MEMBERS ONLY

Is the Market Ready for Another Dip?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG points out how the market is still digesting the big move from the November/December run. It ran a huge sprint, and now needs to cycle down in order to create room for the next leg up. The internals...

READ MORE

MEMBERS ONLY

XLV's Record Rally: The Must-Know Investment Move of the Year

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Healthcare Select SPDR ETF XLV has seen a 16% rise from its October low and is showing upside momentum

* Seasonal patterns in XLV show that July and November are the strongest months in terms of returns and higher close rates

* Combining seasonality patterns and technical indicators shows...

READ MORE

MEMBERS ONLY

SPOT ETFs APPROVED!! The Technical Case for Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Adrian Zduńczyk, CMT of The Birb Nest discusses upside potential for Bitcoin and Ethereum based on expectations around new Bitcoin ETFs, as well as a bullish technical configuration. Dave highlights leading growth stocks, like META scoring new 52-week highs, as...

READ MORE

MEMBERS ONLY

3 Health Care Stocks Flashing Promising Golden Cross: Why You Need to Watch Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Health Care sector has shown upside momentum in 2024

* It may be a good time to add some healthcare stocks to your portfolio

* The Bullish 50/200-day MA Crossovers scan in StockCharts filtered out three healthcare stocks that deserve attention

The Health Care sector started rallying in...

READ MORE

MEMBERS ONLY

Don't Miss Out! 2 Promising Sectors in Early 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Julius de Kempenaer of RRG Research talks stocks over bonds and highlights two sectors with upside potential based on improvements in their relative strength. Dave unveils a bearish momentum divergence for Netflix and reveals two technology stocks that could still...

READ MORE

MEMBERS ONLY

MEM TV: Jobs Growth Reveals NEW Opportunities in These AREAS

by Mary Ellen McGonagle,

President, MEM Investment Research

Not a great start to the year! In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a look at where the broader markets closed, and sees we're hovering around some rather critical areas. The sharp pullback in growth stocks drove last week's...

READ MORE

MEMBERS ONLY

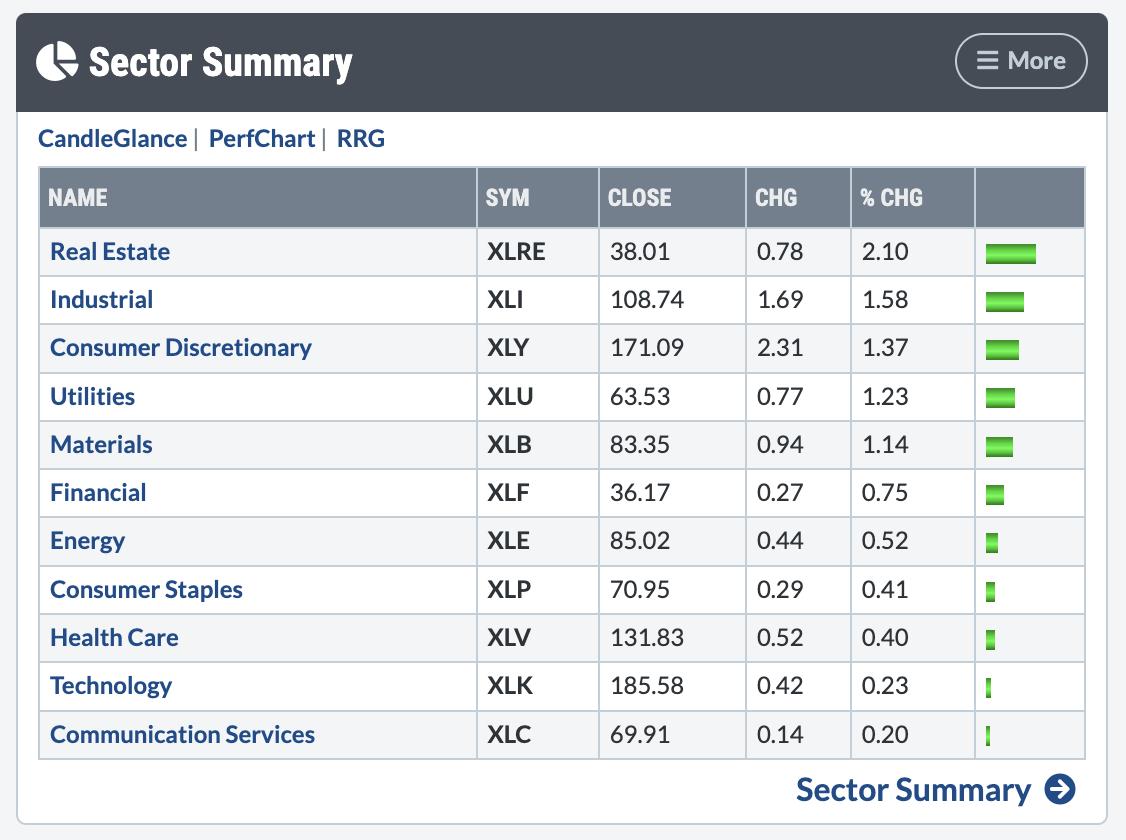

New Year Starts With a Bang as Leadership Areas Get Hit

by Mary Ellen McGonagle,

President, MEM Investment Research

Last week, Growth stocks came under selling pressure, with the Nasdaq falling over 3% amid sharp declines in most of the Magnificent Seven names. These weren't the only 2023 darlings that pulled back, as Semiconductor and Software stocks also underperformed. In turn, the Technology sector was the worst...

READ MORE

MEMBERS ONLY

SPY Resting at Support, But Financials Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is testing, maybe breaking, short-term support

* Next support in 455 area

* Financials sector tails on daily and weekly RRG moving back in sync

* All banks inside the leading quadrant

HAPPY NEW YEAR!!! (I guess that is still allowed on day 5...)

Let's kick off the...

READ MORE

MEMBERS ONLY

Growth Stocks Drop Again -- and That's Just the Beginning?!?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investments speaks to how extreme breadth conditions, sky-high valuations and overly bullish sentiment readings could indicate the beginning of a bear phase in 2024. Dave highlights two value sectors showing renewed signs of strength...

READ MORE

MEMBERS ONLY

GNG TV: Remaining Objective About Trading Rules is CRITICAL!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a look at the GoNoGo Trend® conditions of several key areas of the market. The seasonal roadmap of 2023 may be overemphasized by many market commentators, and remaining objective about trading rules is critical in times like these....

READ MORE

MEMBERS ONLY

Discover the Hottest Sectors of 2024!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the MACD zero line in 2 consecutive timeframes to identify ideal entry zones. He presents two examples of how this pattern works and when to enter. He also examines what he is seeing...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely To Ring In The New Year In This Way

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets have ended the year on a very strong note.

As the week comes to a close, we not only end the month, but also the year. On a monthly basis, the NIFTY has had a stellar run this December, having gained 1598 points (+7.94%). On a...

READ MORE

MEMBERS ONLY

MEM TV: Don't Miss These! TOP Sector and Industry PICKS for 2024

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, join Mary Ellen as she as she dives into the latest news and trends that are driving price action in the markets. From housing updates to consumer confidence and inflationary data, she breaks it all down and shows you how...

READ MORE

MEMBERS ONLY

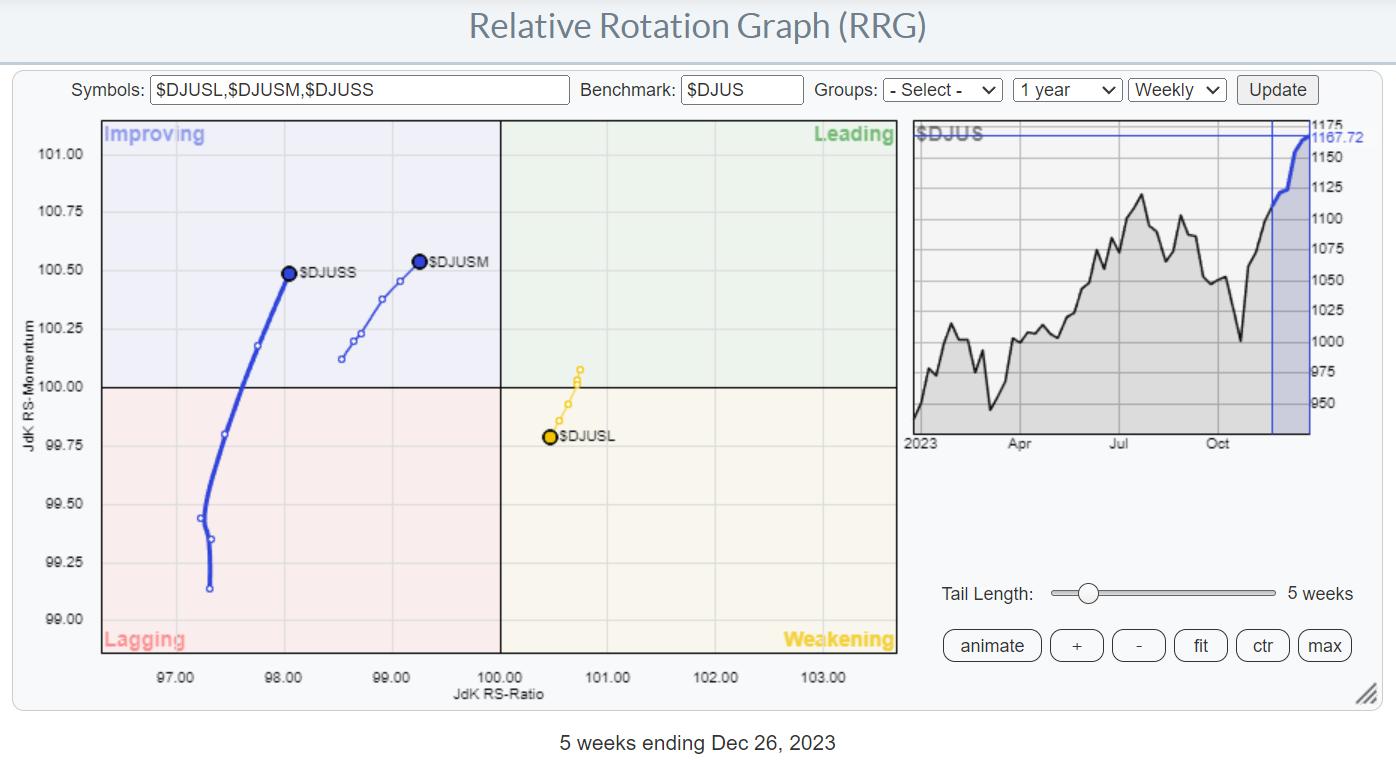

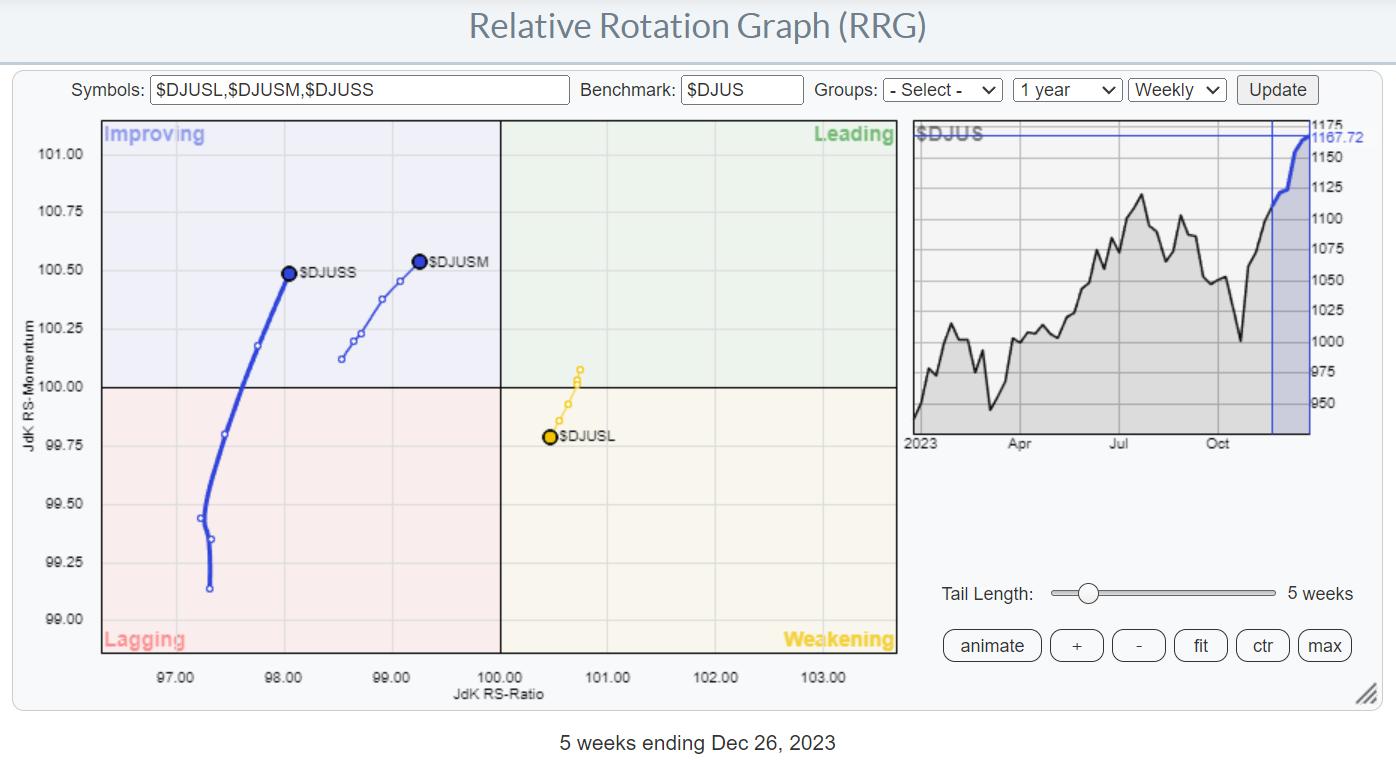

Which Sectors Benefit Most From the Large- to Mid- & Small-Cap Rotation?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Money rotating away from large-cap stocks

* Re-distribution and new inflow to mid- and small-caps

* Majority of sectors show preference for equal weight ETFs over Cap-Weighted counterparts

I have used this Relative Rotation Graph regularly in the past few weeks to indicate the ongoing rotation out of large-cap stocks...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Takes Breather After Seven Weeks of Gains; What to Expect Next?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, given the unabated upmove, the markets have risen near-vertically. This has caused the indices to deviate greatly from their mean, making them overextended and prone to violent profit-taking bouts. While weekly, the markets have just consolidated, but on the daily...

READ MORE

MEMBERS ONLY

Inflation Data Brings Holiday Cheer As We Head Into Year-End

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets were handed a holiday gift today after the Commerce Department reported that underlying inflation pressures are continuing to slow down. This has left more income at the disposal of households with increased spending that will help the overall economy. News of declining inflation sets the stage for interest...

READ MORE

MEMBERS ONLY

MEM TV: Markets in Bullish Mode as We Head Toward Year-End

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, join Mary Ellen as she as she dives into the latest news and trends that are driving price action in the markets. From housing updates to consumer confidence and inflationary data, she breaks it all down and shows you how...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds --The Clear Preference

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, the last one of the year 2023, I assess current rotations in asset classes, as well as US sectors. This big picture calls for a continued/renewed strength for stocks over bonds. As I observe, money is rotating out of...

READ MORE

MEMBERS ONLY

DP Trading Room: Finally! Signs of Life in the Energy Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, with Energy (XLE) finally showing signs of life, Carl and Erin dive into the sector to learn more about participation and new momentum. Carl discusses Total Returns on SPX, which are showing new all-time highs before the actual index....

READ MORE

MEMBERS ONLY

Size (Matters) Over Style!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Growth and Value are moving together in an unusual rotation

* Money from large-cap stocks being distributed into mid- and small-cap segments

* Even all Mag7 names dropping in price is not enough to pull down benchmark indices

Something Strange is Going On

Or, at least, something unusual.

On the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Overextended on Charts; Avoid Chasing Up Moves as Consolidation Look Imminent

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Continuing with the unabated upmove, the markets went on to post their fresh lifetime highs once again; NIFTY has ended on a fresh lifetime high on a closing basis as well. The rally this week was propelled by the Fed, which kept the interest rates unchanged. While this was widely...

READ MORE

MEMBERS ONLY

GNG TV: S&P 500 Breakout -- Will the Rally Continue to All-Time Highs by Year End?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, as equities rally with speed from 4600 to 4700 this week, Alex and Tyler take a look across style boxes, cap scales, asset classes, and sectors, and review small-cap industrials that are part of the broadening leadership groups giving legs to this...

READ MORE

MEMBERS ONLY

Find Aggressive Entry Opportunities & Tradeable Trends with Multi-Timeframe Charts

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use multiple timeframes to help when getting an aggressive entry in a stock. He starts by explaining the tradable trend, then shows how an aggressive opportunity develops. To close out the show, he analyzes...

READ MORE

MEMBERS ONLY

Blow-Off Top?! Market Reacts to the FED Announcement

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Happy Fed Day on this edition of StockCharts TV'sThe Final Bar. There was quite a bit of movement leading into the FOMC announcement, with exceptional amounts of movement afterwards. Markets continued to push aggressively to the upside, with the S&P 500 closing the day out above...

READ MORE

MEMBERS ONLY

This Industry Group Outperformed the S&P 500 by OVER 120% in 2023!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Joe Rabil of Rabil Stock Research shares his biggest takeaway from investing in 2023 and also conducts a deep dive in the Consumer Discretionary sector with a focus on four stocks: SIG, TSLA, RL, and ABNB. Meanwhile, Dave unveils...

READ MORE

MEMBERS ONLY

Sector Spotlight: Timeless Knowledge and Insights into Sector Rotation & Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For the 200th episode of StockCharts TV's Sector Spotlight, I inviteWall Street legend Sam Stovall for an entertaining discussion. Before that, I starts the show with a short look at current market rotations, highlighting the increasing relative weakness for the Energy Sector. I also note money rotating out...

READ MORE

MEMBERS ONLY

Renewed UPTREND for Semis -- SMH and SOXX ETFs Breaking Out!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the renewed uptrend for semis, with ETFs like SMH and SOXX breaking out despite a lack of participation from the largest semiconductor name, Nvidia (NVDA). He answers viewer questions on QQQ, Netflix (NFLX), Resmed (RMD), Avis Budget Group...

READ MORE

MEMBERS ONLY

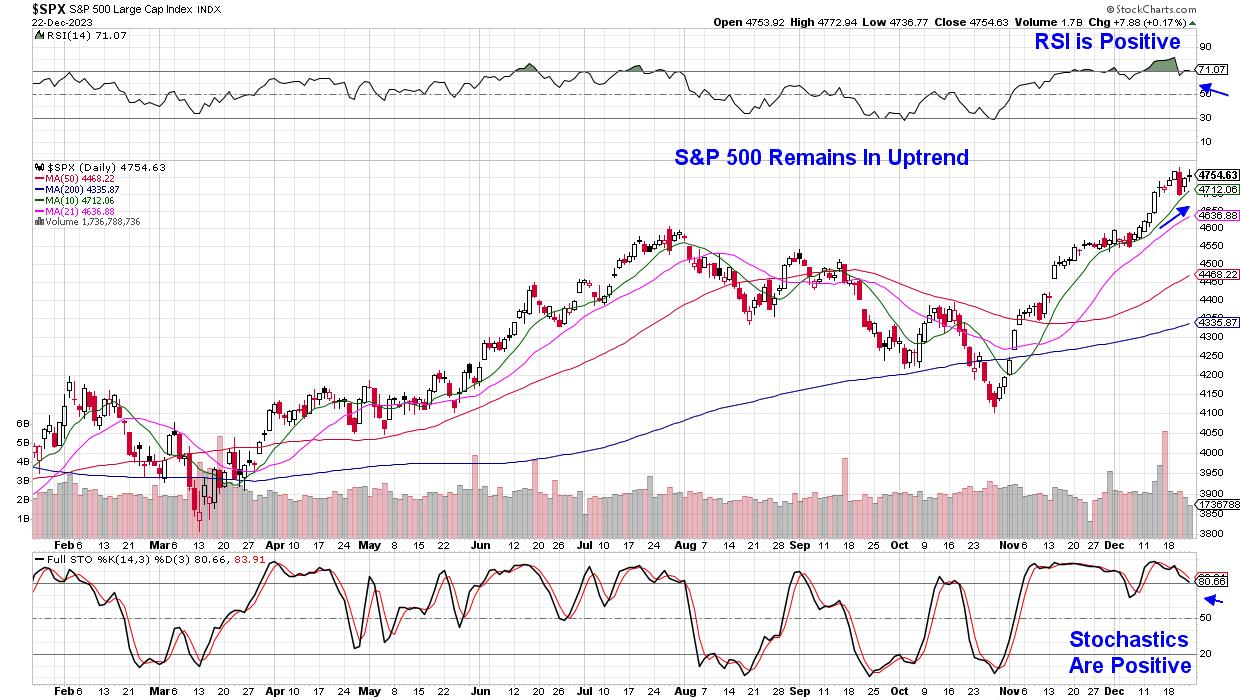

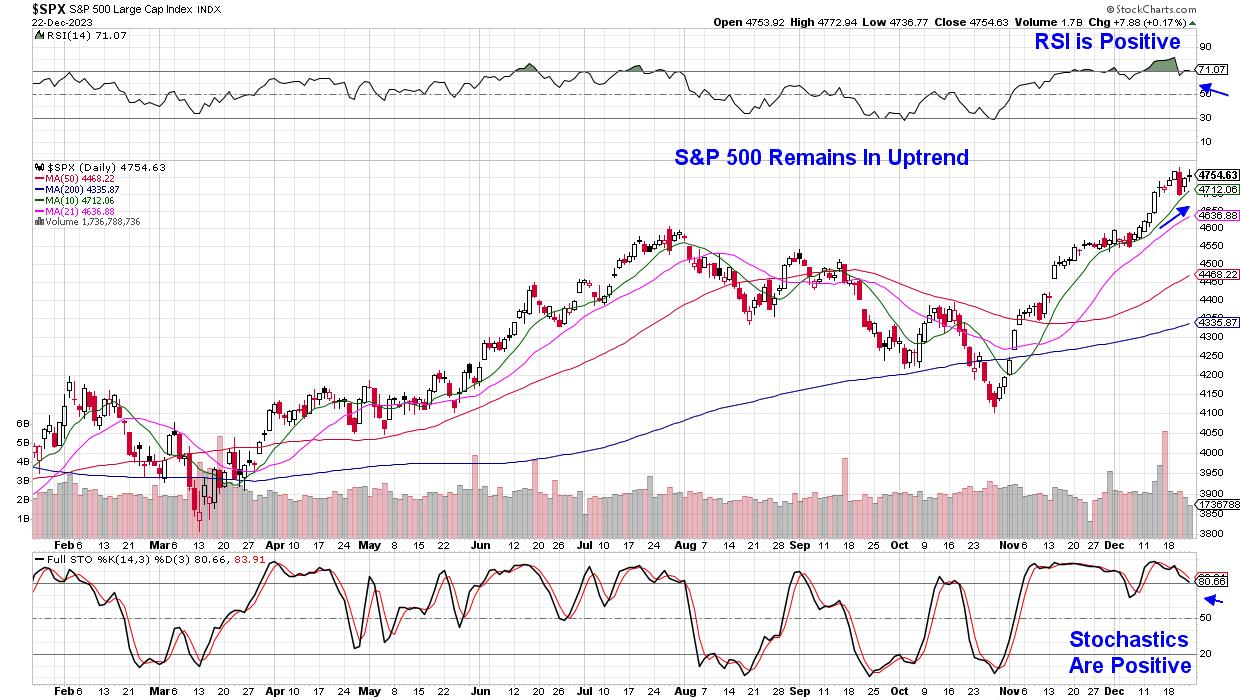

Will the S&P 500 Push Above 4600 Before Year-End?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 index has stalled out at its July high around 4600, and overbought readings from RSI indicate a likely pullback.

* Breadth indicators have reached bullish extreme readings, confirming the long-term bullish, short-term bearish thesis.

* Individual stocks from both growth and value sectors are overbought...

READ MORE

MEMBERS ONLY

MEM TV: Here's Why Growth Stocks Outperformed Last Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's muted price action in the markets, which occurred despite impactful economic data. She also highlights where the broader markets are headed and best ways to participate in the select areas that are outperforming...

READ MORE

MEMBERS ONLY

45% of Market Capitalization In S&P 500 Showing Strong Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* RRG showing very distinct opposite rotations

* Once Sector Inside Leading and Two Sectors Inside Improving and Pushing toward Leading

* Energy Sector At Risk of Completing a Massive Double Top Formation

Usually, I would do this week's Sector Spotlight on the completed monthly charts for November. But...

READ MORE

MEMBERS ONLY

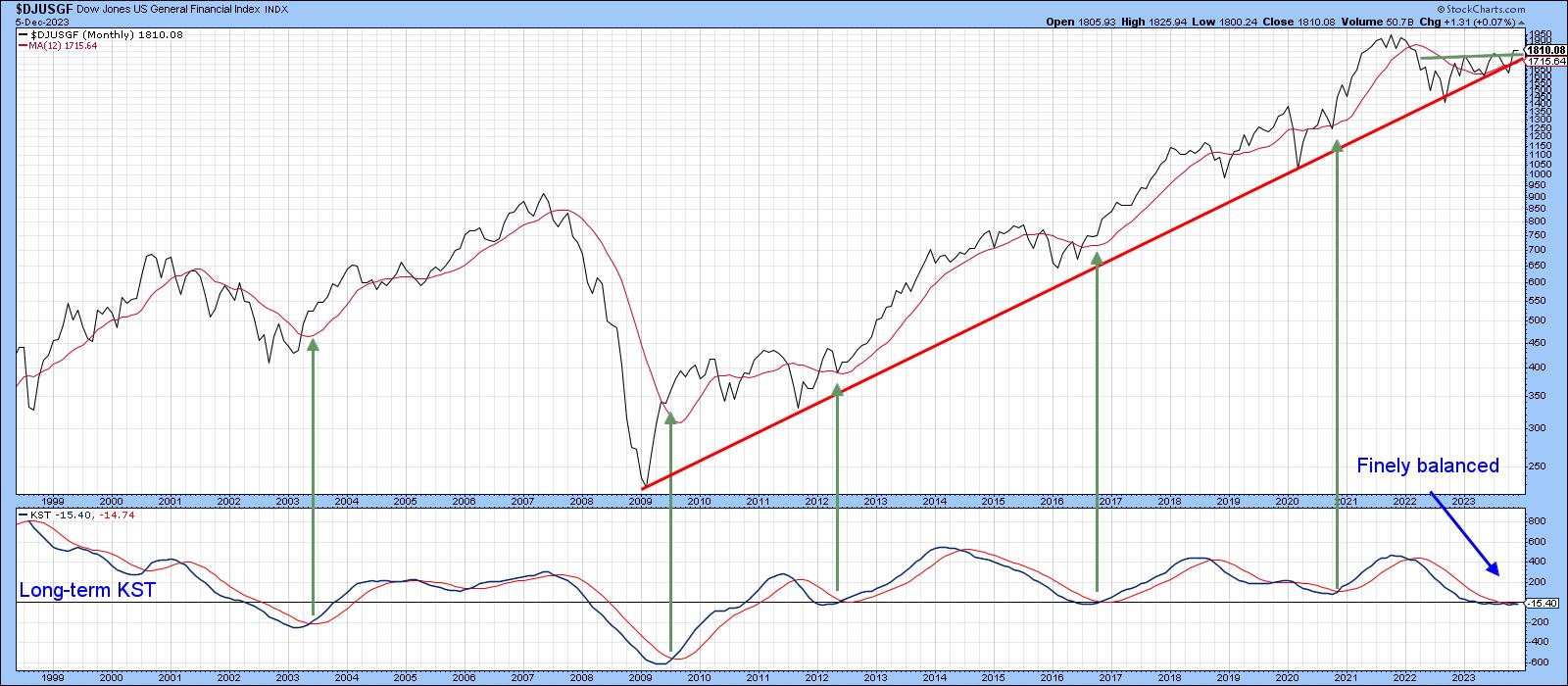

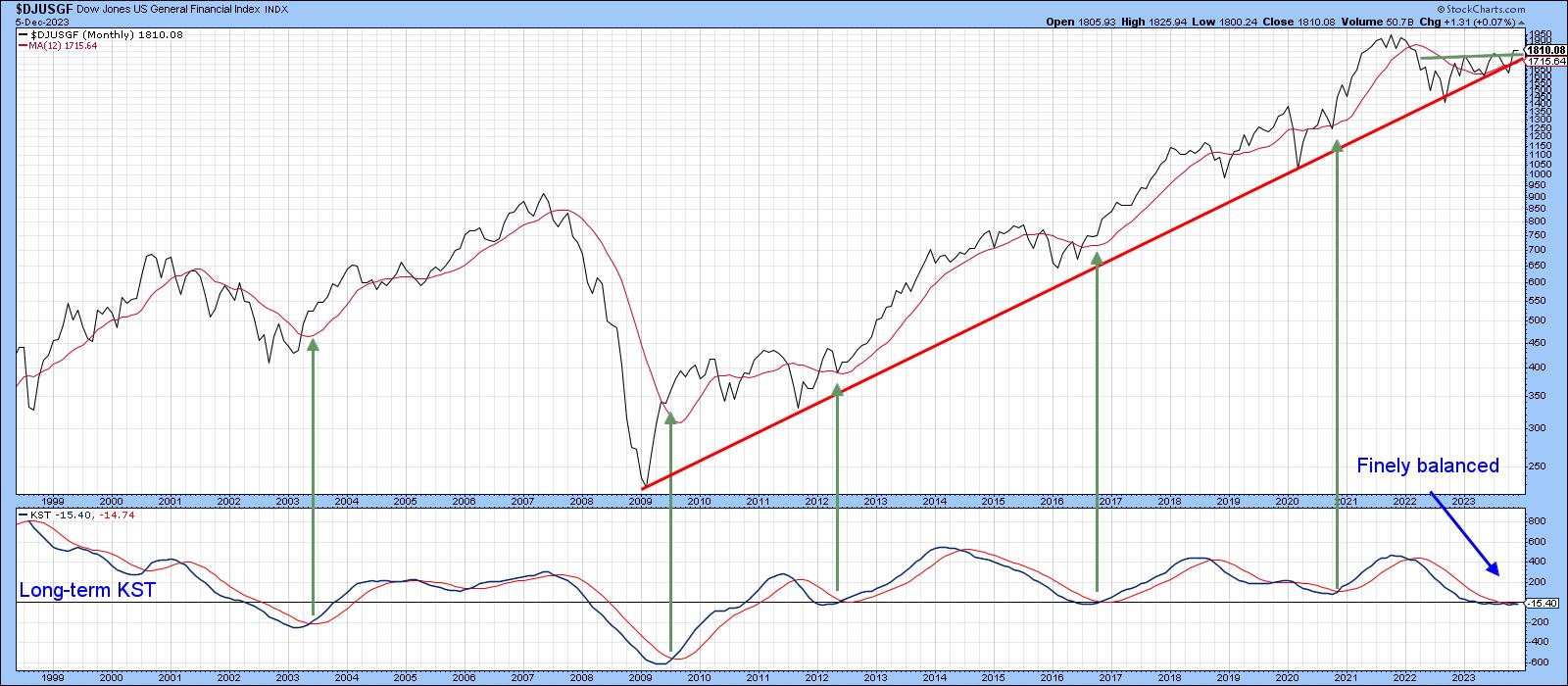

Are Financials Ready to Extend their Leadership?

by Martin Pring,

President, Pring Research

Technology (XLK) and Communications Services (XLC) have been the leaders since the bull market began in October of last year. However, they may need to look over their shoulders, as financials have been creeping up since the October 27 intermediate low. The short answer to the question posed by the...

READ MORE

MEMBERS ONLY

DP Trading Room: How Bad Data From Major Indexes Leads to Bad Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses his recent epiphany regarding data derived from major indexes. Bad data will lead to bad analysis, so it's important to understand this concept for analyzing major indexes. He and Erin discuss the implications of Magnificent...

READ MORE

MEMBERS ONLY

Stock Market Starts December On A Strong Note: What This Means For the Rest of the Year

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 index closed at its 2023 high

* The Dow Jones Industrial Average hits a new 52-week high

* The S&P 600 Small Cap Index led the rally with a 2.89% gain

The stock market is off to a great start on the...

READ MORE

MEMBERS ONLY

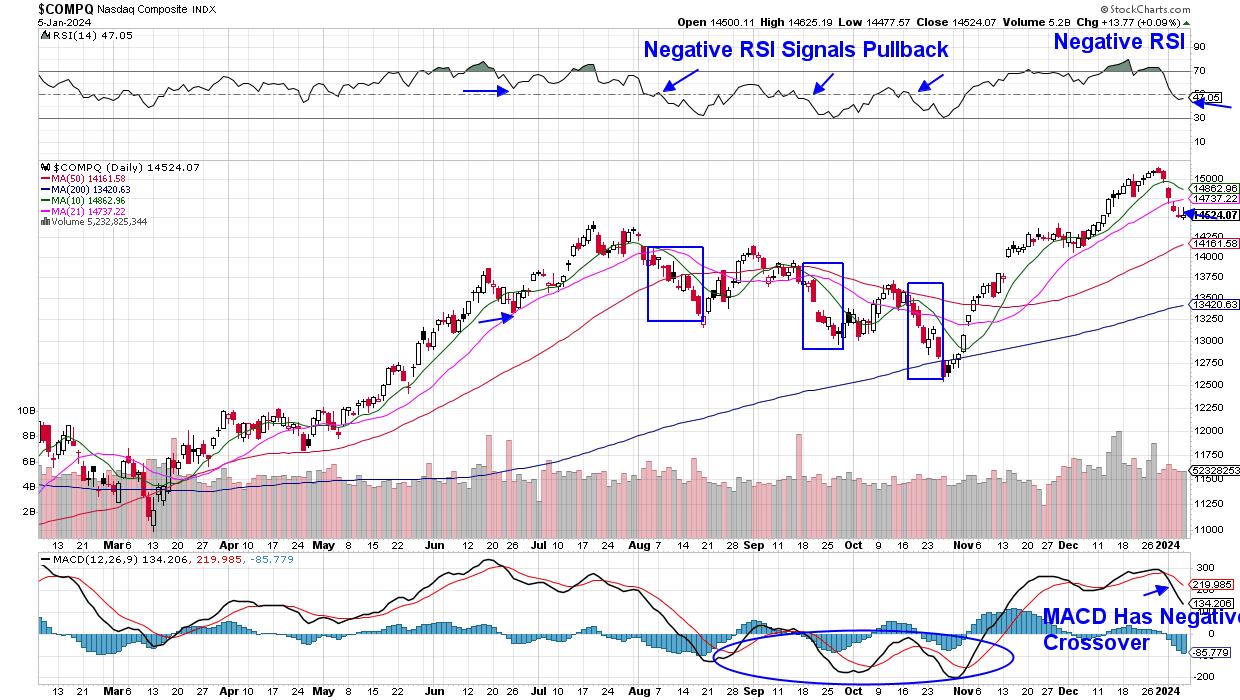

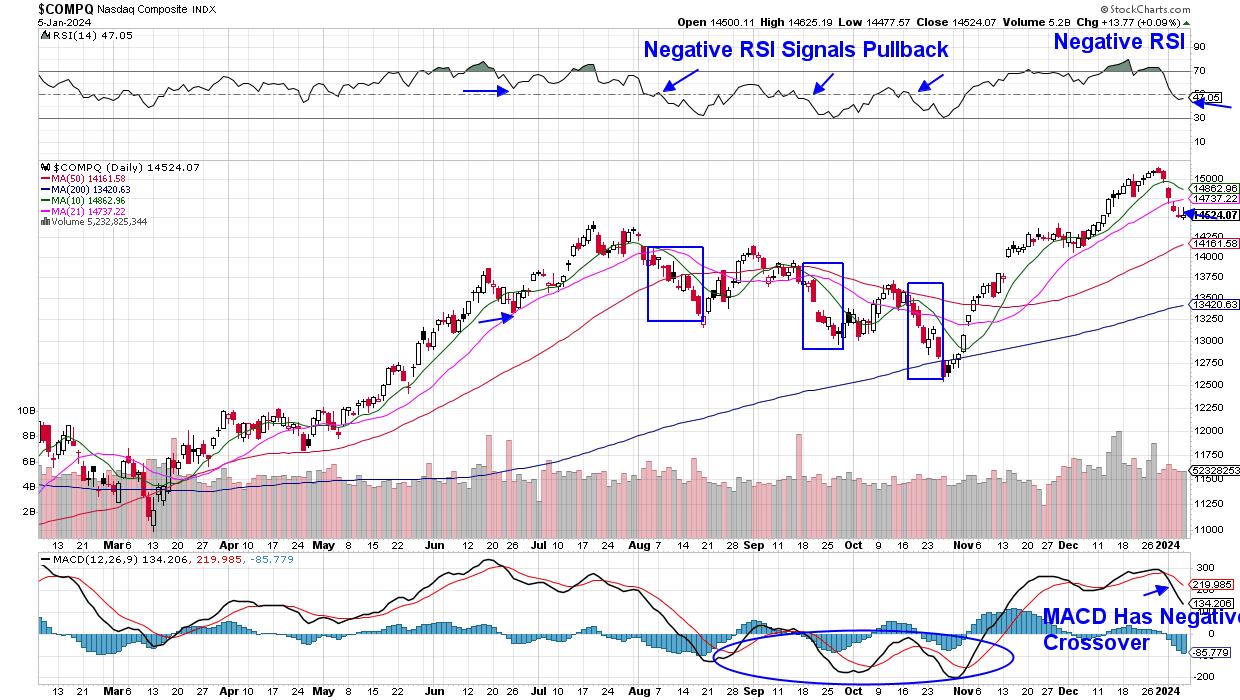

Pullback Imminent for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The recent upside gap around $380 was a key moment for the QQQ, but if leading growth stocks continue to drop, this level may come into question.

* While a new all-time high for the Nasdaq 100 is a possibility over the next six to eight weeks, the overbought...

READ MORE

MEMBERS ONLY

The Halftime Show: Are Rate Cuts on the Horizon? Watch the Jobless Claims

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

As Pete has said several times on theHalftimeshow before, the Fed will likely cut rates when the unemployment rate ticks higher. Year-to-date the unemployment rate is up 14% from its lows in January and even Christopher Waller, an economist and member of the Fed Board of Governors, mentioned the possibility...

READ MORE

MEMBERS ONLY

Sector Spotlight: Decoding The S&P's Monthly Behavior With Sector Rotation and Insights!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's the end of the month, which means it's time for me to take a look at the seasonal behavior for the S&P 500 and its sectors on this episode of StockCharts TV's Sector Spotlight. Is there is any alignment between historical...

READ MORE

MEMBERS ONLY

DP Trading Room: How To Time Your Trade Entries & Exits Like a Pro

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Erin flies solo today and gives everyone a refresher course on how to expertly time your entries and exits for trades, using the 5-minute candlestick chart. She covers the market in general, followed by analysis of sectors of interest...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Consolidating; May Stay Within Broad Trading Range

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets consolidated throughout the week. Although they stayed within a narrow range and traded sideways for almost all days of the week, the Indices were devoid of any directional trend. Following strong weekly gains of over 1.58% in the week before, the NIFTY chose to remain in...

READ MORE

MEMBERS ONLY

How RRG Helps Us Find Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* DJ Industrials closing in on overhead resistance

* Weekly RRG showing some strong opposite rotations

* Identifying two potential pair trading setups (MSFT-MRK & NKE-CAT)

The Dow Jones Industrial Index ($INDU) is reaching overhead resistance between 35.5k and 35.7k, which means that upside potential is now limited. Even...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Home for the Holidays

In the 1995 film, Home for the Holidays, family reunions are explored using both drama and comedy. The film illustrates how we outsiders looking in never really know the love and the madness that goes on inside any one family's home during Thanksgiving.

Happily, our Economic Modern Family...

READ MORE