MEMBERS ONLY

Larry's First LIVE "Family Gathering" Webinar of 2024 Airs NEXT WEEK - Tuesday, January 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Tuesday, January 16 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

Your Questions Answered! Moving Averages, Chart Patterns, Inflation & More

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave presents a special all-mailbag episode, answering viewer questions on simple vs. exponential moving averages, the benefits of analyzing sector rotation, and a good first chart for beginners learning technical analysis.

This video originally premiered on January 12, 2024. Watch...

READ MORE

MEMBERS ONLY

Common Lessons Amongst Corporate, Sports & Investment Portfolio Turnarounds!

by Gatis Roze,

Author, "Tensile Trading"

My many decades of business, investing, and sports experience has shown me time and time again that parallel lessons in all three arenas are remarkably worthy teachers. One essential lesson today (January 2024) is to not allow yourself to become a "legend in your own mind." Yes, you...

READ MORE

MEMBERS ONLY

3 Health Care Stocks Flashing Promising Golden Cross: Why You Need to Watch Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Health Care sector has shown upside momentum in 2024

* It may be a good time to add some healthcare stocks to your portfolio

* The Bullish 50/200-day MA Crossovers scan in StockCharts filtered out three healthcare stocks that deserve attention

The Health Care sector started rallying in...

READ MORE

MEMBERS ONLY

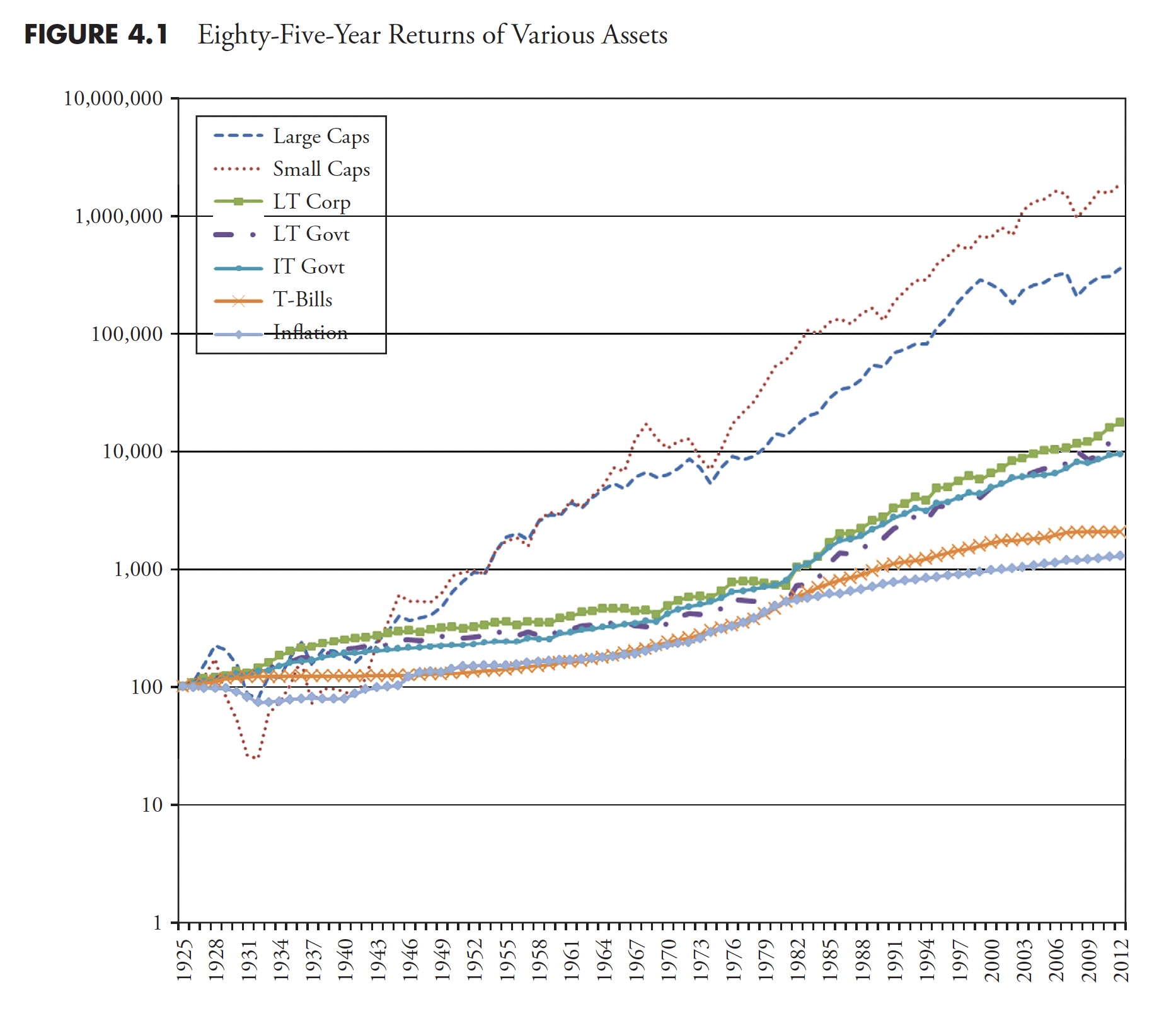

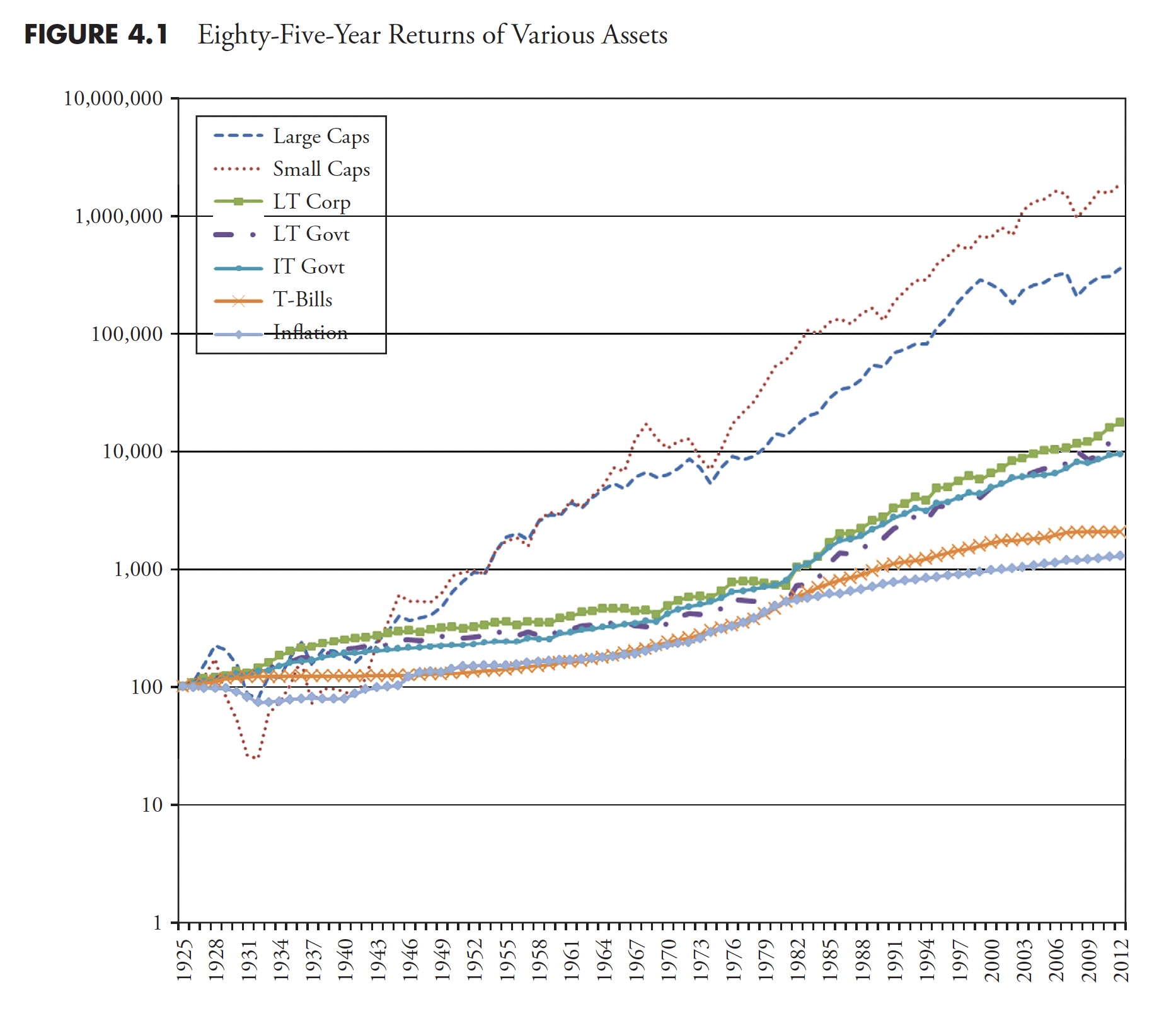

The Hoax of Modern Finance - Part 4: Misuse of Statistics and Other Controversial Practices

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Putting a Mean-Reversion Strategy Into Practice

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Mean-reversion strategies typically buy stocks when they are oversold, which means catching the falling knife. These declines are often rather sharp, but the odds favor some sort of bounce after reaching an oversold extreme. While there are no guarantees, chartists can mitigate risk by insuring that the stock is still...

READ MORE

MEMBERS ONLY

Prepare for 2024: Martin Pring's Expert Insights on the Equity Market

by Martin Pring,

President, Pring Research

In this must-see once a year special, Martin breaks down his comprehensive equity market outlook for 2024, accompanied by Bruce Fraser.

Encompassing a secular (multi-business cycle) perspective of the forces that are likely to influence stocks and bonds over the coming years, Martin presents a look ahead at what'...

READ MORE

MEMBERS ONLY

Supercharge Your SUCCESS with The Ultimate List of Prebuilt Charts

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson kicks off the New Year by hooking you up with every chart you could ever need, and you don't have to create a single one yourself! In just a couple of clicks, you can...

READ MORE

MEMBERS ONLY

Hot Jobs Data Sends Stock Market Seesawing, Ending Nine-Week Winning Streak

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market indices closed higher for the day but ended the week lower

* The 10-year Treasury yield closed higher at 4.04%

* In spite of the pullback in equities, the stock market indices are still looking technically strong

You can't blame the market for taking...

READ MORE

MEMBERS ONLY

GNG TV: Remaining Objective About Trading Rules is CRITICAL!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, Alex and Tyler take a look at the GoNoGo Trend® conditions of several key areas of the market. The seasonal roadmap of 2023 may be overemphasized by many market commentators, and remaining objective about trading rules is critical in times like these....

READ MORE

MEMBERS ONLY

Add Happiness To Your Portfolio With a Sprinkle of Disney Stock

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Disney's stock price is showing signs of consolidation and may be worth watching for signs of a breakout

* The stock is at a critical support level and if the stock is able to hold this support, it could be positive for the stock

* A break above...

READ MORE

MEMBERS ONLY

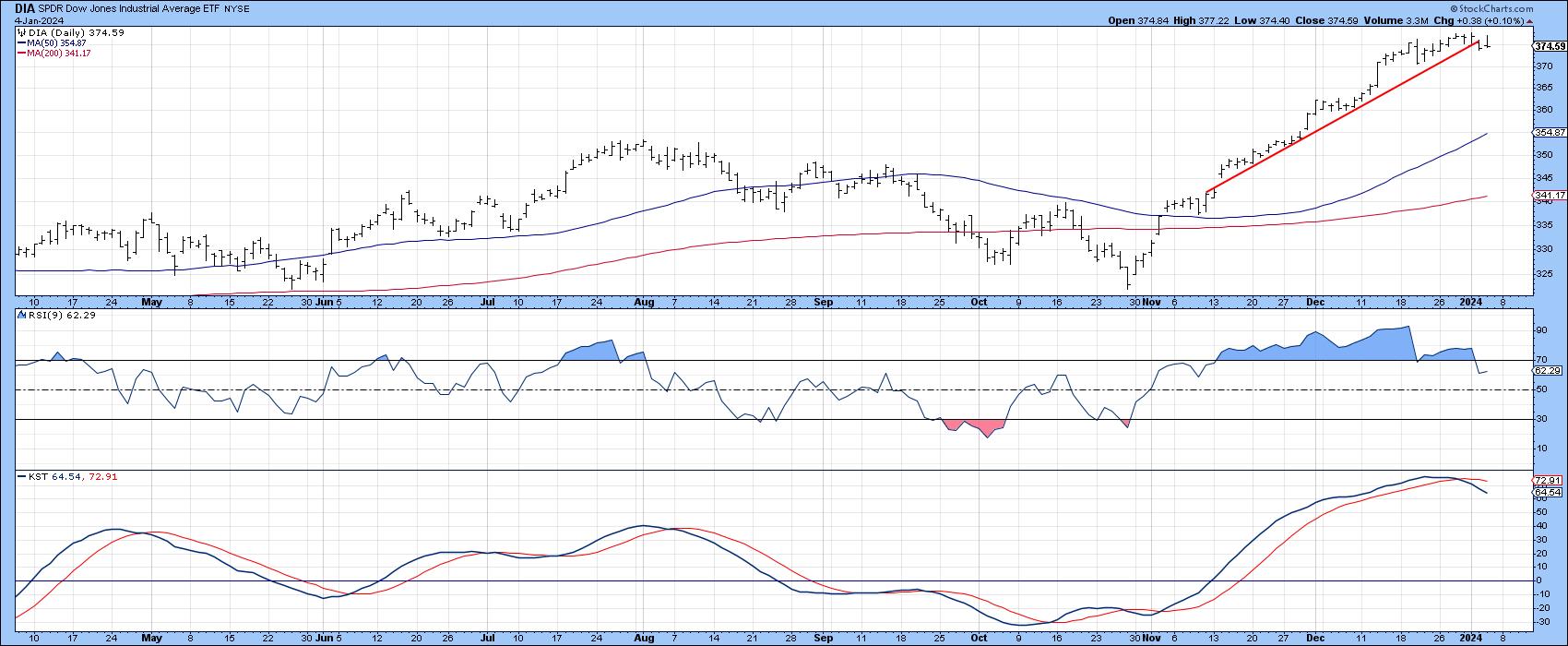

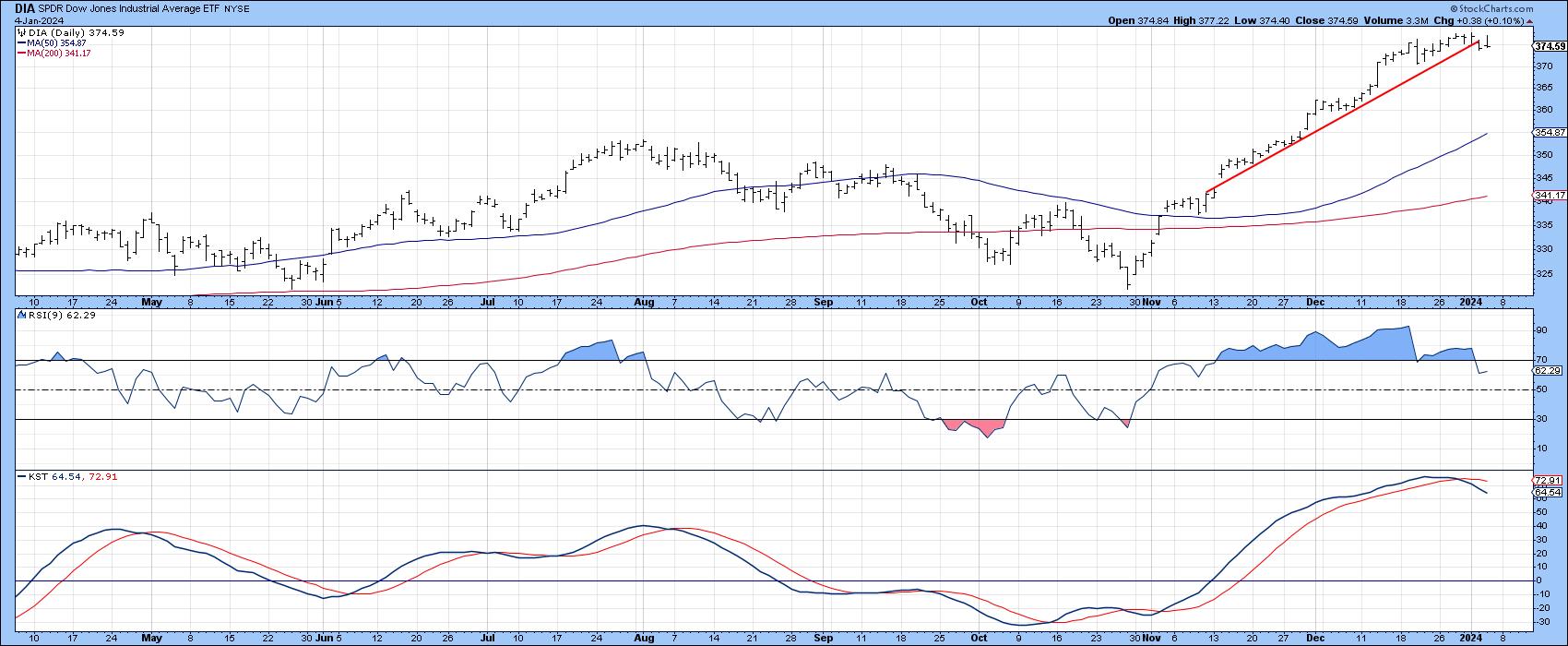

Three Intermarket Relationships to Watch in Early 2024

by Martin Pring,

President, Pring Research

It has been a great rally, but this week has seen the DJIA violate its post November up trendline. In addition, the 9-day RSI has retreated below its 70 overbought zone for the first time since early November, and the daily KST has triggered a sell signal. Is it time...

READ MORE

MEMBERS ONLY

Sprouts Farmers Market: A Hidden Gem on the Corner of Wall and Main Street?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Sprouts Farmers Market has been riding a relatively steady uptrend channel over the last year

* More dominant on Main Street than Wall Street, its earnings have been yielded positive surprises almost every quarter since 2019

* Look for SFM stock to pull back to its 50-day SMA

Most traders...

READ MORE

MEMBERS ONLY

MRNA Stock Gets an Upgrade: When is the Best Time To Buy?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* MRNA stock surges on the potential of widening its vaccine offerings

* Moderna's stock price has crossed above its upper Bollinger Band and is showing technical strength

* Look for MRNA's stock price to move above its 50-week moving average

Last year's vaccine sales...

READ MORE

MEMBERS ONLY

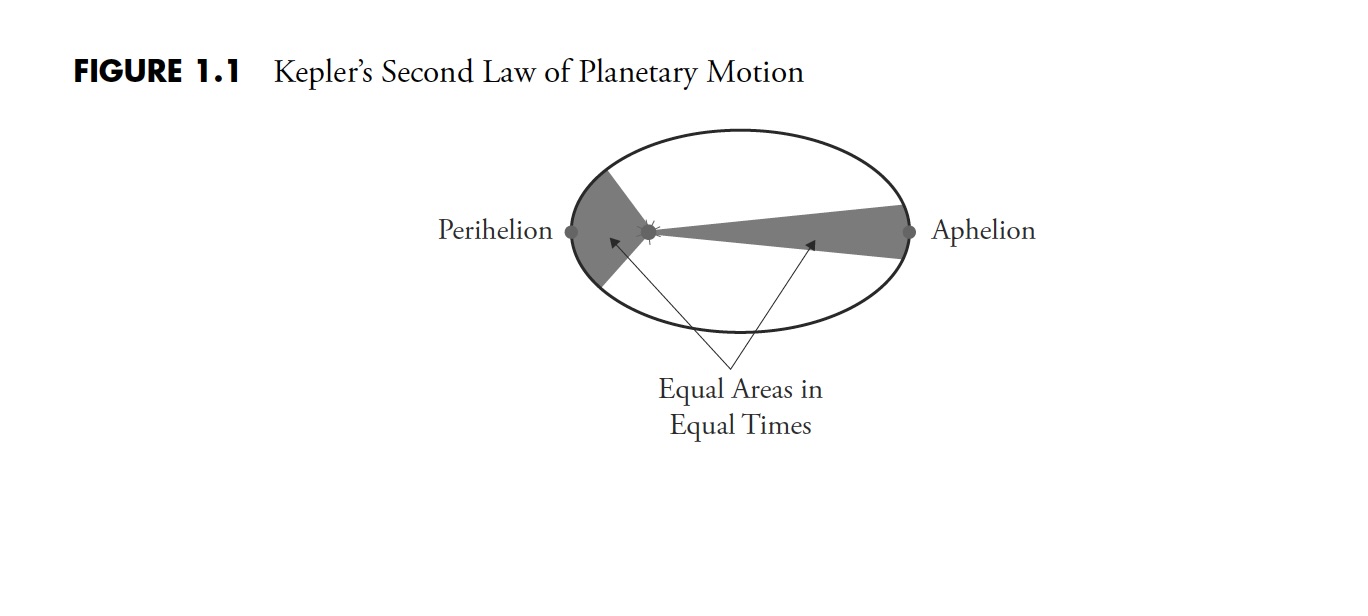

The Science and Art of Stock Market Predictions

Over the holiday, I thought a lot about predictions and how they are formed.

The dictionary meaning of prediction is a statement about a future eventor data.Many of the predictions for 2024 that I have seen are made by what we assume are knowledgeable people in the financial fields....

READ MORE

MEMBERS ONLY

Guidelines for 2024 | Focus on Stocks: January 2024

by Larry Williams,

Veteran Investor and Author

Let's Get This Out of The Way Right Now

For the last 18 years, I've had a love affair with my annual forecast report. Until I began writing this letter, it was the only thing I did. Many of you purchased it last year, and some...

READ MORE

MEMBERS ONLY

Unlocking Russell 2000 SECRETS & Volatility INSIGHTS!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special all-Mailbag edition of StockCharts TV'sThe Final Bar, Dave answers viewers' burning questions, ranging from the effectiveness of short-term moves with the 5-day MA to deciphering the mysteries of the Russell 2000's growth or value positioning and much more!

Click here to take...

READ MORE

MEMBERS ONLY

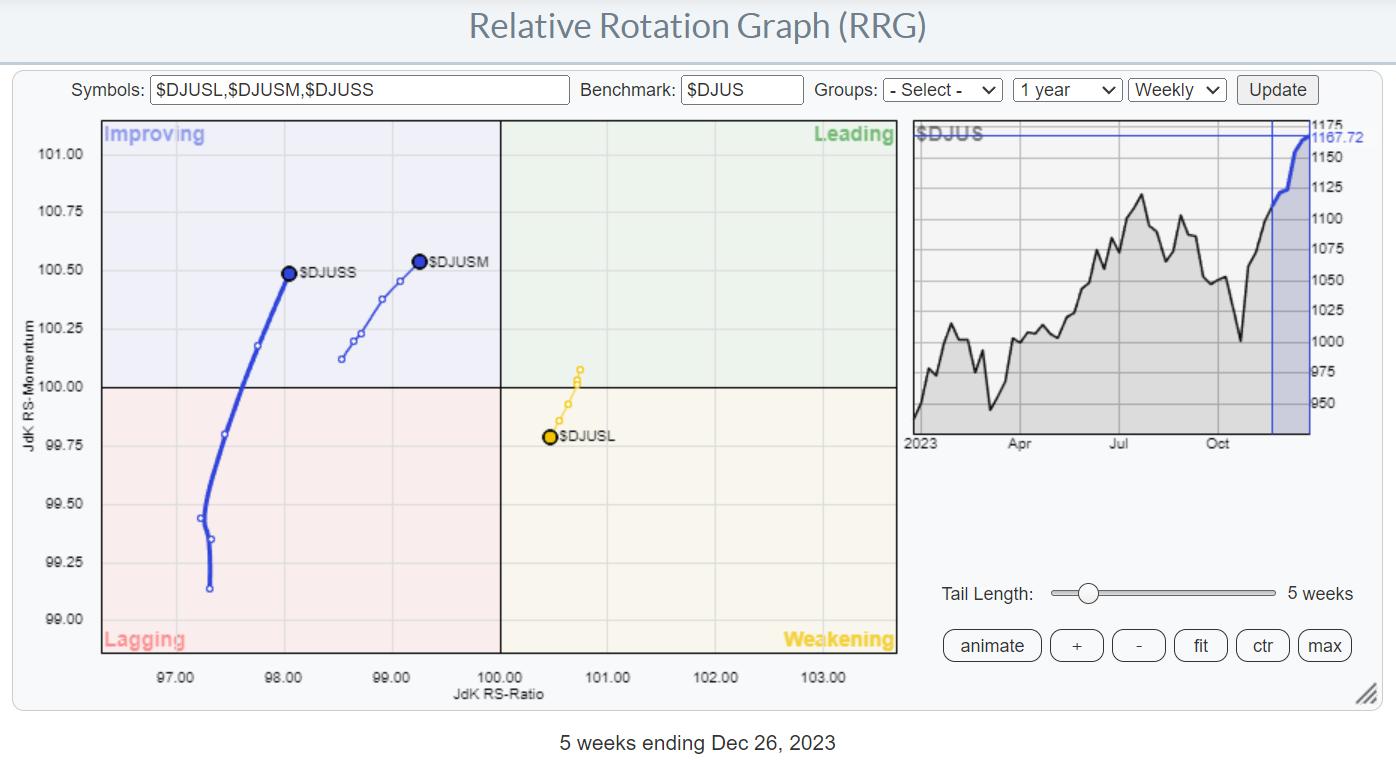

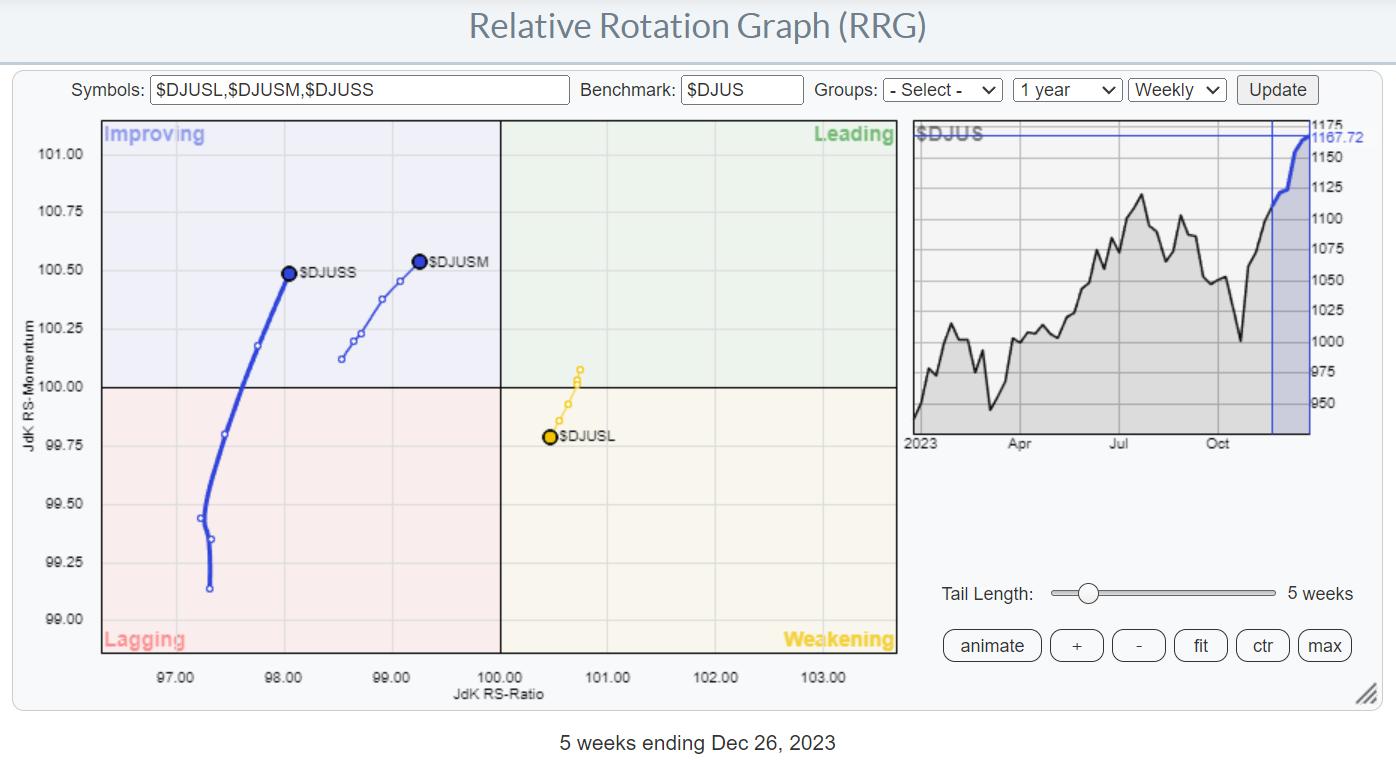

Which Sectors Benefit Most From the Large- to Mid- & Small-Cap Rotation?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Money rotating away from large-cap stocks

* Re-distribution and new inflow to mid- and small-caps

* Majority of sectors show preference for equal weight ETFs over Cap-Weighted counterparts

I have used this Relative Rotation Graph regularly in the past few weeks to indicate the ongoing rotation out of large-cap stocks...

READ MORE

MEMBERS ONLY

This Stock is up a Startling 90% This Year: Last Time This Happened Was in 2003

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Intel stock is up over 90% in 2023 and could see further growth in 2024

* The stock crossed above its upper Bollinger Band and is now pulling back

* Any signs of a reversal followed by price action that confirms the uptrend is resuming will be an ideal entry...

READ MORE

MEMBERS ONLY

The Vanity Trade 2024: All About Me!

According to Wikipedia,

"Self-help or self-improvement is a self-directed improvement of oneself—economically, physically, intellectually, or emotionally—often with a substantial psychological basis."

In the Outlook 2024, I quote Raymond Lo yet again,

"The Dragon is considered a ‘Star of Arts.' The industries that will perform...

READ MORE

MEMBERS ONLY

Is FedEx's Long-Term Uptrend in Jeopardy? Here's What to Watch.

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* A drop in global demand contributed to FedEx's quarterly earnings miss which caused the stock price to fall

* FedEx's stock price action reveals the critical price levels to watch for entry points

* Set technical price alerts at key support and resistance levels to closely...

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- 17 Predictions

One area I cover in the Outlook 2024 is the teachings of Raymond Lo and how he sees the upcoming Year of the Dragon. Part of my comments on his analysis is based on this statement by Lo:

"Many has the misunderstanding that the Dragon is glamorous auspicious animal...

READ MORE

MEMBERS ONLY

Boost Your Trading Success with This Chart Trick

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson we reveals a useful chart trick that will revolutionize your trading toolkit. Get ready to dive into the site, explore the tools, and walk through the features that will help you maximize the value of your...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #4: Leadership Themes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the fourth of a five-part special series on StockCharts TV'sThe Final Bar, Dave discusses the top leadership trends of 2023. From the concept of narrow leadership to the rise of the Magnificent Seven, he explores the most important themes that shaped the year in this engaging episode....

READ MORE

MEMBERS ONLY

More from Mish's Outlook 2024 -- S&P 500

A passage from the Outlook:

SPY's all-time high was made in January 2022 at $479.98.

For now, the chart looks clear. If SPY pushes over 460, we can expect more upside at least until we get near the ATHs.

Should those levels clear, then we are in...

READ MORE

MEMBERS ONLY

Profit From the AI Wave Now: One Stock With Lots of Upside Potential

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* An earnings beat and strong guidance was enough to send shares of Micron Technology higher

* Micron Technology hit a new 52-week high and the stock has room for more upside

* Identify your entry and exit price targets to trade this stock

Yesterday's stock market selloff was...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 3: Fictions Told to Investors

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the third in a series of articles I'm publishing here taken from my book, "Investing with the Trend," in article form here on my blog. Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading...

READ MORE

MEMBERS ONLY

Mish's Outlook 2024 is Here -- Macro to Micro

Coming into 2023, we used the theme, "You can't hunt with the hounds and run with the rabbit." Those who stood back with the hounds, in search of a sure hit, were not only left behind, but missed the move higher as the rabbit got the...

READ MORE

MEMBERS ONLY

Costco's Record-Breaking Surge: Is It Time to Buy or Sell?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Costco experienced a significant rally driven by strong earnings and an upgraded analyst target of $700

* Despite COST's bullish prospects, the stock is overbought and is likely to pull back

* Setting price alerts at several support levels may be key to finding a strong long entry...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #1: S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the first of a five-part special series on StockCharts TV'sThe Final Bar, Dave walks through the S&P 500 index quarter by quarter. From the strong rally phase in the 2nd quarter to the dramatic reversal at the October low, 2023 has provided a perfect case...

READ MORE

MEMBERS ONLY

The 2 Best Holiday Gifts You Can Give Your Kids!

by Gatis Roze,

Author, "Tensile Trading"

Let's begin with the bottom line.

As parents, our reason for being here on planet Earth is to pass on to our children the life skills they'll need to succeed. Everyone talks about leaving a better planet for our children; why don't we try...

READ MORE

MEMBERS ONLY

Larry Williams' 2024 Market Outlook

by Larry Williams,

Veteran Investor and Author

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave to share his lessons learned in 2023, his outlook for stocks in 2024, and which cycles he feels all investors should be following into the new year.

This video originally premiered on...

READ MORE

MEMBERS ONLY

Are We Seeing 2020 All Over Again!?

by TG Watkins,

Director of Stocks, Simpler Trading

The market exploded higher after already being on a winning streak for 5 weeks. While there are blow-off top vibes, there could be a lot of money able to come in from the sidelines to keep the market going. In this week's edition of Moxie Indicator Minutes, TG...

READ MORE

MEMBERS ONLY

Momentum Madness and Nasdaq 100 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks went on a tear the last seven weeks with Nasdaq 100 stocks leading the charge. The S&P MidCap 400 SPDR (MDY) and Russell 2000 ETF (IWM) gained more than QQQ over the last seven weeks, but QQQ is still the only major index ETF to exceed its...

READ MORE

MEMBERS ONLY

Small-Caps Rocket to the Upside, Leave Large-Caps in the Dust

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On this edition of StockCharts TV'sThe Final Bar,Julius de Kempenaer of RRG Research points out that growth vs. value is now more of a small vs. large question, with small caps rocketing to the upside in December. Host David Keller, CMT recaps the top charts of the...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 2: Indicators, Terminology, and Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

Find Aggressive Entry Opportunities & Tradeable Trends with Multi-Timeframe Charts

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use multiple timeframes to help when getting an aggressive entry in a stock. He starts by explaining the tradable trend, then shows how an aggressive opportunity develops. To close out the show, he analyzes...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" December 14, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry presents his forecast for FANG stocks, including an analysis of the stock selloff for META. He then digs into the cycle of debt and why he's bothered about credit card writeoffs. After that, he examines the weekly economic index and GDP and how they...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 1: Introduction

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE