MEMBERS ONLY

Nvidia Breaks the 50-day SMA: Is This a Threat or an Opportunity?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* The long-term trend provides perspective and sets the trading bias.

* The bias is bullish during long-term uptrends.

* Breaks below the 50-day SMA are viewed a opportunities, not threats.

After a big run this year, Nvidia (NVDA) fell over 15% from its high and broke its 50-day simple moving...

READ MORE

MEMBERS ONLY

Missed the Gilead Surge? Here's What You Need to Know About the Big Move

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* In June, Gilead Sciences saw a dramatic surge as positive results of a late-stage trial of its HIV drug had Wall Street buzzing.

* GILD was a "sentiment trade" that spiked too quickly for most technical and fundamental indicators to make heads or tails of the move....

READ MORE

MEMBERS ONLY

After the Tech Bloodbath: Ways to Strategize Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks took a dive on Wednesday but look like they are making up some of those losses prior to hitting the next support level.

* Expect volatility in the stock market in the coming weeks since it's earnings season and there's a Fed meeting...

READ MORE

MEMBERS ONLY

CrowdStrike's Epic Fail: Here are the Critical Trading Levels to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Following the CrowdStrike debacle, the stock is as much a technical trade as it is a news-driven trade

* Crowdstrike's stock price has entered a potential buying zone, but potential lawsuits may be a headwind

* Crowdstrike could be a buying opportunity but watch momentum, buying levels, and...

READ MORE

MEMBERS ONLY

Can Small and Mid-Caps Save the Market?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a look at the markets through the lens of the "market factors" panel you can find on your StockCharts dashboard. Starting from the RRG, he then moves to the individual charts for these factors and notes a low correlation for...

READ MORE

MEMBERS ONLY

DP Trading Room: Behind the Scenes: CrowdStrike (CRWD)

by Erin Swenlin,

Vice President, DecisionPoint.com

Friday was a bad day for CrowdStrike Holdings (CRWD) as a bug was pushed out that disrupted Windows machines worldwide. The trouble for CRWD is the follow-up lawsuits etc that will likely plague the stock for some time to come. You'll be shocked to see the warning signs...

READ MORE

MEMBERS ONLY

Hindenburg Omen: The Truth, Effects, and Duration

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on the best time frames for viewing charts, insights on using Vanguard ETFs for sector rotation, the duration and effect of the Hindenburg Omen indicator, how stocks are indexed in Dow Jones Groups on StockCharts, and...

READ MORE

MEMBERS ONLY

Small-caps Break Out and Lead - Now What?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* IJR broke out and a strong breakout should hold.

* Broken resistance turns first support.

* Small-caps are prone to extended trading ranges.

Small-caps took the lead over the last two weeks with the S&P SmallCap 600 SPDR (IJR) surging over 10% in five days and hitting a...

READ MORE

MEMBERS ONLY

Why Homebuilder Stocks are on Fire Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Homebuilder stocks are rallying on hopes of at least one (if not three) interest rate cuts in 2024

* The SPDR S&P Homebuilders ETF broke out above a short-term downward trend

* Though much depends on the interest rate environment, the charts of individual homebuilder stocks show support...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show, which will include both a presentation from Larry and a viewer Q&A session, will be recorded and posted online for those...

READ MORE

MEMBERS ONLY

Seasonal Sector Investing in the Fall: Top Sectors to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* One sector ETF is slightly outperforming the S&P 500 while the rest are underperforming the index.

* The performances of the four outperforming sector ETFs from September to December vary.

* Check the price action and fundamentals to see if both might agree with each sector's...

READ MORE

MEMBERS ONLY

Carvana Stock Is Picking Up Speed. Is Now the Time To Buy?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock hit a new 52-week high and has potential to move higher

* The weekly chart of Carvana's stock price shows the trend is up and has more upside potential

* Carvana's stock chart shows the relative strength index is just approaching overbought territory, indicating...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, July 18 at 2 PM EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, July 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

DP Trading Room: PMO Sort on Earnings Darlings

by Erin Swenlin,

Vice President, DecisionPoint.com

Earnings are coming into focus and today Erin looks at the big earnings stocks to find out which look the best going into earnings. She took the list of stocks and sorted them by the Price Momentum Oscillator (PMO) which put the strongest stocks at the top of the list....

READ MORE

MEMBERS ONLY

How To Manage Risk Using Technical Analysis!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave completes a three-part series based on the successful "Top Ten Charts" episodes ofThe Final Bar. Today, he wraps the series with talks about risk management and how to use technical analysis tools to better manage risk vs....

READ MORE

MEMBERS ONLY

Simple RSI Trend Strategy: Entry BEFORE a Breakout!

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe shows an RSI strategy that offered a few opportunities to get into AAPL before the big breakout. He then highlights what to watch for in TSLA, which may provide the same type of RSI setup sometime over the next week or so; this...

READ MORE

MEMBERS ONLY

The BEST Way to Track Stock and ETF Performance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave continues a three-part series on selecting top charts to follow every month. In this second episode, Dave reviews charts he and Grayson Roze selected in May and June, reflecting on what has happened, what has...

READ MORE

MEMBERS ONLY

Silver's AI Boom: The Next Big Trade You Need to Know About

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Silver may be the next big "AI trade"

* While silver ETFs are seeing large outflows, silver futures are telling a different story

* Understanding silver's seasonal pattern and identifying the key levels to watch are critical

Over the last few years, the "AI trade&...

READ MORE

MEMBERS ONLY

Identifying Top Charts with Upside Potential in 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave begins a three-part series on selecting top charts to follow every month. In this first episode, he shares how he and Grayson Roze select the charts to include in the Top 10 lists using the...

READ MORE

MEMBERS ONLY

Market Foundation Showing CRACKS!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius continues to look at the narrowing market breadth and puts things into (another) perspective. The conclusion remains the same: it's a Risk-ON market, but the Risk is BIG.

This video was originally broadcast on July 9, 2024. Click anywhere on the...

READ MORE

MEMBERS ONLY

DP Trading Room: These Banks are Bullish Going Into Earnings

by Erin Swenlin,

Vice President, DecisionPoint.com

Earnings season is kicking off and Carl and Erin spotlight the banks that will be reporting on Friday. The setups aren't good for all of these banks, but some are set up nicely going into their earnings calls. Earnings are always tricky as good earnings can still result...

READ MORE

MEMBERS ONLY

The Economy is Slowing - Are You in the Right Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews where things stand after the markets close at another new high. She also shares what drove price action this week and how that may change the markets going forward. Finally, she highlights precise sell strategies in a shifting market.

This video originally...

READ MORE

MEMBERS ONLY

The Chart to Help Navigate a Summer Market Top

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Value sectors have been consistently underperforming the benchmarks since the April market low

* Technology has outperformed the S&P 500 as well as other growth sectors in 2024

* Defensive sectors like Utilities and Consumer Staples may be the most important to watch, as they can demonstrate investor...

READ MORE

MEMBERS ONLY

Tesla Stock's Shocking Comeback: What You Need to Know Before July 23

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* TSLA's stock price surged 32% above its zone of congestion following its April 23 earnings report

* News of Tesla's dwindling inventories, plus expectations of a Fed rate cut before the end of the year (among other things), are fueling the stock's advance...

READ MORE

MEMBERS ONLY

Unmasking Market Moves: Why Focusing on Individual Stocks Beats Indexes in 2024

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Today, we're looking at market breadth from a different perspective

* In this article, we'll plot major US stockmarket indices on a Relative Rotation Graph

* Even inside the NYFANG index, the base is narrow

There's been much chatter and mentions of weak or...

READ MORE

MEMBERS ONLY

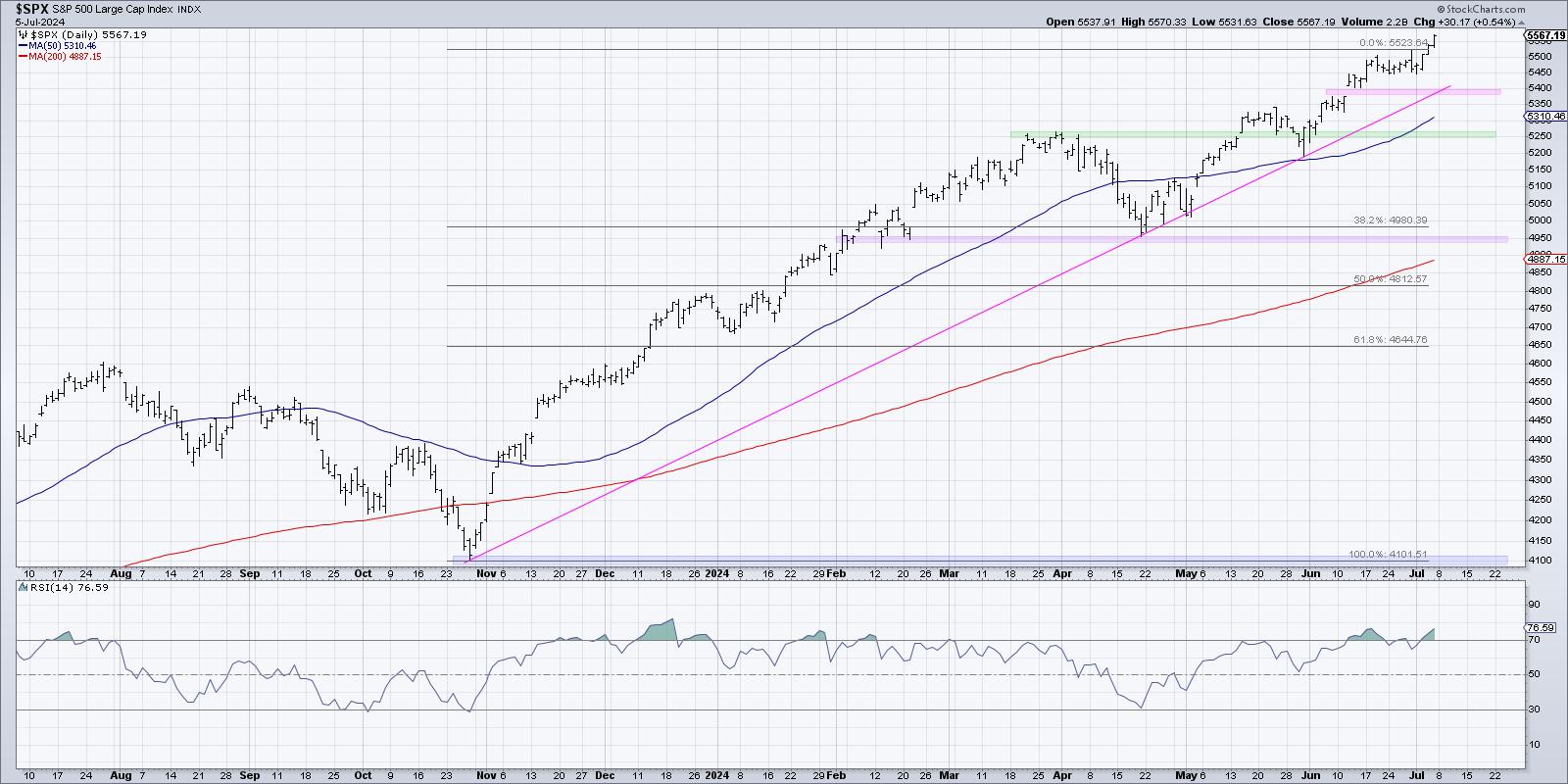

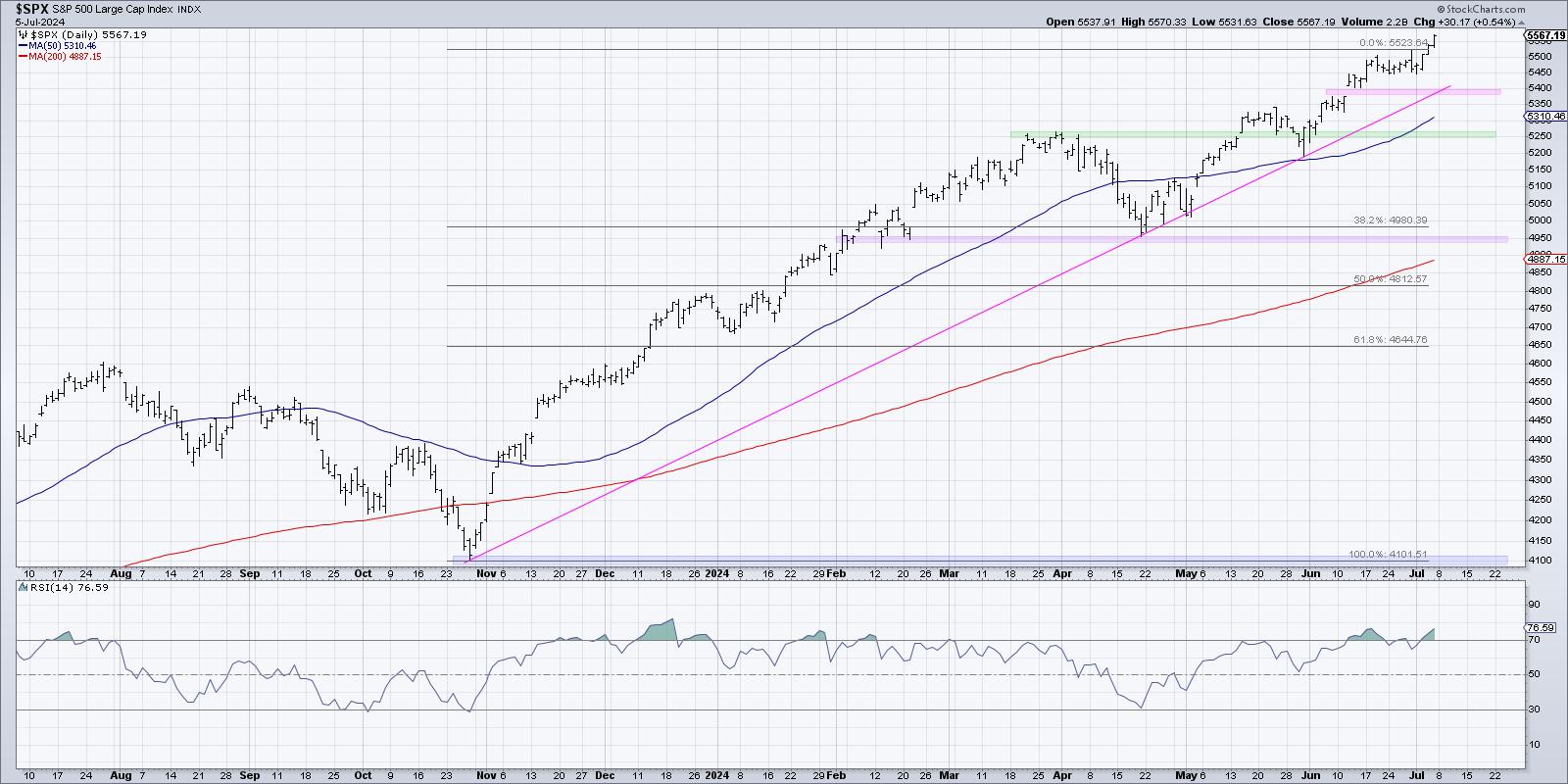

Should You Be Worried About Poor Market Breadth?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, available to watch below, Dave celebrates the S&P 500 closing above 5500, laments the lack of market breadth, and provides updates on the infamous Hindenburg Omen. He also breaks down key levels to watch on charts of V,...

READ MORE

MEMBERS ONLY

Could AMZN's Stock Hit $3 Trillion Valuation? What You Need To Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMZN's stock price entered new all-time high territory, closing at $200.02; it could rise higher

* If AMZN's stock price dips, watch for key levels to enter a long position

* Amazons' next earnings report is expected to drop on August 1, 2024, which...

READ MORE

MEMBERS ONLY

DP Trading Room: Deflation...a Possibility?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's DP Trading Room was jam packed! The lead story is definitely the fact that deflation is another possibility that many are not talking about. We don't know if it will be the final outcome, but we have a link that discusses this possibility: https://hoisington....

READ MORE

MEMBERS ONLY

What to Expect This Month | Focus on Stocks: July 2024

by Larry Williams,

Veteran Investor and Author

Historically, July has seen stock prices move higher almost 80% of the time, cementing this in our trader's notebook as a time to stay home and trade. Others can vacation this month!

Chart 1 is my true seasonal pattern for the Dow for the last 124 years. It...

READ MORE

MEMBERS ONLY

Top 5 Stocks in "Go" Trends | Fri June 28, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Trend Continuation

* Breakouts

* Momentum Confirmation

* Bull Flags

Top 5 Stocks in "Go" Trends

Trend Continuation on Rising Momentum

GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action. The resurgence of momentum in the direction of the underlying price trend...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch in July 2024!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they run through top 10 charts to watch in July 2024! They'll cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into...

READ MORE

MEMBERS ONLY

Mastering GoNoGo Charting: Scanning Securities on StockCharts.com

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Scanning

* screening

* Idea Generation

* Market Breadth

Join Tyler Wood, CMT, in this insightful tutorial where he demonstrates how to effectively scan for GoNoGo conditions using StockCharts.com. GoNoGo Charts, a powerful method developed by Alex Cole and Tyler Wood, blend foundational tools in technical analysis into a powerful...

READ MORE

MEMBERS ONLY

3 Essential Lessons We Investors Can Learn from Top Winemakers

by Gatis Roze,

Author, "Tensile Trading"

"It takes 10 years to learn from the vineyard, and another 10 years to learn the wine from that vineyard."

Metaphors and analogies are powerful teachers and offer behavioral adhesiveness. In other words, the ideas and lessons they present stick in our memory, and can thus more easily...

READ MORE

MEMBERS ONLY

Bank Stress Tests: What They Mean for Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The 2024 bank stress results show that all participating banks are able to withstand an economic collapse

* In spite of the banks passing the stress test, the XLF didn't see much movement

* Look for XLF to reverse at its 50% Fibonacci retracement level and start gaining...

READ MORE

MEMBERS ONLY

Can Nvidia's Stock Skyrocket Again? Key Levels to Watch Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* NVDA shares prices are falling, but it doesn't necessarily mean that the AI trend is at an end

* Expect near-term weakness in NVDA's stock price but keep in mind that longer-term prospects present a different picture

* Watch key support levels since ultra-bullish sentiment could...

READ MORE

MEMBERS ONLY

Why Investors are Betting Big on Berkshire Hathaway Class B Shares Right Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Berkshire Hathaway Class B shares are poised for an explosive breakout

* Fundamentally, BRK/B has been a consistent outperformer and is diversified among different sectors

* BRK/B is working its way through a symmetrical triangle formation and could breakout in either direction

Berkshire Hathaway needs no introduction. The...

READ MORE

MEMBERS ONLY

DP Trading Room: Carl's Grab Bag! - Chipotle (CMG), NVDA, Bahnsen & Hussman

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl brings out his "Grab Bag" during today's free DecisionPoint Trading Room! He gives us a read on Chipotle's (CMG) 50:1 split. He talks about NVDA's strangle hold on the market and gives us homework to read recent articles from David...

READ MORE

MEMBERS ONLY

4 Ways To ENHANCE The Moving Averages On Your Charts

by Grayson Roze,

Chief Strategist, StockCharts.com

Moving averages are a crucial charting tool, but many of us aren't getting the most out of them. In this edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to enhance your moving averages with 4 unique charts, straight out of his own account. You&...

READ MORE

MEMBERS ONLY

Gilead's Game-Changer: What You Need to Know About the Stock

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gilead Sciences' stock price got a boost from positive results of a late-stage trial of its HIV drug

* While Gilead still needs to replicate its results and seek FDA approval, this may be a good time for traders and investors to get in early on a potentially...

READ MORE

MEMBERS ONLY

Deja Dot.com Disaster?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today on Fox Business' Varney & Company, David Bahnsen (The Bahnsen Group) was asked if the current market reminded him of the Dot.com Bubble. He said it did, but not the part about all those worthless dot.com companies that went bust. Big companies like Cisco, Microsoft, and...

READ MORE