Stocks: Bearish Setups

Comerica (CMA), Ebay (EBAY) and Joy Global (JOYG).

Comerica (CMA) fails resistance test. After breaking support with a sharp decline in October, CMA rebounded and never came close to its October high. Broken support around 29.5 turned into resistance and the stock formed a bearish engulfing pattern on Thursday. Further weakness on Monday confirms the pattern and reinforces resistance. CMA is part of the finance sector.

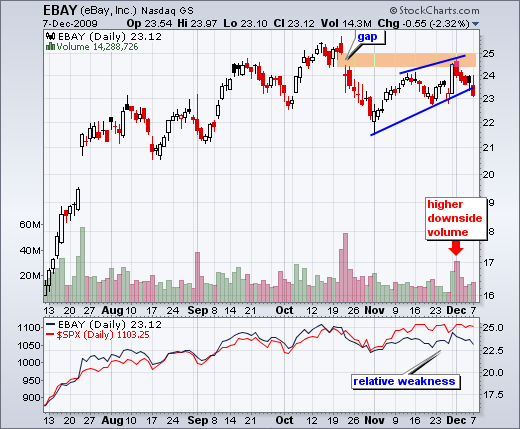

Ebay (EBAY) meets resistance at gap. After breaking down with a gap and sharp decline in October, Ebay returned to the gap zone with a rising wedge. Despite a surge above 24 with a long white candlestick, Ebay failed to completely fill the gap and declined the last five days. The stock broke the rising wedge trendline and looks poised to continue its October decline.

Joy Global (JOYG) consolidates after decline. After meeting resistance around 57.5, JOYG pulled back and then consolidated for two weeks. The stock actually gapped up five days ago, but there was no follow through as four red candlesticks formed. These show selling pressure within the consolidation. Red candlesticks indicate that the close was below the prior close. Filled candlesticks indicate that the close was below the open. A break below support would signal a continuation lower.