MEMBERS ONLY

Getting Perspective and Dealing with Volatility

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Primary moves define the long-term trend

* Secondary moves are corrections within bigger uptrends

* Corrections provide opportunities to partake in the bigger uptrend

The S&P 500 is down 5.5% this month and volatility is rearing its ugly head. This is a good time to get some...

READ MORE

MEMBERS ONLY

MEM TV: Capitulation Signals for a Market BOTTOM

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the negative shift that's evolved over the past week in the market and highlights key signals of capitulation you should be watching for. She then shares the move into Value stocks she's seeing...

READ MORE

MEMBERS ONLY

How to Chart In Multiple Timeframes Like A PRO

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to chart the same symbol in multiple timeframes with ease using ChartStyles and StyleButtons. Learn how to customize multiple charts with the periods and ranges that fit with your system and then set...

READ MORE

MEMBERS ONLY

S&P 500 Approaches 100-Day Moving Average: Is Now an Attractive Time to Buy Stocks?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The possibility of only one interest rate cut and escalation of geopolitical tensions increases uncertainty levels for investors

* The 100-day simple moving average could be the S&P 500's next support level

* Massive selloff in Tech stocks sends the Nasdaq Composite below its 100-day moving...

READ MORE

MEMBERS ONLY

Top 10 Stocks to Watch April 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave and Grayson run through top 10 charts to watch in April 2024! Together they cover breakout strategies, moving average techniques, relative strength, and much more. You don't want to miss these insights into market dynamics and chart...

READ MORE

MEMBERS ONLY

META Stock in Limbo: What You Need to Know Before the Next Big Price Swing

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Meta's prospects look bullish mostly due to the rollout of Meta AI, which is expected to lead to substantial growth in ad revenue

* While analyst price predictions show a wide range, consensus ratings lean towards a "Buy" to a "Strong Buy"

* Technically,...

READ MORE

MEMBERS ONLY

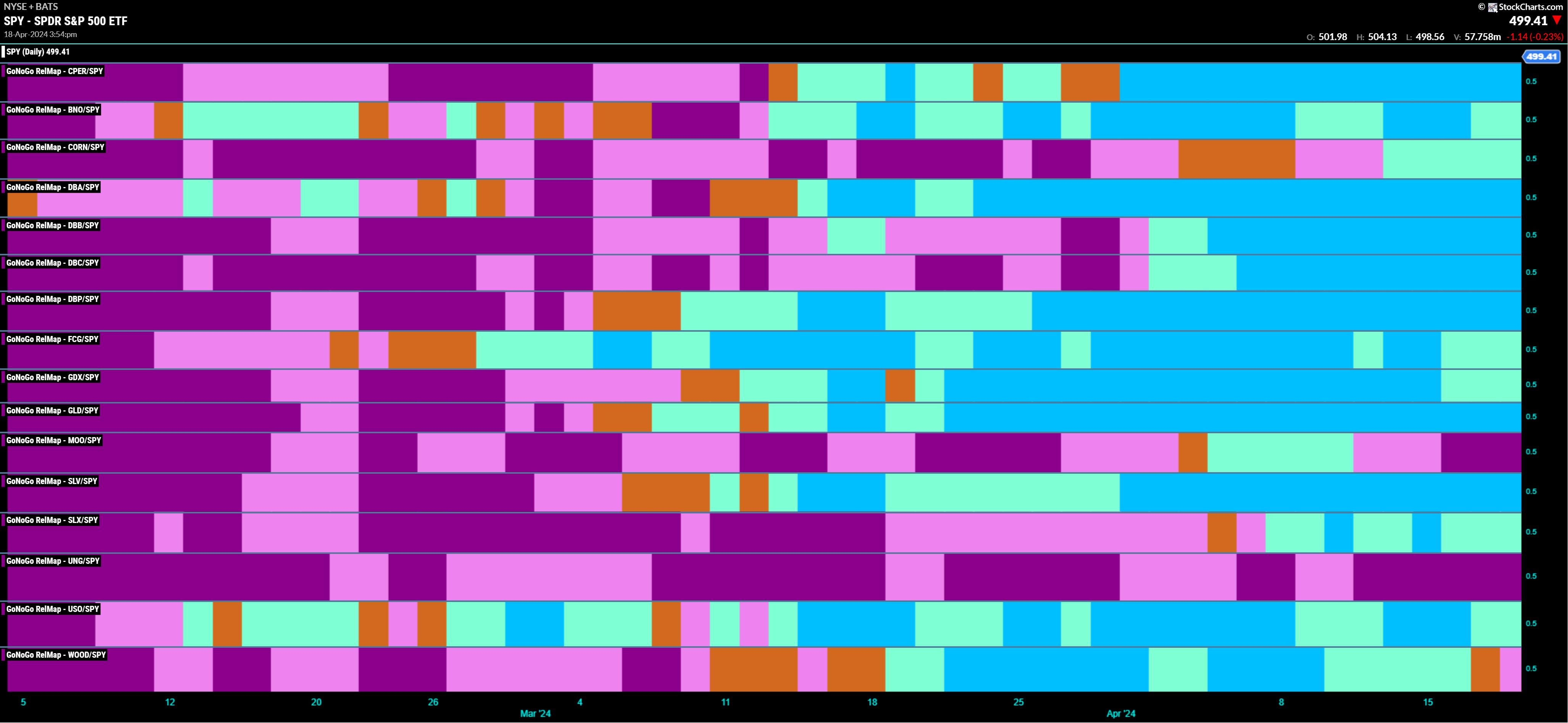

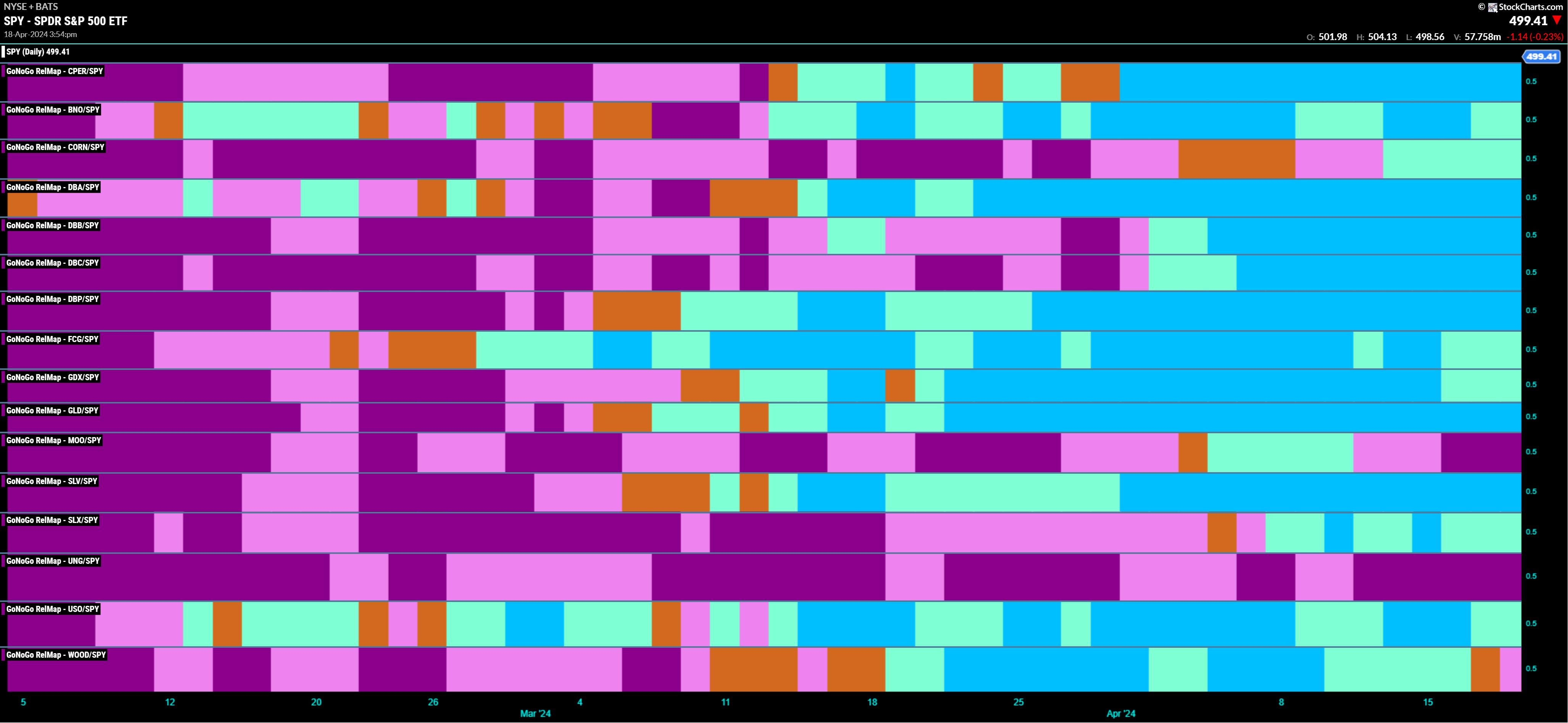

Rocks over Stocks | GoNoGo Show 041824

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* New Risk Off Environment for Equities

* Commodities Leading

The S&P500 trend conditions have reversed into "NoGo" and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" April 18, 2024 Recording

by Larry Williams,

Veteran Investor and Author

Right now, there's lots of room for a downside in the market. Do we really want a rate cut?

In this video, Larry talks about past interest rate cuts from the Fed, and what happens to stock prices as a result. Historically, we've seen these cuts...

READ MORE

MEMBERS ONLY

Intraday Trading Entry and Exit Strategies

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe details a trade setup in the QQQ that demonstrates how he uses MACD and ADX in multiple timeframes for his trading. He gives detail on the entry and exit for this trade. Joe then covers the stock...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Daylight Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Semiconductors are at CRITICAL Level!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Danielle Shay of Simpler Trading. Danielle speaks to the downside rotation for the QQQ, SMH, and leading growth stocks, including why the $210 level is so crucial for the SMH. Dave highlights the recent downswing for Bitcoin,...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs TOMORROW - Thursday, April 18 at 2:00pm EDT!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom on Thursday, April 18 at 2:00pm Eastern Daylight Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

AMD Plunges to a Critical Support Level: Is Now the Time to Go Long?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMD is in a technical (near-term) downtrend, but its fundamentals promise otherwise

* AMD's stock price is trailing NVDA, though its lead over the rest of the industry appears to be waning

* AMD is in a technical "buy" range and the potential for a bullish...

READ MORE

MEMBERS ONLY

Is Market Breadth Signaling THE TOP?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how bearish short-term breadth combined with the deterioration in long-term breadth lines up well with previous market tops. He then breaks down key levels for the S&P 500 index as well as MSFT, TSLA, and more....

READ MORE

MEMBERS ONLY

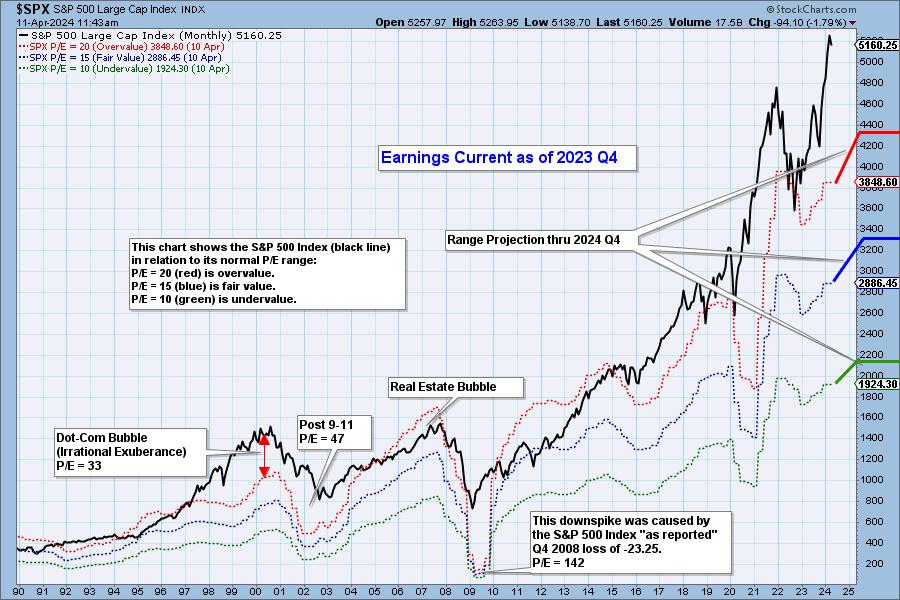

DP Trading Room: Final Earnings are In for 2023 Q4!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl opens the show with a view of the final earnings results for 2023 Q4! His chart reveals whether stocks are fair valued, overvalued or undervalued. Get his take on the current readings.

Carl gave us his market overview including Bitcoin, Gold Miners, Gold and Crude Oil and many more....

READ MORE

MEMBERS ONLY

Stay Ahead of the Markets with AUTOMATED Portfolio Reports

by Grayson Roze,

Chief Strategist, StockCharts.com

Staying on top of your portfolio in a fast-moving market can be a challenge. On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to make things easier on yourself with automated ChartList Reports for your portfolio. You'll learn how to...

READ MORE

MEMBERS ONLY

The Day the Yields Broke Out

by Martin Pring,

President, Pring Research

Wednesday brought an unexpected firming up of the inflation figures, causing analysts and commentators to trim the number of times they expect interest rates to be cut this year. Whenever it is that the questions turn away from whether to when and by how much, as was the case until...

READ MORE

MEMBERS ONLY

From Relic To Reckoning: Can Gold Surge To $3,000?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gold is at record highs with retail investors buying despite sky-high valuations

* Fiscal, monetary, and geopolitical uncertainties are driving this "relic" turned "alternative currency"

* The technical context reveals a few strategic insights for anyone bullish on the yellow metal

The strange thing about gold...

READ MORE

MEMBERS ONLY

NVDA is Holding Strong: It's Time to Think About Accumulating this Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* NVDA stock is rising as the broader market sells off

* NVDA is technically and fundamentally strong and is outperforming the S&P 500

* NVDA's stock price has broken above a downward channel, which could be the start of the next uptrend

Sometimes, it helps to...

READ MORE

MEMBERS ONLY

Master Market Entry with This RSI Strategy!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use the RSI along with the MACD and ADX indicators. RSI is used as a timing tool when things are lined up. Joe goes through some of the key elements he looks for when...

READ MORE

MEMBERS ONLY

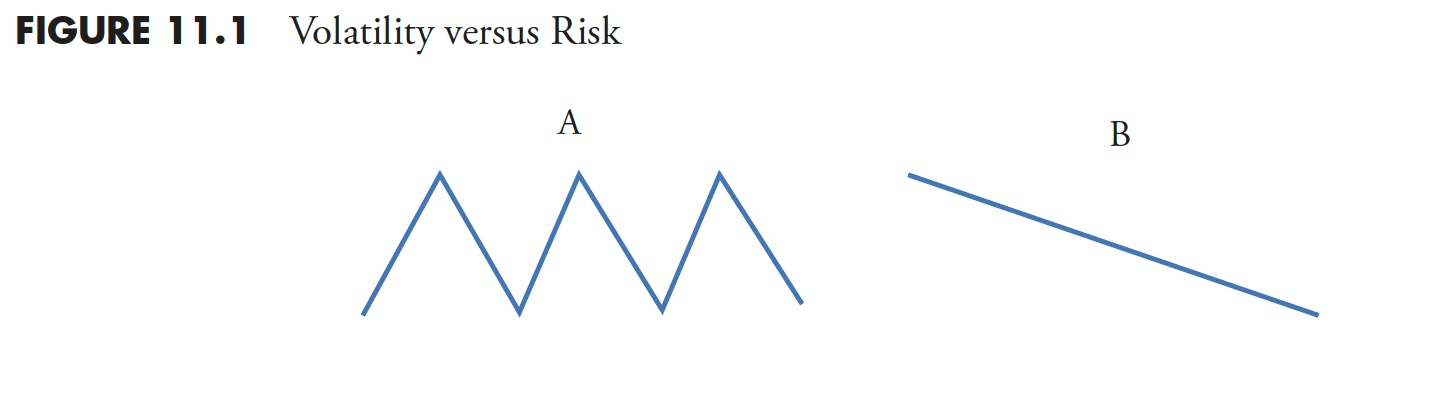

Market Research and Analysis - Part 5: Drawdown Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

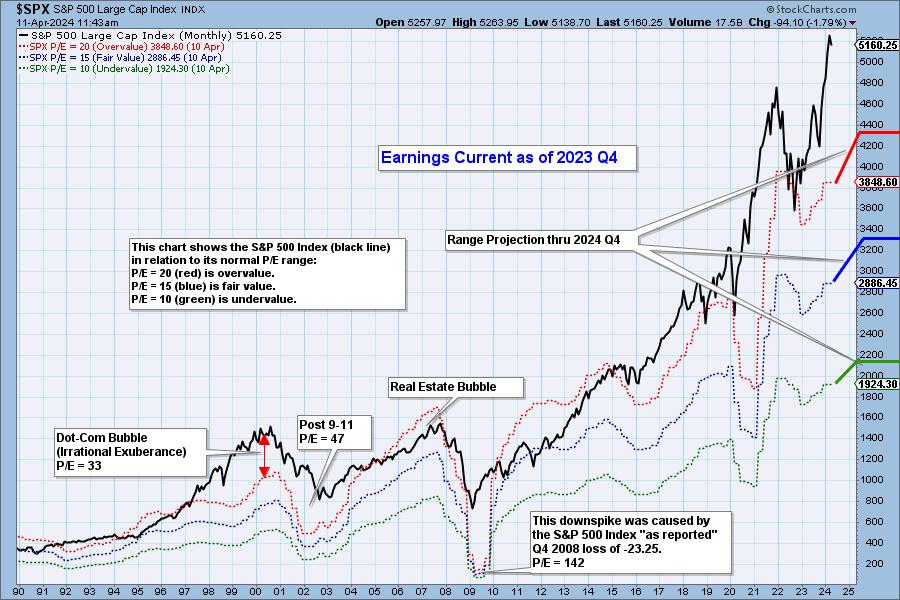

2023 Q4 Earnings Analysis and Projections Through 2024 Q4

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2023 Q4, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

This Sector is Breaking Up and Down Simultaneously

by Martin Pring,

President, Pring Research

This may seem like a contradiction, but it is possible for two different things to be true at the same time.

What I am referring to is the fact that the health care sector (XLV) recently broke out from a consolidation reverse head-and-shoulders pattern, as we can see from the...

READ MORE

MEMBERS ONLY

Despite Stable Markets, Breadth Says Danger

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops a market update, with a focus on Bitcoin's rebound above 70K, deteriorating short-term breadth conditions, and stocks still making new highs despite the market consolidation phase.

This video originally premiered on April 8, 2024. Watch on...

READ MORE

MEMBERS ONLY

Double Top Forming in Growth vs. Value?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers questions from The Final Bar Mailbag. Today he talks about how to use the ADX indicator, how growth vs. value may have formed a double top pattern, how to use VWAP for intraday and historical analysis, and what...

READ MORE

MEMBERS ONLY

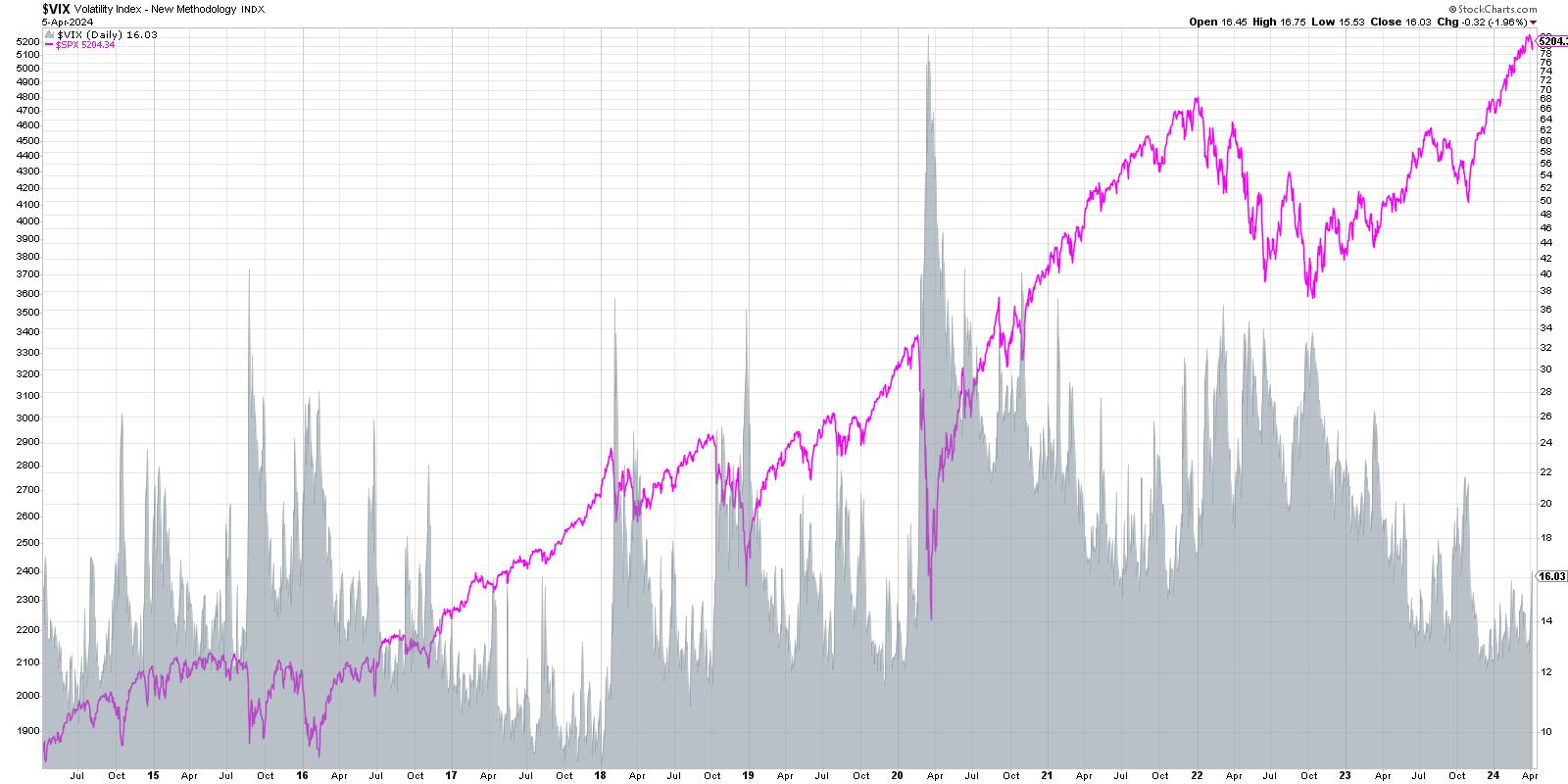

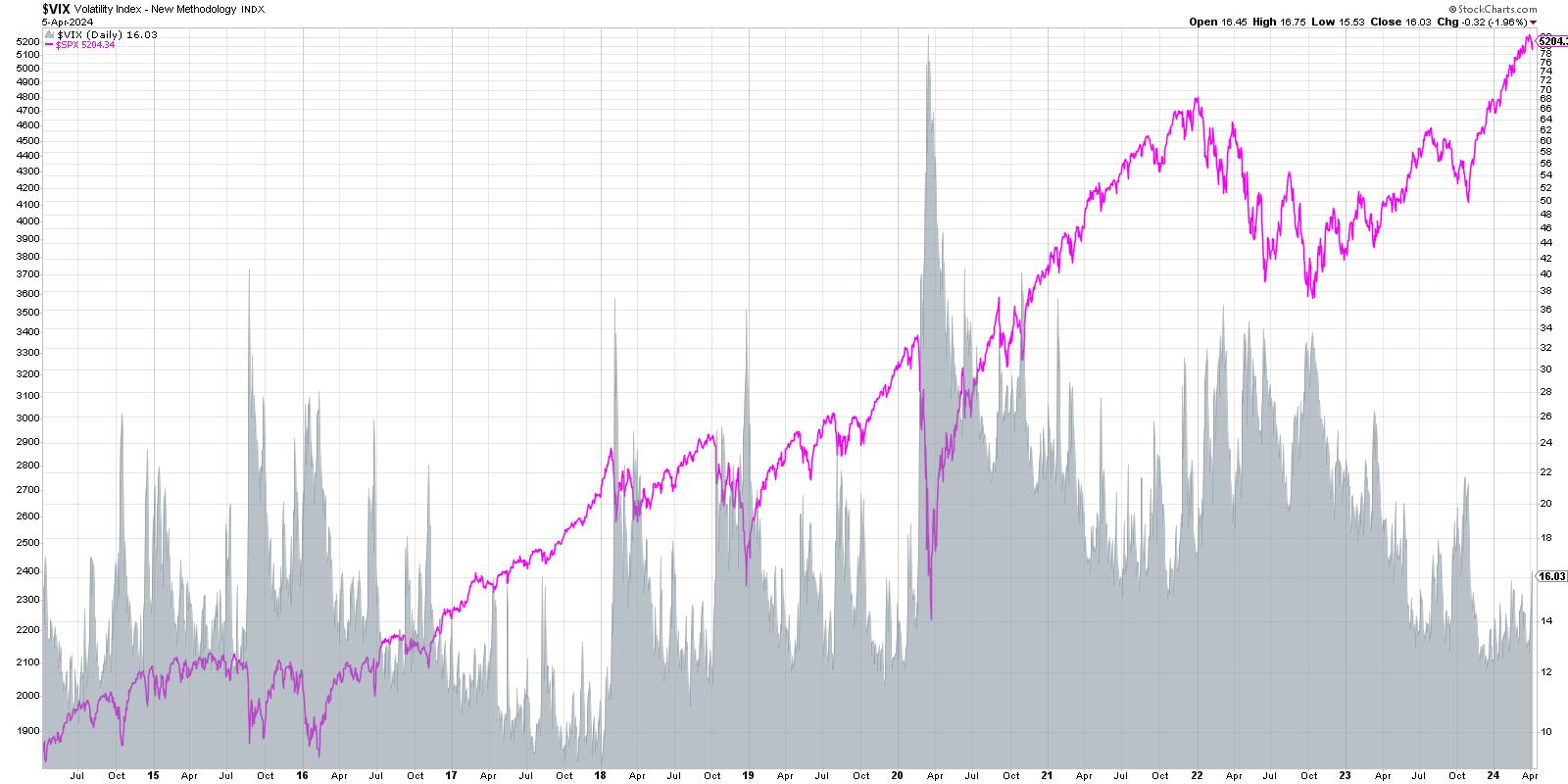

VIX Spikes Above 16 - Is This the End?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The VIX ended the week just above 16, bringing it to its highest level in 2024. What does this tell us about investor sentiment, and how does this compare to previous market cycles?

Let's take a quick tour of market history through the lens of the VIX, focusing...

READ MORE

MEMBERS ONLY

Spot Big Reversals Using the ADX Indicator

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe demonstrates how to use the "Big Green Bar" candlestick pattern. This candlestick provides great confirmation on certain types of entry points, and can also be helpful for exits. Joe finishes up the show covering the...

READ MORE

MEMBERS ONLY

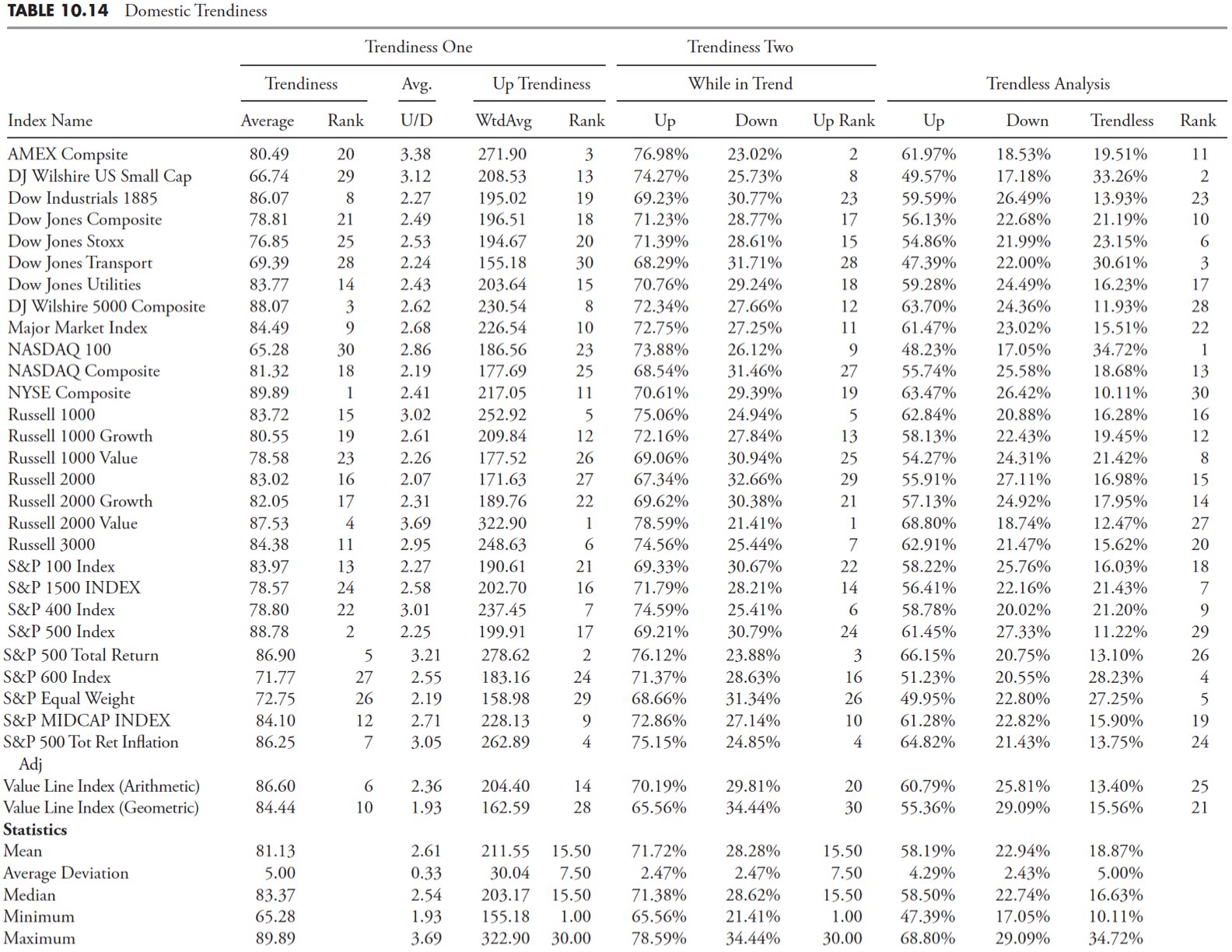

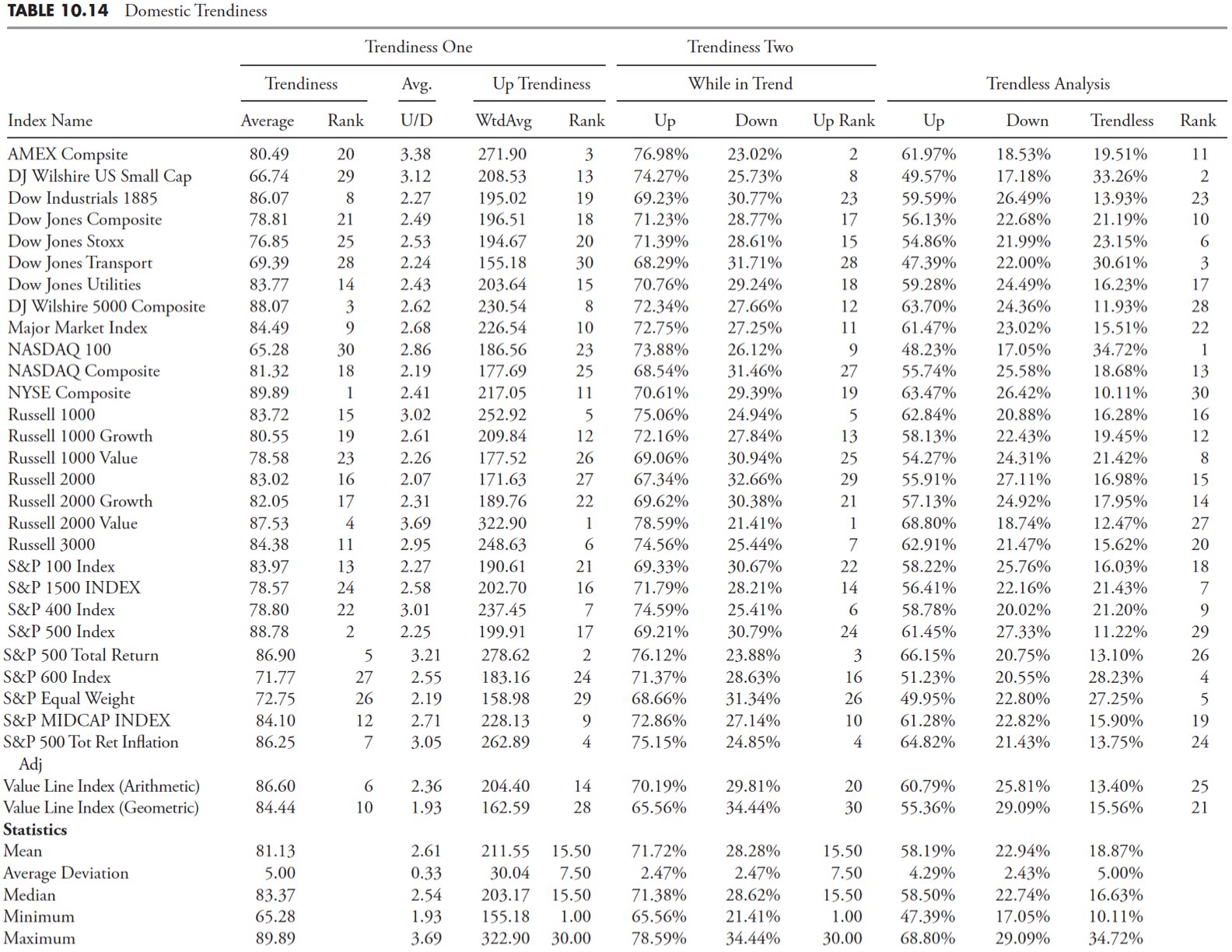

Market Research and Analysis - Part 4: Trend Analysis Continued

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

DJT Has Closed Last Week's Gap, But is It Enough?

by Martin Pring,

President, Pring Research

Sometimes, simple indicators like bar or candlesticks operate just as the textbooks tell us they should. I don't normally follow individual stocks, but the hype surrounding last week's listing of Trump Media piqued my interest to see if the technical position squared with what the many...

READ MORE

MEMBERS ONLY

DP Trading Room: On-Balance Volume (OBV) Explained

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl and Erin cover the topic of On-Balance Volume (OBV) as a representation of volume trends. This came to their attention as they uncovered an OBV negative divergence on the SPY chart.

Carl completes a review of the weekly charts for the Magnificent 7 stocks, giving us a more...

READ MORE

MEMBERS ONLY

Business Confidence and Stocks | Focus on Stocks: April 2024

by Larry Williams,

Veteran Investor and Author

Here comes the answer to a very old question, "Do stocks lead the economy, does the economy lead the stock market, or is there something else?"

My work has shown numerous times that GDP is not a good predictor of the Dow Jones. Also, business inventories and a...

READ MORE

MEMBERS ONLY

Overbought Conditions Reflect Strength and Said Strength Drives Momentum Rotation Strategies

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Overbought is just another term for strong. RSI above 70 shows strong upside momentum, which his bullish. Stocks can become overbought (strong) and remain strong.

Momentum and trend strategies are off to a roaring start here in 2024. More often than not, these strategies buy leading stocks that...

READ MORE

MEMBERS ONLY

Which Magnificent 7 Stock Would You Pick for Q2?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This article represents an exercise I like to call the "Single Stock Portfolio". In this scenario, you can only own one stock in your portfolio for the next three months, and you can pick any one of the following eight stocks. Which one would you select, and why?...

READ MORE

MEMBERS ONLY

Buy Breakout or Fade Divergence on Growth Stocks?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a mailbag show discussing key technical analysis topics. He covers breakouts, the role of TSX, CCI signals, Gartner Group (IT) strategies, seasonal patterns, ATR use, NVDA Fibonacci retracements, and managing high-yield stocks like GLP. You don't...

READ MORE

MEMBERS ONLY

The Fourth Bitcoin Halving Is Upon Us: Is Now the Time to Go Long?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Bitcoin halving are often considered pivotal events for the cryptocurrency

* Bitcoin prices are rising, but momentum appears to be dwindling

* If Bitcoin stalls and reverse, there are a few potential support levels to watch

Bitcoin is about to undergo its fourth halving on April 19. For crypto enthusiasts,...

READ MORE

MEMBERS ONLY

These Breadth Charts PROVE How Strong This Bull Market Is

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson explains the importance of market breadth and shares some of the most crucial charts for understanding what's truly happening beneath the surface of the market. Using the Sample Chart Gallery, you'll see...

READ MORE

MEMBERS ONLY

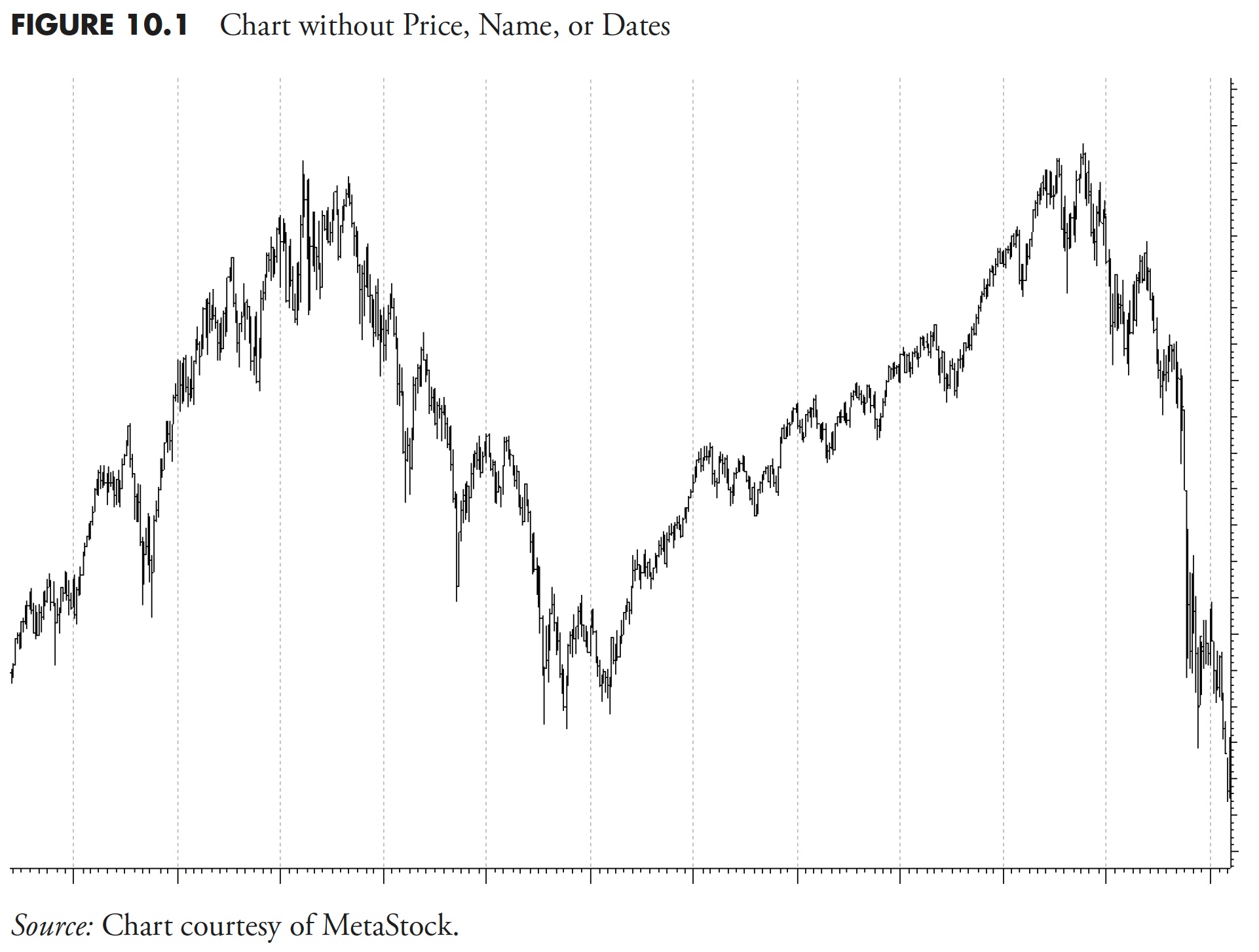

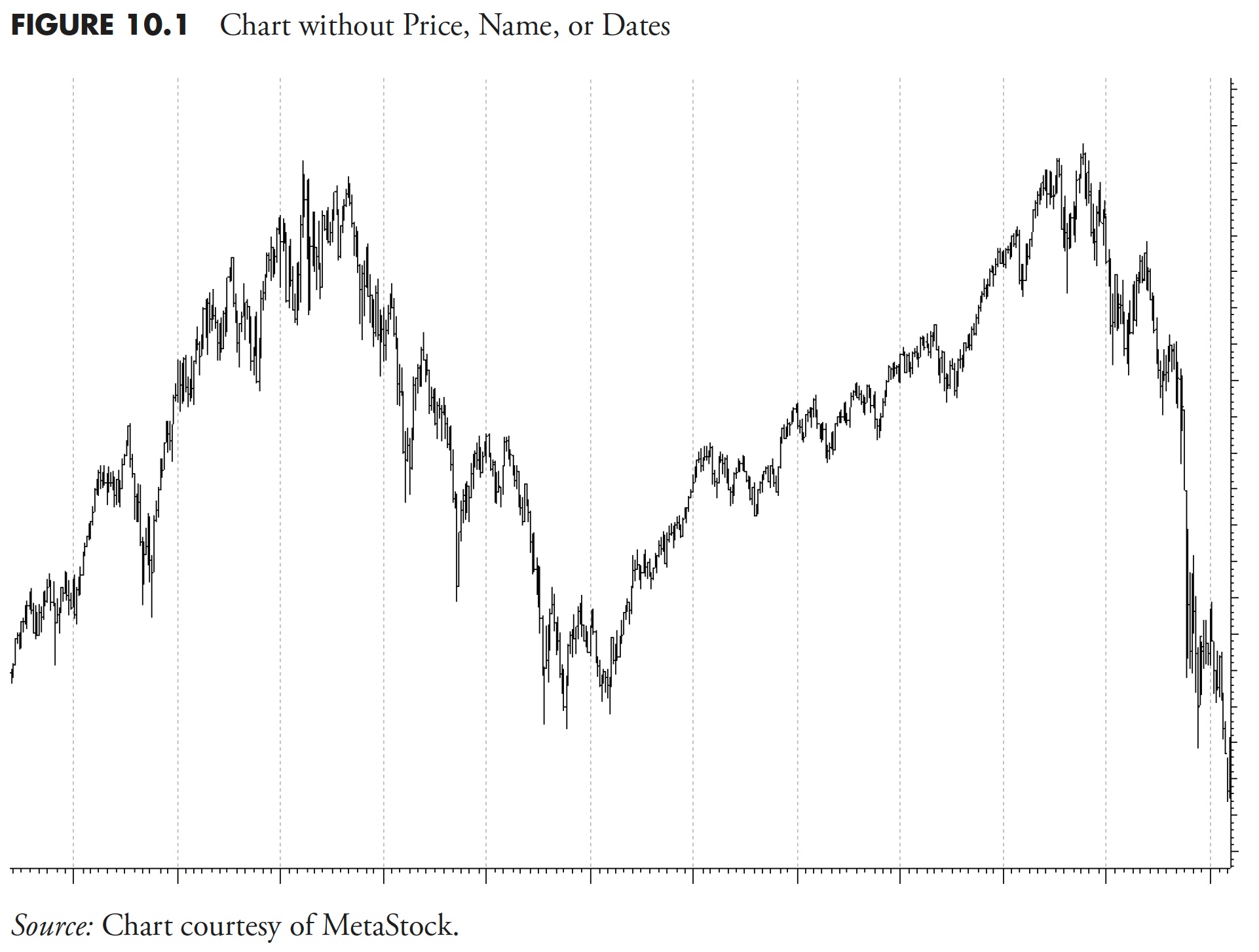

Market Research and Analysis - Part 3: Market Trend Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fourteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

S&P 7000 By End of 2024?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest David Hunter of Contrarian Macro Advisors shares his updated target for the S&P 500, and makes the case for a bullish melt-up phase for stocks, bonds, and gold. Dave Keller focuses in on the relative performance of...

READ MORE

MEMBERS ONLY

KRE's Impending Plunge: What This Emerging Crisis Means

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* KRE (the SPDR S&P Regional Banking ETF) is trading within a fairly wide uptrend channel

* Momentum in KRE appears to be waning which could uncover short-term trading opportunities

* Many regional banks can face increasing debt delinquencies and may be on the brink of collapse

Full disclosure:...

READ MORE

MEMBERS ONLY

Three Industrial Stocks With Room to Run!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Mary Ellen McGonagle of MEM Investment Research. David compares two stocks in the same industry group with dramatically different chart patterns. Which one would you want to own here and why? Mary Ellen shares three stocks with...

READ MORE