MEMBERS ONLY

Larry's Final LIVE "Family Gathering" Webinar of 2023 Airs THIS WEEK - Thursday, December 14th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, December 14 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Faces An Imminent Consolidation; This Index May Finally Start To Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets continued their unabated upmove; following a strongly trending week, the Nifty not only ended at a fresh lifetime high point but also closed with gains for the sixth consecutive week. The markets piled up decent returns despite some signs of consolidation in the second half of the week....

READ MORE

MEMBERS ONLY

This Li'l Checkbox is KEY When Comparing Stocks & Charting Multiple Timeframes

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shares the secret to comparing symbols and making multi-timeframe analysis a breeze! Using the "Load Symbol Only" checkbox, he demonstrates how to review a list of symbols with different chart templates, all without having...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch in December 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave is joined by StockCharts' own Grayson Roze as they break down the trends for the top ten stocks and ETF charts for December 2023. Together, they identify key levels and signals to watch for using technical analysis tools...

READ MORE

MEMBERS ONLY

Useful Directional Indicator Criteria for Your Success as a Trader!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows the 2 criteria he is looking for in directional indicators to determine when the buyers or sellers are taking command. He explains how this signal can be used to your advantage in both analysis and trading....

READ MORE

MEMBERS ONLY

High Risk of Market Downside in December?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research updates his Asbury Six tactical market model and shares how investors can be better positioned for market uncertainty into 2024. Host Dave highlights the strong rally in financials and airlines, and reveals one...

READ MORE

MEMBERS ONLY

Trend Channels Help Define Stock Pullback Scenarios

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Sam Burns, CFA of Mill Street Research focuses on strength in financials, weakness in crude oil, and key macro themes he'll be tracking into 2024. Meanwhile, Dave tracks the relentless upswing for Bitcoin, the pullback in gold...

READ MORE

MEMBERS ONLY

Cryptocurrency Prices in the Spotlight, Small Caps Now in an Uptrend

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Bitcoin closes above 42,000, a 20-month high

* Small caps also closed higher and are now in an uptrend

* Watch how seasonal patterns play out in December as it can be an indication of what to expect in 2024

The stock market seems to be pulling back after...

READ MORE

MEMBERS ONLY

DP Trading Room: How Bad Data From Major Indexes Leads to Bad Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl discusses his recent epiphany regarding data derived from major indexes. Bad data will lead to bad analysis, so it's important to understand this concept for analyzing major indexes. He and Erin discuss the implications of Magnificent...

READ MORE

MEMBERS ONLY

Stock Market Starts December On A Strong Note: What This Means For the Rest of the Year

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The S&P 500 index closed at its 2023 high

* The Dow Jones Industrial Average hits a new 52-week high

* The S&P 600 Small Cap Index led the rally with a 2.89% gain

The stock market is off to a great start on the...

READ MORE

MEMBERS ONLY

MEM TV: Nasdaq Flat But These Top Areas Outperform!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the outperformance that took place amid a declining rate environment, while also highlighting price action in Tech, which trended sideways last week. She also reviews Dow stocks that just entered a new uptrend as the Index hits...

READ MORE

MEMBERS ONLY

Don't Even Think About Investing Without Addressing These 10 Essentials (Part 2: Essentials #6 - #10)

by Gatis Roze,

Author, "Tensile Trading"

I'm not an investment arsonist! I won't try to convince you that stock market perfection is achievable. I will, however, guarantee (strong word) that if you put in the effort, the results will be as Vince Lombardi often claimed: "Perfection is not attainable, but if...

READ MORE

MEMBERS ONLY

SNAP's Stock Price Snaps Out Above Bollinger Band -- Could This Be a Profitable Opportunity?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Snap Inc.'s stock (SNAP) price exceeded its upper Bollinger Band. But what does this mean for the stock's price move?

To start, a move above a Bollinger Band isn't necessarily a signal to buy. It's more of an indication of strength, and...

READ MORE

MEMBERS ONLY

Unlock the Secrets of Five Candlestick Patterns

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe presents 5 specific candlestick patterns and how to use them. He explains how the location of these candles have an impact on their importance, and also discusses how a higher timeframe candle can help with trades on...

READ MORE

MEMBERS ONLY

Santa Comes to Wall Street | Focus on Stocks: December 2023

by Larry Williams,

Veteran Investor and Author

Santa Comes to Wall Street

Maybe St. Nick gets into the eggnog before he visits Wall Street each year, because the trading pattern has been a step up, then a stumble down before recovering at the end of the year. I first noticed this Up-Down-Up pattern back in the early...

READ MORE

MEMBERS ONLY

MSFT Stock At Record High: Is Now the Time to Buy Before It Skyrockets Further?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* MSFT stock price surges past its 52-week high but. pulls back, closing just shy of $379

* Investors should watch for dips and resistance-turned-support levels for long entries

* Microsoft's massive investment in OpenAI could help push the stock price higher

While Microsoft's (MSFT) Azure contends...

READ MORE

MEMBERS ONLY

Follow This Powerful Seasonal Playbook in Election Years

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Hirsch of theStock Trader's Almanacshares the suggested seasonal pattern for 2024 and breaks down how previous election years have played out. Host David Keller, CMT highlights a breakout in gold miners, regional banks breaking above their...

READ MORE

MEMBERS ONLY

The Final Episode: Jesse Livermore Insights and Holding 'Dead Money' Positions

by Dave Landry,

Founder, Sentive Trading, LLC

In the final edition of Trading Simplified, Dave shows his methodology in action by sharing two positions that he continues to hold, even though they were "dead money" most of the time, and why he applied discretion to stick with a losing position to possibly avoid a loss....

READ MORE

MEMBERS ONLY

Coinbase's Stock Price Could See a Sizable Move: Time to Seize the Opportunity?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Coinbase stock has broken above its trading range

* The stock ranked in top position in the SCTR ranking for large-cap stocks

* The stock may be overbought and due for a pullback

The cryptocurrency space has had its share of challenges, but Coinbase (COIN) looks like it may be...

READ MORE

MEMBERS ONLY

DP Trading Room: How To Time Your Trade Entries & Exits Like a Pro

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Erin flies solo today and gives everyone a refresher course on how to expertly time your entries and exits for trades, using the 5-minute candlestick chart. She covers the market in general, followed by analysis of sectors of interest...

READ MORE

MEMBERS ONLY

Market Secrets Revealed! Final Bar Mailbag -- US Dollar, S&P 500 ETF, Fibonacci Pivots

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave devotes the show to the Mailbag. He answers viewer questions about the impact of the US Dollar on the stock market, why he uses the S&P 500 ETF rather than the S&P Index for relative...

READ MORE

MEMBERS ONLY

Now is NOT the Time to Start a Long Trade - Be Patient!

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG notes that the markets are deciding to hang on tight to their upper levels over the holiday week. He thinks we still need a pullback, but perhaps it will be more of a flag. Either way, initiating long trades...

READ MORE

MEMBERS ONLY

How RRG Helps Us Find Pair Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* DJ Industrials closing in on overhead resistance

* Weekly RRG showing some strong opposite rotations

* Identifying two potential pair trading setups (MSFT-MRK & NKE-CAT)

The Dow Jones Industrial Index ($INDU) is reaching overhead resistance between 35.5k and 35.7k, which means that upside potential is now limited. Even...

READ MORE

MEMBERS ONLY

Gap's Stock Defies Gravity: Time To Exploit Its Dynamic Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Gap's earnings expectations, caused the stock price to gap up by more than 30%

* Despite the gains, both the RSI and volume suggest Gap's stock may be overbought and losing momentum

* The stock was filtered in the Strong Volume Gainers scan which you can...

READ MORE

MEMBERS ONLY

HUGE NEWS! New SharpCharts Workbench Updates + Black Friday Week MEGA SALE

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson kicks off the BIGGEST week of the year here at StockCharts with two exciting announcements: our Black Friday Week sale and a fresh round of updates on the new SharpCharts Workbench. He'll show you...

READ MORE

MEMBERS ONLY

Equity and Inflation Outlook -- Watch These Videos!

On Monday the 20th, I gave 2 interviews. The first is the clip below is from Yahoo Finance where we focus on oil and agricultural commodities.

The second interview is the Daily Briefing with Maggie Lake on Real Vision. This chart above is featured, along with:

1. Inflation thesis

2....

READ MORE

MEMBERS ONLY

Magnificent 7 Stocks Testing HUGE Resistance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the technical setups on all of the Magnificent 7 stocks, addressing the balance between strong trends and overbought conditions. He answers viewer questions on investor sentiment, trailing stops, potential upside for TSLA, and the latest thinking on...

READ MORE

MEMBERS ONLY

This Stock Hit a 52-Week High -- And It's Still Surging

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* This stock reached new 52-week high again and can be profitable trading candidate

* Adding a momentum indicator to your charts will help identify if there's enough momentum to push the stock higher

* A StockCharts Technical Rank (SCTR) score above 90 makes this stock technically strong

Palantir...

READ MORE

MEMBERS ONLY

Check These Out: Buyable Pullbacks Under the Surface!

by TG Watkins,

Director of Stocks, Simpler Trading

In the previous episode, TG explained that we needed to wait for the right opportunities to buy pullbacks from when the market shot up. The mega-caps and the major indexes did one small day of pulling back, but underneath that, many individual stocks have pulled back and come into buyable...

READ MORE

MEMBERS ONLY

EB Weekly Market Report - Monday, November 20, 2023

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sample Report

Below is our latest Weekly Market Report (WMR), which is published on Sunday/Monday of every trading week. It's unlike our Daily Market Report (DMR) as the WMR focuses almost exclusively on the Big Picture and is more designed for those with longer-term investing/trading horizons....

READ MORE

MEMBERS ONLY

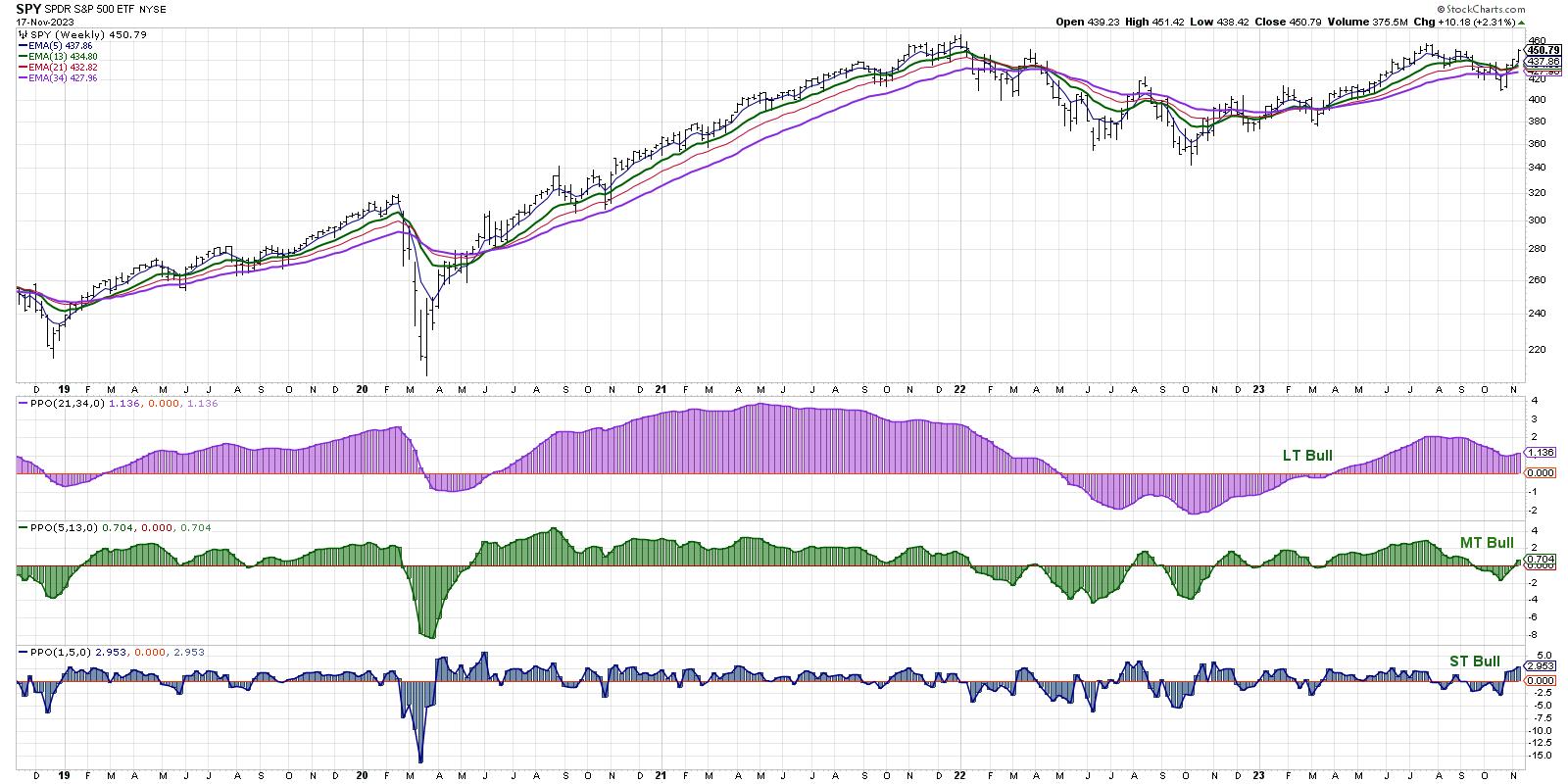

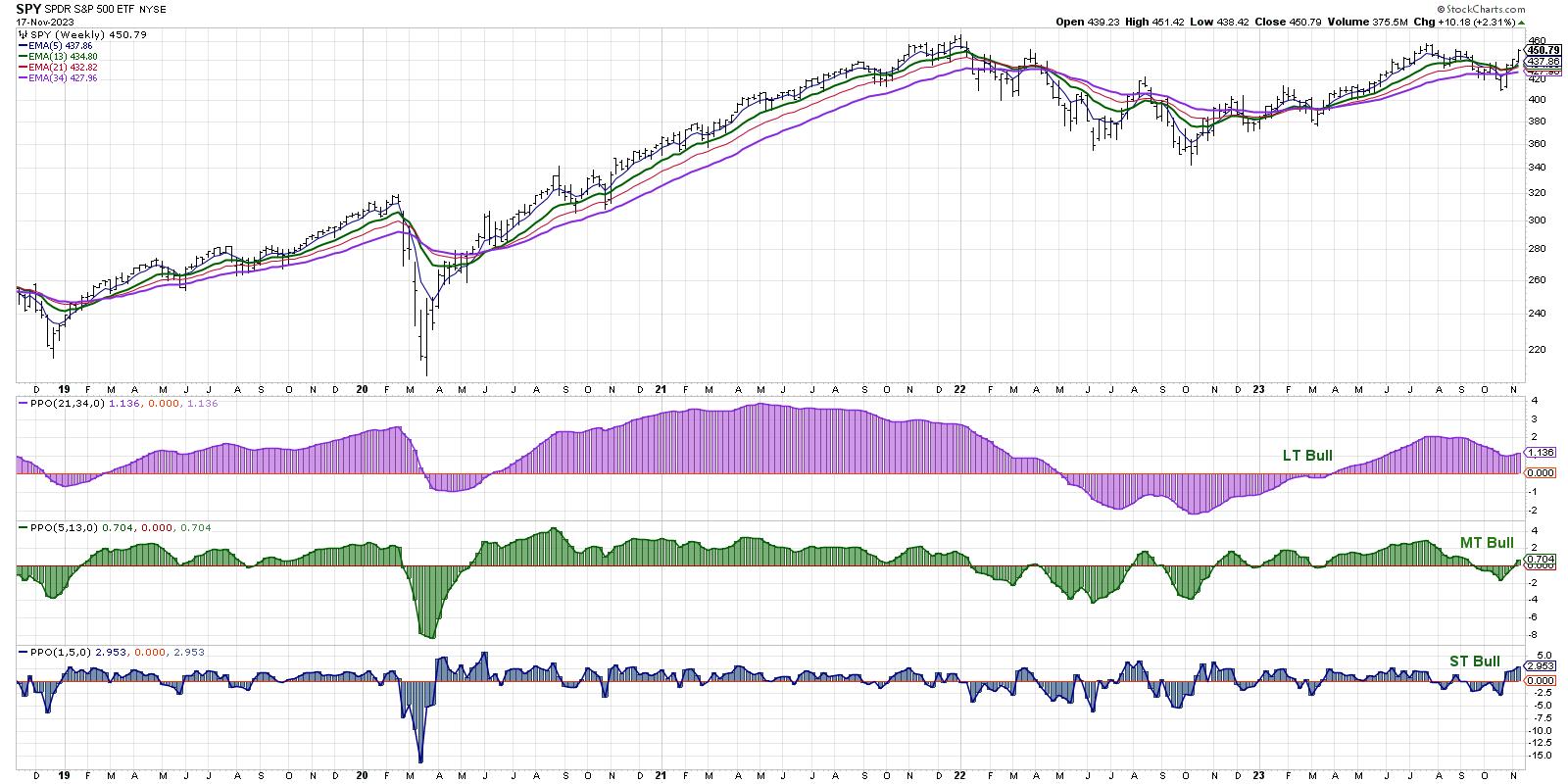

My Market Trend Model is Pretty Bulled Up

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* We use a series of weekly exponential moving averages to define the trend on three time frames.

* The medium-term model just turned bullish, suggesting a risk-on environment for stocks.

* Our Market Trend Model had a similar setup in March 2022, before a downturn eliminated the bullish configuration.

Am...

READ MORE

MEMBERS ONLY

MEM TV: Easy Way To Uncover Best Candidates for These Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reveals areas of the market that are reversing lengthy downtrends and the best way to participate. She also highlights where the strength is in the markets as the uptrend remains firmly in place.

This video originally premiered November...

READ MORE

MEMBERS ONLY

The Bull Has Left the Bear in the Dust: It's Time To Add Small Caps To Your Portfolio

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite notched a three week winning streak.

* Small-cap stocks are showing signs of rallying to the upside

* Overall, the economy looks to be chugging along, investor sentiment is bullish, and we coudl see a year-end rally

The...

READ MORE

MEMBERS ONLY

Oil the New Gold -- Buy When There's Blood in the Streets

A weaker labor market, manufacturing production slowing, new home prices falling and crude oil inventories rising more than expected are all to blame for the big drop in oil prices. US also eased sanctions on Venezuelan oil.

That's the nature of commodities; fresh news can supersede older headlines...

READ MORE

MEMBERS ONLY

Capitalizing on Market Momentum: The Art of Pullback Swing Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use multiple timeframes to trade a pullback. He shows the reasons why the setup looked attractive on the daily chart, then goes down to the hourly chart to evaluate the quality of the pullback...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" November 16, 2023 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins with a followup on the October rally kickoff. He then covers stocks like CRWD, META, NVDA, LULU, and DKNG. Larry answers questions about seasonal and cyclical differences, his personal indicators, and what retailers rely most on for the Christmas season. He highlights some trades that...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Three Ways to Stay on the Right Side of the Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Dave Landry of DaveLandry.com reveals his three charts to define the market trend, limit losses, and stay on the right side of the market. Host David Keller, CMT targets names trading higher and testing key resistance, including TGT,...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, November 16th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this Thursday, November 16 at 2:00pm EST.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current market topics, directly...

READ MORE

MEMBERS ONLY

A Supercharged Stock Market Rally: Catch These Stocks Before They Get Away

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Cooling CPI data sends equities roaring higher

* The 10-year Treasury yield fell below 4.5%, a critical support level

* Small-cap stocks were clearly the biggest winners today

October's unchanged headline US CPI and lower-than-expected core CPI were reasons for investors to celebrate. The broader stock market...

READ MORE