DIVIDE AND CONQUER

To understand the Nasdaq and Nasdaq 100, it is important to look at the individual parts. These two indices can be broken down into four key industry groups: semiconductors (SMH), networking (IGN), software (SWH) and internet (HHH). While retail, telecom, hardware, biotech and other industry groups certainly play a part, these four are the key drivers and the first place to look for signs of weakness or strength.

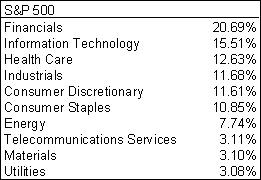

The same approach works for the S&P 500. This index can be broken down into six key sectors: Finance (XLF), HealthCare (XLV), Consumer Discretionary (XLY), Information Technology (XLK), Industrials (XLI) and Consumer Staples (XLP). Even though Industrials and Consumer Staples each make up over 10% of the index, I tend to focus on the other four sectors, which make up over 60% of the index when combined.

In particular, the retail group is a major influence on the Consumer Discretionary sector and retail spending drives ~2/3 of GDP. As it name implies, the Consumer Discretionary sector represents cyclical stocks and these are more prone to economic fluctuations than the other sectors. This makes it an important component of the S&P 500. And finally, notice that Energy, Materials and Utilities (combined) account for less than 15% of the index. However, their influence is growing.