MEMBERS ONLY

Week Ahead: NIFTY May Continue Finding Resistance at Higher Levels; These Sectors May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, while the markets may attempt to inch higher, they may not form anything beyond minor incremental highs and could largely continue to stay under consolidation. In line with the analysis, the Nifty did form a new lifetime high, but eventually...

READ MORE

MEMBERS ONLY

MEM TV: Is It Safe To Reenter The Markets?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares what to be on the lookout for to tell if it's safe to put new money to work. She also shares the weakness in select sectors and which areas she suggests to underweight. Last up,...

READ MORE

MEMBERS ONLY

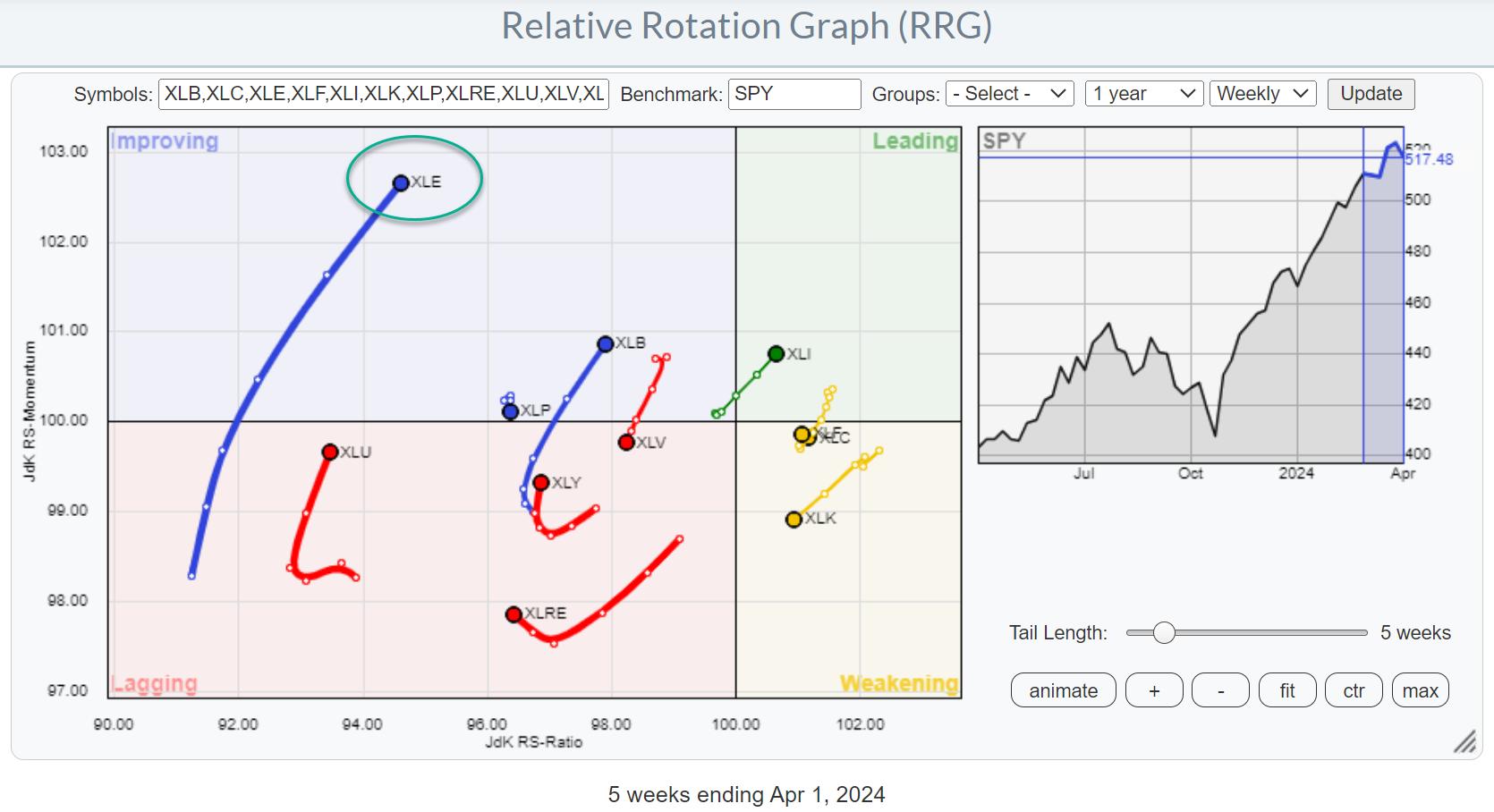

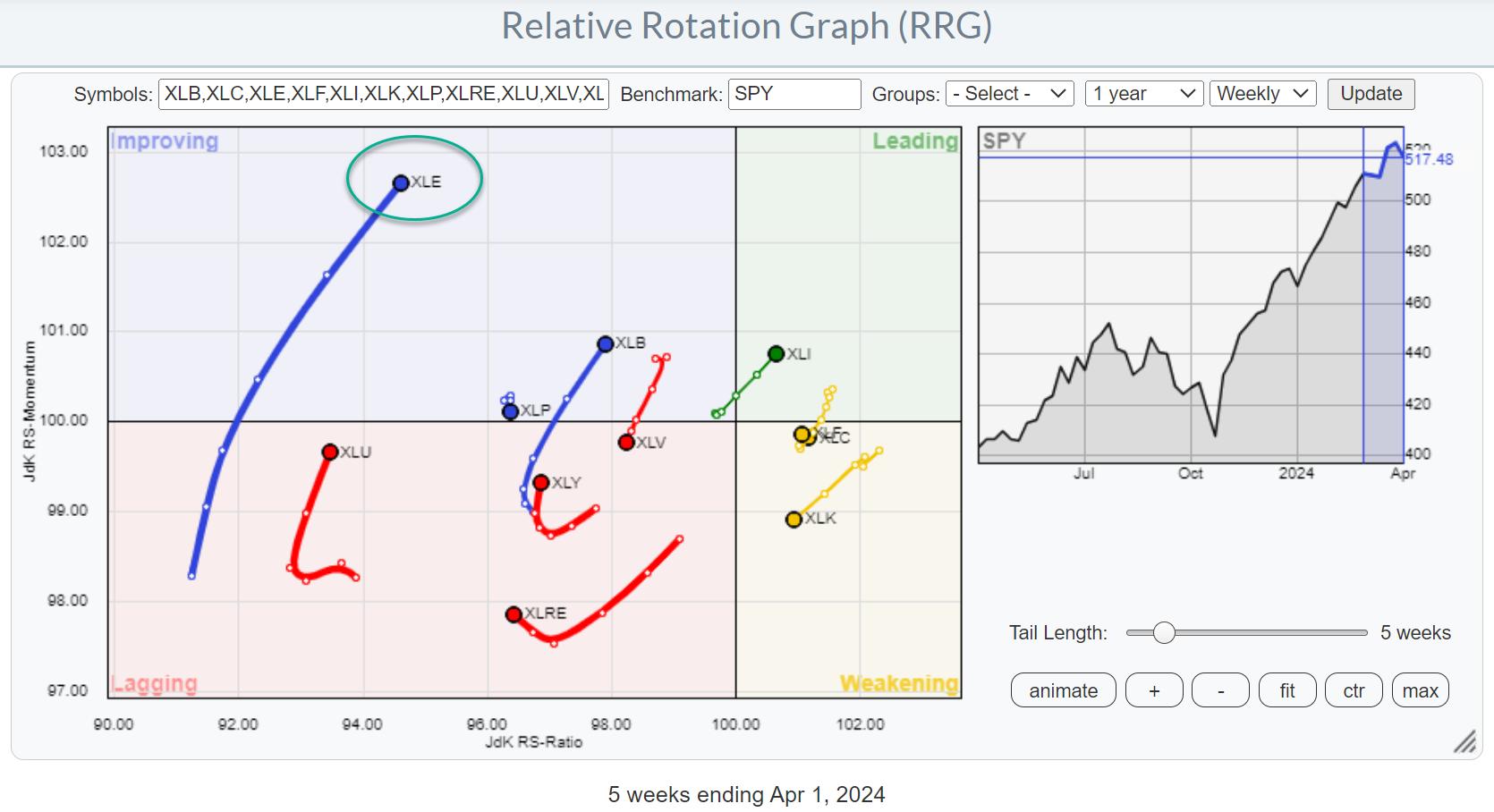

Energy is on Fire

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector is breaking higher on price chart

* XLE's RRG tail is continuing to pick up steam

* The exploration & production industry is leading inside the energy sector

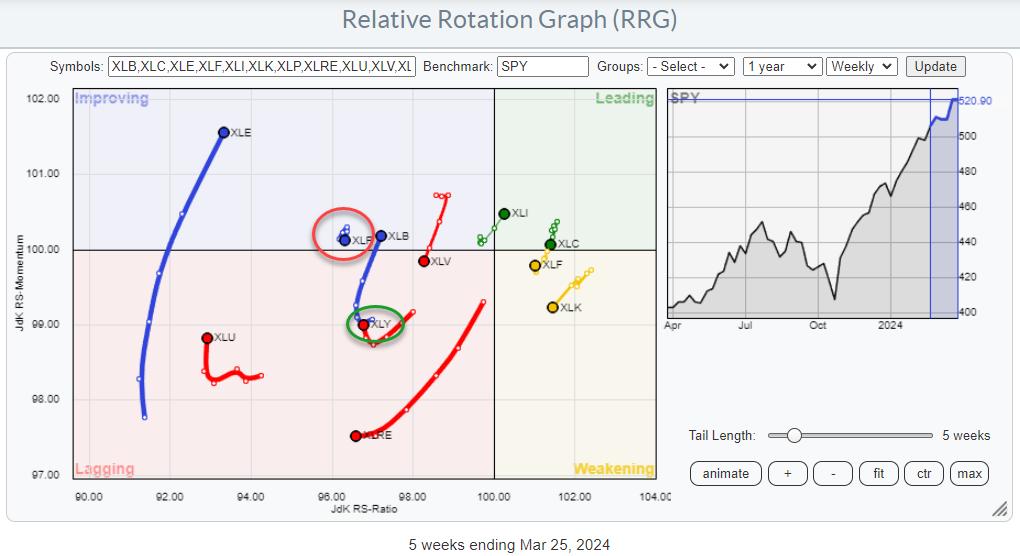

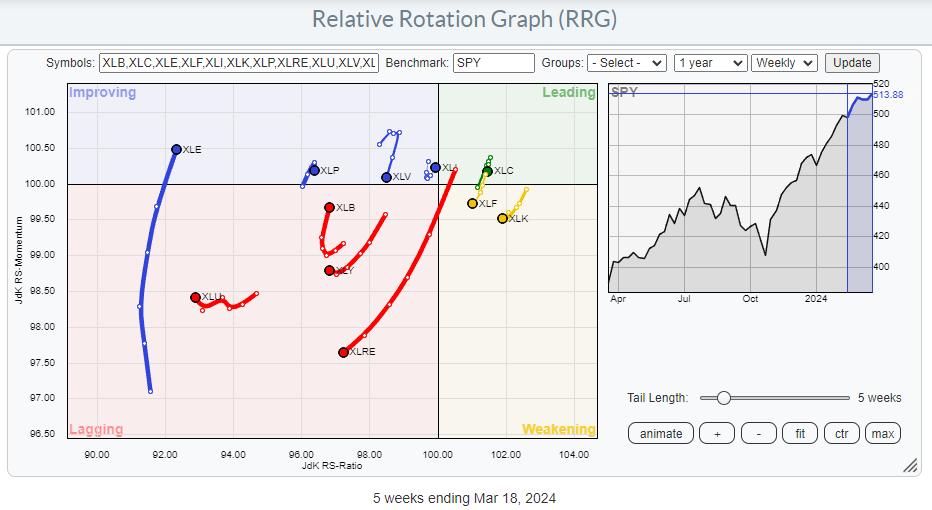

Strong Rotation on the Weekly RRG

For a few weeks now, the improvement in the energy sector (XLE)...

READ MORE

MEMBERS ONLY

Two Options Plays Amid Market Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Sean McLaughlin of All Star Charts. Sean shares his outlook for the Ark Innovation Fund (ARKK) and energy stocks (XLE) and how to employ options strategies to bet on particular outcomes. David tracks the afternoon selloff which created...

READ MORE

MEMBERS ONLY

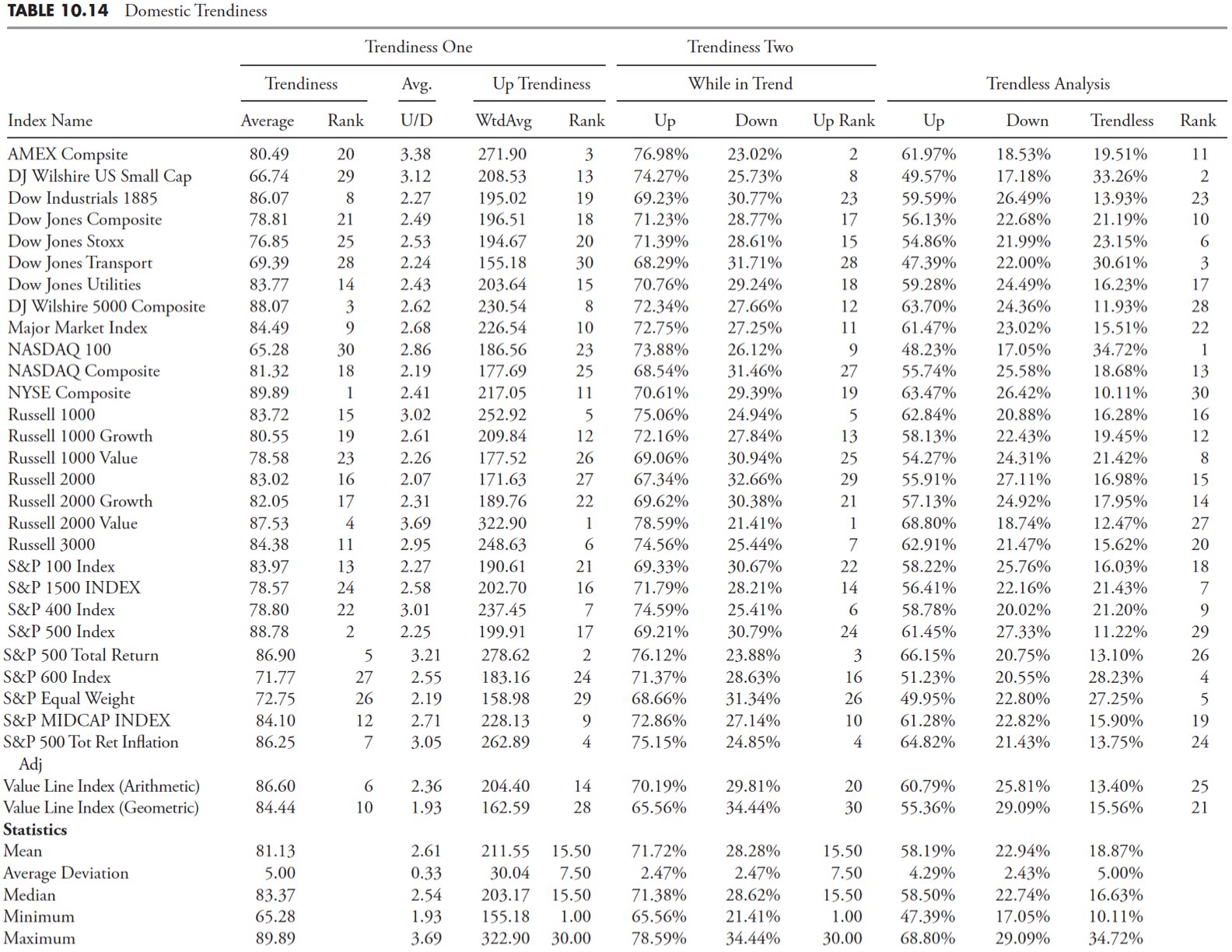

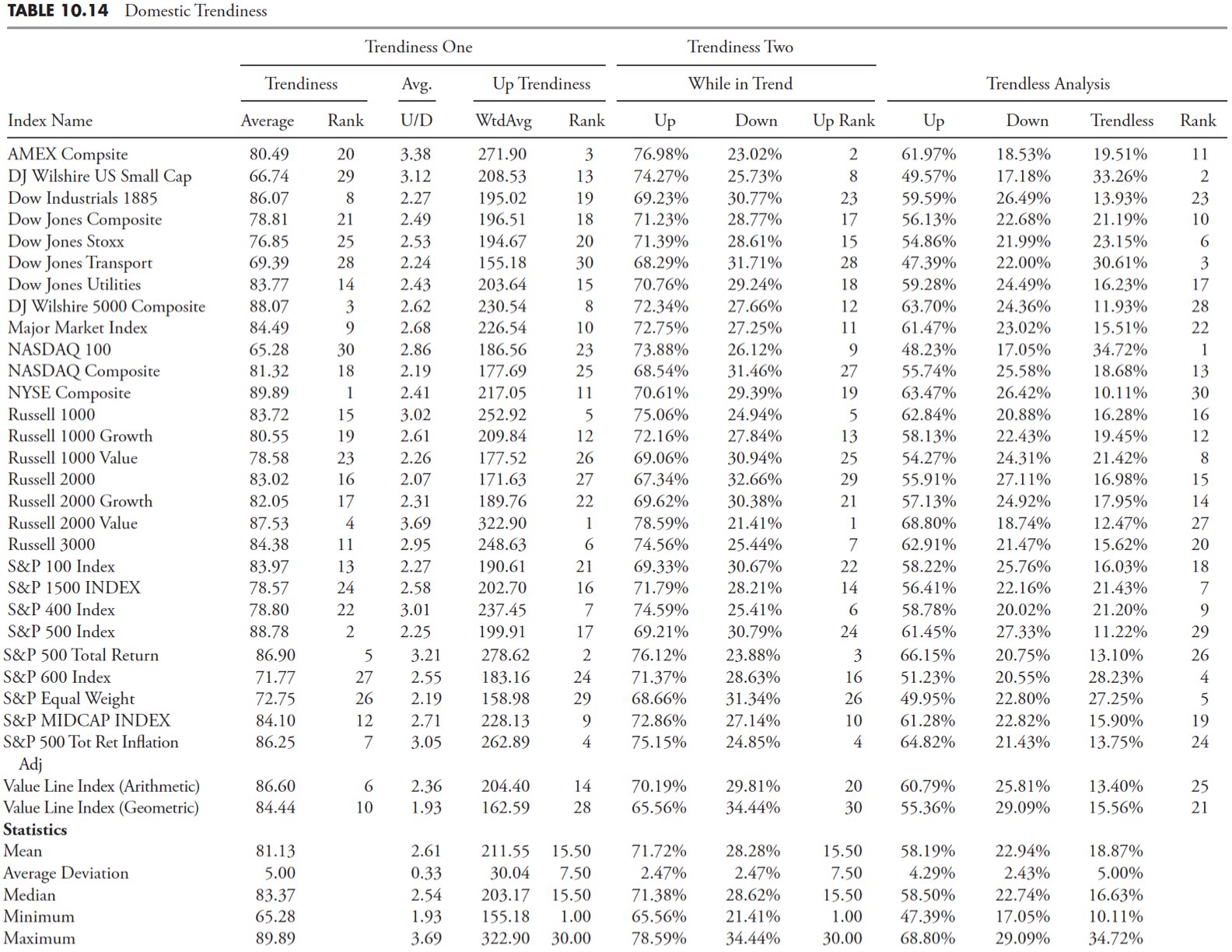

Market Research and Analysis - Part 4: Trend Analysis Continued

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

These Sectors are Poised to Lead in Q2

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Mish Schneider of MarketGauge as she walks through charts of the Swiss Franc, solar stocks, and uranium, with a focus on price momentum and multiple time frame analysis. Dave breaks down the S&P 500 sectors into...

READ MORE

MEMBERS ONLY

Top Two Sectors to Watch in April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Joe Rabil of Rabil Stock Research, who shares two sectors, Energy and Materials, where he sees upside potential given the recent upswing in commodity prices. Dave speaks to the developing pullback in growth leadership names and why...

READ MORE

MEMBERS ONLY

Should You be Concerned About These Four Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave and guest Julius de Kempenaer of RRG Research talk sector rotation, growth vs. value, offense vs. defense, and an outlook for the US equity markets as we begin Q2 2024. Dave also charts the strong breadth readings and low...

READ MORE

MEMBERS ONLY

DP Trading Room: On-Balance Volume (OBV) Explained

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin cover the topic of On-Balance Volume (OBV) as a representation of volume trends. This came to their attention as they uncovered an OBV negative divergence on the SPY chart.

Carl completes a review of the weekly charts for the Magnificent 7 stocks, giving us a more...

READ MORE

MEMBERS ONLY

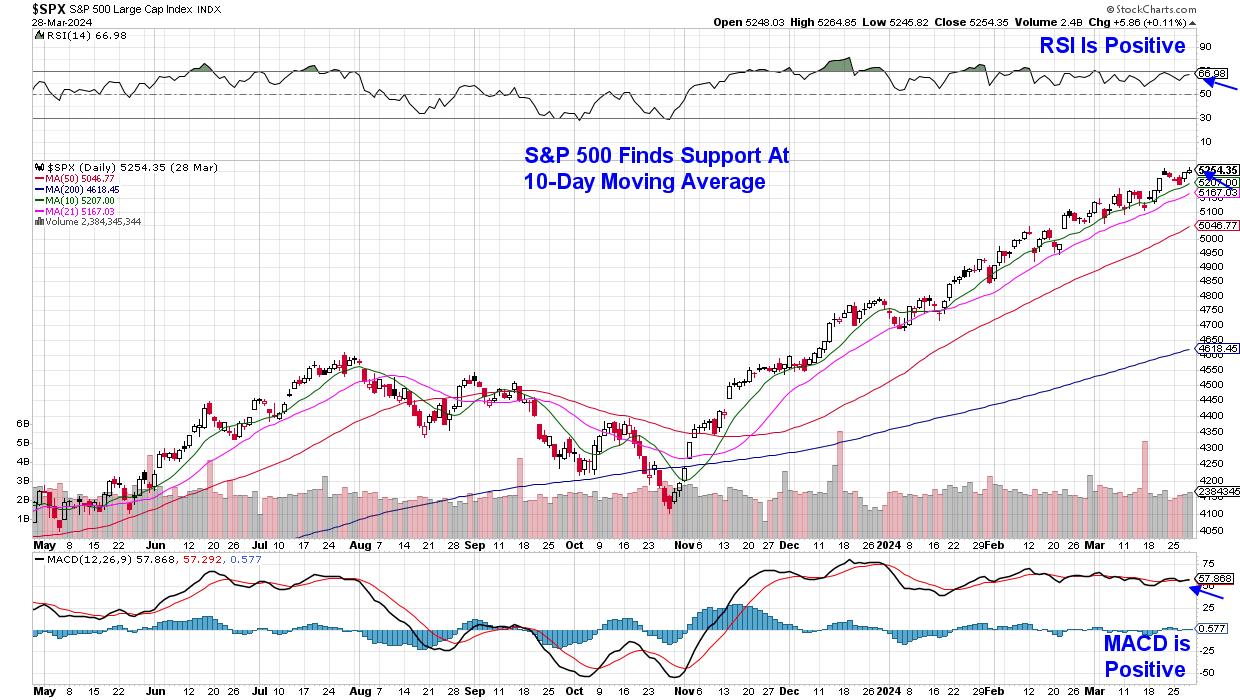

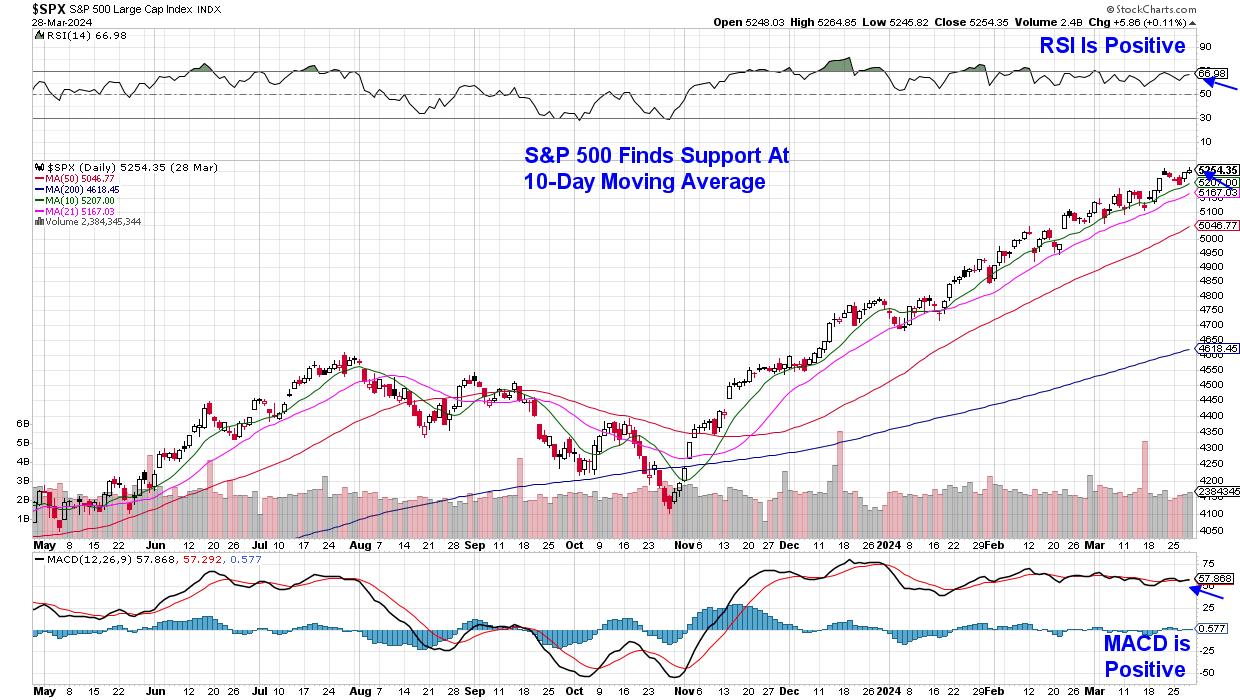

Core PCE Data Has Powell Pleased - May Set Tone For Q2

by Mary Ellen McGonagle,

President, MEM Investment Research

The Fed's preferred gauge of inflation was released today and, according to Fed chief Jerome Powell, "it was good," as there were no ugly surprises. This news could boost the markets, as sticky inflation data has had investors on edge amid interest rates that have remained...

READ MORE

MEMBERS ONLY

MEM TV: Small Cap STOCKS SHINE! 4 Names to Play the Strength

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's shaping up in the broader markets after the Fed announced their rate cut plans. She also shares how to use ETFs to shape your investment decisions for the longer term. In addition, Mary Ellen...

READ MORE

MEMBERS ONLY

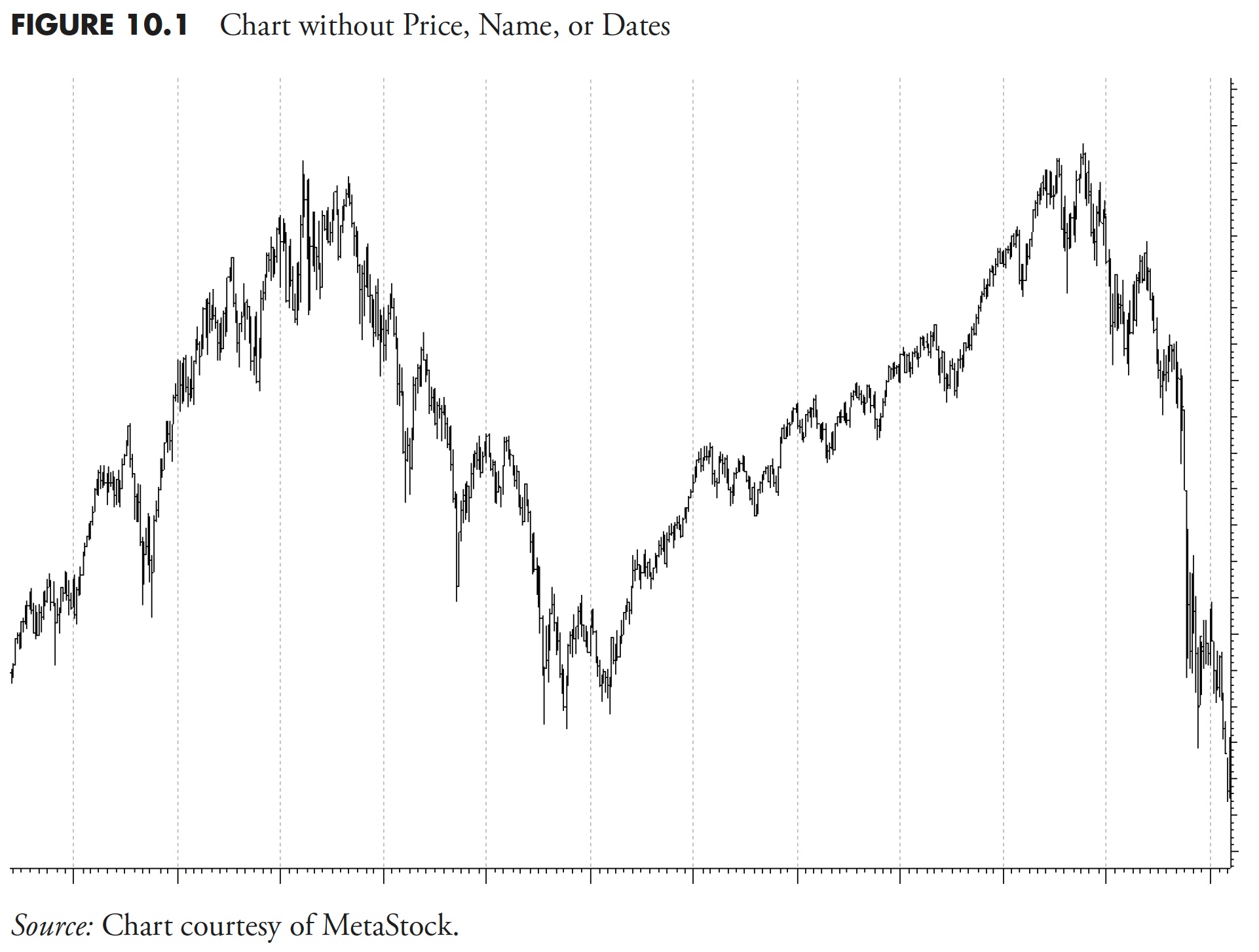

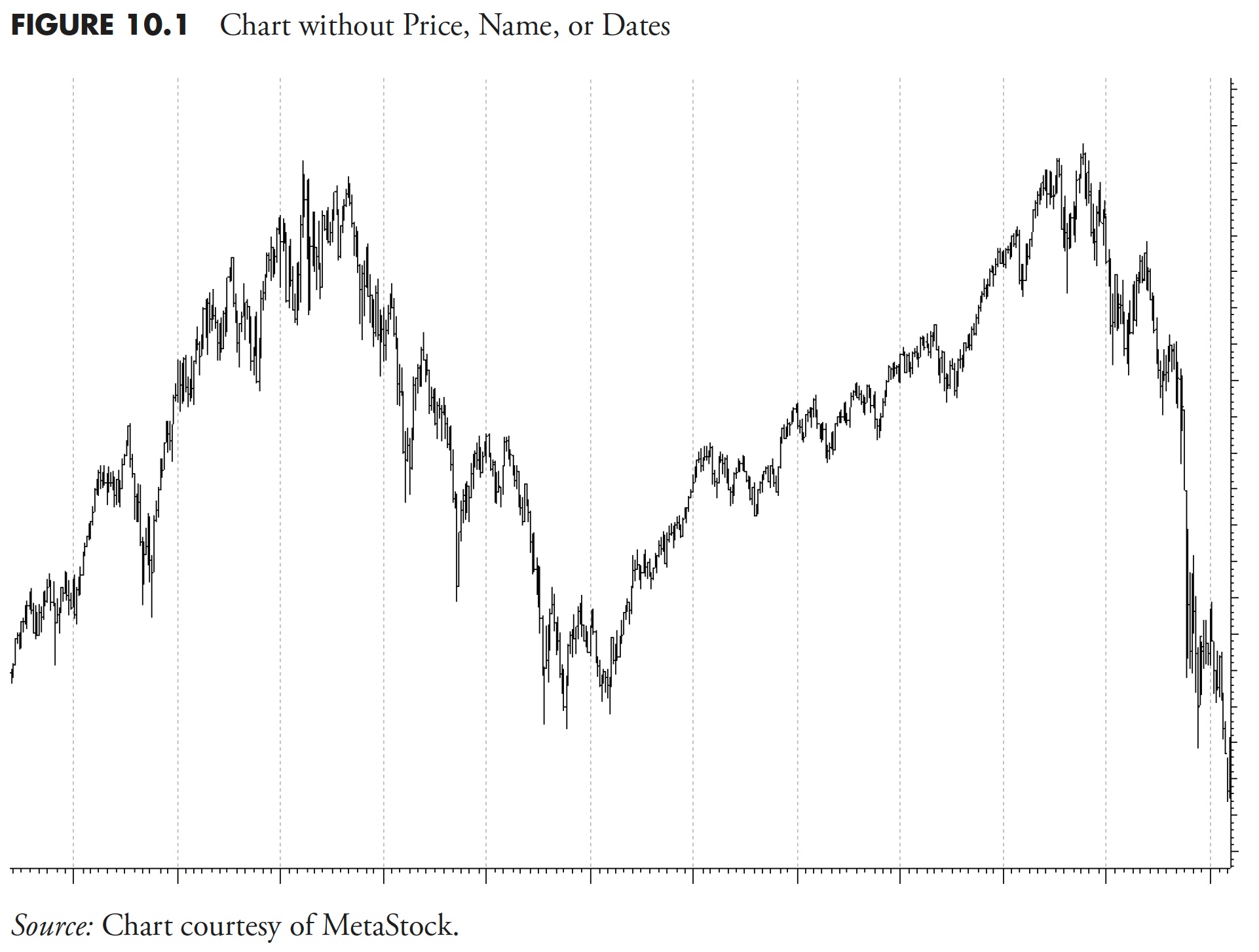

Market Research and Analysis - Part 3: Market Trend Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fourteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Return of the Meme Stock Frenzy: Is Now the Time to Shift Your Investment Focus?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Wednesday's broad stock market rally shows that investors are still willing to take chances in the stock market

* Even though the stock market rallied, Communication Services and Technology were the worst performing S&P 500 sectors on Wednesday

* Gold prices have been on a tear...

READ MORE

MEMBERS ONLY

S&P 7000 By End of 2024?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest David Hunter of Contrarian Macro Advisors shares his updated target for the S&P 500, and makes the case for a bullish melt-up phase for stocks, bonds, and gold. Dave Keller focuses in on the relative performance of...

READ MORE

MEMBERS ONLY

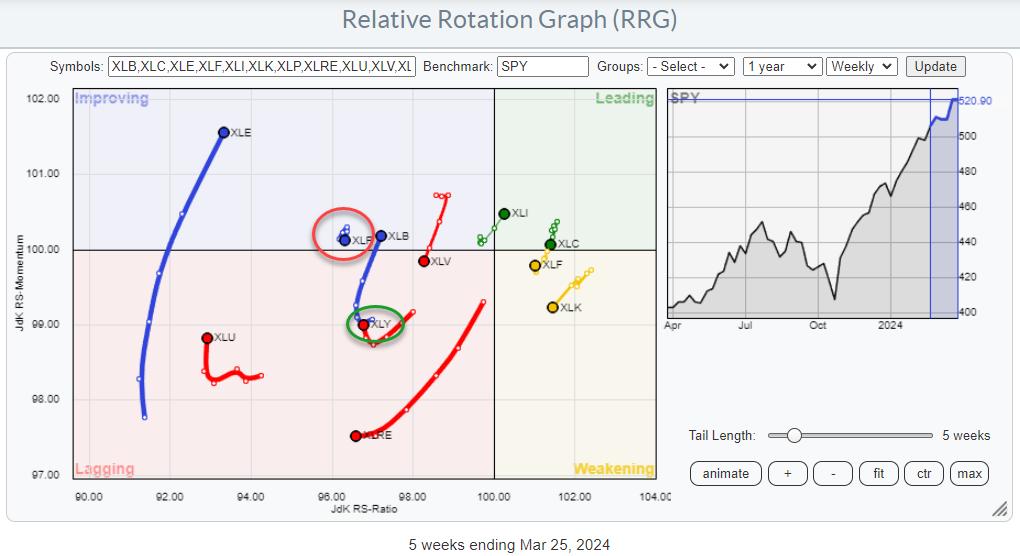

When These Levels Break, The S&P 500 is Going to Explode Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Discretionary Beating Staples

* Sectors Pushing Against Major Resistance Levels

Summary

The Relative Rotation Graph for US Sectors for this week mainly shows a continuation of the rotations as they were underway last week.

XLB: This is moving from lagging into improving at a strong RRG-Heading, underscoring the...

READ MORE

MEMBERS ONLY

KRE's Impending Plunge: What This Emerging Crisis Means

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* KRE (the SPDR S&P Regional Banking ETF) is trading within a fairly wide uptrend channel

* Momentum in KRE appears to be waning which could uncover short-term trading opportunities

* Many regional banks can face increasing debt delinquencies and may be on the brink of collapse

Full disclosure:...

READ MORE

MEMBERS ONLY

DP Trading Room: Shake Up at Boeing (BA)

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin reviewed the Boeing (BA) chart together discussing the technical ramifications of the step down of the CEO and two other board members. We do note that the CEO will finish out the year so problems could continue throughout the year. The technicals on the chart are...

READ MORE

MEMBERS ONLY

Week Ahead: Short Week May Not See NIFTY Adopting Sustained Directional Bias; Volatility May Return

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a corrective action the week before, the markets continued to wear a tentative look throughout this past week as well.

In the previous technical note, it was mentioned that the level of 22525 has become an intermediate top for the markets, and any runway upsides should not be expected....

READ MORE

MEMBERS ONLY

MEM TV: Get In EARLY! These Areas Are Seeing LIFT OFF

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's shaping up in the broader markets after the Fed announced their rate cut plans. She also shares how to use ETFs to shape your investment decisions for the longer term. In addition, Mary Ellen...

READ MORE

MEMBERS ONLY

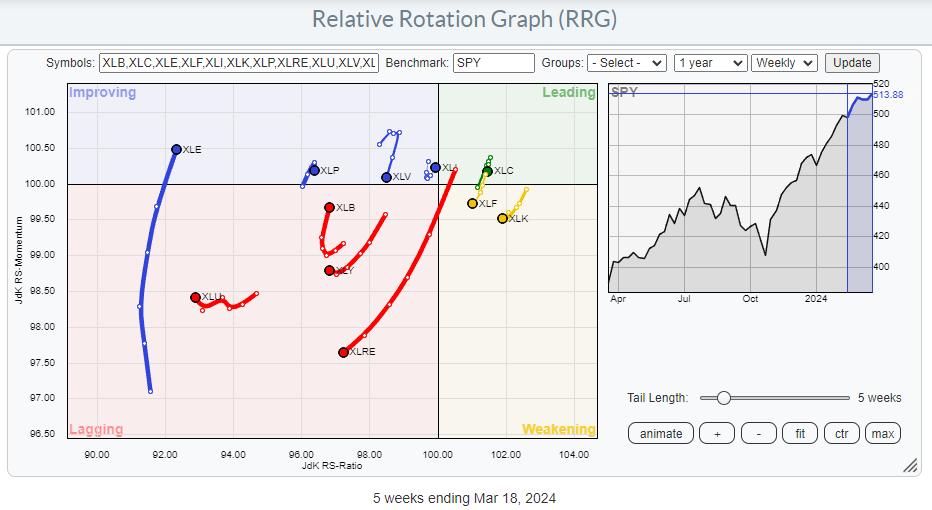

Energy: A Long-Term Turnaround in Relative Strength is Brewing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector showing relative strength in three timeframes

* The sector is nearing a heavy resistance area

* A long-term turnaround in relative strength appears to be underway

Energy Improving in Three Time Frames

Watching the sector rotation at the start of this week shows a continued improvement for the...

READ MORE

MEMBERS ONLY

How Would YOU Rank the Magnificent 7 Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the continued leadership rotation from growth to value, with SMCI breaking below $1000 and GOOGL dropping a shooting star candle on Monday's session. He walks through a process to compare and contrast the Magnificent 7 stocks,...

READ MORE

MEMBERS ONLY

DP Trading Room: Use a Price Momentum Oscillator (PMO) Sort to Find Winners!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin open the show with an example of how you can find stock and ETF relative strength using a Price Momentum Oscillator (PMO) sort. Many may not know but PMO readings can be compared to one another to determine relative strength.

Carl gives us a review of...

READ MORE

MEMBERS ONLY

Week Ahead: Technical Setup Stays Weak; NIFTY May See Corrective Pressure At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After inching higher for six weeks with intermittent corrective bouts, Indian equities finally took a breather and succumbed to a corrective move as it ended the week on a negative note. In the previous weekly technical outlook, it was categorically mentioned that the markets remain prone to corrective retracement. In...

READ MORE

MEMBERS ONLY

MEM TV: Risk-Off Signals Possible Downside Ahead

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews investors' responses to the rise in interest rates after inflation numbers come in higher than expected. She also shares how riskier areas of the market sold off while cyclicals came into favor. Earnings reports continue to...

READ MORE

MEMBERS ONLY

Spot The Warning Signs of Bankruptcy!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents an in-depth discussion on technical analysis patterns, market trends, and risk management. Explore how to spot bankruptcy risks, candlestick patterns, Dave's approach to QQQ, optimizing the Market Trend Model, RSI and MACD signals, "master risk...

READ MORE

MEMBERS ONLY

What Loss?! NVIDIA and ORACLE Rip Higher

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down today's market action direct from New York, tracking technology shares including NVDA and ORCL regaining lost ground after last Friday's losses. In a segment called Crypto Corner, he outlines two ways to apply...

READ MORE

MEMBERS ONLY

GNG TV: Materials, Industrials, Financials, Oh My...!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show from StockCharts TV, as the S&P 500 continues the rally at all time highs, Alex and Tyler take a look at GoNoGo Trend® conditions of several areas of the market. The recent breakout in Gold has much...

READ MORE

MEMBERS ONLY

DP Trading Room: Semiconductors - SOXX v. SMH, They're Not the Same

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and Erin explore the differences between two Semiconductor ETFs, SOXX and SMH. They are NOT the same. One offers far more upside potential than the other. Learn how to easily compare two ETFs or even two stocks using relative strength.

Carl covered the market in general with special attention...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stares at Both Incremental Highs and Consolidation at Higher Levels; Tread with Caution

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets continued to trade on expected lines. The trading week was short, as Friday was a trading holiday on account of Mahashivratri. In the four trading sessions, the markets stayed choppy and failed to make any definite and convincing moves while continuing to modestly advance on a weekly basis....

READ MORE

MEMBERS ONLY

MEM TV: Growth Stocks Fade While These Areas Shine

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets amid last week's pullback. She also highlights sector rotation taking shape as Growth stocks pull back. With Bank stocks outperforming, she shares how to use StockCharts to uncover top candidates.

This video...

READ MORE

MEMBERS ONLY

The Halftime Show: 100th and LAST Show!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Pete presents the 100th and final edition ofStockCharts TV'sHalftime! This week, Pete shares some parting tips on what to look for when the trends change from defense, (risk off) to offense (risk on). He explains how he saw them coming and how the Chaikin Power Gauge did as...

READ MORE

MEMBERS ONLY

Clear Split in NY FANG+ Universe Offers Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* NYFANG+ Index at elevated levels in strong uptrend.

* New long positions are exposed to high risk.

* I found a pair trading opportunity within the NYFANG universe to avoid directional market risk.

It is no secret that the NYFANG+ Index is still in in incredible up-run after bottoming out...

READ MORE

MEMBERS ONLY

Small Caps Breaking Out BULLISH

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave interviews Ari Wald, CFA CMT of Oppenheimer. He also covers Kroger, the iShares S&P 500 Value ETF, and Costco.

This video originally premiered on March 7, 2024. Watch on our dedicated Final Bar pageon StockCharts TV!

New...

READ MORE

MEMBERS ONLY

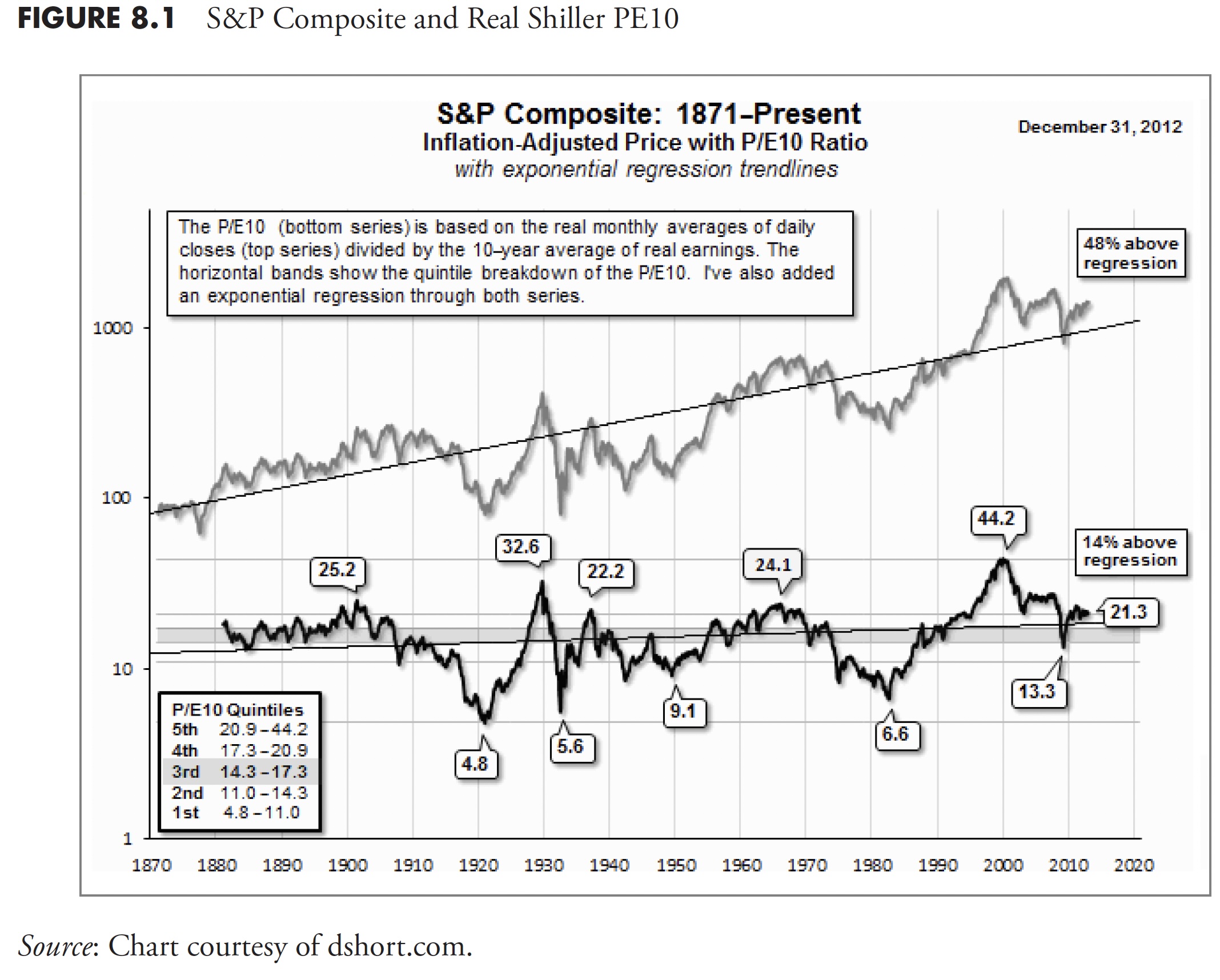

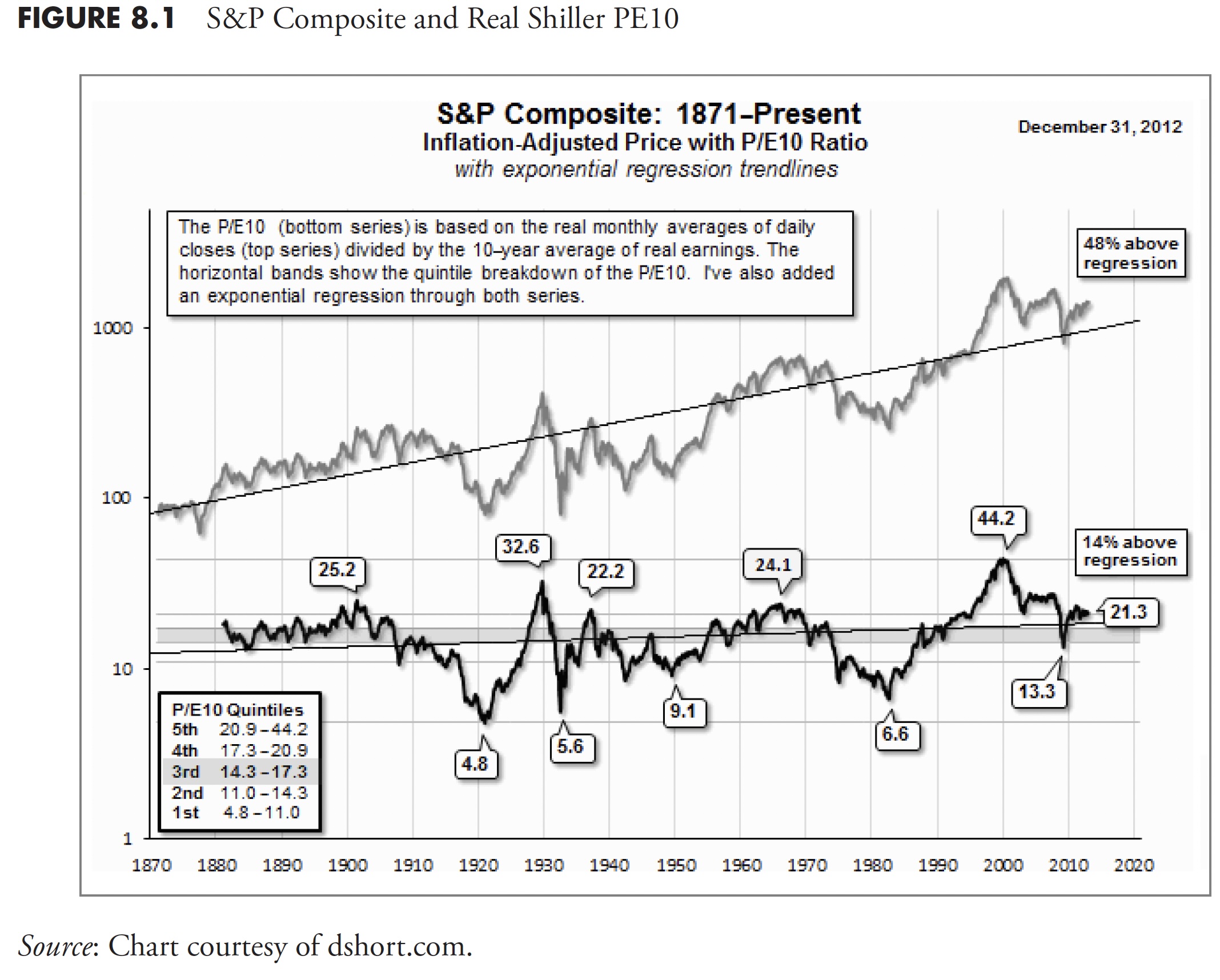

The Hoax of Modern Finance - Part 11: Valuations, Returns, and Distributions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eleventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

AAPL and TSLA Stocks Are COLLAPSING!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights mega-cap growth names that are in full breakdown mode, including TSLA, AAPL, and GOOGL. He also updates the latest market breadth indicators which suggest more of a leadership rotation into value-oriented sectors, and even Consumer Staples names including...

READ MORE

MEMBERS ONLY

Bitcoin Tests All-Time Highs While Growth Stocks Sag

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the hourly chart of Bitcoin and highlights recent breakouts for regional banks. Guest Julius de Kempenaer of RRG Research focuses in on the Communication Services sector, including META, DIS, and GOOG, and shows how defensive sectors have...

READ MORE

MEMBERS ONLY

DP Trading Room: Must See Gold Charts!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl begins today's show with a walk through General Electric (GE) which was in the news this week. See what Carl thinks of the charts!

Carl covers the market in general and pays particular attention to Gold as it launches skyward. Can this run continue? What does this...

READ MORE

MEMBERS ONLY

MEM TV: 3 Great WAYS to Play AMD Stock

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the move into Semiconductors and shares what that means for Technology. Diving in to volatility, she highlights 3 ways investors can take advantage of the moves in Advanced Micro Devices (AMD). She also highlights other bright spots...

READ MORE

MEMBERS ONLY

Magnificent 7 Not All Magnificent!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to the diversifying patterns within the Magnificent 7, with GOOGL and AAPL showing clear signs of short-term distribution. He also tracks Bitcoin reaching the 64K level and shares some initial thoughts from the CMT Dubai Summit.

This video...

READ MORE

MEMBERS ONLY

Flip the Script: Defense as Your New Offensive Playbook

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* March is a strong seasonal month for Utilities and Consumer Staples in relation to the broader market

* Utilities and Consumer Staples are defensive plays which, if timed correctly, can result in a positive market outcome

* The StockCharts Seasonality charts can help you identify sector plays that may not...

READ MORE