SPY surges to short-term resistance

SPY hit the 62% retracement last week and bounced with two good moves this week. At this point, I still consider the medium-term trend up on the daily chart. SPY forged a higher high in early January and held support so far in February. Moreover, the ETF bounced at a key retracement, which is what should happen in a medium-term uptrend. Failure to hold this week's gains and a move below last week's low would argue for a medium-term trend reversal.

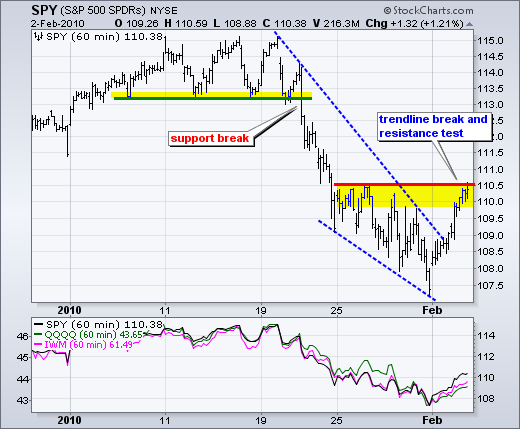

SPY has hit its moment-of-truth on the 60-minute chart. With a surge over the last two days, SPY is trading at the top of its resistance zone. While a break above 110.5 would be positive, I think the risk of a pullback or another test around 107.5-108.5 is high. There is one problem here: thinking too much can get me in trouble. There were two weeks surges in September, October and November. These moves were sharp 5-7% advances in two weeks. I don't think the same thing will happen here, but you never know. All roads lead to Friday's employment report, which often produces big moves and volatility. We will get an employment preview with the ADP Employment report today before the open and Initial Claims on Thursday before the open.