MEMBERS ONLY

Flip the Script: Defense as Your New Offensive Playbook

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* March is a strong seasonal month for Utilities and Consumer Staples in relation to the broader market

* Utilities and Consumer Staples are defensive plays which, if timed correctly, can result in a positive market outcome

* The StockCharts Seasonality charts can help you identify sector plays that may not...

READ MORE

MEMBERS ONLY

DP Trading Room: The PMO Versus the MACD!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl explains the benefits of using the Price Momentum Oscillator versus the MACD. They are not the same!

Carl then gives us his insights on the market in general as well as Bitcoin news, Magnificent 7 overview, as well as Crude Oil and Interest Rates.

Erin gives us an...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Consolidating; Finding Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, while the overall trend may stay intact, the markets could continue to largely consolidate. In line with the analysis, the markets kept consolidating, staying in a broad but defined trading range. That range, over the past week, was 422 points;...

READ MORE

MEMBERS ONLY

How Overextended Are You, QQQ?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've highlighted all the warning signs as this bull market phase has seemed to near an exhaustion point. We shared bearish market tells, including the dreaded Hindenburg Omen,and how leading growth stocks have beendemonstrating questionable patterns. But despite all of those signs of market exhaustion, our growth-led...

READ MORE

MEMBERS ONLY

MEM TV: Simple Way to Identify a Buy Point in NVDA

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets to new highs and what areas are outperforming. She also shares how to identify a buy point in NVDA after its gap up following earnings, as well as how to determine when a...

READ MORE

MEMBERS ONLY

Is Energy About to Undergo a Strong Seasonal Sector Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Combining fundamental forecasts with seasonality patterns offers a potent strategy for identifying tradable opportunities in specific sectors

* The Energy (XLE), Utilities (XLU), and Materials (XLB) sectors exhibit the strongest seasonal performance in the near-term

* Seasonality charts provide valuable insights, but checking overall stock market conditions and technical trading...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Box the Invisible Man -- EPS Reports

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete takes a look at long-term trends. Semiconductors taking it on the chin. Inflation is still a problem. Bonds are selling off, and the Fed isn't cutting rates until, in Pete's opinion, the unemployment rate falls....

READ MORE

MEMBERS ONLY

Sector Spotlight: Dominant Trend for Stocks Still UP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I separate the 11 sectors in the S&P 500 into Offensive, Defensive, and Sensitive, assessing their group rotational patterns to see if there is any alignment with the current technical condition of the S&P 500. After...

READ MORE

MEMBERS ONLY

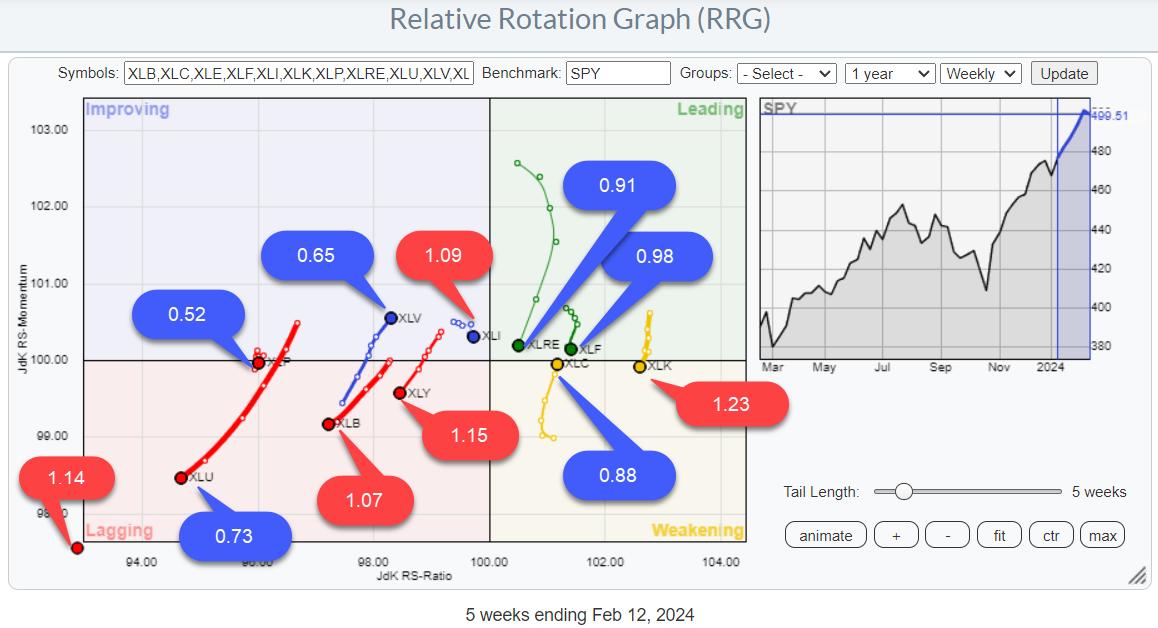

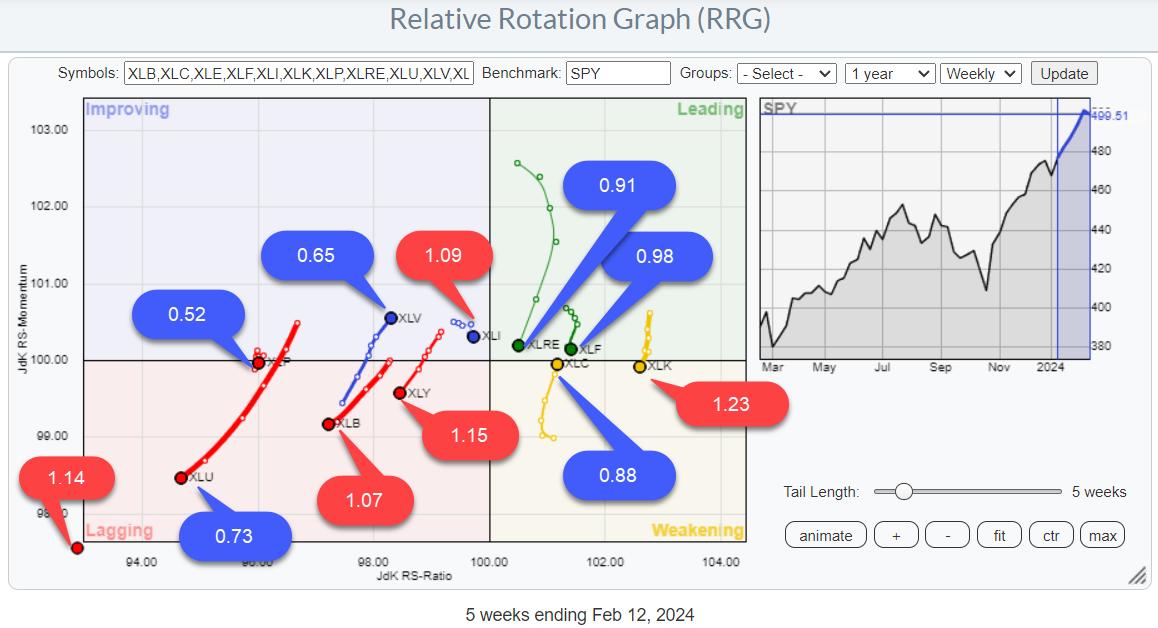

SPY Uptrend Intact, But Mixed Sector Rotation Signals Hesitation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Looking at Risk ON / OFF through BETA

* RRG shows mixed rotations

* SPY Uptrend intact with limited downside risk

BETA

One of the Risk ON/OFF metrics I like to keep an eye on is BETA.

From Investopedia:

—systematic risk—

I have updated my spreadsheet with last year'...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays In A Defined Range; Expect Directional Moves Only Outside These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Some serious consolidation continued in the markets as the Nifty oscillated in a defined range before closing the week with modest gains. Examination of daily charts shows that the Nifty tested its 50-DMA again and rebounded from that level while defending that point as important support. The trading range widened...

READ MORE

MEMBERS ONLY

MEM TV: Risk-On Trades Emerge Amid Big Tech Selloff

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sloppy week for the markets, driven by the key economic data that was released. We saw interest rates rise, which had some other carry-on impact. While the S&P 500 saw a bit of a...

READ MORE

MEMBERS ONLY

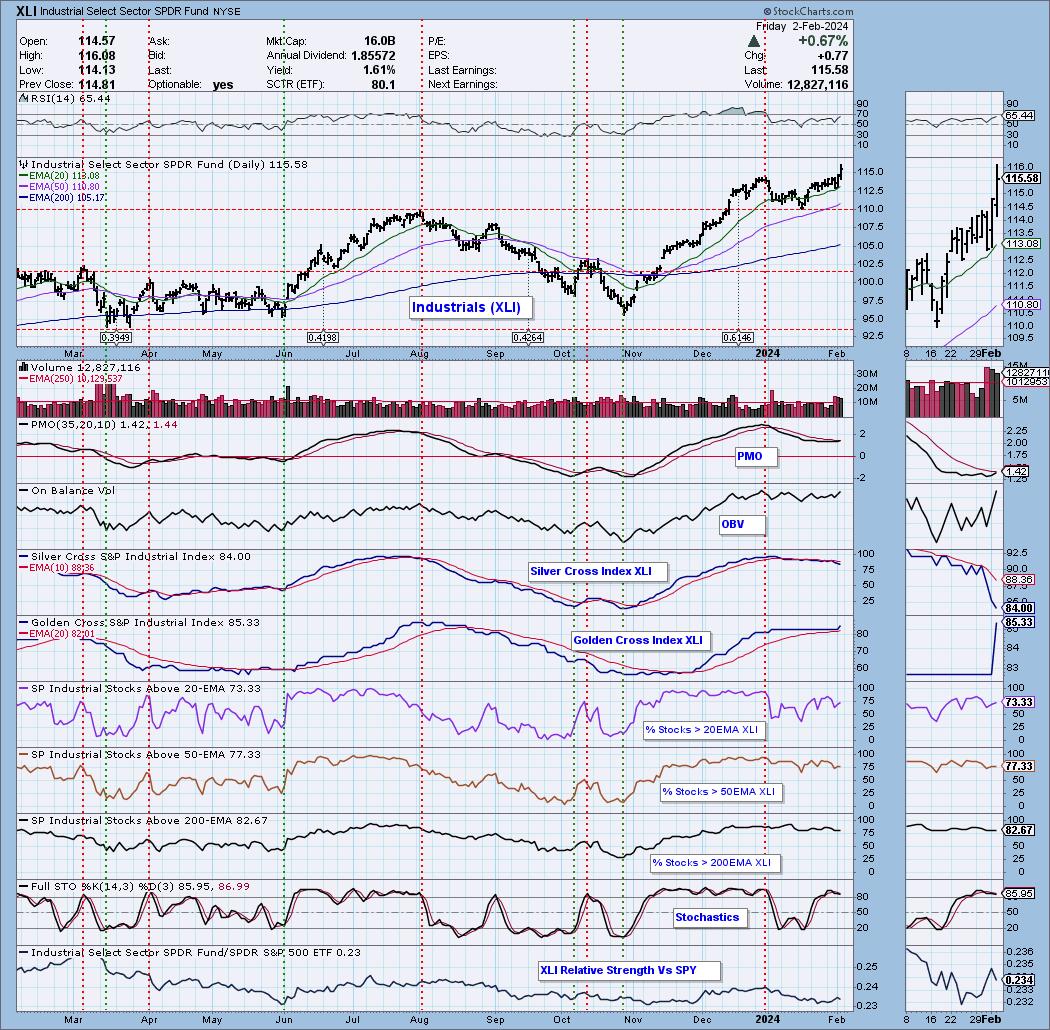

BUY Signals Continue to Diminish

by Carl Swenlin,

President and Founder, DecisionPoint.com

A Golden Cross BUY Signal is generated when the 50-day EMA of a price index crosses up through its 200-day EMA. DecisionPoint's Golden Cross Index (GCI) shows the percentage of stocks in a price index that have a Golden Cross BUY Signal, and is an expression of long-term...

READ MORE

MEMBERS ONLY

Sector Spotlight: EASY SCAN! Find Growth Names in Small-Caps

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I start with an assessment of the daily and weekly charts for SPY, trying to put recent developments into perspective. Then, I go over various Relative Rotation Graphs slicing the market down into various-size segments, as well as growth and...

READ MORE

MEMBERS ONLY

DP Trading Room: Avoid These "Magnificent 7" Stocks!

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode, Carl reviews the Magnificent 7 and gives you his opinion on their current and possible future states. He warns against two in particular and gives his stamp of approval on three others. Negative divergences are still a problem and Carl explains why....

READ MORE

MEMBERS ONLY

MEM TV: Best Way To Participate in Stronger Areas of The Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews why the markets continue to hit new highs while also highlighting which areas are driving this strength. She then shares a low-risk, simple way to participate in the uptrend among these stronger areas.

This video originally premiered...

READ MORE

MEMBERS ONLY

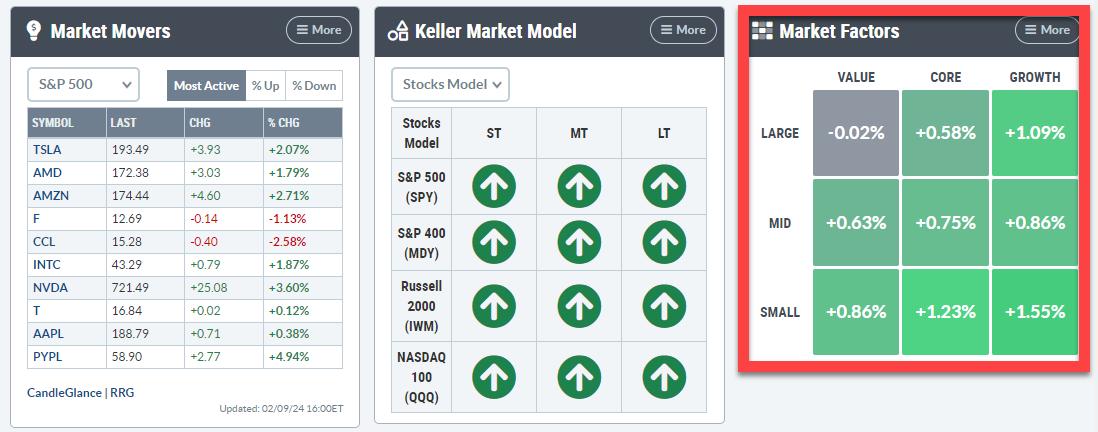

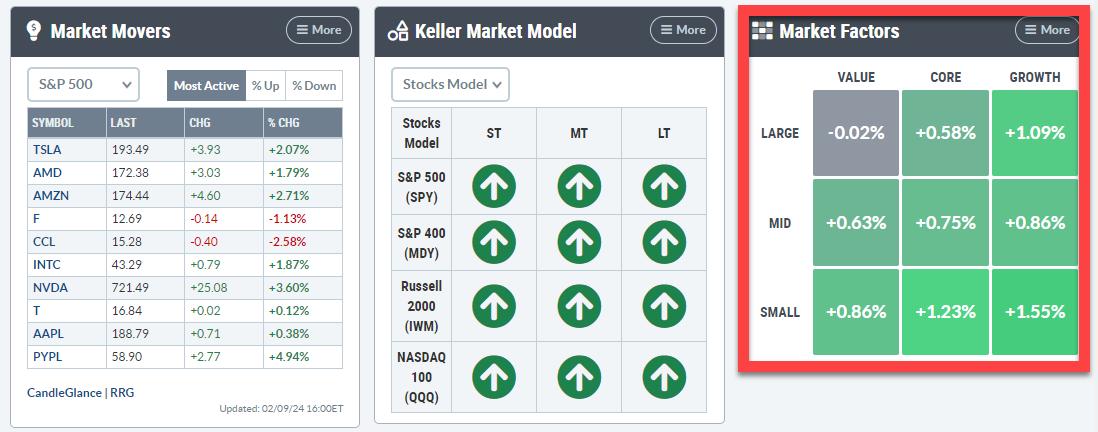

Visualizing the Market Factors Panel on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Bring the New Market Factors Panel to a Relative Rotation Graph

* Same approach using different index family shows a different image

With the release of the new Panels feature on the StockCharts dashboard, there are a lot of ways that users of RRG charts can take advantage! Let&...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds -- Monthly Trends Revealed!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I review the monthly charts for January 2024, in combination with the Relative Rotation on the Monthly RRGs for asset classes and sectors. At asset class level, the preference for stocks over bonds remains clearly visible. Looking at the monthly...

READ MORE

MEMBERS ONLY

DecisionPoint Trading Room: Narrow Advance a Big Problem!

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rally last week was very narrow, driven mainly by large gains in communication services stocks like Meta. Many technical indicators are showing negative divergences. The broader market struggled. Erin reviews all of the sectors under the hood and then takes your symbol requests.

Key Takeaways:

- Communication services...

READ MORE

MEMBERS ONLY

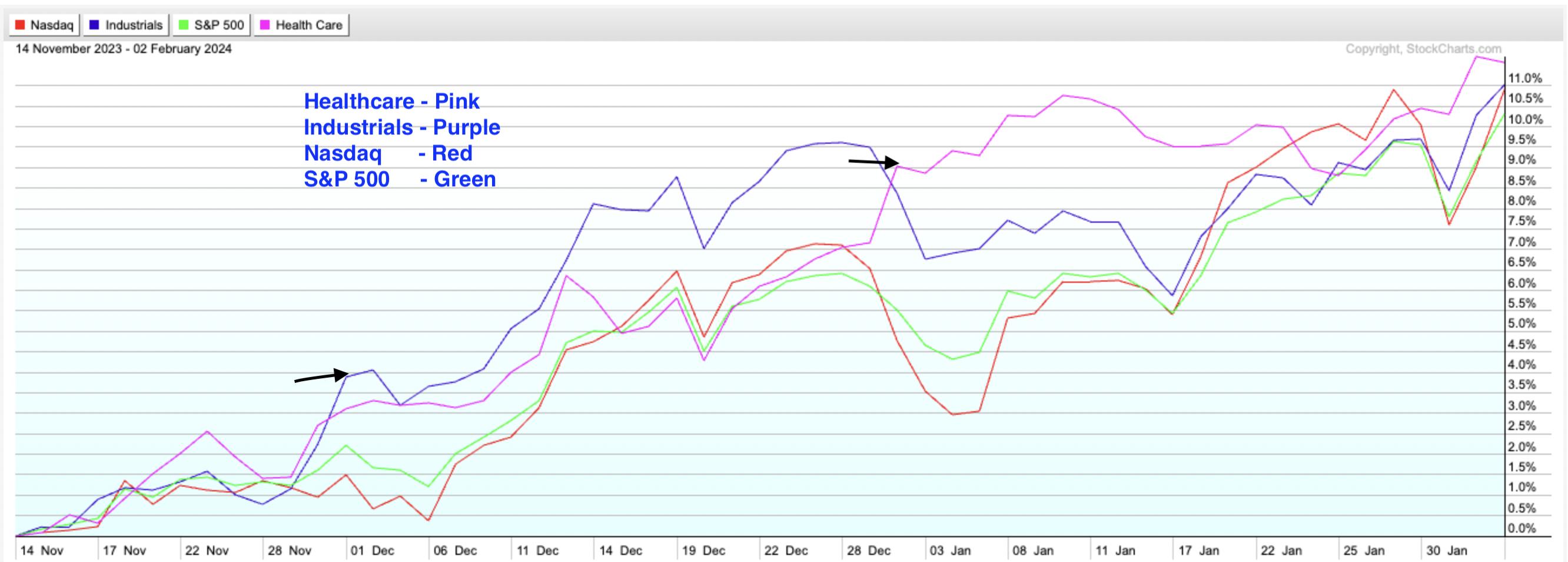

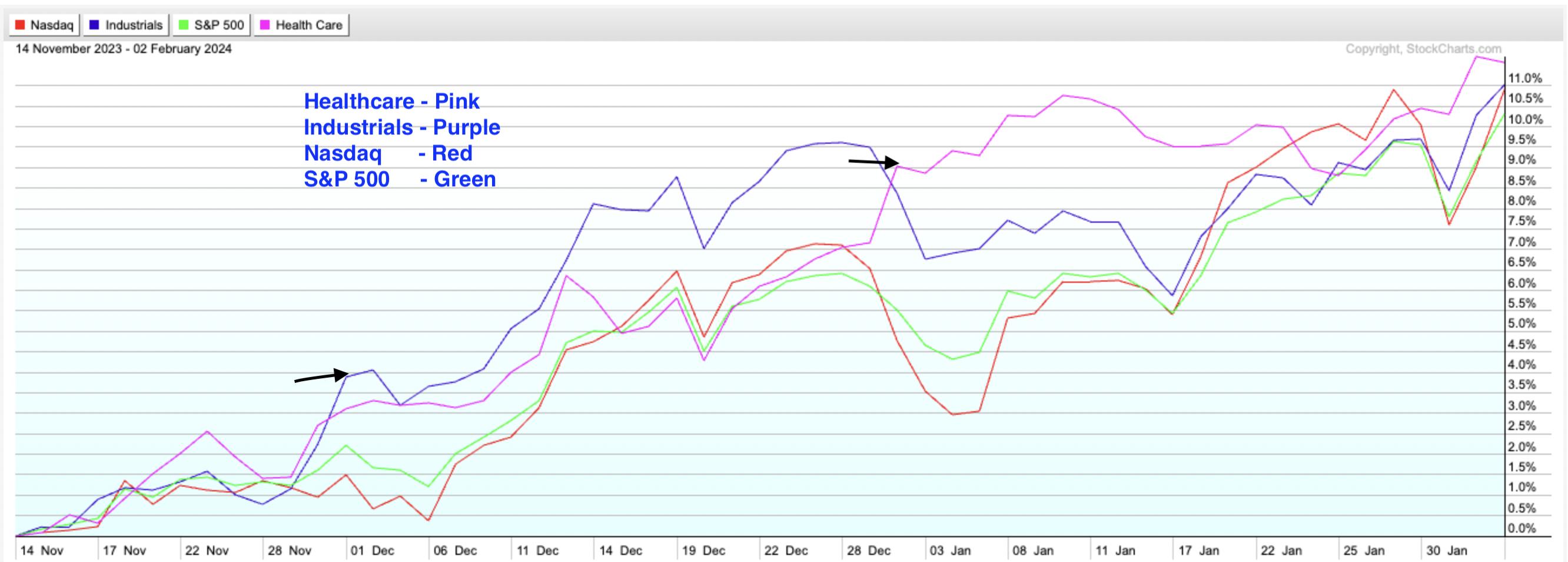

Strong Earnings Is Driving Sector Rotation Into These 2 Groups

by Mary Ellen McGonagle,

President, MEM Investment Research

It was a choppy push to new highs for the S&P 500 this week, after a sharp drop Wednesday on Fed news was followed by a recovery rally on the heels of strong earnings from select Magnificent 7 names. All three indexes posted a 4th consecutive week of...

READ MORE

MEMBERS ONLY

MEM TV: Here's How to Trade Gaps Up After Earnings!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the market's recovery from Fed Chair Powell's comments on Wednesday, sharing exactly what drove the S&P 500 to new highs. She also reviews the sector rotation that's taking place,...

READ MORE

MEMBERS ONLY

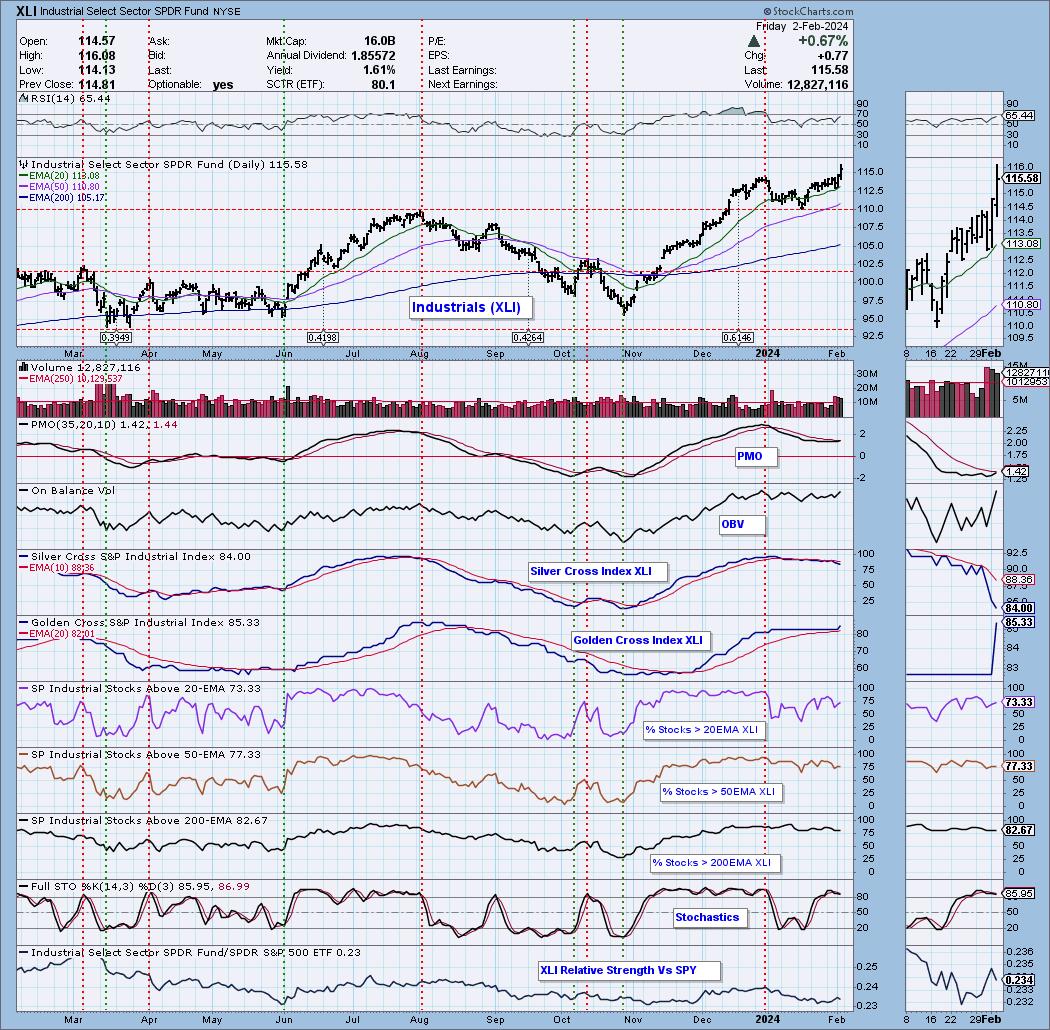

This Week's Sector & Industry Group to Watch

by Erin Swenlin,

Vice President, DecisionPoint.com

Before we get started today, I want to encourage you to subscribe to our new YouTube Channel for DecisionPoint. We post the recording of our weekly trading room there, and it is also full of educational videos that Erin has done over the years. Click on this LINK to subscribe...

READ MORE

MEMBERS ONLY

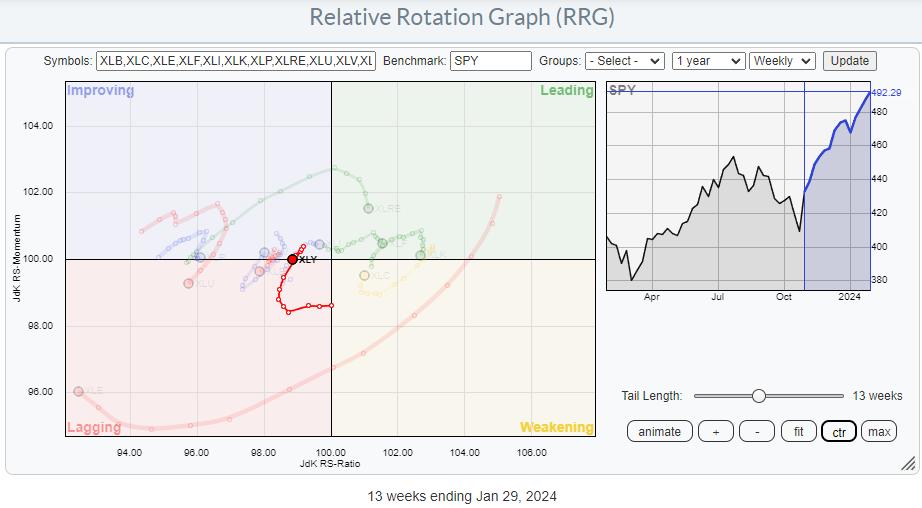

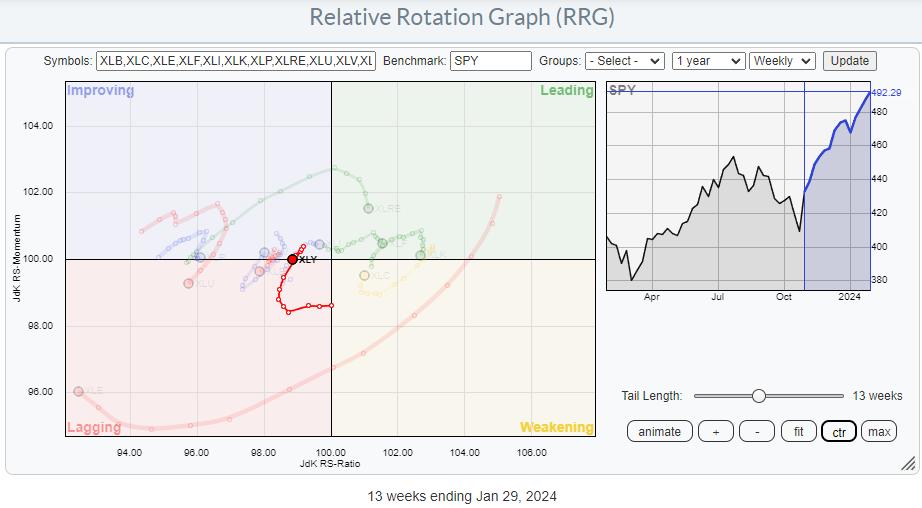

Discretionary vs. Discretionary, a Fierce Battle Under the Hood

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Not all is what it looks like inside the Consumer Discretionary Sector

* Using Cap-weighted vs. Equal-Weighted Sectors on RRG reveals underlying differences

* Mega-cap Stocks are dragging XLY down

* Using a Simple Scan Leads to four interesting charts

Cap-Weighted vs. Equal-Weighted

Sometimes, you need to look a little further....

READ MORE

MEMBERS ONLY

Bullish Buyers Return After Market Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Jay Woods, CMT of Freedom Capital Markets brings the energy of the NYSE floor to the show, relating today's market rebound to longer term themes for small caps and regional banks. Dave shares one breadth indicator recognizing broad...

READ MORE

MEMBERS ONLY

DR Horton Stock Plummets: Is Now the Time to Buy the Dip?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* DHI's stock plummeted after missing Wall Street's earnings expectations and soft guidance

* Technical indicators provide a clearer view for those looking to buy the dip

* You can use StockCharts seasonality charts to provide a big-picture context to your trading setup

The tight supply environment...

READ MORE

MEMBERS ONLY

Betting Against the Fed is RISKY!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity shares insights on today's Fed meeting and what data he's following to anticipate rate cuts through 2024. Dave tracks mega cap growth stocks, including MSFT and GOOGL, which are in pullback...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Market is Moving Higher, BUT Avoid Real Estate in February!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, after a quick look at asset class rotation and sector rotation for US stocks, I dive into a comparison of cap-weighted sectors vs. equal-weighted sectors and find a big difference for the Consumer Discretionary sector, which underscores and supports the...

READ MORE

MEMBERS ONLY

MEM TV: Market Uptrend Endures Ahead of BIG Earnings Next Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the markets stand as we head into earnings from MSFT, GOOGL, AAPL and META. She also discusses how ETFs can help you refine your trading strategies and stock selection, then shares base breakouts and downtrend reversal...

READ MORE

MEMBERS ONLY

Stock Market Indexes Keep Setting New Highs: How Much Higher?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P notched new record highs in five consecutive trading sessions but snapped the winning streak on Friday

* Investors still are complacent, as indicated by the CBOE Volatility index

* The benchmark 10-year Treasury yield remains within a 4% to 4.2% range

In the first week...

READ MORE

MEMBERS ONLY

Sector Spotlight: US Stocks Once Again Lead the World

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I highlight the short-term weakness in BTC, the price strength in USD, and the clear strength of stocks over all other asset classes. In sectors, I analyze the continuing rotation out of defensive sectors, which is another positive for stocks...

READ MORE

MEMBERS ONLY

Economic Modern Family Has Divisive Weekly Charts

Over the weekend, I covered the daily charts on the Economic Modern Family, featuring the Russell 2000 (IWM) and Retail (XRT). Both are lagging the benchmark and in the middle of their January trend calendar ranges.

As Semiconductors, NASDAQ, the Dow, and S&P 500 continue to post new...

READ MORE

MEMBERS ONLY

MEM TV: Tech Stocks Blast Higher! S&P 500 Bull Market Confirmed!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish price action in the markets and shares her longer-term outlook. She also highlights the primary driver of last week's rally and which areas and stocks pushed the S&P 500 higher. In...

READ MORE

MEMBERS ONLY

Tech and Semis Leading from the Dip

by TG Watkins,

Director of Stocks, Simpler Trading

The market was severely overbought going into the new year, so some steam was left off, which, as TG Watkins notes, we can see in the breadth readings. Now with notable names in the tech space leading and taking off, its time to get back in and see if the...

READ MORE

MEMBERS ONLY

Economic Modern Family's Engine Idles While Growth Goes Fast and Furious

Let's get right to it. The charts and our tools are telling.

To start, I always look at moving averages and phases. Then I look at Real Motion and momentum to see if there is a divergence to price. After that, I check out our Leadership indicator which...

READ MORE

MEMBERS ONLY

Utilities' Unique Seasonal Powers: The Best Months to Invest

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Utilities sector has periods of cyclical outperformance

* Seasonality charts in StockCharts can identify which months Utilities are likely to outperform

* Analyzing a price chart of the XLU ETF can help time your entries so they coincide with seasonal patterns

The Utilities sector is known as a defensive...

READ MORE

MEMBERS ONLY

Sector Spotlight: Is the S&P 500 Facing a Double Top?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I look at asset class rotation and examine the continued preference for stocks over bonds. After that, I move on to sector rotation and the Technology sector, breaking it down into industry groups and plotting them on a Relative Rotation...

READ MORE

MEMBERS ONLY

The Case for a Tactical Stock Selloff

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Adam Turnquist of LPL Financial lays out the case for a tactical selloff for stocks, as well as why long-term indicators remain constructive in early 2024. Dave breaks down the bearish momentum divergence prevalent in the technology sector, and...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" January 16, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry digs into rate cuts and how they affect the markets. When interest rates are high, money is in circulation. He's been watching the rate of inflation; as he notes, an object in motion tends to stay on the same path. He also warns against...

READ MORE

MEMBERS ONLY

View The Large Cap - Small Cap Debate in a Direct Comparison on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Using RRG to see Large-Cap vs Small-Cap sector rotation

* The current strength for Small-Cap stocks vs Large-Caps is evident

At the end of last year, I wrote a blog article about the relationship between Large-Cap and Equal-Weight sectors. It involved plotting the ratios of the large-cap sector ETFs...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Showing Strong Rotation For Stocks in All Time Frames

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Stocks Showing Relative Strength in All Time Frames on RRG

On this episode of StockCharts TV's Sector Spotlight, 2024's first episode, I dive into both Asset Class and Sector Rotation to set the stage for 2024. Today, I focus on a synchronized rotation of...

READ MORE

MEMBERS ONLY

MEM TV: The Easy Way to Uncover Stocks Poised to Outperform

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at some of the items that drove price action last week. Growth stocks came roaring back for week two of 2024, which is great news for those that were believers last year. They can renew...

READ MORE