MEMBERS ONLY

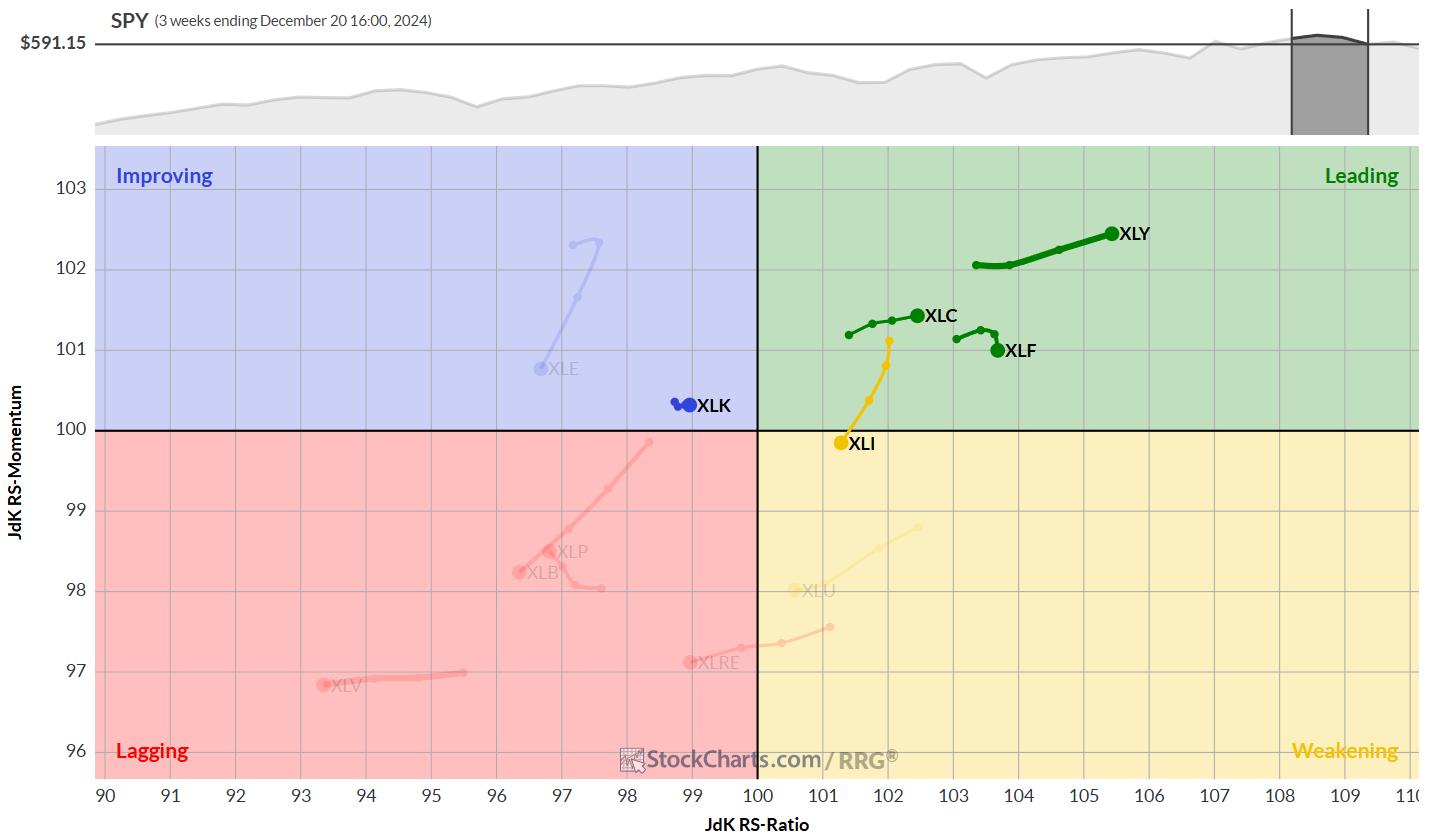

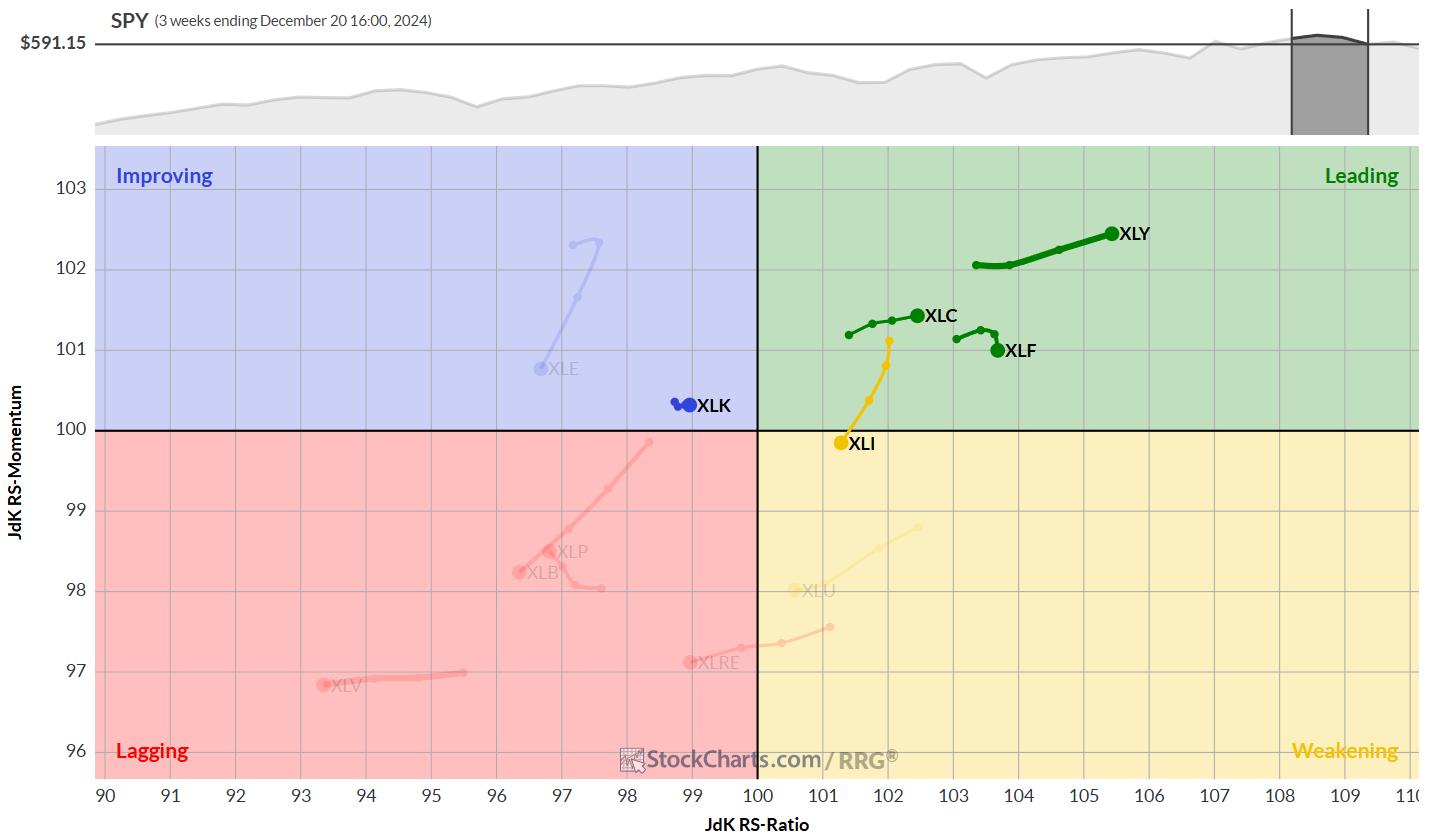

The Best Five Sectors, #5

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

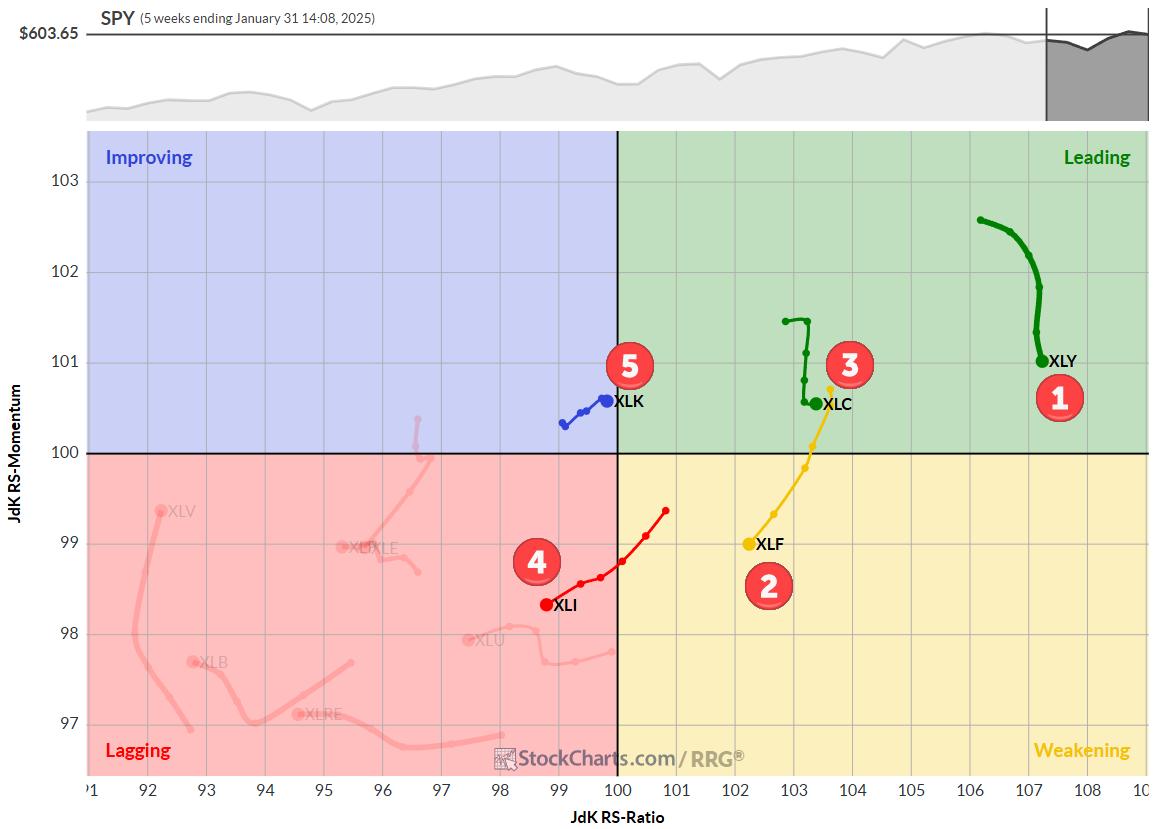

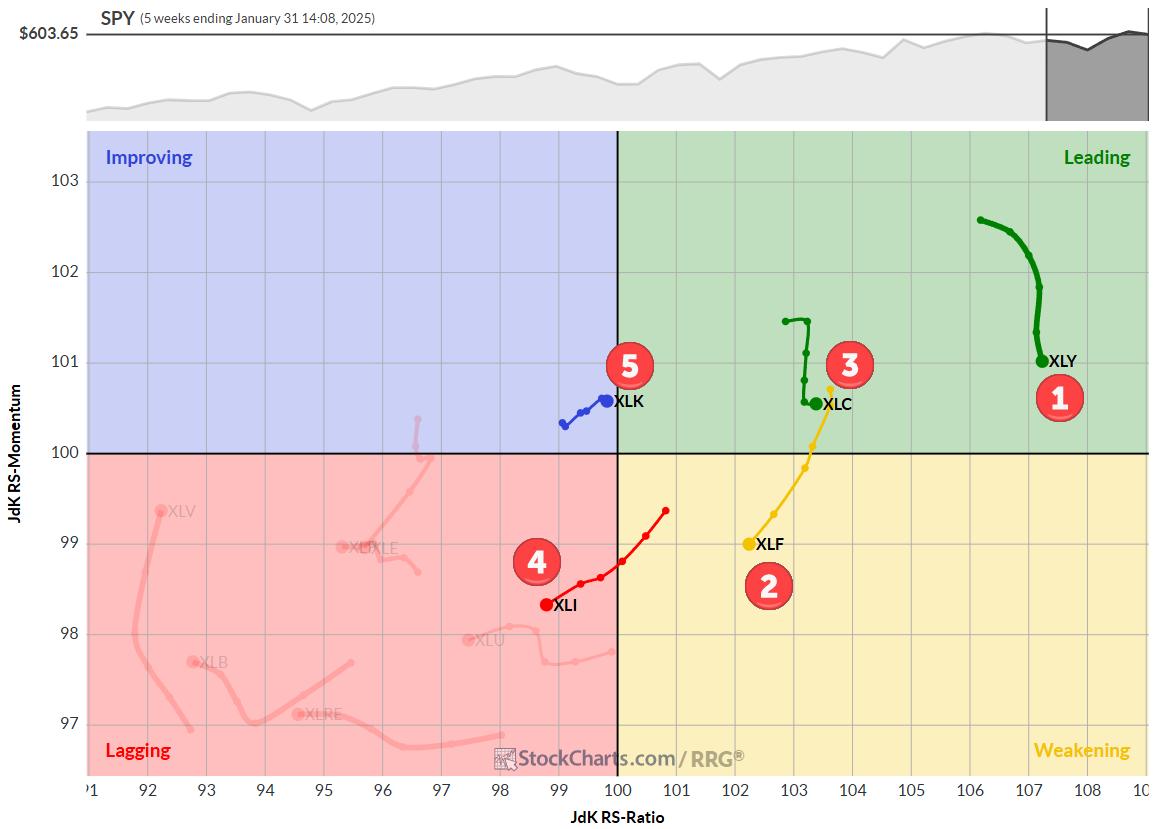

* Technology (XLK) re-enters top 5 sectors, displacing Energy (XLE)

* Consumer Discretionary (XLY) maintains #1 position

* Weekly and daily RRGs show supportive trends for leading sectors XLY and XLC

* Top-5 portfolio outperforms S&P 500 by nearly 50 basis points

Technology Moves Back into Top-5

As we wrap...

READ MORE

MEMBERS ONLY

XLF's Record Highs: Buy the Dip or Bail Out Now?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* XLF, heavily weighted in bank stocks, broke into all-time high territory, though conviction appears low.

* Breadth, momentum, and technical strength are leaning bullish.

* A likely pullback signals an opportunity for entry.

As the FOMC prepared to announce its rate decision on Wednesday, the Financial Select Sector SPDR Fund...

READ MORE

MEMBERS ONLY

An Enticing Gold Mining Stock with a Strong SCTR Score

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Gold stocks have been rising, which has helped gold mining stocks.

* This gold mining stock is close to its all-time high.

* In this article, we will present an analysis of the monthly and daily charts.

Gold stocks have risen, even after the Federal Reserve decided to keep interest...

READ MORE

MEMBERS ONLY

Quantum Computing Stocks You NEED to See

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe shares the details of his favorite MACD setup. Joe then covers NVDA, and cryptocurrencies, before covering which Quantum Computing stocks look the best right now, including IONQ and RGTI. Finally, he goes through the symbol requests that came through this week, including AAPL, COIN,...

READ MORE

MEMBERS ONLY

Investing in the Age of Tariffs: Safeguard Your Portfolio Now

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors should monitor the broader US stock market indexes and their performance relative to international markets.

* The strength of the US dollar can help gauge the strength of the US economy.

* If tariffs are imposed, specific sectors, such as Materials and Industrials, will feel more pain than others....

READ MORE

MEMBERS ONLY

Some Silver Linings Following a Day of AI Panic

by Martin Pring,

President, Pring Research

I woke up this morning noting that NASDAQ futures had been down nearly 1,000 points at their overnight intraday low. Later, I tuned into a couple of general purpose, as opposed to financial, cable news channels. They, too, were talking about the sell-off and its rationale. I began to...

READ MORE

MEMBERS ONLY

Still BULLISH NVDA Despite DeepSeek?

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony gives a macro review of where we currently stand with the broader markets given the impact of DeepSeek on the AI space. He then shares some trade ideas for the week, including NVDA, META, LULU, DIS, & AAPL.

This video premiered on January 27, 2025....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY to Stay Tentative Over 6-Day Trading Week; RRG Shows Defensive Sectoral Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities continued to trade with a corrective undertone as they ended the week on a mildly negative note.

Over the past five sessions, the Nifty continued facing selling pressure at higher levels while staying mainly in a range. The markets remained in a very defined trading range and...

READ MORE

MEMBERS ONLY

BEWARE! META, TSLA, AMZN, MSFT & AAPL Report Earnings Next Week!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen reviews the new uptrend in the S&P 500, and highlights what's driving it higher. She then shares new pockets of strength that are poised to take off, and what to be on the lookout for ahead of next week's...

READ MORE

MEMBERS ONLY

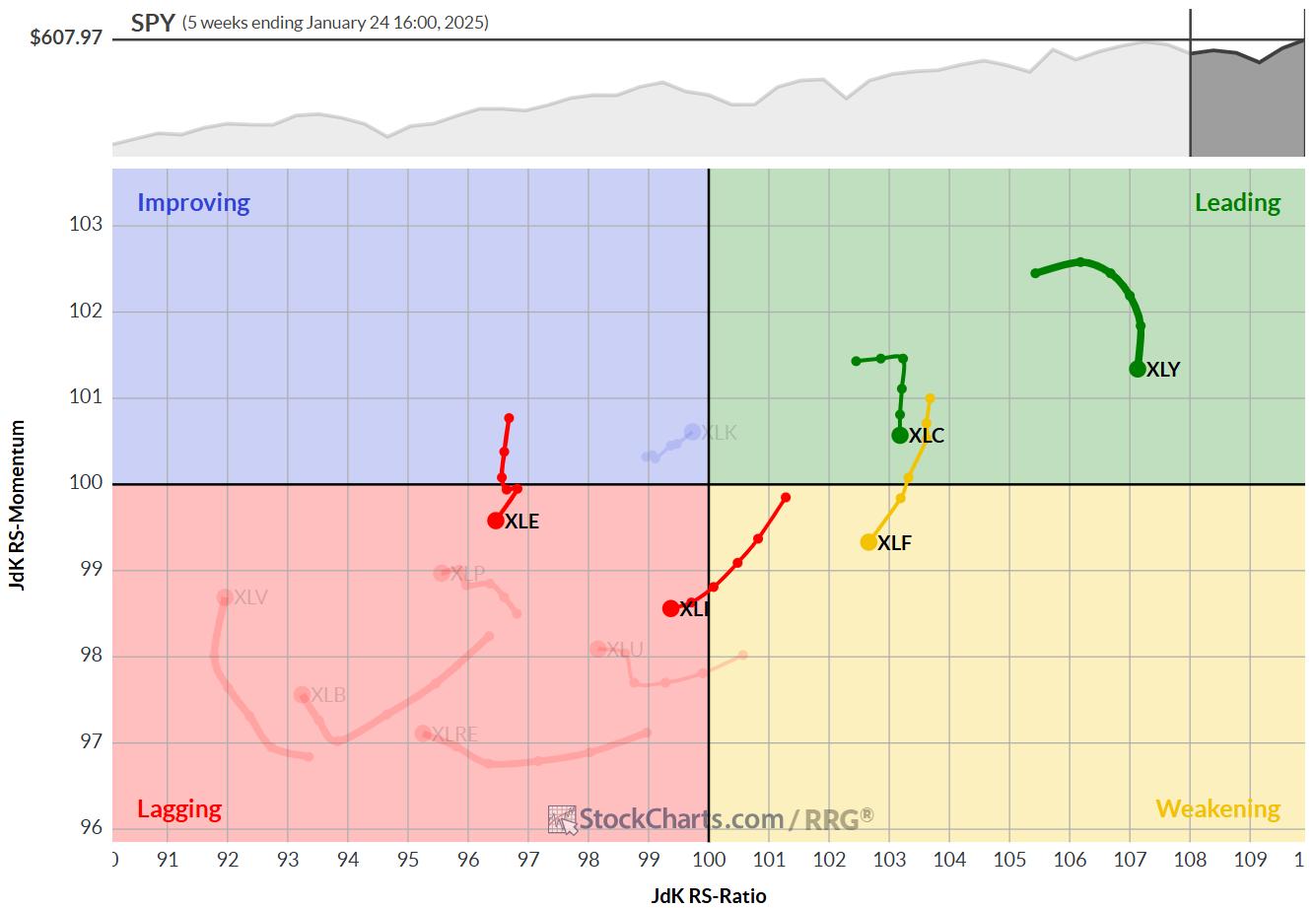

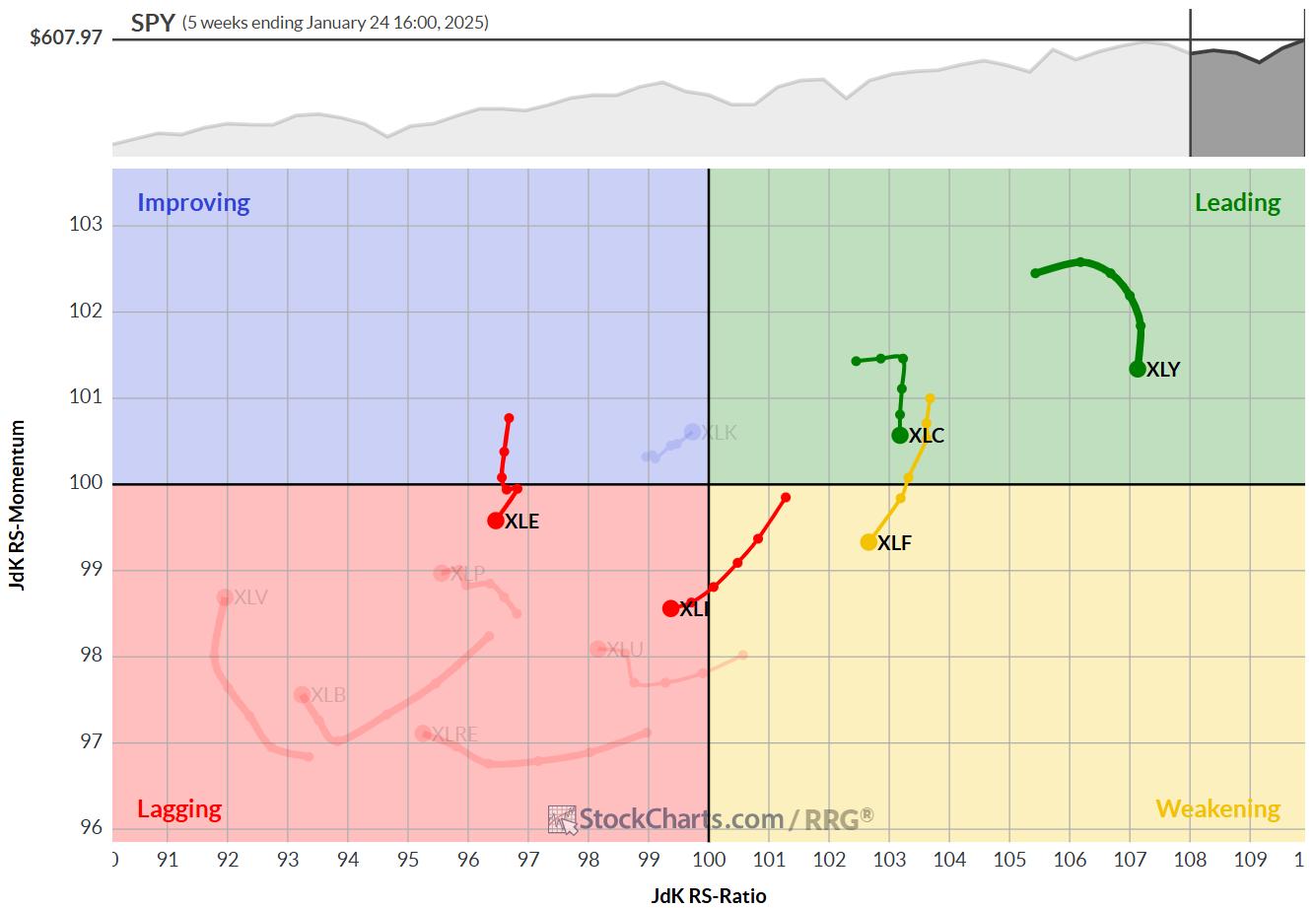

The Best Five Sectors, #4

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* No changes in top-5 sectors

* XLC showing strong break from consolidation flag

* XLE remains just barely above XLK as a result of strong daily RRG

No changes in the top-5

At the end of this week, there were no changes in the ranking of the top-5 sectors.

1....

READ MORE

MEMBERS ONLY

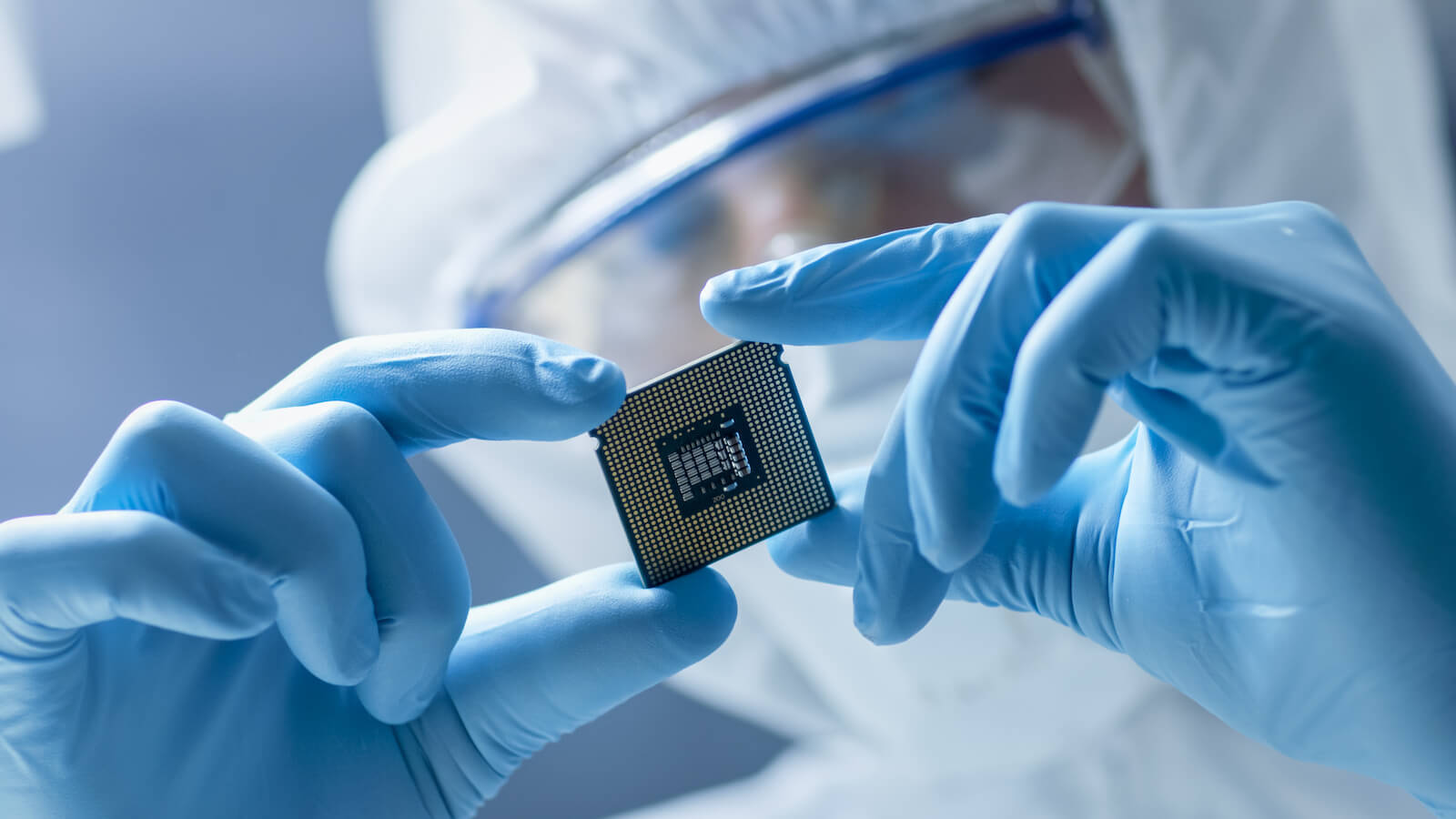

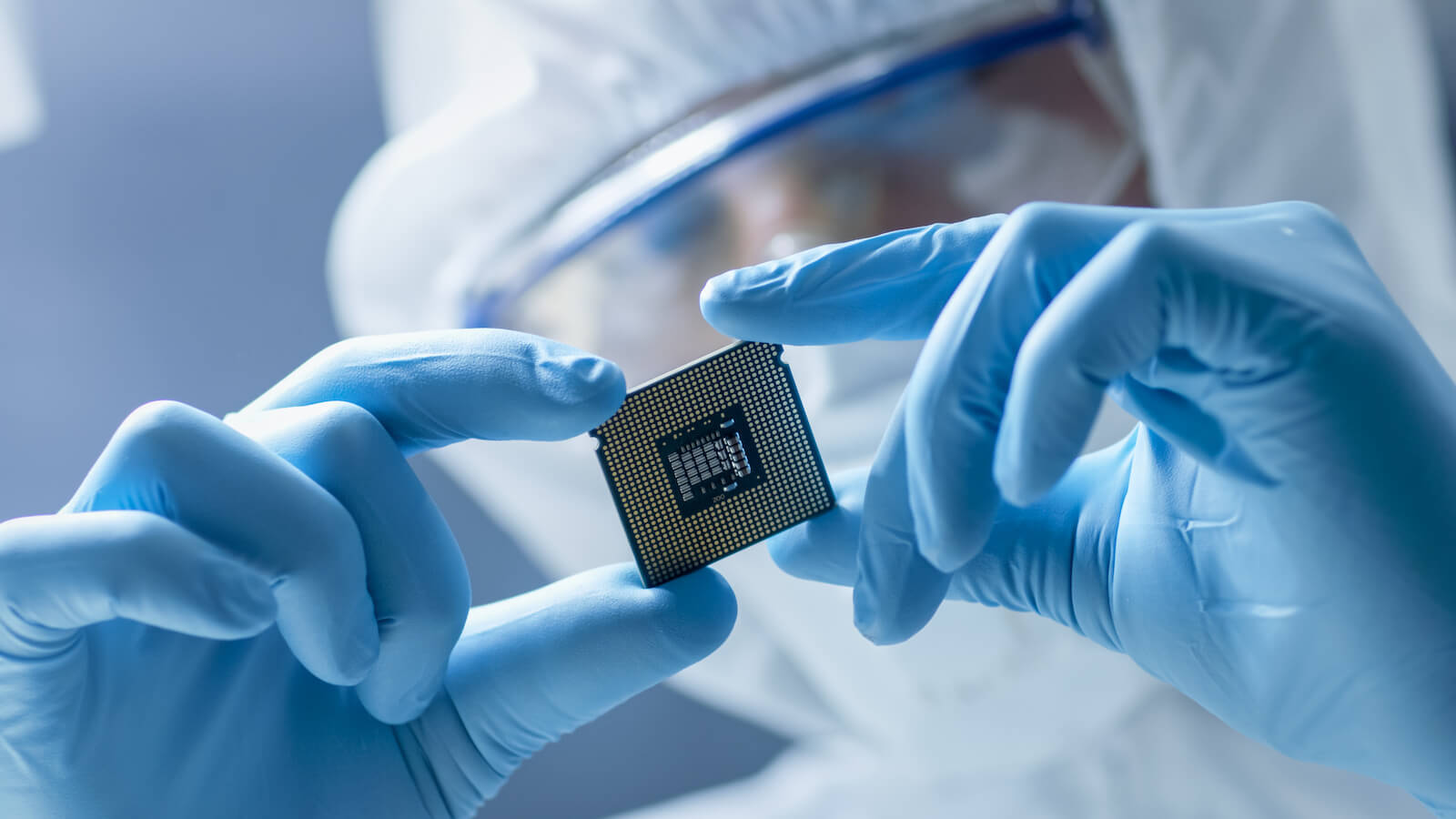

NVDA, TSMC, and Broadcom: Top Semiconductor Plays as SMH Hits New Highs

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* SMH has broken out of its three-month trading range.

* Trump's $500 billion Stargate AI initiative has injected optimism into the sector, accelerating gains in AI-related semiconductor stocks.

* Monitor the key levels for Nvidia, Broadcom, and TSMC for buying opportunities.

In the last quarter of 2024, semiconductors...

READ MORE

MEMBERS ONLY

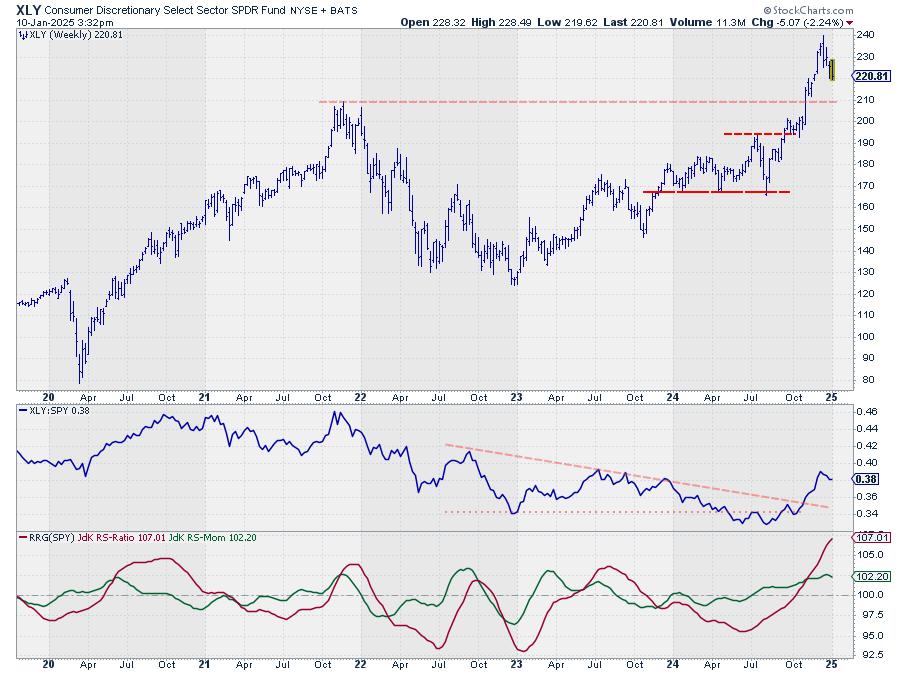

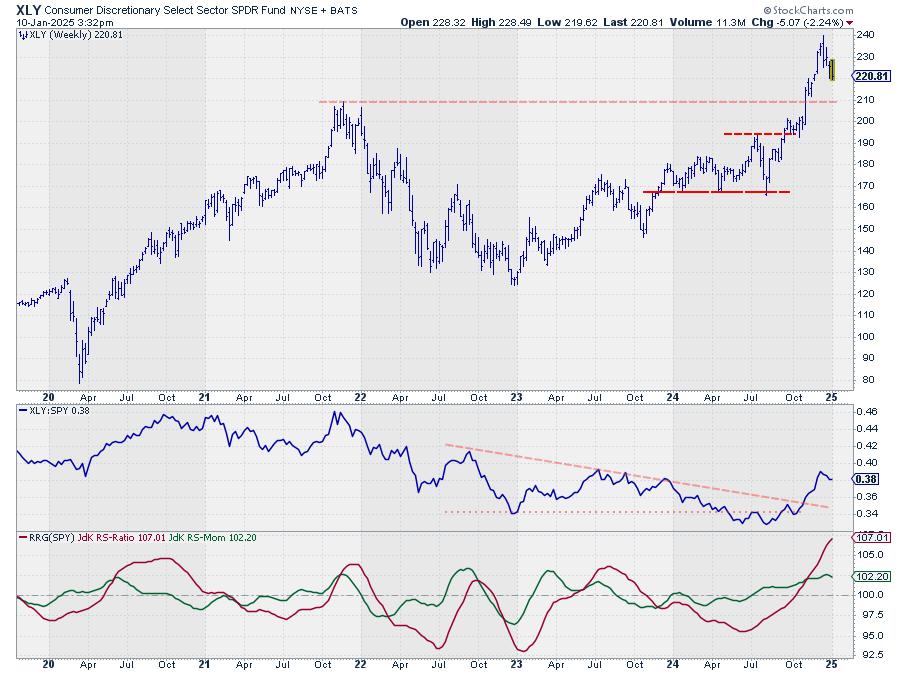

Energy Picks Up and Consumer Discretionary Continues to Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Short term strength drags enery sector up

* Long term strength keeps consumer discretionary on top

* Massive upside potential ready to get unlocked in EOG

I have been traveling in the US since 1/15 and attended the CMTA Mid-Winter retreat in Tampa, FL 1/16-1/17 and then...

READ MORE

MEMBERS ONLY

Market Internals Point to Large Growth Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the stronger US Dollar suggests caution for growth stocks, the ratios shows that growth continues to dominate value.

* While macro conditions appear beneficial for small cap stocks, large caps are back to a confirmed leadership role.

* Measures of offense vs. defensive suggest that investors are favoring offense...

READ MORE

MEMBERS ONLY

Discover the BEST Way to Spot TREND CHANGES

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe demonstrates how to use the 1-2-3 reversal pattern as a buy signal on the weekly chart. This approach can be used when the monthly chart is in a strong position. Joe shares how to use MACD and ADX to help when the trendline pattern...

READ MORE

MEMBERS ONLY

Five Key Market Ratios Every Investor Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares five charts from his ChartList of market ratios that investors can use to track changing market conditions through 2025. If you want to better track shifts in market leadership, identify where funds are flowing, and stay on top of evolving market trends, make sure to...

READ MORE

MEMBERS ONLY

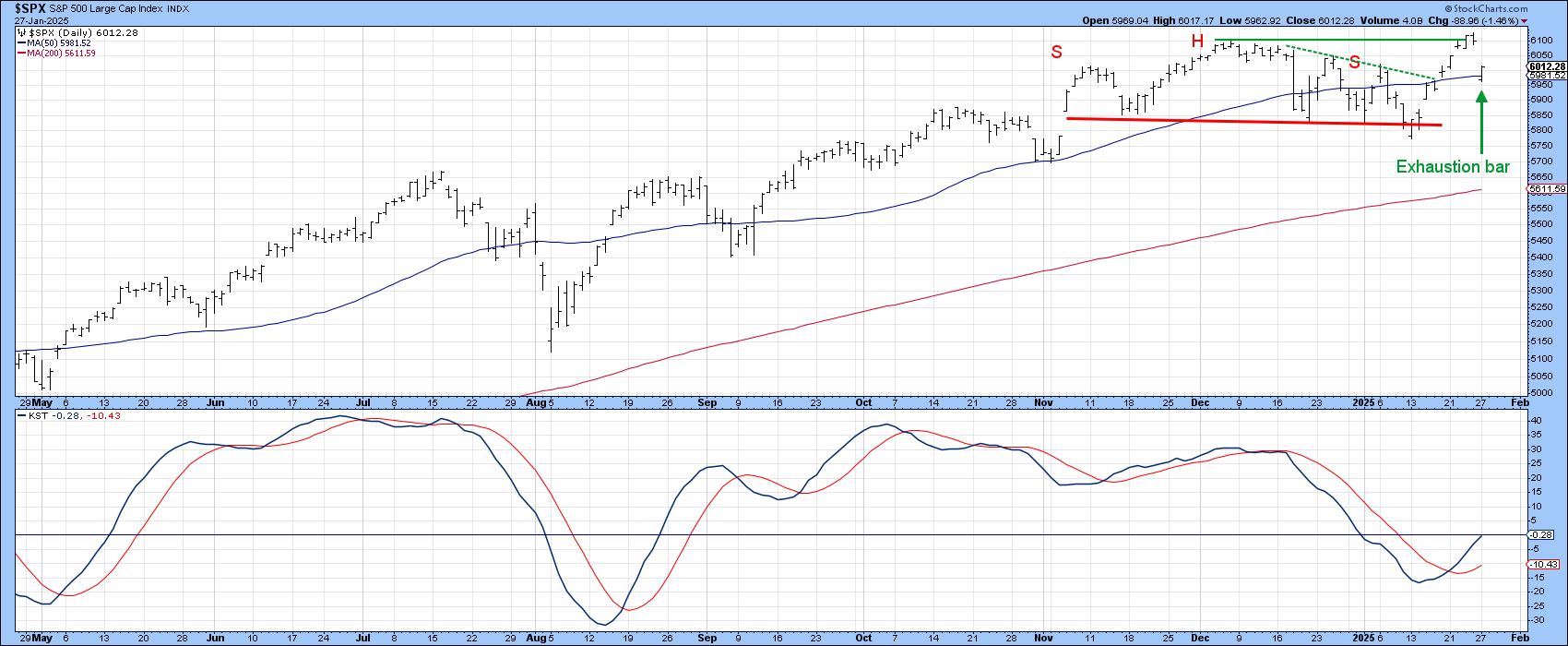

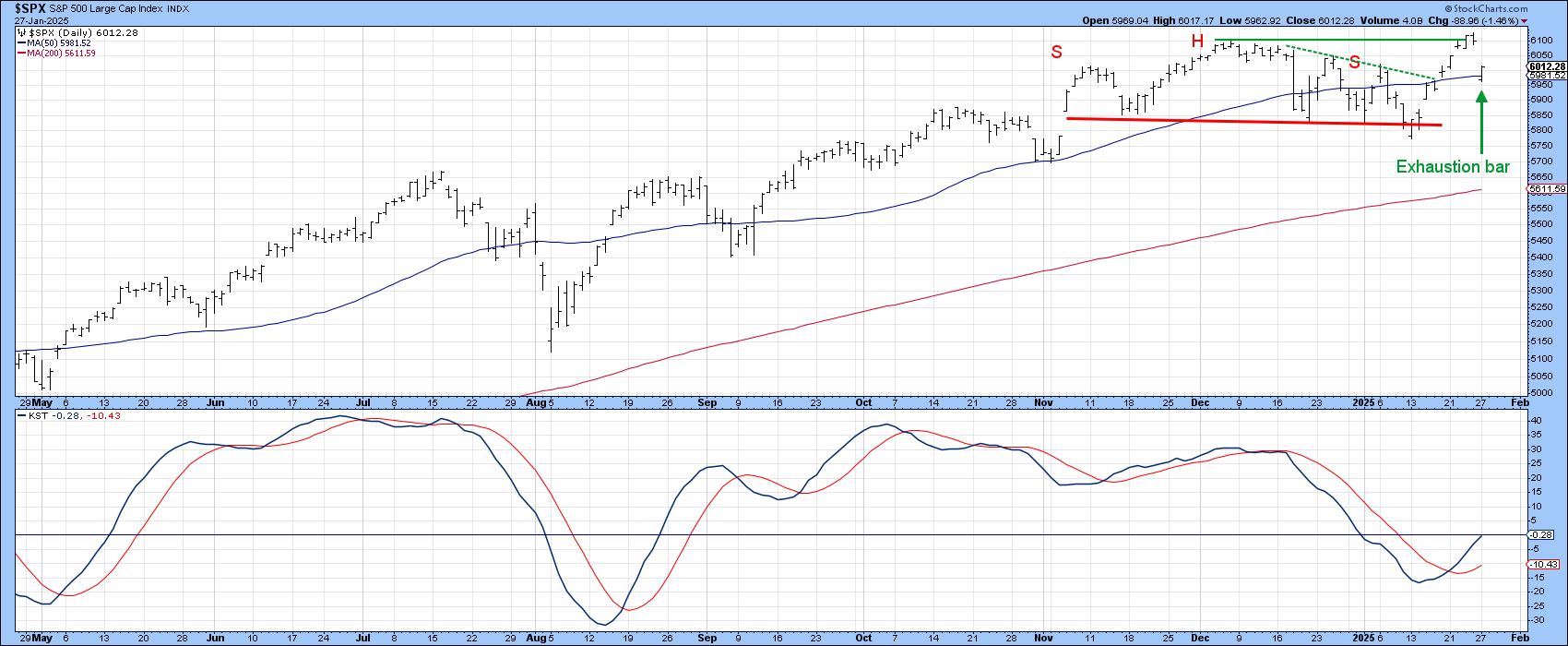

Stocks are Facing an Important Test

by Martin Pring,

President, Pring Research

I have been expecting a bull market correction for about a month, but it's not been as deep as I expected. Now, however, several indexes have completed small bullish two-bar reversal patterns on the weekly charts. If they work, that would be a characteristic of a bull market,...

READ MORE

MEMBERS ONLY

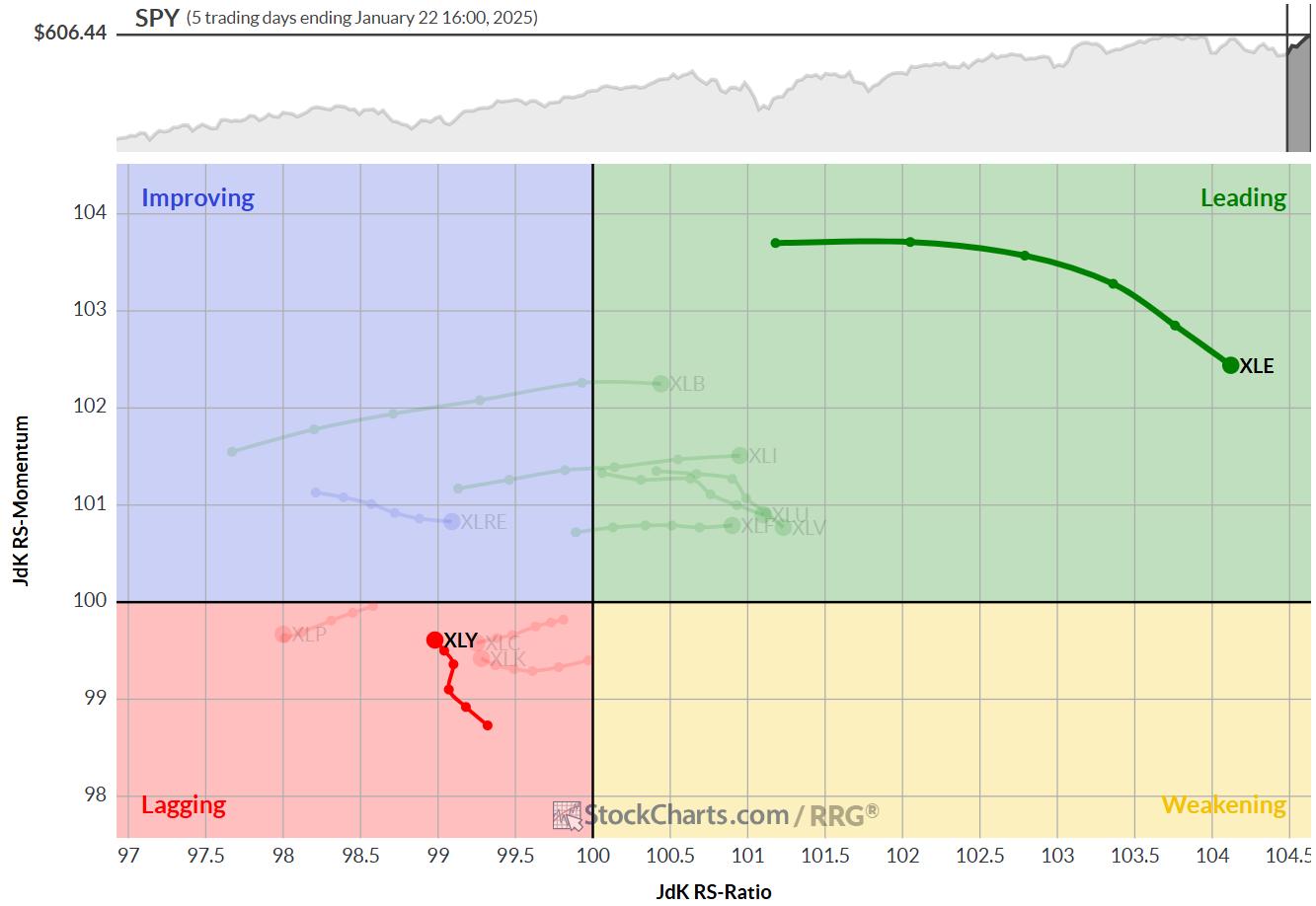

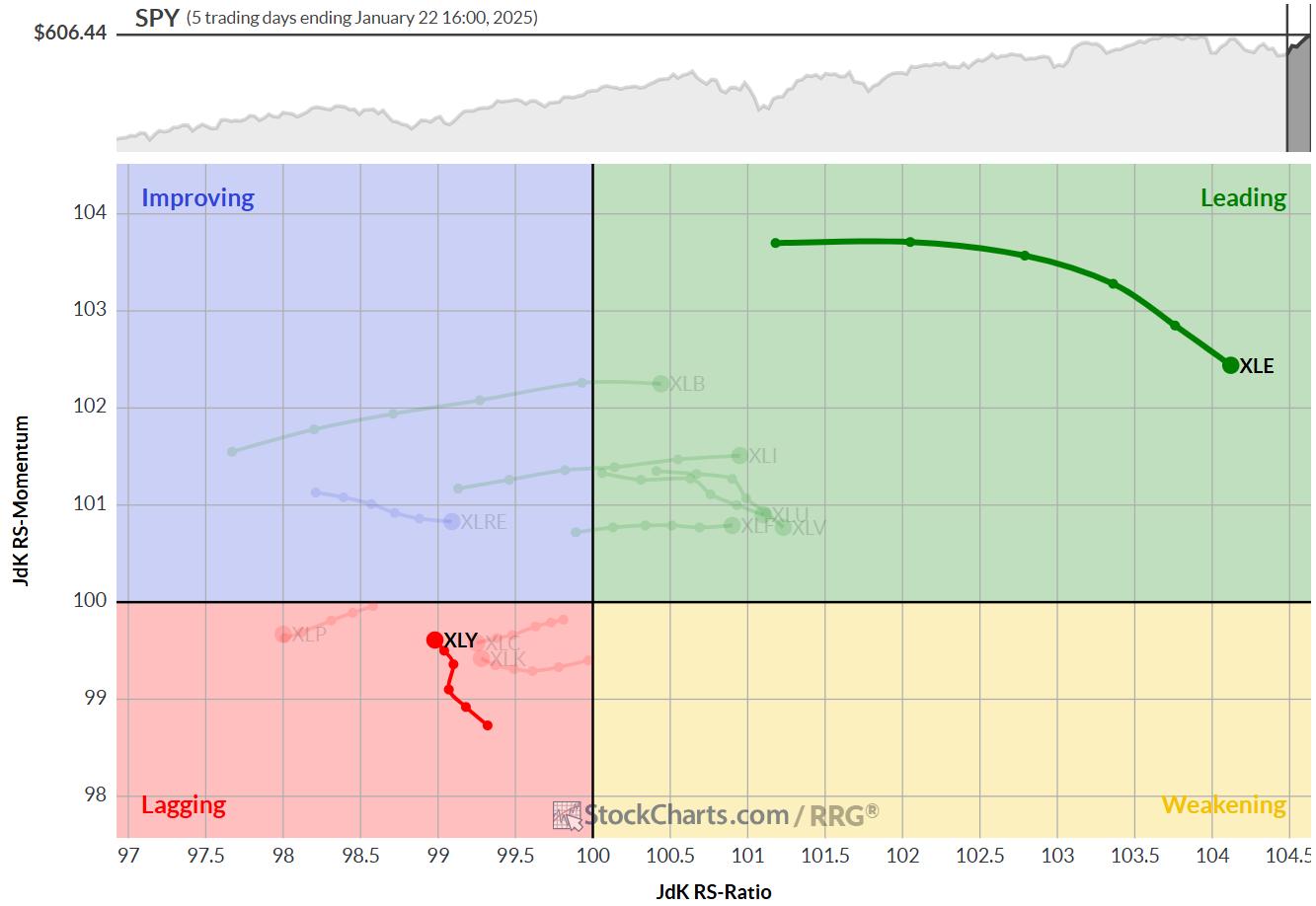

The Best Five Sectors, #3

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy replaces Technology in top-5

* Financials rise to #2 position pushing XLC down to #3

* Top-5 portfolio out-performs SPY 0.52%

* A closer look at the (equal) weighting scheme

Energy Replaces Technology

At the end of this week, 1/17/2024, the Technology sector dropped out of the...

READ MORE

MEMBERS ONLY

Quantum Computing: Top Stocks You Should Watch Now!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Quantum computing stocks may be bouncing back.

* Four stocks made it to the Top 10 SCTR Report in the mid-cap category.

* Watch for quantum computing stocks to gain momentum and revisit their 52-week highs.

Jensen Huang may have burst the quantum computing bubble when he said it would...

READ MORE

MEMBERS ONLY

The Financial Sector's Bullish Comeback: Is It Time to Start Looking at Bank Stocks?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* The Bullish Percentage Index for Financials made a dramatic jump on Wednesday.

* Positive bank earnings plus encouraging CPI and PPI data are driving market optimism.

* Citigroup stock notched a 52-week high, making the stock worth analyzing.

One effective way to spot potential market opportunities on a sector level...

READ MORE

MEMBERS ONLY

Investors Await CPI and Bank Earnings: Will They Spark Investor Optimism?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader stock market indexes are seeing a lot of choppy activity.

* December CPI and bank earnings are on deck and could move the markets.

* The interest rate-sensitive banking sector will be impacted by CPI and bank earnings.

The December Producer Price Index (PPI) came in cooler than expected,...

READ MORE

MEMBERS ONLY

The Bullish Case for Small Caps vs. Large Caps

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Will small cap stocks finally take on a leadership role in 2025? In this video, Dave provides a thorough technical analysis discussion of the Russell 2000 ETF (IWM) and how that compares to the current technical configuration of the S&P 500 index. He also shares three charts he&...

READ MORE

MEMBERS ONLY

Bullish AND Bearish Options Trade Ideas

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, Tony starts the week with a very different tone as he looks at how markets are currently playing out. He then shares individual trade ideas, pointing out which ones they continue to have a bullish or bearish outlooks on. He looks at some key stocks including META,...

READ MORE

MEMBERS ONLY

Stocks UNDER PRESSURE! Which Sector is Leading Now?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius takes a look at asset class rotation on Relative Rotation Graphs. He then addresses the 6 sectors that are NOT in the "best five sectors" for this week. To conclude, he dives into the Technology sector to find some of the best...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Steps Into Next Week With These Two Negative Technical Developments

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets extended their decline over the past five sessions and ended the week in a negative way. While the week started on a bearish note, the Nifty violated a few key levels on higher and lower time frame charts. Along with the weak undercurrent, the trading range widened again...

READ MORE

MEMBERS ONLY

Stock Market Panic: Why Strong Jobs and Inflation Signal Trouble Ahead

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market indexes end the week lower on concerns of fewer rate cuts in 2025.

* Treasury yields rose on strong jobs data.

* Strong earnings from Delta Air Lines helped boost airline industry stocks.

December non-farm payrolls data came in much hotter than expected. More jobs were added, the...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #2

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The best five sectors remain unchanged.

* XLC and XLF are both starting to show weakness.

* XLI is holding above support, while XLK remains within rising channel.

The composition of the top five sectors remains unchanged this week, despite an interrupted trading week. This stability comes against a backdrop...

READ MORE

MEMBERS ONLY

THIS is the BEST Market Sector Right Now!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius takes a look at what he recently called "The Best Five Sectors" on a relative rotation graph side-by-side with their price charts. He then takes an in-depth at Consumer Discretionary, and shares some interesting stocks within, including AMZN, ULTA, and more.

This...

READ MORE

MEMBERS ONLY

Inflation Sparks Stock Market Downturn: What This Means for Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Strong Services PMI and more job openings puts inflation narrative back in focus.

* Rising Treasury yields put pressure on large-cap tech stocks.

* Energy and healthcare stocks saw the biggest gains in Tuesday's trading.

What a difference a day makes! December ISM Services data suggests the service...

READ MORE

MEMBERS ONLY

BEST Options Trading IDEAS This Week!

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, after a general market and sectors review, Tony shares the latest OptionsPlay trade ideas, including bullish and bearish ideas for GOOGL, NVDA, DIS, SHOP, and many more. He analyzes sector rotation with RRGs, and takes a look at key earnings.

This video premiered on January 7, 2025....

READ MORE

MEMBERS ONLY

Which Top AI Semiconductor Stocks are Positioned for Growth?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* CES 2025 kicks off this week with many products likely to feature AI functionalities.

* Semiconductors are among the backbone components driving AI tech.

* Be sure to monitor the general industry and focus on key semiconductor stocks, a few of which may be approaching buy points.

On Tuesday, January...

READ MORE

MEMBERS ONLY

DP Trading Room: Does This Rally Have Legs?

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DP Trading Room Carl and Erin discuss whether this market rally can get legs and push the market even higher? Mega-caps are looking very positive with the Magnificent Seven leading the charge. Technology is showing new strength along with Communication Services.

Carl starts the trading...

READ MORE

MEMBERS ONLY

These Riskier Areas Start the New Year RALLY!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen analyzes the divergence between the S&P 500 and the Nasdaq while highlighting some of the areas driving Growth stocks. She also talks about the continuation rally in Energy and Utility stocks and shares which stocks are driving these areas higher.

This video originally...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #1

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

HAPPY NEW YEAR!!!

Ever since the introduction of RRG back in 2011, many people have asked me questions like: "What is the track record for RRG" or "What are the trading rules for RRG"?

My answers have always been, and will continue to be, "There...

READ MORE

MEMBERS ONLY

DP Trading Room: Natural Gas (UNG) Breaks Out!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's an interesting market day with the market moving lower despite positive seasonality. Natural Gas (UNG) broke out in a big way up over 15% at the time of writing. Is it ready to continue its big run higher?

Carl took the day off so Erin gave us...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Consolidates, Must Close Above This Level Crucial to Avoid Weakness

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After suffering a brutal selloff in the week before this one, the Nifty spent the truncated week struggling to stay afloat just below the key resistance levels. With just four working days, the Nifty resisted each day to the 200-DMA and failed to close above that point. The trading range...

READ MORE

MEMBERS ONLY

Trump's Policy Shift Reveals Potential Big Winner!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen highlights whether to buy last week's pullback. She discusses the rise in interest rates and why, as well as which areas are being most impacted. Last up, she reviews potential winners with new Trump policy, how to spot a downtrend reversal, and the...

READ MORE

MEMBERS ONLY

MUST SEE Options Trade Ideas! DIS, AAPL, META, BA, LULU

by Tony Zhang,

Chief Strategist, OptionsPlay

In this video, after a rundown of the general markets and sectors, Tony brings you the latest options trade ideas. These include a number of bullish and bearish ideas, including DIS, AAPL, META, BA, LULU, and many more.

This video premiered on December 23, 2024....

READ MORE

MEMBERS ONLY

DP Trading Room: Deceptive Volume Spikes

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room Carl discusses volume spikes and how we have to analyze big volume spikes carefully to determine whether they express a confirmation of a move or whether they are a special case and do not really provide insight.

Carl goes over the signal...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY's Behavior Against This Level To Influence Trends For The Coming Weeks

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After staying in the green following a sharp rebound the week before this one, the markets finally succumbed to selling pressure after failing to cross above crucial resistance levels. The Nifty stayed under strong selling pressure over the past five sessions and violated key support levels on the daily charts....

READ MORE

MEMBERS ONLY

AI Boom Meets Tariff Doom: How to Time Semiconductor Stocks

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Semiconductors are caught in a tug-of-war with AI demand on one side and tariff fears on the other.

* The industry's technical performance shows a narrow standstill that can break either way.

* Watch SMH and its top three holdings—NVDA, TSM, and AVGO—for insights into timing...

READ MORE