TLT and GLD Plunge on Fed Minutes - UUP Breaks Out

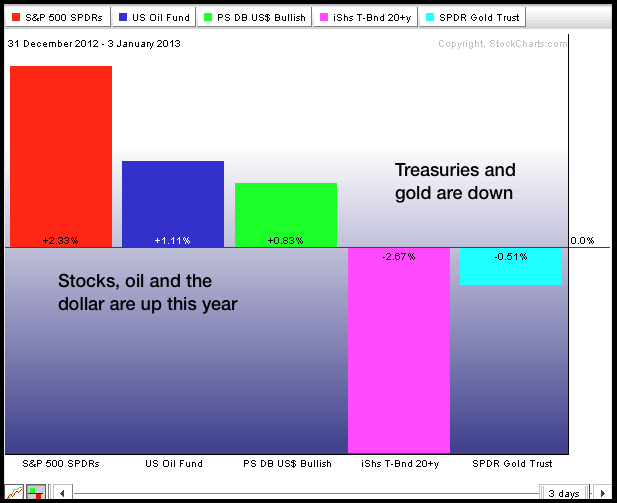

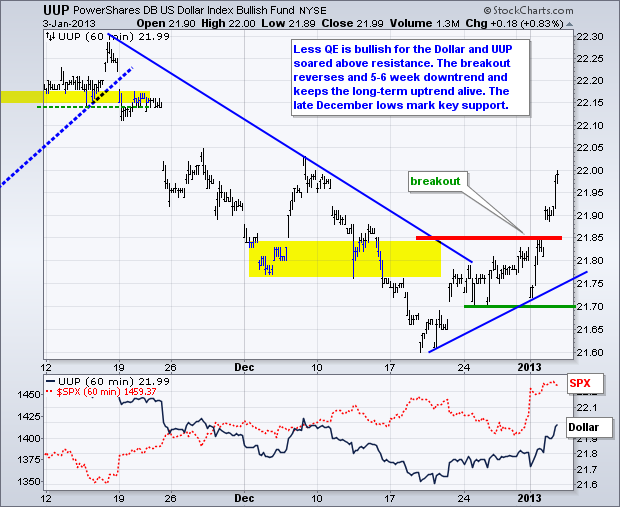

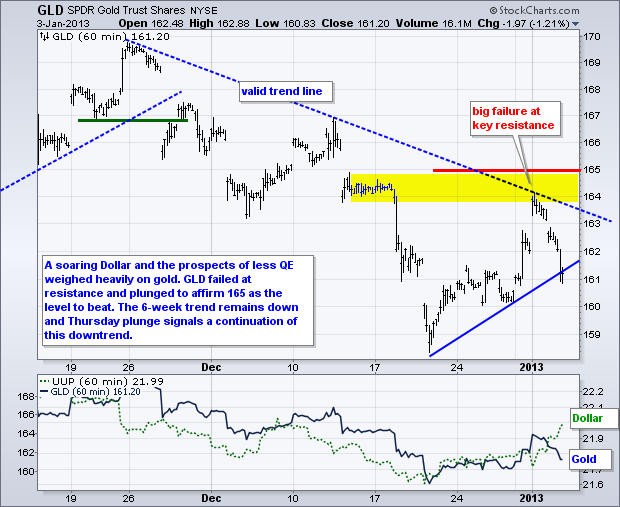

The Fed minutes threw the intermarket arena a curve ball on Thursday. Basically, the Fed admitted that the affects of quantitative easing were diminishing over time and it was running out of bullets. This news sent Treasuries sharply lower, the Dollar sharply higher and gold sharply lower. Stocks and oil were largely unaffected, for now. The decline in Treasuries is bullish for stocks. However, a surging Dollar is typically bearish for stocks. It looks like Treasuries, and the Fed, are winning the day because money is moving out of safe-havens and into risky assets.

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events:

Fri - Jan 04 - 08:30 - Employment Report

Fri - Jan 04 - 10:00 - Factory Orders

Fri - Jan 04 - 10:00 - ISM Services Index

Charts of Interest: Tuesday and Thursday

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it comes to trading our own accounts. First, it is

the only way to really learn. Second, we are the only ones responsible for our decisions.

Think of these charts as food for further analysis. Before making a trade, it is important

to have a plan. Plan the trade and trade the plan. Among other things, this includes setting

a trigger level, a target area and a stop-loss level. It is also important to plan for three

possible price movements: advance, decline or sideways. Have a plan for all three scenarios

BEFORE making the trade. Consider possible holding times. And finally, look at overall market

conditions and sector/industry performance.