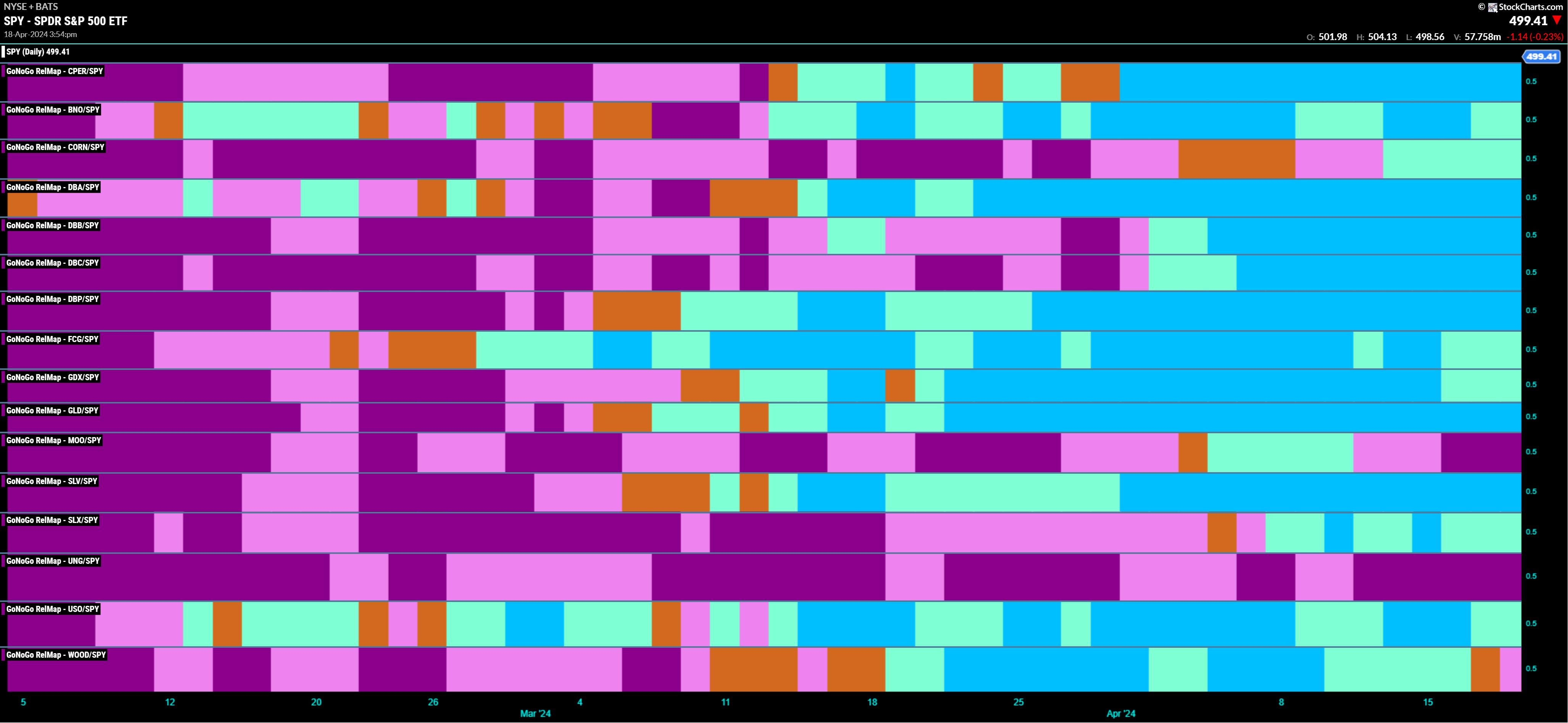

DEFENSE IS ON THE FIELD | GoNoGo Show APRIL 26, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Defensive Sector Leadership

* Risk Off Macro Environment

* Opportunities in Electricity Utilities Companies

Chart Above (XLU:SPY) highlights trending relative strength of Utilities Sector. Watch Video below for details:

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole...

READ MORE

MEMBERS ONLY

MEM TV: Wait For This Before Getting Back In

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

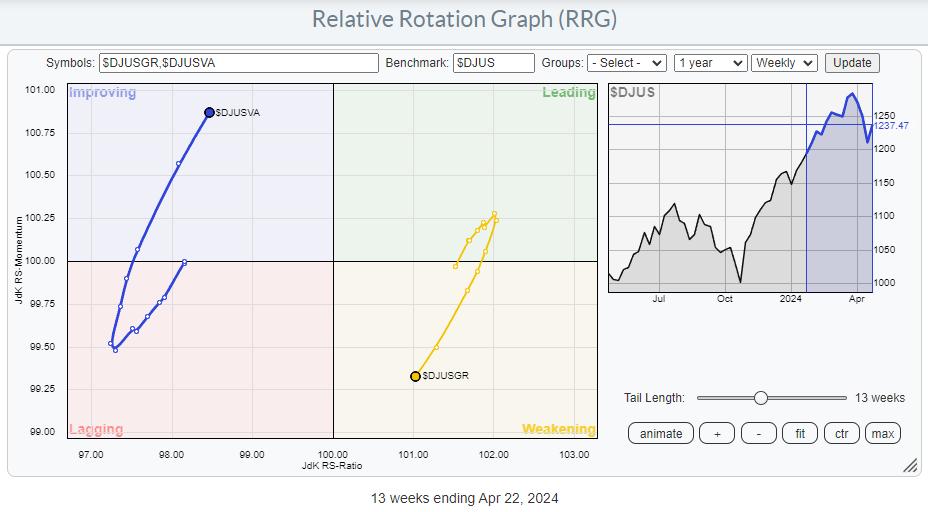

10% Downside Risk For Stocks as Value Takes The Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Value stocks are taking over the lead from Growth

* When Value beats Growth, the S&P 500 usually does not do too well

* The strength of Value is surfacing across all size segments of the market

* Important support areas for SPY at 480 and 460

Value Taking...

READ MORE

MEMBERS ONLY

Three Sectors are Showing Strength, Three are Not

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD. Ryan shares key levels to watch on the S&P 500, along with...

READ MORE

MEMBERS ONLY

Weak Charts Keep Getting Weaker

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave examines names making moves in the market like Tesla (TSLA), Verizon (VZ), and Nucor (NUE). Explore the world of equity benchmarks and learn how large caps, mid caps, and small caps can offer unique opportunities based on sector rotation...

READ MORE

MEMBERS ONLY

DP TRADING ROOM: Find Shorts Using the Diamond Dog Scan

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin shared her Diamond Dog Scan that she uses to find shorting opportunities. She was able to uncover five possible shorts. She discusses each chart and let's you know what she looks for in a good short.

Carl did the market overview with special attention paid to...

READ MORE

MEMBERS ONLY

Week Ahead: Mild Technical Pullbacks Likely; NIFTY Remains Prone to Selling Pressure at Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the truncated week, the markets looked largely corrective, as the key indices lost ground during the week. In the previous technical note, it was mentioned that, on the one hand, no runaway moves should be expected, and on the other hand, the support for Nifty exists much below at...

READ MORE

MEMBERS ONLY

MEM TV: Capitulation Signals for a Market BOTTOM

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the negative shift that's evolved over the past week in the market and highlights key signals of capitulation you should be watching for. She then shares the move into Value stocks she's seeing...

READ MORE

MEMBERS ONLY

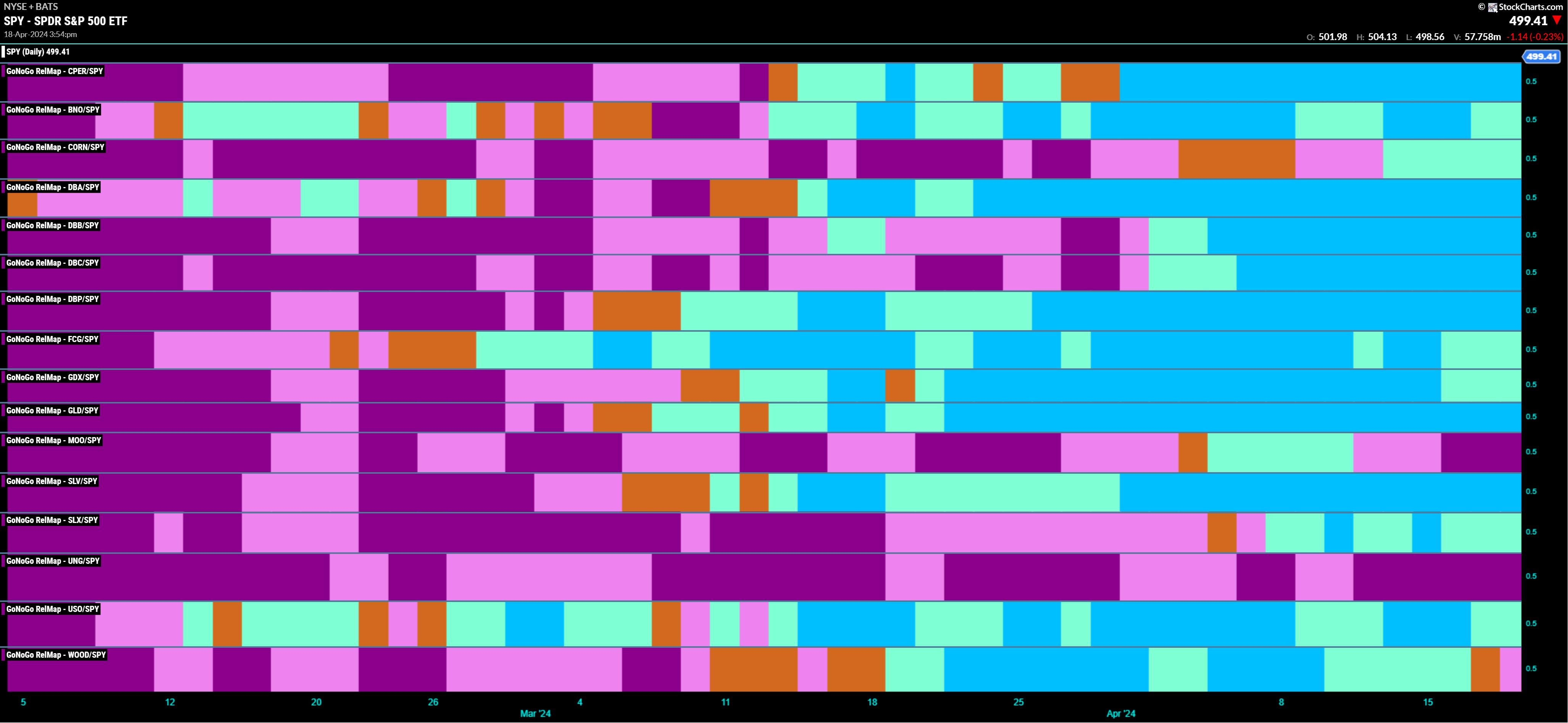

Rocks over Stocks | GoNoGo Show 041824

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* New Risk Off Environment for Equities

* Commodities Leading

The S&P500 trend conditions have reversed into "NoGo" and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds...

READ MORE

MEMBERS ONLY

DP Trading Room: Final Earnings are In for 2023 Q4!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl opens the show with a view of the final earnings results for 2023 Q4! His chart reveals whether stocks are fair valued, overvalued or undervalued. Get his take on the current readings.

Carl gave us his market overview including Bitcoin, Gold Miners, Gold and Crude Oil and many more....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Subdued Over the Truncated Week; Defensive Play May Seem Evident

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Going into the previous week, the markets had been expected to inch higher; however, at the same time, while it was believed that incremental highs may be formed, it was also expected that a runaway move would not happen. Over the past four trading sessions, the markets traded precisely on...

READ MORE

MEMBERS ONLY

MEM TV: Time To SELL EVERYTHING?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares key signals that it's time to sell a stock, using INTC as an example. She also reviews a key area of support for the markets, and new sectors that have entered a downtrend. She finishes...

READ MORE

MEMBERS ONLY

RRG Indicates That Non-Mega Cap Technology Stocks are Improving

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The energy sector remains on a very strong rotational path

* A completed top formation in Healthcare opens up significant downside risk

* Smaller Technology stocks are taking over from mega-cap names

A Sector Rotation Summary

A quick assessment of current sector rotation on the weekly Relative Rotation Graph:

XLB:...

READ MORE

MEMBERS ONLY

Master Market Entry with This RSI Strategy!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the MACD and ADX indicators. RSI is used as a timing tool when things are lined up. Joe goes through some of the key elements he looks for when...

READ MORE

MEMBERS ONLY

Is the Banking System on the Verge of Systemic Implosion? What to Look Out For

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A few fringe economists are sounding the alarm on a looming series of banking collapses

* With bank holdings of government debt now underwater, some claim that banks are virtually insolvent as a result

* Whether any of this takes place, even partially, technical levels on the charts can help...

READ MORE

MEMBERS ONLY

This Sector is Breaking Up and Down Simultaneously

by Martin Pring,

President, Pring Research

This may seem like a contradiction, but it is possible for two different things to be true at the same time.

What I am referring to is the fact that the health care sector (XLV) recently broke out from a consolidation reverse head-and-shoulders pattern, as we can see from the...

READ MORE